Altcoins

Ethereum Breaking $3,100 Is ‘Just The Beginning’

Published

5 months agoon

By

admin

Analysts see that Ethereum has the potential to reach a new all-time high by December after it achieved its first breakout in three months.

Its growth can be attributed to the growing optimistic sentiment on cryptocurrencies fueled by the results of the recently concluded national elections.

Related Reading

Ether Breaks The $3,000 Barrier

Data has shown that Ethereum experienced a big price hike–a growth that analysts said could be the result of the triumphant victory of Donald Trump in the US elections.

Analysts said that the second largest crypto in terms of market capitalization was able to move past the “critical” $2,000 level, peaking at $3,179 on Sunday noon.

Ethereum’s price rally is being viewed as an indicator that after a period of stagnation, the digital currency will gain momentum and will be on the road to recovery, which is good news for ETH investors.

Many analysts suggested that the growth has something to do with the incoming Trump administration. During the campaign, Trump has already hinted that he is more inclined to have more favorable regulations on cryptocurrencies. Hence, his victory signaled great optimism about the future of crypto under his leadership.

Ethereum is among the digital currencies riding on this optimism, resulting in a 20% price hike in the past week.

Analysts also note that another major contributor to the bullish momentum is the significant increase in spot Ether ETF inflows. On November 8, data showed that inflows recorded a weekly high of $85.9 million, an indicator that investors are getting more confident about the long-term potential of Ether.

Ether market cap currently at $385 billion. Chart: TradingView.com

An All-Time High Is Possible

Market commentators said that many indicators showed that a new all-time high for Ethereum could be just around the corner, saying that it could reach $3,366 any time soon. They added that ETH increased by 8% last Thursday.

Analysts predicted that the crypto could hit a new all-time high by December, fueled by a growing demand for the top altcoin. One of these growth indicators is the coin’s open interest which is also on the rise.

#Ethereum $ETH at $3,000 today is just the beginning! https://t.co/gpAfqbe2v5

— Ali (@ali_charts) November 9, 2024

Reports illustrated that ETH’s futures open interest (OI) experienced a massive uptick. It increased by about 20% to $16.18 billion from $13.05 billion in the last two days.

Analysts explained that OI refers to the total number of outstanding contracts in a derivatives market. They added that if OI went up together with prices, it meant new funds were entering the market to fuel an upward trend.

If Ethereum’s OI keeps on growing, it might result in a massive price surge, propelling the digital coin to reach a new record high before the year ends.

Related Reading

The $10,000 Projection

Analyst Ali Martinez forecasted that there is a possibility that Ethereum could reach the $10,000 mark, saying that breaching the $3,000 level is only the start of the upward price movement.

Martinez claimed that ETH is on the right trajectory to attain the $10,000 level, comparing the crypto to the S&P 500.

Geoffrey Kendrick of Standard Chartered agrees with the prediction, saying that ETH could hit that level soon.

Kendrick explained that the anticipation of clearer crypto regulations by the new administration and what is being perceived as a crypto-friendly government could fuel this massive growth.

Featured image from OneSafe, chart from TradingView

Source link

You may like

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

Altcoins

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

Published

8 hours agoon

April 14, 2025By

admin

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

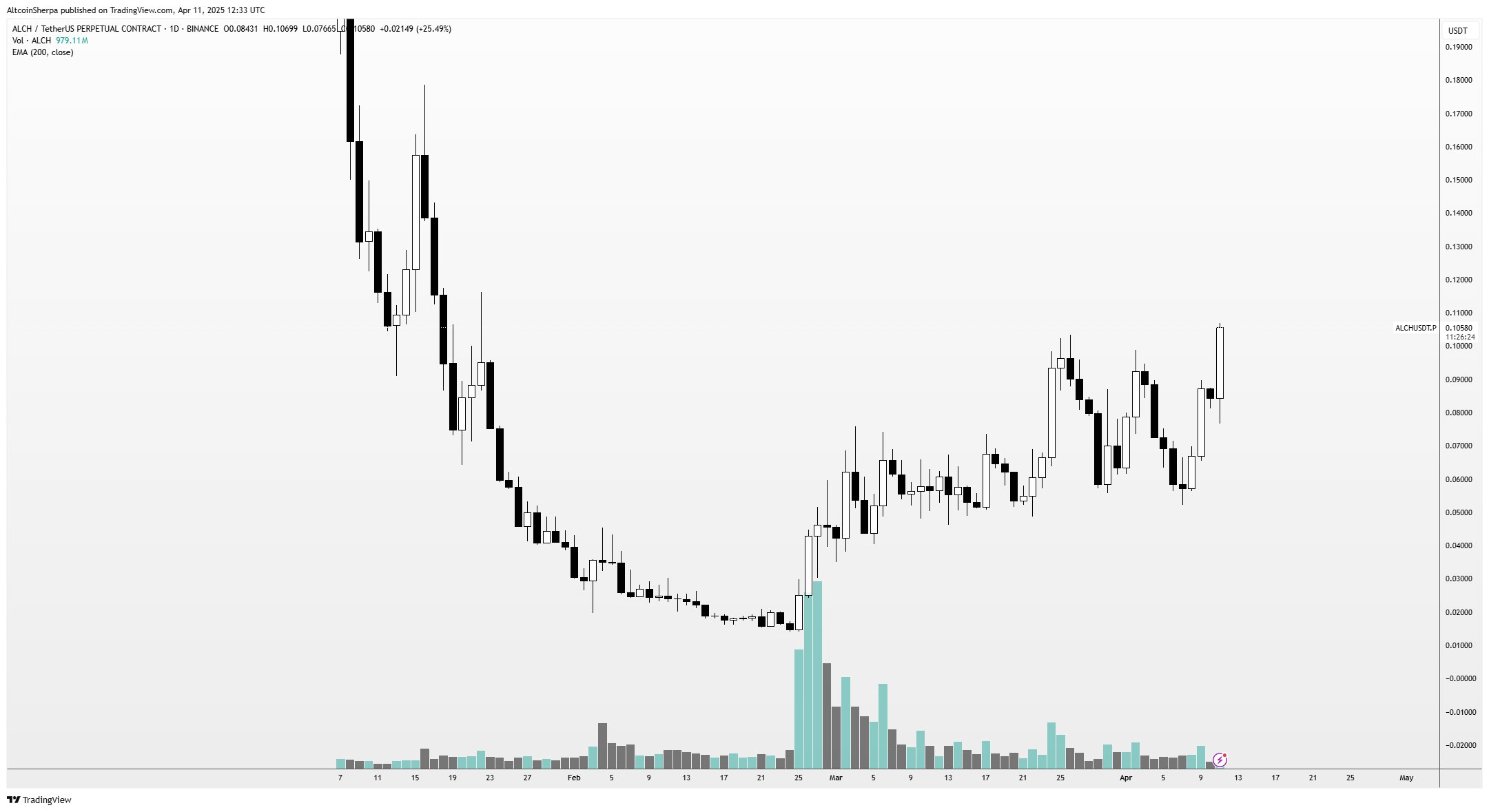

ALCH

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Published

10 hours agoon

April 14, 2025By

admin

A closely followed crypto analyst believes one meme token operating on Solana (SOL) is in the early stages of a market recovery.

Pseudonymous analyst Altcoin Sherpa tells his 243,800 followers on the social media platform X that he’s bullish on the memecoin Bonk (BONK).

The trader shares a chart suggesting that BONK will face resistance at the $0.000012 level before printing a bullish higher low setup and rallying to his target above $0.0000145.

“BONK is looking strong in the short term, and should go higher. Should be a pullback around the 200 EMA (exponential moving average) on the four-hour chart but still, I think this has pulled back enough to where any buying down here is probably reasonable.”

At time of writing, BONK is worth $0.00001376.

Turning to the low-cap altcoin Alchemist AI (ALCH), the analyst says the coin appears to be in an uptrend and that he’s waiting for potential dips to accumulate the asset.

ALCH is an artificial intelligence (AI)-based crypto project that allows users with no coding skills to generate codes by providing natural language descriptions.

Says Altcoin Sherpa,

“ALCH still seems like a really strong chart, don’t see it being mentioned much. I think it’s basically taken the place of ARC; a super volatile AI coin that moves 20% a day. Not in it but traded it a lot before; will look to buy dips.”

At time of writing, ALCH is the 431st-largest crypto asset by market cap, trading at $0.109.

Looking at Bitcoin, Altcoin Sherpa thinks that BTC will continue to consolidate within a large trading range in the short to mid-term.

“Expecting there is some sort of chop between $70,000-$90,000 over the next several weeks for BTC. Relative bottom probably in, but still some more consolidation to come.”

At time of writing, Bitcoin is trading for $85,366.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoin

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Published

16 hours agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana appears to be gearing up for a major technical breakout, with recent price action building up an interesting chart formation. A familiar bullish pattern has formed, and if validated, it could drive the price to a level not seen in recent weeks. This new development was highlighted by popular analyst Titan of Crypto on social media platform X.

Pattern Breakout Sets $143 In Sight

Like every other large market-cap cryptocurrency, Solana has experienced an extended period of price crashes since late February. In the case of Solana, this price crash has been drawing out since January, when it reached an all-time high of $293 during the euphoria surrounding the Official Trump meme coin. Since then, Solana has corrected massively, even reaching a low of $97 on April 7.

Related Reading

The price action before and after this $97 low has created an interesting formation on the 4-hour candlestick timeframe chart. As crypto analyst Titan of Crypto noted, this formation is enough to send Solana back up to $143.

At the heart of the latest bullish outlook is a clearly defined inverse head and shoulders structure, which is known for its reliability in signaling a reversal from a downtrend to a bullish breakout. The left shoulder of the pattern began forming in early April as Solana attempted to rebound from sub-$110 levels. The subsequent drop to the $96 bottom on April 7 formed the head of the structure. From there, a recovery started as buyers cautiously stepped back in, giving rise to the right shoulder.

The breakout of the neckline resistance has taken place in the past 24 hours. With this in mind, Titan of Crypto predicted that $143 becomes the next logical destination based on the measured move from the head to the neckline.

Image From X: Titan of Crypto

Momentum Strengthens With Structure Confirmation

Looking at the chart shared by the analyst, the momentum behind Solana’s price movement appears to be gaining strength. Trading volume is an important metric in evaluating the strength of a breakout, and the volume accompanying the recent breakout above the neckline seemingly confirms it.

Particularly, Solana has seen a 5.3% increase in its price during the past 24 hours, with trading volume surging by 3.76% within this timeframe to $4.21 billion.

Although it is common to see a throwback or minor consolidation just above the neckline, the projected path suggests continued upside as long as price action holds above that key breakout zone.

Related Reading

At the time of writing, Solana is trading at $129, 10% away from reaching this inverse head-and-shoulder target. A move to $143 would not only represent a meaningful recovery from April’s lows but could also improve the confidence in Solana’s price trajectory moving into Q2. The next outlook is what happens after it reaches this target of $143, which will depend on the general market sentiment.

Featured image from The Information, chart from TradingView

Source link

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x