Altcoins

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Published

4 months agoon

By

admin

Recent price movements in the cryptocurrency market have seen Ethereum experience a significant downturn, with the altcoin finally sustaining a break below the critical $3,000 support level. Ethereum has suffered a notable 4.76% decline over the past 24 hours, bringing its current trading price to just above $2,900.

Related Reading

While retail traders are still scrambling for their next move, on-chain data shows an interesting accumulation pattern of ETH by a particular whale entity. This whale, whose strategic moves have historically demonstrated an impressive 100% investment win rate, has been steadily increasing their holdings of ETH for the past two months.

Whale Sees Crash As Buying Opportunity

According to on-chain data noted by Lookonchain on social media platform X, a smart money whale has been taking advantage of the recent ETH price fall to add to its holdings. As revealed by the on-chain tracker, this whale recently bought another 2,424 ETH worth $7.22 at the time of purchase. This latest acquisition brings the whale’s total purchases to 19,436 ETH worth $68.25 million at an average of $3,511 per ETH since May 29. At the time of writing, the smart money whale is sitting on almost $8 million in unrealized losses.

At first glance, this aggressive buying approach might appear risky, especially given the prevailing bearish sentiment surrounding Ethereum. However, history suggests they might actually know what they’re doing better than most. This particular whale boasts a flawless track record with a 100% win rate since November 2022 and seems to know when exactly to buy and sell Ethereum.

Notably, this smart money whale has been buying Ethereum at low points and selling at higher prices between Nov 21, 2022, and May 23, 2024, with a total profit of more than $38 million. The whale’s recent purchases, despite the ongoing market downturn, suggest a level of confidence and insight that has proven accurate in the past.

A smart money with a 100% win rate bought 4,000 $ETH($12.58M) again 5 hours ago!

This smart money bought and sold $ETH 7 times from Nov 21, 2022 and May 23, 2024, buying at low prices and selling at high prices each time, with a 100% win rate and a total profit of more than… pic.twitter.com/3fnCkyfmQT

— Lookonchain (@lookonchain) August 2, 2024

What’s Next For Ethereum?

As of the time of writing, Ethereum is trading at $2,900, marking a significant decline of 12% over the past seven days. This sharp downturn has triggered substantial liquidations in the market. According to data from Coinglass, $78.72 million worth of ETH long positions were liquidated in the past 24 hours alone.

Related Reading

While the crypto’s drop below $3,000 is worrisome for investors, bullish hope might not be lost yet. The $3,000 price point is a critical support level backed by substantial on-chain activity. Data indicates that over 1.7 million addresses acquired Ethereum just below this level, highlighting a robust area of buying interest. This means $3,000 is still a strong support level for ETH, which might prevent further losses in the coming week.

Featured image from CNBC, chart from TradingView

Source link

You may like

AI bot transfers $50k in crypto after user manipulates fund handling

Perpetual DEX Hyperliquid to Launch Native Token Following Bullish October

Ethereum Foundation Invests Millions Into zkVM, What’s Happening?

Cardano’s Hoskinson believe Bitcoin will surpass $250,000

BTC AT $97K, XRP Rises 7%, ALGO Surges 23%

Major Bitcoin miners spent $3.6 billion on infrastructure

Altcoins

This Solana Rival Is Looking Great Amid Bitcoin Pullback, Says Top Crypto Analyst

Published

2 days agoon

November 27, 2024By

admin

A closely followed crypto analyst says that one Solana (SOL) rival is exhibiting market strength despite Bitcoin’s (BTC) pullback to the lower $90,000 range.

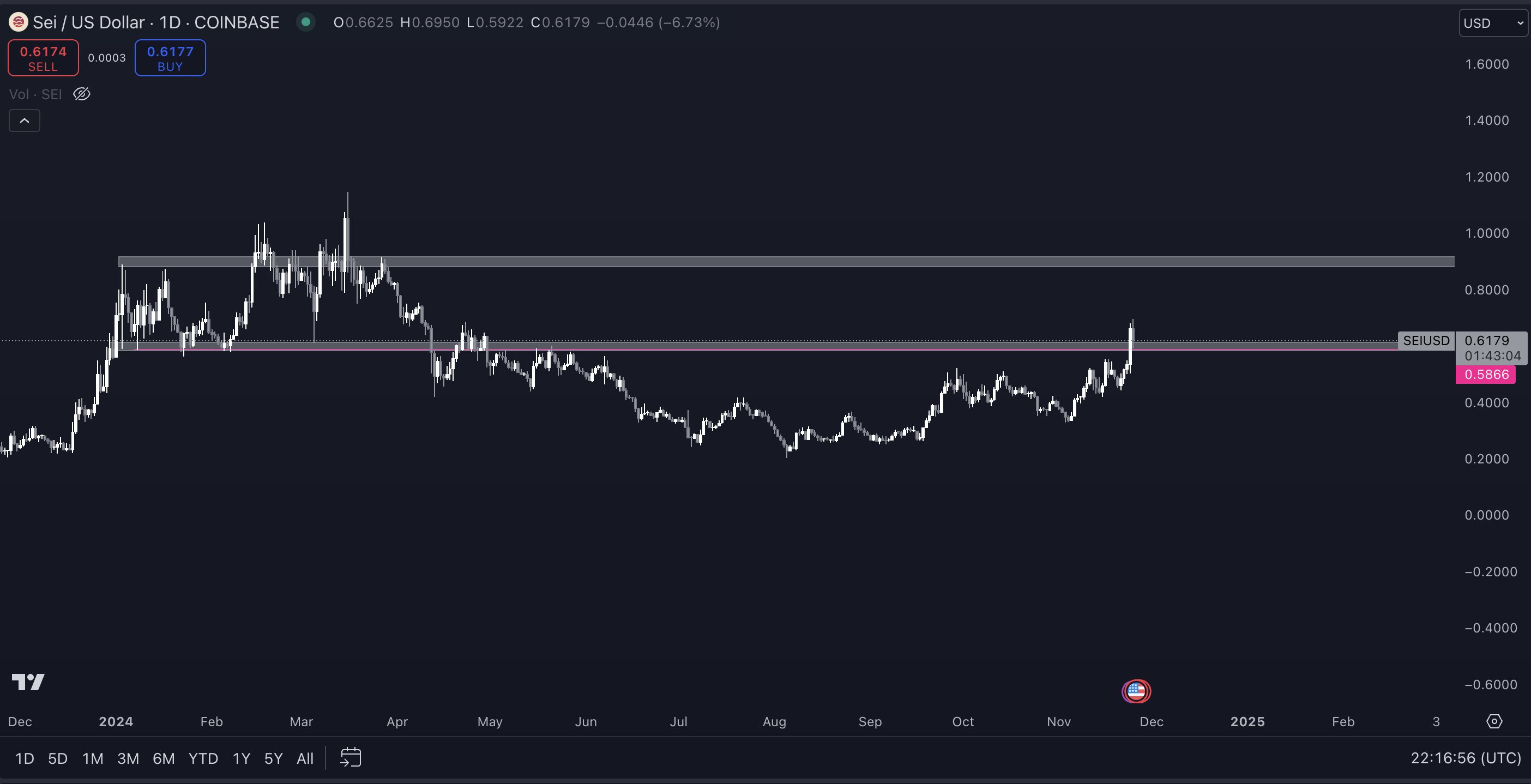

Pseudonymous analyst Pentoshi tells his 822,400 followers on the social media platform X that the native token of the layer-1 blockchain Sei (SEI) is primed for another leg up.

“SEI is another one that not only looks great with a high timeframe flip and clear invalidation, but also holding up very well like many alts on this BTC pullback. Here is the daily and weekly. Just to compare to a similar setup shared [on November 23rd]. When BTC chills out, alts should continue up.”

SEI is trading for $0.69 at the of writing, up 12.9% in the last 24 hours.

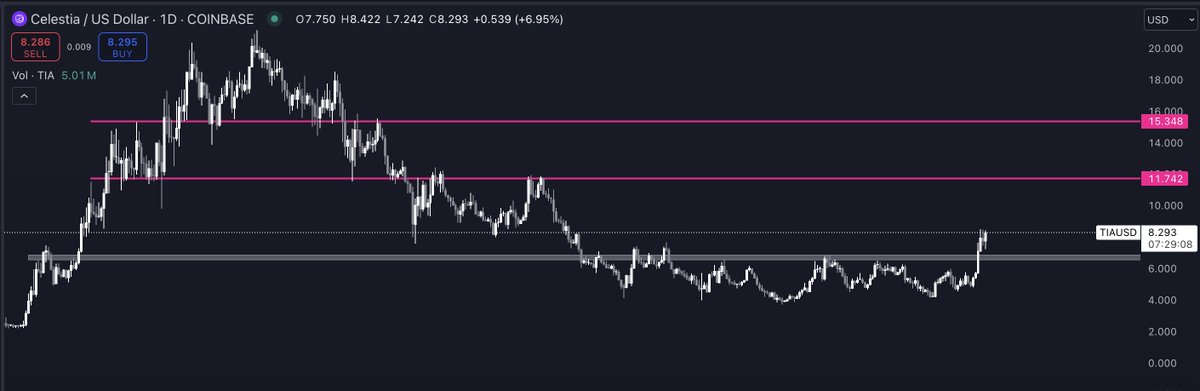

The analyst is also bullish on the modular blockchain network Celestia (TIA) after the native token took out its resistance at around $7.00.

“Really strong, and we should see it continue higher.”

TIA is trading at $8.22 at time, up 3.9% in the last 24 hours.

The analyst believes that many altcoins may start outperforming Bitcoin. He shares a chart of the Bitcoin Dominance (BTC.D), which has suddenly dropped out of the 60% range. The BTC.D index tracks how much of the total crypto market cap belongs to Bitcoin. A bearish BTC.D chart suggests that altcoins are about to outshine Bitcoin.

“Looks a lot more convincing 1732712443 and our large/mid caps have made some decent moves in terms of both USD and BTC pairs.”

The BTC.D is hovering at 58.61% at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Published

3 days agoon

November 26, 2024By

admin

A closely followed trader in the crypto space says there may be opportunities for select altcoins once Bitcoin (BTC) stabilizes.

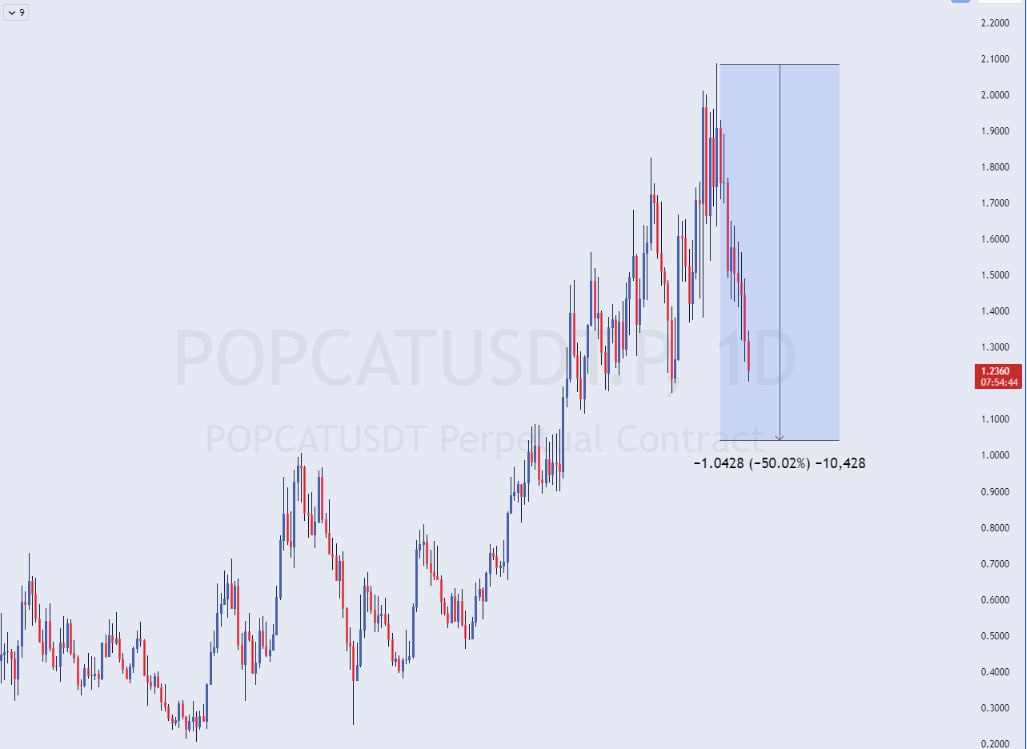

Pseudonymous analyst The Flow Horse tells his Telegram subscribers that the more liquid altcoins within the top 100 could present good entry points for bulls after their 50% dips.

The trader names cat-themed memecoin POPCAT as an example.

“Gentle reminder that alts probably can go a bit lower if Bitcoin does but after this type of mark up the 50% retracement level on liquid top 100 pairs is often a very good level to bid.

I would start creating filters and alerts for charts that are approaching their 50% retracement levels, Popcat is a good example.”

The Flow Horse also says that Celestia (TIA) and SEI are “good examples” of coins that are showing strength despite Bitcoin currently correcting and dragging much of the digital assets markets down with it.

The trader says it’s more than likely that BTC will consolidate under the $100,000 level, with some money flowing out of the risk curve into altcoins.

“Regardless of the near-term outcome, I think you can take one thing from BTC, no need to force anything here, BTC imo is more than likely going to take a little breather anyway before any real move above 100k.

Ideally, the market comes into agreement that we don’t have to worry about much lower prices, or that it doesn’t make sense to yet, and we can see some of the capital that does come out of Bitcoin go into alts.”

At time of writing, Bitcoin is trading at $94,201.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal/Vladimir Sazonov

Source link

Altcoins

Trader Warns of Potential XRP Correction, Says Dogecoin Trading at Most Likely Area To Expect Rejection

Published

3 days agoon

November 26, 2024By

admin

A crypto strategist is warning that two large-cap altcoins may witness deep corrective moves after massive rallies this month.

Crypto trader Credible tells his 473,800 followers on the social media platform X that payments-focused altcoin XRP looks primed for a pullback after completing a five-wave rally on the four-hour chart.

Credible practices Elliott Wave theory, which states that an asset may correct or consolidate after concluding a five-wave upside burst. During a five-wave rally, a bullish asset surges in waves one, three and five with waves two and four serving as corrective periods.

According to the trader, XRP needs to hold a crucial support level to maintain its bullish momentum.

“And that, ladies and gents, is a crystal clear five-wave impulsive move, subwaves and all on XRP.

This:

1. confirms our absolute bottom was in at $0.49.

2. means if we move below $1.05 (origin of the 5th subwave), then it means we are seeing a larger wave two correction underway before the next impulse (wave 3).

3. If we hold above $1.05, it would mean this fifth subwave is extending which would mean we will see $2+ before any major pullback.”

At time of writing, XRP is trading for $1.37, down over 7% on the day but up about 180% this month.

Looking at Dogecoin against Bitcoin (DOGE/BTC), the trader warns that the pair is hovering at levels where it will likely witness a downside move.

“The BTC pairing is now at HTF (high time frame) resistance – really the only major obstacle between us and new ATH (all-time high) on the BTC pairing – but also the most likely place to expect a rejection on the entire HTF historical chart if we are not ready for new highs yet…

In other words – if BTC doesn’t hold $94,000 and instead sees a correction back down into the $80,000s – then DOGE likely takes a big hit.”

At time of writing, DOGE/BTC is trading at 0.00000431 BTC worth $0.42.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

AI bot transfers $50k in crypto after user manipulates fund handling

Perpetual DEX Hyperliquid to Launch Native Token Following Bullish October

Ethereum Foundation Invests Millions Into zkVM, What’s Happening?

Cardano’s Hoskinson believe Bitcoin will surpass $250,000

BTC AT $97K, XRP Rises 7%, ALGO Surges 23%

Why Financial Advisors Must Adapt to Crypto or Risk Losing High-Net-Worth Clients

Major Bitcoin miners spent $3.6 billion on infrastructure

John Deaton Calls For Probe Into Operation Chokepoint 2.0

Solana whales back this new crypto as analysts predict 5,000% surge

Swiss Canton Bern Passes Bill To Probe Impact of Bitcoin Mining

Swiss lawmakers to study Bitcoin for power grid upgrade

Bitcoin Could Reach up to $500,000 Within 24 Months, Says Cardano Founder Charles Hoskinson – Here’s Why

Why Is The Worldcoin Price Up 20% Today, Rally To Continue?

Bybit x Block Scholes report

How High Can Shiba Inu Price Climb If Bitcoin Hits $100,000?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential