Ethereum

Ethereum enjoys price increase, ETF anticipation intensifies

Published

5 months agoon

By

admin

Ethereum (ETH) has experienced an over 15% price increase in the past two weeks. This surge has captured the attention of investors and analysts alike, highlighting the cryptocurrency’s resilience and potential amidst a turbulent crypto market environment.

Ethereum began an upward trajectory on July 10 as regulators seemed ready to approve spot Ether ETF applications.

On July 10, Ethereum led the charge with a 9% increase, reaching $3,680.98 and peaking at $3,835.43 earlier that day. Bitcoin also followed with a 2% rise, trading around $71,350.

Issuers and exchanges have reportedly updated their documents, indicating that the U.S. Securities and Exchange Commission (SEC) may be reconsidering its position on spot Ether ETFs. While it was previously thought that these funds would not be approved, final decisions on applications from VanEck and Ark Invest are now anticipated.

In May, the SEC approved updated 19b-4 filings for Ethereum ETFs, marking a significant step towards full approval. It is widely expected that the SEC will approve Ethereum ETFs sometime this year.

Ethereum’s price analysis reveals a dynamic trajectory influenced by market trends and investor sentiment. Currently priced at $3,492, Ethereum has seen a 1.8% increase in the past 24 hours. It is expected to fluctuate between $3,500 and $3,750 in the near term.

Since its inception, the cryptocurrency has seen significant fluctuations, peaking at an all-time high of $4,200.86 in May 2021.

Tornado Cash

Meanwhile, Tornado Cash — the Ethereum-based mixer — has seen a remarkable resurgence, attracting nearly $2 billion in deposits despite ongoing sanctions from the U.S. Office of Foreign Assets Control (OFAC).

Data from Flipside Crypto shows that Tornado Cash received around $1.9 billion in deposits in the first six months of this year, a 50% increase over the total deposits for all of 2023.

In August 2022, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash, a cryptocurrency mixer, for allegedly facilitating money laundering for cybercriminals, particularly North Korean hackers.

This action caused a dramatic decline in Tornado Cash’s activity, with volumes dropping by approximately 85% in 2023.

Despite sanctions, Tornado Cash has remained a tool for illicit actors. While North Korean hackers have largely shifted to traditional Bitcoin mixers, some continue to use Tornado Cash.

Source link

You may like

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

CryptoQuant

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Published

14 hours agoon

December 22, 2024By

admin

Amid a general crypto market price fall in the past week, Ethereum (ETH) recorded a price correction of over 19.5% finding support at a local bottom of $3,100. Since then, the prominent altcoin has only shown slight resilience rising by over 5% in the past two days. However, recent data on wallet activity provides much cause to be bullish on Ethereum’s long-term future.

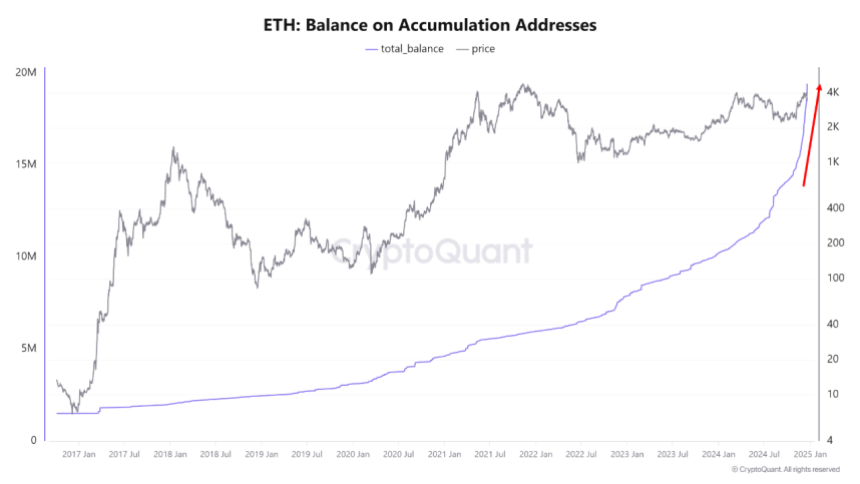

Ethereum HODL Addresses Increase Supply Dominance To 16%

In a recent QuickTake post, CryptoQuant analyst MAC_D shared some positive insights on the Ethereum market.

The crypto market expert reports that the balance of Ethereum Accumulation Addresses has surged by a remarkable 60% from August to December. During this time, these HODL wallets have boosted their portion of ETH supply from 10% to 16% i.e. 19.4 million ETH of 120 million ETH.

To explain, the Accumulation Addresses are wallets that hold Ethereum but rarely move or sell their holdings. They are considered a measure of long-term investment and confidence.

According to MAC_D, the rapid increase in these Ethereum HODL wallets’ holdings is a new development absent from previous bull cycles. The analyst attributed this massive accumulation rate to investors’ bullish expectations of the incoming Donald Trump administration in the US.

These expectations include more favorable regulations on the DeFi industry which represents a major sector of the Ethereum ecosystem. Therefore, regardless of Ethereum’s current price movement, these long-holding wallets are likely to keep increasing their holdings in anticipation of future price growth.

In addition, MAC_D emphasizes the importance of these Accumulation Addresses in that the price of Ethereum has never slipped below their realized price. Therefore, a continuous purchase by these wallets provides a high potential for a long-term price gain.

What’s Next For ETH?

In regards to Ethereum’s immediate movement, MAC_D warns that macroeconomic factors are likely to exert a stronger influence on ETH’s price in the short-term as illustrated by the recent price crash induced by potential reduced interest rate cuts in 2025.

At the time of writing, the altcoin trades at $3,352 following a 3.07% decline in the past 24 hours. In tandem, ETH’s daily trading volume is down by 53.25% and valued at $31.15 billion.

Following recent price falls, Ethereum also presents a negative performance on larger charts with losses of 14.74% and 1.05% in the past seven and thirty days, respectively. On a positive note, the asset’s price remains far above its initial price point ($2,397) at the start of the post-US elections price rally, indicating that long-term sentiment remains positive.

With a market cap of $401 billion, Ethereum continues to rank as the second-largest cryptocurrency and largest altcoin in the digital asset market.

Source link

24/7 Cryptocurrency News

How Low Will Ethereum Price Go By The End of December?

Published

18 hours agoon

December 22, 2024By

admin

In a recent analysis, crypto analyst Justin Bennett provided insights into how low the Ethereum price could drop by the end of December. This came as the analyst revealed that buyers need to step or ETH could enter next week with a bearish outlook.

How Low Ethereum Price Can Go By Year-End

In an X post, Justin Bennett suggested that the Ethereum price could drop to as low as $3,027 by year-end. While analyzing ETH’s daily chart, the analyst stated that ETH needs to flip $3,541 as support to turn bullish next week. If that doesn’t happen, he remarked there is a decent chance that Ethereum drops lower. The analyst’s accompanying chart showed that ETH could even drop to as low as $2,560 if it loses the $3,027 support level.

In an earlier X post, the crypto analyst stated that he is bullish on the Ethereum price based on the overall setup going into 2025. however, he believes that buyers still have work to do. He gave an example of how ETH needs to recover $3,540 on the weekly time frame to look bullish next week.

These buyers already look to be stepping in, as there has been an accumulation trend among ETH whales. Coingape reported that Ethereum whales are buying the dip as ETH eyes a quick rally to $4,000.

These whales have withdrawn 17,698 ETH worth $61.66 million from the crypto exchange Binance. Donald Trump’s World Liberty Financial has also gotten in on the act as the DeFi project accumulated more ETH on this dip.

Correction Might Be Over

In an X post, crypto analyst Titan of Crypto provided a more bullish outlook for the Ethereum price, stating that the correction might be over. The analyst made this statement based on his Ichimoku cloud analysis.

Titan of Crypto stated that Ethereum has retested both Tenkan and Kijun. He added that the worst-case scenario would be a retest of the Kumo Cloud SSB, Ichimoku’s strongest line.

According to a CoinGape market analysis, this might indeed be the last dip before ETH hits five digits. There are predictions that the Ethereum price could hit $15,937 by May 2025.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Altcoins

Trader Predicts ‘God Candle’ Breakout for Ethereum, Says New All-Time High Loading for One Memecoin

Published

4 days agoon

December 19, 2024By

admin

A popular crypto analyst thinks that Ethereum (ETH) is on the verge of printing a massive breakout rally also known as a god candle.

Pseudonymous analyst Inmortal tells his 221,100 followers on the social media platform X that Ethereum’s two-hour chart looks similar to Bitcoin’s (BTC) price action over the last two weeks.

The analyst says that while Ethereum struggles to clear resistance at $4,000, he notes that BTC also had trouble breaching $100,000 for weeks before surging to new all-time highs.

“Same price action, but with one difference.

God candle after the breakout.

ETH.”

Based on the trader’s chart, he seems to predict that ETH will surge close to its all-time high of $4,800 after the breakout. At time of writing, ETH is worth $3,892.

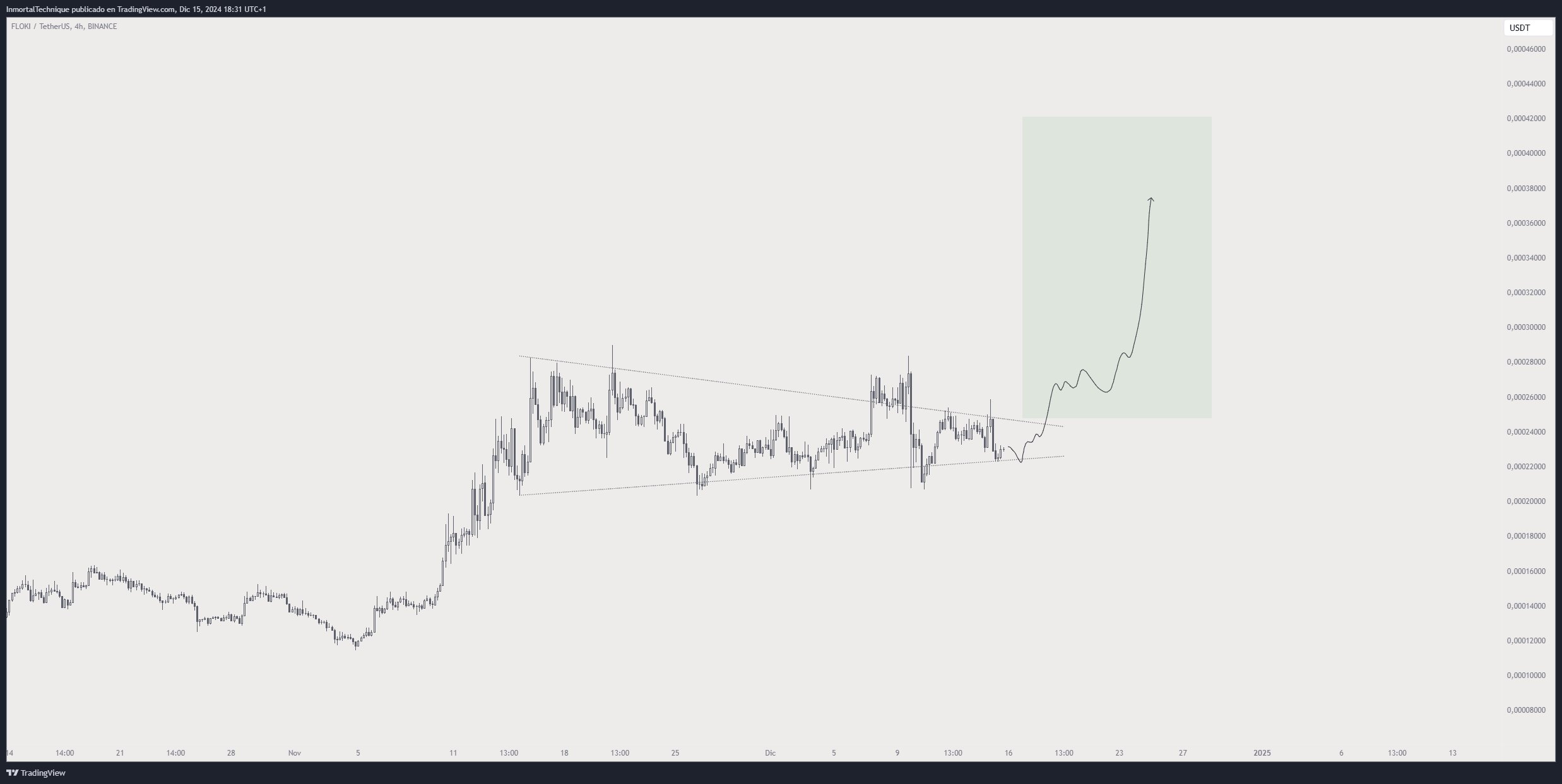

The trader also has his radar locked on the memecoin Floki (FLOKI). According to the trader, FLOKI appears to be trading in a symmetrical triangle pattern and is gearing up to shatter the structure’s diagonal resistance en route to new record highs.

“Second leg up – loading.

New ATH – loading.

Price discovery – loading.

FLOKI.”

Based on the trader’s chart, he seems to predict that FLOKI will explode to a new all-time high of $0.00038. At time of writing, FLOKI is worth $0.000219.

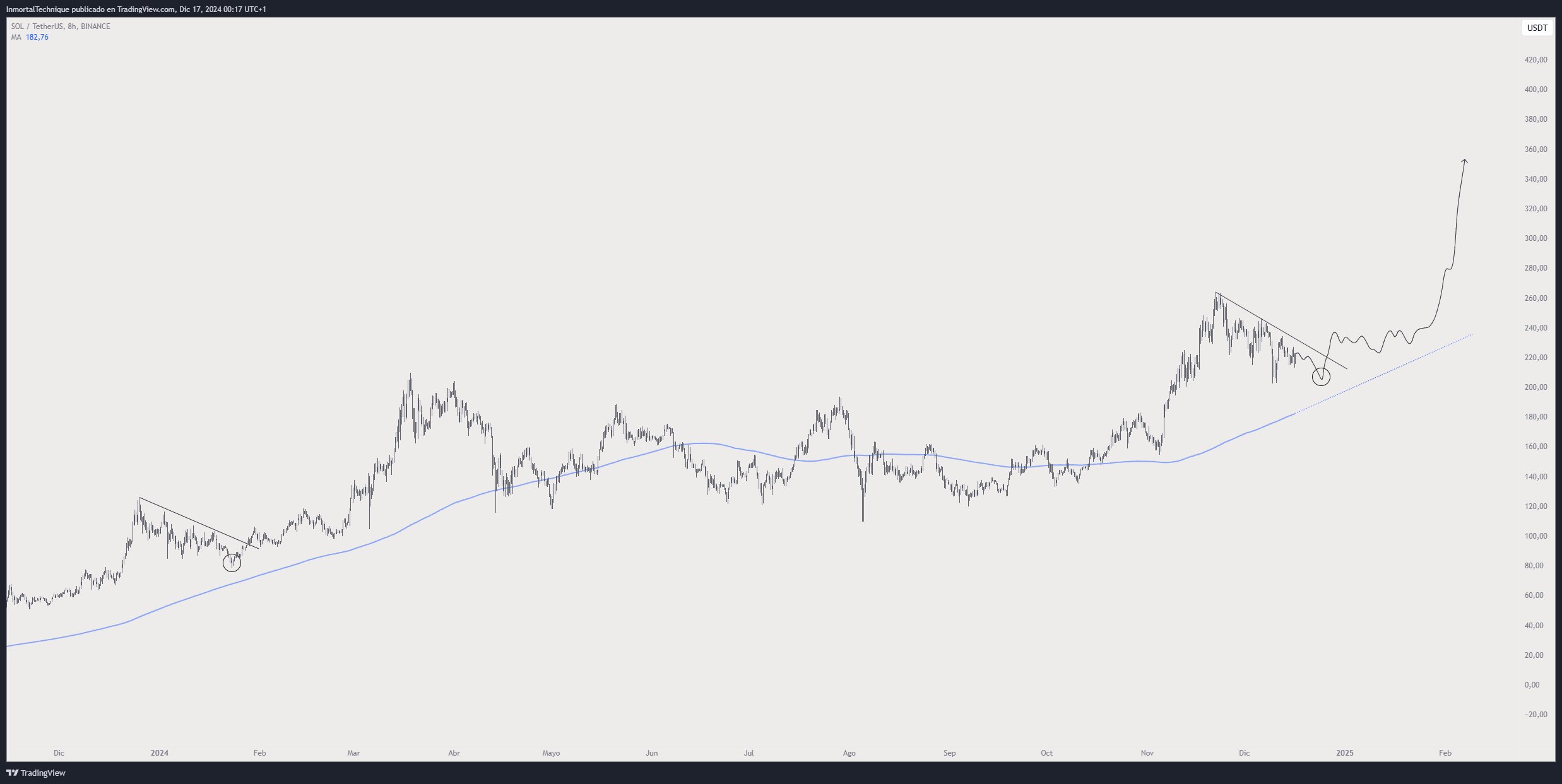

Looking at Solana (SOL), the trader sees the Ethereum rival bursting above its diagonal resistance to rally toward $300.

“Something like this.

SOL.”

At time of writing, SOL is worth $222.60.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

Filecoin, Monero, and Lunex dominate smart investor portfolios

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: