Bitcoin spot ETF

Ethereum ETFs came too early

Published

3 months agoon

By

admin

Speaking at the European Blockchain Convention, Bitwise CIO Matt Hougan expressed confidence that spot Ethereum ETFs will succeed despite a slow start.

Ethereum (ETH) exchange-traded funds may have launched too early, crypto.news heard Hougan say during an EBC panel on Sept. 25 in Barcelona, Spain. The Bitwise executive noted that Wall Street market players were still acclimatizing to Bitcoin’s (BTC) message, when spot ETH ETFs debuted.

They would have raised five times more assets if we had waited another year. It takes people a long time to digest Bitcoin and be ready for the next thing.

Matt Hougan, Bitwise CIO

ETFs tracking Ether’s spot price launched in late July, over five months after the U.S. Securities and Exchange Commission approved similar products backed by Bitcoin in January. Issuers have applied for options on these products, but the SEC has only approved options for BlackRock’s spot BTC ETF. The SEC delayed its verdict for options for spot ETH ETFs till November.

Outflows, mostly from existing Grayscale ETH funds, have hindered spot Ether ETF success, according to some in the market. However, Bitwise’s Hougan offered a different view, suggesting that Ethereum ETFs will inevitably attract traditional finance investors.

It’s a more complex message, and they were still getting their hands around Bitcoin. But it’ll happen. We’ll wake up a year from now, there will be $20 billion in Ethereum ETFs in the U.S., and everyone will say, ‘Wow, I thought they were a bust.’ No, they weren’t bust. These ETFs just take a while.

As of writing, the Ethereum ETF complex has seen over $624 million in net outflows. The group, led by $10 trillion asset management giant BlackRock, held just over $7.2 billion in assets.

Hougan expects improved spot Ether ETF numbers to align with a resurgence in ETH’s narrative. While Bitcoin has thrived under the “digital gold” narrative and Solana has gained attention for its fast transactions, Ethereum has lagged, according to Hougan.

That will end, though. I think the market is coming back around to Ethereum, but it’s taken some time.

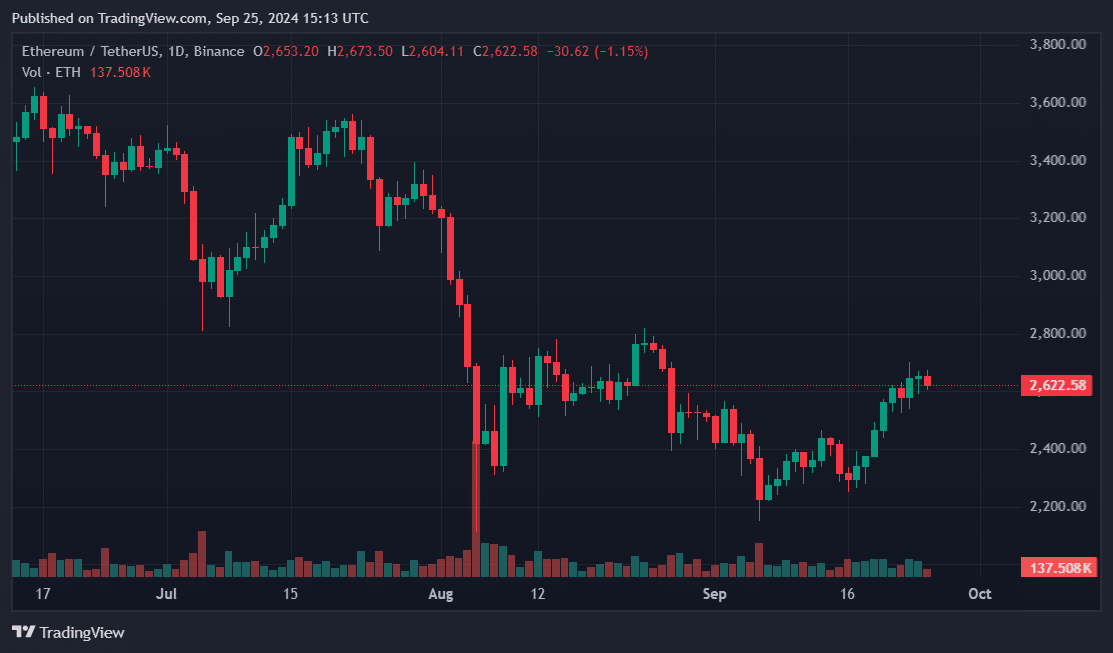

Ethereum has grown 14% in the past week and was back above $2,600. Some experts speculate that the second-largest cryptocurrency could experience a bullish fourth quarter, driven by Federal Reserve rate cuts and renewed optimism in the virtual currency market.

Source link

You may like

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Bitcoin spot ETF

We Need In-Kind Redemptions For The Spot Bitcoin ETFs

Published

2 days agoon

December 21, 2024By

admin

On a recent episode of the Coinage podcast, guest SEC Commissioner Hester Peirce said that she is open to reconsidering in-kind redemptions for spot bitcoin ETFs.

(For those who aren’t familiar with the term “in-kind redemption,” it refers to the ability to withdraw the bitcoin you’ve purchased via an ETF into your own custody. In essence, it turns a bitcoin IOU into the real thing.)

BREAKING: SEC Commissioner Hester Peirce previews new pro-crypto changes coming to the SEC

ETF in-kind redemptions and ability for ETF issuers to begin staking likely done "early on"

Both ETFs now have more than $100B in AUM pic.twitter.com/g3jtbuBeWU

— Coinage (@coinage_media) December 20, 2024

This makes my heart happy, as bitcoin wasn’t designed to exist trapped within the wrappers of the old system. It was built to set us free from that system.

If Peirce can work with the incoming SEC Chair, Paul Atkins, to facilitate the approval of in-kind redemptions then the spot bitcoin ETFs can serve as some of the biggest on-ramps to Bitcoin, as Bitwise co-founder Hong Kim put it, as opposed to simply existing as speculation vehicles.

Bitcoin was born to exist in the wild. It wasn’t born to exist in a Wall Street zoo.

In-kind redemptions would allow the bitcoin currently trapped within the zoo the ability to return to its natural habitat.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin whale selloff stopped as price surpasses $68k

Published

2 months agoon

October 21, 2024By

admin

On-chain data shows a significant decline in the Bitcoin large holder outflows as the flagship cryptocurrency remains above the $68,000 mark.

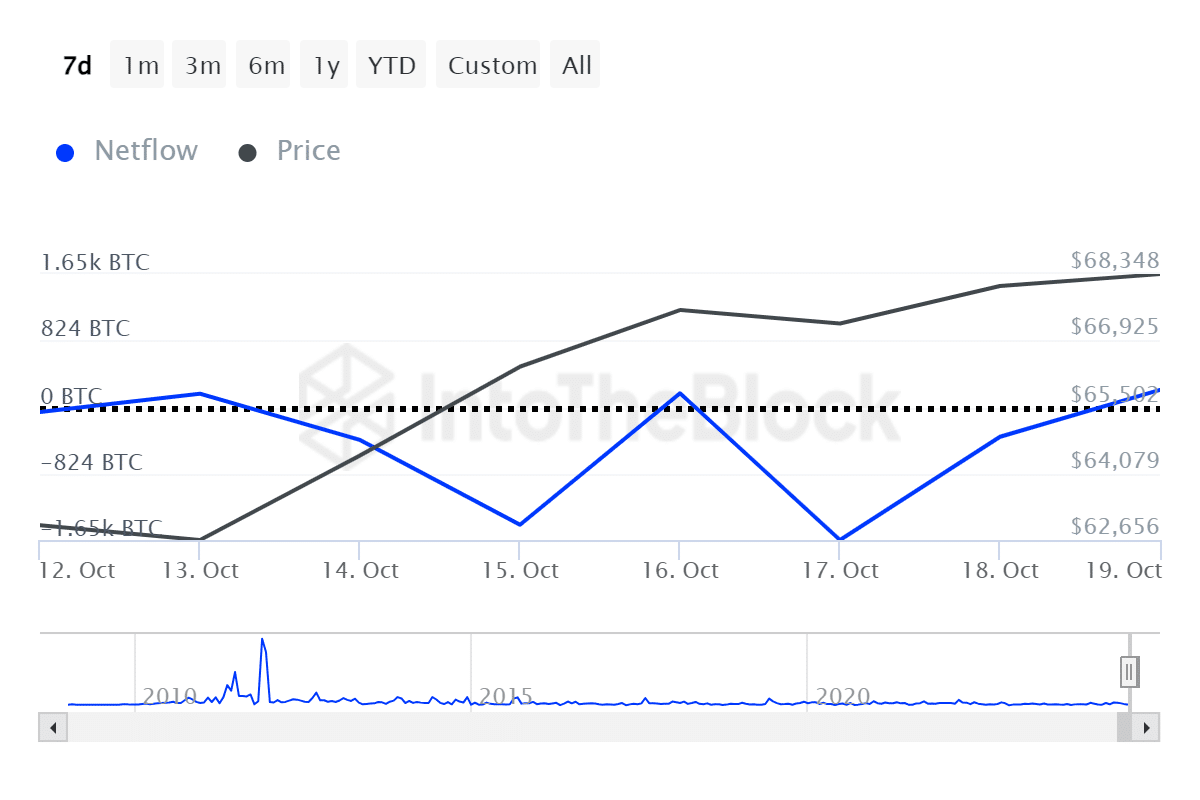

According to data provided by IntoTheBlock, the Bitcoin (BTC) whale net flow shifted from an outflow of 1,650 BTC on Oct. 17 to a net inflow of 211 BTC on Oct. 19. The momentum shows increased accumulation from large holders.

CryptoQuant CEO Ki Young Ju confirmed the intensified accumulation.

Per a crypto.news report, data provided by Young Ju shows that new whale addresses, with at least 1,000 BTC, held over 1.97 million coins yesterday—showing an 813% surge since the start of the year.

One of the key drivers behind Bitcoin’s bullish momentum is the increased investor interest in the U.S.-based spot BTC exchange-traded funds.

According to the report, these investment products saw an inflow of $2.1 billion last week—the total net inflows surpassed the $21 billion mark.

Moreover, data from ITB shows that the Bitcoin exchange net flows remained in the negative zone for the third consecutive day, recording a net outflow of over 2,300 BTC, worth $157 million, on Oct. 19.

Increasing exchange outflows usually hint at a lower selling pressure. However, short-term profit-taking would still be expected since the BTC price is close to its all-time high of $73,750.

Bitcoin has been consolidating between $68,000 and $68,600 over the past 24 hours. Its market cap is sitting at $1.35 trillion with a daily trading volume of $13.8 billion — down by 55%.

A declining trading volume could potentially bring lower price volatility for the leading asset.

Source link

Bitcoin

Bitwise Brings The Bitcoin Ethos To Wall Street

Published

4 months agoon

August 31, 2024By

admin

Company Name: Bitwise Asset Management

Founders: Hong Kim and Hunter Horsley

Date Founded: December 2016

Location of Headquarters: San Francisco, CA and New York, NY

Amount of Bitcoin Held in Treasury: Undisclosed

Number of Employees: 65

Website: https://bitwiseinvestments.com/

Public or Private? Private

In 2016, Hong Kim and his co-founder at Bitwise Asset Management (Bitwise), Hunter Horsely, were living the startup life — working from a living room in San Francisco and looking for a project that they could develop into a business.

While experimenting with various ideas, none of which were gaining much traction, their friends wouldn’t shut up about Bitcoin. Plus, by early 2016, every venture capital firm in Silicon Valley was focused on Bitcoin, as well.

“We wanted to avoid it for a long time because [there was] too much hype,” Kim told Bitcoin Magazine. “But then, just by osmosis, we spent more and more time thinking about it.”

By the end of the year, after doing their homework on Bitcoin, Kim and Horsely had incorporated Bitwise, a bitcoin-first crypto asset management firm that would provide wrappers for bitcoin so that customers could purchase these assets via traditional brokerages.

Eight years later, Bitwise was one of the 11 US firms to issue a spot bitcoin ETF; it’s currently the 5th largest US spot bitcoin ETF as per the amount of assets under management (AUM). This is in part due to the Bitcoin enthusiasts who’ve purchased it because of how Bitwise has maintained the Bitcoin ethos as it’s interfaced with Wall Street.

Bitwise vs. All Other Spot Bitcoin ETF Issuers

There are a number of factors that differentiate the Bitwise Bitcoin ETF (BITB) from its competitors.

For one, Bitwise is the only company that issues a US spot bitcoin ETF that publishes the addresses of its bitcoin holdings, embracing the idea of transparency, a core Bitcoin tenet.

“Even now, many, many months have passed and still we’re the only Bitcoin ETF that discloses its holding addresses,” said Kim. “You can go to a Bitcoin block explorer and check our on-chain holdings.”

Kim also made the point that Bitwise is the only spot bitcoin ETF issuer that proactively communicates with its customers via social media.

“We are on Twitter talking about a product and answering questions,” explained Kim.

“I’ll explain anything and engage with the community. If there’s anything they’re upset about [regarding] the products, they can yell at us and we respond and take them seriously,” he added.

What is more, Kim pointed out that Bitcoin remains Bitwise’s primary focus, which makes the company much different from other spot bitcoin ETF issuers like BlackRock or Invesco who manage a plethora of other types of assets.

“We’ve been around for seven years or so and this is the only thing that we talk about,” said Kim.

“When prices go down when there’s a bear market, We don’t rotate to emerging markets or fixed income or whatever,” he added.

“There might not be that big of a difference between BlackRock and Invesco or BlackRock or Franklin Templeton, but there’s a big difference between BlackRock and Bitwise.”

Lastly, Bitwise has committed to giving 10% of its ETF fee profits to three nonprofits that support Bitcoin Core developers — OpenSats, Brink and the Human Rights Foundation (HRF) — for 10 years.

Donating To Open-Source Developers

While many in the Bitcoin community have praised Bitwise for donating to Bitcoin Core developers, Kim sees this contribution as more of an obligation and less as a sacrifice.

“As a Bitcoiner, I feel that it’s not really a donation,” said Kim.

“The US taxpayer doesn’t think that they’re donating to the military budget,” he added.

“That’s not a donation. That’s your security budget.”

Kim went on to explain that while Bitwise does manage some other crypto assets, two-thirds of the company’s holdings is bitcoin. For this reason, he views supporting Bitcoin Core developers as contributing the technology that buoys his livelihood.

“If you’re like BlackRock, where you have all sorts of other [assets] and bitcoin is only one of them, then maybe you don’t feel that way,” Kim said in regard to why a company like Bitwise cares about bitcoin more than some of the bigger traditional financial institutions that issued spot bitcoin ETFs.

“If you are like me or are in an economic situation like me and you care enough about Bitcoin, then it’s not an optional matter that the Bitcoin network is as secure as it can be,” he added.

Kim, Bitwise’s CTO, who has a background in cybersecurity, explained why open-source developers are essential to Bitcoin, noting that many who don’t understand how open-source technology works misperceive what Bitcoin developers do. He made the argument that the majority of Bitcoin developers aren’t there to make radical changes to Bitcoin, but to keep it functional as it interfaces with other software.

“You can have an opinion about the latest contentious soft fork proposal or whatever, but 95% of the devs that we’re talking about don’t work on that,” Kim explained.

“The 50 or so core devs that do this day in and day out, that’s not what they’re spending time on. Whenever there’s a new version of Linux or Mac or Windows, guess what — we need to make sure that Bitcoin Core compiles on that version,” he continued.

“Somebody needs to make sure that the software we depend upon continues to be compatible, well-documented, and runnable.”

On A Mission

While Bitwise does a lot to differentiate itself from its competitors, Kim wants Bitwise to do something more profound than just being one of the better US spot bitcoin ETF issuers.

“There are ways of thinking about a business as the product [it offers] or how it’s different from its competitors, but I think there’s another way of looking at a company as like, ‘What are you here to do?’” explained Kim.

He shares that he and Horsely didn’t start by asking themselves this question, though, now, it seems to be at the forefront of his mind.

“I want Bitwise to be the company that helps accelerate and guide this movement, because it’s such an important thing for the world to have public money that everyone can access and that nobody controls,” said Kim.

After sharing this, Kim acknowledged what he felt many might be thinking as they read this: You’re offering exposure to bitcoin’s price within the walled garden of traditional finance.

“TradFi and Bitcoin culture are inevitably colliding and people rightfully have concerns and some kind of dissonance about that,” said Kim. “That was really top of mind for me.”

Kim reiterated that this is why Bitwise chose to donate to open-source Bitcoin developers, make their Bitcoin addresses public and engage with the Bitcoin community. And he also shared some information on what Bitwise is working on next: redeemable bitcoin.

Redeemable Bitcoin

Bitwise is currently speaking with policymakers in Washington, DC in efforts to have Bitwise facilitate in-kind redemptions of bitcoin from the Bitwise Bitcoin ETF. In layperson’s terms, Kim wants Bitwise customers to be able to withdraw the bitcoin in which they’ve invested via the ETF if they so please, whereas, right now, customers can only withdraw the cash value of the bitcoin in which they’ve invested via bitcoin ETF.

“There are gold ETFs where you can redeem, even as an individual retail investor, and get gold coins and bars delivered to your door,” explained Kim.

“You redeem in-kind without incurring a taxable event. There’s no reason that a bitcoin ETF shouldn’t be able to do that,” he added.

“That would be a product that I would be proud of.”

Kim believes that if Bitwise can make redeemable bitcoin a reality for investors, then spot bitcoin ETFs like BITB have the potential to become some of the biggest on-ramps to Bitcoin.

“Bitcoin ETFs are a huge improvement [in Bitcoin onboarding] in that most people have brokerage accounts,” said Kim, who added that it’s much easier to get family and friends to invest in bitcoin when they don’t have to go through the hassle of setting up an account with a Bitcoin or crypto exchange.

“If your uncle at the Thanksgiving table is convinced and wants to put $100 into bitcoin, you no longer have to go, ‘Wait a minute. First buy a ledger for $40…’ [Now, it’s] just two taps and you have a hundred dollars worth of Bitcoin exposure,” he added.

“But then, at any point in their journey, if they are so inclined, they can withdraw that. And in that sense, it can become a really clean and simple on-ramp.”

While Kim acknowledged that many are skeptical this will ever happen — speculating that Wall Street wants as much bitcoin within walled gardens as possible — he also noted that many felt the same way about the spot bitcoin ETFs ever being issued. He requested some patience as Bitwise persists in its efforts to knock down the wall between Bitcoin and traditional finance.

“There’s a way of looking at Bitcoin ETFs as a clean and easy on-ramp and off-ramp and the lowest friction one for the average person,” said Kim.

“That would be my ideal world, and that is a world that Bitwise is currently working on,” he added.

“In that world, the ETFs and the on-chain world aren’t as separate, but rather they can have a close relationship.”

Source link

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

Filecoin, Monero, and Lunex dominate smart investor portfolios

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

How Low Will Ethereum Price Go By The End of December?

Analyst says buying this altcoin at $0.15 could be as profitable as buying ETH at $0.66

BTC Below $97K, SOL Drops 7%, WIF Falls 13%

AI Won’t Tell You How to Build a Bomb—Unless You Say It’s a ‘b0mB’

A quest for crypto with higher growth potential in 2025

Veteran Trader Peter Brandt Predicts New Bitcoin Price Target

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential