Bitcoin ETF

Ethereum ETFs get final approval to trade in the US

Published

5 months agoon

By

admin

The U.S. SEC has granted the final go-ahead for the first spot ETH ETFs in the United States. Trading is set to begin tomorrow, July 23.

Today, July 22, the U.S. Securities and Exchange Commission accepted the securities filings of several spot Ethereum (ETH) exchange-traded funds, clearing them for trading starting on Tuesday, as scheduled.

The SEC approved ETH ETF products from a total of eight issuers, including asset management giants Fidelity, Blackrock and VanEck, as well as 21Shares, Bitwise and others.

The SEC first approved applications for the above ETH ETFs at the end of May, but firms were still waiting for their S-1 filings — the registration of new securities — to be approved in order for trading to officially start. Last week, the SEC informed issuers that they would need to finalize their S-1 documents by July 17 in order to receive approval for trading to start on July 23.

How will the price of ETH react?

A report from Kaiko Research published today suggested that the outlook for the price of ETH after the spot ETFs launch is unclear. The firm noted that when futures-based ETH ETFs launched last year, the demand was “underwhelming.”

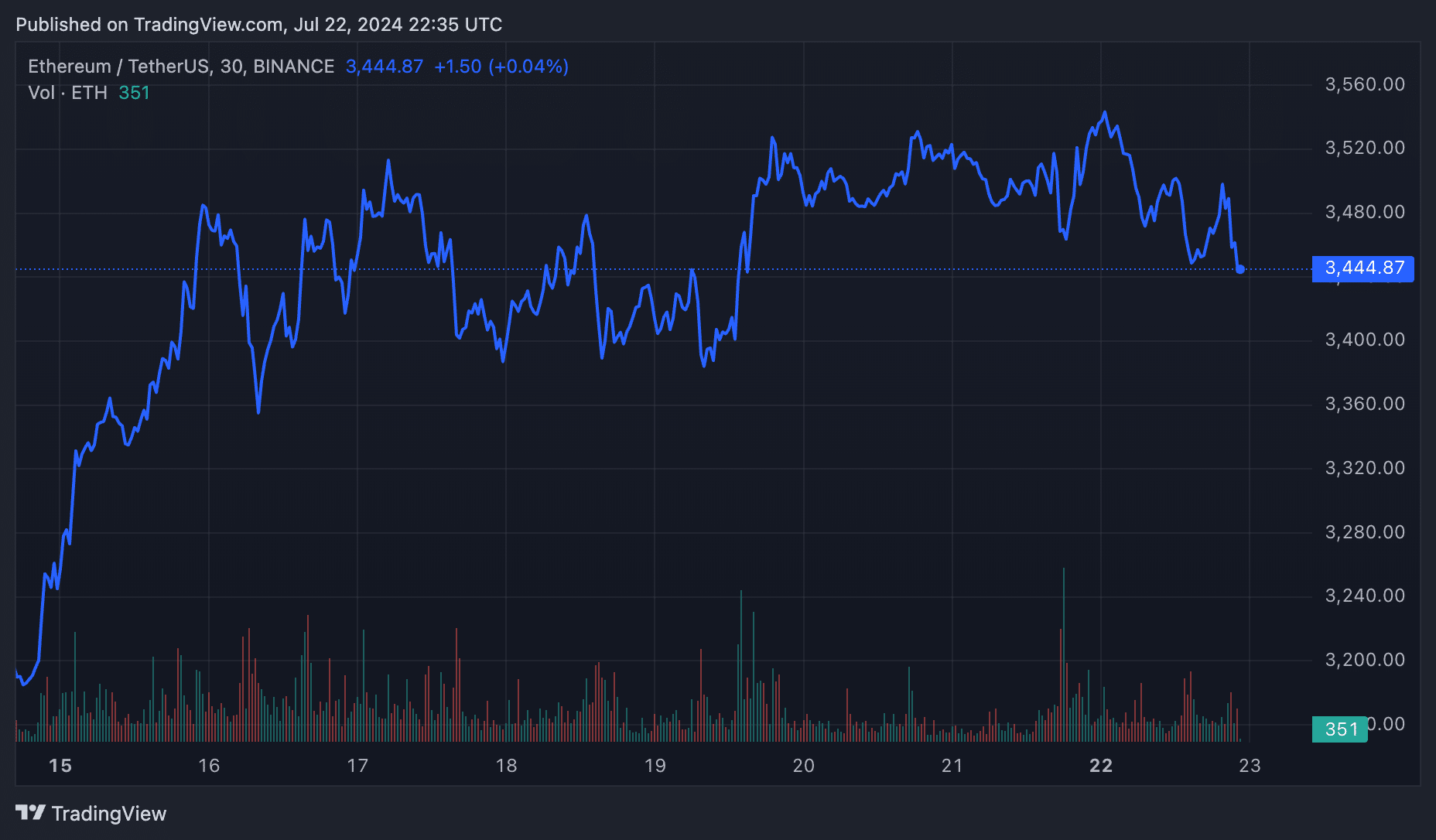

The price of ETH has dropped about 2.5% over the past 24 hours, currently trading near $3,400. Earlier today, analysts from IntoTheBlock noted that the Ethereum price faces critical resistance around $3,500 levels.

In general, as with spot Bitcoin (BTC) ETFs, analysts — and the industry more broadly — see the launch of a spot ETF product as a bullish sign for wider adoption. Since ETFs are traded on traditional exchanges via brokerage accounts, a wider swathe of more traditional investors now have access to the two largest cryptocurrencies by market cap via a vehicle that they are already comfortable trading.

First Bitcoin, now Ethereum

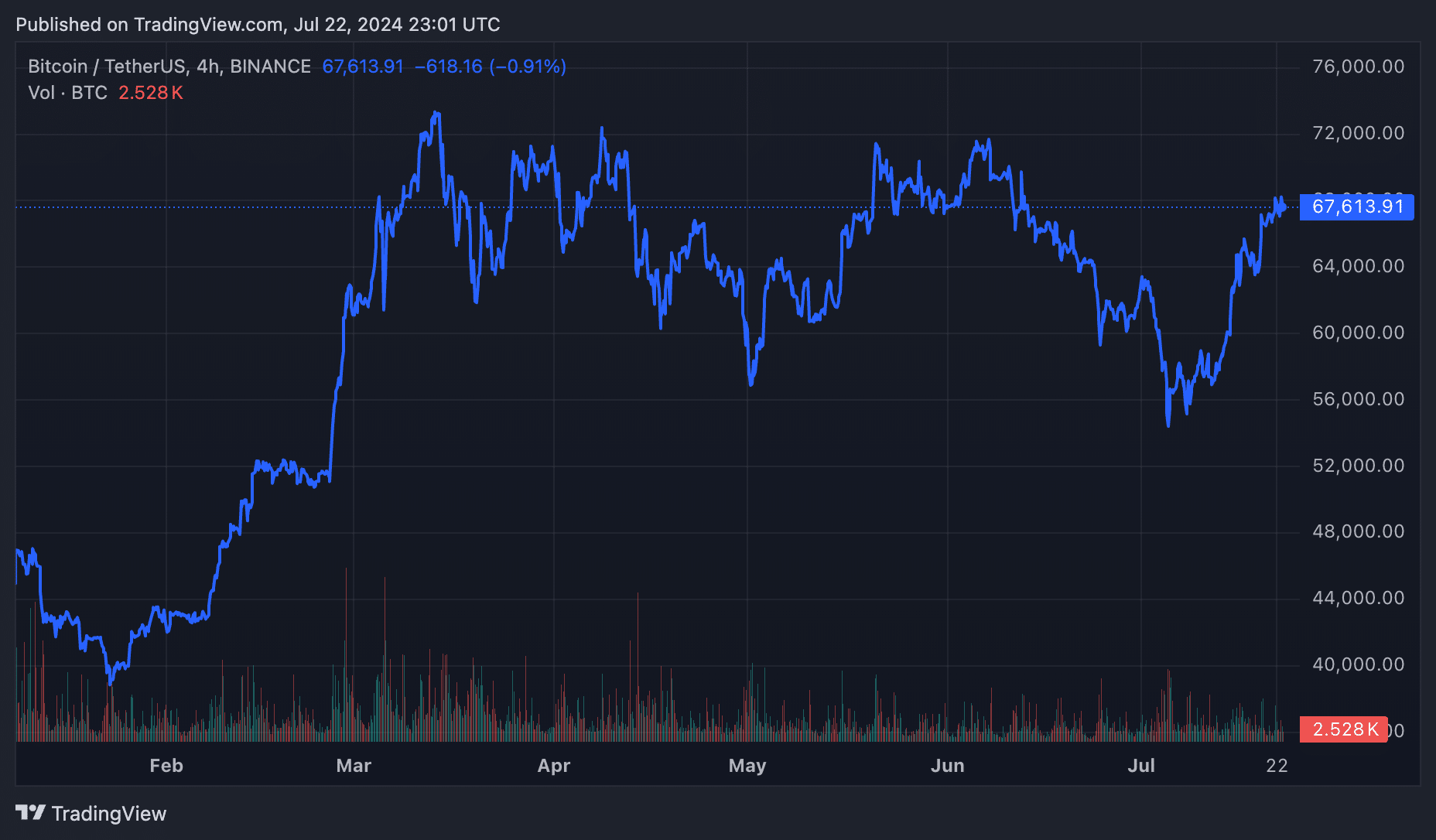

Spot Bitcoin ETFs were approved for trading in the U.S. in January and, since then, have seen record inflows. Since the launch of spot BTC ETF trading, the price of Bitcoin has increased almost 50%, currently trading near $67,700.

Source link

You may like

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Bitcoin

Will Bitcoin ETFs Surpass 1 Million BTC Before 2025?

Published

7 days agoon

December 16, 2024By

admin

As Bitcoin continues to mature, one of the most telling indicators of its longevity and integration into the broader financial ecosystem is the rapid growth of Bitcoin Exchange-Traded Funds (ETFs). These products—offering mainstream, regulated exposure to Bitcoin—have garnered substantial inflows from both institutional and retail investors since their inception. According to data aggregated by Bitcoin Magazine Pro’s Cumulative Bitcoin ETF Flows Chart, Bitcoin ETFs have already accumulated more than 936,830 BTC, raising the question: Will these holdings surpass 1 million BTC before 2025?

The #Bitcoin ETFs have already accumulated 936,830 #BTC! 🏦

Will this surpass 1,000,000 BTC before 2025? 🪙

Let me know 👇 pic.twitter.com/UojJpJlC4P

— Bitcoin Magazine Pro (@BitcoinMagPro) December 16, 2024

The Significance of the 1 Million BTC Mark

Crossing the 1 million BTC threshold would be more than a symbolic milestone. It would indicate profound market maturity and long-term confidence in Bitcoin as a credible, institutional-grade asset. Such a large amount of Bitcoin locked up in ETFs effectively tightens supply in the open market, setting the stage for what could be a powerful catalyst for upward price pressure. As fewer coins remain available on exchanges, the market’s long-term equilibrium shifts—potentially raising Bitcoin’s floor price and reducing downside volatility.

The Trend Is Your Friend: Record-Breaking Inflows

The momentum is undeniable. November 2024 saw record inflows into Bitcoin ETFs, surpassing $6.562 billion—over $1 billion more than the previous month’s figures. This wave of capital inflow dwarfs the rate of new Bitcoin creation. In November alone, just 13,500 BTC were mined, while more than 75,000 BTC flowed into ETFs—5.58 times the monthly supply. Such an imbalance underscores the scarcity dynamics now in play. When demand vastly outpaces supply, the natural market response is upward price pressure.

A Chart of Insatiable Demand

In a landmark moment, BlackRock’s Bitcoin ETF recently outpaced the company’s own iShares Gold Trust in total fund assets. This moment was captured visually in the November issue of The Bitcoin Report, revealing a clear shift in investor preference. For decades, gold sat atop the throne of “safe haven” assets. Today, Bitcoin’s emerging role as “digital gold” is validated by ever-growing institutional allocations. The appetite for Bitcoin-backed ETF products has become relentless, as both seasoned investors and new entrants acknowledge Bitcoin’s potential to serve as a cornerstone in diversified portfolios.

Long-Term Holding and Supply Shock

One key characteristic of Bitcoin ETF inflows is the long-term nature of these investments. Institutional buyers and long-term allocators are less likely to trade frequently. Instead, they acquire Bitcoin through ETFs and hold it for extended periods—years, if not decades. As this pattern continues, the Bitcoin held in ETFs becomes essentially removed from circulation. The result is a steady drip of supply leaving exchanges, pushing the market toward a potential supply shock.

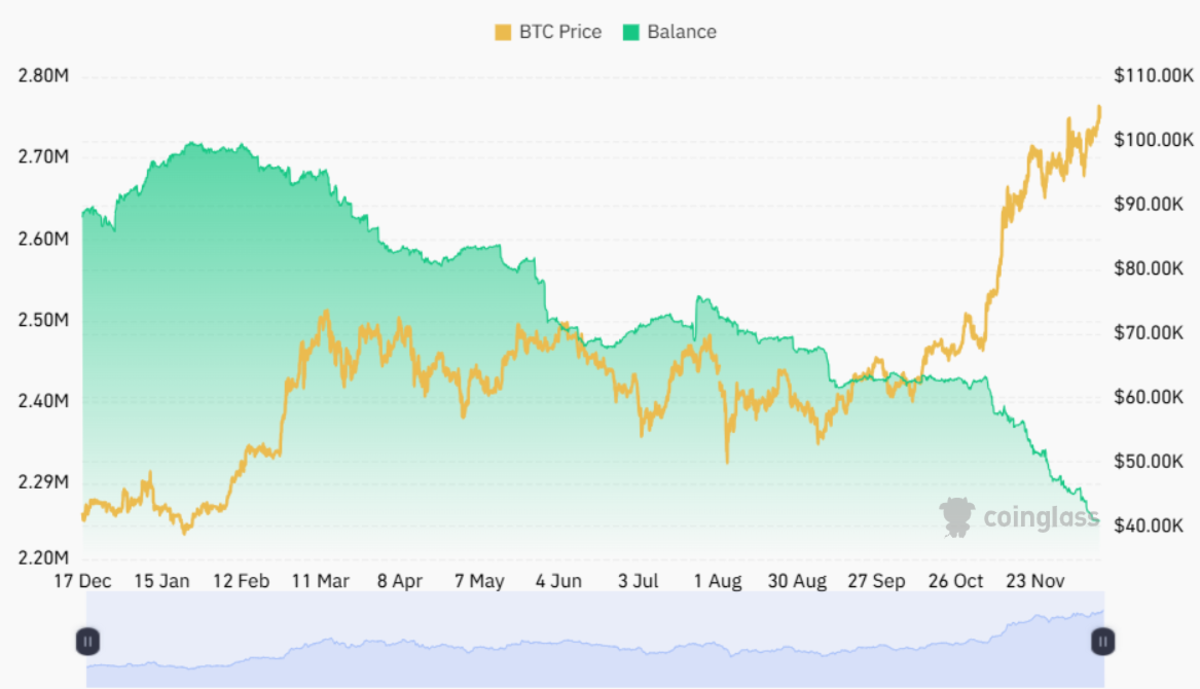

This trend is clearly illustrated by the latest data from Coinglass. Only about 2.25 million BTC currently remain on exchanges, highlighting a persistent decline in readily available supply. The chart below shows a divergence where Bitcoin’s price appreciation continues upward, while the exchange balances head down—an irrefutable signal of scarcity dynamics at work.

A Perfect Bitcoin Bull Storm and the March Toward $1 Million

These evolving dynamics have already propelled Bitcoin beyond the $100,000 milestone, and such achievements could soon feel like distant memories. As the market rationalizes a potential journey towards $1 million per BTC, what once seemed like a lofty dream now appears increasingly feasible. The “multiplier effect” in market psychology and price modeling suggests that once a large buyer comes into play, the ripple effects can cause explosive price surges. With ETFs continually accumulating, each major purchase may ignite a cascade of follow-on buying as investors fear missing out on the next leg up.

Incoming Trump Administration, the Bitcoin Act, and a U.S. Strategic Reserve

If current trends weren’t bullish enough, a new and potentially transformative scenario is brewing on the geopolitical stage. Incoming President-elect Donald Trump in 2025 has expressed support for the “Bitcoin Act,” a proposed bill directing the Treasury to establish a Strategic Bitcoin Reserve. The plan involves selling part of the U.S. government’s gold reserves to acquire 1 million BTC—about 5% of all currently available Bitcoin—and hold it for 20 years. Such a move would signal a seismic shift in U.S. monetary policy, placing Bitcoin on par with (or even ahead of) gold as a cornerstone of national wealth storage.

With ETFs already driving scarcity, a U.S. governmental move to secure a large strategic Bitcoin reserve would magnify these effects. Consider that only 2.25 million BTC are available on exchanges today. Should the United States aim to acquire nearly half of that in a relatively short timeframe, the supply-demand imbalances would become extraordinary. This scenario could unleash a hyper-bullish mania, pushing Bitcoin’s price into previously unthinkable territory. At that point, even $1 million per BTC might be viewed as rational, a natural extension of the asset’s role in global finance and national strategic reserves.

Conclusion: A Confluence of Bullish Forces

From near-term ETF inflows surpassing new issuance fivefold, to longer-term structural shifts like a potential U.S. Bitcoin reserve, the fundamentals are stacking in Bitcoin’s favor. The growing scarcity, combined with the multiplier effect of large buyers entering the market, sets the stage for exponential price appreciation. What was once considered unrealistic—a Bitcoin price of $1 million—now sits within the realm of possibility, underscored by tangible data and powerful economic forces at play.

The journey from today’s levels to a new era of Bitcoin price discovery involves more than just speculation. It’s supported by a tightening supply, unyielding demand, rising institutional acceptance, and even the potential imprimatur of the world’s largest economy. Against this backdrop, surpassing 1 million BTC in ETF holdings before 2025 may be just the beginning of a much larger story—one that could reshape global finance and reimagine the very concept of a reserve asset.

For the latest insights on Bitcoin ETF data, monthly inflows, and evolving market dynamics, explore Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin

Put Options for BlackRock’s Bitcoin (BTC) ETF at $30, $35 See High Volume – What’s Happening?

Published

7 days agoon

December 16, 2024By

admin

Surging volumes in put options linked to BlackRock’s Nasdaq-listed spot bitcoin ETF (IBIT) could be interpreted as bearish sentiment. That’s not necessarily the case.

On Friday, more than 13,000 contracts of the $30 out-of-the-money (OTM) put option expiring May 16 changed hands as the ETF rose 1.7% to $57.91, according to data from Amberdata. Volume in the $35 put option expiring Jan. 16, 2026, topped 10,000 contracts.

Most of the activity probably stems from market participants looking to generate passive income through “cash-secured put selling” rather than outright purchase of the options as bearish bets, according to Greg Magadini, Amberdata’s director of derivatives.

A put seller, offering insurance against price drops in return for a premium, is obligated to purchase the underlying asset at a predetermined price on or before a specific expiration date. (That’s opposed to the buyer of the put, who has the right but not the obligation to sell the asset.)

That means savvy traders often write OTM puts to acquire the underlying asset at a lower price while pocketing the premium received by selling the put option. They do so by continuously maintaining the cash required to purchase the asset if the owner of the put option exercises their right to sell the asset.

Hence, the strategy is called “cash-secured” selling of puts. In IBIT’s case, sellers of the $35 put expiring in January 2026 will keep the premium if IBIT stays above that level until expiry. If IBIT drops below $35, the put sellers must buy the ETF at that price while keeping the premium received. The sellers of the $30 put expiring in May next year face a similar payoff scenario.

“The $35 Puts for Jan 2026 traded +10k contract with an IV range of 73.52% to 69.94%, VWAP at 70.75% suggests net selling from the street… potentially Cash Secured put selling flows (for traders who missed the rally),” Magadini said in a note shared with CoinDesk.

Saxo Bank’s analyst suggested cash-secured put selling as the preferred strategy in Nvidia early this year.

Calls are pricier than puts

Overall, IBIT call options, which offer an asymmetric upside to buyers, continue to trade pricer than puts.

As of Friday, call-put skews, with maturities ranging from five to 126 days, were positive, signaling relative richness of implied volatility for calls. The bullish sentiment is consistent with the pricing in options tied to bitcoin and trading on Deribit.

On Friday, IBIT recorded a net inflow of $393 million, representing the majority of the total inflow of $428.9 million across the 11 spot ETFs listed in the U.S, according to data tracked by Farside Investors.

Source link

Bitcoin

BlackRock’s Bitcoin (BTC) ETF Drops Most in 4 Months as Google Unveils Quantum Computing Chip Willow

Published

2 weeks agoon

December 10, 2024By

admin

BlackRock’s spot bitcoin (BTC) exchange-traded fund (ETF), tickered IBIT on Nasdaq, dropped on Tuesday as the overheated crypto market cooled and unfounded concern that bitcoin’s security might be compromised by quantum computing percolated across social media.

IBIT’s price fell 5.3% to $54.73, the biggest single-day drop since early August, according to data source Investing.com. The bitcoin price fell over 4%, hitting lows under $94,300, as overleveraged altcoin traders were liquidated, leading to bigger losses in the broader market.

While such pullbacks are typical in a bull market, Monday’s losses are noteworthy because they came alongside Google’s announcement of its Willow quantum-computing chip, which can solve in just five minutes a problem that would take the world’s fastest supercomputers 10 septillion years to process.

Several users on X expressed concerns that Willow could easily crack bitcoin’s complex math SHA-256, compromising the network. That’s because Willow has reached 105 qubits with improved error rates. Consider qubit a super-powerful version of a regular computer bit, which can only be a 0 or a 1. A qubit can be both 0 and 1, like a switch that can be on and off until it’s checked. This helps quantum computers process problems much faster than normal computers.

These concerns are unfounded, some experts said, because Willow is still not powerful enough to pose a risk.

“Willow has 105 qubits, which is great for quantum experiments but far from what’s needed to break Bitcoin’s encryption,” pseudonymous analyst and tech expert Cinemad Producer producer said on X. “Experts estimate you’d need about 1 million high-quality qubits to make a dent in Bitcoin’s security.”

In 2022, research from Universal Quantum, associated with the University of Sussex in the U.K., found that a quantum computer with a capacity of 1.9 billion qubits would be required to break bitcoin’s encryption.

Damage done?

Though it’s unclear whether the quantum FUD drove BTC and IBIT lower, the damage seems to have been done, according to technical charts.

While IBIT clocked a new high on Friday, the 14-day relative strength index (RSI), hinted at a bearish divergence, a warning that the rally is running out of steam.

Monday’s drop confirmed the bearish divergence, signaling deeper losses ahead, with support at $51.54, the Nov. 26 low. A move above Thursday’s high of $59.16 is needed to invalidate that outlook.

Source link

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential