Ethereum

Ethereum ETFs see $341.8m net outflows in first week, triggered by Grayscale’s ETHE

Published

5 months agoon

By

admin

U.S. spot Ethereum exchange-traded funds have had a mixed start this week, with net inflows into most ETFs overshadowed by significant net outflows from Grayscale’s converted fund, ETHE.

Data from Farside Investors shows that spot Ethereum (ETH) ETFs saw just over $162 million in total outflows on Friday, July 26, marking the third consecutive day of net negative flows. In contrast, spot Bitcoin (BTC) ETFs recorded $51.8 million in net inflows on the same day, continuing a trend of positive flows for three days straight.

The first ever spot Ethereum ETFs in the U.S. — nine products from eight issuers — started trading on Tuesday, July 23, following their approval by the Securities and Exchange Commission in May.

ETH ETFs’ first week

In the first week of trading, most of the newly launched Ethereum ETFs saw positive inflows, except for Grayscale’s ETHE, which experienced $1.51 billion in net outflows. ETHE’s outlfows have resulted in an overall weekly outflow of $341.8 million for the ETFs.

BlackRock’s ETHA led the pack in terms of inflows, generating $442 million worth of net inflows, followed by Bitwise’s ETHW with $265.9 million and Fidelity’s FETH with $219.4 million.

VanEck’s ETHV and Franklin Templeton’s EZET saw smaller inflows of $35.4 million and $23.3 million, respectively. 21Shares’s CETH received an inflow of $7.5 million only on launch day and saw zero inflows on the following three trading days.

Grayscale’s two Ethereum ETFs, explained

Major crypto asset manager Grayscale has introduced two spot Ethereum funds to the markets this past week, trading under the tickers ETHE and ETH. The Grayscale Ethereum Trust, ETHE, was initially launched in 2017 as a private placement, meaning it was only available to select investors and institutions in the U.S. Since 2019, the shares of the Ethereum Trust have been publicly traded OTC under the ticker ETHE. OTC trading of ETHE came with a 6-month holding period. However, since ETHE was converted to a spot Ethereum ETF last week, investors gained the ability to sell their holdings more freely.

The 2.5% management fee for ETHE — which is relatively quite high compared to fees of 0.25% or less from other ETF issuers — has driven investors to switch to competing products with lower fees, spurring the outflows from Grayscale’s fund. This situation is very much similar to what happened with Grayscale’s Bitcoin Trust (GBTC), which was also converted to a BTC ETF in January and then saw over $5 billion in outflows in its first month post-conversion.

Likely in expectation of this dynamic, Grayscale launched another ETF product this week, the Ethereum Mini Trust (under the ticker ETH). The new product boasts a competitive fee of 0.15%, positioning it as one of the most affordable spot Ethereum funds in the U.S. In contrast to ETHE, Grayscale’s Mini Trust saw inflows every trading day this past week, for a total of $164 million.

Grayscale’s ETHE, which held around $10 billion in assets (2.9 million ETH) before its conversion to an ETF, allocated $9.2 billion to its ETHE ETF product and just over $1 billion to its ETH fund.

The ETHE outflows, coupled with a more than 6% drop in the price of Ethereum since the ETFs launched, have reduced Grayscale Ethereum Trust’s assets under management to approximately $7.46 billion (2.28 million ETH), as reported on its fund page.

Ethereum ETFs vs Bitcoin ETFs: first week

It’s still early days, and if Grayscale’s spot Bitcoin ETF pattern is an indicator, the net outflows for ETHE might slow down. However, with an average net outflow of around $378 million per trading day this past week, ETHE’s assets could be depleted within a month.

In terms of the Grayscale effect, a significant difference between GBTC and ETHE is that GBTC shares were trading at a discount to the price of spot BTC when the GBTC ETF product launched. In contrast, ETHE’s “discount” — or the difference between the price of an ETHE share and the spot price of ETH — had closed by the time the spot Ethereum ETFs went live, partly explaining the stronger incentive to exit the fund.

Additionally, Bitcoin’s price had surged considerably before the spot Bitcoin ETFs launch in January, nearly doubling after approval expectations increased in October. In contrast, the price of Ethereum has been declining, falling more than 15% since the spot Ethereum ETFs were first approved on May 23.

“The major difference to me is the comparatively massive ETHE outflow. I think GBTC didn’t have that on day one because it was still at a meaningful discount when it launched,” noted James Seyffart, a Bloomberg ETF analyst, when comparing the outflows of the two products.

The the nine newly launched Ethereum ETFs saw total net inflows of $106.7 million on their first trading day, July 23, compared to $628 million in inflows for Bitcoin ETFs on their debut, according to data from SoSoValue

In terms of trading volume, the ETH ETFs saw around $1.1 billion in trades on their first day, while BTC ETFs saw $4.66 billion in trading volume on their inaugural day.

Throughout the first week, Ethereum ETFs generated a total trading volume of approximately $4.05 billion, compared to $7.85 billion for Bitcoin ETFs in their initial week.

Analysts anticipate that spot Ethereum ETFs will attract inflows ranging from 6% to 48% of those seen by Bitcoin ETFs in the first six months. This estimate suggests total inflows into Ethereum ETFs could reach between $1 trillion and $7.5 trillion by late January 2025.

At the time of writing, ETH, the second-largest cryptocurrency, was trading at $3,280. Its market cap is around $393 billion, with a 24-hour trading volume near $14.4 billion.

Source link

You may like

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

24/7 Cryptocurrency News

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Published

2 hours agoon

December 23, 2024By

admin

Tron founder Justin Sun has been heavily offloading his ETH holdings with Ethereum price crashing 17% following the rejection at $4,000. Over the past 7 days, Sun has offloaded another 50% of his holdings worth $143 million. Market analysts predict that ETH price could further take a dip below $3,000 once again before resuming upside momentum.

Tron’s Justin Sun on ETH Selling Spree

Justin Sun is on a massive Ethereum selling spree since the coin resumed its upward journey after Donald Trump’s election win. This continued even until last week, when Tron founder offloaded $143 million worth of ETH causing Ethereum price to tank over 15% amid the crypto market crash.

Blockchain analytics firm Spot On Chain reported that Justin Sun redeemed 39,999 ETH (valued at $143 million) from liquid staking platforms Lido Finance and EtherFi. He subsequently deposited the entire amount into HTX.

Since November 10, as Ethereum price has trended upward, Sun has deposited a total of 108,919 ETH (worth $400 million) to HTX at an average price of $3,674. Notably, many of these deposits occurred near local price peaks.

Spot On Chain also revealed that Justin Sun currently has 42,904 ETH (valued at $139 million) in the process of unstaking from Lido Finance. The Tron founder might potentially send this funds to HTX later.

Ethereum Price Drop Below $3,000 Coming?

With Ethereum price losing its crucial support of $3,500, the market sentiment for the world’s largest altcoin has turned bearish. Last week, crypto market analysts turned bearish on Ethereum expecting the ETH price to drop $2,800 on selloff by whales.

Popular market analyst IncomeSharks stated that it was a “low-volume weekend,” for Ethereum following a volatile week for stocks. The analysts added that it won’t be the right time to sell.

The On-Balance Volume (OBV) indicator, a tool used to gauge buying and selling pressure, remains steady, oscillating within a channel. Recent Ethereum buyers are still in profit, providing some support for the market. However, the below chart shows that there’s still scope for Ethereum to take a dip to $3,000.

Prominent crypto analyst “I am Crypto Wolf” also highlighted a bullish outlook with a potential inverse head-and-shoulders (iHS) pattern. According to the analyst, Ethereum price chart is currently forming the “right shoulder” of the iHS continuation pattern.

This setup could provide the momentum needed to surpass the $4,000 resistance and aim for a $10,000 target by May. A breakout is anticipated by the end of January, though a retest of the $3,000 level remains a possibility before the rally takes off, he noted.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

CryptoQuant

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Published

16 hours agoon

December 22, 2024By

admin

Amid a general crypto market price fall in the past week, Ethereum (ETH) recorded a price correction of over 19.5% finding support at a local bottom of $3,100. Since then, the prominent altcoin has only shown slight resilience rising by over 5% in the past two days. However, recent data on wallet activity provides much cause to be bullish on Ethereum’s long-term future.

Ethereum HODL Addresses Increase Supply Dominance To 16%

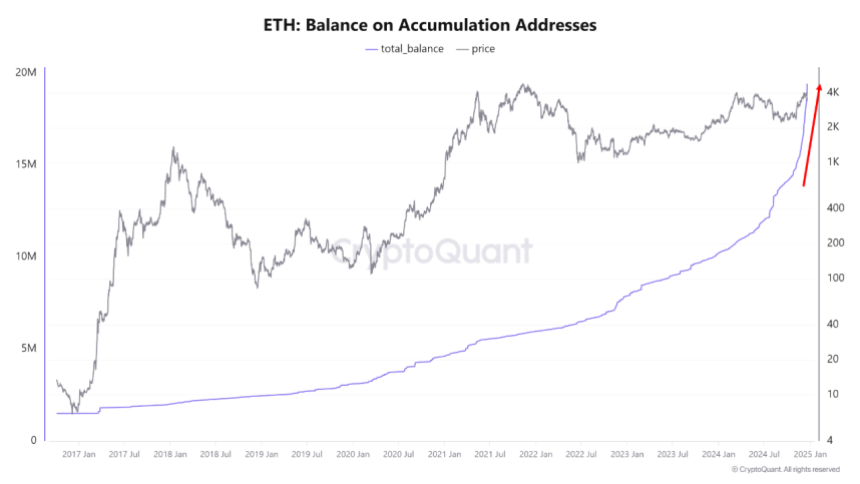

In a recent QuickTake post, CryptoQuant analyst MAC_D shared some positive insights on the Ethereum market.

The crypto market expert reports that the balance of Ethereum Accumulation Addresses has surged by a remarkable 60% from August to December. During this time, these HODL wallets have boosted their portion of ETH supply from 10% to 16% i.e. 19.4 million ETH of 120 million ETH.

To explain, the Accumulation Addresses are wallets that hold Ethereum but rarely move or sell their holdings. They are considered a measure of long-term investment and confidence.

According to MAC_D, the rapid increase in these Ethereum HODL wallets’ holdings is a new development absent from previous bull cycles. The analyst attributed this massive accumulation rate to investors’ bullish expectations of the incoming Donald Trump administration in the US.

These expectations include more favorable regulations on the DeFi industry which represents a major sector of the Ethereum ecosystem. Therefore, regardless of Ethereum’s current price movement, these long-holding wallets are likely to keep increasing their holdings in anticipation of future price growth.

In addition, MAC_D emphasizes the importance of these Accumulation Addresses in that the price of Ethereum has never slipped below their realized price. Therefore, a continuous purchase by these wallets provides a high potential for a long-term price gain.

What’s Next For ETH?

In regards to Ethereum’s immediate movement, MAC_D warns that macroeconomic factors are likely to exert a stronger influence on ETH’s price in the short-term as illustrated by the recent price crash induced by potential reduced interest rate cuts in 2025.

At the time of writing, the altcoin trades at $3,352 following a 3.07% decline in the past 24 hours. In tandem, ETH’s daily trading volume is down by 53.25% and valued at $31.15 billion.

Following recent price falls, Ethereum also presents a negative performance on larger charts with losses of 14.74% and 1.05% in the past seven and thirty days, respectively. On a positive note, the asset’s price remains far above its initial price point ($2,397) at the start of the post-US elections price rally, indicating that long-term sentiment remains positive.

With a market cap of $401 billion, Ethereum continues to rank as the second-largest cryptocurrency and largest altcoin in the digital asset market.

Source link

24/7 Cryptocurrency News

How Low Will Ethereum Price Go By The End of December?

Published

20 hours agoon

December 22, 2024By

admin

In a recent analysis, crypto analyst Justin Bennett provided insights into how low the Ethereum price could drop by the end of December. This came as the analyst revealed that buyers need to step or ETH could enter next week with a bearish outlook.

How Low Ethereum Price Can Go By Year-End

In an X post, Justin Bennett suggested that the Ethereum price could drop to as low as $3,027 by year-end. While analyzing ETH’s daily chart, the analyst stated that ETH needs to flip $3,541 as support to turn bullish next week. If that doesn’t happen, he remarked there is a decent chance that Ethereum drops lower. The analyst’s accompanying chart showed that ETH could even drop to as low as $2,560 if it loses the $3,027 support level.

In an earlier X post, the crypto analyst stated that he is bullish on the Ethereum price based on the overall setup going into 2025. however, he believes that buyers still have work to do. He gave an example of how ETH needs to recover $3,540 on the weekly time frame to look bullish next week.

These buyers already look to be stepping in, as there has been an accumulation trend among ETH whales. Coingape reported that Ethereum whales are buying the dip as ETH eyes a quick rally to $4,000.

These whales have withdrawn 17,698 ETH worth $61.66 million from the crypto exchange Binance. Donald Trump’s World Liberty Financial has also gotten in on the act as the DeFi project accumulated more ETH on this dip.

Correction Might Be Over

In an X post, crypto analyst Titan of Crypto provided a more bullish outlook for the Ethereum price, stating that the correction might be over. The analyst made this statement based on his Ichimoku cloud analysis.

Titan of Crypto stated that Ethereum has retested both Tenkan and Kijun. He added that the worst-case scenario would be a retest of the Kumo Cloud SSB, Ichimoku’s strongest line.

According to a CoinGape market analysis, this might indeed be the last dip before ETH hits five digits. There are predictions that the Ethereum price could hit $15,937 by May 2025.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: