bear market

Ethereum Foundation Transfers 95 Million ETH, Price Rally To Stall?

Published

4 months agoon

By

admin

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency.

Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems.

In two years of active crypto writing, Semilore has covered multiple aspects of the digital asset space including blockchains, decentralized finance (DeFi), staking, non-fungible tokens (NFT), regulations and network upgrades among others.

In his early years, Semilore honed his skills as a content writer, curating educational articles that catered to a wide audience. His pieces were particularly valuable for individuals new to the crypto space, offering insightful explanations that demystified the world of digital currencies.

Semilore also curated pieces for veteran crypto users ensuring they were up to date with the latest blockchains, decentralized applications and network updates. This foundation in educational writing has continued to inform his work, ensuring that his current work remains accessible, accurate and informative.

Currently at NewsBTC, Semilore is dedicated to reporting the latest news on cryptocurrency price action, on-chain developments and whale activity. He also covers the latest token analysis and price predictions by top market experts thus providing readers with potentially insightful and actionable information.

Through his meticulous research and engaging writing style, Semilore strives to establish himself as a trusted source in the crypto journalism field to inform and educate his audience on the latest trends and developments in the rapidly evolving world of digital assets.

Outside his work, Semilore possesses other passions like all individuals. He is a big music fan with an interest in almost every genre. He can be described as a “music nomad” always ready to listen to new artists and explore new trends.

Semilore Faleti is also a strong advocate for social justice, preaching fairness, inclusivity, and equity. He actively promotes the engagement of issues centred around systemic inequalities and all forms of discrimination.

He also promotes political participation by all persons at all levels. He believes active contribution to governmental systems and policies is the fastest and most effective way to bring about permanent positive change in any society.

In conclusion, Semilore Faleti exemplifies the convergence of expertise, passion, and advocacy in the world of crypto journalism. He is a rare individual whose work in documenting the evolution of cryptocurrency will remain relevant for years to come.

His dedication to demystifying digital assets and advocating for their adoption, combined with his commitment to social justice and political engagement, positions him as a dynamic and influential voice in the industry.

Whether through his meticulous reporting at NewsBTC or his fervent promotion of fairness and equity, Semilore continues to inform, educate, and inspire his audience, striving for a more transparent and inclusive financial future.

Source link

You may like

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

American HODL

Buying Bitcoin Is Easy, HODLing Is the Hard Part

Published

5 days agoon

December 18, 2024By

admin

HODLing bitcoin is so simple, yet it’s one of the most difficult and challenging things to do.

HODLing bitcoin is a choice. You have to wake up every day and choose to continue HODLing BTC. When you have every reason to sell bitcoin, you have to continue HOLDing. This is where most people fail.

The anxiety of losing money kicks in. The fear of being wrong becomes a cloud over your head and you start to wonder if you’re wasting your time and ruining your future by HOLDing bitcoin.

It really isn’t for the weak, so I understand why so many people could not fathom holding onto an asset this volatile, this early into its existence. It makes sense why most people were not ready to go all in on bitcoin, but those who did were highly rewarded for their efforts.

This American HODL thread sums up HODLing bitcoin perfectly.

Here’s a story for $106,600 per Bitcoin.

6 years ago in 2018 I stacked cash all year knowing I would rebuy bitcoin at the “bottom”.

We spent 3 months or so consolidating around $6,600.

I got impatient and was like fuck it this is my moment and deployed half my stack.…

— AMERICAN HODL 🇺🇸 (@americanhodl8) December 17, 2024

I remember what it was like back in 2018 when the price of bitcoin dropped by 50%. Only at the time, I was a young college student working in physical therapy. I was in a position to take on as much risk as possible because taking care of myself was my only responsibility, so that giant drop did not affect me mentally too much. But for American HODL, as well as many other Bitcoiners who had wives and children to take care of, the stakes here were raised significantly.

Many Bitcoiners want the price to drop lower, so they can accumulate cheaper BTC. But for many Bitcoiners who have already accumulated bitcoin at cheaper prices, it can be soul crushing to watch the price of bitcoin drop by 70-80% in the bear markets. Bitcoiners, after all, are in this for wealth preservation and to increase their purchasing power. So when bitcoin dramatically drops in price, many feel like it’s a punch in the gut. Losing money sucks.

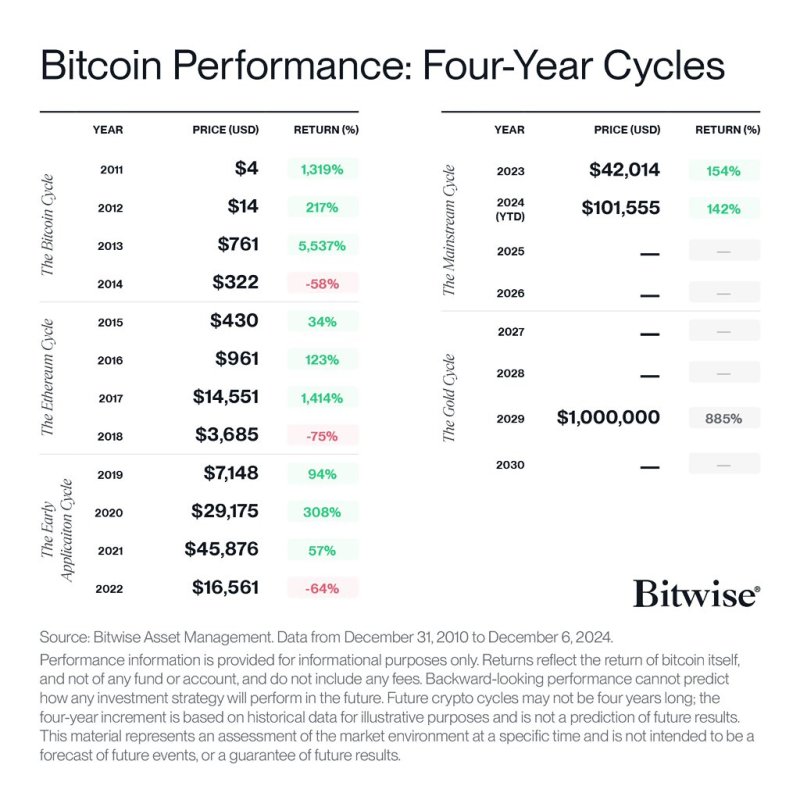

However, if you can withstand the brutal bear markets, the bull markets reward those who sheltered the storm, those who put in the effort to understand this asset and why it has these intense drops and rises. Historically, the price of bitcoin rises for three years in a row, then dumps for one year.

HODLing bitcoin is not easy. It is normal and human to feel the depression of the bear market and the euphoria of the bull. So when bitcoin inevitably dumps in the future after the bull market, be prepared to HODL.

Don’t put yourself in a position where you cannot withstand a 70-80% correction.

Understand the asset you got into and realize this is normal and everything is OK. If you can do that, you will make it out of the bear market alive, and be in prime position to take advantage of the next bull market.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

bear market

Uptober? Cryptocurrencies bounce heading into October’s first weekend

Published

3 months agoon

October 4, 2024By

admin

Cryptocurrencies attempted to shrug off geopolitical conflict-driven market slump ahead of October’s first weekend.

Major cryptocurrencies and the total digital asset market cap jumped north of 2% on Oct. 4 as ecosystem leaders like Bitcoin (BTC) and Ethereum (ETH) staged price recoveries by publishing time. Almost $36 billion flowed into Bitcoin, pushing BTC’s price above $62,300 and marking a 3% jump. Ether’s 4% appreciation raised ETH to over $2,400, and Solana (SOL) edged toward $145, per CoinGecko.

Memecoins, especially on Solana, surged with the market upswing heading into the weekend. Tokens like Gigachad (CHAD), Michi (MICHI), Popcat (POPCAT), and dogwifhat (WIF) spiked 20%-40% in the last 24 hours.

Weekly green close uncertain for crypto

Daily price upticks only slightly reversed the plunge triggered by military altercations in the Middle East. Global economies and assets shed hundreds of millions in hours as Iran launched missiles into Israel.

The resulting pullback fixed the total cryptocurrency market cap in a red candle on the weekly timeframe. Digital assets had cumulatively closed in green for three consecutive weeks during September, a month usually bearish for cryptos.

History backs green Q4

The overall digital asset market would require an 8% recovery to regain last month’s close, and expert consensus suggested a crypto market rise might be inbound. Bitcoin has enjoyed a bullish October the last three times BTC closed September with a green monthly candle. Nine out of 11 times, the asset has surged in Q3’s first month regardless of the previous month’s price action.

Indeed, Bitcoin has averaged price increases of 22%, 46%, and 5% in the final three months of every year since 2013.

Source link

bear market

Middle East explodes, Bitcoin steady: is something broken?

Published

3 months agoon

October 2, 2024By

admin

Why are markets staying calm while the Middle East is on fire? Is Bitcoin really immune to geopolitical chaos, or are we missing something bigger here?

Missiles fly, Bitcoin steady

A year ago, Israeli Prime Minister Benjamin Netanyahu stood confidently at the UN General Assembly, celebrating what appeared to be growing peace in the Middle East. However, today, the landscape looks drastically different.

The ongoing war in Gaza is nearing its one-year mark, but the conflict has expanded beyond the region. With Iran now involved, tensions between Israel and Hezbollah have sharply escalated, raising fears of a broader regional war.

A major turning point occurred on Sep. 27, when Hezbollah’s leader, Hassan Nasrallah, was reportedly killed in an Israeli airstrike. Nasrallah suffocated after being trapped in his secret bunker, which had been hit by 80 tons of bunker-busting bombs.

The same strike also killed IRGC commander Abbas Nilforoshan in Beirut, dealing a serious blow to Iran-backed militias in the region.

These deaths significantly increased tensions, prompting Iran to retaliate just days later. On Oct. 1, Iran launched a large-scale missile attack on Israel, firing approximately 180 missiles — an escalation even more intense than the April barrage.

While many of the missiles were intercepted by Israeli defences, some found their targets, hitting military bases, restaurants, and schools. Iran’s Islamic Revolutionary Guard Corps claimed a 90% success rate for their strikes, which included the use of hypersonic missiles.

Amid these escalating hostilities, one might expect markets to react as they have in the past. Yet, the recent dynamics tell a different story.

The assassination of Hamas leader Ismail Haniyeh in July sent shockwaves through both traditional markets and the cryptocurrency space, with Bitcoin (BTC) tumbling in response.

However, despite the heightened tension after Nasrallah’s death and Iran’s missile attacks, the crypto markets — particularly Bitcoin — have defied the usual pattern of panic selling during the conflict.

So, why did the markets react so sharply in April and August but seem resilient to this latest flare-up? Let’s dive deeper into what has changed and what this could mean going forward.

From August’s sell-off to September’s rally

On Jul. 31, the Middle East’s political arena shifted dramatically when Haniyeh, the prominent Hamas leader, was assassinated in Tehran.

Haniyeh had been a major figure in Hamas since its early days in 1987. He’d even served as the prime minister of the Palestinian Authority and was the highest-ranking Hamas leader to be killed since the Israel-Hamas war began. His death struck a heavy blow to the Palestinian militant group and sent tensions soaring across the region.

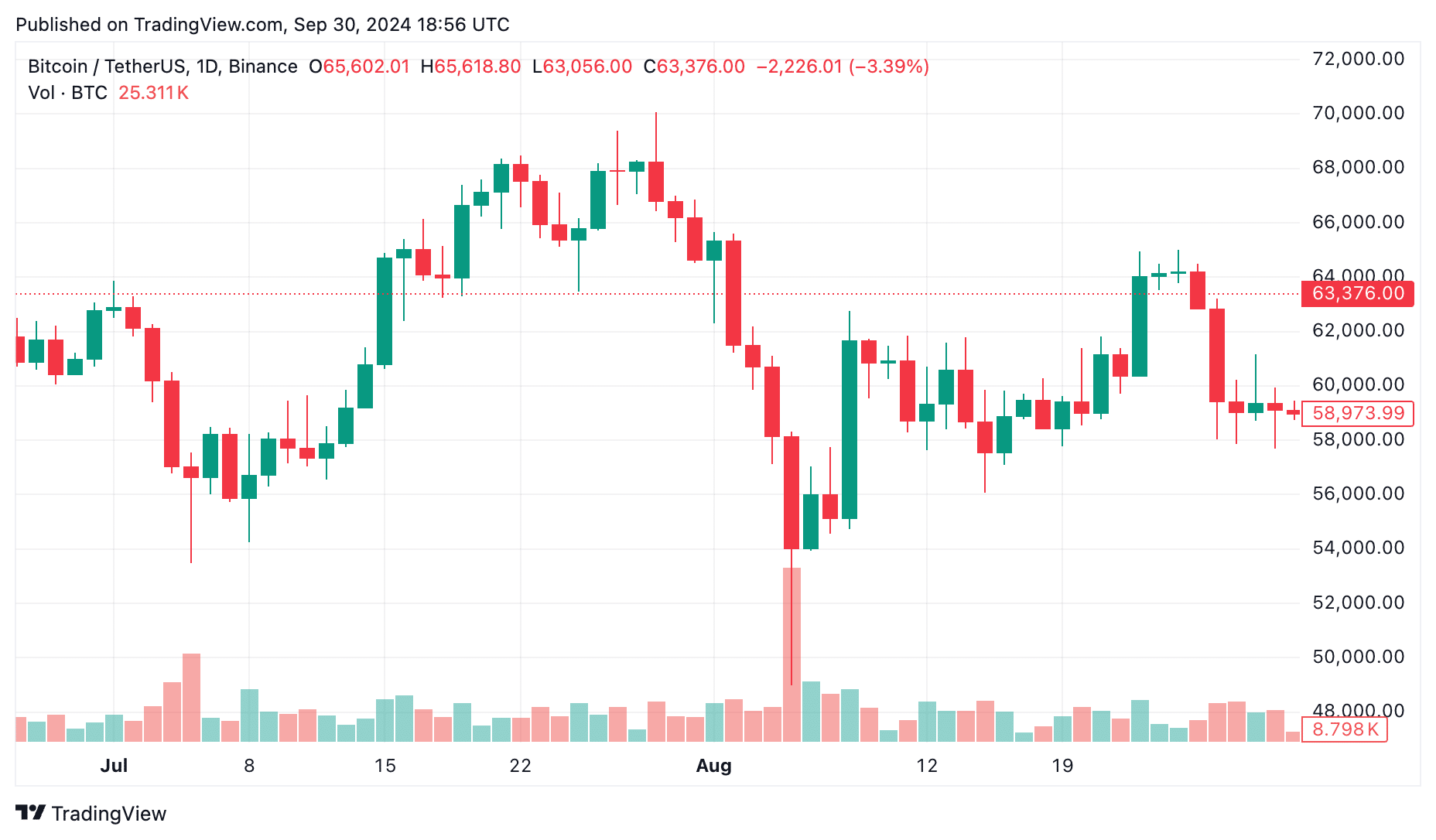

As the news hit, markets reacted instantly. Bitcoin, which had been sitting at around $66,500, took a sharp nosedive, losing almost 10% of its value in just a few days. By Aug. 4, it had dropped to $60,500.

Global stock markets didn’t fare much better. Between Jul. 31 and Aug. 4, the NASDAQ tumbled from 17,600 to 16,200 points—a brutal 8% decline. The S&P 500 followed suit, dropping from 5,500 to 5,150—around 6.5%.

Investors were rattled. The markets, already shaky from macroeconomic pressures, spiralled further, and crypto assets started behaving just like high-risk tech stocks.

And the timing couldn’t have been worse. While this geopolitical shock unfolded, the global economy was facing worsening recession fears. Add to that the unwinding yen carry trade and murmurs of stagflation, and things looked pretty grim.

Then came Aug. 5, now known as “Crypto Black Monday.” Major crypto assets took another beating. Bitcoin plunged to $53,000, a staggering 20% drop from its highs in late July.

Ethereum (ETH) and Solana (SOL) were caught in the same downward spiral, with steep losses. Investors were scrambling, worried that a full-scale Middle Eastern war was about to erupt, only deepening those recession fears.

Fast forward to September 2024, and the conflict has escalated again. Hezbollah, Lebanon’s powerful Iran-backed armed group, ramped up its attacks on Israel.

On Sep. 20, Hezbollah launched a barrage of rockets into northern Israel, targeting cities such as Haifa, escalating tensions in the region.

In response, Israel retaliated with hundreds of airstrikes on Hezbollah positions in Lebanon, marking the deadliest exchange between the two since the 2006 Israel-Hezbollah war. The airstrikes resulted in over 490 Lebanese casualties, significantly heightening the conflict.

Then, on Oct. 1, Iran further escalated the situation by launching a large-scale missile attack on Israel, pushing the region closer to a broader confrontation.

Despite the severity of the escalating conflict, the crypto markets have responded differently this time. Rather than experiencing a stark downturn, Bitcoin has remained relatively stable, dropping only a few percentage points.

As of Oct. 2, BTC is trading around $61,800, reflecting a decline of about 3% in the past 24 hours but still holding above the critical $60,000 support level. Meanwhile, Ethereum has seen a steeper drop, declining by over 6% and trading at around $2,480.

Liquidity and central bank policies shield crypto

One key difference between the two periods is the broader macroeconomic environment. Back in August, global markets were still grappling with a storm of negative data.

Back then, China’s post-pandemic recovery was stalling, and the U.S. Federal Reserve had shown no signs of easing up on its tight monetary policy. Liquidity was drying up across the board.

Then came a surprise in August — the Bank of Japan (BoJ) raised interest rates for the first time since 2007. This decision sent shockwaves through global markets.

Why? Many investors had been taking advantage of Japan’s ultra-low interest rates by borrowing cheap yen and investing those funds into higher-yielding assets, a strategy known as the ‘yen carry trade.’ But when the BoJ hiked rates, the cost of borrowing yen increased, forcing investors to unwind those positions.

As a result, they quickly exited riskier assets, including crypto, which caused prices to nosedive. Bitcoin, Ethereum, and other cryptocurrencies were caught in the selling frenzy as liquidity drained from the markets.

Fast forward to October, and the situation looks different. On Sep. 18, the Federal Reserve made a surprising move by cutting rates by 50 basis points, injecting much-needed liquidity back into the global financial system.

At the same time, China has been rolling out a series of economic stimulus measures to reignite its faltering growth.

Historically, crypto tends to perform well when there’s plenty of liquidity in the markets, and that’s exactly what we’re seeing now. Bitcoin’s recent surge, alongside Ethereum’s rise, is largely due to the Fed’s pivot toward a more accommodative monetary policy.

But liquidity isn’t the only factor at play. In recent weeks, fears of a global recession have eased. U.S. jobs data has come in stronger than expected, and although inflation is still a concern, it appears to be moderating.

All of this has helped ease worries about a hard landing for the U.S. economy, giving investors a bit more confidence to hold onto riskier assets like crypto.

Another major difference between August and October is how institutional investors view Bitcoin. Since the Fed’s announcement, Bitcoin has seen strong inflows into spot BTC ETFs, with only a few days of outflows.

The total assets under management of all spot BTC ETFs have surged, now standing at over $50 billion. So, during times of political turmoil, like the ongoing conflicts in the Middle East, Bitcoin actually attracts inflows rather than triggers panic selling.

However, it’s worth noting that the rally we’re seeing now doesn’t mean the underlying problems are solved.

China’s economy is still struggling to gain traction, and the U.S. is not out of the woods yet, with the possibility of a soft recession still looming. The Fed’s rate cut has provided some temporary relief, but deeper structural issues remain unresolved.

Why markets have stayed calm amid rising geopolitical tensions

As tensions between Israel and Hezbollah heat up, surprisingly, though, the markets remain calm, almost indifferent to the escalating conflict.

To better understand this unusual market reaction, crypto.news reached out to industry experts, whose insights reveal a shift in how investors are approaching geopolitical risks in 2024.

Anna Kuzmina, Founder of What the Money, believes this apparent indifference may stem from the overwhelming flood of global news. With constant coverage of conflicts and crises across the world, investors might see this particular situation as less impactful than others.

“The current Middle East conflict’s limited impact on crypto and stock markets, compared to previous incidents, could be due to the sheer volume of geopolitical news flooding the market. Investors might simply see this conflict as contained or are more focused on inflation and interest rates.”

Kuzmina also highlighted how investor behavior has evolved over time. In the past, geopolitical tensions often sparked sharp reactions in the markets, but today, both global and regional markets seem better equipped to absorb such disruptions without panicking.

Adding to the conversation, Daria Morgen, Head of Research at Changelly, brought in another perspective. She notes that crypto investors, having endured prolonged periods of volatility, approach geopolitical risks with a different mindset.

“Crypto investors assess geopolitical risk differently than stock market investors. They often have a higher tolerance for volatility, shaped by the recent bear market and wild price fluctuations.”

Morgen cited the continuous nature of crypto trading as a key factor. Unlike traditional financial markets, which have set trading hours, the 24/7 nature of crypto allows investors more flexibility to reassess their positions without rushing into panic-driven decisions.

“They’ve learned to hold through volatility, and this conflict, while serious, doesn’t seem to be a catalyst for panic—at least not yet.”

While crypto traders seem to embrace patience, Kuzmina points out that participants in traditional stock markets often take a more defensive stance, typically shifting their portfolios toward safer assets when geopolitical uncertainty arises.

Morgen shares a similar view, explaining that crypto’s decentralized nature also plays a role. It offers a certain level of protection from the shocks that usually jolt traditional financial systems.

“Crypto investors see digital assets as a hedge against traditional market instabilities. That decentralized nature keeps crypto somewhat insulated from global political issues.”

Morgen stresses that while geopolitical conflicts can still move the markets, the majority of investors are more focused on immediate economic concerns that directly impact their portfolios.

“Immediate economic concerns like inflation and interest rates are overshadowing these conflicts. Investors react more to global events when they have clear, direct economic consequences.”

Kuzmina agrees, noting that in today’s information-heavy environment, investors have become increasingly selective about which news events trigger market moves.

“Investors are bombarded with information daily. They’ve become more selective, tuning out the noise unless it directly impacts their bottom line.”

While crypto markets may seem more adaptable in today’s geopolitical environment, they still remain vulnerable to changes in regulatory policies, which could disrupt this newfound stability.

What to expect next?

The Middle East is still a tinderbox, and while markets have remained calm so far, that doesn’t guarantee smooth sailing ahead.

For now, the key takeaway is to stay alert. The calm we’re seeing might be a sign of a maturing market, but it’s also a reminder that things can change fast.

Keeping an eye on global events, central bank policies, and market sentiment will be crucial in the coming weeks and months.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential