Ethereum

Ethereum instant finality? Buterin aims to silence critics

Published

1 week agoon

By

admin

Ether had the worst first quarter in seven years regarding price action. Nevertheless, the Ethereum platform continues to develop as founder Vitalik Buterin introduces a new roadmap to increase the ecosystem’s security and finality.

Ethereum killers

Platforms copying Ethereum’s functionality while trying to tackle its downsides are usually dubbed “Ethereum killers.”

Talks about Ethereum’s death have been so persistent that a special website called Ethereum Obituaries was created. It tracks all the Ethereum “deaths,” ticking at the 133 mark as of press time.

Ethereum is criticized for ignoring the community’s demands and opinions during the current cycle.

In general, Ethereum’s market underperformance, especially compared to Solana’s success, may signal a serious crisis.

Even though Ethereum’s journey has been rough lately, and, at times, users and developers showed preference for its competitors, Ether is still the second-largest crypto after Bitcoin in terms of market capitalization.

In March, Ethereum outpaced its main competitor, Solana, in trading volume by 22%, becoming the leading platform in the DeFi space for the first time since September 2024. In terms of TVL, Ethereum is by far larger than Solana.

Furthermore, 53% of the stablecoin market is built on Ethereum. So, despite the ongoing price decline, Ethereum is still the second-biggest crypto brand after Bitcoin.

the only thing wrong with ethereum

is price and your bagsno alternative has significant enough improvements to make everyone switch over.

the network effects make that incredibly hard. it has 50% of all TVL & L2s add another 10%.

ethereum is built the right way to scale to…

— rip.eth (@ripdoteth) March 19, 2025

The platform still has many supporters among crypto enthusiasts, investors, and professionals from the crypto sector. Buterin is still a prominent voice in the crypto space, and what matters most is that the platform keeps on moving forward.

The new roadmap introduced in March confirms this.

Scalability issues

The new roadmap, published on March 28, reveals the planned steps to tackle one of Ethereum’s most notorious problems–its poor scalability. Throughout the time, the network experienced several major congestions that resulted in performance lags.

The most prominent example is the network slowing down caused by the Cryptokitties game in December 2017. The game involved in-game ETH transactions, and in December 2017, their volume reached 10% of all Ethereum transactions, causing substantial lags in the network.

Because ETH doesn’t scale, and those examples aren’t even firsts.

It’s really easy to build things on top of SQL databases that look interesting and useful. Indeed, if you’re ok with centralization they can be.

But that’s just not comparable to Bitcoin’s goals. pic.twitter.com/fCErmUzuAH

— Peter Todd (@peterktodd) December 21, 2019

The scalability concerns were discussed in 2017, and by 2025, Ethereum is still struggling to address this issue, which is very critical, given that Ethereum serves as the backbone for the majority of the NFT and stablecoin markets and various other decentralized platforms and tokens built on top of it.

The Ethereum team has been working on a solution ever since, and the 2022 transition from the proof-of-work consensus mechanism to proof-of-stake was one of the crucial steps in this direction.

In addition to addressing the scalability issues, the new roadmap aims to increase the network’s security.

Digesting the new roadmap

Buterin outlined three directions in the future development of Ethereum:

- Increasing the number of blobs up to 72 by 2026

- Reaching instant secure finality via 2-of-3 hybrid-proof architecture

- Improving aggregation levels

This list may seem difficult to understand for people unfamiliar with Ethereum’s architecture, so we’ll break it down.

The improvements will involve the increase of active roll-ups and blobs. Roll-ups are smart contracts that settle transactions off-chain and relay the data back to the mainnet, thus elevating the network’s speed and decreasing transaction costs.

There are three different layers of roll-ups: optimism (OP), zero-knowledge (ZK), and trusted execution environments (TEE).

Ethereum aims to scale through sharding, a split of the network into smaller manageable sections. Blobs are the Proto-Danksharding objects used to structure data. Increasing the number of blobs improves the work of rollups.

According to Buterin, by the end of the year, the network upgraded to the Pectra version (an upgrade is scheduled for May 2025) will use six blobs, while the Fusaka version of the network may use up to 72 blobs.

The base direction of the new roadmap is deploying a hybrid-proof architecture that will increase the speed and soundness of the Ethereum network.

To avoid dependency on a single type of proof, Ethereum will use a hybrid model in which transactions may be finalized immediately if their state roots are approved both via ZK and TEE rollups.

If ZK or TEE doesn’t approve a transaction, it gets approved with the help of the OP rollups, but it will take much longer.

According to Buterin’s description, such cases won’t be normal. Most of the transactions will be finalized instantly while being approved by two independent roll-ups, one of which (ZK) is fully trustless.

Buterin concludes:

This gets us to a pragmatic higher level of fast finality and security while getting us to the key stage 2 milestone of full trustlessness in the case where proof systems (OP and ZK) work correctly. It will reduce round-trip times for market makers to 1 hour or even much lower, allowing fees for intent-based cross-L2 bridging to be very low.

In the final part of the roadmap, Buterin stressed that the dev team should work harder on standardized proof aggregation layers scaled to the entire Ethereum ecosystem.

ZK-based proof systems should use single aggregate proofs to reduce gas expenses. Vitalk named Layer2 applications and zkemail-like wallet recoveries “the most natural initial use cases” for that.

The roadmap received mixed feedback, as some in the Ethereum community didn’t like its focus on Layer2. Will the proposed changes save Ethereum from tumbling down? Time will tell.

Source link

You may like

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Ethereum

Crypto malware silently steals ETH, XRP, SOL from wallets

Published

5 hours agoon

April 13, 2025By

admin

Cybersecurity researchers have shared details of a malware campaign targeting Ethereum, XRP, and Solana.

The attack mainly targets Atomic and Exodus wallet users through compromised node package manager (NPM) packages.

It then redirects transactions to attacker-controlled addresses without the wallet owner’s knowledge.

The attack begins when developers unknowingly install trojanized npm packages in their projects. Researchers identified “pdf-to-office” as a compromised package that appears legitimate but contains hidden malicious code.

Once installed, the package scans the system for installed cryptocurrency wallets and injects malicious code that intercepts transactions.

‘Escalation in targeting’

“This latest campaign represents an escalation in the ongoing targeting of cryptocurrency users through software supply chain attacks,” researchers noted in their report.

The malware can redirect transactions across multiple cryptocurrencies, including Ethereum (ETH), Tron-based USDT, XRP (XRP), and Solana (SOL).

ReversingLabs identified the campaign through their analysis of suspicious npm packages and detected multiple indicators of malicious behavior including suspicious URL connections and code patterns matching previously identified threats. Their technical examination reveals a multi-stage attack that uses advanced obfuscation techniques to evade detection.

The infection process begins when the malicious package executes its payload targeting wallet software installed on the system. The code specifically searches for application files in certain paths.

Once located, the malware extracts the application archive. This process is executed through code that creates temporary directories, extracts the application files, injects the malicious code, and then repacks everything to appear normal.

The malware modifies transaction handling code to replace legitimate wallet addresses with attacker-controlled ones using base64 encoding.

For example, when a user attempts to send ETH, the code replaces the recipient address with an attacker’s address decoded from a base64 string.

The impact of this malware can be tragic because transactions appear normal in the wallet interface while funds are being sent to attackers.

Users have no visual indication that their transactions have been compromised until they verify the blockchain transaction and discover funds went to an unexpected address.

Source link

Altcoins

Ethereum Price Suffers 77% Crash Against Bitcoin, On-Chain Deep Dive Reveals Reasons Why

Published

21 hours agoon

April 13, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Despite rolling out a large number of upgrades and innovations, the Ethereum price continues to lag behind Bitcoin (BTC) by a wide margin. Reports reveal that ETH has suffered a staggering 77% price crash against BTC — a decline likely fueled by a mix of technical, macro, and sentiment-driven factors. Notably, On-chain analytics platform, Santiment has now pinpointed and broken down the key reasons behind these price struggles.

Ethereum Price Nosedives Against Bitcoin

On April 11, Santiment released a detailed report on Ethereum, highlighting its almost four-year underperformance and the reasons behind it. Ethereum, once revered as the cryptocurrency most likely to dethrone Bitcoin, has recently suffered a brutal price decline when measured directly against BTC.

Related Reading

According to Santiment’s on-chain data, Ethereum has crashed by approximately 77% against Bitcoin since December 2021. While the dollar value of ETH hasn’t completely collapsed, especially compared to other altcoins, the long-term BTC/ETH ratio still paints a gruesome picture for Ethereum holders.

Notably, Ethereum has also failed to recover anywhere near its November 2021 all-time high of $4,760. In contrast, Bitcoin has surged ahead, reclaiming much of its market dominance and outpacing ETH across almost every timeframe.

This disparity has led many traders and former maximalists to compare ETH to a “shitcoin.” Even worse, various mid to low-cap altcoins have already outperformed Ethereum over the short, mid, and long-term timeframes, causing further embarrassment for the world’s second-largest cryptocurrency by market capitalization. Based on Santiment’s report, the ETH/BTC price ratio chart alone is enough to trigger doubt and uncertainty among long-term holders.

Behind The Scenes Of Ethereum Price Struggles

Beyond price action and market volatility, Santiment reveals that there are fundamental reasons for Ethereum’s sluggish performance over the years. Some of the major criticisms that analysts and traders have pinpointed include technical, sentimental, and regulatory issues.

Related Reading

Ironically, Ethereum’s Layer 2 solutions are one of the key drivers of its underperformance. L2 solutions like Arbitrum, Optimism, and zkSync are reportedly cannibalizing activity on the mainnet, taking investments from ETH while spreading investor attention thin.

Secondly, Ethereum seems to struggle with complex roadmaps and communication, which has led to investor confusion. Major updates like The Merge and Shanghai have been difficult for investors to comprehend, making ETH feel less accessible than BTC.

Thirdly, users remain frustrated by Ethereum’s relatively high gas fees and the slow rollout of key upgrades. This has pushed them toward more affordable and faster alternatives, significantly reducing adoption.

Another primary reason for Ethereum’s crash against Bitcoin is ongoing regulatory concerns. Unlike Bitcoin, which has a more established legal precedent, Ethereum faces constant uncertainty about whether it could be labeled a security.

Other points include ETH’s lack of investment appeal. While Bitcoin maintains the title as a stable digital gold, Ethereum appears to be caught in between, having no clear or attractive investment narrative. Moreover, newer blockchains like Solana and Cardano are also attracting a significant number of users with cheaper and faster solutions, ultimately pulling investments away from ETH.

The final reason Santiment has identified for Ethereum’s long-term price descent is rising selling pressure. Post-upgrade withdrawals of stakes ETHs have created steady sell-side pressure, limiting growth and momentum compared to Bitcoin.

Featured image from Unsplash, chart from Tradingview.com

Source link

Ethereum

Wayfinder spikes 180%, MIM pumps 150%, Ethereum struggles

Published

1 day agoon

April 12, 2025By

admin

Despite Ethereum’s continued struggle to maintain the $1,600 price level, several altcoins posted triple-digit gains.

Wayfinder (PROMPT), Magic Internet Money (MIM), and Bitcoin Wizards (WZRD) are leading the charge in the past 24 hours.

Wayfinder has risen by 179.2% in the last 24 hours and trades at $0.5043 from a low of $0.1798. The token currently has a market cap of $113 million.

The impressive rally follows several key developments for the project. Wayfinder recently completed an airdrop, distributing 40% of the total PROMPT supply to eligible participants.

This wide distribution was complemented by listings on multiple major exchanges like Bitget, KuCoin, OKX, Hyperliquid, HTX, Gate.io, etc.

Social media visibility has also played a role in PROMPT’s price surge as the token has also been trending on X.

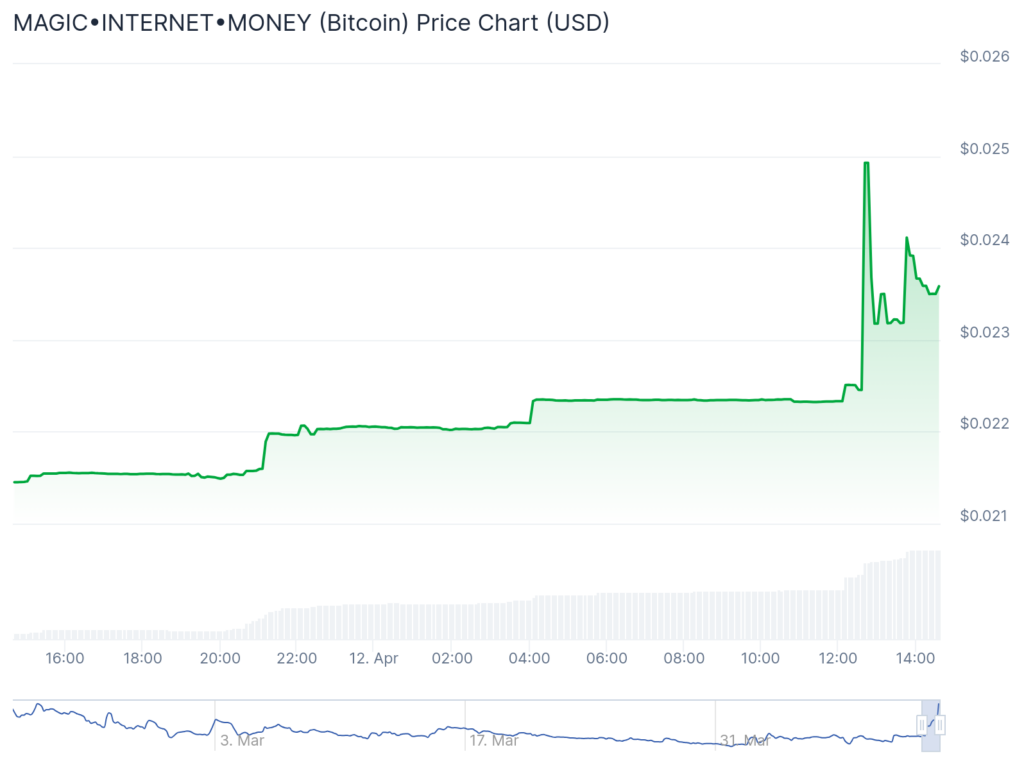

Second on CoinGecko’s top crypto gainers list is MAGIC•INTERNET•MONEY (MIM). MIM has gained 147% over the past 24 hours to $0.003587 from a low of $0.00145.

MIM’s price surge appears directly connected to the project’s recently announced token migration. The team behind MIM has implemented a migration plan allowing holders of Bitcoin Wizards (WZRD) tokens to claim MIM until April 15.

This migration announcement has driven increased trading activity for both tokens.

Bitcoin Wizards has jumped 127.5% in the last 24 hours and has reached $2.50 from $1.09. The token has maintained a strong surge over longer timeframes as well, with 100% growth over the past week and 96% over the last month.

Created by the same team behind Mavensbot, WZRD’s performance is closely tied to the ongoing token migration.

Both tokens have been trending on social media platforms as users discuss the migration process.

While these smaller tokens rally, Ethereum (ETH) continues to face pressure and struggles to maintain price stability in the past few weeks, even as Bitcoin (BTC) has shown some stability around $83,000.

Source link

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Bitcoin price tags $86K as Trump tariff relief boosts breakout odds

Where Top VCs Think Crypto x AI Is Headed Next

India’s Leading Bitcoin And Crypto Exchange Unocoin Integrates Lightning

Solana Triggers Long Thesis After Pushing Above $125 – Start Of A Bigger Rally?

Popcat price surges as exchange reserves fall, profit leaders hold

Crypto Analyst Says Bitcoin Back in Business, Calls for BTC Uptrend if One Support Level Holds

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x