fetch.ai

FET price rises as CEX inflows rise ahead of Cudos merger vote

Published

3 months agoon

By

admin

The Artificial Superintelligence Alliance token rose for the third consecutive day, reaching its highest point since June 27.

Artificial Superintelligence Alliance coin (FET) jumped to a high of $1.5768 on Sept. 19, 127% above its lowest point this month. This rally mirrored the performance of most cryptocurrencies, which surged after the Federal Reserve slashed interest rates.

FET also spiked as data from Nansen showed it had over $7.8 million in centralized exchange inflows in the last 24 hours, representing a 127x jump from the previous average. A big increase in exchange inflows often signals that some holders are starting to sell.

Meanwhile, the number of FET tokens held by smart money wallets continued to rise, reaching a year-to-date high of 5.9 million. These smart money wallets increased to 25, up from last month’s low of 21.

Data also revealed that the volume of FET traded across exchanges surged to over $623 million, its highest point since March this year. According to CoinGlass, FET’s futures open interest rose to over $92 million, its highest level since June 9.

The Artificial Superintelligence Alliance token also gained momentum following several significant AI-related news developments. In China, Alibaba unveiled a series of AI tools, including over 100 open-source AI models.

Meanwhile, OpenAI is reportedly raising funds at a $150 billion valuation, solidifying its position as the biggest player in the AI industry. The company also partnered with T-Mobile, a move that the company believes will boost its earnings by over $39 billion in the long term.

The coin also rose ahead of an important vote in which alliance members will determine whether Cudos will become the next part of the alliance. The current three members of the alliance are Fetch, Ocean Protocol, and SingularityNET.

Cudos, the potential new member, bridges the gap between blockchain and cloud computing by providing decentralized storage solutions. Its token was up by 13%, giving it a market cap of over $68 million.

ASI Alliance: Your Vote Matters

Today at 6 PM UTC, the voting portal OPENS for the important governance proposal on @CUDOS_ joining and merging their native token with the Alliance.

This decision will strengthen the ASI ecosystem and drive innovation, contributing to the… pic.twitter.com/TlSOQTcikP— Artificial Superintelligence Alliance (@ASI_Alliance) September 19, 2024

FET, the biggest AI cryptocurrency, does well when there are good news about the industry. Other AI tokens like Bittensor (TAO) and Akash Network (AKT) have also jumped by double digits in the past few days.

Source link

You may like

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

crypto assets

Top cryptocurrencies to watch this week

Published

4 months agoon

August 25, 2024By

admin

A rebound from the broader cryptocurrency market triggered a $170-billion recovery in valuation, spiking the market cap 8% to $2.26 trillion.

Here are some of the most notable movers to watch this week.

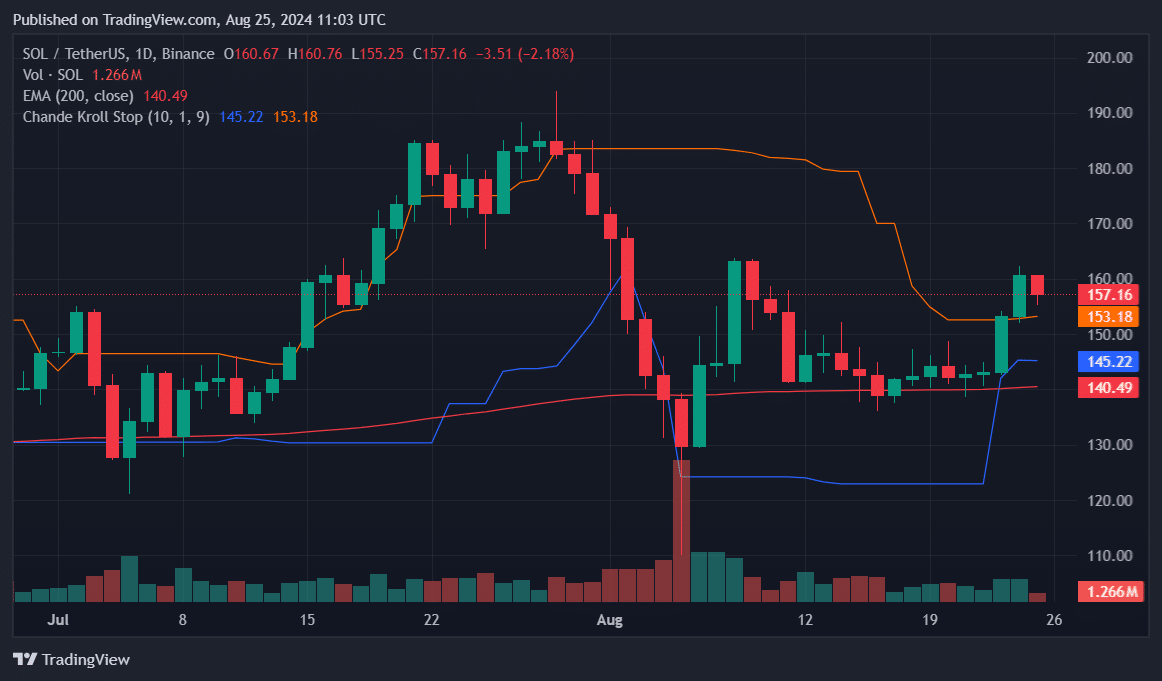

Solana reclaims $160

Last week, Solana (SOL) surged 12%, reclaiming the $160 level and peaking at a two-week high of $162 on Aug. 24 despite setbacks in its ETF product. After closing the week strong, SOL has now pulled back to $157.17.

However, Solana remains above the 200-day EMA at $140.12, signaling ongoing bullish momentum. This week, SOL needs to hold above the 200-day EMA to sustain the ongoing upward trend.

Meanwhile, the Chande Kroll Stop indicators place the Stop Long at $145.22 and the Stop Short at $153.18. Maintaining above $153.18 is key for further gains, as a breach could lead to a bearish reversal.

This week, investors should watch for a retest of the $160 and $162 resistance zones or a decline toward key support at $153.18.

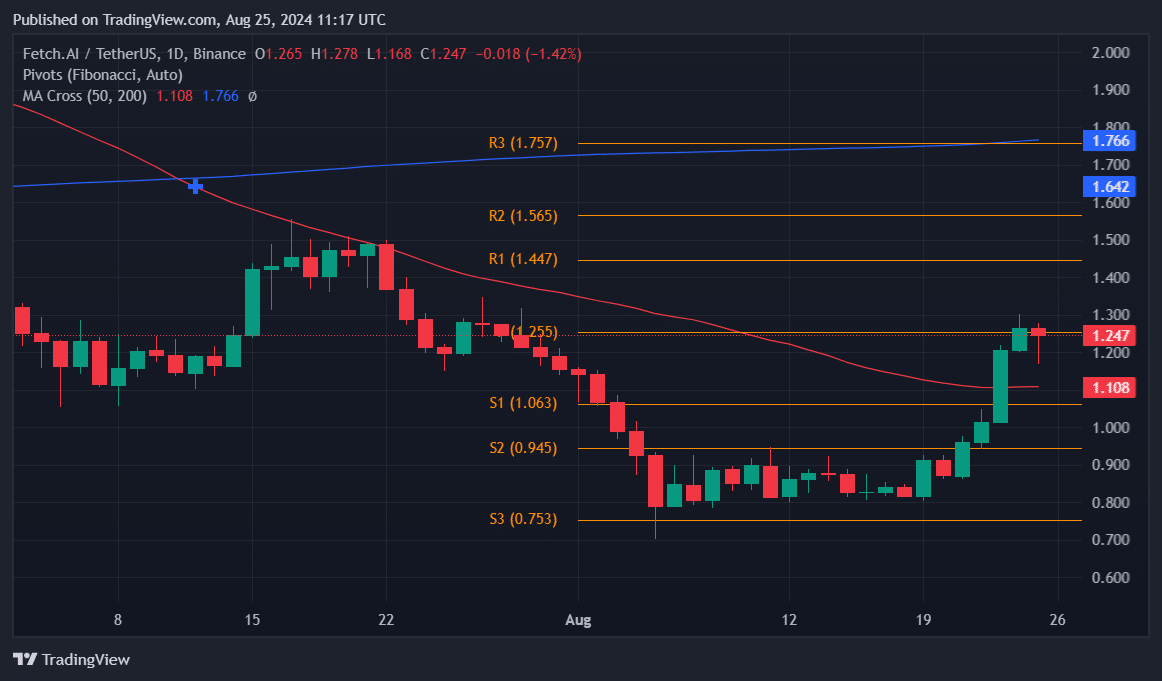

FET spikes 50%

Fetch.ai (FET) closed last week as one of the top gainers, spiking 50% and reclaiming the $1 level. On Aug. 24, FET reached a monthly peak of $1.3 but has since retraced to $1.249.

FET currently trades above the 50-day EMA ($1.108), signaling midterm bullish momentum. However, it remains below the 200-day EMA ($1.766), indicating lingering long-term bearish sentiment.

FET’s immediate resistance points this week are at $1.447 and $1.565, with strong support at $1.063 and $0.945, with a pivot level of $1.255. A break above the resistance could target the 200-day EMA, while failing to hold support would lead to a drop below the 50-day EMA.

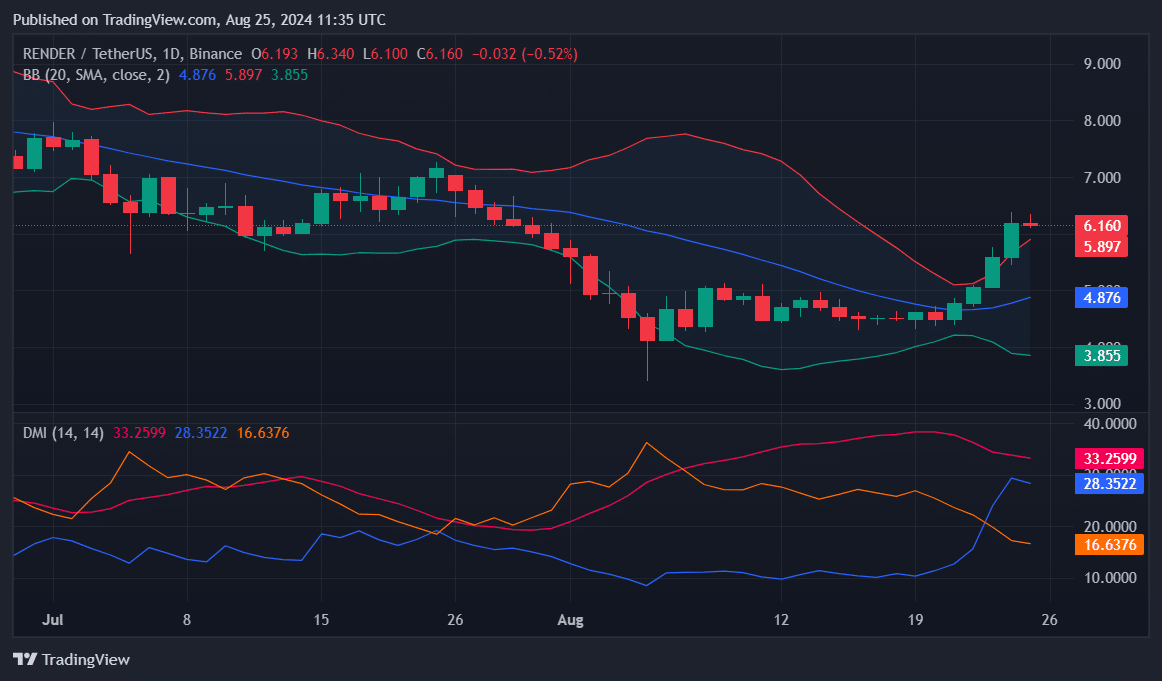

RENDER breaches upper Bollinger Band

Render (RENDER) saw a 37% rise last week, reclaiming the $6 level for the first time this month.

Currently trading at $6.153, RENDER is comfortably above the Upper Bollinger Band ($5.894), which often signals overbought conditions. This suggests a potential pullback or consolidation might be on the horizon.

However, the strong trend indicated by the ADX at 33.25 supports the idea of sustained upward momentum. The asset maintains a bullish bias with the +DI at 28.35 and -DI at 16.63.

If the current momentum holds this week, Render could aim for higher targets around $6.5 and potentially $7.0.

Nonetheless, a dip below the Upper Band might lead to a retest of the 21-day moving average ($4.875).

Source link

Bitcoin

Render tops hottest small/mid-cap cryptos of 2024: report

Published

5 months agoon

July 17, 2024By

admin

A CoinLedger report examined the top five most-bought small/mid-cap cryptocurrencies and the most sold digital assets this year.

2024 has ushered hundreds of billions of dollars into the cryptocurrency markets. Data shows that the digital asset industry has grown over 44% year-to-date (YTD) and has the potential to surpass the $3 trillion peak set in 2021.

A booming crypto market also means eager investors and traders hunting for profits in a fast-paced market. Big names like Bitcoin (BTC) and Ethereum (ETH) are ever the talk of the town, especially with Wall Street wading in under the ETF wrapper.

However, assets with small to mid-market caps have also garnered interest and claimed investor capital.

Based on data from over 500,000 crypto investors, CoinLedger researchers found that Render (RNDR), Fetch.ai (FET), Internet Computer (ICP), Injective (INJ), and Hedera (HBAR) are the top five most bought cryptocurrencies so far this year.

Render and Fetch.ai have surged 48% and 113% YTD, respectively. The tokens have likely piggybacked off interest around GPU giant Nvidia and artificial intelligence as investors look for web3 alternatives to traditional stakeholders. As of this writing, RNDR had a $2.5 billion market cap, while FET had a $3.6 billion valuation.

Most sold cryptocurrencies of 2024

Conversely, large-cap digital assets have seen incredible selling volume despite noticeable growth with these tokens. Bitcoin, Ethereum, Solana (SOL), Cardano (ADA), and Ripple (XRP) were named the five most sold virtual currencies in 2024.

“Unsurprisingly, this list comprises some of the biggest cryptocurrencies by market cap. The rally in the cryptocurrency market in early 2024 likely led many investors to take profits and sell some of their major holdings,” said CoinLedger researchers.

Specifically, Bitcoin achieved a new all-time high in March, and Ethereum has come close to previous highs. It’s not unusual for investors to book profits in these cases. For Solana, the SOL ecosystem has become the defacto memecoin chain and has seen billions in meme token traders. It’s possible that memecoin traders and meme swaps account for most of the SOL selloff.

Source link

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential