Markets

First-Ever Spot XRP ETF Gets Green Light in Brazil

Published

2 months agoon

By

admin

The first spot exchange-traded fund based on XRP’s ongoing price will soon begin trading—just not in the U.S.

The Hashdex Nasdaq XRP Index Fund has launched in a pre-operational phase and will debut on Brazil’s B3 exchange after the country’s financial investments regulator greenlit the ETF on Wednesday. Crypto asset manager Hashdex has not yet specified a start date.

The fund’s approval comes as issuers worldwide aim to address surging demand for crypto-focused investments, amid a more favorable regulatory environment for these products and widening acceptance among retail and institutional investors.

In recent weeks, multiple firms, including issuing giants Bitwise Asset Management, 21Shares, CoinShares, and Grayscale, have submitted applications for spot XRP funds. XRP is the third-largest digital asset with a $158 billion market cap as of this writing.

Brazil: A crypto hub

Brazil is Latin America’s largest economy, and the third-largest economy in the Americas after the U.S. and Canada.

It is also the region’s biggest crypto player: Brazil has more Bitcoin ETFs than any other Latin American nation, and many of the country’s major banks offer investors some type of digital asset exposure.

Hashdex currently does not have a spot Bitcoin ETF in the United States, but in December received approval from the SEC for a product giving investors exposure to both Bitcoin and Ethereum.

XRP was created by the founders of fintech company Ripple, which focuses on moving money across borders in a faster, more efficient way.

J.P. Morgan analysts have predicted that between $3 billion and $6 billion could be invested in such funds. Spot Bitcoin funds have generated more than $40 billion in net inflows since debuting in January 2024. ETFs based on Ethereum’s price have received more than $4.5 billion in net flows since trading began last July.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Bank of America Handing $2,850,000 To Customers in Settlement Over Alleged Illegal Fees and Account Restrictions

US SEC and Binance Agree To Pause Legal Proceedings for 60 More Days

Why Fartcoin Is Blasting Off Again Amid Crypto Market Chaos

US Senate bill threatens crypto, AI data centers with fees — Report

More Deputy Attorney General, Less New York Attorney General

Bitcoin Poised For W-Bottom Reversal, Says John Bollinger

Markets

Why Fartcoin Is Blasting Off Again Amid Crypto Market Chaos

Published

2 hours agoon

April 11, 2025By

admin

Crypto traders are leaning into absurdity during a time of tariff volatility and broader market uncertainty, catalyzing the recent surge around Fartcoin and other Solana-based meme coins inspired by topics like flatulence and anatomical features.

Fartcoin is up 30% in the last 24 hours to $0.96, marking a 97% gain in the last seven days and nearly 250% jump in the last 30 days, according to CoinGecko.

During a time when major coins have taken hard hits and some remain well down—Ethereum is down 13% on the week—why is Fartcoin resonating with traders? There may be comfort in nonsense, or at least in meme coins that previously skyrocketed and now are doing so yet again.

If you bought Fartcoin 7 days ago you out traded eth holders that have held eth for the past 4 years.

Lmfao.

— TOPFUD

(@Topboycrypto) April 11, 2025

“I think everyone knows what they’re getting into,” Matthew Nay, a research analyst on Messari’s protocol services team, told Decrypt about tokens like Fartcoin. “Like how Bitcoin is the original meme coin. You didn’t know the founder… it was this decentralized thing in practice. With Fartcoin, there is no founder to rug you, there is no timeline or roadmap that it has to adhere to. Instead, you’re just speculating on sentiment.”

Sentiment surrounding the token has improved of late as its mindshare has more than doubled to 28.72% since April 1, leading all other AI-related tokens according to data from analytics platform Cookie.fun. The platform uses data from X (formerly Twitter) and the Solana blockchain to determine a token’s mindshare among crypto participants.

For those participants, the risk appetite and “long-term bullish bias” on crypto haven’t faded, according to Nay.

“Not that many people left in the last 2-3 months, and they all remember making a lot of money on meme coins, specifically Fartcoin with its incredible run-up,” he added.

The token, which was dreamt up by an AI agent last October, hit an all-time high mark of $2.48 in January. It then crashed to a low of about $0.20 in March, but has substantially rebounded in recent weeks.

The simplicity and absurdity of Fartcoin has seemingly trickled into other high-performing meme coins on the Solana blockchain, where Buttcoin and Titcoin—both of which have a logo that turns the Bitcoin “B” sideways to mimic buttocks and breasts—are running higher.

The coins are up 39% and 18% on the day, respectively, outpacing the entire meme coin category—which is up just 2%, according to CoinGecko. To Nay, their success follows a popular crypto phenomenon of riffing on existing successes.

“This is just a continuation we see across all of crypto with forked projects,” he said. “As soon as someone sees something successful, they try to recreate a very similar version to draft on the first iteration’s success: Uniswap to Sushi Swap, Ohm to Abracadabra, etc.”

Their fate in the near future is anyone’s guess, however, particularly given Fartcoin’s wild swings over the past months. The Messari analyst said he’s curious to see what happens to these memes should even more negative financial news come out in the near-term.

“We’re simmering down on the macro environment,” he said. “People are ready to turn on the gas a little more and get back to focusing on crypto fundamentals,” he added, noting that without major negative news ahead, a new meme coin surge could arrive.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Altcoin

Hyperliquid shows bullish reversal, key target at $18.50 in sight

Published

7 hours agoon

April 11, 2025By

admin

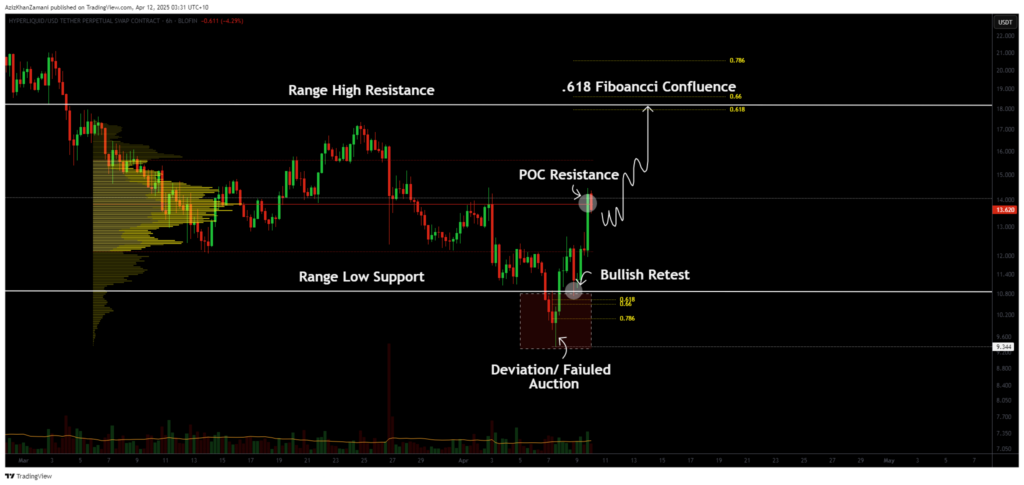

Hyperliquid just pulled off a strong bounce back into its range after faking out to the downside. In this breakdown, we’ll go over what levels matter next, and where price could be heading if momentum continues.

Hyperliquid (HYPE) has recently shown strong signs of a bullish reversal following a deviation below its range low. With a confirmed reclaim and a clean bullish retest, the current price structure suggests that higher prices are on the horizon. As long as the deviation low remains intact, traders should keep a close eye on this setup as it continues to build bullish momentum.

Key Points:

- Price deviated below $9.34 before reclaiming the range — a failed auction signal

- Bullish retest of the range low aligned with the 0.618 Fibonacci retracement

- Current consolidation could lead to a breakout toward $18.50 — the range high

Deviation of the range low

Hyperliquid established a key swing low at $9.34 before quickly reclaiming the previous trading range. This price action formed what is considered a deviation or failed auction, a signal that sellers were unable to push the market lower and were instead trapped beneath the range.

The reclaim was not just emotional but technical, with a precise bullish retest of the range low that aligned perfectly with the 0.618 Fibonacci retracement level — a well-respected area of interest among technical traders.

Following this reclaim, two consecutive bullish engulfing candles confirmed renewed momentum, pushing price back into the point of control the zone where the highest volume has been traded within this range. This shows that market participants are stepping back in with conviction.

Now, price action finds itself consolidating in the middle of the range, forming a textbook bull flag or shallow pullback pattern. If this resolves upward, it could provide a springboard toward the next major resistance zone.

The next upside target lies at $18.50, the top of the range and another 0.618 Fibonacci resistance level. As long as the deviation low at $9.34 holds, this structure remains firmly bullish. However, traders should watch closely: any breakdown below that level could invalidate the setup and spark a downside move.

For now, the bullish scenario remains valid. This setup offers a strong opportunity for short-term swing traders, but only with proper confirmation. Wait for a breakout above local resistance with strong volume support before entering. Patience in such setups often leads to better trade entries and reduced risk exposure.

Source link

CEX.io

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Published

1 day agoon

April 10, 2025By

admin

As risk assets including cryptocurrencies struggled on Thursday amid tariff uncertainties, tokenized gold once again emerged as an outperformer in the carnage.

The market capitalization of gold-backed tokens swelled to just under $2 billion on Wednesday, up 5.7% over the past 24 hours, according to CoinGecko data. The rise coincided with the yellow metal briefly touching a fresh all-time above $3,170/oz, TradingView shows.

Alongside the price rally, gold tokens experienced a frenzy of activity and demand over the past weeks, fueled by the broader market turmoil. Weekly tokenized gold trading volume surpassed $1 billion, the highest since the U.S. banking turmoil of March 2023, according to a report by digital asset platform CEX.IO.

The two largest tokens, Paxos Gold (PAXG), Tether Gold (XAUT), making up the bulk of the tokenized gold market, saw their weekly trading volumes surging over 900% and 300%, respectively, since January 20, according to the report citing CoinGecko data. PAXG also experienced continuous inflows totalling $63 million during this period, DefiLlama data shows.

The rally tracks the broader gains in physical gold, which posted double-digit increases in 2025 amid geopolitical uncertainty and inflation concerns. However, even gold wasn’t spared during the market-wide sell-off triggered by U.S. tariffs, with prices briefly dropping 6% before quickly recovering to record highs.

Since Trump’s inauguration, tokenized gold has been one of crypto’s top performing sectors, with its market cap up 21%, the report noted. By contrast, stablecoins gained a more modest 8% in market cap, while bitcoin declined 19% and the total crypto market lost 26%.

“Tokenized gold is emerging as one of the key diversification strategies among crypto-native users, alongside bitcoin,” wrote Alexandr Kerya, VP of product management at CEX.IO. “It provides a safer and more stable approach to portfolio management, enabling users to stay within the crypto ecosystem while benefiting from the value and stability of the underlying physical asset.”

“At the same time, the broader RWA narrative helps make gold exposure more accessible and intuitive for users who may not have considered it before,” Kerya added.

Disclaimer: This article, or parts of it, was generated with assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Source link

Bank of America Handing $2,850,000 To Customers in Settlement Over Alleged Illegal Fees and Account Restrictions

US SEC and Binance Agree To Pause Legal Proceedings for 60 More Days

Why Fartcoin Is Blasting Off Again Amid Crypto Market Chaos

US Senate bill threatens crypto, AI data centers with fees — Report

Crypto Emerges From the Tariff War

More Deputy Attorney General, Less New York Attorney General

Bitcoin Poised For W-Bottom Reversal, Says John Bollinger

Hyperliquid shows bullish reversal, key target at $18.50 in sight

AB Charity Foundation Launches Global Operations with Blockchain-Backed Public Good Framework

“DOGE to be Set Free!” – Dogecoin Price to Soar as Top Trader Spots Rare Pattern

Ripple, SEC File to Suspend Appeals Pending ‘Negotiated Resolution’ of Case

Cointelegraph’s Q1 crypto editorial roundtable

BTC Defies Peak Fear as USD Plunges Over Trump’s China Trade War

How Semler Scientific (SMLR) Escaped The Zombie Zone With A Bitcoin Treasury Strategy

Analyst Compares Trump’s Market Impact to Obama Era as Bitcoin Sees Momentum

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x