crypto assets

Florida has $800m in crypto-related holdings: CFO

Published

2 months agoon

By

admin

Florida Chief Financial Officer Jimmy Patronis revealed that the state holds approximately $800 million in crypto-related investments as part of its portfolio, a position he discussed during a CNBC interview.

Patronis emphasized Florida’s commitment to exploring cryptocurrency as a viable investment, despite traditional concerns about its role in state retirement funds.

“Crypto is not going anywhere. It’s not going to contract. It’s going to continue to be expanding,” Patronis stated in the interview, expressing confidence in the technology’s long-term potential.

Patronis made it clear that he views cryptocurrency as an established asset class with substantial investment prospects.

“We have about $800 million in crypto-related investments in our state portfolio,” Patronis said in reference to Florida’s crypto holdings.

Florida isn’t the first U.S. state to dabble in crypto holdings. Wisconsin’s Investment Board had invested in the two largest spot Bitcoin (BTC) ETFs, holding 2.4 million shares of BlackRock’s iShares Bitcoin Trust worth nearly $99.1 million as of May 2024. Additionally, a U.S. SEC filing revealed that the state-owned over 1 million shares of Grayscale’s GBTC, valued at more than $63.3 million at the end of March.

Other states like Ohio and Pennsylvania have pushed pro-crypto legislation as well.

Florida and crypto regulation

The interview also covered regulatory concerns. Patronis discussed Florida’s approach to crypto regulation, particularly regarding national issues like the potential implementation of a central bank digital currency.

He expressed concerns about possible federal overreach with a centralized digital currency, emphasizing that cryptocurrency offers an alternative for preserving purchasing power amid inflationary pressures.

Patronis outlined a broader vision to position Florida at the forefront of the crypto landscape, with the aim of making Miami a key global crypto hub.

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

crypto assets

India’s Ambiguous Crypto Policy: Time for Worldwide Unity

Published

6 days agoon

December 17, 2024By

admin

The Indian government stated in a recent declaration to Lok Sabha that there is no fixed timeline for the rollout of the comprehensive set of regulatory guidelines for virtual assets.

The government’s response followed queries posed by two Members of Parliament on what steps were being taken to set up a structured regulatory framework along with an expected timeline for such regulations.

Although the administration noted that it consulted with industry stakeholders and relevant international organizations both formally and informally, it asserted that policy efforts on VDA are needed globally in order to avoid regulatory arbitrage to ANI. India seeks to have effective regulation of borderless crypto assets emerge only through deep international cooperation.

BREAKING: 🇮🇳 Crypto regulation discussed in parliament: 🧵

1⃣ Comprehensive Framework: The government is working on a regulatory framework for VDAs but emphasizes the need for international collaboration to address their borderless nature and avoid regulatory arbitrage. pic.twitter.com/Njlvw48Urj

— Crypto India (@CryptooIndia) December 16, 2024

As taxation on VDA-related income already exists and with VDA transactions brought under the Prevention of Money Laundering Act since March 2023, the government said crypto assets are borderless and thus require international cooperation to prevent regulatory arbitrage. The adoption of the “G20 Roadmap on Crypto Assets” during India’s G20 Presidency brought forth the pressing need for collaborative action at the global level while urging all jurisdictions, especially emerging economies, to develop risk-sensitive regulation.

However, challenges linger as India navigates the path of innovation and investor protection alongside economic strength and financial stability. Given that VDAs transcend borders, the investor protection framework is seen as lacking without robust international cooperation. A clear regulatory timeline leaves market participants with clarity to contend with, as policies rooted in national interest as well as shifting global consensus about how to regulate digital assets continue to take shape.

These latest developments uphold a rising vulnerability in India’s quickly changing crypto sector. While it leads many countries in grassroots digital asset adoption, its popularity has also put it at the top of the list for many fraudsters.

The Andhra Pradesh scam, the most recent in a string of high-profile crypto-related frauds, fits a mold that has emerged elsewhere this year in India, where the lure of appealing monthly returns and aggregates framed as affiliated to reputable exchanges have brought investors from all backgrounds into elaborate enterprises.

Source link

Bitcoin

Fair Value Accounting for Bitcoin: FASB Rules Take Effect

Published

1 week agoon

December 16, 2024By

admin

As of today, the Financial Accounting Standards Board will put its Fair Value accounting rules on BTC and other eligible crypto assets into effect.

Under the new rules, companies will measure crypto assets at fair value and update them at each reporting period in their financial statements. This will help companies realize both profits and losses based on Bitcoin’s (BTC) market prices, helping them keep pace with the often fluctuating traded status of the currency. FASB ASC Subtopic 350-60 outlines a new accounting standard that is suitable for fungible crypto assets that meet certain requirements. However, NFTs, wrapped tokens, and internally generated digital assets are exempt from the scope.

HISTORY: FASB FAIR VALUE ACCOUNTING RULES FOR #BITCOIN OFFICIALLY TAKE EFFECT TODAY

Previously, companies could only value BTC at the price they bought, NOT the gains

THE CORPORATE ADOPTION WAVE 🙌 pic.twitter.com/3NHmLsEauX

— The Bitcoin Historian (@pete_rizzo_) December 16, 2024

Companies holding BTC as treasury reserve assets can now benefit from simplified reporting processes due to FASB’s decision to embrace fair value accounting. The update is anticipated to accelerate corporate adoption by providing greater transparency and a more precise valuation of crypto holdings for investors, creditors, and other stakeholders. As businesses increasingly turn to BTC as a long-term strategic reserve, this rule change will cement BTC’s dominance further into the fabric of modern finance.

Allowing companies to account for BTC, with BTC assets priced at fair value, will do away with a major disjunction in corporate reporting, given that BTC used to be to be valued using its purchase price until now. Any gains were left out of the records, and only losses were recorded if the value decreased. Offering this option will also give retail investors an unrounded view of a company’s financial position.

The new rules, which mandate reporting of BTC at current market value, will provide more transparency and accuracy of the financial statements, allowing investors to assess risks, cash flows, and performance more effectively for companies such as MicroStrategy, Tesla and so on. Differences between traditional markets and the crypto economy fade as BTC’s grip as a financial asset becomes firm and clearer, and fair-value accounting standards are now in place.

Source link

Altcoin

Bitcoin Flash Crash Drags Meme Coins Down: Doge, Shiba, Pepe

Published

2 weeks agoon

December 11, 2024By

admin

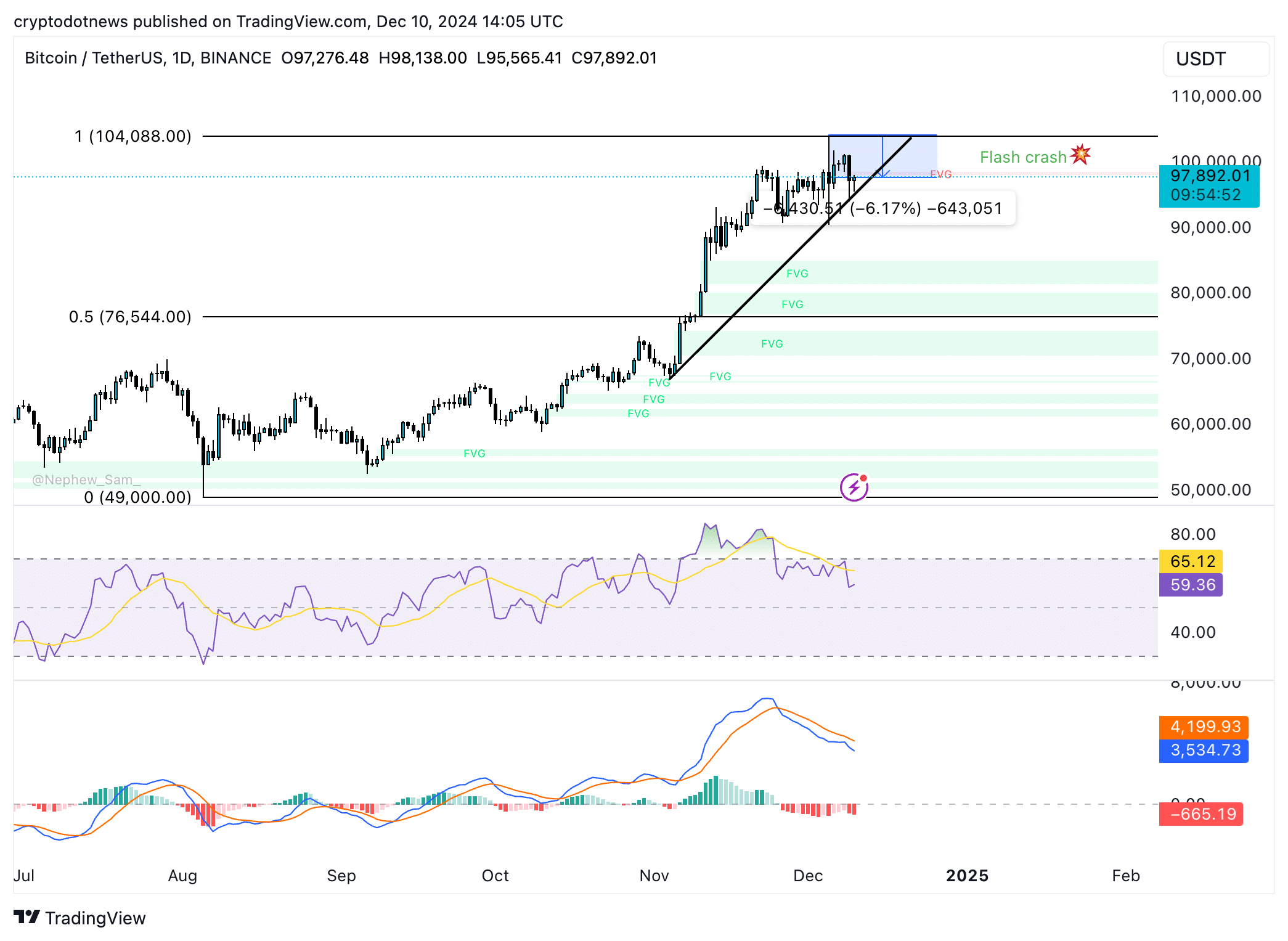

Bitcoin crashed nearly 10% below its all-time high of $104,088 to a low of $94,150 on Monday. The flash crash was short-lived, but it dragged down altcoins and meme coins like Dogecoin, Shiba Inu, Pepe, Dogwifhat and Bonk.

The top 10 meme coins ranked by market capitalization noted nearly double-digit losses in the past 24 hours. As altcoin season ends abruptly, it remains to be seen whether meme coins can recover from their recent losses and hit their cycle bottom.

Bitcoin correction and meme coin price trend

Bitcoin trades nearly 6% below its all-time high on Tuesday. The largest cryptocurrency’s flash crash ended the altcoin season. The blockchain centre altcoin season index reads 65 on a scale from 0 to 100, meaning the alt season has ended.

Technical indicators show mixed signals on where the BTC price is headed; the relative strength index reads 59 and is sloping upwards. However, moving average convergence divergence shows underlying negative momentum in the Bitcoin price trend.

Further correction in Bitcoin does not bode well for meme coins as a decline in the largest cryptocurrency ushers mass liquidation in meme coins and altcoins across derivatives exchanges.

Meme coins have suffered a steep decline in the past 24 hours, and while the tokens have started a recovery in the past hour, there have been double-digit corrections across the top 10 tokens.

The meme category erased nearly 15% in market capitalization in the past 24 hours, down to $128.26 billion.

Meme coins and Santa rally

While meme coins led gains this altcoin season, it remains to be seen whether the “seasonal” gains will push prices higher. Typically, during the Christmas holidays, altcoins tend to rally, this is a result of less activity across crypto exchanges and a relatively lower volume of trades.

Both factors make it easier for the market to move and prices to fluctuate against lower liquidity.

Meme coin price charts show tokens have rallied ahead of Christmas on previous instances, if history repeats meme tokens lead by Dogecoin could recover lost ground and make a comeback before the end of 2024.

DOGE has rallied nearly 350% year-to-date. In the same timeframe, SHIB, PEPE, WIF and BONK gained 160%, 1,860%, 145% and 180% respectively.

Despite the recent pullback in meme coin prices, each of the tokens in the top five has yielded over three-digit gains for hodlers in 2024. This supports a thesis of price recovery and year-end rally for the category.

Trump correlation and bullish drivers

The incoming U.S. President Donald Trump and his Department of Government Efficiency D.O.G.E, led by tech giant Elon Musk and fellow Presidential candidate Vivek Ramaswamy have acted as key drivers of the meme coin rally this cycle.

Elon Musk’s comments and D.O.G.E’s incorporation are top market movers for DOGE, other factors like capital rotation from altcoins and altcoin season drove meme coin prices higher in the past four weeks.

While several meme coins rank among trending tokens every day, DOGE, SHIB, PEPE, WIF and BONK have earned the reputation of blue-chip meme coins. The tokens have a market capitalization of between $1.21 billion and $15.33 billion, per CoinGecko data.

Even as top five cryptocurrencies compete with each other, Solana battles XRP and Ethereum for market share, meme coins play a crucial role in the narrative. A report by 21Shares published earlier this week states meme coins contributed to a majority of the trade volume across Solana-based decentralized exchanges.

Data from the Artemis Terminal shows that as of November 27, meme coins have achieved a 261% year-to-date growth, making them the second-best-performing sector in the crypto space, trailing only Real-world assets.

LBank, a cryptocurrency exchange platform, identified the top 10 meme coins of 2024 that include tokens that are not considered blue-chip but outperformed the sector.

Technical analysis and price targets

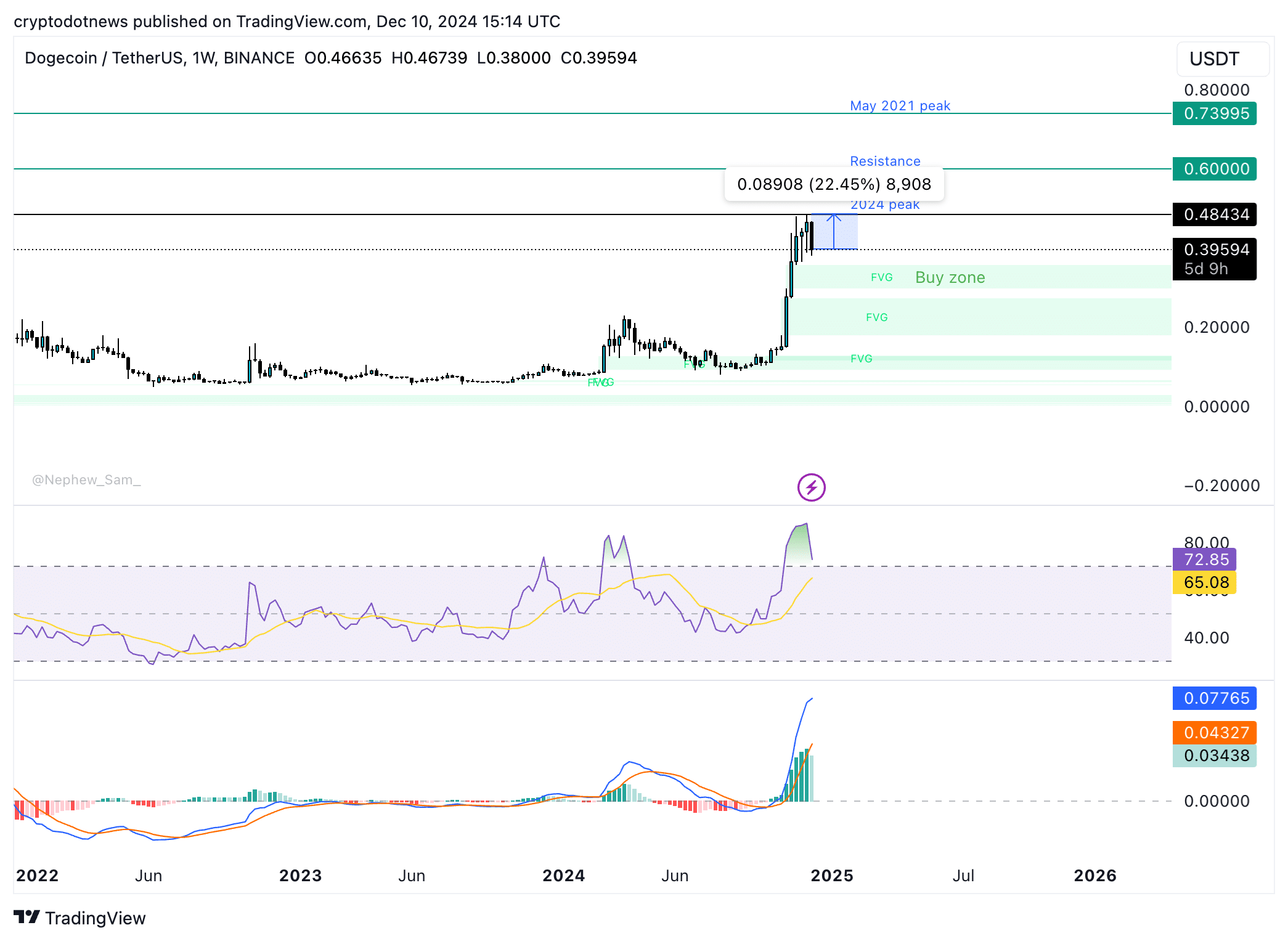

Dogecoin is currently trading 22% below its 2024 peak of $0.48434, as seen in the DOGE/USDT weekly price chart. The target for the cycle is the May 2021 peak of $0.73995, and a key resistance on the path is at $0.60000.

RSI shows DOGE is currently overvalued, and typically, this is considered a sell signal. A short-term correction could send the meme coin to the buy zone between $0.29874 and $0.35740.

MACD indicates an underlying positive momentum in the DOGE price trend.

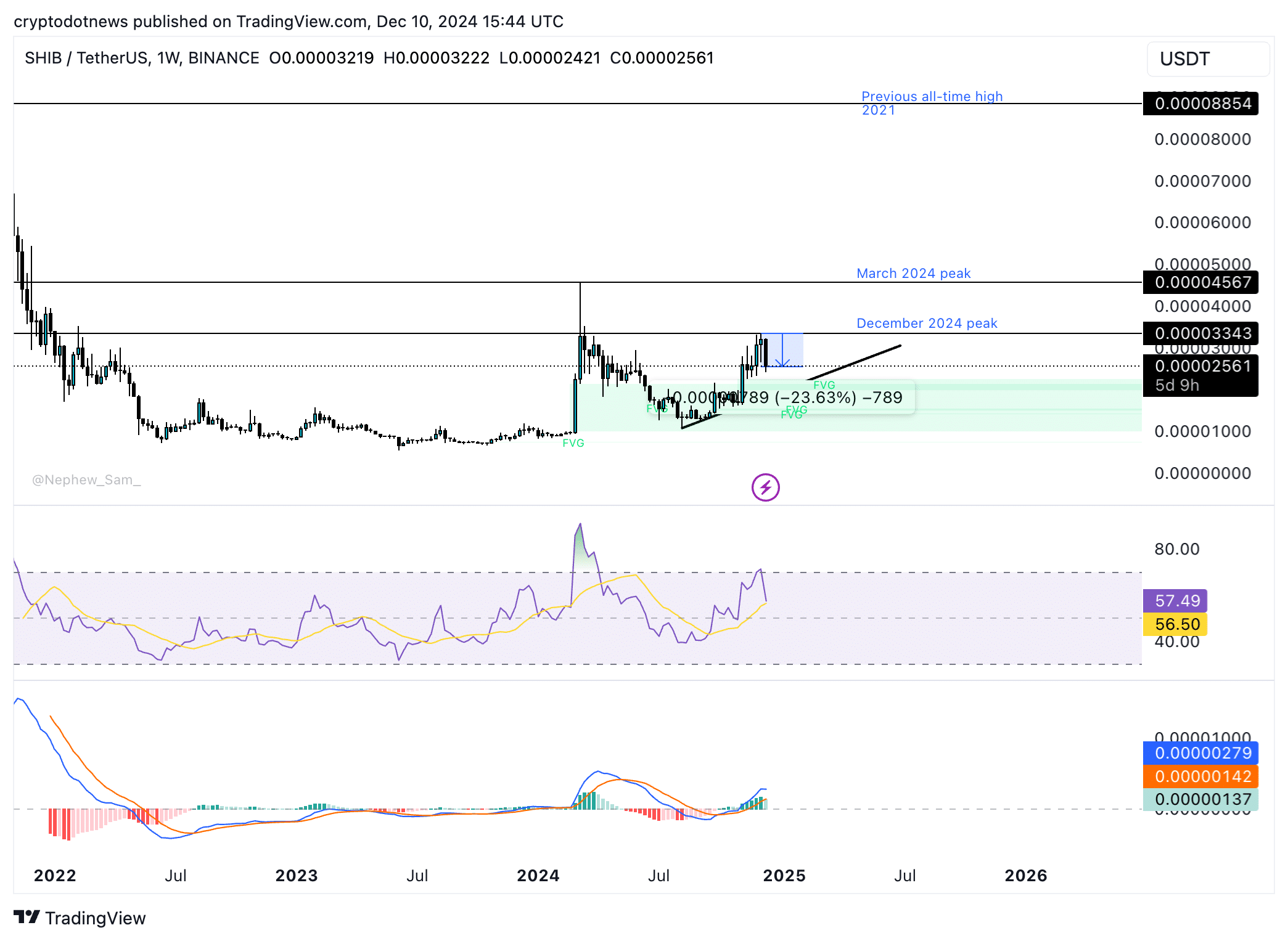

Shiba Inu declined nearly 23% from its December 2 top of $0.00003343. The momentum indicator MACD shows an underlying positive momentum in the SHIB price trend.

The target for the cycle is a March 2024 peak of $0.00004567, nearly 40% above the current price. The buy zone for Shiba Inu is between $0.00001983 and $0.00002259.

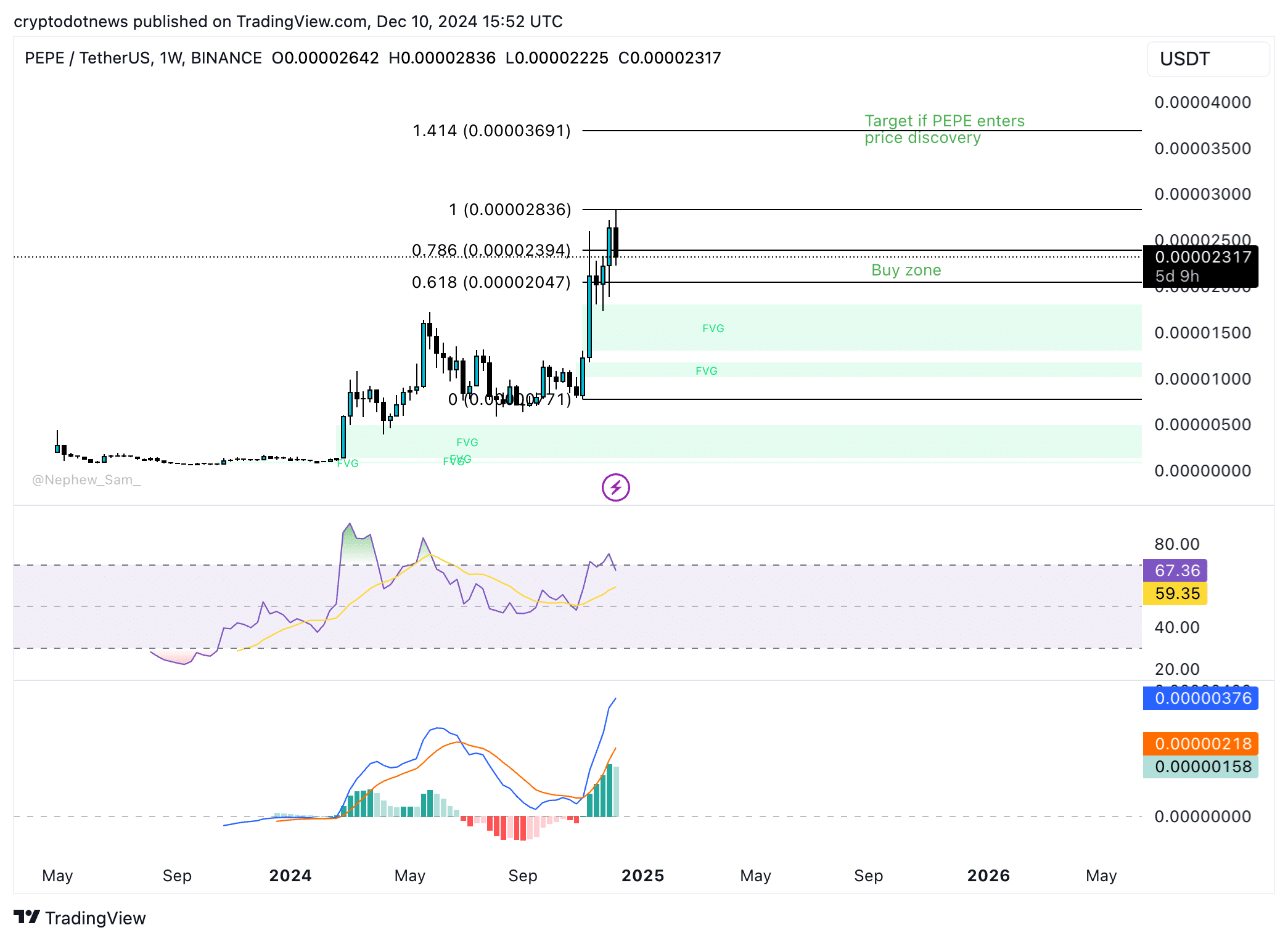

PEPE is currently within the buy zone, marked by the 61.8% and 78.6% Fibonacci retracement levels of the rally from the November 4 low of $0.00000771 and the December 9 peak of $0.00002836.

The target for the cycle is 141.4% Fibonacci retracement level at $0.00003691.

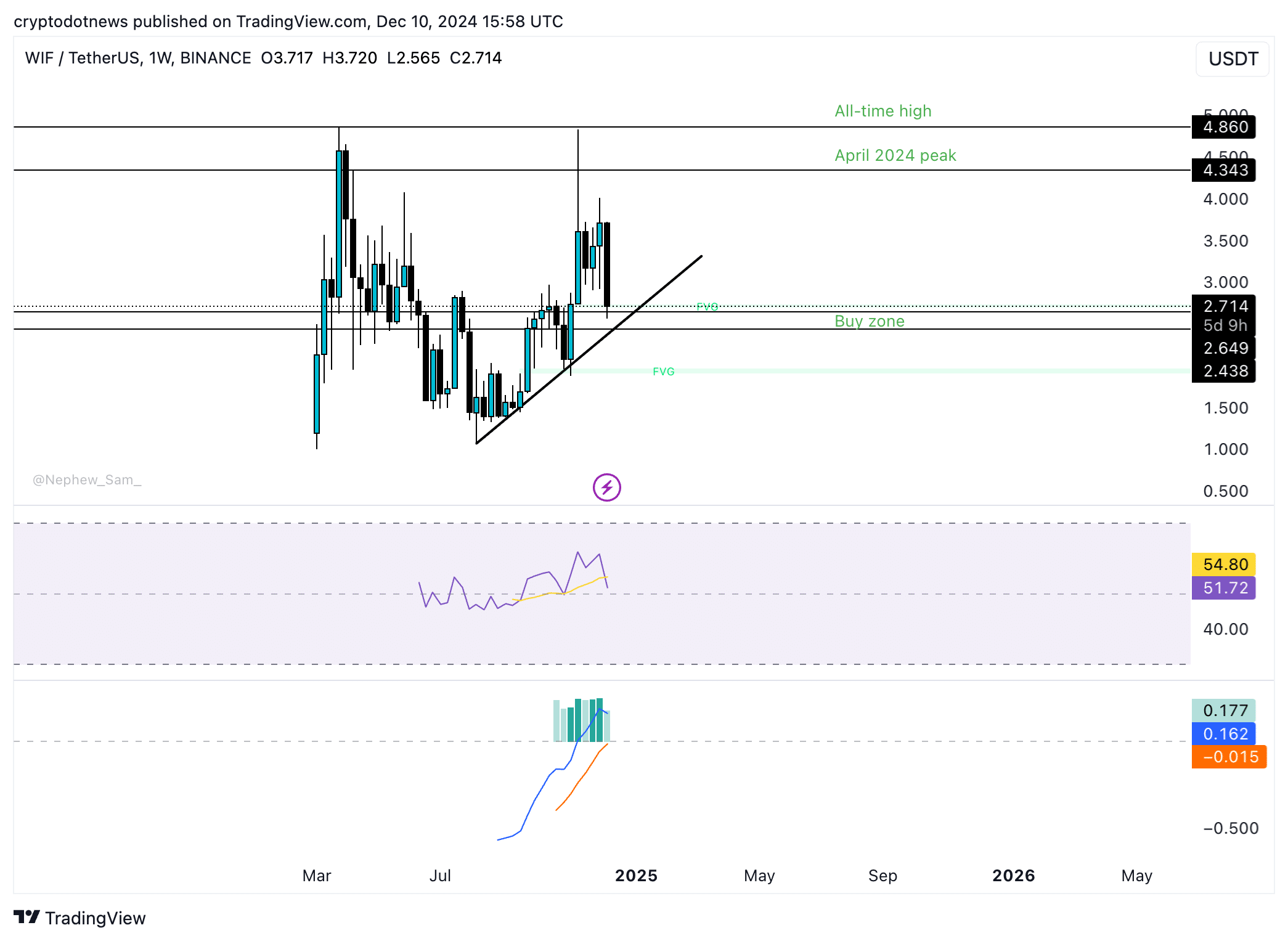

WIF’s target for the cycle is the all-time high of $4.860, the resistance is the April 2024 peak of $4.343. The buy zone for sidelined trades is between key support levels at $2.438 and $2.649.

MACD supports a thesis of further gains in WIF price this cycle, traders need to keep their eyes peeled for trend reversal as RSI is sloping downward.

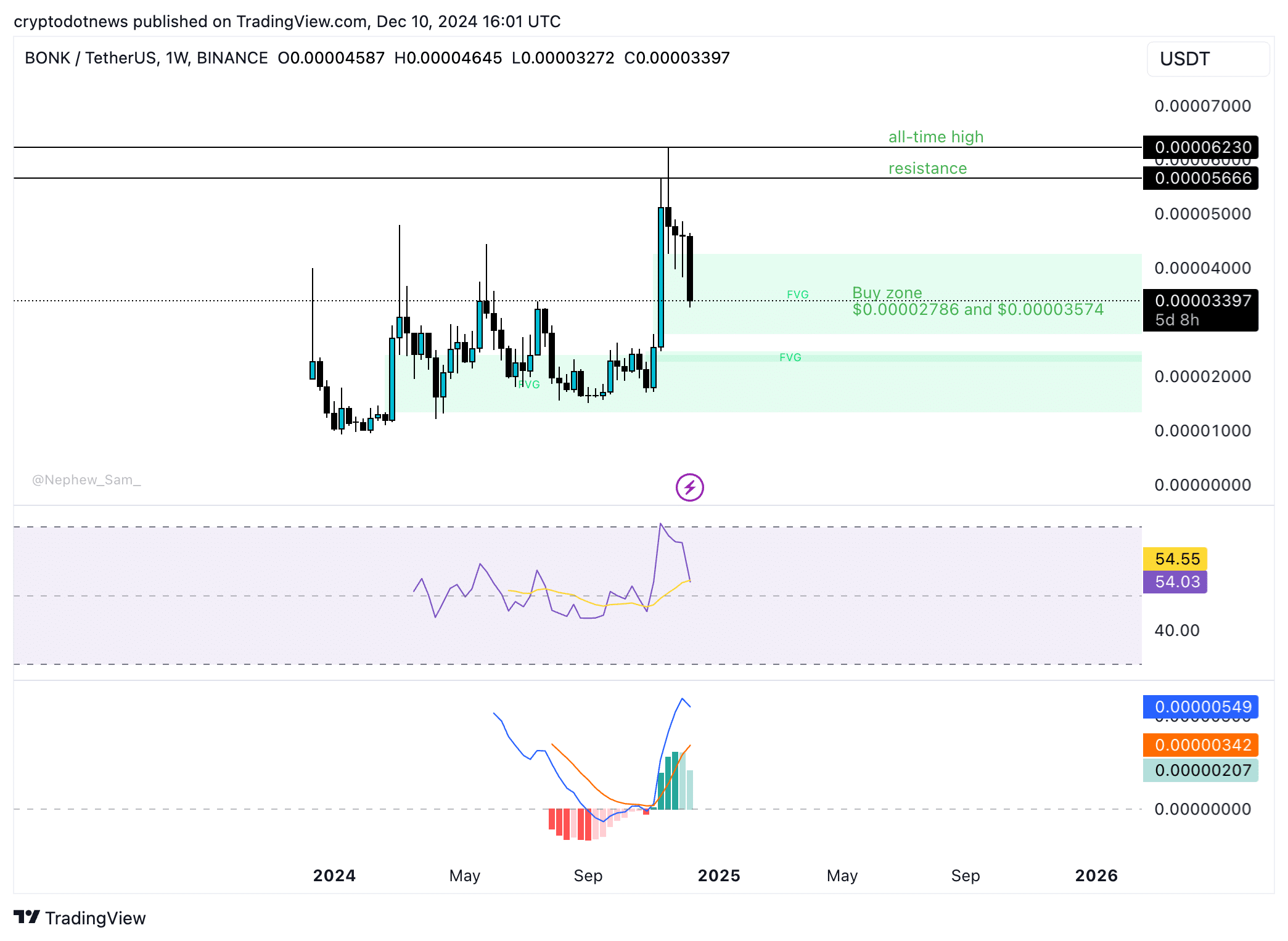

BONK is currently within its buy zone between $0.00002786 and $0.00003574. BONK’s target is at an all-time high of $0.00006230, and resistance is at $0.00005666. MACD supports a bullish thesis for BONK price.

RSI is sloping downward and reads 54, close to the neutral level. BONK could observe a short-term correction prior to its recovery and rally towards its cycle top.

Strategic consideration

Bitcoin’s steep price decline pushed the meme coin category nearly 15% lower in market capitalization. Meme tokens typically react negatively to corrections in Bitcoin price. Traders need to watch the BTC price trend closely for drops in meme coin prices this cycle.

Altcoin season has ended, and meme coins no longer lead gains among different crypto token categories. Traders need to pick meme coins with strong community, liquidity and relatively high market capitalization to protect against rug pull incidents and unprecedented losses.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential