Bitcoin

Franklin Templeton crypto index ETF delayed by SEC

Published

5 months agoon

By

admin

Franklin Templeton, one of the crypto exchange-traded fund (ETF) issuers, has expressed interest in releasing the crypto index ETF, but the authorities are now delaying it.

The Securities and Exchange Commission (SEC) detained the deadline for approving the crypto index ETF by Franklin Templeton. According to the filing on Nov. 20, the authorities raised their concern about the sufficient time they needed to decide whether it would be accepted or declined.

“The Commission may designate if it finds such longer period to be appropriate and publishes its reasons for so finding or as to which the self-regulatory organization consents, the Commission shall either approve the proposed rule change, disapprove the proposed rule change, or institute proceedings to determine whether the proposed rule change should be disapproved,” SEC fillings.

On August. 17, based on their filing, Franklin proposed the crypto index ETF by holding Bitcoin (BTC) and Ethereum (ETH) with the ticker EZPZ. The proposed fund would allow the two most prominent crypto in the world under the same index with an unspecified ratio weighted by market capitalization.

If approved by the authorities, EZPZ would use the Coinbase custody and be listed on the Cboe BZX exchange. Franklin may add another crypto into the index but should gain approval from the SEC.

Franklin Templeton moves on crypto

Franklin Templeton, which is based in New York, is one of the most adaptable asset managers that allows investors to gain more exposure from the crypto price movement. Franklin created another crypto-related product after receiving the authority approval in January for Bitcoin spot ETF.

On October. 31, they tokenized money market funds into several blockchains, including Base, Arbitrum, Polygon, Avalanche, Aptos, and Stellar. The U.S. government money market fund (FOBXX) has $410 million in assets being tokenized into that blockchain.

Franklin also works with SBI Group in Japan to prepare for the possibility of accepting the crypto fund in the country, but this work’s development has not been published yet.

Source link

You may like

$227,000,000 Worth of OM Tokens Moved to Crypto Exchanges Prior to 90% Price Collapse of Mantra: On-Chain Data

Binance, KuCoin face interruptions due to ‘large-scale outage’ in Amazon’s data center

Tariffs May Help Fund US Bitcoin Reserve Buildup Says White House Advisor Bo Hines

Here’s Why a Massive Ethereum Price Rally is Next

Dogecoin Slumps 3%, Bitcoin Steady Around $85K as Traders Fear U.S. Recession

Crypto exec warns of ‘ELUSIVE COMET’ threat after losing 75% of assets

Bitcoin

Bitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

Published

8 hours agoon

April 15, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $83,500 zone. BTC is now consolidating gains and might attempt to clear the $85,500 resistance.

- Bitcoin started a fresh increase above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Eyes More Gains

Bitcoin price started a fresh increase above the $82,500 zone. BTC formed a base and gained pace for a move above the $83,000 and $83,500 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,000 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the bulls were active near the $83,000 zone and the price recovered losses. Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,000 level. The first key resistance is near the $85,500 level. The next key resistance could be $86,200. A close above the $86,200 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $88,000 level.

Another Rejection In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start another decline. Immediate support on the downside is near the $84,200 level and the trend line. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,200, followed by $83,500.

Major Resistance Levels – $85,500 and $85,850.

Source link

Altcoins

Analyst Says Solana Flashing Biggest Bear Trap, Predicts New All-Time High for SOL by End of 2025

Published

10 hours agoon

April 15, 2025By

admin

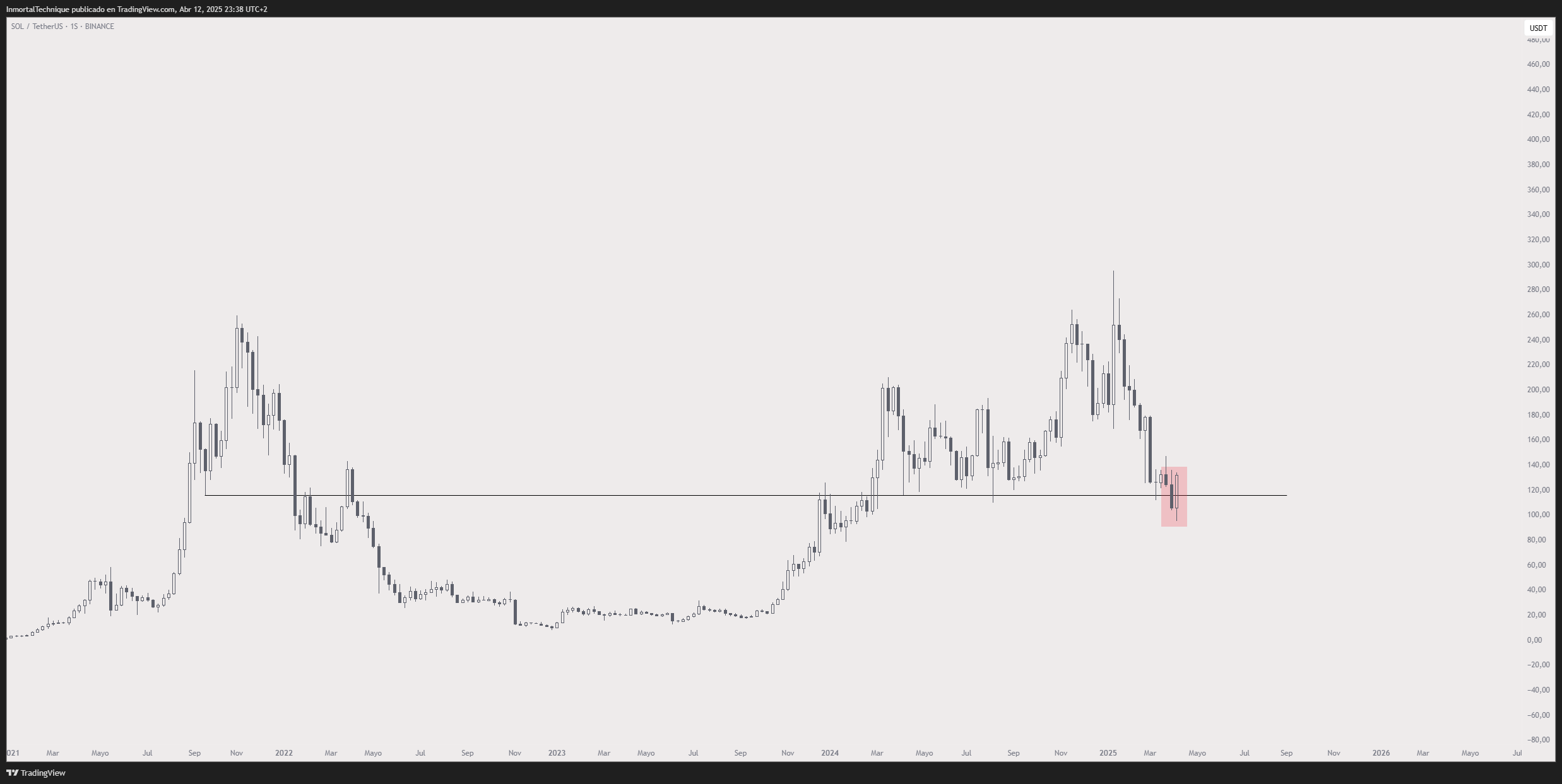

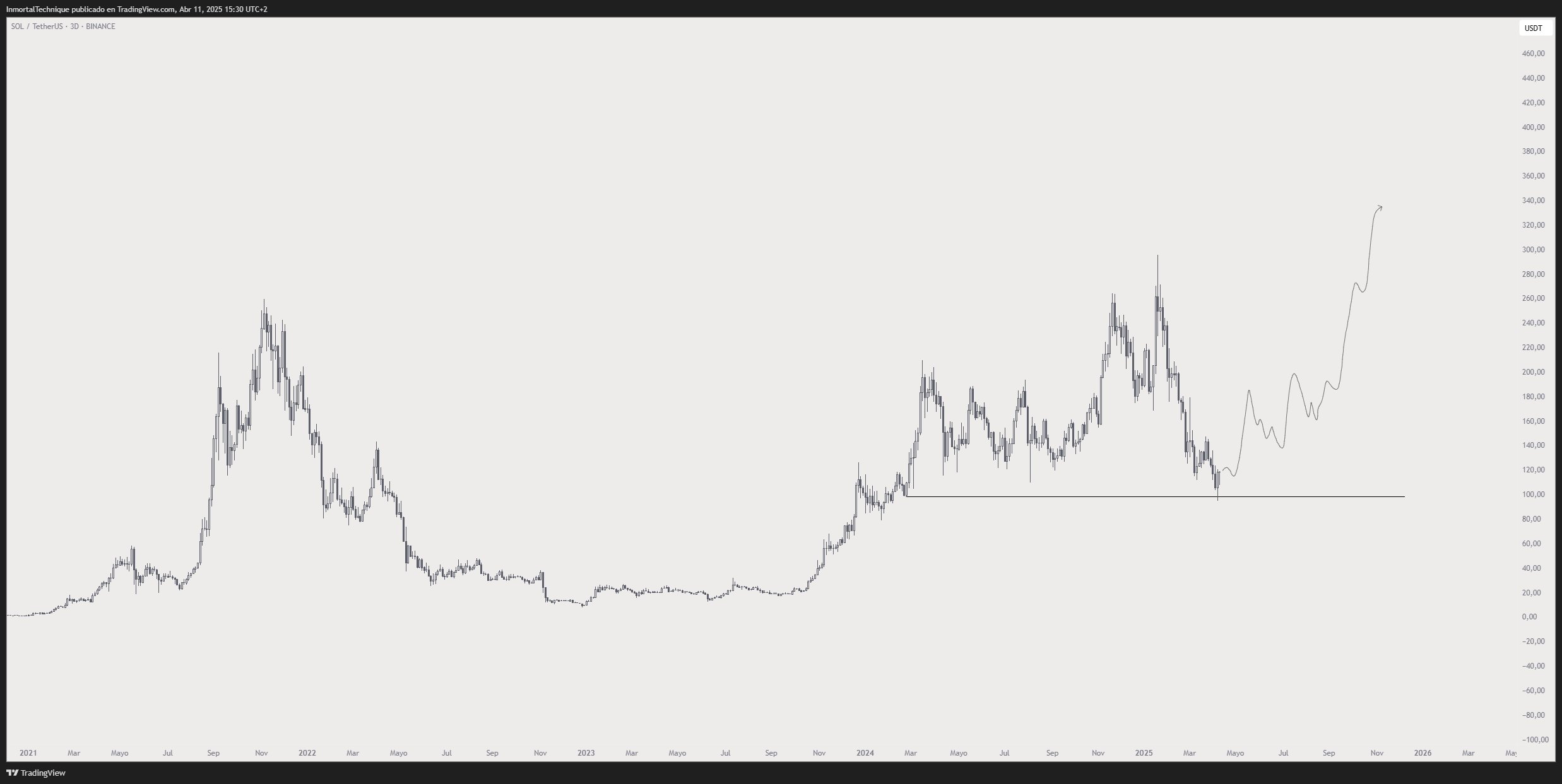

A closely followed trader believes that the layer-1 protocol Solana (SOL) may have just flashed a strong bullish reversal signal.

Pseudonymous trader Inmortal tells his 231,500 followers on the social media platform X that Solana appears to have set a massive bear trap earlier this month when the price of SOL briefly dropped below $100.

A bear trap is a false signal that makes it appear that the price of an asset is heading to much lower levels, but instead, the price abruptly reverses and rallies, leaving short-sellers trapped.

Says Inmortal,

“That weekly candle is maybe the biggest bear trap I’ve ever seen, SOL.”

The analyst now believes that SOL is setting the stage for strong rallies en route to a new all-time high of $340 by December 2025.

“In retrospect, it will be so obvious, SOL.”

At time of writing, Solana is trading for $128.19, down over 3% on the day.

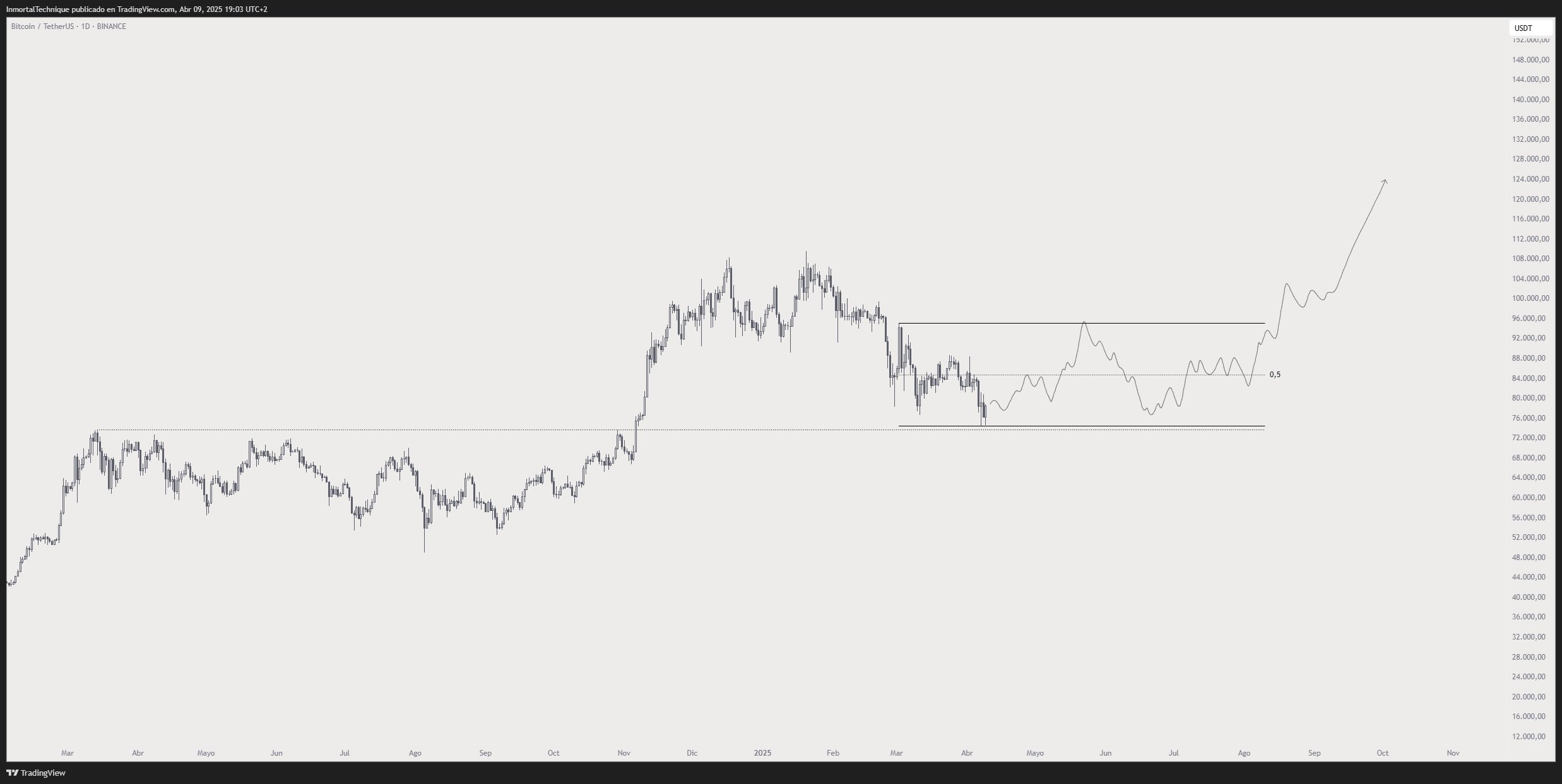

Looking at Bitcoin, Inmortal thinks that BTC will trade between $74,000 and $95,000 in the coming months before sparking a breakout rally toward the end of the year.

“Expecting something like this:

> Bounce to $90,000

> More chop/ranging ($67,000 maybe)

> Uptrend in the second half of this year

Maybe not in this exact order.

BTC.”

Based on the trader’s chart, he appears to suggest that Bitcoin will soar close to $130,000 by the end of 2025. At time of writing, Bitcoin is worth $84,943.

Turning to the memecoin Floki (FLOKI), Inmortal thinks the altcoin is at a price level where it can potentially carve a major cycle bottom.

“Accumulating more FLOKI at these levels.

RSI (relative strength index) is at the same levels it was 700 days ago, and price at pre-bullrun levels.”

The RSI is a momentum indicator that can help traders spot levels where an asset is oversold or overbought. At time of writing, FLOKI is worth $0.000057.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Bitcoin Price Hovers at $85K as Fed’s Waller Suggests ‘Bad News’ Rate Cuts if Tariffs Resume

Published

14 hours agoon

April 14, 2025By

admin

Bitcoin (BTC) drifted ever so gently upwards Monday as the broader market adjusts favorably to trade-related news.

The largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7% in the same period of time to $1,630. The broad-market CoinDesk 20 Index — consisted of the top 20 cryptocurrencies by market capitalization except for stablecoins, memecoins and exchange coins — advanced 1.2%, led by gains in SOL and AVAX.

After a couple of wild weeks, the stock market also edged higher today, the Nasdaq closing with a 0.6% gain and the S&P 500 rising 0.8%. Strategy (MSTR) and MARA Holdings (MARA), led among crypto stocks with roughly 3% gains.

The modest rally came as Federal Reserve Governor Christopher Waller signalling that a return of the original punitive Trump tariffs would trigger the need for sizable “bad news” rate cuts.

“[Tariff] effects on output and employment could be longer-lasting and an important factor in determining the appropriate stance of monetary policy,” said Waller in a speech. “If the slowdown is significant and even threatens a recession, then I would expect to favor cutting the FOMC’s policy rate sooner, and to a greater extent than I had previously thought.”

Further easing concerns was the European Commission, the executive arm of the EU, confirming to hold off on retaliatory tariffs on U.S. goods worth €21 billion until July 14 to “allow space for negotiations.”

Odds that the U.S. and EU will reach a trade agreement to avoid tariffs rose to 65% on blockchain-based prediction market Polymarket after U.S. President Donald Trump reportedly stated that a deal was in the works.

Bitcoin fundamentals recovering

Bitcoin’s relief rally from last week’s tariff turmoil stalled out around the $85,000 resistance level, but the network’s improving fundamentals spur hopes for a breakout, crypto analytics firm SwissBlock Technologies noted.

“Since March, we’ve seen a consistent inflow of new participants,” Swissblock analysts wrote in a Telegram broadcast. “Liquidity is stabilizing, no more erratic swings from early 2025.”

“Once the liquidity gauge holds above the 50 line, short-term price action tends to follow with strength,” Swissblock analysts said. “With network growth aligning, key levels aren’t just being revisited, they’re being accumulated.”

“This is the kind of structural support that underpins sustainable rallies,” they concluded.

Source link

$227,000,000 Worth of OM Tokens Moved to Crypto Exchanges Prior to 90% Price Collapse of Mantra: On-Chain Data

Binance, KuCoin face interruptions due to ‘large-scale outage’ in Amazon’s data center

Tariffs May Help Fund US Bitcoin Reserve Buildup Says White House Advisor Bo Hines

Here’s Why a Massive Ethereum Price Rally is Next

Dogecoin Slumps 3%, Bitcoin Steady Around $85K as Traders Fear U.S. Recession

Crypto exec warns of ‘ELUSIVE COMET’ threat after losing 75% of assets

Bitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

The Smarter Web Company’s UK IPO To Include Retail Access And Bitcoin Treasury Plan

Analyst Says Solana Flashing Biggest Bear Trap, Predicts New All-Time High for SOL by End of 2025

Solana liquidity grab below $90 coming first or a reclaim of point of control resistance?

OpenAI Releases GPT-4.1: Why This Super-Powered AI Model Will Kill GPT-4.5

XRP Price Retains Breakout Potential Despite Open Interest Slip

Bitcoin Price Hovers at $85K as Fed’s Waller Suggests ‘Bad News’ Rate Cuts if Tariffs Resume

South Korea blocks 14 crypto exchanges on Apple Store — Report

Ethereum Price Threatened With Sharp Drop To $1,400, Here’s Why

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x