Bankruptcy

FTX сreditors reveal compensation details: What’s wrong with it?

Published

3 months agoon

By

admin

Users were confused by the news that FTX clients would receive between 10% and 25% of the value of the deposited crypto assets. Why did this happen?

Sunil Kavuri, one of the creditors, recently said several other changes are also planned in the reorganization plan. One of the points, which concerns the amount of compensation payments to victims, raised questions in the community.

What is known about the compensation plan

Crypto assets deposited on the platform will be valued at the rate when filing for bankruptcy. Therefore, the actual compensation will be between 10% and 25% of the market value of their cryptocurrency.

FTX is transferring 18% of DOJ forfeiture funds up to $230m to FTX equity holders (Plan supplement)

FTX crypto holders are getting 10% to 25% of their crypto back pic.twitter.com/3f6BePpoNU

— Sunil (FTX Creditor Champion) (@sunil_trades) September 28, 2024

FTX shareholders will also receive an additional 18% of the funds confiscated by the U.S. Department of Justice, but no more than $230 million. This became an additional clause on increasing the share of preferred shareholders.

However, many expressed dissatisfaction with the terms of the payments, calling it a scam. One user suggested this payment schedule may be because most FTX shareholders are either Sullivan & Cromwell (representing FTX debtors) or Quinn Emanuel’s clients, hired by FTX’s new management, acting as conflicts counsel. Both law firms are working to recover assets from the bankrupt exchange’s clients.

The community speculates on the timing of compensation payments

Work is underway to return funds to account holders affected by the FTX collapse. Amid speculation about the timing of the payments, information appeared on the network that FTX crypto holders could begin receiving payments as early as Sep. 30.

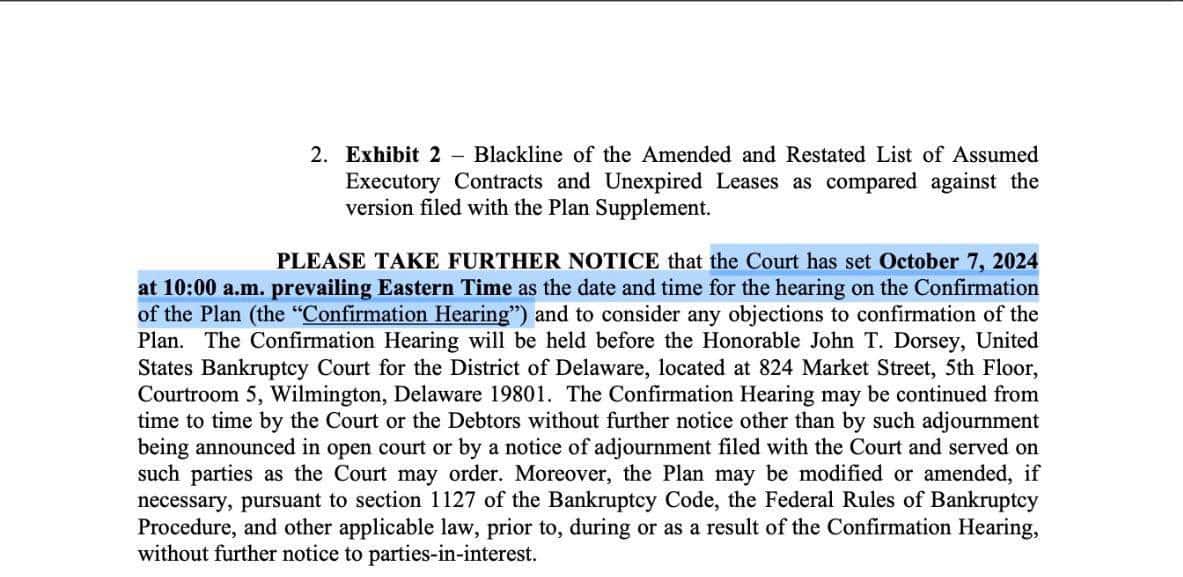

However, this was soon refuted — according to the latest data from the bankruptcy case materials under Chapter 11, the court is still studying a compensation plan.

The court filing shows that the next hearing to approve the restructuring plan is scheduled for Oct. 7. If the court approves the plan, payments for claims under $50,000 could begin in late 2024,

while others will receive compensation during the first half of 2025.

FTT Reacts With Growth

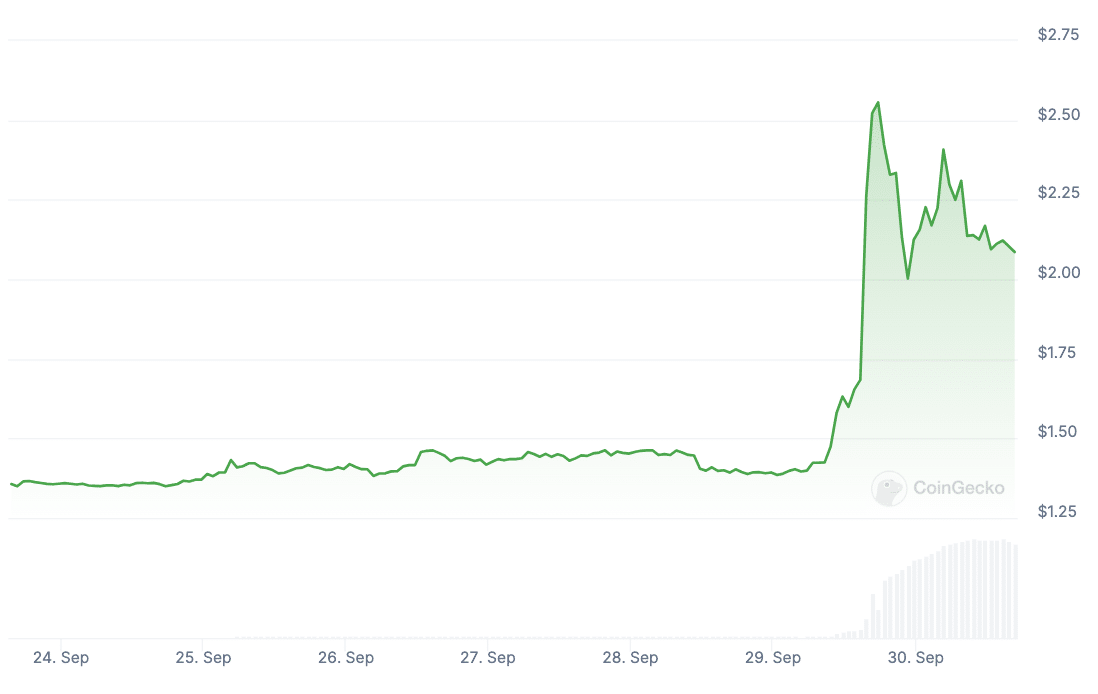

Amid the recent news, FTX has delighted investors. Hoping that the infamous crypto exchange would soon begin returning funds, investors have become more optimistic. Such an event could lead to an influx of $16 billion into the market.

At its peak on Sep. 29, the FTX token (FTT) had gained 113% in a day. By the end of the day, the price had corrected and eventually dropped to $2.11 at the time of writing.

Where did the client funds go?

FTX, once worth $32 billion, used client funds for risky investments through its closely associated hedge fund, Alameda Research. Investigations revealed that the company used client funds to cover losses in other related businesses and finance risky investment deals.

FTX’s colossal budget deficit was discovered after clients requested their money back. After FTX’s bankruptcy, a restructuring procedure was initiated, and processes began to return funds to clients. However, at that time, the exact reasons for the disappearance of funds and where they were sent remained the subject of an investigation. In total, the exchange owes about $9 billion.

Victims are waiting, and the culprits are serving their sentences

FTX’s bankruptcy shook the crypto market and affected the prices of many coins. It also raised concerns among users and regulators about the security and liability of crypto exchanges. In addition to creating a refund plan, the exchange’s top managers are being punished one after another.

Bankman-Fried was charged with fraud, money laundering, and other financial crimes related to the management of FTX and client payments. The charges are based on the fact that he allegedly used client funds to support his other businesses, including the trading company Alameda Research. In March, he was sentenced to 25 years in prison.

Caroline Ellison, former CEO of Alameda Research CEO, was sentenced to two years in prison and forfeited $11 billion on fraud and money laundering charges. Her active cooperation in the investigation of Bankman-Fried mitigated the verdict. The judge emphasized that the collapse of FTX is one of the most significant financial crimes, and Ellison’s cooperation does not absolve her of responsibility. She admitted her guilt and apologized to the victims.

Following the verdict of the former Alameda CEO, other defendants are now awaiting court decisions: FTX co-founder and CTO Gary Wang, as well as head of engineering Nishad Singh.

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Bankruptcy

The FTX Co-Founder Proved Assistance to the US Authorities

Published

1 month agoon

November 14, 2024By

admin

FTX co-founder Gary Wang, convicted of misusing funds at a fictitious crypto exchange, may face punishment after his case goes to trial.

On Nov. 13, prosecutors in the U.S. District Court for the Southern District of New York filed a brief alleging that Wang provided significant assistance in the investigation of crimes related to FTX, as well as in the prosecution of Sam Bankman-Fried and several other cases.

The government’s attorneys noted the importance of Wang’s testimony at the trial of Bankman-Fried, who was sentenced to 25 years. They also suggested that if Judge Lewis Kaplan decides to sentence Wang, he could develop a tool to identify potential illegal activities in the crypto market. Prosecutors noted that Wang’s testimony was truthful and corroborated by other evidence.

“Wang has also provided substantial assistance – and in the process taken steps to right past wrongs – by putting his extraordinary computer programing skills to use in detecting potential fraud in the stock and cryptocurrency markets.”

Court filing

Wang, who pleaded guilty to wire fraud, commodities fraud, and securities fraud in December 2022, is awaiting final sentencing on Nov. 20.

Is the FTX story nearing its end?

The latest updates would make Wang the fifth and final FTX or Alameda Research executive to face sentencing. Bankman-Fried was the only one to plead not guilty. In contrast, former Alameda CEO Caroline Ellison and FTX Digital Markets co-CEO Ryan Salame pleaded guilty. All of them are currently serving federal prison sentences.

However, the Bankman-Fried case has continued to see new details and court cases emerge, even as the founder of one of the world’s once-largest exchanges is serving his time in prison.

Meanwhile, Bankman-Fried’s assets are under threat

Earlier, U.S. prosecutors filed a lawsuit seeking to seize cryptocurrency, which they say Bankman-Fried used to bribe Chinese officials.

The lawsuit, filed on Nov. 12 in New York District Court, alleges that a Binance account, then worth about $8.6 million but later growing to about $18.5 million, was used to launder money related to bribes before FTX collapsed in late 2022.

Prosecutors noted that in 2021, Chinese authorities froze two Alameda Research accounts on Chinese exchanges that held $1 billion in cryptocurrency. Later, on Nov. 16, 2021, Bankman-Fried was recorded transferring $40 million to a personal wallet, after which the Alameda accounts were unfrozen. Prosecutors allege that Bankman-Fried initiated additional transactions worth tens of millions of dollars in cryptocurrency to complete the bribe.

“As a result of the Investigation, the Government learned that on or about November 16, 2021, at Bankman-Fried’s direction, approximately 40 million USDT (the “Bribe Payment”) was transferred from an Alameda cryptocurrency wallet hosted by FTX.”

Court filing

The account contained five linked deposit accounts, obscuring the origin of the bribe funds. They described a “flood” of deposits and withdrawals from the account and regular transfers of Bitcoin (BTC) and stablecoins to five wallets. Ellison testified that the total amount of bribes was about $150 million.

Bankman-Fried was initially charged with additional charges related to financial fraud and bribery of foreign officials, which were later dropped. On Sept. 13, his defense team filed an appeal, arguing that Bankman-Fried’s trial was unfair.

Meanwhile, the new FTX management is bombarded with lawsuits

FTX’s new management, meanwhile, is once again preparing lawsuits and demanding money. This time from Binance.

FTX bankruptcy trustees have filed a lawsuit against Binance and its former CEO, Changpeng Zhao, demanding a return of about $1.8 billion. The plaintiffs claim that Binance obtained the funds in a fraudulent transaction in 2021.

According to court documents, FTX and its trading subsidiary Alameda Research were probably insolvent from the start and were certainly insolvent on their balance sheets by early 2021. Therefore, the plaintiffs allege that the share buyback deal was fraudulent.

The lawsuit is one of many filed by FTX and Alameda against their former investors, affiliates, and customers as part of the bankruptcy case. On Nov. 9, the companies filed 23 lawsuits. Among them are claims against U.S. exchange Crypto.com and the political group FWD.US founded by Mark Zuckerberg.

FTX has also filed claims against Anthony Scaramucci and his hedge fund, SkyBridge Capital. The exchange’s lawyers claim that in 2022, Bankman-Fried invested $67 million in various SkyBridge projects since Scaramucci was “seeking financial assistance.” However, these investments “brought virtually no benefit,” the plaintiffs say. According to court documents, FTX is now trying to recover more than $100 million in damages from the company.

Alameda has also filed a lawsuit against Sasha Ivanov, the founder of the Waves blockchain. The company intends to return the $90 million invested in Vires Finance. This liquidity platform then operated on Waves.

“To divert attention from his involvement in the fraud, Ivanov attempted to publicly blame Alameda for destabilizing the Waves ecosystem, tweeting that Alameda had manipulated the WAVES price and organized FUD (“Fear, Uncertainty, and Doubt”) campaigns to trigger panic selling.”

Alameda lawsuit

And what’s next?

In general, the history of the FTX and exchange executives are two different stories. While the platform executives serve their sentences, FTX creditors are frantically trying to return the money they wasted.

The debt to creditors is about $11.2 billion, and the funds available to cover the debt is $14.6-16.3 billion.

Thus, there is very little time left before the end of the scandalous exchange story – to decide on punishment for Wang and repay everyone’s debts.

Source link

Bankruptcy

Here’s how Bitcoin reserves have changed since FTX collapse

Published

1 month agoon

November 10, 2024By

admin

November marks two years since the FTX exchange went bankrupt. Since then, major crypto exchanges have seen their Bitcoin reserves grow.

FTX’s inability to maintain sufficient reserves to meet user requests exposed severe flaws in its controls. It also highlighted the need for greater transparency and reliable reserve reporting among all crypto exchanges.

Observers have grown keenly aware of the risks that exchanges face when they lack sufficient reserves. If they cannot meet withdrawal requests, it undermines user confidence and puts them at risk of losing funds. Maintaining adequate reserves is critical for liquidity and order execution, especially during volatile periods.

In light of this trend, CryptoQuant shared with crypto.news a study on the state of exchange proof-of-reserves (PoR).

How has crypto changed post-FTX?

FTX‘s collapse in November 2022 was one of the most significant and dramatic events in the crypto industry’s history. This incident undermined investor confidence and caused profound changes in the crypto market’s structure and functioning.

At the time, the price of Bitcoin (BTC) and other major cryptocurrencies fell, reflecting fear and distrust of institutional players in the market. Many investors began to doubt the safety and stability of crypto and, as a result, decided to leave the market completely.

Attention toward security issues became even more urgent. Many crypto exchanges and projects have begun implementing new measures to protect users’ funds, including two-factor authentication, monitoring systems, and analyzing transactions for suspicious activity.

New security standards have emerged, as well as solutions to prevent the loss of funds in case of hacks or fraudulent activities. Among others, the PoR standard has emerged — a mechanism cryptocurrency exchanges use to publicly demonstrate that they have enough assets in reserve to cover all user balances.

“PoR fosters trust and transparency, as it allows users to confirm that an exchange has not over-leveraged or mismanaged their assets, which has become particularly crucial following high-profile exchange collapses in the industry.”

CryptoQuant

Major exchanges record Bitcoin outflow

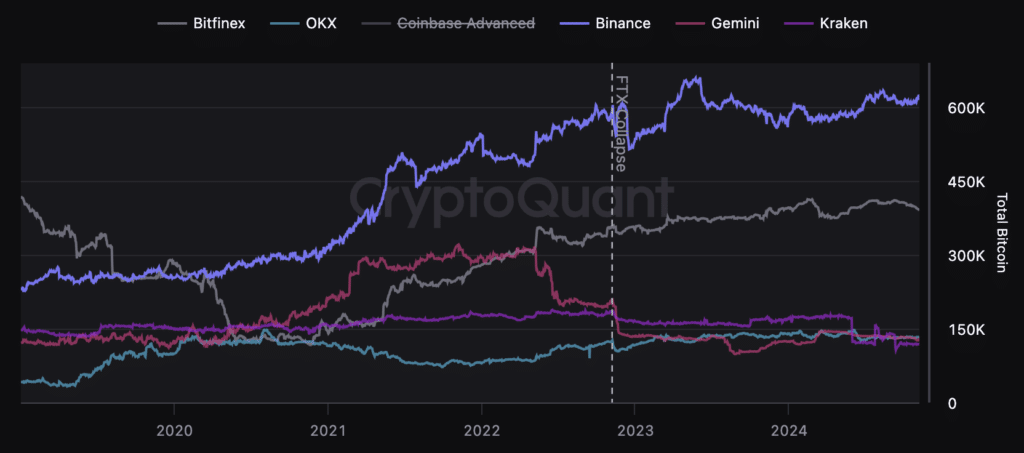

Among the major exchanges with the most prominent Bitcoin reserves, only Coinbase does not publish PoR reports. Experts note that the other major exchanges periodically provide such reports with varying degrees of transparency.

Binance’s reserve increased by 28,000 BTC, or 5%, reaching 611,000, despite the pressure from the U.S. authorities in 2023. Among the major exchanges, Binance also shows the most minor reserve decrease over the entire period, not exceeding 16%.

Three key exchanges hold 75% of all Bitcoins held by exchanges. These are Coinbase Advanced, with 830,000 BTC, Binance with 615,000, and Bitfinex, which has 395,000 Bitcoins.

Together, the reserves of these platforms reach 1.836 million BTC, which is 9.3% of the total amount of Bitcoins in circulation. The remaining 17 exchanges hold a total of 684,000 BTC.

Reserves landing

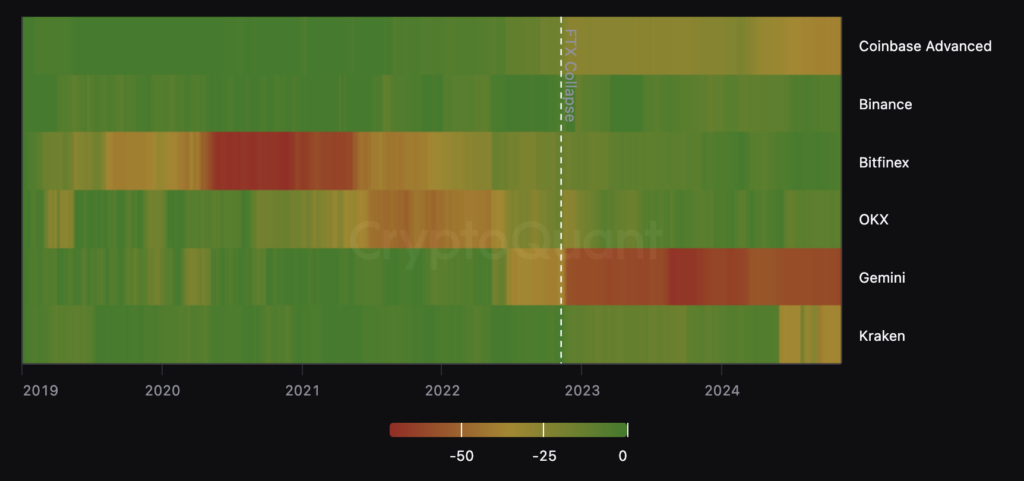

Currently, Binance, Bitfinex, and OKX show small decreases in reserves. At the same time, Binance appears to be the only exchange that has not experienced significant drawdowns in its history.

Analyzing exchange reserves based on tracking their changes allows us to assess their ability to meet user demands over time.

Significant declines may indicate that users are massively withdrawing their funds, indicating a decrease in trust or financial problems.

The most significant decline in Binance’s reserves was 15%, which occurred in December 2022, shortly after the FTX crash. At the time, Binance faced considerable criticism and distrust over its reserve report.

However, Binance’s reserves have recovered and are currently down only 7%. Other significant exchanges have also seen slight declines, with Bitfinex down 5% and OKX down 11%.

While industry leaders like Binance and Bitfinex have managed to shore up their reserves since the FTX crash, the situation is still tense. The failure of some major players like Coinbase to publish PoR reports suggests that the road to full transparency is still far off. But the current reserve dynamics indicate a desire to improve and increase users’ trust.

The expert, in a comment to crypto.news, emphasized that the bankruptcy of FTX underscored the need for crypto exchanges to prove that they have enough reserves.

“This event led to a shift where users prefer exchanges that show proof of their assets on-chain. This pushed the industry to adopt PoR practices, helping rebuild trust and ensure exchanges can back up their users’ funds.”

Nick Pitto, head of marketing at CryptoQuant

Source link

Bankruptcy

Delaware Judge Approves FTX Estate’s Bankruptcy Plan

Published

3 months agoon

October 7, 2024By

admin

A U.S. court approved FTX’s bankruptcy plan on Monday, which will see the majority of the crypto exchange’s customers get the equivalent of their 2022 losses, and then some.

Source link

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential