News

Fundstrat’s Tom Lee Says Positive Setup for Stock Market Forming, Sees Incoming Rebound for 2025

Published

2 months agoon

By

admin

Fundstrat’s head of research Tom Lee says that the US stock market is most likely about to benefit from a bullish setup despite its recent correction.

In a new interview with CNBC, Lee says in the face of tariffs and political uncertainty, markets still appear to be climbing a wall of worry, or the tendency for assets to ascend higher despite otherwise negative sentiment.

“What really stands out to us is that the market has alluded extended periods of weakness because investors are bearish at the highs at the time when there’s record cash on the sidelines. So to us, this is a market that is very skeptical of these new highs. That bearishness and the concerns about tariffs means there’s a wall of worry so I think this is actually a very positive setup for stocks.”

Regardless of recent volatility and the perceived riskiness, the seasoned investor says that growth stocks will continue to outperform this year and that the latest market correction will most likely be shallow and shortlived.

“Investors really want to own stocks that actually have structural advantages, and that’s best evidenced by revenue growth, margin expansion, earnings growth and reasonable prices so the reason growth stocks will still outperform is that in a period like this, if we have macro uncertainty, they’re going to be names with some visibility.

It’s not pleasant to own a growth stock today, but we know the lesson of 2025 is that these pullbacks have not been deep and investors have been buying these dips, so I don’t think today is any different. In fact, it’s no different than the DeepSeek panic, or the tariff-day panic, or the CPI (consumer price index) panic so I think this is going to be a buying opportunity.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

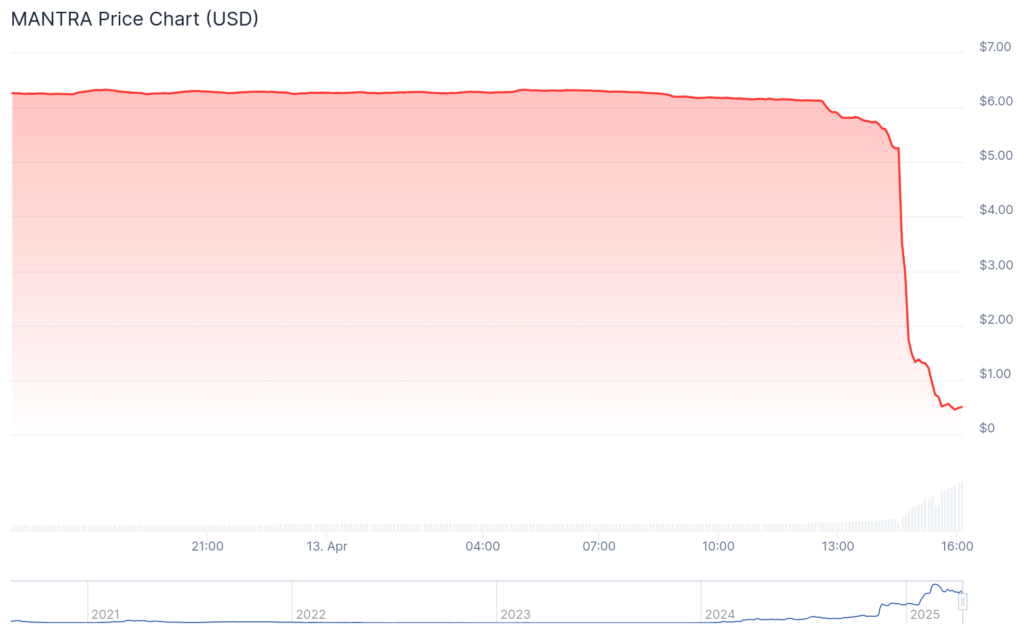

Mantra, known as the second real-world asset token after Chainlink, nosedived more than 90% over the past 24 hours.

Here’s what we know.

Just a couple of days ago, Mantra (OM) touted a 640% gain in 12 months. At last check, its $6-billion market cap fell to about $485 million.

Patrick Mullin, Mantra’s CEO, recently spoke to crypto.news about being a fully compliant, end-to-end ecosystem for RWA tokenization and trading. The company, fresh from securing a VASP license from Dubai’s VARA, had plans to legally operate as a virtual asset exchange.

Its unclear whether the recent downtrend will stymie those plans.

MANTRA Ecosystem Fund

Mantra’s newly launched fund, MEF, has been established to support RWA and DeFi projects globally for over four years.

The company, which offers OM-token grants and capital investments, remained focused on lending/borrowing, trading, asset management, derivatives, and infrastructure.

Mantra also inked a $1-billion tokenization deal with DAMAC Group, covering real estate, hospitality, data centers.

The company had several initiatives in the works, but the crypto X community was quick to point out several developments that they perceived as problematic.

One research analyst known as Choze compared Mantra’s free fall to the May 2022 collapse of the Terra ecosystem.

“Welcome to Terra Luna V.2,” Choze tweeted to 20,000-plus followers.

“For those wondering, the $OM team dumped their entire allocation,” Choze added. “That’s 90% of the total circulating supply, gone. They also deleted Mantra’s official Telegram group. Just like that, $3.5 billion in market cap vanished.”

TrimBot, who describes himself as an RWA bull, blasted Mantra as “pure market manipulation.”

Crypto.news attempted to contact a Mantra spokesperson via its website, but was unsuccessful. It was not clear whether the startup’s web page was down or not accepting media inquiries.

More on MEF

“With the MEF, we’re not just writing checks—we’re building a strategic on-ramp for the next wave of blockchain innovation,” Mullin said in a prepared statement earlier this month.

“This fund will serve as a growth engine, giving founders access to capital, infrastructure, and a deep regulatory support network,” he added.

The MEF is supported by a global coalition of capital partners, including Laser Digital, Shorooq Partners, Brevan Howard Digital, Valor Capital, Three Point Capital, Amber Group, Manifold, UoB Venture, DAMAC, Fuse, LVNA Capital, and Forte.

Crypto.news attempted to reach Three Point Capital but was unable to submit an inquiry.

This is a developing story. Stay tuned for more coverage.

Source link

ALCH

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Published

3 hours agoon

April 14, 2025By

admin

A closely followed crypto analyst believes one meme token operating on Solana (SOL) is in the early stages of a market recovery.

Pseudonymous analyst Altcoin Sherpa tells his 243,800 followers on the social media platform X that he’s bullish on the memecoin Bonk (BONK).

The trader shares a chart suggesting that BONK will face resistance at the $0.000012 level before printing a bullish higher low setup and rallying to his target above $0.0000145.

“BONK is looking strong in the short term, and should go higher. Should be a pullback around the 200 EMA (exponential moving average) on the four-hour chart but still, I think this has pulled back enough to where any buying down here is probably reasonable.”

At time of writing, BONK is worth $0.00001376.

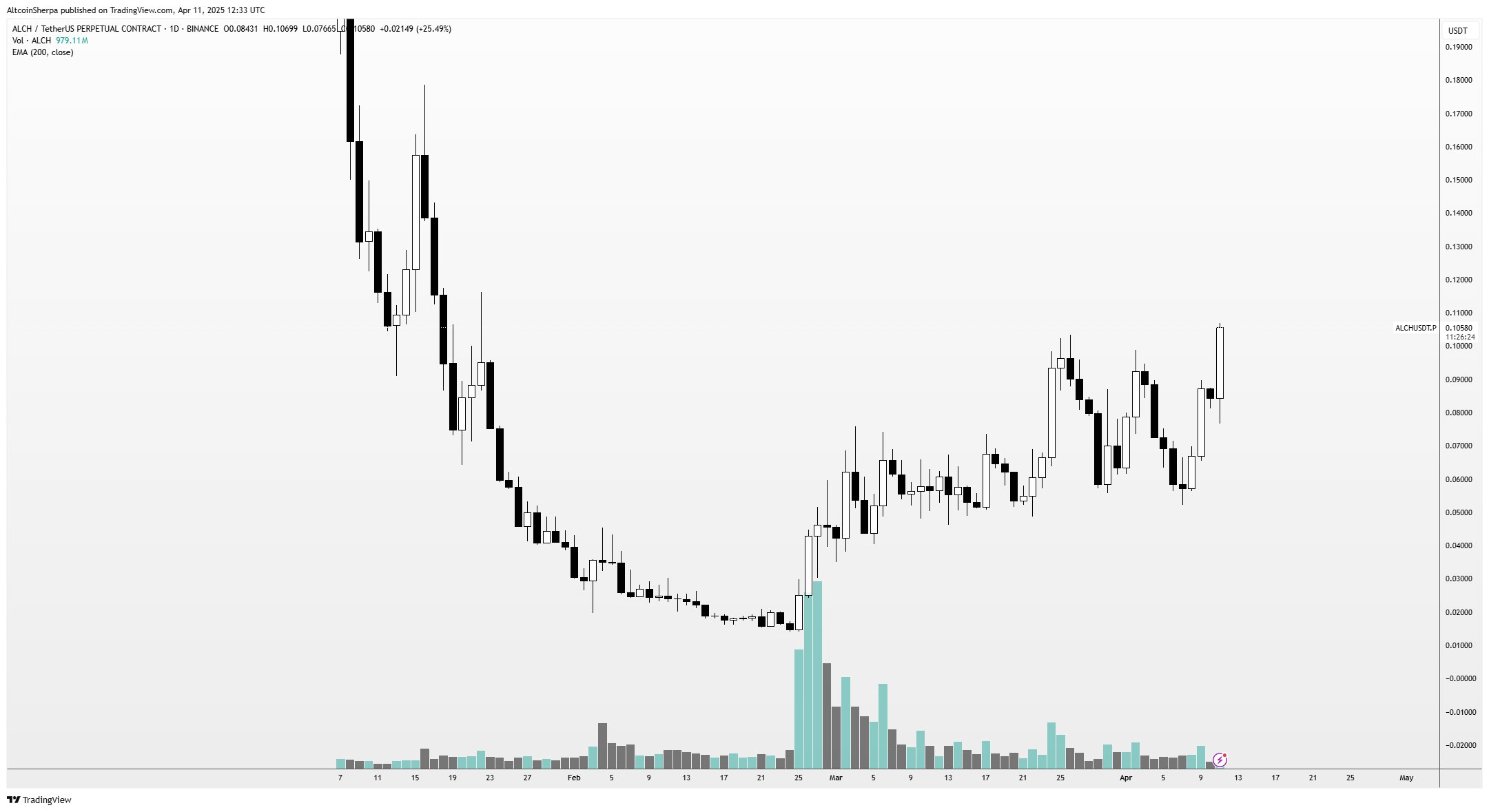

Turning to the low-cap altcoin Alchemist AI (ALCH), the analyst says the coin appears to be in an uptrend and that he’s waiting for potential dips to accumulate the asset.

ALCH is an artificial intelligence (AI)-based crypto project that allows users with no coding skills to generate codes by providing natural language descriptions.

Says Altcoin Sherpa,

“ALCH still seems like a really strong chart, don’t see it being mentioned much. I think it’s basically taken the place of ARC; a super volatile AI coin that moves 20% a day. Not in it but traded it a lot before; will look to buy dips.”

At time of writing, ALCH is the 431st-largest crypto asset by market cap, trading at $0.109.

Looking at Bitcoin, Altcoin Sherpa thinks that BTC will continue to consolidate within a large trading range in the short to mid-term.

“Expecting there is some sort of chop between $70,000-$90,000 over the next several weeks for BTC. Relative bottom probably in, but still some more consolidation to come.”

At time of writing, Bitcoin is trading for $85,366.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Ethereum

Crypto malware silently steals ETH, XRP, SOL from wallets

Published

9 hours agoon

April 13, 2025By

admin

Cybersecurity researchers have shared details of a malware campaign targeting Ethereum, XRP, and Solana.

The attack mainly targets Atomic and Exodus wallet users through compromised node package manager (NPM) packages.

It then redirects transactions to attacker-controlled addresses without the wallet owner’s knowledge.

The attack begins when developers unknowingly install trojanized npm packages in their projects. Researchers identified “pdf-to-office” as a compromised package that appears legitimate but contains hidden malicious code.

Once installed, the package scans the system for installed cryptocurrency wallets and injects malicious code that intercepts transactions.

‘Escalation in targeting’

“This latest campaign represents an escalation in the ongoing targeting of cryptocurrency users through software supply chain attacks,” researchers noted in their report.

The malware can redirect transactions across multiple cryptocurrencies, including Ethereum (ETH), Tron-based USDT, XRP (XRP), and Solana (SOL).

ReversingLabs identified the campaign through their analysis of suspicious npm packages and detected multiple indicators of malicious behavior including suspicious URL connections and code patterns matching previously identified threats. Their technical examination reveals a multi-stage attack that uses advanced obfuscation techniques to evade detection.

The infection process begins when the malicious package executes its payload targeting wallet software installed on the system. The code specifically searches for application files in certain paths.

Once located, the malware extracts the application archive. This process is executed through code that creates temporary directories, extracts the application files, injects the malicious code, and then repacks everything to appear normal.

The malware modifies transaction handling code to replace legitimate wallet addresses with attacker-controlled ones using base64 encoding.

For example, when a user attempts to send ETH, the code replaces the recipient address with an attacker’s address decoded from a base64 string.

The impact of this malware can be tragic because transactions appear normal in the wallet interface while funds are being sent to attackers.

Users have no visual indication that their transactions have been compromised until they verify the blockchain transaction and discover funds went to an unexpected address.

Source link

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Bitcoin price tags $86K as Trump tariff relief boosts breakout odds

Where Top VCs Think Crypto x AI Is Headed Next

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x