bitcoin market

Global Liquidity Hits All Time High, Bitcoin To Follow?

Published

5 months agoon

By

admin

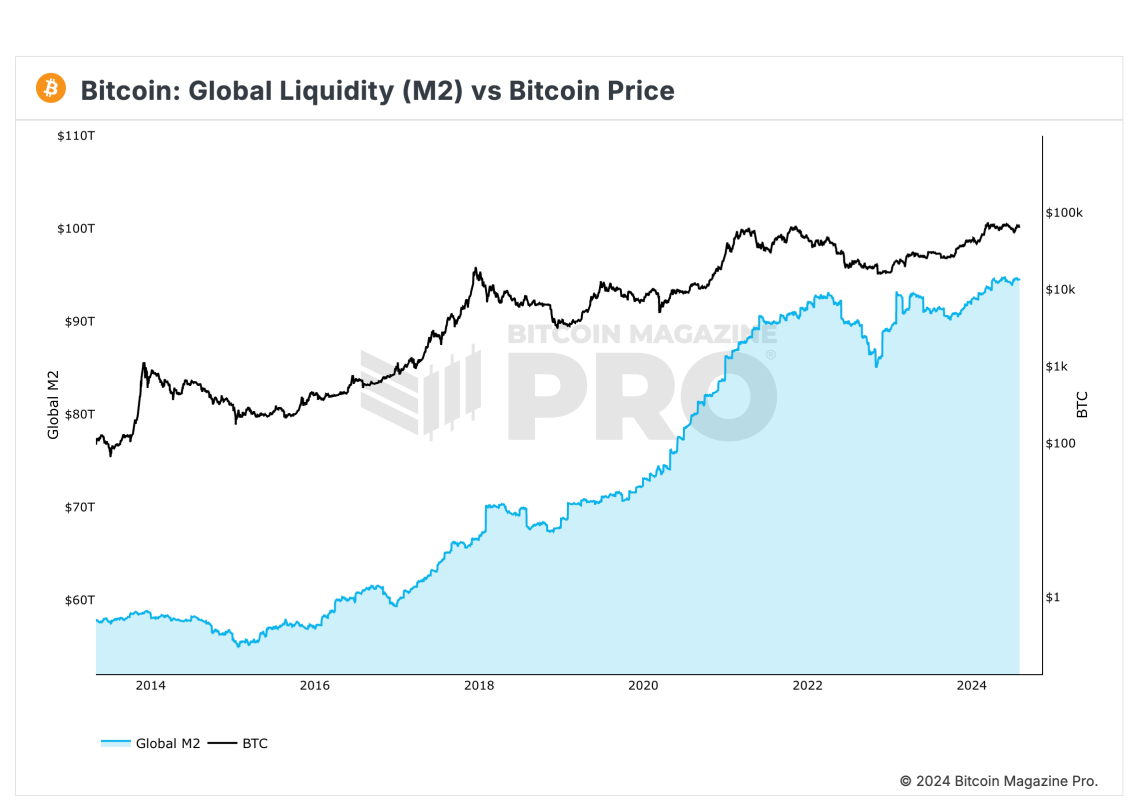

According to data from Bitcoin Magazine Pro, the global money supply, also known as global liquidity, has hit an all-time high of $95 trillion; Bitcoin investors and analysts closely watch this key indicator, as higher liquidity has historically preceded major bull runs.

Global liquidity is the total amount of money circulating in the global financial system. It encompasses the M2 money supply of major economies like the U.S., China, EU, Japan, etc. M2 includes cash, bank deposits, money market mutual funds, and other near-money assets.

This figure recently hit $95 trillion, approaching the $100 trillion milestone. The previous all-time high was around $95 trillion, as well, when Bitcoin hit a new ATH in March this year at $73,000 and $90 trillion when Bitcoin hit its peak of $69,000 in November 2021.

Higher global liquidity encourages spending on riskier assets like Bitcoin. Past data shows a strong correlation between liquidity expansion and Bitcoin bull markets. This is because more money creation typically leads central banks to lower interest rates and implement quantitative easing. This dynamic has played out repeatedly over Bitcoin’s history.

Some investors view Bitcoin as an alternative to the central banking system because it has a fixed supply schedule. Bitcoin could be poised for another price surge if the current upward liquidity trend persists.

Bitcoin has already recovered to around $64,500 after dipping below $60,000 briefly last month. With global liquidity hitting new highs, Bitcoin appears primed to continue its bull run.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

Bitcoin

Bitcoin Drops Below $98K—Is This the Perfect Buying Opportunity for Investors?

Published

2 days agoon

December 21, 2024By

admin

Bitcoin, the leading cryptocurrency by market capitalization, has recently experienced a significant and sudden price correction, sparking debate among investors.

Concerns have surfaced about whether this downturn signals the conclusion of the current bull cycle or merely represents a temporary setback.

While short-term holders face losses, long-term metrics provide a broader perspective on Bitcoin’s trajectory, as analyzed by CryptoQuant’s Avocado Onchain in a recent report.

Opportunity Or End of The Bull Cycle?

According to Avocado Onchain, the realized price for investors who entered the market during Bitcoin’s recent peak at $98,000 places them in a loss-making position.

However, for those who invested between one to three months ago, the realized price is significantly lower at $71,000, offering a cushion against the current correction.

Avocado pointed out that historical patterns from Bitcoin’s 2021 bull cycle reveal similar alternations between record highs and sharp corrections, suggesting that these dips may not necessarily indicate the end of the cycle. Instead, they have historically been “opportunities” for market rebalancing and subsequent growth.

A key indicator analyzed is the 30-day moving average of the short-term SOPR (Spent Output Profit Ratio). This metric tracks whether recent market participants are selling at a profit or a loss.

The current SOPR data reveals that recent short-term inflows into Bitcoin have yet to result in substantial profit-taking. Unlike previous cycle peaks characterized by aggressive selling, the ongoing correction appears subdued, indicating that the market may still have room for upward movement.

Bitcoin Short-Term Dips vs. Long-Term Trends

Additionally, Avocado Onchain highlights the importance of distinguishing between short-term corrections and broader cycle trends. Bitcoin’s tendency to rebound after corrections in past bull cycles reinforces the notion that the current downturn might not mark the cycle’s end.

These insights align with the behaviour of long-term holders, who often use corrections to consolidate their positions, strengthening market resilience.

Avocado concluded the analysis, noting:

For investors who have yet to enter the market, this may be an excellent opportunity to buy Bitcoin at a discount. Instead of succumbing to panic selling during short-term downturns, adopting a long-term perspective and a dollar-cost averaging (DCA) strategy could be a more effective approach.

At the time of writing, Bitcoin is seeing a gradual rebound in its price surging by 1.3% in the past 1 hour. Regardless, the asset still appears to be overshadowed by the bears as BTC remains down by 3.5% in the past day and 10.5% from its peak of $108,135 recorded last week.

Featured image created with DALL-E, Chart from TradingView

Source link

Bitcoin

Bitcoin Exchange Reserves Hit Record Low, Could $120K Be on the Horizon?

Published

4 days agoon

December 19, 2024By

admin

Bitcoin has seen continuous bullish momentum in recent weeks resulting in the asset’s consistent new highs. According to recent analysis, this momentum appears to not just be random as it comes amid major moves behind the scenes.

Particularly, recent data indicates that Bitcoin reserves have dropped to a historic low of 2.4 million, signaling a “supply shock” that has coincided with a surge in Bitcoin’s price.

This reduction in exchange reserves, coupled with strong demand, has created a bullish environment that could set the stage for further price increases.

A Supply Shock In The Making

A CryptoQuant analyst known as Kripto Baykus shared the outlook on Bitcoin’s exchange reserve hitting historic low in a post on the QuickTake platform. In the post, Baykus highlighted that the year began with Bitcoin reserves at approximately 3 million on exchanges.

However, a steady decline throughout 2024 has led to the current levels, reflecting a clear shift in investor behaviour. Institutional investors, in particular, have embraced long-term holding strategies, pulling their assets off exchanges, Baykus noted. The analyst added:

This shift is particularly evident among institutional investors, who have increasingly embraced the “hodl” approach, demonstrating strong confidence in Bitcoin’s future potential.

Meanwhile, Bitcoin’s price has mirrored this movement, starting the year at around $40,000 and accelerating in November to surpass $100,000, eventually reaching a new peak above $104,000. Baykus wrote:

The limited supply of Bitcoin, combined with shrinking reserves, is seen as a strong bullish signal for the market. Investors are pricing in the effects of the supply shock, and if the trend persists, Bitcoin is likely to break further records in late 2024 and into 2025.

Bitcoin Current Demand Stance

In addition to supply-related trends, another CryptoQuant analyst known as Yonsei Dent has recently turned to the Coinbase Premium Index to offer insights into Bitcoin’s demand in North America.

This metric tracks activity on Coinbase, one of the largest exchanges in the region, and has traditionally been used to predict short-term price movements. However, over the past two weeks, a divergence between the Coinbase Premium Index and Bitcoin’s price has raised concerns.

Dent pointed out that despite Bitcoin’s price rising from $94,000 to $106,000 during this period, the Coinbase Premium has declined. This suggests that the recent price surge may not have been driven by US.-based demand, raising questions about the medium-term momentum of Bitcoin’s rally.

Dent noted:

If this price surge has not been supported by U.S.-based demand, it could indicate underlying weakness in medium-term upward momentum. Investors should remain cautious and monitor this development closely.

Featured image created with DALL-E, Chart from TradingView

Source link

Bitcoin

Bitcoin to Enter Final Bull Phase? Key Indicator Hints at Major Price Movement

Published

3 weeks agoon

December 3, 2024By

admin

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis.

Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics.

When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…)

Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life.

In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps.

Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think’s probably unfeasible, I’ve done already a hundredfold.”

PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp.

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential