Law and Order

Gotbit? Never Heard of It! Meme Coins Try to Distance Themselves

Published

2 months agoon

By

admin

Days after the U.S. government announced unprecedented criminal and civil charges against four crypto companies for alleged market manipulation and “wash trading,” meme coin projects dependent on those same firms have begun attempting to distance themselves from the fallout.

In particular, token teams that partnered with one of the implicated companies, the market maker Gotbit, have started issuing statements vigorously disavowing the firm they depended on for liquidity.

“We have halted our relationship with Gotbit, who were our market maker partners,” the Ethereum meme coin project Neiro posted on Twitter Friday. “None of the issues involving Gotbit or its employees involve or are relevant to Neiro in any capacity.”

Important announcement

We have halted our relationship with Gotbit, who were our market maker partners. None of the issues involving Gotbit or its employees involve or are relevant to Neiro in any capacity. However it is the right decision for the Neiro project and community to…

— Neiro (@neiro) October 11, 2024

Members of the crypto community were not so quick to accept Neiro’s assurances. The pseudonymous on-chain sleuth ZachXBT, for example, soon after excoriated Neiro for partnering with Gotbit prior to this week’s charges, despite the fact that concerns about the market maker have been public knowledge for over a year.

Perhaps your team should explain to the community why you chose Gotbit in the first place when they have always had a bad reputation with lots of evidence showing pump and dumps prior to them being charged for fraud and market manipulation by the US government this week. https://t.co/hxS5mxWMlH

— ZachXBT (@zachxbt) October 11, 2024

Other meme coin projects jumped on Friday to make clear they didn’t want to associate with Gotbit any longer—despite the fact that the self-described hedge fund and meme coin market maker still exercised substantial control over their tokens.

“Unfortunately, Gotbit still holds a large portion of our supply, including marketing, treasury, and team tokens, and they are currently unwilling to return them,” the team behind the Tron meme coin BMS conceded, in a post intended to announce a severing of ties with the company.

We regret to announce that $BMS is officially cutting ties with @gotbit_io, our former market maker, following their ongoing investigation by the SEC.

We had high hopes for this partnership, but BMS cannot be involved with any entity or company under the scrutinisation of the…

— BUY MY SHIT COIN 😂😂 (@BMScoin) October 11, 2024

Even meme coins that claim to have stopped working with Gotbit prior to this week made a point of emphasizing their condemnation of the company’s alleged conduct.

We are aware that Gotbit team is being accused of wash trading and market manipulation.$BEER team has stopped working with Gotbit as a Market Making partner long-time ago and switched to another provider.

Thanks for staying with us 💛 pic.twitter.com/lH4SQDQ9Vz

— beercoin (@beercoinmeme) October 11, 2024

The U.S. Department of Justice (DOJ) has accused Gotbit of making illegal wash trades with digital tokens to artificially inflate the tokens’ prices, before selling off the tokens in alleged “pump and dump” schemes. The U.S. Securities and Exchange Commission (SEC) further accused Gotbit of providing “on-demand market manipulation” by “generating fake, daily trading volume often in the millions of dollars by essentially trading crypto assets with itself.”

Those allegations probably surprised very few. Back in 2019, Gotbit co-founder Alexey Andryunin openly told CoinDesk in detail about his company’s business model: manipulating crypto markets for a fee, to increase the perceived legitimacy of obscure tokens.

“The business is not entirely ethical,” Andryunin said at the time.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Law and Order

Trump Picks Bo Hines to Lead Presidential Crypto Council

Published

13 hours agoon

December 22, 2024By

admin

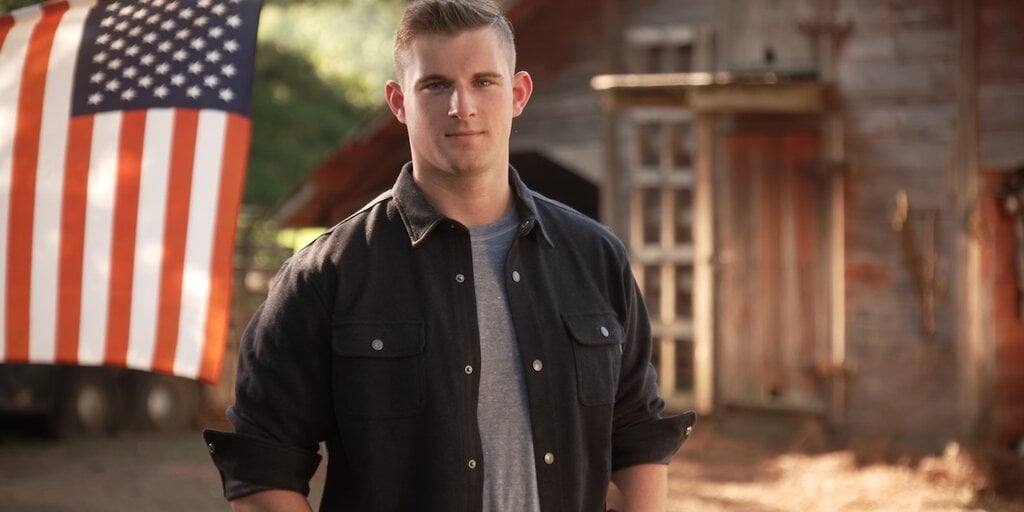

Bo Hines, a former Republican nominee for the House of Representatives, has been named by President-elect Donald Trump to be the Executive Director of the Presidential Council of Advisers for Digital Assets.

Per a Truth Social post from Trump, Hines will oversee a “new advisory group composed of luminaries from the crypto industry” and work alongside David Sacks, Trump’s pick for the White House AI and Crypto Czar.

“In his new role, Bo will work with David to foster innovation and” growth in the digital assets space, while ensuring industry leaders have the resources they need to succeed,” Trump posted. “Together, they will create an environment where this industry can flourish, and remain a cornerstone of our nation’s technological advancement.”

Hines was the Trump-endorsed Republican House nominee in North Carolina’s 13th District in 2022, but lost the race to Democratic rival Wiley Nickel. During that race, Hines received backing from former FTX Digital Markets CEO Ryan Salame, who later went to prison for unrelated campaign finance law violations, among other charges.

The 29-year-old Hines ran again for the House this year in the state’s 6th District, but lost in the primaries, placing fourth among Republican candidates. He does not appear to have a substantial public history of making comments related to Bitcoin or cryptocurrency.

“Thank you, Mr. President! It will be the honor of a lifetime to serve in your next administration. Thank you for everything you have done and continue to do for our country,” Hines wrote on X (formerly known as Twitter) on Sunday. “I am thrilled to work alongside the brilliant David Sacks to ensure that this industry will thrive and remain a cornerstone of our nation’s technological advancement.”

Alongside Hines, Trump also named former Andreessen Horowitz venture capitalist Sriram Krishnan as the Senior Policy Advisor for Artificial Intelligence at the White House Office of Science and Technology Policy. Krishnan, who departed from the prominent VC firm in November, will also work closely with Sacks.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

United States of Bitcoin? These States Are Considering BTC Reserves

Published

2 days agoon

December 21, 2024By

admin

Donald Trump and his political allies are plugging away at plans to stockpile Bitcoin at a national level in the U.S. Treasury.

And now, with the asset’s price repeatedly soaring to new peaks since Election Day, some U.S. states are following suit.

So far, three states are fielding proposals to establish strategic Bitcoin reserves, while digital asset advocates are calling for other local governments to do the same.

Here’s which states are considering topping up their coffers with the world’s oldest and most valuable digital currency.

Texas

Texas legislators will soon weigh in on whether or not they should establish a strategic Bitcoin reserve.

Texas State Representative Giovanni Capriglione proposed a bill in December that calls for the Lone Star State to create a Bitcoin stockpile.

The draft legislation stipulates that Texas must hold the Bitcoin for at least five years. The cryptocurrency must be kept in cold storage—that is, on some kind of a device that is not connected to the internet—and the assets cannot be used to make transactions outside of Texas, according to the bill.

“A strategic Bitcoin reserve aligns with Texas’s commitment to fostering innovation in digital assets and providing Texans with enhanced financial security,” the bill reads.

Finally, the proposal also enables Texans to donate to the state’s Bitcoin fund.

Pennsylvania

The Pennsylvania House of Representatives put forth a bill in November that called for the establishment of a strategic Bitcoin reserve.

Under the Bitcoin bill, Pennsylvania’s Treasurer would be able to buy Bitcoin with “up to 10%” of the State General Fund, Rainy Day Fund, and the State Investment Fund.

Tapping 10% of the State General Fund would allow the Pennsylvania Treasury to purchase nearly $1 billion worth of Bitcoin.

“Bitcoin, which has appreciated significantly over the years, can help Pennsylvania keep pace with inflation and economic change,” the state’s lawmakers said in a legislative memo published on November 12.

Ohio

Ohio State Representative Derek Merrin on December 17 proposed a bill to establish a strategic Bitcoin reserve in the Buckeye State.

The Ohio Bitcoin Reserve Act calls for the creation of a Bitcoin fund in the state Treasury. It also vests Ohio’s State Treasurer with discretionary power to purchase the asset.

“Ohio must embrace technology and protect tax dollars from eroding,” Merrin said Tuesday in an X post.

Although some details of how the reserve will work remain unclear, the draft legislation is expected to serve as a framework for Ohio lawmakers to build out in 2025.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

Hawk Tuah Girl Wakes Up, Plays Ball With Lawyers Suing Meme Coin Makers

Published

3 days agoon

December 20, 2024By

admin

After 372 hours, Haliey Welch, better known as the Hawk Tuah girl, has finally woken from her slumber to announce she’s made some new friends—namely, the same law firm that’s suing her business partners over her failed meme coin project.

Sixteen days ago, Welch’s would-be meme coin debut, a Solana token called HAWK, imploded at launch, enriching an apparently interconnected web of early investors and leaving most retail traders in the lurch. That evening, Welch told an irate audience on an X Spaces that she was going to bed and would see everyone in the morning—before going radio silent for weeks on end.

On Friday, Welch broke that silence by announcing she is cooperating with the law firm that sued the HAWK token’s creators Thursday for allegedly violating American securities laws.

I take this situation extremely seriously and want to address my fans, the investors who have been affected, and the broader community. I am fully cooperating with and am committed to assisting the legal team representing the individuals impacted, as well as to help uncover the…

— Haliey Welch (@HalieyWelchX) December 20, 2024

“I am fully cooperating with and am committed to assisting the legal team representing the individuals impacted, as well as to help uncover the truth, hold the responsible parties accountable, and resolve this matter,” Welch said on X (formerly known as Twitter).

A spokesperson for Welch told Decrypt that the influencer was “totally siloed” from the HAWK project and “had zero control over it.”

The spokesperson also asserted that Welch only received a fixed sponsorship fee for lending her likeness to the meme coin project, adding “there was no guarantee she would make any additional money from the meme coin thereafter.”

That story runs somewhat counter to one put forward earlier this week by the team taking responsibility for building most of HAWK. The crypto token launch platform OverHere said on Tuesday that it only took leadership over the doomed token because one of Welch’s associates, a mysterious figure known as “Doc Hollywood,” “vanished when things got hard.”

The OverHere team claimed it took zero fees from HAWK and made zero profit on the project, and pointed the finger at Welch and Doc Hollywood for an alleged lack of transparency.

The lawsuit filed Thursday against the project—by 12 American plaintiffs claiming to have suffered damages in excess of $151,000 from the project—listed OverHere as one of multiple defendants. It did not list Welch.

Alexandra Roberts, a law professor at Northeastern University, told Decrypt that she has never before seen a situation like this—in which a celebrity such as Welch has actively aided a lawsuit aimed at a project the celebrity lent their likeness to.

“I think it’s a great PR move,” Roberts said. “I think she’s trying to get out in front of it and make a really clear statement: ‘Not only did I not know what was going on, but I want to advocate on behalf of the people who were swindled.’”

Burwick Law, the firm suing HAWK’s creators, told Decrypt that it does not represent Welch, but is in conversations with her counsel.

When asked why Welch was not listed as a co-defendant in the HAWK lawsuit, Max Burwick, managing partner at Burwick Law, said the decision was intentional, and hinted it might help make his clients whole sooner.

“In this matter, we have chosen the strategy we believe to be most effective in helping our clients achieve meaningful results,” Burwick told Decrypt.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential