Sponsored

GPT Protocol Unveils Mainnet: A Game-Changer for the Future of AI

Published

3 months agoon

By

admin

GPT Protocol announces the official launch of Mainnet, marking a pivotal moment in the evolution of decentralized AI. This launch propels GPT Protocol and its native GPT Token (MEXC: GPT) (UNI: GPT) closer to realizing its vision of a fully decentralized, AI-driven ecosystem. Mainnet introduces groundbreaking infrastructure designed to handle all facets of AI, from on-chain large language model (LLM) training to dynamic compute resource allocation.

A New Era of Self-Sustaining AI Ecosystem

Mainnet represents a leap forward in AI technology, setting the stage for Web4 and ushering in a self-sustaining AI ecosystem. It provides the infrastructure needed for the next generation of AI applications within a decentralized environment. GPT Protocol’s innovative approach makes it the first blockchain to publish “Prompts and Responses” from LLMs on-chain, paving the way for unprecedented transparency, security, and efficiency in AI development.

Built on a Layer 2 solution leveraging the Polygon CDK, Mainnet ensures high scalability and seamless mass adoption of on-chain AI applications. The combination of Polygon CDK with an Ethereum Virtual Machine (EVM) framework supports intensive computing requirements while providing a developer-friendly platform. Key pillars of GPT Protocol’s ecosystem include:

- Polygon CDK Integration: Enables efficient and secure operation at scale, ideal for rapid AI application development.

- Full EVM Compatibility: Facilitates ease of use with existing tools and ecosystems, enhancing interoperability.

- zk-Enabled Technology: Strengthens privacy and security, making GPT Chain a top choice for decentralized AI applications.

- World-First Innovations: Publishes “Prompts and Responses” from LLMs on-chain, opening new possibilities for AI transparency and collaboration.

Empowering the AI Token Economy

The launch of Mainnet heralds the beginning of a transformative AI token economy. It will enable the creation of AI-driven tokens. Mainnet will also facilitate new token pairs with other protocols, thereby boosting the TVL on GPT Chain. This evolution will enhance niche values within the AI sector and expand the Web4 ecosystem through the $GPT token.

Looking ahead, GPT Protocol is poised to unveil NeuraSwap DEX, the industry’s first decentralized exchange dedicated to AI-related tokens, in collaboration with ApeBond (formerly ApeSwap). This initiative will pioneer multichain capabilities, improving interchain interoperability and fostering broader adoption.

Become a part of the AI Revolution

Developers are invited to harness GPT Protocol’s cutting-edge infrastructure to build groundbreaking AI applications and drive future advancements.

To become part of the GPT Protocol community and explore Mainnet’s capabilities, visit the following links:

Join us in revolutionizing the future of AI with GPT Protocol’s Mainnet launch!

About GPT Protocol

GPT Protocol is at the forefront of decentralized artificial intelligence, offering a scalable and secure blockchain network designed to empower the future of AI. Our mission is to create sovereign AI technology that is truly open, censorship-resistant, and transparent. By enabling on-chain data transparency, GPT Protocol facilitates participation in federated learning and collective intelligence. Join us in building a freer and more creative AI internet, where innovation thrives in a decentralized ecosystem.

Twitter | Discord | Telegram | Instagram

Contact Information: [email protected]

Disclaimer

This article is a paid publication and does not have journalistic/ editorial involvement of CoinGape. CoinGape does not endorse/ subscribe to the contents of the article/advertisement and/or views expressed herein. Do your market research before taking any actions . The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Guides

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Published

2 hours agoon

November 27, 2024By

admin

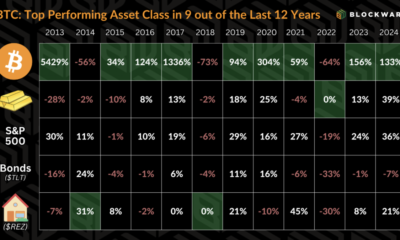

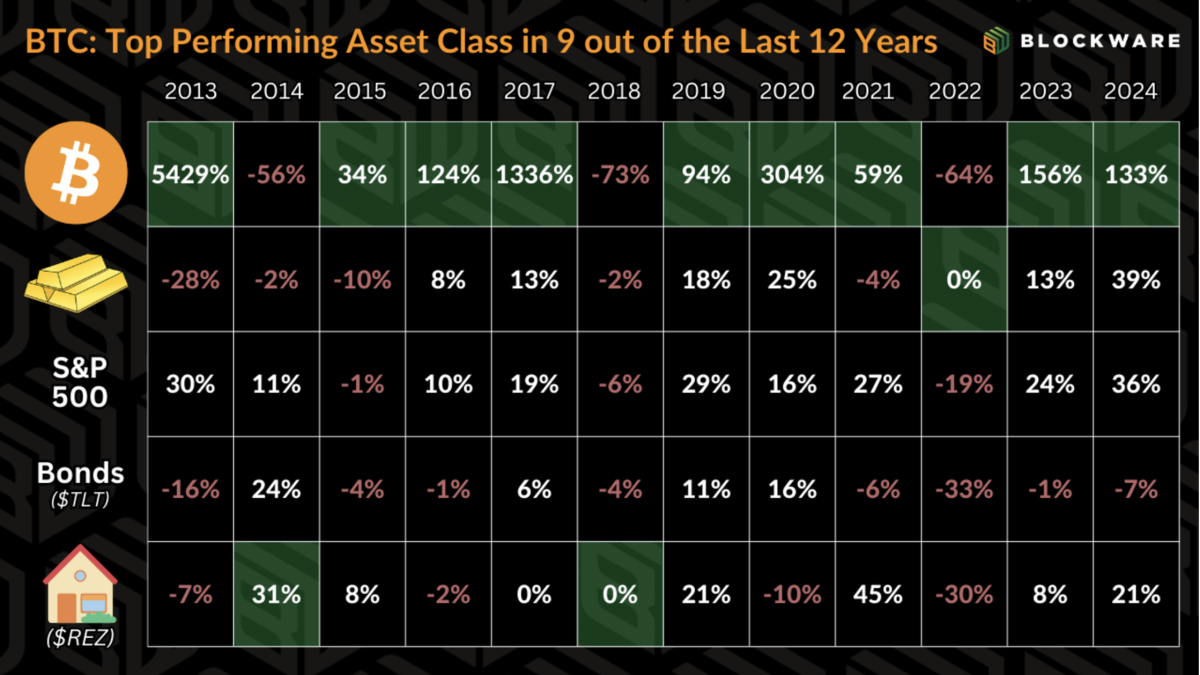

Bitcoin has consistently outperformed all major asset classes over the past decade, solidifying its role as the benchmark for digital asset investors. For those committed to Bitcoin’s long-term vision, the ultimate financial goal often shifts from acquiring more dollars to maximizing their Bitcoin holdings.

Bitcoin is the Hurdle Rate

Bitcoin is to digital assets what treasury bonds are to the legacy financial system—a foundational benchmark. While no investment is without risk, Bitcoin held in self-custody eliminates counterparty risk, dilution risk, and other systemic risks common in traditional finance.

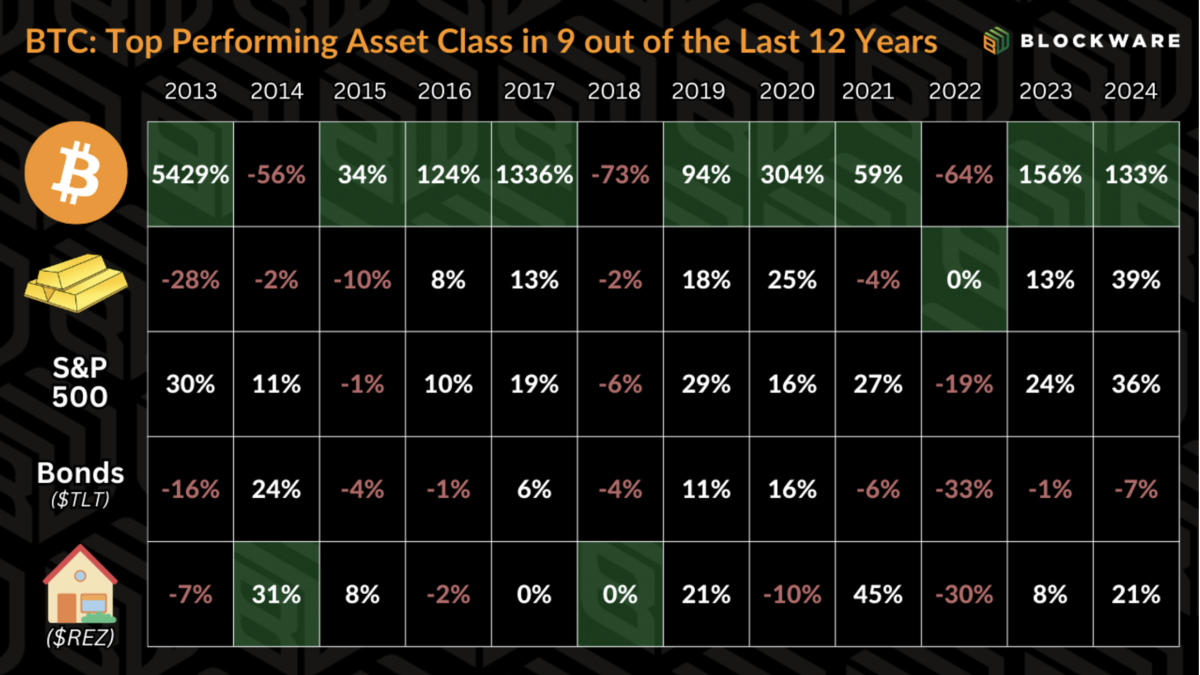

With BTC outperforming every other asset class in 9 of the past 12 years (by orders of magnitude), it’s no surprise that it has usurped treasury bonds as the “risk free rate” in the minds of many investors – especially those knowledgeable about monetary history and thus the appeal of Bitcoin’s verifiable scarcity.

Another way to phrase this would be that the financial objective of digital asset investors is to acquire more BTC rather than acquire more dollars. All investments or spending are viewed through the lens of BTC being the opportunity cost.

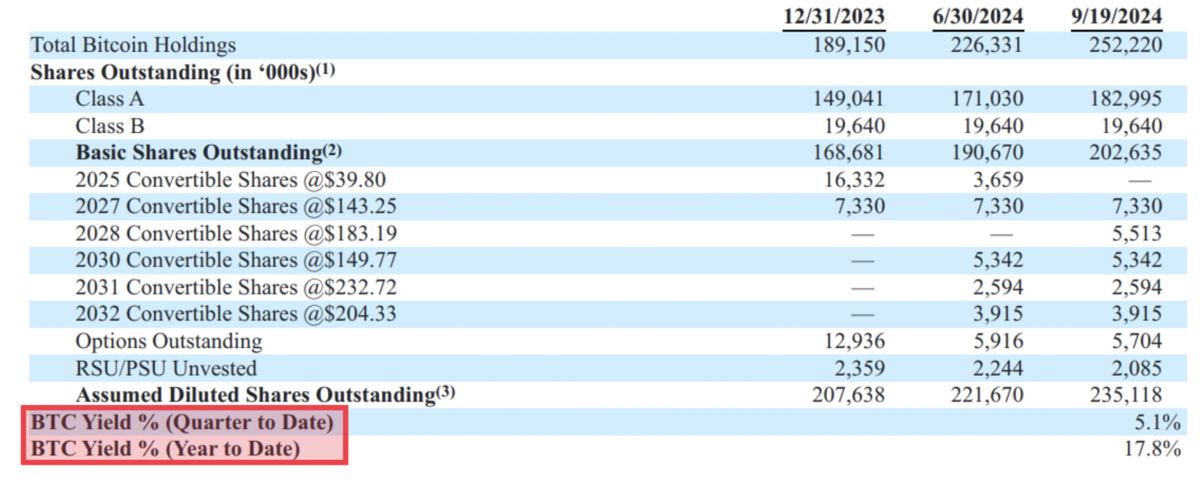

MicroStrategy has demonstrated what this looks like in the corporate world with their new KPI: BTC Yield. To quote from their September 20th, 8-K form: “The Company uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner the Company believes is accretive to shareholders.” MicroStrategy has taken full advantage of the tools available to them as a multi-billion dollar public company: access to low interest rate debt and the ability to issue new shares. This KPI shows that they are acquiring more BTC per outstanding share despite the fact that they are engaging in the traditionally dilutive activity of new share issuance.

Mission accomplished: they are acquiring more bitcoin.

But MicroStrategy has an advantage that the average fund manager or retail investor does not: they are a publicly traded company with the ability to tap into capital markets at little to no relative cost. Individual holders are unable to issue shares into the public market in order to raise capital and acquire BTC. Nor can we issue convertible notes and borrow dollars at a near zero % interest rate.

So that begs the question: how can we accumulate more bitcoin? How can we have a positive ‘BTC Yield’?

Bitcoin Mining

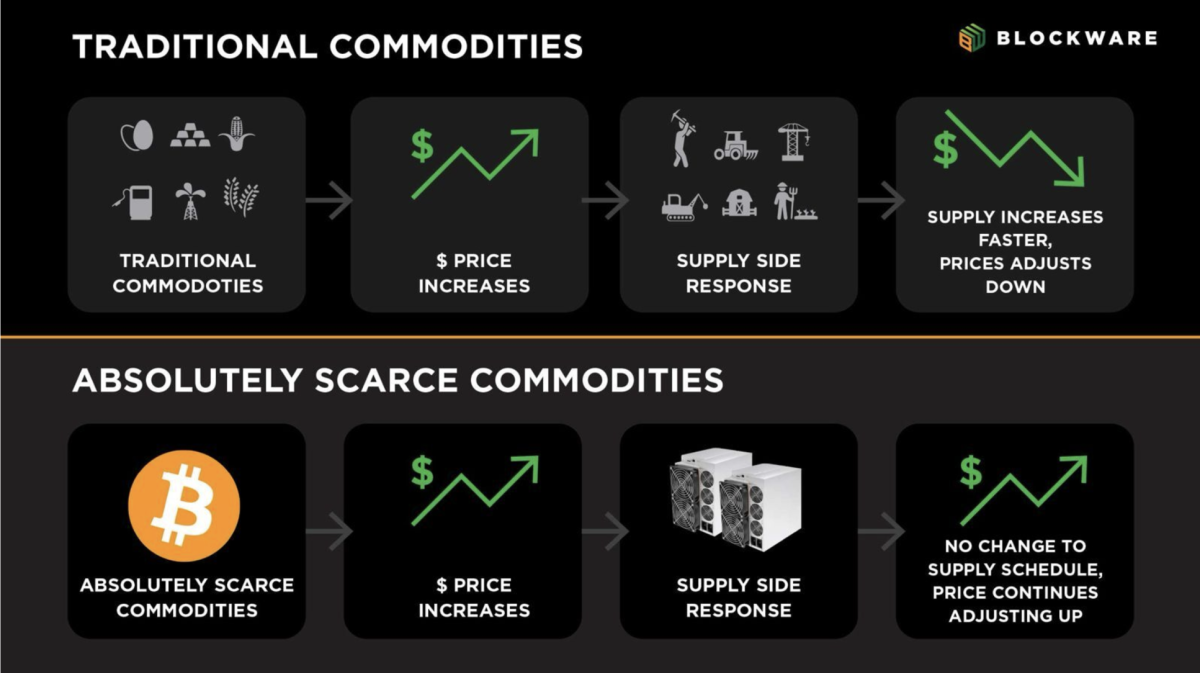

Bitcoin miners acquire BTC by contributing computational power to the Bitcoin network, and receiving a greater amount of BTC than what it costs in electricity to operate their machine(s). Now this is easier said than done. The Bitcoin protocol enforces a predetermined supply schedule using “difficulty adjustments” – meaning that more computational power dedicated towards Bitcoin mining results in the finite block rewards getting split up into smaller pieces.

The most effective Bitcoin miners are those that maximize their computational power while minimizing their operational costs. This is accomplished by acquiring the latest, most-efficient Bitcoin mining hardware, and operating with the lowest possible electricity rate.

Under current market conditions (as of 11/21/2024), 1 bitcoin has a price of ~$98,000. However, an Antminer S21 Pro mining with an electricity rate of $0.078/kWh is able to produce 1 BTC for ~$40,000 in electricity. This is an operating margin of nearly 145%. A business is typically considered to have “healthy profit margins” if they are in the 5-10% range – mining beats this easily. This is in spite of the fact that as of the April 2024 Bitcoin halving, they earn half as much BTC per unit of compute.

Price Growth Outpacing Difficulty Growth

The price of a financial asset – specifically bitcoin – is set at the margin. This means that the asset’s price is determined by the most recent transactions between buyers and sellers. In other words, the price reflects what the last buyer is willing to pay and what the last seller is willing to accept.

This, in part, is what enables BTC’s notoriously volatile price action. A lack of sellers at price X means buyers must bid the price higher than X in order to find the next marginal seller. Inversely, a lack of buyers at price X means a seller must lower their ask to find the next marginal buyer. BTC can quickly move up or down based on a lack of sellers or buyers in a specific range.

Consequently, the velocity at which the Bitcoin price can move is much higher than that of network mining difficulty. Substantial growth in network mining difficulty is not achieved by marginal bid/ask spreads, it is achieved by the culmination of ASIC manufacturing, energy production, and mining infrastructure development. There is not shortcutting the time and human capital necessary to increase the total computational power on the Bitcoin network.

This dynamic is what creates opportunities for Bitcoin miners to accumulate vast amounts of bitcoin.

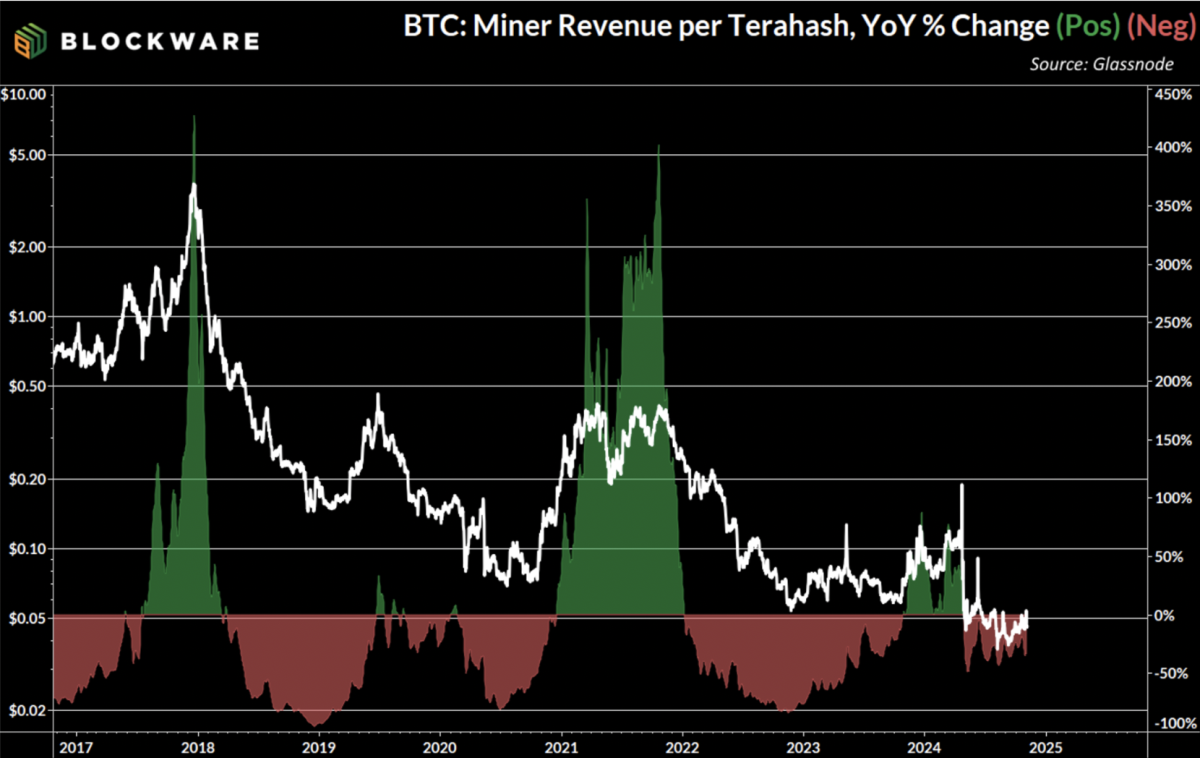

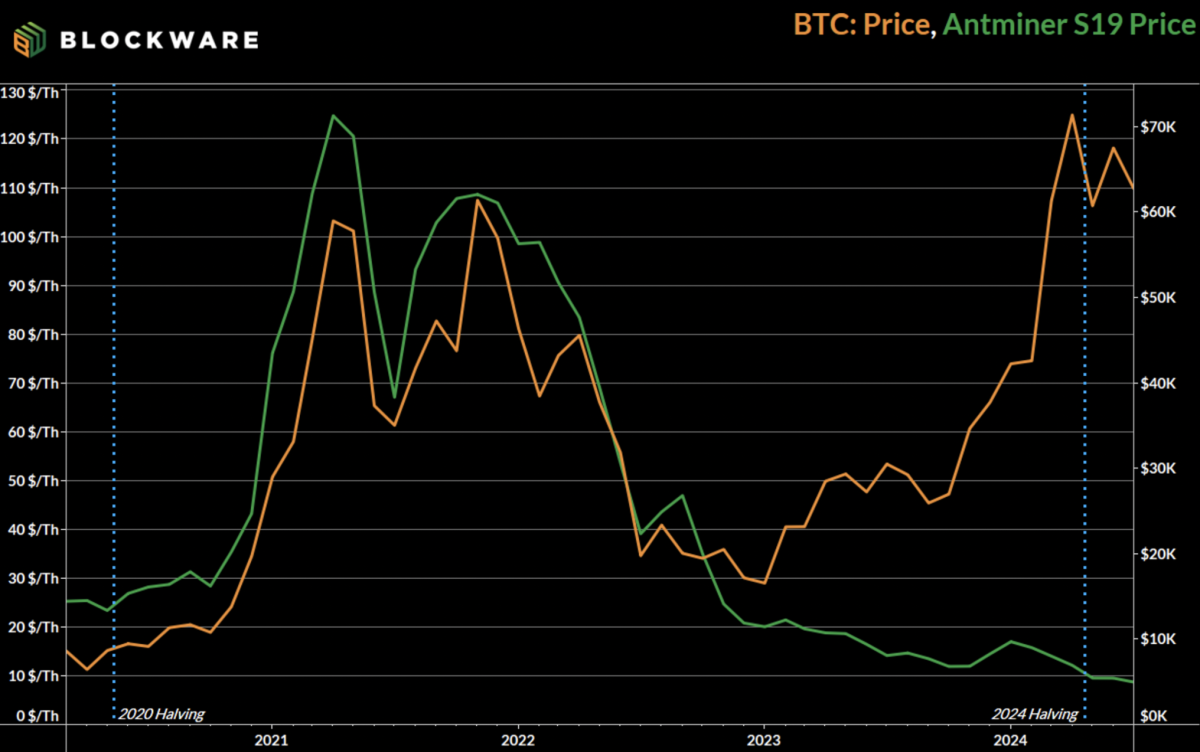

The chart here illustrates the explosive growth of Bitcoin mining profitability that takes place during bull markets. “Hashprice” measures the amount of revenue that Bitcoin miners earn per unit of compute on a daily basis. On a year-over-year basis, hashprice has increased by more than 300% at the height of each bitcoin mining cycle. This means that miners have had their profit margins more than triple in a 12-month span.

Over the long-run this metric trends down as more entities begin mining bitcoin, miners upgrade to more powerful & efficient machines, and the block subsidy is cut in half every four years. However, during bull markets, the combination of the forces that are a positive catalyst for mining difficulty (and thus net-negative for mining profitability) pale in comparison to the rapid growth in the price of bitcoin.

Price Volatility in Bitcoin Mining Hardware

In addition to wider profit margins during bull markets, Bitcoin miners have the simultaneous benefit of the fact that ASIC prices tend to move in tandem with the Bitcoin price. During the 2020 – 2024 cycle, the Antminer S19 (most efficient ASIC at the time) began trading at ~$24/T. By November 2021 – when the BTC price was peaking – they began trading for north of $120/T.

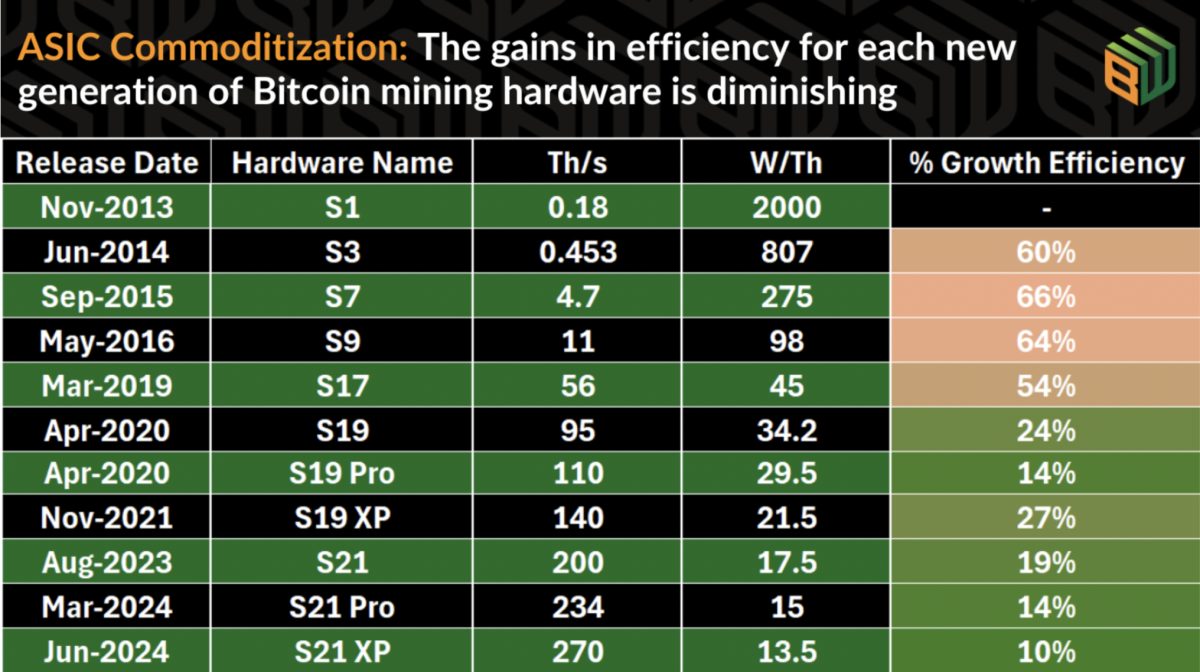

Bitcoin mining hardware retaining resale value is becoming increasingly the case with each new generation of hardware. In the early days of Bitcoin mining, technological advancements were swift and forceful – to the point that new ASICs would make older models obsolete overnight. However, the marginal gains of new ASICs have diminished to the point that older models are able to remain competitive for multiple years after release.

Since the S19 was launched in 2020 and retains a non-zero market price today, it is reasonable to expect that the S21 line of machines will be able to retain value for even longer. This gives miners a significant leg-up when it comes to accumulating bitcoin, because the upfront cost of purchasing machines is no longer “sunk”. Their machines have a price, one that is correlated to bitcoin, and there is a resource available to get liquidity.

Blockware Marketplace

Blockware developed this platform to enable any investor – institutional or retail – the opportunity to gain direct exposure to Bitcoin mining. Users of the marketplace are able to purchase Bitcoin mining rigs that are hosted at one of Blockware’s tier 1 data centers and have access to industrial power prices. These machines are online already, eliminating lengthy lead times that have historically caused some miners to miss out on those key months in the cycle in which price is outpacing network difficulty.

Moreover, this platform is built by Bitcoiners, for Bitcoiners. Which means that machines are purchased using Bitcoin as the medium of exchange, and mining rewards are never held by Blockware – they are sent directly to the users own wallet.

Lastly, this provides miners with the aforementioned opportunity, but not obligation, to sell their machines at any time and price. This enables miners to capitalize on volatility in ASIC prices, recoup the cost of their machines, and accumulate more BTC faster than they would with a traditional “pure play” approach.

This innovation removes the obstacles that have historically made hosted mining difficult, enabling miners to concentrate on the mission: accumulating more Bitcoin.

For institutional investors looking for bulk pricing on mining hardware, contact the Blockware team directly.

Source link

Partner Content

Cardano eyes spot ETF entry as analyst foresees surge, Rollblock set to explode next

Published

20 hours agoon

November 26, 2024By

admin

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Cardano ETF buzz fuels ADA’s bullish momentum while Rollblock’s GambleFi presale sparks excitement as the next crypto to explode.

ETF coming to Cardano? Maybe. The recent buzz for Solana ETFs has swirled the whispers of a potential spot ETF launch on Cardano, and as you’d expect, ADA forecast got more bullish. ETF expert Nate Geraci hinted that Cardano could join the US spot ETF market alongside Solana, and XRP; it has sparked fresh optimism as the next crypto to explode. But the positive ADA forecast is only half the week’s highlight – Rollblock surging in demand and presale growth is the other.

The new GambleFi brilliance has taken over with its presale, and analysts think it’s the next crypto to explode. Let’s find out why.

ADA: Cardano ETF buzz fuel market optimism

Speculation of a potential ETF launch has sent ADA forecast soaring again. This month, ADA saw a renewed surge after blazing past $1 for the first time since 2022 after Trump’s pro-crypto win and Hoskinson’s partnership. Now, Nate Geraci’s hinting at the possibility of a Cardano ETF entering the US market has sparked more enthusiasm.

Following the news, Cardano has been on a tear and has just retreated modestly from its $1.12 high. Analysts like Ali Martinez put ADA forecast as high as $6 if market conditions align with this momentum. Additionally, broader market confidence in US-issued crypto assets could further solidify ADA’s position as a strong contender in the ETF space.

Cardano’s on-chain metric surge: Strength behind ADA’s rally

The talk of the potential Cardano ETF has gathered momentum. But that is not the only thing fueling the positive ADA forecast. Impressive on-chain performance has given wings behind ADA’s bullish prospects. Trading volume soared to a 7-month high of $52.26 billion, while whale transactions hit a 6-month peak.

Even Cardano’s Futures Open Interest (OI) has surged past a yearly high of $717m. Although RSI suggests overbought conditions, the technical outlook suggests that ADA could push past another dollar, especially if the rally sustains its momentum. These metrics paint a picture of robust investor confidence in Cardano.

Rollblock’s GambleFi sees skyrocketing demand

The crypto world is abuzz, and all eyes are on Rollblock—a rising star redefining the GambleFi niche with a potent mix of unique solutions and transparency. In an industry often plagued by shadows, Rollblock’s commitment to trust has ignited a frenzy, propelling its presale to jaw-dropping heights.

But what’s behind the hype? Rollblock offers more than promises—it delivers. This platform isn’t just attracting gamblers; it’s drawing savvy investors hunting for the next big crypto gem with 7,000 electrifying games, deflationary tokenomics, and a groundbreaking revenue-sharing model.

Rollblock stands out with a fully functional ecosystem that is already buzzing with thousands of active users. Could this be the next crypto to explode? If the surging demand is any indication, Rollblock may very well be the ticket to GambleFi dominance—and beyond.

Conclusion

The crypto market is at an inflexion point. Positive ADA forecast that followed Nate Geraci’s projections has sparked impressive on-chain performance, and now, the new Rollblock GambleFi protocol is riding the wave as the next crypto to explode. The whole industry is taking notice – presale is edging closer to a $6m valuation, and the price is still at $0.036 in stage 8 presale.

To learn more about Rollblock, visit the website and its socials.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

Partner Content

Multichain AI token poised to dethrone SOL, TON: 5,000% gains expected

Published

2 days agoon

November 25, 2024By

admin

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

A new AI-powered multichain crypto, CYBRO, is disrupting the market with projections of up to 5,000% growth, attracting investors eager for the next big opportunity.

A new multichain AI cryptocurrency is set to shake up the market, with projections of massive growth by year’s end. Experts predict it could surpass established players like Solana and Toncoin. With anticipated gains of up to 5,000%, this token is attracting attention from investors eager to catch the next big thing in crypto.

CYBRO presale breaks $4 million milestone

CYBRO is blazing a trail in the crypto world, shattering its presale target by surpassing $4 million and capturing the interest of major crypto whales. As a groundbreaking NeoBank, CYBRO is delivering unmatched opportunities to investors, providing advanced DeFi solutions that maximize earnings across multiple blockchains.

At a presale price of $0.04, CYBRO tokens present a unique chance for significant gains, with experts estimating a potential ROI of up to 1200%. With its powerful blend of AI-driven strategies and DeFi capabilities, the project is attracting a high level of trust from both whales and influencers alike.

The CYBRO ecosystem goes beyond mere tokens—it introduces an exclusive Points system, adding even more value for investors. Holders of these Points automatically qualify for CYBRO Airdrops, where the quantity of tokens received correlates with the number of Points accumulated. Every week, up to 1 million Points are distributed to those participating in CYBRO’s DeFi Vaults, making it an exciting way to engage with the platform.

Owning CYBRO tokens comes with many exclusive perks, including generous staking rewards that average around 10%, access to airdrops, cashback on purchases, and significantly reduced fees for trading and lending. In addition, the platform features a strong insurance program, designed to secure investments and enhance the overall user experience.

With only 21% of the total token supply available for the presale and around 80 million tokens already sold, time is of the essence for those aiming to capitalize on this promising project.

Interested investors can join CYBRO today.

Solana continues to soar

Solana is a high-performance blockchain designed to support decentralized applications (dApps) with unparalleled speed and scalability. Unlike platforms such as Ethereum and Cardano, Solana achieves rapid transactions without relying on sharding or second-layer solutions, simplifying the development process for creators.

Its native cryptocurrency, SOL, powers transactions, program execution, and network rewards while providing access to a diverse ecosystem of projects. SOL has managed to cross its all-time highs in the past few days, standing tall at $252.31.

Toncoin rises amid bull market

Toncoin, the native currency of The Open Network, powers a decentralized, open-source blockchain initially developed by Telegram and now championed by the TON Foundation and its community. Utilizing a proof-of-stake consensus mechanism, TON ensures scalability, security, and minimal transaction fees. The ecosystem is rapidly evolving, incorporating features like decentralized storage, services, DNS, anonymous networking, and seamless payment solutions.

With robust technology and active community support, Toncoin is emerging as a prominent player in the blockchain space. Currently priced at $6.23, TON has managed to surge 14% in the last seven days.

Conclusion

As the crypto market enters the 2024 bull run, established coins like Solana and Toncoin may offer less short-term potential. In contrast, CYBRO emerges as a promising DeFi platform on the Blast blockchain. It provides investors with unique opportunities to maximize earnings through AI-powered yield aggregation. With attractive staking rewards, exclusive airdrops, and cashback on purchases, CYBRO enhances the user experience with smooth deposits and withdrawals. Its commitment to transparency, compliance, and quality sets it apart. The strong interest from prominent investors and influencers underscores its potential for significant growth. CYBRO stands poised to outperform others, offering a compelling option for those seeking high returns in the evolving crypto market.

To learn more about CYBRO, visit the website, Twitter, Discord, and Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: