Bitcoin miners

Heat Your Home While Earning Bitcoin With Heatbit

Published

4 months agoon

By

admin

Company Name: Heatbit

Founder: Alex Busarov

Date Founded: April 2020

Location of Headquarters: Remote

Number of Employees: 25

Website: https://heatbit.com/

Public or Private? Private

In early 2020, Alex Busarov was stuck in his Shanghai apartment during COVID. To quell his boredom, he ordered an Antminer S9, a Bitcoin mining machine, to toy around with.

After plugging it in, he quickly learned two things: Bitcoin miners are noisy and they run hot.

While Busarov saw the prior byproduct as an annoyance, he viewed the latter as an opportunity.

Fast-forward to the present day and Busarov and his team are preparing holiday shipments of bitcoin miners that run quietly and double as space heaters (as well as air purifiers) — the flagship product for his company, Heatbit.

What is more, Busarov has created a product that helps to decentralize Bitcoin’s hashrate, which has become dangerously centralized.

“The first kind of value that I saw in this was how to use energy for heating your home and mining Bitcoin at the same time, but then the mission started evolving as I realized the importance of the decentralization of Bitcoin mining,” Busarov told Bitcoin Magazine. “I think we’re enabling the most resilient infrastructure for Bitcoin to run on.”

How Heatbit Devices Work

Heatbit devices stand at 24 inches in height and 8 inches in diameter. They’re cylindrical in shape and have a sleek finish.

Getting started with a Heatbit device is “as difficult as it is to plug in a Dyson device,” according to Busarov.

After doing so, users need only download the Heatbit app and connect the device to WiFi to begin mining bitcoin.

Once the device is running, using no more energy than a Dyson space heater and making no more noise than a whirring sound at the volume of whisper, it points the hash power that it produces to a default mining pool, which is currently NiceHash and soon to be Luxor. Users will eventually also be able to choose their own mining pool or search for Bitcoin blocks without being part of a pool if they please.

“Basically, you can start without even knowing what a mining pool is,” explained Busarov. “But once you learn a little more or if you already know about mining pools, you just plug in the details for the mining pool you want to join, or solo mine.”

Busarov clarified that the functionality to choose your mining pool or to mine solo hasn’t been enabled for all users yet, but it will be in the near future.

“We don’t have any intention to lock users into a particular pool,” he said.

If the device runs 24/7, it mines approximately 700 sats per day, which equates to approximately 20,000 sats per month — about $20 per month as per bitcoin’s price at the time of writing.

The sats earned are held in a smart contract until the amount reaches a certain threshold (which is currently between $10 and $20 worth of bitcoin) before they’re deposited into the user’s wallet address on the Bitcoin base chain.

Busarov is aware that some users are concerned with Bitcoin fees rising, which is why he and his team are working on implementing Lightning.

“Lightning is definitely coming,” said Busarov. “It’s not enabled yet, but it’s coming.”

Decentralizing The Hashrate

As Busarov mentioned, it wasn’t his original intention in creating Heatbit devices to contribute to the decentralization of the Bitcoin hashrate. However, once he began considering just how centralized it is in some regards, he acknowledged this deeper dimension of Heatbit’s value proposition.

“When you have five big mining companies and 20 well-known mining locations, if you want to damage Bitcoin, you know those 20 locations, right?” cautioned Busarov.

“Also, if the price of Bitcoin goes down a lot, which happens sometimes, and the mining companies are overleveraged, they might not exist anymore,” added Busarov regarding the risk of major mining companies going bankrupt.

“But people will still use the heaters, because they’re not spending any extra money to mine this way. They will still use their miners because they’re not losing any money, which makes it the cheapest way to mine.”

At first thought, Busarov’s claim that the home miners he’s built can play a legitimate role in supporting the Bitcoin network seems a bit hyperbolic, especially considering the fact that the amount of hashrate Heatbit devices currently produce is infinitesimal compared to the amount that major mining companies produce.

However, when one considers the size of the home heater market, Busarov’s assertion seems a bit more believable.

“There’s about 200 million electric heaters being sold every year,” said Busarov, referring to the market Heatbit is looking to capture in the long run.

In the short term, though, Busarov understands that the buyers in that market don’t necessarily have the money for a space heater like a Heatbit, which retails for $799.

“Most people wouldn’t buy an $800 heater,” he explained. “We’re looking into making a more affordable version so that we can sell more.”

Prioritizing affordability has taken a back seat to focusing on quality and timeliness, however. Busarov and his team have been putting all of their efforts into making a durable and dependable device that they can ship with haste.

Built To Last, Ready To Ship

The current iteration of Heatbit devices is the product of a tremendous amount of R&D as well as the sourcing of quality parts from over 70 different suppliers.

In other words, Busarov and his team have built a device that can take a beating. (Not that you should beat your Heatbit device; we don’t condone home Bitcoin miner / home heater abuse here at Bitcoin Magazine.)

“Today, I was doing some testing of the devices for the latest batch,” said Busarov.

“I put one into the box and was literally throwing it around. I was throwing it like UPS or FedEx might, and I took it out to find that it didn’t break,” he added.

Busarov shared this information with a smile, one seemingly half born from my reaction to his account of how he tests the resiliency of his products and half derived from the faith that many in the Bitcoin community have come to have in him.

“When we started building, it was taking longer than expected,” explained Busarov, adding that he and his team were operating under pressure as customers had preordered devices.

“Some people would complain about a delay in shipping and ask for refunds, and we refunded the money, but then a lot of people said, ‘Hey, guys, you’re doing a great thing. We believe in you. Keep going,” he added.

“When people say something like that to you, you can’t stop. When there’s so much faith and trust that people place in you, that gives you so much energy and motivation to keep going.”

Keep going Busarov and his team did, eventually creating a dependable product that’s now ready to ship en masse.

The Future Of Heatbit

Busarov hopes that when major household appliance companies see what Heatbit has created, they become interested in building similar products.

“I think once we show that this is possible, more companies will come to it,” he said.

“It will start getting really interesting when companies like Dyson and Samsung and the major electronics companies start looking into this,” he added.

“Imagine Samsung starts producing home devices — not necessarily space heaters — but other home devices that do mine at scale.”

Busarov has also been keeping an eye on developments in the open source Bitcoin mining movement, and has been in touch with one of its leaders: Skot, the founder of Bitaxe. He’s looking at what he might be able to incorporate from that movement, while staying conscious of the fact that he’s building a consumer product for which safety is paramount.

“I really like the open source Bitcoin mining movement, and I hope we’ll be able to contribute to it,” said Busarov.

“That being said, we need to be careful, because heaters use a lot of power and it can be dangerous for people to just play with them,” he added.

As a final thought, Busarov reiterated that he doesn’t believe he’s simply building an innovative product for the average consumer, but that Heatbit is playing a role in shaping the future of Bitcoin mining.

“Bitcoin mining is not going to be about these huge warehouses using loads of energy and then these big companies having to sell the bitcoin they mine to pay for the energy they use and their operational costs,” he explained. “With home mining, you don’t have to sell any of the bitcoin you earn.”

Source link

You may like

Bitcoin Primed To Outperform the S&P 500 Index As Markets Crash, Says Investor Dan Tapiero – Here’s His Outlook

This Easy Bitcoin ETF Flow Strategy Beats Buy And Hold By 40%

Solana, Chainlink Support Coming to Both PayPal and Venmo

Bitcoin holds steady amid stock market crash, says Unchained analyst

U.S. SEC Staff Clarifies That Some Crypto Stablecoins Aren’t Securities

PayPal Adds Chainlink And Solana To Its US Cryptocurrency Service

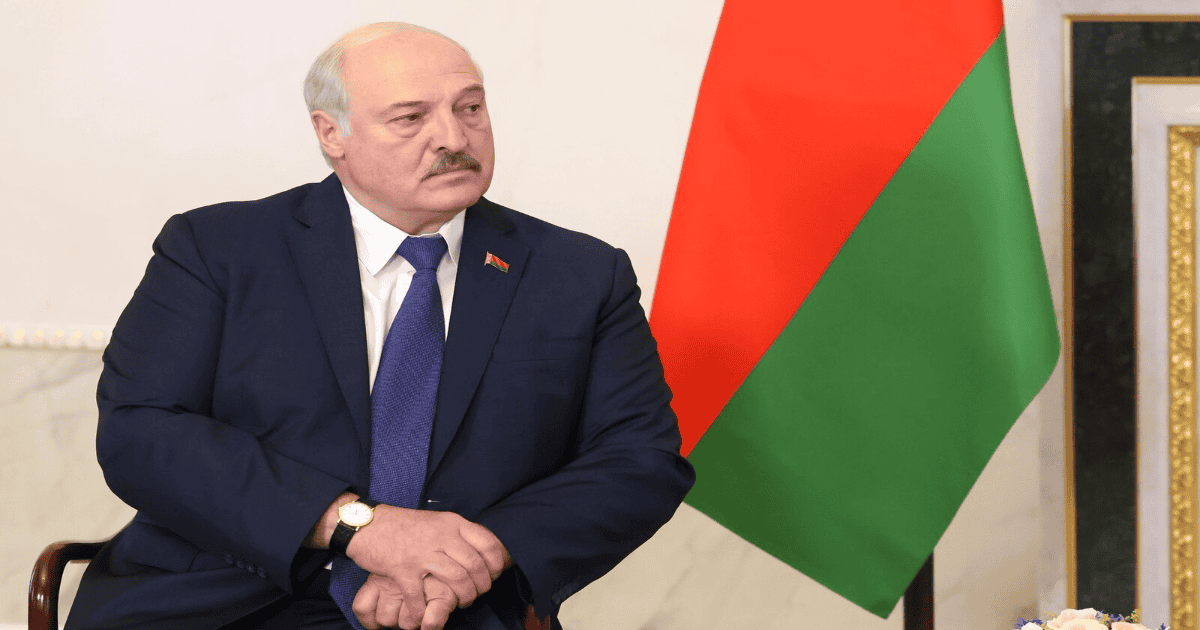

Belarus

Belarus President Wants To Mine Bitcoin & Crypto Using Surplus Energy

Published

1 month agoon

March 6, 2025By

admin

This week, Belarus’ President Alexander Lukashenko told the country’s Energy Minister Alexei Kushnarenko that he wants to use their surplus of electricity to mine cryptocurrency like Bitcoin to accumulate a reserve.

“Look at this mining. More and more people are turning to me. If it is profitable for us, let’s do it,” President Lukashenko said. “We have excess electricity. Let them make this cryptocurrency and so on.”

NEW:

Belarus President Alexander Lukashenko says if Bitcoin & crypto mining is profitable, “let’s do it.”

“We have excess electricity. Let them make this cryptocurrency and so on.” pic.twitter.com/rSmqUR5gdn

— Bitcoin Magazine (@BitcoinMagazine) March 5, 2025

President Lukashenko touched on how the United States is embracing the mining industry under President Donald Trump, and also creating a strategic reserve of Bitcoin and other cryptocurrencies: “Moreover, you see the path the world is going. And especially the largest economy in the world. They announced yesterday that they will keep [Bitcoin & cryptocurrency] in reserve.”

“Therefore, there will be demand for them. Well, maybe we should do it ourselves,” Lukashenko continued. “Well, we attract some investors, sell them electricity, although I do not rule it out. But we need to do it ourselves. There are such proposals. I think that you will step over this bureaucracy and report what needs to be done.”

Last summer, President Trump hosted American-based Bitcoin miners at his Mar-a-Lago residence to learn and get a better understanding of the industry to best serve them under what would be his upcoming presidency. Since then, President Trump has repeatedly backed the Bitcoin mining industry and championed Bitcoin in many other ways, catching the attention of other world leaders like Lukashenko. Other nation’s leaders are taking notice.

Since President Trump proposed the idea of creating a strategic reserve of Bitcoin at The Bitcoin Conference in Nashville last summer, government officials around the world have begun proposing legislation for their own country to adopt it as well, and have discussed the potential feasibility of adopting one. Now, it is officially happening, after Trump announced on his Truth Social channel that there will be a U.S. strategic reserve of BTC.

U.S. Commerce Secretary Howard Lutnick stated today that he thinks President Trump is going to move forward with these plans at the White House’s Digital Assets Summit this Friday. As President Trump and the United States continue to embrace Bitcoin, other nations paying attention like Belarus are following suit as nation state adoption accelerates.

Source link

analysts

Bitcoin (BTC) Mining Economics Weakened in February, JPMorgan Says

Published

1 month agoon

March 4, 2025By

admin

The total market cap of the 14 publicly-listed U.S. miners that Wall Street bank JPMorgan (JPM) tracks dropped 22% in February as the bitcoin (BTC) price declined and mining economics came under pressure.

Bitcoin miners with high performance computing (HPC) exposure fell following the DeepSeek artificial intelligence (AI) announcement, and due to concerns about demand for data center capacity in the near-term, the bank noted.

Revenue and profitability fell last month. The bank estimated that bitcoin miners earned $54,300 per EH/s on average in daily block reward revenue in February, a 5% decline from the month previous.

“Daily block reward gross profit declined 9% m/m to $29,500 per EH/s in February,” analysts Reginald Smith and Charles Pearce wrote.

The average network hashrate rose 3% to 810 exahashes per second (EH/s) last month, the report said.

The hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain.

Mining difficulty rose 2% from January, the bank said. Network difficulty is now 28% higher than before the halving event in April last year.

Core Scientific (CORZ) was the best performer with a 9% drop, and Greenidge Generation underperformed with a 36% decline for the month, the report added.

Read more: U.S.-Listed Bitcoin Miners Accounted for 29% of Global Hashrate in February: JPMorgan

Source link

Bitcoin

Grayscale Investments Launches Bitcoin Miners ETF

Published

2 months agoon

February 2, 2025By

admin

Grayscale Investments LLC has officially launched the Grayscale Bitcoin Miners ETF (MNRS), providing investors with a unique opportunity to gain exposure to the Bitcoin mining industry. This ETF is designed for those who want to invest in Bitcoin miners without directly purchasing Bitcoin itself, making it an attractive option for traditional investors looking to diversify their portfolios.

Introducing the Grayscale Bitcoin Miners ETF ($MNRS)

, offering investors targeted, pure-play exposure to Bitcoin Miners and the Bitcoin Mining Industry, available directly in your investment account. Learn more below. Brokerage fees and other expenses may still apply.

— Grayscale (@Grayscale) January 30, 2025

Key Takeaways

- Grayscale’s Bitcoin Miners ETF (MNRS) targets companies involved in Bitcoin mining and related services.

- The ETF is listed on NYSE Arca and tracks the Indxx Bitcoin Miners Index.

- Investors can gain exposure to the Bitcoin mining ecosystem without direct investment in BTC.

Overview Of The ETF

The Grayscale Bitcoin Miners ETF aims to provide targeted exposure to companies that derive a significant portion of their revenue from Bitcoin mining activities. This includes firms that offer mining infrastructure, hardware, and software services. The ETF is particularly appealing to investors who may not be ready to invest directly in Bitcoin but still want to participate in the growing market.

Investment Strategy

The ETF will not invest directly in Bitcoin or other digital assets. Instead, it focuses on companies that support the Bitcoin network’s operations. The Indxx Bitcoin Miners Index, which the ETF tracks, includes major players in the mining sector, such as:

- MARA Holdings – 16.65%

- Riot Platforms – 11.92%

- Core Scientific – 9.2%

- CleanSpark – lower weight

- Iren – lower weight

These companies are crucial for maintaining the security and integrity of the Bitcoin network, positioning them for potential growth as Bitcoin adoption increases.

Related: Nasdaq Proposes In-Kind Redemptions for BlackRock’s Bitcoin ETF

Market Context

The launch of the Grayscale Bitcoin Miners ETF comes at a time when the market is experiencing significant fluctuations. Despite Bitcoin’s impressive performance in 2024, with a return of 113%, many publicly traded mining companies have struggled to keep pace. Some have reported declines of up to 84% in their stock prices, highlighting the volatility and risks associated with the mining sector.

Future Prospects

Grayscale’s Global Head of ETFs, David LaValle, emphasized the importance of Bitcoin miners, stating, “Bitcoin miners, the backbone of the network, are well-positioned for significant growth as Bitcoin adoption and usage increases.” This sentiment reflects the broader trend of institutional interest in Bitcoin-related investments, as more traditional investors seek to diversify their portfolios with innovative financial products.

Related: Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Conclusion

The Grayscale Bitcoin Miners ETF represents a significant step forward in making Bitcoin investments more accessible to a wider audience. By focusing on the mining sector, Grayscale is tapping into a critical component of the Bitcoin ecosystem, offering investors a way to engage with the market without the complexities of direct Bitcoin ownership. As the demand for Bitcoin continues to grow, the ETF could serve as a valuable tool for investors looking to capitalize on the evolving landscape of digital assets.

Source link

Bitcoin Primed To Outperform the S&P 500 Index As Markets Crash, Says Investor Dan Tapiero – Here’s His Outlook

This Easy Bitcoin ETF Flow Strategy Beats Buy And Hold By 40%

Solana, Chainlink Support Coming to Both PayPal and Venmo

Bitcoin holds steady amid stock market crash, says Unchained analyst

U.S. SEC Staff Clarifies That Some Crypto Stablecoins Aren’t Securities

PayPal Adds Chainlink And Solana To Its US Cryptocurrency Service

Is Korea Propping Up The XRP Price? Pundit Explains What’s Happening

Crypto stocks down, IPOs punted amid tariff tumult

Financial Firm Republic Plans To Acquire Crypto and Tokenized Securities Trading Platform INX for $60,000,000

The Future Of Bitcoin Mining Is Distributed

Tether Won’t Try to Make USDT Comply With US Laws, ‘Needs’ New Stablecoin: CEO

SEC says “Covered Stablecoins” not under its jurisdiction

Circle’s IPO Filing Tests Crypto Market Confidence After Trump’s Tariff Shock

$90K Breakout Ahead as BTC Decouples from US stocks after China’s Tariffs

Toncoin Takes A Hit With 12% Correction After Failing To Break $4.34, More Pain?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x