Hedera

Hedera’s HBAR momentum has just began, analyst says

Published

5 months agoon

By

admin

Hedera Hashgraph was one of the best-performing cryptocurrencies on Friday, November 15, as a popular crypto analyst made his bullish case.

Hedera Hashgraph (HBAR) price rose to $0.0767, its highest level since July 17, and 66% above its lowest level this month.

In an X post, a trader known as Maverick, who has over 145,000 followers, said that HBAR’s climb had just begun. He believes that it can surge to the year-to-date high of $0.1813, which is about 182% higher than the current level.

$HBAR Breaking Barriers!

After nearly 250-day downtrend, @hedera is on a stellar rally:

+40% in the last 7 days

+16% in the last 24 hours

112% spike in trading volume to $563M in 24 hours

Momentum surged after Canary Capital’s Hedera ETF filing, marking a pivotal… pic.twitter.com/N5F3j2I1U3

— Maverick (@degen_maverick) November 15, 2024

Maverick cites the rising Hedera Hashgraph’s volume and the recent application of a spot ETF by Canary Capital as a potential catalyst. There is a likelihood that Donald Trump’s Securities and Exchange Commission would easily approve such an ETF.

Another potential catalyst for Hedera Hashgraph is that its futures open interest has been in a strong uptrend. It jumped to $66.7 million, up from $26.6 million in September, a sign that it is seeing strong demand.

Still, Hedera Hashgraph has numerous challenges. For one, while it counts large companies like Ubisoft, Dell, Boeing, Google, and Deutsche Bank as members of its governance council, its ecosystem is fairly small.

For example, it has a DeFi total value locked of just $44 million, making it much smaller than newer blockchains like Sui and Base Blockchain. DEX networks in its ecosystem handled tokens worth $35.4 million in the last seven days, making it the 32nd biggest chain in the industry.

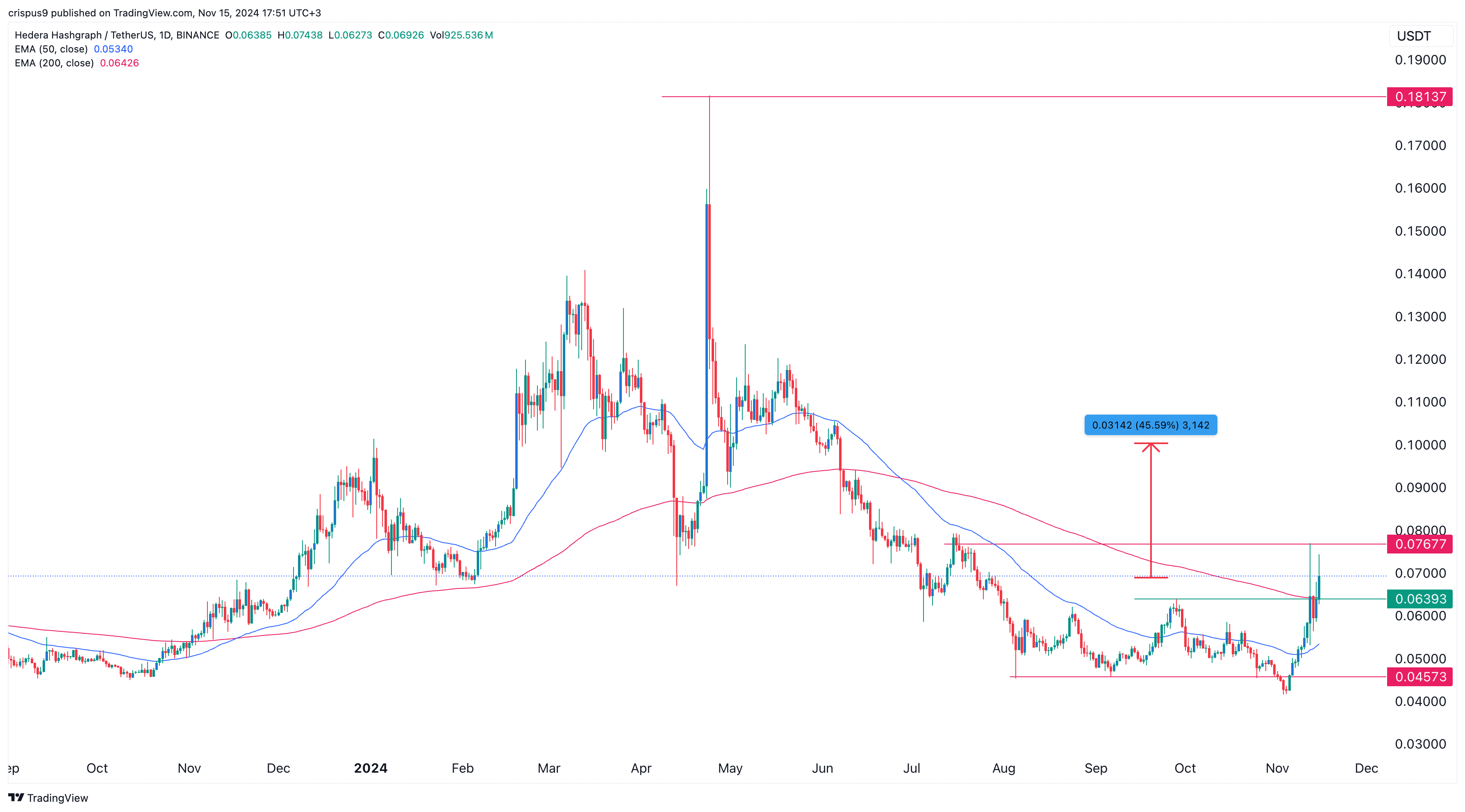

HBAR price could hit $0.1 soon

The daily chart shows that the Hedera Hashgraph price has bounced back in the past few days. This recovery happened after it formed a double-bottom pattern around the support at $0.045. In most periods, this is one of the most bullish patterns in the market.

Hedera has also soared above the key resistance level at $0.063, the neckline of this pattern. It has also jumped above the 50-day and 200-day moving averages.

Therefore, the path of the least resistance for the coin is bullish, with the next psychological level to watch being at $0.10, which is about 45% above the current level. The stop-loss of this trade will be at $0.055.

Source link

You may like

Senator Tim Scott Says Crypto Market Structure Bill To Be Passed by August of This Year

DOT recovery, Bitget burn update and BlockDAG’s $1 forecast, 10 CEX listings

Strategy Buys More Bitcoin as Tariff Exemptions Send Tech Stocks Soaring

Kraken Expands To TradFi, Set To Launch Stock & ETF Trading

U.S. Crypto Lobbyists Flooding the Zone, But Are There Too Many?

Michael Saylor’s Strategy buys $285M Bitcoin amid market uncertainty

24/7 Cryptocurrency News

Bloomberg Analysts Predict Litecoin, Hedera ETFs To Come Before Solana, XRP ETFs

Published

4 months agoon

December 17, 2024By

admin

Bloomberg analysts, including Eric Balchunas and James Seyffart, have predicted that the Litecoin and Hedera ETFs could launch before the Solana and XRP ETFs. These analysts also provided insights into why they hold such beliefs regarding the crypto ETF landscape.

Bloomberg Analysts Predict Litecoin, Hedera ETFs To Come First

In an X post, Bloomberg analyst Eric Balchunas shared his team’s prediction that the Litecoin and Hedera ETFs could come first before the Solana and XRP ETFs. The analyst stated that they expect a wave of crypto ETFs next year, although not at once.

They expect the SEC to first approve Bitcoin and Ethereum combo ETFs. Bitwise, Franklin Templeton, and Hashdex have all filed to offer these Dual ETFs. The Bitcoin and Ethereum ETFs have enjoyed massive success. These Bitcoin ETFs recently surpassed Satoshi Nakamoto’s BTC holdings.

These Bloomberg analysts predict the next crypto ETFs will probably be the Litecoin and Hedera ETFs, followed by the Solana and XRP ETFs. In his outlook, James Seyffart explained why they believe these ETFs would come before the Solana and XRP ETFs.

Why The Solana And XRP ETFs Have Lower Approval Odds

Seyffart stated that the Solana and XRP ETFs would have to wait for the next SEC administration before the Commission can consider the pending applications. Even then, the Bloomberg analyst noted that there are complex legal issues around these coins and others relating to their status as securities, which need to be resolved first.

In XRP’s case, the Ripple SEC lawsuit is still pending, which is likely one of the legal issues that Seyffart is referring to. The SEC and Ripple have a long history with their long-running legal battle. However, despite these obstacles, crypto figures like Ben “Bitboy” Armstrong are confident that an XRP ETF is imminent.

Meanwhile, unlike Solana and XRP, the Bloomberg analyst noted that Litecoin and Hedera haven’t been referred to as securities by the US SEC. The analyst added that while they believe that Litecoin and Hedera ETFs have higher approval odds, they remain uncertain whether there is actual demand for these funds.

Canary Capital is the only asset manager that has filed for a Litecoin and Hedera ETF, which suggests that issuers do not believe there is enough demand for these crypto products. Bitwise, Canary Capital, 21Shares, and WisdomTree have all filed for XRP ETFs. Meanwhile, Grayscale, VanEck, Canary Capital, and Bitwise have all filed for Solana ETFs.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

cryptocurrency

What is Hedera Hashgraph (HBAR)? Guide to History, Uses, and Trends

Published

4 months agoon

December 13, 2024By

admin

The Internet is a big world; every country represents a digital ledger. Most of these ledgers are blockchains but most have ‘slow economies’. Here is where the global leader Hedera Hashgraph comes into the picture. It is a distributed ledger technology that replaces the old blockchain system, making the ‘economy’ fast, fair, and secure.

In this article, we will discuss what is hedera hashgraph, how it works, its key features, the challenges it faces, and the future of Hedera (HBAR).

What is HBAR?

The Hedera (HBAR) token is the native token of the Hedera ecosystem. The entire network’s transactions are fueled by HBAR, which guarantees their speed and security.

In simpler words, you can consider Hedera’s HBAR as the rocket fuel, allowing users to pay for network services like file storage, smart contracts, and token production. Through staking, HBAR contributes significantly to preserving the integrity of the network in addition to serving as a transactional tool for users to take advantage of the key features offered by Hedera’s infrastructure.

At the time of writing, the HBAR token is trading at around $0.313 and has experienced around 800% price surge in the past 2 months.

How does Hedera Hashgraph work?

A decentralized network of nodes makes up the Hedera Hashgraph ecosystem, which verifies transactions and adds them to the common ledger. The Public Hedera Network’s Hashgraph consensus method is built for fast transaction speeds and low latency, guaranteeing quick and effective transaction processing.

Fundamentally, Hedera Hashgraph relies on a novel consensus process known as “gossip about gossip.” Until everyone agrees, nodes exchange information about who they spoke with and what transactions they are aware of.

Byzantine Fault Tolerance and fairness are maintained while the inefficiencies of blockchain’s proof-of-work are eliminated. The network is very quick and impenetrable since transactions are timestamped and arranged according to when the majority of the network gets them.

The Hedera platform allows developers to create smart contracts that facilitate the execution of transactions and the operation of decentralized apps.

The platform’s native cryptocurrency, HBAR, is utilized for handling and safeguarding network transactions. A technical board and a council oversee the platform, and HBAR holders have the power to shape significant choices about the project’s future.

Now let’s discuss what is Hedera Hashgraph used for.

How to use Hedera Hashgraph and HBAR?

Using Hedera is a straightforward process. It offers APIs that let developers manage smart contracts, create tokens, and build decentralized apps.

The Hedera ecosystem is made up of several components that cooperate to form the network as a whole. It consists of nodes that record transactions, developers who use the Hedera SDK to create dApps and smart contracts, businesses, and organizations like IBM and LG that play around with the technology.

For more efficient operations, businesses can use Hedera’s token services and file storage. HBAR can also be used by regular users to make payments, stake, or communicate with dApps. To enter this quick and safe ecosystem, all you need is some HBAR and a wallet that works with Hedera.

Hedera’s cryptocurrency holders use the cryptocurrency for platform oversight and operations, and dApp users take advantage of the quick and safe transactions made possible by Hashgraph technology.

Key features and benefits of Hedera Hashgraph and HBAR

Speed is one of the key features of Hedera Hashgraph as it is designed to handle thousands of transactions per second with very low latency. It is environmentally beneficial thanks to its energy-efficient consensus method.

It also offers key benefits including its Hedera services which include Consensus-as-a-service (CaaS), file storage, identity management, and cryptocurrency payments. These services use hashgraph technology, which offers lightning-fast speeds, safety, and flexibility.

The Hedera platform’s native cryptocurrency is called HBAR Token. In addition to voting on important platform decisions, it is utilized to process and secure network transactions.

Furthermore, the Hedera SDK gives developers the resources and tools they need to create smart contracts and dApps on the Hedera platform. It provides a large selection of languages of programming as well as the ability to integrate with other platforms and programming tools.

The usefulness of HBAR extends to network transaction fuelling, governance, and staking. It is a solid option for both developers and businesses because of its fairness, decentralization, and regulatory compliance features.

How to buy, store, and use HBAR

Buying, selling, and storing Hedera’s cryptocurrency i.e. the HBAR token is a straightforward process.

The easy way is to create an account on any major centralized exchange like Binance, Coinbase, or Bybit. Then you can deposit fiat currency and buy a stable coin in which HBAR is traded on that exchange. In this case, it can be USDT or USDC.

Then you can buy the HBAR token at its current price or set a buy limit on which you want to buy the HBAR token. After buying the tokens will show in your exchange wallet after which you can sell them by using market or limit order.

The other option is to use decentralized exchanges like Uniswap or Pancakeswap to buy HBAR tokens which can be done after creating a digital crypto wallet like Metamask. After buying the token you can secure it in your digital crypto wallet and sell it by going to any decentralized exchange.

If you don’t want to store HBAR tokens in your digital wallet or any centralized exchange you can also stake HBAR by following the official guide here.

Challenges and criticisms

Hedera Hashgraph offers impressive technology that solves a lot of problems that normal blockchains don’t, however, despite its excellent technology, its governance mechanism comes under criticism now and then. This is because, despite the diversity of its governance council, the authorities on the governance panel are centralized which points questions to the core concept of decentralization on which every cryptocurrency stands on.

Additionally, the coding behind Hedera Hashgraph isn’t open-source which can be a security issue as public audit of code is often a better alternative than keeping it private. While Hedera does claim to be highly scalable this claim hasn’t been tested in the real world, however, as crypto gets wider acceptance, a large number of users can be onboarded to Hedera’s platform and it may pose a challenge to it in the future.

Future of HBAR and Hedera Hashgraph

The roadmap outlined by Hedera’s team is impressive. The network’s potential for use in the gaming, supply chain, and financial industries increases as it shifts to a more decentralized governance and consensus architecture. The usefulness of HBAR will increase with further improvements, such as mirror nodes for increased transparency and sharding for scalability.

Collaborations with significant corporations such as Google and IBM show faith in Hedera’s goal. A promising future is indicated by the growing usage of Hedera for identity management, tokenization, and safe micropayments. Hedera has the potential to be a key component of Web3 infrastructure if it can successfully negotiate regulatory environments and keep coming up with new ideas.

How many Hedera coins are there?

The total and max supply of the HBAR token is set at 50 billion tokens and its circulating supply is 38 billion (at the time of writing). This essentially means that Hedera Hashgraph cannot mint more HBAR tokens which is a good sign for the long-term stability of any cryptocurrency project.

Source link

ETF

Get ready for new spot ETFs, hints President Nate Geraci

Published

5 months agoon

November 21, 2024By

admin

Nate Geraci, President of the ETF store, shared that major players are interested in new crypto index funds.

In a recent X post, Nate Geraci shared that established asset managers like Grayscale and Bitwise are open to new crypto index funds with a focus on Solana (SOL), Ripple (XRP) and Hedera (HBAR). This is a step in the right direction, as believed by the crypto community, as asset managers are beginning to look beyond just Bitcoin and Ethereum. Geraci noted that asset managers are looking to expand their portfolios to include other popular digital currencies in the exchange-traded funds market.

The move toward altcoin ETFs indicates a growing interest among institutional investors seeking more diverse exposure to cryptocurrencies. SOL has gained attention due to its scalability and lower transaction fees. VanEck recently filed a spot ETF to capitalize on its growing ecosystem.

In addition to crypto index fund uplistings from Grayscale & Bitwise, there are currently spot ETF filings for the following…

-SOL

-XRP

-HBARGuessing at least one issuer takes a flier on ADA or AVAX ETF as well.

— Nate Geraci (@NateGeraci) November 21, 2024

On the other hand, XRP has been in the headlines after attaining clarity regarding legality over its status as a security, which led to Bitwise asset management filing for an XRP spot ETF, showing their confidence in the prospect of the asset going long-term. Moreover, earlier this month, HBAR, powered by a robust distributed ledger, is one of the assets attracting ETF filing, in which Canary Capital submitted an S-1 registration statement, typically used during initial public offerings.

Geraci also surmised that issuers might soon begin filing for other well-known cryptocurrencies, such as Cardano (ADA) and Avalanche (AVAX). Both assets come with robust blockchain ecosystems. ADA emphasizes the security and scalability involved in its proof-of-stake consensus. At the same time, AVAX stands out for sub-second finality and a multi-chain architecture.

Still, as the need for crypto exposure increases and regulatory clarity improves, market participants remain optimistic that 2024 could witness a breakthrough for more altcoin ETFs.

Source link

Senator Tim Scott Says Crypto Market Structure Bill To Be Passed by August of This Year

DOT recovery, Bitget burn update and BlockDAG’s $1 forecast, 10 CEX listings

Strategy Buys More Bitcoin as Tariff Exemptions Send Tech Stocks Soaring

Kraken Expands To TradFi, Set To Launch Stock & ETF Trading

U.S. Crypto Lobbyists Flooding the Zone, But Are There Too Many?

Michael Saylor’s Strategy buys $285M Bitcoin amid market uncertainty

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: