Decentralization

Helium enters correction as crypto fear and greed index declines

Published

4 months agoon

By

admin

Helium token suffered a reversal on Aug. 15 amid profit-taking and worsening sentiment in the crypto industry.

The Helium (HNT) crypto price retreated to $6.50, down by over 13% from its highest point this week, indicating it has moved into a local correction.

HNT is up by 126% from August low

Despite its pullback, HNT remains one of the best-performing cryptocurrencies since Aug. 5, when most tokens retreated. It has surged by over 126% from its lowest point this month, pushing its market cap to over $1 billion.

Helium’s retreat coincided with the crypto fear and greed index dropping from this month’s high of 57 to 43. If the decline continues, the index could move into the fear zone, below 40.

The decline also occurred as Bitcoin (BTC), Ethereum (ETH), and other altcoins retreated. Bitcoin fell from this week’s high of over $60,000 to $58,000 while Ether, Solana (SOL), and Binance Coin (BNB) were down by over 4% in the past 24 hours.

Helium has solid fundamentals

Helium has become one of the top-performing cryptocurrencies in recent months, bolstered by its ecosystem growth.

The network is reportedly in talks with two major U.S. carriers, who are conducting tests to offload their traffic onto the MOBILE network. Carrier 1 has over 185,000 subscribers, while Carrier 2 has over 122,000 users participating in the trial.

If successful, the carriers could save money and offer better coverage, while Helium would benefit from increased traffic and funds, which would flow to hotspot providers.

The @helium Carrier Offload Program is one of the most exciting developments in recent memory.

Telecom carriers are leveraging Helium with clear synergies for both parties:

– Carriers save $$ and offer better coverage.

– Helium receives more traffic routed through the network… pic.twitter.com/sHcY7TLkTa— Nick Garcia (@NickDGarcia) August 13, 2024

According to its stats page, Helium MOBILE has almost 20,000 active hotspots, while its IoT solution has 360,000 locations, and these numbers are rising.

HNT formed a golden cross

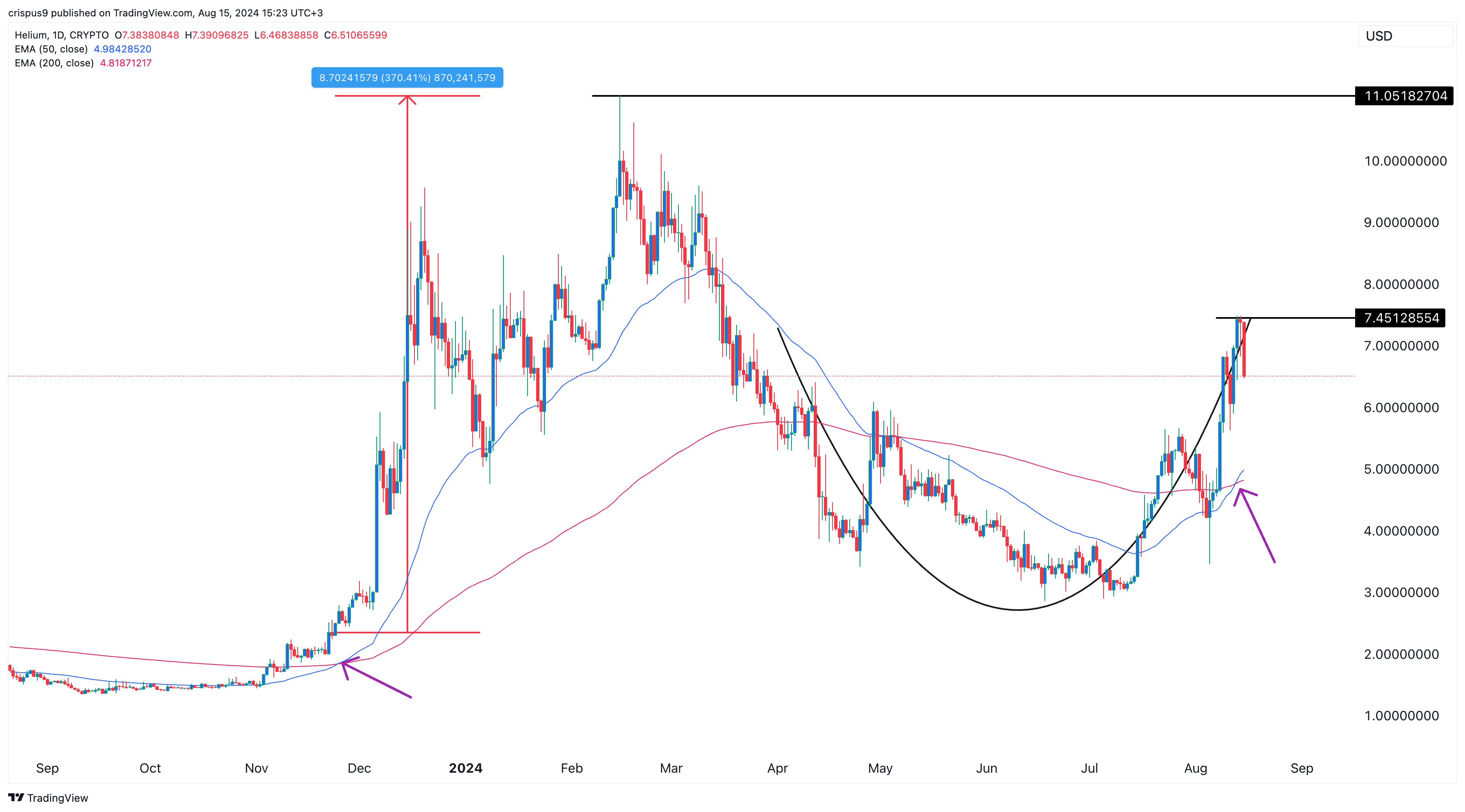

Technicals suggest that the HNT token could resume its upside as it recently formed a golden cross pattern, with the 200-day and 50-day Exponential Moving Averages making a bullish crossover.

In most cases, this pattern leads to further upside. For example, the last time HNT formed this cross in November 2023, the Helium token soared by over 370%.

Helium has also formed a rounded bottom, another bullish pattern. A cross above this week’s high of $7.45 could signal more upside as buyers target the year-to-date high of $11.05, 70% above its Aug. 15 level.

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

cryptocurrency

Launchpads are the key to decoding crypto investment

Published

1 week agoon

December 14, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

When investors decide which stocks or ventures to invest in, they usually have a set of criteria to evaluate which options best align with their financial goals. One main factor to consider is risk appetite, which refers to investor willingness to take on risk in pursuit of potential returns.

Those with a lower risk appetite prefer more stable blue-chip stocks with steady but modest returns. On the other hand, investors with a higher risk tolerance may seek out more volatile stocks or emerging markets, enticed by the possibility of substantial returns. They are often willing to endure market fluctuations, believing the potential long-term rewards outweigh the risks.

However, when it comes to crypto, retail investors have remained conservative. Despite the industry’s notorious promises of high returns, many retail investors cautiously approach crypto. Their hesitation is due to crypto’s well-known volatility, the perception that frauds and scams are prevalent, and a general lack of technological understanding compounded by a complex user experience.

With 2025 on the horizon and Bitcoin (BTC) soaring amid bullish vibes, crypto has steadily gained traction as a legitimate investment class. While recent price jumps stem from Donald Trump’s election victory and his crypto-friendly appointees, the industry has been gaining traction for some time.

The industry has found a new product-market fit for stablecoins, DeFi is booming, and newly improved infrastructure has enabled a variety of new applications while also reducing transaction costs. As such, many retail and institutional investors are becoming enamoured with crypto’s investment potential and growing technological capabilities.

This begs the question: How can blockchain-based projects effectively convert conservative retail and institutional investors into active participants beyond their comfort zone?

Enter crypto launchpads

Crypto launchpads grant investors early access to tokens before they list on public exchanges. In practice, this offers investors enticing investment opportunities as they have the potential for higher ROIs.

Cryptocurrency uncertainty can be unsettling for those who prefer investing in safe stocks with steady growth. Launchpads address these concerns by helping make crypto approachable, challenging the perception that it is unsafe, and emphasizing transparency to foster trust among hesitant new investors.

The concept wasn’t always perfect. For one, ICOs became notorious during the 2017 bull run due to scammy token launches and straight-up fraud. However, the next generation of crypto launchpads incorporates stronger vetting practices to bolster safety and informed investment. This allows investors to engage with early-stage projects with a sense of security they might not get when exploring projects independently.

Investors gain here in two ways. They get to actively engage with projects with some level of protection and gain bragging rights to say they helped launch an innovation in a growing field. As crypto expands and matures, so do the launchpads that propel many of the industry’s most promising projects, even putting community-focused spins on the “auction house” vibe launchpads sometimes inhabit.

For instance, Gems’s launchpad emphasizes community and networking as it seeks to establish an exclusive ecosystem for crypto investing and fundraising. At the heart of Gems’s platform is a diverse network of “Leaders,” eager and discerning investor influencers who then rally their community around projects on the launchpad based on their interests and speciality.

Compared to other launchpads, Gems recognizes the unpredictability of crypto investments and offers an optional protection program through a trusted insurance provider. To make sure the projects utilizing their launchpad are the cream of the crop, Gems’s investment committee also conducts a thorough vetting process to pinpoint teams with the most disruptive potential.

It’s understandable why investors may be cautious about investing in unknown crypto projects. However, launchpads are an irreplaceable asset for an industry that is in the midst of expansion by helping demystify early-stage investing and broadening access to everyone.

Source link

Adoption

The transformative potential of Bitcoin in the job market

Published

4 weeks agoon

November 26, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Bitcoin (BTC) has already changed the world, and as it gains traction, its potential to reshape the job market is becoming increasingly apparent. Even though recently we saw layoffs by big companies like Consensys and Kraken, it must be due to the industry’s maturing nature where companies are not yet certain about hiring principals.

The real story is that Bitcoin and its associated technologies will drive long-term job growth and create new roles. Unlike traditional assets, Bitcoin is decentralized. So, it fosters innovation and creates jobs in software development, cybersecurity, and financial services.

Even despite the not well-regulated environment, it already attracts different professionals. By this, Bitcoin boosts local economies and increases tax revenues, so not only people benefit but governments as well.

A new frontier for jobs—but not without growing pains

To start with, Bitcoin was the first-ever cryptocurrency. It came as a novelty that wasn’t accepted right away. However, later on, as people were getting more into it, more companies started launching their crypto tokens. To do this, they, of course, needed people who had already gained certain knowledge about Bitcoin.

It’s been 16 years since its invention, and crypto is no longer an unexplored phenomenon. Little by little, it becomes an integral part of our lives—the future is digital, as they say. From blockchain development and data security to market analysis and customer support, the skill sets needed in the crypto industry are expanding.

However, the industry is not fully mature, so there are no set hiring standards yet. At first, companies rushed to hire employees, anticipating the massive growth they predicted. But this has sometimes led to overhiring as companies face difficulty estimating the precise number of employees needed.

So, this boom in hiring has recently faced setbacks. Major players in the crypto industry, such as Consensys, Kraken, and dYdX, have all laid off significant portions of their workforces in recent weeks. They let go of 20%, 15%, and 35% of their employees, respectively. However, it only shows that the crypto industry as a whole is still defining its optimal workforce size.

A closer look at the layoffs reveals a more nuanced reality. Crypto companies are rather re-strategizing—they are shifting to smaller company types. Why? Because they think that companies with fewer but highly specialized employees who use web3 tools and AI function more efficiently.

In this sense, Bitcoin and its associated technologies are not just creating traditional roles but are increasing the demand for a workforce with cross-functional and adaptable skill sets. Companies need more and more roles that can be dynamic and evolve along with the industry.

Also, the volatility of the crypto market means that hiring trends tend to rise and fall depending on the Bitcoin prices and overall market sentiment: During bullish periods, companies have higher profits and often expand their workforce. In contrast, bear markets, regulatory challenges, and internal restructurings can lead to workforce reductions. This is what we see with the recent layoffs.

The bigger picture: long-term growth despite setbacks

The picture of crypto industry employment trends is much wider than it might be seen at first sight. Despite the recent flow of layoffs, crypto-related jobs still seem attractive to the masses—demand for crypto-related roles continues to rise.

The supply also remains in a positive trend. The biggest increase in positions is tracked in blockchain development and product management. There is also a need for individuals skilled in, for example, decentralized finance, digital asset custody, or blockchain law. And it is very interesting, as such a tendency represents the diversity and growth of the job market around Bitcoin.

To provide the future workforce, the introduction of educational programs and certifications in crypto and blockchain prepare new generations for work in this new economy. Education around crypto has become more common, so job seekers have become better equipped with the skills necessary for roles in this sector. This, in turn, reduces the need for companies to hire large teams.

Adapting to the sector

Since the market hasn’t reached its full maturity, there will be a need for adaptability. Many of the roles in the crypto industry didn’t exist a decade ago, and even more new roles will continue to emerge. Some professionals might find themselves in positions that didn’t exist when they entered the job market.

Continuous education and upskilling are essential as never before. The Bitcoin job market requires a mix of technical expertise and regulatory understanding. Companies are definitely going to experiment with different business models and will have to navigate regulatory challenges. To do all these, they will need employees who can adjust quickly to changes and operate efficiently.

Arthur Azizov

Arthur Azizov is the CEO of B2BINPAY, an all-in-one crypto ecosystem for businesses. A thought leader and visionary with a global view, he launched his first business, a payment terminal company, in 2007, boasting over 15 years of practical entrepreneurial experience since then. Before B2BINPAY, he founded and scaled an international broker company, B2Broker Group, with over 450 employees and a $70M valuation.

Source link

Data

Web3’s responsibility is to advance data privacy

Published

1 month agoon

November 16, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In the United States, 92 per cent of individuals reported concern over their privacy while using the internet, highlighting how recent massive data breaches and narratives around Big Tech data monetization have eroded internet users’ trust. This has been especially heightened by the rise of opaque artificial intelligence systems and evolving sociopolitical landscapes.

Gaps in regulation

While the European Union’s General Data Protection Regulation in 2018 set a benchmark as the first comprehensive legal act aimed at enhancing internet users’ privacy rights, it is not without its shortcomings.

GDPR and subsequent regulatory frameworks have largely been ineffective at enforcing and holding Big Tech companies, particularly Google and Meta, accountable for collecting and selling user data. Claims surrounding potential GDPR violations have reportedly taken years, sometimes more than four, to be handled. The delays stem from complex procedures involving multiple agencies and countries handling complaints against specific companies, creating significant backlogs and weakening the act’s ability to enforce and uphold its mandate.

In the United States, the absence of federal legislation on data protection has led numerous states to take matters into their own hands. The US’s patchwork regulatory reality may create more harm than good, as variations on specific matters create endless compliance complexities for businesses operating across numerous states.

Users then receive varying degrees of data protection based on their location at any given time. Furthermore, for small- and medium-sized businesses, developing individual compliance programs for individual state regulators heightens costs that limit their ability to compete with Big Tech and other large corporations.

Meanwhile, Big Tech has been throwing its weight around with intense lobbying efforts, claiming any sort of legislation with real teeth to it will undermine innovation. While this is a discussion worth having, companies whose business model is highly dependent on data-based ad revenue don’t want increased consumer data protections.

Despite heightened awareness surrounding the value and vulnerability of personal data privacy, centralized entities, in the form of Big Tech conglomerates and governments, hold powerful sway over our user data. Regulatory protections are usually welcomed, but the lack of transparency between the intentions of Big Tech and governments won’t repair the distrust many have toward both.

Web3’s heightened role

This is precisely where web3’s decentralized infrastructure can bypass centralized entities, whose interests may not align with most users, to provide a higher standard of data protection.

Blockchain—and web3 more broadly—have had countless iterations and use cases of its technology designed to try and build wealth through games, crypto schemes, or other avenues. However, many projects and developers are either missing or choosing to ignore the potential they have in protecting user data.

Thanks to blockchain’s inherent encryption technology and immutable ledger, some web3-based privacy projects are staking their claim as an alternative to the current web2 system that dominates online interactions to profit from ad revenue. One such example is tomi, a DAO-governed project that leverages web3’s data-preserving strengths to create a decentralized, privacy-focused “alternative internet.”

tomi’s modus operandi is to champion security, data privacy, and freedom of speech throughout its operations and product offering. This includes offering services that advance its mission in material ways—including a VPN, storage, and private messaging service for its users to safeguard their browsing and communications by leaning into web3’s capacity for data privacy. Since the project is governed by a community and works on a unified model to keep the familiarity and UX of web2, tomi’s focus lies in making decentralized technology as intuitive and accessible as possible.

The reality is that as much as regular users would like to take more steps to preserve their data privacy, they’re unlikely to take these measures if there’s any inconvenience involved. This simple fact creates an obstacle that many web3 infrastructure projects don’t feel comfortable trying to overcome.

So, what is the takeaway here? For one, web3 projects must take themselves more seriously as champions of data privacy and protection within a cratered regulatory landscape worldwide. By stepping in with alternatives for those who are concerned about both Big Tech and regulatory overreach, developers have a strong and compelling use case that won’t fizzle out during a market downturn. However, preserving privacy cannot come at the expense of UX, and this must remain at the forefront if projects ever want a significant user base to transition to web3.

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential