Helium

Helium spikes 51% in August as investors favor new proposals

Published

4 months agoon

By

admin

Helium, touted as Solana’s biggest Decentralized Public Infrastructure Network, outperformed the broader altcoin market throughout August.

Helium (HNT) jumped by over 51% in the last 30 days, outperforming the top 100 altcoins in the market. The crypto asset has reached an intraday high of $7.33, a rise of over 2.4% in the past day.

Helium has almost doubled from its lowest point of $3.65, seen on Aug. 5, when the crypto and stock markets crashed, causing over $1 billion in liquidations across the global crypto market.

The monthly hike in Helium’s price comes as its community strongly supported the HIP130 and HIP131 proposals. This decision enables all compatible Wi-Fi access points to be set up to support operators such as Helium Mobile.

MOBILE Network HIP 130 and 131 Passed 🎉🎉

HIP 130 passed with 96.62% votes, and HIP 131 passed with 99.37% votes, both of which are above the passing threshold. ✅🗳️

With the passing of HIP 130, compatible Wi-Fi access points (including ones already deployed in venues all over…

— Helium Foundation 🎈 (@HeliumFndn) August 28, 2024

On the other hand, proposal HIP131 permits service providers to start enhancing Hex areas, focusing only on the top-earning regions. These proposals will be implemented seven days following their announcement.

Furthermore, recent discussions in the crypto space have centered on Helium’s potential to reshape wireless infrastructure. Traditionally, expanding coverage requires large carriers to invest heavily in building additional cell towers. Helium provides a novel technique for increasing wireless coverage through a decentralized network of mobile nodes.

HNT also gained traction after announcing trials with two major US telecom companies to test offloading network traffic onto the Helium MOBILE network. The carrier offload test involves over 500,000 users participating in these trials.

The strategy could allow these carriers to cut costs and improve coverage by offloading some users to the Helium Network. At the same time, Helium would benefit from increased traffic, revenue directed toward its hotspot providers, and enhanced value for investors through increased HNT token burns.

According to Helium’s statistics, the MOBILE network currently operates around 20,680 active hotspots, and its IoT solution is deployed across 357,359 locations, with both figures steadily increasing.

Meanwhile, the ongoing price rally for HNT is supported by a 65% surge in total open interest, indicating a rise in trader interest. According to Coinglass data, open interest in the futures market has climbed to $7.43 million, the highest since April and significantly above the low of $2.35 million earlier this month.

The community sentiment on the HNT token was also bullish on CoinGecko and CoinMarketCap.

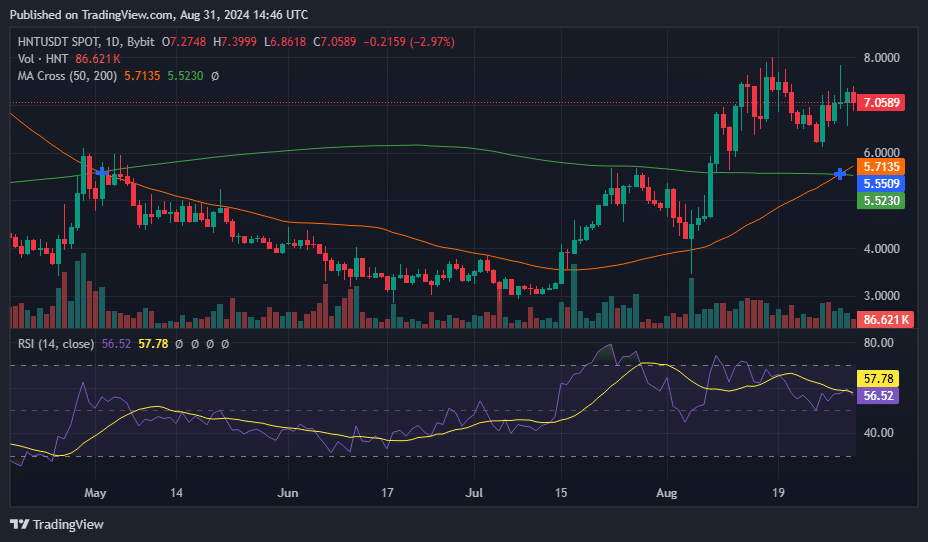

HNT’s technical analysis reveals strong bullish momentum, highlighted by the golden cross pattern where the 50-day and 200-day Moving Averages intersect. This key bullish signal, coupled with a mid-range Relative Strength Index around the mid-50s, indicates balanced market conditions with potential for further gains.

Helium has also developed a cup and handle pattern, where the latest consolidation phase corresponds to the handle part of the pattern.

Combined with high trading volumes and a spike in open interest in the futures market, these indicators reveal robust market participation and optimism about Helium’s strategic initiatives to expand its decentralized network, potentially driving further price hikes in HNT’s value.

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Altcoins

Helium: Development Proposals Ignite 15% HNT Price Rally

Published

4 months agoon

August 27, 2024By

adminHelium (HNT) is continuing its upward trajectory despite the market dip. According to CoinGecko, the token is up nearly 15% since yesterday, sparked by the recent on-chain developments that will expand on Helium’s decentralized physical infrastructure (DePIN).

Related Reading

Recently, Helium’s official X account announced the voting period for two crucial proposals for Helium Mobile. Aptly named HIP 130 and 131, these two proposals have sparked speculation for HNT’s near-future performance.

Helium Proposes New Security Measure Against Malicious Activity

HIP 130, titled ‘Data-Only Hotspots’, proposes that the network should expand its reach by using any hotspot that uses passpoint authentication. These devices may come from non-certified Helium Hotspot vendors.

These new hotspots will act almost exactly as their Helium-made counterparts, except that they will be used to pass already paid-for data. Users of this new type of hotspot will be rewarded with MOBILE, one of the tokens inside the Helium ecosystem.

In addition to this, HIP 131, named ‘Bridging the Gap Between Verification Mappers and Anti-Gaming Measures’, will implement a new system to protect the reward system of the network. The proposal is an “extension” of HIP 125 (Temporary Anti-Gaming Measures for Boosted Hexes) and amends the latter to better protect the network.

The new system works by limiting the Oracle Hex boosts in points of interests (PoIs), reducing the rewards multiplier if a hotspot engages in malicious activity. To regain the boost, that hotspot only needs to submit 1 accurate Call Detail Records (CDR).

As of writing, both proposals are still under voting with only 11 hours left for the community to engage on.

Related Reading

HNT To Stabilize Between $6.8 And $7.5

As of writing, the token is trading well between $6.8 and $7.5 with the momentum on the side of the bulls. The current trajectory is eyeing gains well above $8 in the long run. This significant increase in price is accompanied by a proportional increase in HNT’s momentum. However, there might be barriers for the budding rally.

HNT’s position, although great in itself, is barred by the dip in the market that further hinders any increase in momentum. Helium can move by itself– only by a short while. How short this timeframe may be is up to speculation as it can dip next week or next month.

For now, investors and traders could buy in a small position in HNT while monitoring the broader market sentiment which today, unfortunately, is bearish. Once the situation improves, we will see a rally, breaking through $8 or potentially $10 in the long-term. Until then, caution is the name of the game to protect long-term gains.

Featured image from Fortune, chart from TradingView

Source link

Altcoins

Helium Rockets Up 18% As Investors Weigh In New Developments

Published

4 months agoon

August 19, 2024By

admin

Investors flock to Helium (HNT) after it showed strength despite the stagnating momentum of the market. According to CoinGecko, the token is up more than 21%, going against the market’s flat trajectory. This came after a cryptic post about Helium’s plans that might indicate a better future for the platform and its users.

Related Reading

With this in mind, HNT continues to be an attractive investment for both users of the platform and those who are chasing gains in the long term. But with the market’s stagnating momentum, investors and traders should exercise caution as any swing by the broader market might lead to a downturn.

Cryptic Message Boosts Investor Interest On HNT

Abhay recently posted a mysterious message that’s hinting at a possible network upgrade soon. This sent the community spiraling into speculation, with Abhay stating that it would be a busy month for the network.

The hype this post generated is substantial as community members await an official announcement for the speculated upgrade that might happen soon.

1.0 – launch a wireless network

2.0 – scale two networks

3.0 – scale all networksstay tuned, @helium pic.twitter.com/2aNUG8IyDe

— abhay 🎈 (@abhay) August 16, 2024

Mobile Carrier Beta Passed, Expands Network Reach

HIP 129 was passed three days back, allowing all Mobile hotspots to participate in the Carrier Beta. This expands the reach of the Carrier Beta which will affect the performance of the network in the long term.

With almost the entire mainland United States having Helium network coverage, the community will observe a jump in the number of users trying to offload Carrier beta. As of press time, over 58,000 users have joined since last week, a net gain of 5,122.

Data usage has also experienced an uptick with an additional 1.5 terabytes of data flowing through the platform.

Investors Win With New Opportunities For Helium

The token is currently resting above the $7.2 support with the bulls approaching the $8 ceiling confidently. With a strong bullish sentiment backing its trajectory, HNT is set to break through this ceiling in the coming hours or days. Thanks to Helium’s on-chain developments, investors’ confidence is at its highest as they continue to accumulate the token.

Related Reading

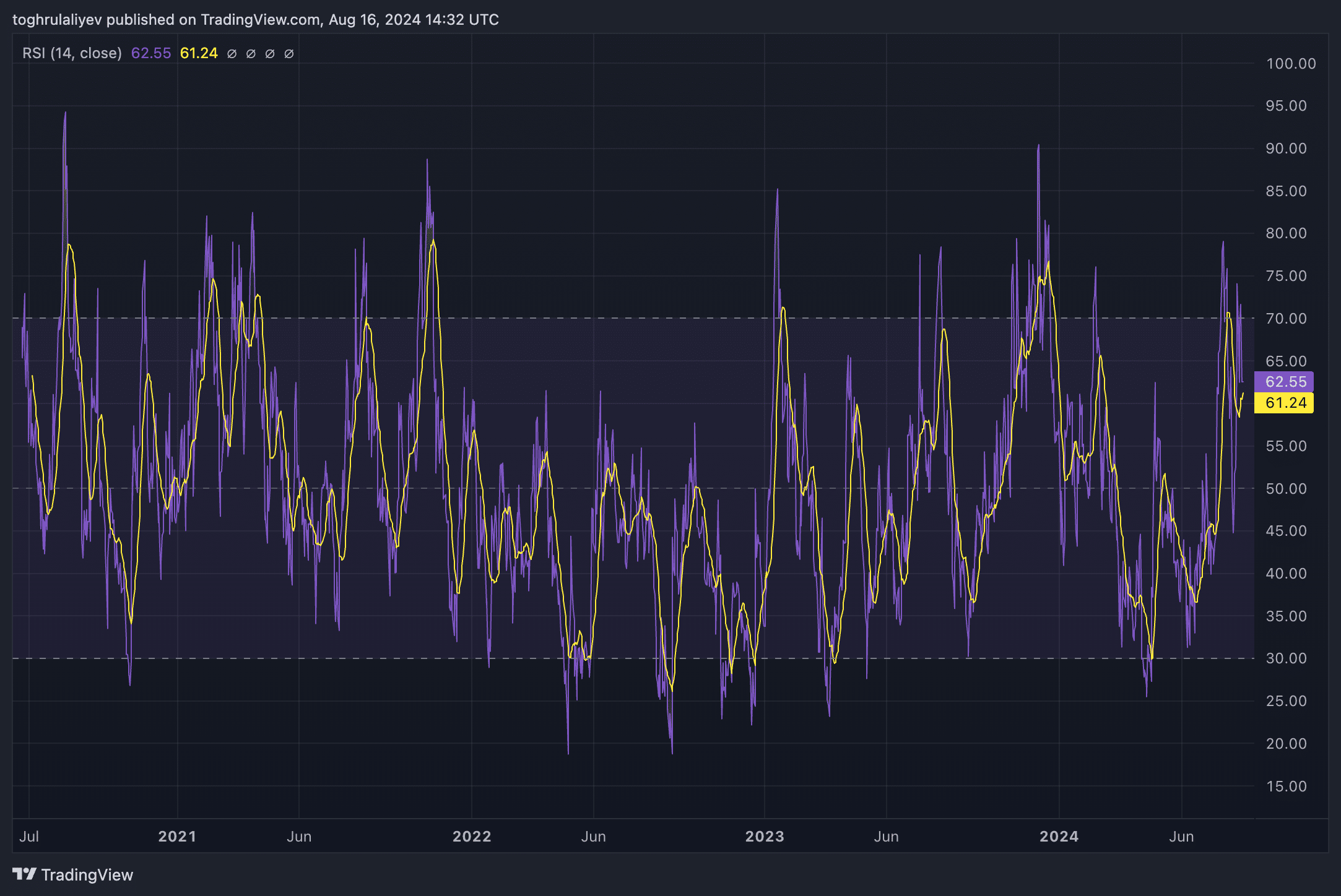

However, the relative strength index (RSI) suggests that the momentum will slow down. But this may occur well after a breakthrough on the $8 ceiling. If this occurs, investors and traders have a shot at $9 in the long term.

Putting the market’s general sentiment into consideration, HNT might experience a slight pullback, possibly returning to the $7-$8 price range before a strong upward push towards $9. This represents a nearly 22% increase in price.

Investors and traders, however, should be mindful of the market as any swing of the broader market might influence the token’s trajectory in more ways than one.

Featured image from Live Science, chart from TradingView

Source link

crypto traders

Helium’s 158% rally may be nearing a turning point

Published

4 months agoon

August 17, 2024By

admin

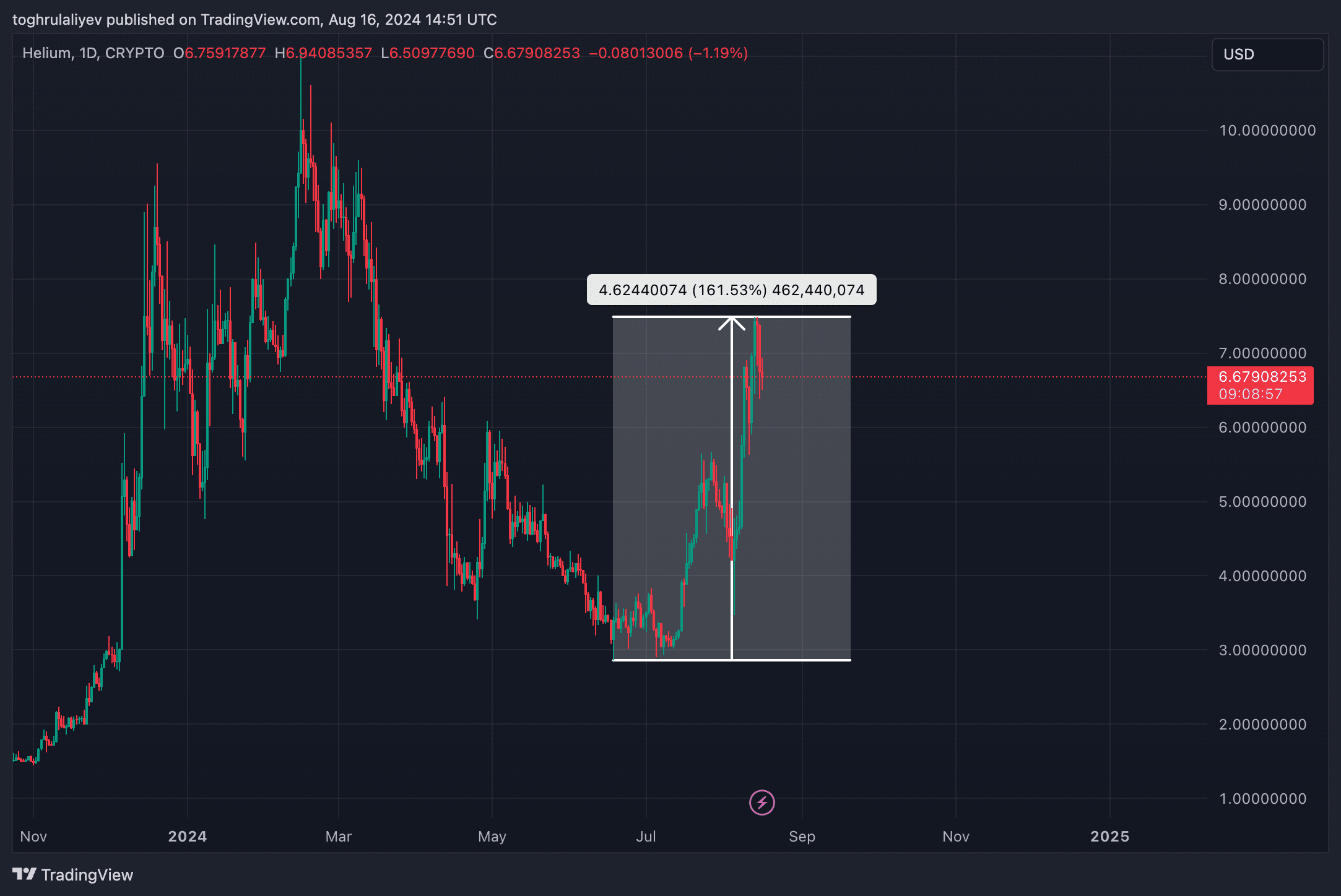

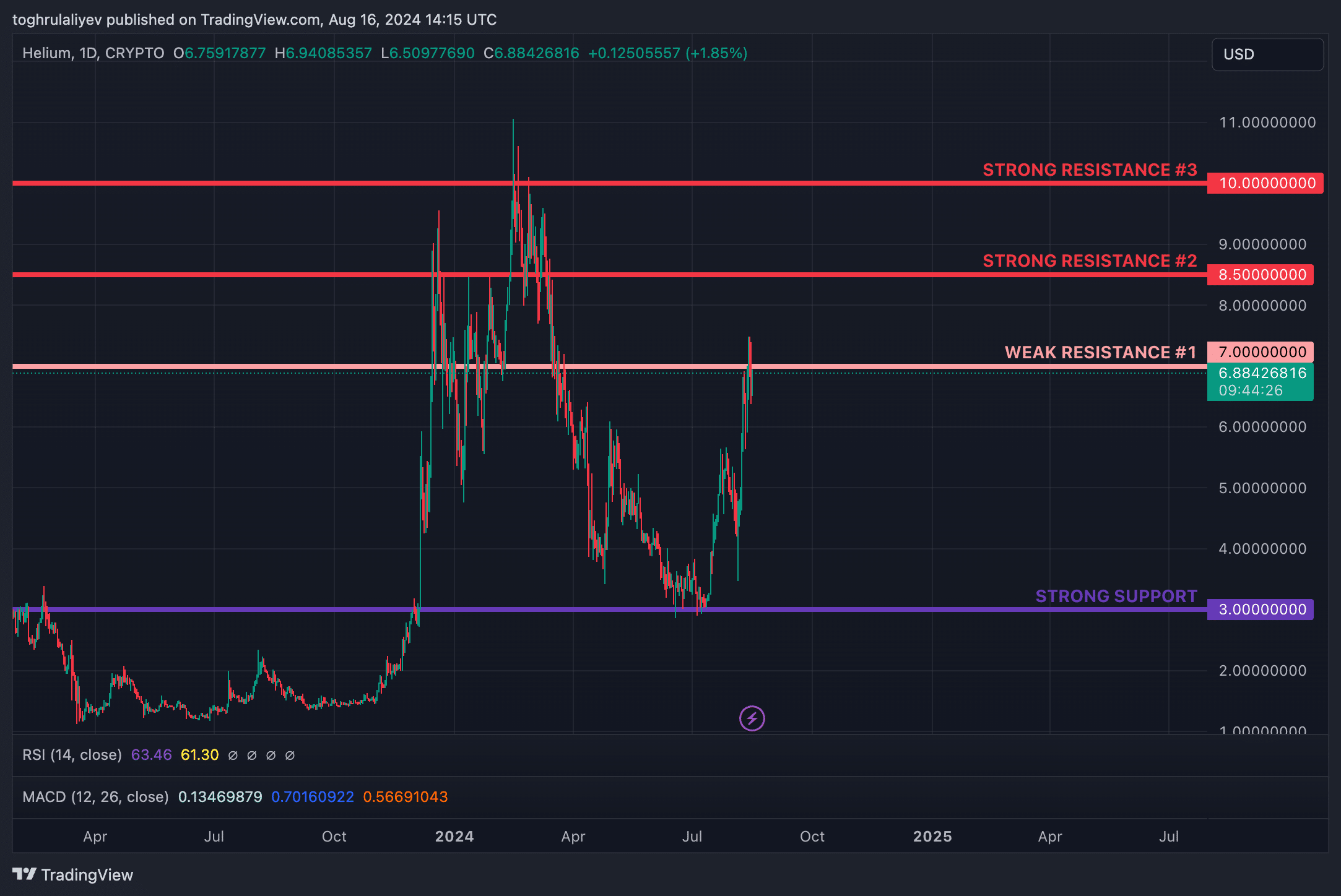

Helium (HNT) has gained 158.15% since the beginning of July, showing a strong upward trend. The key question now is whether HNT will continue its climb or if there will be a pullback on the horizon.

While Helium’s (HNT) bullish run has been exciting, it may soon turn into a disappointment for investors. The lack of consolidation or pullback during this rally raises concerns that one might be on the horizon. Here’s why a pullback could be imminent.

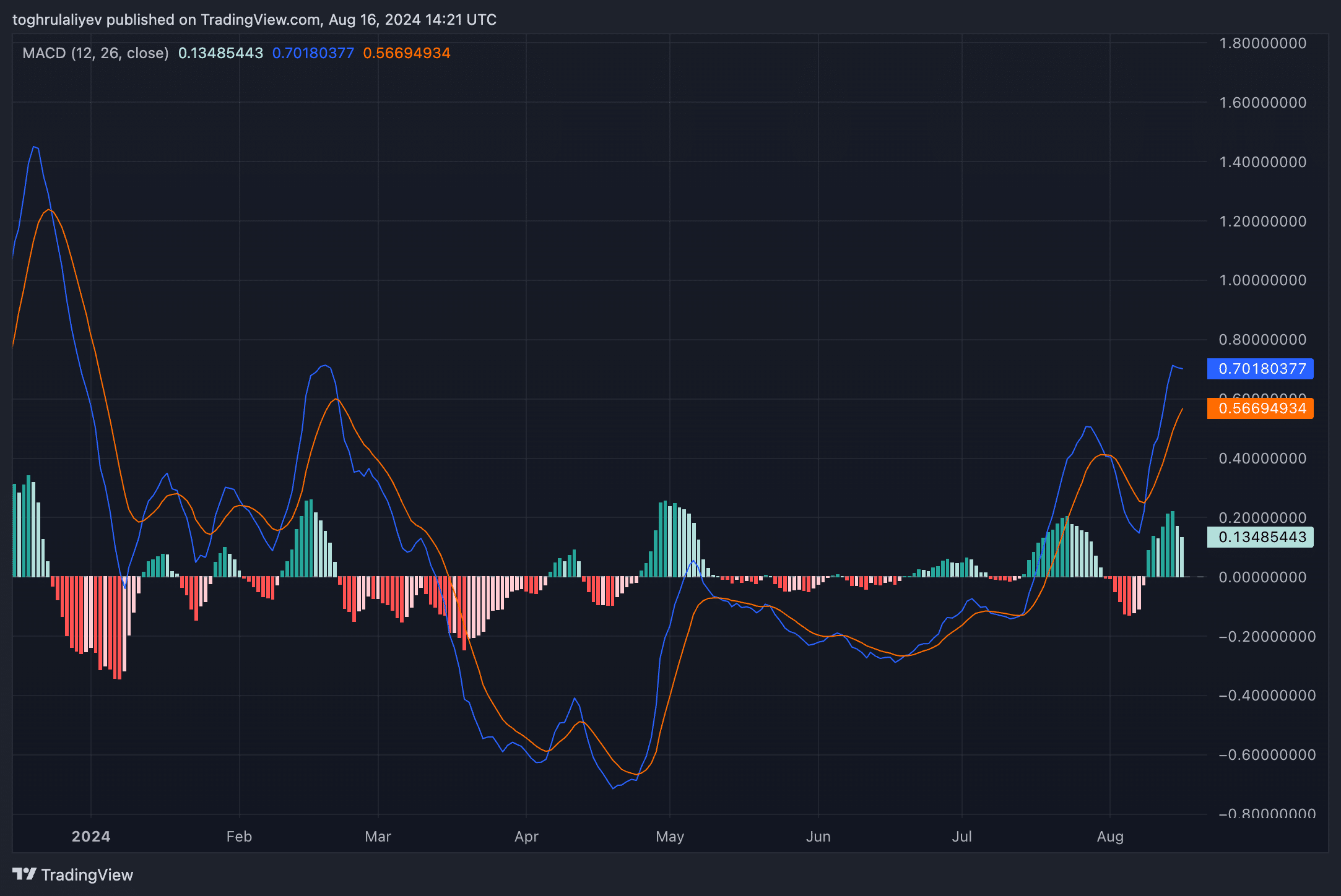

Moving Average Convergence Divergence

Examining the daily Moving Average Convergence Divergence (MACD), we notice the histogram shifting from dark green to light green, indicating a weakening bullish momentum. The MACD lines are also beginning to converge, suggesting that the current uptrend may be losing steam. A potential bearish crossover could signal a reversal in trend.

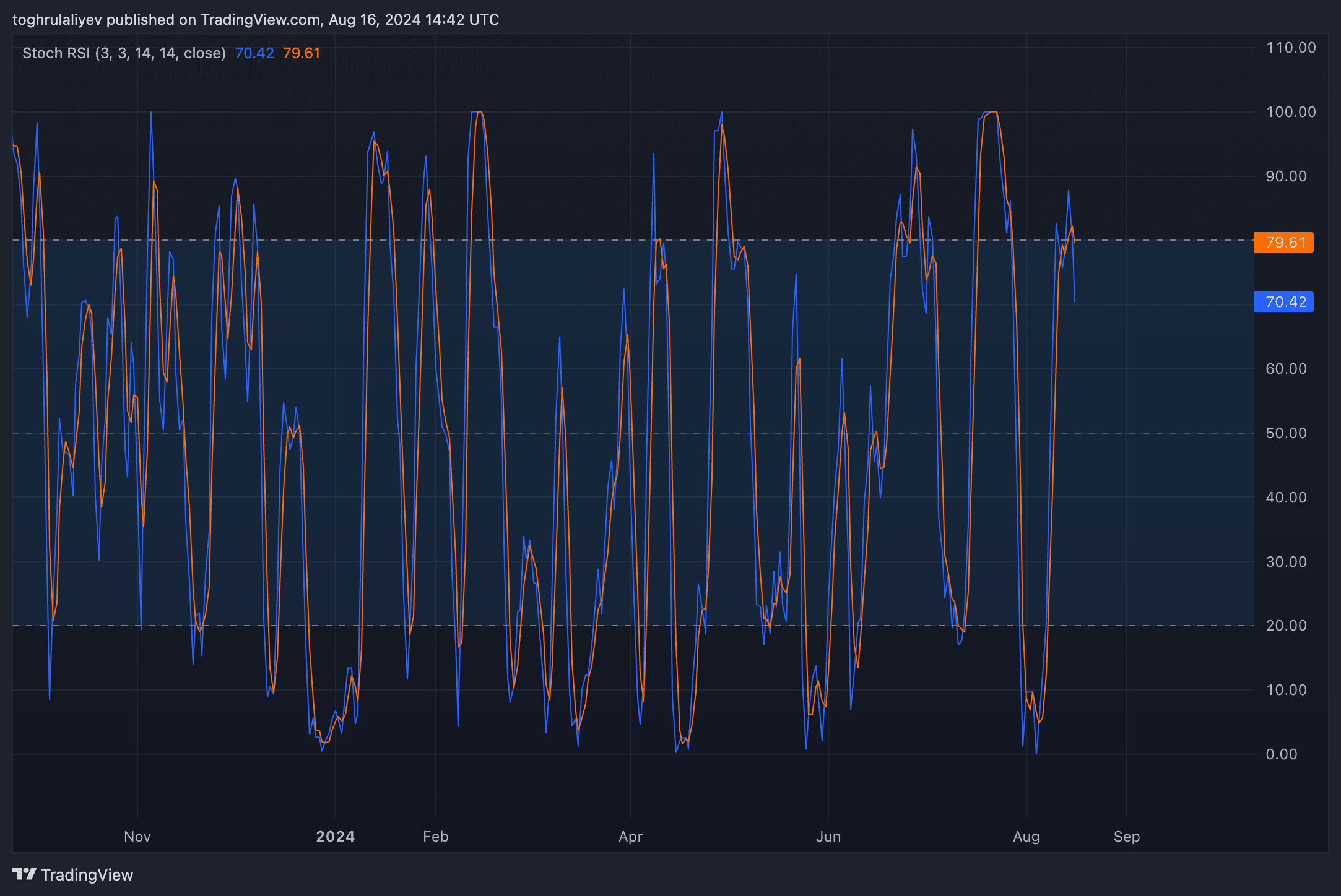

RSI and Stochastic RSI

Both the Relative Strength Index (RSI) and Stochastic RSI are in overvalued territory, with readings above 60. Historically, when RSI and Stochastic RSI have reached 60+ levels, they tend to retreat significantly, often accompanied by a sharp price decline.

Support and resistance levels

The current price action shows strong resistance levels at $8.5 and $10. These levels have proven difficult to surpass or acted as strong support levels in the past. Meanwhile, the $7 level serves as a weak area. Currently, it has acted as resistance, but its role could change if HNT breaks above it. If the price fails to break through $7, a more pronounced downtrend is likely to begin.

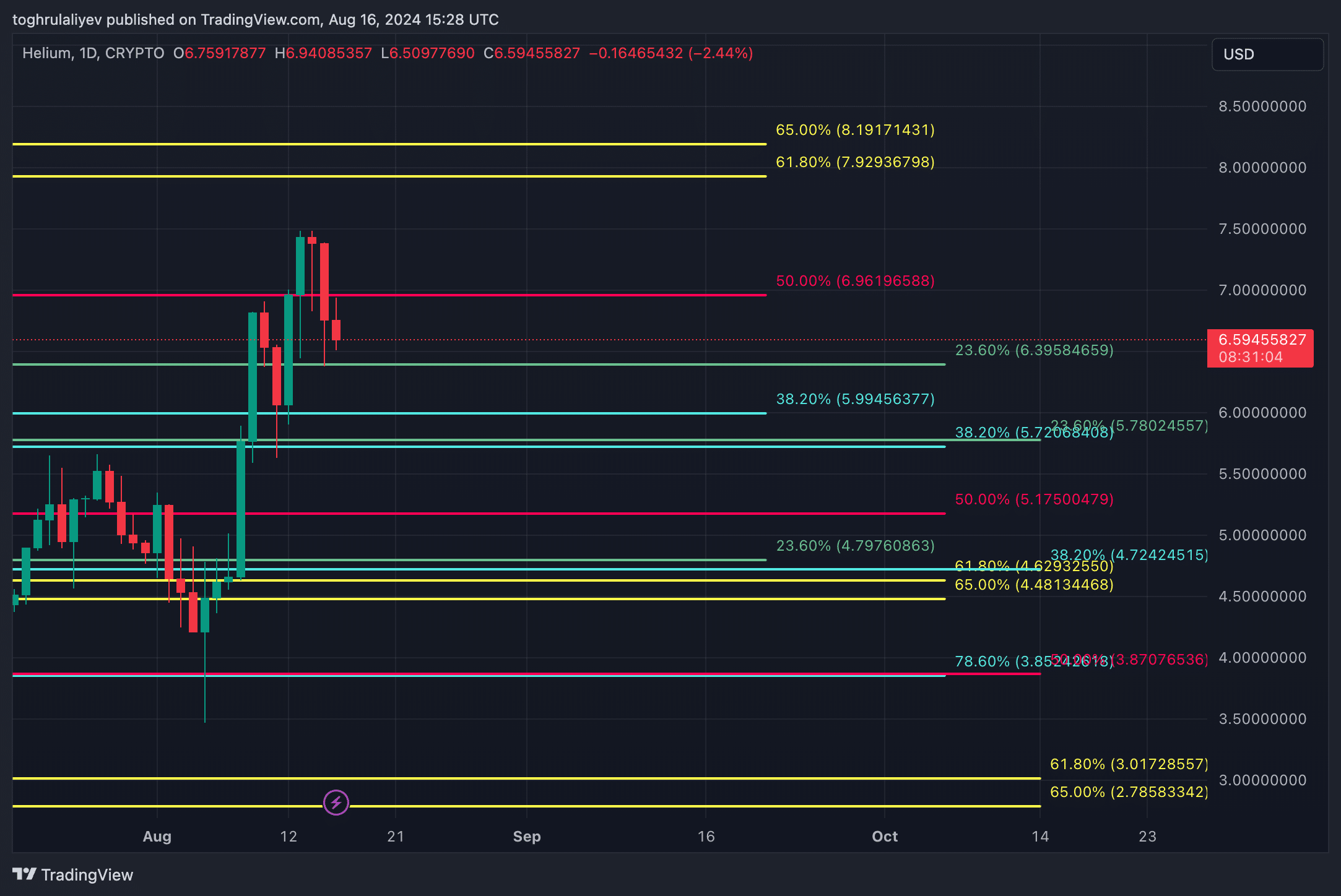

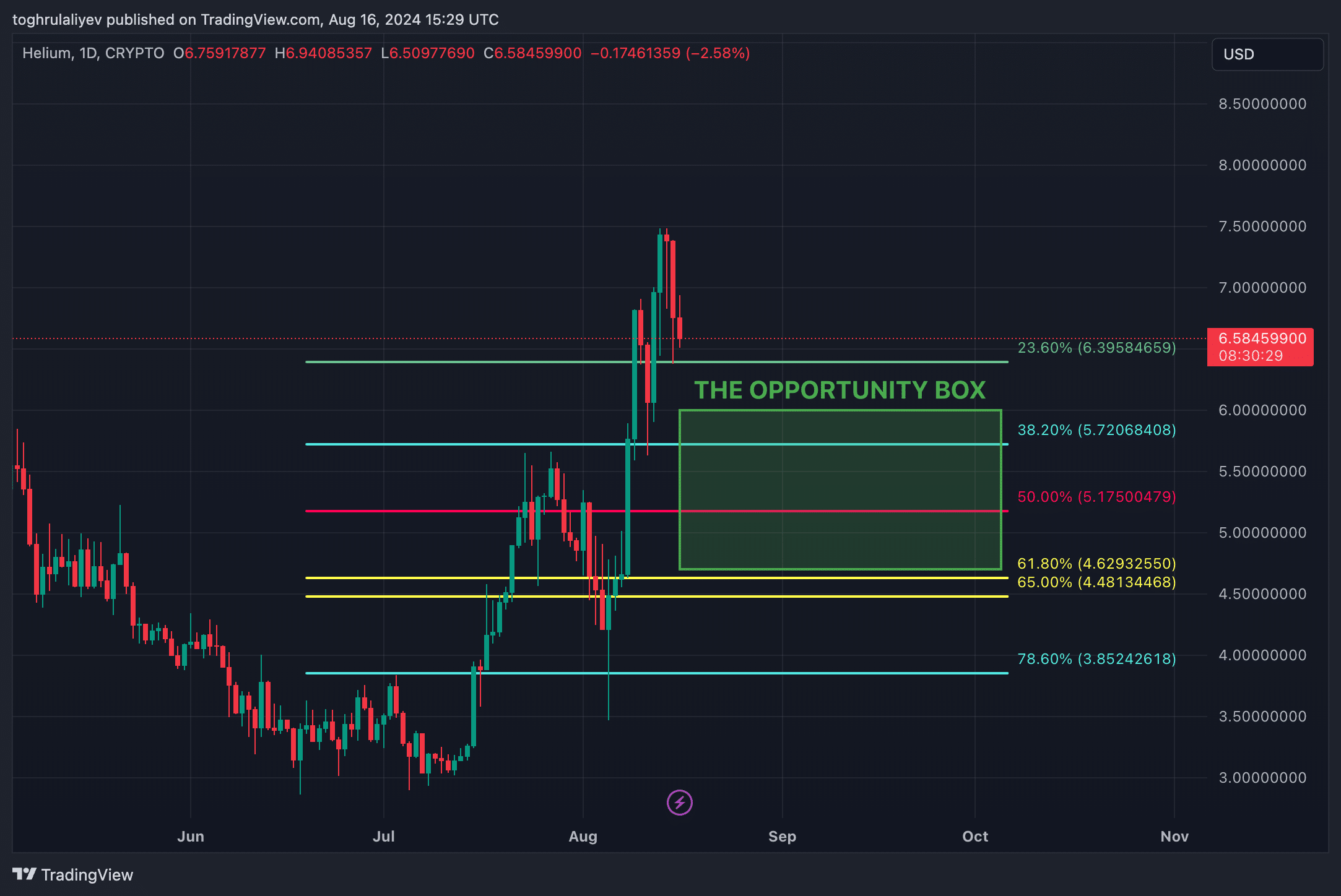

Fibonacci confluence levels

By applying Fibonacci retracement levels from three different time frames—the initial day of trading to the recent high, the low of June to the recent high, and the high of March to the low of June—we identify multiple confluence levels. These confluence levels are clustered around $6 and $4.7.

The area between $4.7 and $6 forms what we refer to as a “box of opportunity.” This range presents a potential target zone for a short position, with the expectation that HNT could retrace this area if the downtrend continues.

Historical support lies at $3, but a drop to this level seems unlikely unless significant negative events occur in the broader market, similar to what happened with Japan’s surprise rate hike and Jump Trading’s selling spree in late July and early August.

Strategic Considerations

Before initiating a short position, it’s important to confirm the downtrend. Although the trend has recently shifted, there’s always the possibility of a bear trap. To minimize risk, we recommend waiting for HNT to fall below $6.3958, which is the 23.6% Fibonacci retracement from the June low to the August high. Once HNT breaks below this level, and it acts as resistance, the shorting opportunity becomes much safer.

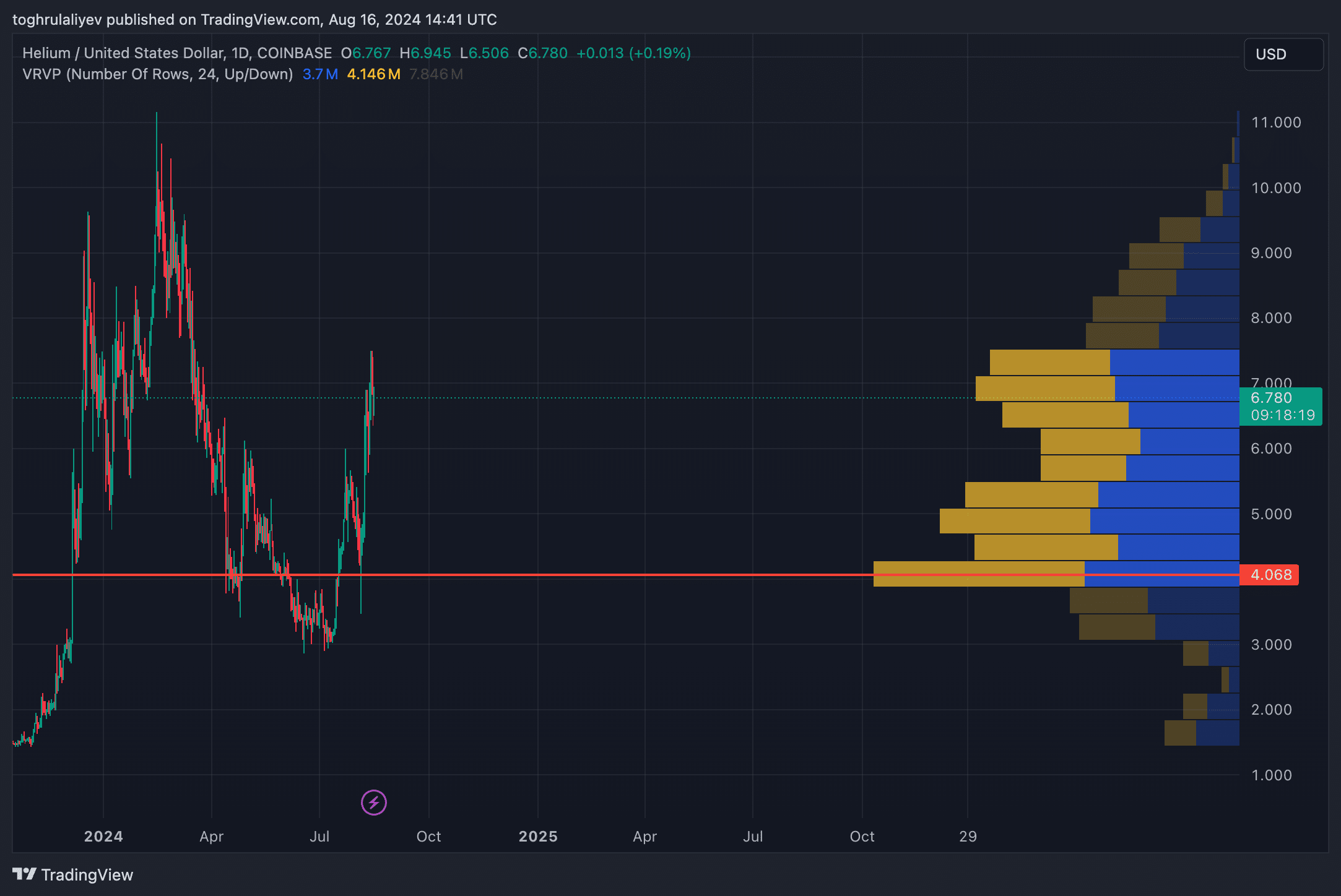

Another factor to consider is the Visible Range Volume Profile, which shows a weak volume area between $5.5 and $6.5. Prices tend to move quickly through such low-volume zones, further supporting the likelihood of a downward move. However, currently, HNT is within a high-volume zone, which could potentially serve as a consolidation area.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential