Altcoin

Here’s why Bitcoin, altcoins, and the stock market continued falling on Friday

Published

6 days agoon

By

admin

Bitcoin, altcoins, and the stock market continued their downward trend on Friday as the trade war between the U.S. and China escalated.

Bitcoin (BTC) price dropped to $82,000, erasing some of the gains made during the Asian and European markets. Ethereum (ETH) dropped below $1,800, while the market cap of all coins fell to $2.64 trillion.

The stock market’s performance was even worse as futures tied to the Dow Jones, S&P 500, and Nasdaq 100 indices plunged by over 3%. This means that these blue-chip indices have all moved into a correction.

Trade war escalates

Bitcoin, altcoins, and equities declined after China announced its retaliatory measures against the U.S. In a statement, Beijing said it would impose a 34% tariff on all goods imported from the U.S.

In addition, China will restrict exports of certain rare earth minerals, halt sorghum imports from U.S. companies, and add 11 American firms to its unreliable entity list.

These measures mark the most significant response to Donald Trump’s Liberation Day tariffs. Other countries, especially those in Europe, have called for negotiations to prevent the trade war from expanding.

Trump and senior officials have warned that the U.S. will deliver reciprocal tariffs on any country that retaliates. They’ve urged trading partners to lower their tariffs and non-tariff barriers instead.

Therefore, Bitcoin, altcoins, and the stock market are falling as these actions lead to higher odds of a recession. Polymarket data shows that traders have boosted their recession odds to 56%. Companies like Goldman Sachs and PIMCO have also boosted their recession odds.

These fears have pushed market sentiment into extreme territory. The CNN Money Fear and Greed Index dropped to 6, the lowest reading since the onset of the COVID-19 pandemic.

Investor pessimism intensified after billionaire and former Bond King Bill Gross warned against buying the dip. He said:

“Investors should not try to ‘catch a falling knife. This is an epic economic and market event similar to 1971 and the end of the gold standard except with immediate negative consequences.”

Bitcoin, altcoins, and the stock market fall after NFP data

Markets also weakened after the U.S. released the latest nonfarm payrolls (NFP) report. The data showed that unemployment rose to 4.2% in March, up from 4.1% in February.

The economy added 228,000 jobs, beating analysts’ median forecast of 137,000. However, the manufacturing sector, which Trump aims to protect with his tariff policy, created just 1,000 jobs.

These figures will likely have minimal impact on the Federal Reserve, which remains focused on inflation and GDP growth.

Meanwhile, the bond market is signaling expectations of lower interest rates. The 10-year Treasury yield fell to 3.89%, while the 30-year and 2-year yields declined to 4.38% and 3.5%, respectively. If the Fed cuts rates, it would likely be bullish for Bitcoin, altcoins, and the broader stock market.

Source link

You may like

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Altcoin

Why Isn’t XRP Skyrocketing? Expert Explains The Hidden Forces

Published

1 day agoon

April 9, 2025By

adminXRP prices dipped below $2 for the first time since December 2024 on Monday, even after a number of positive developments for the cryptocurrency.

The decline is surprising to many investors who had hoped recent good news would send its value higher. Market analyst Vincent Van Code attributes this underperformance to underlying economic issues and not with XRP itself.

Trump Tariffs Are Blamed For Crypto Market Decline

Van Code attributes the recent decline in cryptocurrencies to the tariffs imposed by US President Donald Trump on other nations.

The tariff situation is just a power play to utilize economic pressure to get better negotiating terms, said Van Code. He expects these trade tensions to be short-term and perhaps pave the way for the market to rebound in the near future.

Current #XRP prices are not aligned with recent @Ripple market announcenets, SEC case conclusion news, XRP US stockpile.

Do you think this is becuase XRP is not performing well?

I DONT! This is a global market downturn. Impacts across multiple markets, multiple countries, and…

— Vincent Van Code (@vincent_vancode) April 9, 2025

XRP Fundamentals Strong

Even after falling to $1.64 on April 7, XRP has shown a rebound by increasing to $1.82—a 10% increase. Van Code pointed out that Ripple and XRP’s fundamental strengths have not changed. They’re a hundred times better than a year ago when the SEC lawsuit was at its peak, he said.

The SEC-Ripple case resolution, potential inclusion in US digital asset reserves, and Ripple’s Hidden Road acquisition were all considered positive developments for the cryptocurrency.

Investment Strategy During Market Uncertainty

Van Code described his approach to today’s market condition, showing he buys such assets like XRP when sentiment is low but fundamentals remain in place.

He looks at weekly charts for larger decisions and uses hourly charts for intraday action. The market commentator termed XRP the “Fight Club” of cryptos because of its ability to withstand market action and stress.

Future Growth Drivers For XRP

Going forward, Van Code identified three key drivers to XRP adoption: regulation, corporate usage, and solid partnerships. He warned investors to avoid being influenced by short-term price fluctuations due to outside influences such as the tariff scenario.

The analyst said that he would only be jittery if XRP was the sole cryptocurrency that is dropping in value. He also stated that the current decline is part of a larger market trend and not particular to XRP.

The cryptocurrency market still responds to economic policy as investors look for indications that the tariff issue is resolved. Most XRP supporters are optimistic that as soon as these external pressures are gone, the price will more accurately reflect the good news surrounding Ripple and its currency.

Featured image from Unsplash, chart from TradingView

Source link

Altcoin

Ethereum, Solana And Cardano Trend After Crypto Crash

Published

5 days agoon

April 6, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

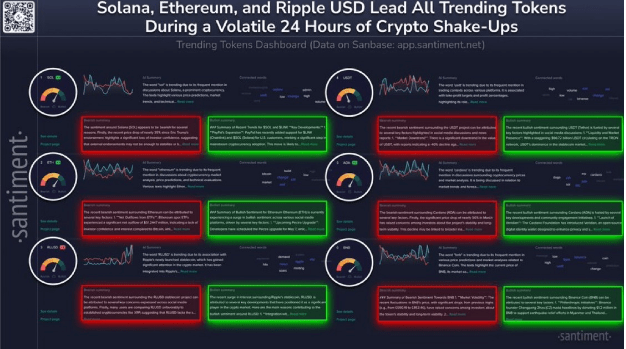

Despite the recent crypto crash that sent most digital assets tumbling, Ethereum (ETH), Solana (SOL) and Cardano (ADA) have managed to hold their ground. According to latest reports, these three cryptocurrencies are now leading the charts as the most trending coins in the market after the crash.

Related Reading

Santiment Unveils Top Trending Cryptos

The crypto market took a significant hit after fears of new tariffs implemented by United States President Donald Trump rattled investors and sent digital assets plunging across the board. However, while US stock markets closed, signs of recovery began to emerge across specific cryptocurrencies, with Ethereum, Solana, and Cardano leading the post-crash chatter.

According to an X (formerly Twitter) post by Santiment, a market intelligence platform, Solana is now back in the headlines as market analysts closely watch its price action following its crash.

The popular meme coin is seeing an increased level of speculative predictions, market trends, and technical chart breakdowns. As a result, SOL is recapturing the attention of retail and institutional investors. There’s also been notable activity within the Solana network as anticipation for a price rebound or breakout keeps spreading.

Ethereum is also trending in the crypto market, not just for its prolonged price slump and reaction to the crypto crash, but its ongoing transition to Ethereum 2.0 — a key upgrade focused on scalability and energy efficiency.

Santiment notes that analysts are highlighting Ethereum’s network performance during the market stress, showcasing an increase in discussions about the cryptocurrency’s market analysis. There have also been increased price predictions, technical evaluations, and talks about the cryptocurrency’s scalability and adoption.

Just like Solana and Ethereum, Cardano is seeing renewed attention as traders assess the cryptocurrency’s position in the broader market. There has been an influx of mentions surrounding Cardano’s market trends, with users speculating on its future price action and potential investments. Forecasts for the ADA price also range widely, with social media buzz and speculative posts fueling the cryptocurrency’s presence on trending charts.

While not as widely discussed as ETH, SOL, and ADA, Binance Coin (BNB) has also been showing up in technical forecasts. Santiment reveals that analysts are tracking BNB’s trading ranges and potential price movements, making it a focal point for investors and traders.

Related Reading

Stablecoins Join List Of Trending Assets

In addition to the altcoins above, Santiment has disclosed that stablecoins have also joined the list of top trending assets. While Ethereum, Solana, and Cardano experienced major declines after the crypto crash, stablecoins, as their names imply, remained stable against the dollar.

Ripple’s newly launched stablecoin RLUSD is trending due to its association with the crypto payments company, which gained significant attention following the completion of its legal battle with the US Securities and Exchange Commission. The stablecoin has been integrated into Ripple’s payment system, improving cross-border transactions and attracting institutional interest.

There has also been a significant increase in adoption and trading volume, with crypto exchange Kraken reporting an 87% surge in the latter and a $10 billion growth in the former.

Featured image from Gemini Imagen, chart from TradingView

Source link

Altcoin

Is Korea Propping Up The XRP Price? Pundit Explains What’s Happening

Published

6 days agoon

April 5, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A crypto analyst has shared insights into the recent strength in the XRP price, suggesting that South Korea may be the reason behind it. The analyst noted that the altcoin has been seeing high trading volume on South Korean exchanges, and this localized demand may be holding up its price while other altcoins struggle to gain traction.

How South Korea Is Bolstering The Price

According to XForceGlobal South Korea is currently one of the major drivers of the XRP price action. In a recent post on X (formerly Twitter), the analyst disclosed that the engagement and adoption from the crypto users in South Korea was a major contributor to XRP’s bullish performance.

Related Reading

Currently, South Korea is one of the most active crypto markets in the world, leading in global trading volume across multiple assets. However, among the numerous cryptocurrencies in the market, XRP stands out the most within the country. The analyst has revealed that even during low trading days, XRP frequently outpaces Bitcoin, underscoring its high demand and adoption in South Korea.

XForceGlobal has suggested that South Korea’s notable interest in XRP likely stems from its status as one of the most isolated countries in terms of crypto regulations. The analyst revealed that millions of citizens currently own the altcoin, making up about 20% of the cryptocurrency’s market cap valuation.

Moreover, due to a lack of large-scale cross-border payment solutions, most South Koreans opt to use cryptocurrencies like XRP to facilitate transactions. This, in turn, fuels adoption and strengthens the cryptocurrency’s utility, which positively influences its price action.

Compared to South Korea, the regulatory uncertainties and legal challenges in the United States (US) have slowed down XRP’s growth. XForceGlobal has stated that the active participation of retail institutions, strong community support, and early adoption in South Korea have helped prop up prices despite the difficulties it faced over the past years.

What The Future Holds For XRP In South Korea

While discussing the impact of South Korea’s support for XRP on its price action, XForceGlobal offered insights into the cryptocurrency’s future in the country. The analyst revealed that the market is at a pivotal moment where XRP has evolved from a speculative asset to a symbol of Korea’s dominance in the crypto market.

Related Reading

Currently, Upbit, the largest crypto exchange in South Korea, holds the most significant market share of XRP in terms of total supply. The exchange reportedly has about 6 billion XRP, accounting for roughly 5% of the entire supply.

XForceGlobal has revealed that the continued demand from retail investors combined with Upbit’s massive XRP reserve will make South Korea a key driver to the cryptocurrency’s global future price action.

Moving forward, the analyst has discussed XRP’s price movements on the Korean won chart, suggesting that its current action may be foreshadowing upcoming events. He pointed out that the altcoin has already formed a lower low on the chart, possibly hinting at a more controlled pullback rather than an impulsive decline — an outlook he described as “arguably bearish”.

The crypto analyst also noted that XRP may be forming a potential bottom on the Korean won chart, indicating a possible impulse to the upside and a bullish continuation.

Featured image from Adobe Stock, chart from Tradingview.com

Source link

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Tariffs, Trade Tensions May Be Positive for Bitcoin (BTC) Adoption in Medium Term: Grayscale

The U.S. Tariff War With China Is Good For Bitcoin Mining

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Web3 search engine can reshape the internet’s future

Billionaire Ray Dalio Says He’s ‘Very Concerned’ About Trump Tariffs, Predicts Worldwide Economic Slowdown

Top 4 Altcoins to Sell Before US-China Trade War Extends Beyond 125% Tariffs

OpenAI Countersues Elon Musk, Accuses Billionaire of ‘Bad-Faith Tactics’

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x