Culture

How Bitcoin Empowers Women

Published

2 months agoon

By

admin

I was recently having a conversation with a friend in Kenya who described how difficult it was for women in that country to stand in local elections due to the complexity of setting up a bank account. The first challenge is to obtain identification documents, which is a process that is complicated by cultural attitudes in certain communities in which the men may object to women seeking independent documents. Many women also live far from registration centres, have limited literacy to complete the forms and may not be able to afford the journey and the documentation fees. Furthermore, many women lack birth certificates, do not have proof of residence if they live with a male relative and processing delays are common which means multiple visits to a faraway registration centre are often required.

Without a bank account, or the ability to independently store, build and access money, one is not truly free. In many countries around the world, it is a prerequisite to accessing government services, formal employment, registering to vote and setting up a business. Crucially, it is also required for standing in local elections and, thus, being involved in local governance. This means many women, especially in developing nations, are having their basic human rights restricted by a failing legacy financial system that is not fit for purpose in the 21st century.

In Pakistan only 13% of women have a formal bank account compared to 34% of men. Furthermore, the process of opening a bank account for a woman is more complex, in many cases it requires more ID and evidence of permission from a male relative. The picture is not much better across South Asia more broadly, with only 37% of women having bank accounts compared to 55% of men. Things are slightly better in the Middle East, where only 45.5% of women have bank accounts compared to 59.6% of men. Whilst in sub-Saharan Africa, 37% of women have a bank account compared to 48% of men.

Even when women do have bank accounts in many developing nations they are less likely to be regarded as credit worthy compared to men. For example, in India women receive credit equivalent to only 27% of the deposits they contribute, whereas men receive credit equal to 52% of their deposits. Additionally, female entrepreneurs in India receive only 5.2% of the outstanding credit granted to enterprises by Indian public sector banks, even though they have higher repayment rates than men. This perceived lack of credit-worthiness is linked to the fact that women own less property, and other hard assets, that can be used as collateral for loans. This, again, is linked to lower rates of banking.

Given the above, it is fair to conclude that the world is desperate for an alternative to the legacy financial system. This system, it seems, merely reflects the biases and prejudices of the people who run it and so women cannot achieve financial equality without a global social revolution that reconfigures views of women. Whilst such a revolution is desirable, it is highly unlikely to happen in a short space of time and in some places, such as Afghanistan and Iran, the direction of travel seems to be in the wrong direction.

However, the mass adoption of Bitcoin in the developing world could completely transform the economic landscape. A gender blind digital currency that does not require users to ask for permission from family members, and is not tainted by local prejudices and cultural practices that restrict the role of women in society and business, is a game-changer whose time has come. Bitcoin could not only empower women, but uplift society in general since it will give 50% of the population an equal ability to store, build and transact money without any cultural or geographic limitations.

Female entrepreneurs who live in rural areas are often required to visit bank branches in person which can be miles away and potentially unsafe and expensive to access. Bitcoin eliminates this barrier entirely. With just a mobile phone and internet connection, women can receive payments, save money, and participate in global commerce – all from the safety of their homes. Bitcoin’s borderless nature benefits women in the informal economy too. Street vendors, artisans, and domestic workers can accept payments digitally without the need for a bank account or government identification. This capability is revolutionary in regions where obtaining official documentation requires male guardianship or navigating complex bureaucratic systems.

Bitcoin’s privacy features also provide crucial protection for women in vulnerable situations. In societies where financial abuse is common, the ability to maintain private control over funds can be life-changing. Women can build savings without fear of discovery or confiscation, creating essential safety nets for themselves and their children. The remittance market demonstrates another vital application. Many women in developing countries depend on money sent from family members working abroad. Traditional remittance services often charge excessive fees and require recipients to travel to specific locations during business hours. Bitcoin enables near-instant transfers at a fraction of the cost, allowing women to receive funds directly and securely.

Central to Bitcoin’s revolutionary nature is the concept of self-custody, which means individuals have direct access to their wealth, without any third party involvement. Self-custody also means privacy is maintained and the wealth is accessible from anywhere in the world at any time. When this global accessibility is combined with a form of money that is limited in supply, hence holds value and is resistant to hyperinflation, the transformational power of Bitcoin cannot be understated.

Bitcoin can do for finance what the internet did for information, creating a level playing field in which immutable characteristics play no role in access or usage. As such, when barriers to money are removed, the social conventions that were used to augment these barriers also begin to wither. Self-custody means we take power away from large and decrepit financial institutions that seek to maintain a stagnant status quo. Self-custody means power to the people and power to the women who have struggled to achieve financial autonomy and equality. Self-custody means a better world for all.

This is a guest post by Ghaffar Hussain. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

conference

The 14 Types Of People You’ll Definitely See At Bitcoin 2025

Published

2 days agoon

April 12, 2025By

admin

Loud. Friendly. Huggy. The Bitcoin Bro is your hype man for hyperbitcoinization. He doesn’t know what “joules per terahash” means, but he’s onboard for the vibes and will yell “Buy the dip!” during your panel Q&A.

They party hard, orange-pill harder, and are basically Bitcoin’s version of a frat brother with a bull market pump tattooed on his calf.

Slicker than a fresh seed phrase, this guy’s teeth are whiter than your Lightning wallet. He’s rented a Lambo for the afternoon and drops your first name way too often, like he’s trying to sell you a time-share in the metaverse.

He doesn’t care about decentralization. He cares about gains, baby. And tailoring. Always with the tailoring.

The apocalypse isn’t a threat—it’s a plan. This dude hasn’t touched fiat since 2018 and bathes in non-KYC sats. He’s already learned to make his own soap and catch fish from nearby lakes and streams.

He’s not paranoid. He’s prepared.

Lives in a van. Pays for tacos with lightning. Might be hiding from the IRS (but only spiritually). They believe Bitcoin is peace, man. And also chaos. And also freedom.

Will fix your flat tire in exchange for a hammock spot and a cold yerba mate.

The unsung hero of Bitcoin. Speaks only in thermodynamic math and SATA cable specs. Makes ASIC firmware upgrades look like wizardry, but can’t explain what he does to his mom without her crying.

Definitely knows the precise BTU-to-wattage ratio for his off-grid, solar-powered mining container. Definitely doesn’t know what “small talk” means.

Yes, plural. Yes, anonymous.

They don’t want to talk to you. They don’t want to be on your podcast. They don’t even want you to know they’re here. Ask them when something will be done and you’ll get the sacred prophecy: “Two weeks.”

They are the shadowy super coders that Elizabeth Warren warned you about—hunched over ThinkPads, pushing protocol upgrades that will quietly redefine monetary history. You won’t recognize them. That’s by design.

Armed with a gimbal and a dream. Their camera roll is 80% memes, 20% selfies with CEOs. Some are here to spread the signal. Some are here for the clout. All are uploading something right now.

Will say “Let’s run it back!” at least 17 times a day.

You’ll spot him by the gravity-defying stack of laminated badges swinging from his neck like a wearable timeline. He doesn’t say much—he lets the passes do the talking. Each one’s a badge of honor. Each one says: I was there.

He’s not here to attend panels—he’s here to assert conference dominance.

Branded polo. Branded backpack. Branded soul. You don’t even know how you ended up holding his business card. He’s not here to network—he’s here to execute. He moves in packs, wears his lanyard like a badge of honor, and will be back at the booth precisely 15 minutes after lunch.

Doesn’t talk about Bitcoin. Is Bitcoin.

Old-school finance dudes who smelled the smoke from Wall Street and headed toward the orange glow. Calm. Calculated. Dollar cost averaging into the sunset.

They don’t shill. They don’t yell. They just quietly stack and nod wisely at panels.

Sleeps 3 to a hotel room and burned half their Series A to get to Vegas. They’re pitching a new Lightning wallet-slash-social network-slash-AI market prediction engine and just need one person to believe in them.

Respect the hustle.

God bless them. They’ve been standing next to their Bitcoin-obsessed partner for three straight days, pretending to understand mining pool fee structures and nodding politely through 5-hour dinner debates.

They are the backbone of the conference. The true MVPs. Probably counting down the minutes to the spa.

Not who you think. No Gucci belts. No megaphones. Just quiet confidence, a phone permanently in hand, and a passive stake in something that’s quietly revolutionizing finance.

Some got lucky. Some built empires. All will ignore your pitch deck.

The rarest sighting of all: A woman. Yes, they exist. Yes, they know more than you. And yes, they’re already five steps ahead of your “Have you heard of Bitcoin?” icebreaker.

Bonus: They’ll probably be the ones explaining immersion cooling to you.

One Event. Endless Energy. Absolute Chaos.

Bitcoin 2025 is more than a conference. It’s a decentralized carnival of code, conviction, and characters. Whether you’re here to build, learn, chill, or meme—there’s a place for you in the movement.

This article was inspired by the video “The People of Bitcoin 2022 Miami Conference” by SPACE DESIGN WAREHOUSE. We acknowledge and appreciate the original creative concept, which served as a foundation for this updated and expanded interpretation for Bitcoin 2025. We encourage readers to view the original video and support the creator on YouTube.

At Bitcoin Magazine, we believe in the power of open-source ideas—because great content, like great code, is better when it’s built together. If you have something you’d like to see featured—whether it’s a video, meme, sketch, or spicy take—send it our way at [email protected]. If we use it, we’ll give you credit in the article and share your work with the broader Bitcoin community.

Source link

Culture

Surreal And Immersive Art On Bitcoin & The Future Of Digital Expression

Published

2 weeks agoon

April 3, 2025By

admin

As the Bitcoin Conference 2025 approaches, set for May 27-29th at the Venetian in Las Vegas, digital artist Post Wook—known for her surreal, psychedelic landscapes that merge cosmic and natural elements—is set to bring her latest series, “The Astronomer’s Daughter” to a large audience of bitcoiners. In tribute to her father, a long-time NASA employee, this ordinals series uniquely merges satellite data and bitcoin block times, alongside seasonal and astronomical patterns such as the phases of the moon. Post Wook will showcase this work as part of both B25 and the off-site ordinals event, Inscribing Vegas.

I caught up with Post Wook to discuss her latest digital art series, the future of immersive art, and the experience of seeing her work featured on the Sphere in Las Vegas.

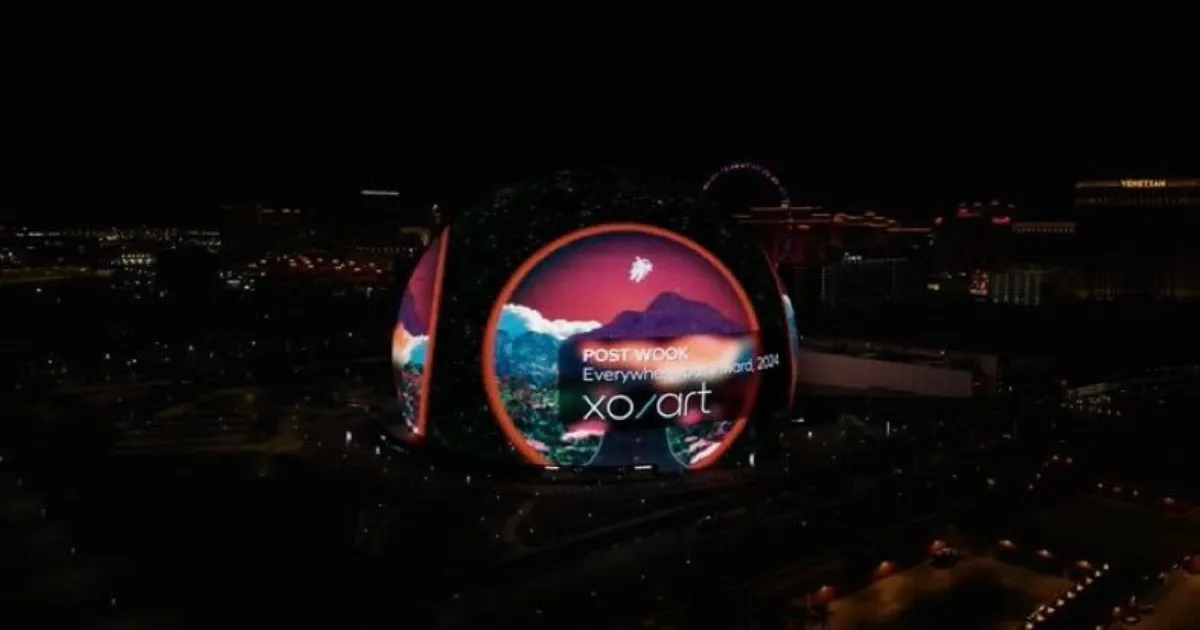

The Las Vegas Sphere has quickly become the principal attraction on the Las Vegas Strip. What was it like to see your artwork, “Everywhere but Inward,” displayed on the Sphere for the first time?

It honestly felt very surreal! Having worked on the piece for over a year, I was super familiar with the animation sequencing, but seeing it actually on the Sphere for the first time felt so cool. The Sphere is LARGE, and you think you know that when you see photos, but then when you see it in real life it blows you away. We got to our lookout spot in Vegas about 15-20 min before it popped up in the programming, and once it actually came on it felt so wild! I think I started clapping. I never do that. I was just so happy to be in the moment.

The Sphere is one of the world’s largest and most sophisticated immersive platforms, featuring a 16K resolution interior and an exterior LED display that spans over 580,000 square feet. How does the scale of the Sphere’s surface affect the viewer’s perception of your digital artwork? You’re no stranger to fantastical landscapes or extra-perceptionary vistas, so this must have been especially interesting to take in.

The actual process of animating Everywhere but Inward, 2024 for Sphere was interesting because with a screen that big the animation had to be a lot slower than I’d normally animate. So honestly, watching the animation as an equirectangular piece on my monitor felt like watching paint dry. But watching it on Sphere, it feels like a regular animation. I guess that’s just showbiz.

On the whole I’m just excited to see digital art take center stage. With Sphere in Vegas becoming literally the talk of the strip to the new Sphere they’re building in Dubai, it’s pretty obvious that digital art is on the rise and is becoming increasingly legitimate to the world around us.

The ephemeral nature of a public display on the Sphere contrasts with the permanence and immutability of on-chain art. How do you view the tension between the grandeur of public spectacle and the private, immutable ownership of digital art? Does this shift in how art is owned and experienced influence your approach to creating and presenting your work?

I sort of look at it like ‘exterior’ and ‘interior’ work with Sphere showing people that digital art is cool and on-chain art reinforces that digital art is valuable. The public spectacle brings people in and on-chain ownership provides traceable provenance. I’d like to think I balance that tension well. By having licensed work in Target and auctions in Sotheby’s, I’m able to find solace in providing art at every level because I really believe art is for everyone, and everyone deserves a little bit of POST WOOK finery in their lives.

On the other hand, on-chain art has broken open the door for me to become a mad scientist for my ‘upper end’ artwork by creating art that uses blockchain as a medium, and honestly it’s become some of my favorite art to make. I’ve always had a soft spot for research, so being able to combine complex data sets and my creativity feels like a dream. To off-chain people, I like to explain this work sort of like the photographs from Harry Potter, except instead of using magic to animate the images, we use code and blockchain.

I find it even cooler that I get to sit down with collectors that share my same data-driven interests and chat about the future of digital art. I honestly have to pinch myself sometimes because I feel like I truly have the best of both worlds with creating meticulously detailed on-chain art and aesthetically pleasing retail art.

Tell us more about “The Astronomer’s Daughter” series, and what can Bitcoin Conference or Inscribing Vegas attendees expect to see from this series in May? I heard a rumor that your dad might be making the trip.

The Astronomer’s Daughter has sort of become my favorite little brainchild, and it’s been really fun to watch it blossom. It’s a collection that honors my dad’s legacy working for NASA through the blended use of satellite data and my artistic style. I chose 100 rare satoshis with varying levels of astronomical and on-chain significance to showcase what happened in space that day.

Of all the various components, the moon phases are accounted for as the moon displayed in each image, the constellation the moon passes through is represented by the color of the sky, any planets close to earth are displayed accordingly, the month and the season are shown as the landscape in the image, solar holidays (equinoxes and solstices) are recorded, and there’s a chromatic filter on top of every image based on the year of the satoshi to tie it all together.

Each piece is then pulled together using recursion and inscribed directly on the satoshi that the artwork represents.

In May, I’m debuting five (5) physical shadow boxes of select pieces from The Astronomer’s Daughter to showcase each layer of the artwork, acting almost as a physical representation of each recursive element. These pieces will be on display in the Bitcoin Conference Las Vegas, and they’ll be a sight to see! And yes, Father Wook might even be there but I don’t want to give too much away – people will have to come see for themselves!

See Post Wook’s artwork at both Bitcoin Conference Las Vegas and Inscribing Vegas. Tickets for these events, along with access to a full range of after parties, are available as part of the Bitcoin Week bundle here: https://b.tc/conference/2025/bitcoin-week.

Source link

Michael Saylor, you were forced to realise that all the store-of-value assets are defective and pushed you to focus on the only asset that is not. That does not make you immune to seeing the medium of exchange case. You will see how the housing market is huge when you watch it from one point of view and horrible from another. But if you experience pain driving you to keep your billions of dollars purchasing power, housing is a decent tool to keep it.

Your SoV obsession misses the mark—badly. The biggest aspect of Bitcoin is the medium of exchange. Even though the fiat system increasingly separates money’s functions, that doesn’t mean it should. I get that saying Bitcoin is a medium of exchange is kicking the hornet’s nest, and all the other currency lords will try to stop Bitcoin. It’d be great if they joined in instead of fighting it. That will give all the billionaires certainty that they can put money in it, but simply using Bitcoin just to store value is attacking it. That approach will turn it into digital gold 2.0, captured.

There’s no store of value without a medium of exchange! The medium of exchange comes first. You receive a transaction, then you store the Bitcoin. If the store of value were the main point, imagine announcing you lost your keys for your Bitcoin stack—you’d still store it perfectly, but without the medium of exchange function, the market will wipe out the fictional fiat value layered on top. That value is there exactly because it can move and still can be used as a medium of exchange.

An oxygen tank is vital for reserves, but breathing matters more. The store of value is secondary and relies on the ability to transact. Without that, the store of value means nothing. Michael, you learned this firsthand when your million-dollar holdings in Argentina were diluted by 90%. You struggled to preserve the value not because you did not see it coming but because you couldn’t use it as a medium of exchange. True, a poor store of value weakens the medium of exchange, but why does the latter take priority? Because the ability to exchange is what lets you respond.

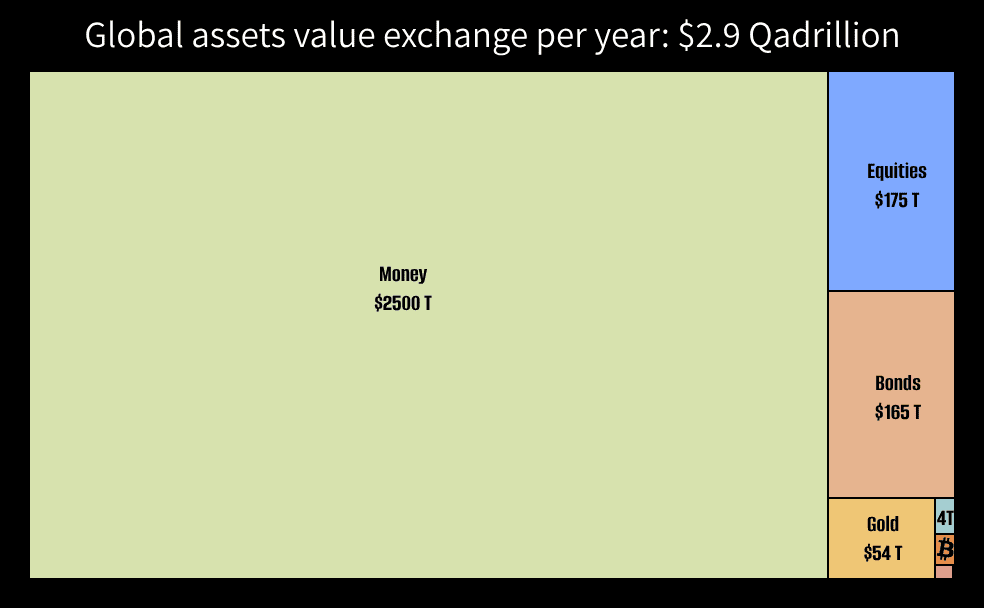

By now, most people exposed to Bitcoin know the chart from Jesse Mayers that you popularized. You claim there’s no better idea than a $900 trillion clean store of value, then immediately call Bitcoin one of the world’s most liquid markets, running 24/7/365. Guess what? Liquidity means medium of exchange.

Now, let’s break down the Jesse chart, starting with the housing market. It’s valued at $330 trillion, but it’s such a poor medium of exchange that it only trades for $1.3 trillion annually. Regulations and taxes make trading real estate even tougher. Still, since it’s more than 100 times better as a store of value, billionaires prize it, increasingly dominating the market and pricing out younger generations.

A house might be valuable, but its worth grows not just from what it is but from its ties to nearby utilities. Build a road to it, and the value rises. Add a superstore or a gas station, or connect it to the electrical grid, and the value climbs again. The network creates opportunities for energy to flow into the area, boosting the chance to capture that energy as economic value, like money. So the exchanges that happen in the network are what increases the value of a house. But I see the flip side: if you’re a billionaire and everyone’s after your resources, you don’t want a big network around your house. You’d prioritize privacy instead. The house might lose value, but the goal shifts to raising the cost for others to reach you, reducing the chance to be attacked.

What about the bond market? Bonds are valued at $300 trillion as a store of value, with $140 trillion traded yearly plus $25 trillion in new bond issuance. That means the medium of exchange value is about 50% of its total value annually. It’s better than houses in that sense, but the numbers still show people primarily use it as a store of value.

Next up are equities. Valued at $115 trillion, they were traded for about $175 trillion. This shows their strength as a medium of exchange exceeds their store of value role. Take your MicroStrategy stock—you know it better than anyone. How much value did it store last year, and how much was exchanged through it?

The next two sections are interesting. The art industry’s yearly transactions are so minor that they don’t even register on the chart. Meanwhile, the cars and collectibles sector sees trading volumes of nearly $4 trillion annually. This highlights that they’re mostly seen as a store of value each year, but it also reveals how poorly the housing market performs as a medium of exchange—outdone even by the car market.

Ooooh gold! Gold bugs rave that it’s been around for over 5,000 years, calling it the ultimate store of value for whatever reason—yet it’s just 1.78% of the store of value market. This shows that once its medium of exchange role was stripped away, it became vulnerable to capture and manipulation. Sorry, gold bugs, that genie’s not going back in the lamp. Gold holds $16 trillion in value, and the gold bugs claim it could store the $120 trillion worth of money in it. They’re desperate to pump their bags, but the market disagrees, valuing the defective fiat money ten times higher than the shiny, lifeless rock. Is gold a better medium of exchange, then? It trades at $54 trillion yearly, boosted by derivatives, making its medium of exchange use 3.5 times its store of value role.

Money might not dominate as a store of value among assets, but it’s the leading medium of exchange by far. Other stores of value assets don’t even come close. What if the dollar, the top currency, became just a store of value? It would collapse the USD network, boosting the value of non-US assets as their networks step in to meet the demand. Over time, their store of value assets would rise while USD assets would plummet. Global money totals around $120 trillion, but look at the top central banks’ transaction volumes: Fedwire at ~$1,182 trillion, TARGET2 at ~$765 trillion, CHAPS at ~$145 trillion, and others (partial) at ~$500 trillion (a conservative estimate due to incomplete data). So, while the store of value is $120 trillion—per the Jesse chart—the medium of exchange utility of these networks is over 20 times greater, which is around ~$2.5 quadrillion. What would the medium of exchange value be if 2 billion unbanked people were included? How many more transactions would that spark? And what if microtransactions were possible?

Where does Bitcoin fit into all of this? The prevailing narrative urges holders never to sell, positioning Bitcoin solely as a store of value. Yet, the market tells a different story. In 2024, Bitcoin’s market cap hit $2 trillion, while the value exchanged on its first layer—the blockchain—reached $3.4 trillion. Factor in the Lightning Network (though its exact figures remain elusive), and the total likely approaches $4 trillion. This suggests that Bitcoin’s role as a medium of exchange is twice as significant as its store-of-value function. So, what happens if that long-standing “hold forever” propaganda narrative begins to fade?

Bonds and equities are financial “instruments” that pretend to be money because fiat currency is flawed. This creates a market that shuts out much of the population from safeguarding their wealth, further splitting money’s store of value role. But how inclusive are these instruments? Or are they just tools to siphon value from the fiat medium of exchange, channeling it to privileged individuals and billionaires and others alike with a need to hoard?

Globally, only 10-20% of people have exposure to bonds, mostly indirectly through pension or investment funds, not directly. For equities, 15-25% of the population has some access. That leaves at best 80% of humanity without these tools to protect themselves, making them vulnerable to exploitation. Splitting the store of value from the medium of exchange sets up a dynamic of extractors and the extracted. This amplifies the “cantillion effect”: those who can print the medium of exchange buy up store-of-value assets, sidelining 80% or more of people. It’s a feedback loop that weakens the system, widening the gap between haves and have-nots. The more you print, the more you disconnect money from its store-of-value role.

Another very big part of the whole system is the fees. There are fees for sending dollars via the banking system, and that is a service, but how much are the fees when you want to switch from the medium of exchange into the store-of-value instruments? A lot more. That is creating so much friction in the whole system, and it contributes to excluding the have-nots from storing their value. At this point, the medium of exchange turns more and more into the medium of extraction rather than for exchange. This is also a reason why the store of value case is more appealing in the fiat system.

Bitcoin is not pretending to be money like everything else; it is the first engineered money that doesn’t erode like a melting ice cube and doesn’t discriminate. It is the money of those who choose it. With no printer behind it, there’s no urge to swap it for a “better” store of value—there’s no second best. Even those without Bitcoin can use it to shape their lives into the lives they desire. Moving away from chasing money to store in something and instead building whatever enriches their lives on top of Bitcoin.

The biggest idea isn’t storing value—it’s moving it. But to move value, you first need to have some stored. Then again, to have some stored, someone needs to move some your way first. That’s why the rich prefer assets that don’t erode like a melting ice cube. Meanwhile, those starting their careers focus more on receiving value than storing what they don’t yet have.

Why does the store of value case draw so much attention? One reason could be the effort involved. With a store of value, you buy and hodl—no work needed to improve your life. With a medium of exchange, you must work to grow your savings, persuading others to pay for your goods or services in Bitcoin. Another factor: for most, their fiat portfolio still outweighs their Bitcoin one. Only when Bitcoin surpasses their fiat holdings will they consider enhancing their lives with it. That shift isn’t tough for much of the world’s population, who lack savings or assets anyway. This might explain why the current system resists letting them exit, pushing dependency by offering to custody their Bitcoin—trading one reliance for another.

Even ossification ties into the need for more mediums of exchange use. You, Michael, strongly support ossification, but if Bitcoin isn’t used to reach more people, you’re delaying it. Unlike you, America knew that to make the dollar the world’s reserve currency, they had to distribute it widely to lock in the network effect. They saw the network as the key to ossification, and it worked easily since printing and sharing bills cost little. With Bitcoin, its absolute scarcity requires balancing how much to spread versus store. Still, that doesn’t mean you shouldn’t spend any at all.

The metaphor of storing fat in the body is key to long-term survival. True, but it overlooks the need for a steady food income to stay alive before storing fat. Without income, there’s nothing to store—so exchange comes first. Yet, for someone not worried about hunger, the focus shifts to storing food to prevent spoilage. I keep hammering this point to highlight your bias toward the store of value, which skews your judgment and misleads others.

At this stage of my Bitcoin journey, I’m certain of this: chasing money corrupts you. Bitcoin shifts that—it stops you from pursuing money endlessly and lets you use it for the life you want. What happens when you have enough of everything you desire? What then? With Bitcoin, that’s entirely possible, and every Bitcoiner should be ready with an answer for when it happens. Chasing money, though, is a bottomless pit you can’t fill. The Bible says the love of money is the root of all evil. I agree, but how does it play out? What is the mechanism? Chasing money—making it the top priority and making the other things lesser—is the mechanism.

You’re not building a Bitcoin standard—you’re stacking a deck. Like gold in the past, you’re the one this time hoarding Bitcoin from people and institutions, further entrenching the fiat standard. Saylor, you’re not attacking the dollar as some believe—you’re bolstering it by boosting your stock and its ecosystem. Instead, you’re speculatively hitting those who fund your Bitcoin buys. You’re not just hurting them; by strengthening the dollar, you’re amplifying the pain for other currency holders. Hoarding sats while the world watches? That’s not a cybercity—it’s a gated estate funded by their own money.

I wonder if people would want to invest their Bitcoin in your securities. How many would actually do it? I’m sure true Bitcoin maximalists wouldn’t trade their perfect store of value asset for a fiat “instrument.” Ask yourself: at this point, would you spend your Bitcoin to buy Apple stock? You did invest in them before, after all. It makes no sense—I’d give you Bitcoin just for you to turn it into some fiat thing, pay fiat fees, bolster fiat custodians and third parties, only so you can buy Bitcoin again on the other end.

In the end, I don’t have proof, but I’m fairly certain you already know everything I’m saying in this article/message. Though it’s written to you, Michael, it’s aimed at those who see you as the new Bitcoin Jesus, blindly following without questioning your actions. They make reckless bets in their own lives—bets that could wipe out their Bitcoin—lacking the financial safeguards and interest rates you have. Your messages, which they echo, don’t apply to most of humanity.

Bitcoin isn’t just another asset or financial tool—it’s borderless, permissionless money for the people. Treating it otherwise diminishes its true worth. Merely storing it won’t bring freedom. Letting sats flow builds the network. Letting sats flow fosters cooperation for a better future. Letting sats flow strengthens the ecosystem. Store some for tomorrow, but do not be the richest man in the grave—save them for plans that keep them moving later.

This is a guest post by Ivan Makedonski. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x