Pi Network

How High Can Pi Network (PI) Price Go?

Published

1 month agoon

By

admin

Pi Network price has fluctuated after launching its Open Mainnet this month. It has gained momentum, attracting more attention. Despite increased market risks, Pi Network remained stable while other cryptocurrencies declined. The token formed a bullish trend on daily charts, signaling a potential breakout. The question rises as how high can Pi network (PI) price go?

Will Pi Network (PI) Price Hit New Highs?

Pi Network price is drawing interest as it nears its all-time high of $2.10. The coin has declined 23% from its peak but remains a strong contender in the digital asset space. Experts suggest that Pi Coin’s potential depends on increased adoption, exchange listings, and higher liquidity.

OKX has already committed to listing Pi once it meets the exchange’s criteria. Now, Binance is considering adding the coin to its platform, and community support is playing a key role. The exchange launched a voting process to gauge interest, with 86.2% of eligible users voting in favor. Only two days remain before the poll closes.

A Binance listing would be a major milestone, potentially increasing exposure to over 200 million users worldwide.

$PI will be listed in Binance.

86.2% of the eligible users have voted yes.

2Days until the vote closing. #PiNetworkpic.twitter.com/NU6J8bMv2O

— MOON JEFF

(@CRYPTOAD00) February 25, 2025

Market analysts believe this could also lead to Pi’s inclusion in Binance’s futures market. If successful, other major exchanges, including Coinbase, Kraken, and Upbit, may follow suit.

Pi is already listed on several platforms, including OKX, HTX, Bitget, and Gate.io. A Binance listing could further establish it as a key player in the digital asset space. With growing interest, the market is closely watching Pi Network’s next move.

Can Pi Network Price Rally to $3?

The latest Pi price shows consolidation after a strong breakout, holding near the $1.59 level. The price briefly surged above $1.60 but faced resistance, leading to a minor pullback.

The market is stabilizing, with technical indicators suggesting a potential next move. Crypto market is trading in bearish trend, with BTC and ETH hovering below the support levels.

Pi Network is currently trading at $1.59, marking a 0.75% decline in the past 24-hours Despite this, the token maintains higher support near $1.00, which previously acted as a major buying zone.

If the price successfully holds above $1.50, it could attract more buying interest, setting the stage for a test of $2.10 previous ATH in the coming day. If bullish mounts more pressure could rally to $3. While a rejection may push the price back toward $1.40 before testing the $1.00 support level.

The Relative Strength Index (RSI) is at 58, indicating neutral momentum. This suggests the asset is neither overbought nor oversold, leaving room for further price action in either direction.

The Moving Average Convergence Divergence (MACD) indicator displays a bearish signal, with the MACD line crossing below the signal line. This indicates slowing momentum, hinting at possible short-term consolidation before the next significant move.

Pi Network price continues to gain attention, with key exchanges considering listings. If adoption and liquidity grow, its price could reach new highs, possibly testing the $3 mark.

Frequently Asked Questions (FAQs)

Its Open Mainnet launch and potential Binance listing have fueled interest.

If momentum builds and adoption grows, PI could potentially test $3.

Key resistance is near $2.10, while support holds around $1.00.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Elon Musk Folds X Into xAI, Creating a $113 Billion Juggernaut

Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future

Top 4 Crypto to Buy Now as XRP Price Struggles above $2

US regulators FDIC and CFTC ease crypto restrictions for banks, derivatives

US Authorities Seize $201,400 Worth of USDT Held in Crypto Wallets Allegedly Intended to Support Hamas

Is Bitcoin’s Bull Market Truly Back?

CRO

Top 4 Crypto to Buy Now as XRP Price Struggles above $2

Published

3 hours agoon

March 28, 2025By

admin

tHESSSSSSStHE The XRP price continues to face challenges in sustaining support at $2 during the recent market period. The bearish trend exists, yet XRP continues to stay above its essential support level. Investors now explore alternative cryptocurrencies because of declining interest in XRP. The crypto that is promising to buy includes CRO alongside EOS, PI, and SOL, which present strong investment possibilities.

Crypto to Buy: Cronos (CRO)

The cryptocurrency market recognizes Cronos (CRO) as one of the cryptos to watch today because of its increased vitality and expanding user base. In the last 24 hours, CRO experienced a 5% increase, which brought it to $0.1036. The token holds a position among the highest-performing assets.

The major partnership between CRO and Donald Trump’s Truth Social platform became recently public. CRO investors will soon have access to a fresh ETF focusing on the cryptocurrency. Market analysts predict this token will have a robust rally throughout the current market cycle because of the recent developments.

Eos (EOS)

EOS price maintains $0.5752 support position at a vital entry point which market analysts track for potential breakouts. Market watchers identify the asset as a key observation because breaking out from this position could generate a bullish price movement reaching between 65% and 80% The trading volume keeps rising which indicates increasing buying pressure and developing momentum.

The noticeable traits of EOS Network as a high-performance open-source blockchain platform include its focus on flexibility and security and developer-friendly design, along with its emphasis on scalability and user experience making it among the crypto to buy.

Pi Network (PI)

Pi price is trading at $0.8224 PI price is among the top altcoins to buy as investors are eyeing recover. The Pi Network price crashed in March as it lacked a clear bullish catalyst and as the market remained concerned about its burn rate. The Pi coin crashed to a low of $0.83 on Friday, meaning it collapsed by over 65% in March.

A potential exchange listing by Binance in April could catalyze the Pi Network’s price. Other notable exchanges that may drive its price higher are South Korean giants such as Upbit and Bithumb and US companies like Coinbase, Kraken, and Gemini.

Solana (SOL)

Solana (SOL) price is gaining traction amid a broader market correction as Bitcoin trades below $88,000 and Ethereum stays under $2,000. SOL recently dipped to $129 but remains crypto to watch, especially with XRP struggling to hold above $0.62.

According to analysts on X, $125 stands out as a key support zone for Solana in the short term. Despite current pressure, speculation tied to ETF and overall sentiment may trigger a SOL rebound this week making top altcoin to buy now. The 24-hour trading volume for Solana stands at $3.43 billion, showing an 18.77% increase.

Final Thoughts

As XRP price faces resistance, these cryptos to buy now, including CRO, EOS, SOL, and PI, could see growth potential in the current market.

Frequently Asked Questions (FAQs)

CRO surged 5% recently and gained attention due to its Truth Social partnership.

A possible listing on Binance and other major exchanges could support a price rise

Solana is holding near $125, seen as a short-term support zone.

Anna

Annah enjoys writing about cryptocurrency and blockchain technology. With More than 5 years of experience. For years she has followed their development and now believes these technologies could potentially revolutionize many industries. She has specialized in technical analysis to help cryptocurrency traders make more informed decisions.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Why Is Pi Coin Price Down Another 12% Today?

Published

3 days agoon

March 26, 2025By

admin

Pi Network continues to remain under strong selling pressure as native cryptocurrency Pi Coin has corrected another 12% today, with its price dropping to $0.81 support levels. With this, it has extended its weekly losses to 28% amid delays in mainnet launch, Binance listing, etc. and initial investor sentiment waning significantly. Investors are turning anxious about whether the Pi Coin price could stage an upside above $1 anytime soon or not.

Pi Network Core Team Needs to Step Up

With delays in plans of a mainnet launch, listing on Binance, or the Pi Domain auction, the Pi community members are seeking answers from the Core team, asking them to step up the game, as the Pi Coin price faces a steep fall from $3 to $0.82. Community members believe that the recent turbulence comes as the Core Team (CT) remains silent on critical updates.

Furthermore, there have been allegations that the Pi core team has been drifting away from its promise of full decentralization, to now attracting big institutions. Large corporations handling billions of dollars in daily transactions naturally prioritize security and transaction speed over complete decentralization.

With these opposing interests, the Pi Network core team seems to have made some compromises while trying to strike a balance between inclusivity and global adoption. Popular community member, Dr. Altcoin noted:

“We should embrace this collaboration between everyday users and big institutions. High-volume trading driven by businesses is what is required to drive our utilities, and that will ultimately push the price upward. The Core Team should also remain committed to rewarding the Pi community. Without the Pi community, the Pi Network would have been just another typical memecoin story”.

What Happens to Pi Coin Price Next?

Despite the strong community back, the Pi Coin price has been seeing a one-directional downside all the way to $0.82. Crypto analyst Moon Jeff has issued a bold prediction regarding Pi Network’s price trajectory. According to Jeff, the token is poised to decline to $0.60, which he identifies as its last significant support level.

Despite this, the analyst remains optimistic of the Pi Coin price recovery, suggesting that a rebound from this point could spark a rally toward the $5 mark. Dr. Altcoin also shared a similar outlook noting: “Let’s HODL and buy both Patience and Pi together while they’re still available. Let’s also not be surprised if Pi shoots up to $3.14 in the coming weeks or even to $10 in the coming months”. Recent reports also suggest a projected PI listing on the crypto exchange Upbit.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Altcoins have been attracting investor attention this weekend, with Bitcoin and Ethereum prices stagnating around $85,000 and $2,000, respectively, since Friday. Prominent crypto analysts have published data insights showing investors are increasingly rotating capital toward altcoins after recent U.S. macroeconomic updates.

Analysts Predict Altcoin Season as Fed Rate Pause Triggers Risk-On Appetite

The altcoin market had a rough start to March 2025 when U.S. President Donald Trump announced new tariffs on Canada and Mexico. However, the macroeconomic landscape has since improved. The Trump administration made adjustments to the tariffs, while U.S. CPI and PPI data indicated that inflation risks from the tariffs were overestimated.

This shift in sentiment was further reinforced after the latest Federal Open Market Committee (FOMC) meeting on Wednesday, where the U.S. Federal Reserve announced a pause in interest rate hikes.

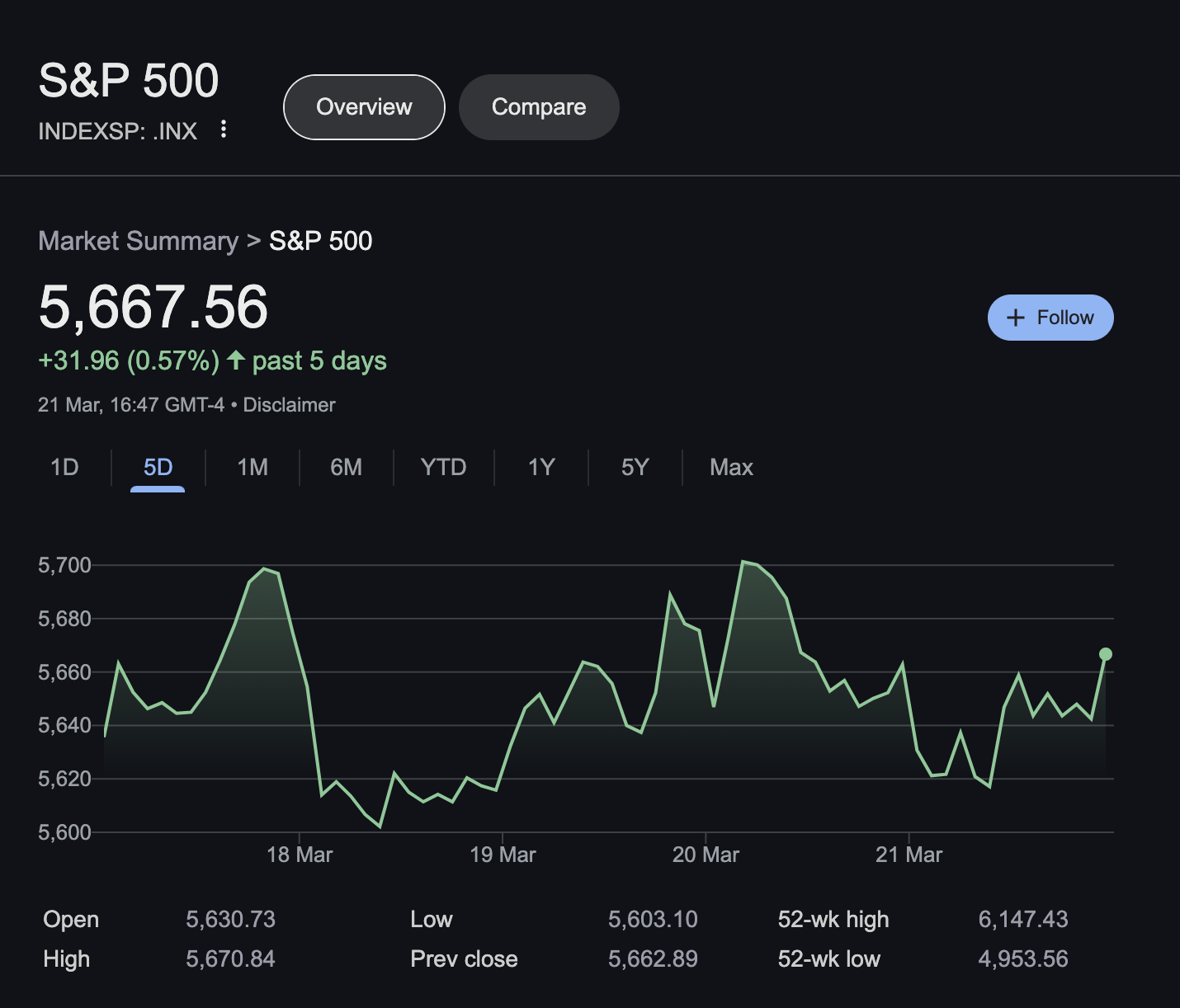

Traditional finance (TradFi) investors reacted by moving capital out of safe-haven assets like gold and into stocks, pushing the S&P 500 up by 31.7 points last week.

Crypto markets appear to be following suit, with traders increasingly rotating funds from Bitcoin and Ethereum into altcoins.

Crypto Analysts Signal Imminent Altcoin Breakout

Adding to the growing optimism around altcoins, two major crypto analysts took to social media to highlight technical indicators pointing to an incoming “Alt Season”—a market phase where altcoins significantly outperform Bitcoin.

“2025 #ALTSEASON starts in less than 3 days now,” alongside a chart illustrating past cycles of altcoin dominance relative to Bitcoin.

Crypto analyst Sensei (@SenseiBR_btc) made a bold declaration, March 21, 2025 ,

The accompanying chart showed clear historical patterns where altcoins surged against Bitcoin, with a third major rally seemingly about to begin.

In response, OBI Real Estate (@Obirealestate) weighed in on the discussion, adding, “Markets are buzzing, timing will be everything.”

Key Takeaways: Why This Weekend Matters for Altcoins

Capital Rotation: With Bitcoin and Ethereum trading sideways, traders are diverting funds toward altcoins, anticipating stronger returns.

Macro Trends: Improved inflation outlook and the Fed’s rate pause have boosted risk-on sentiment across global markets.

Technical Indicators: Historical charts from top analysts suggest that the long-awaited Alt Season could be days away from starting.

As traders look ahead, this weekend may present a critical window of opportunity to accumulate promising altcoins before a broader market breakout.

3 Top Trending Altcoins to Watch in the Week Ahead

Bitcoin (BTC) has surged past the $85,000 mark, signaling strong market sentiment despite a slight 0.9% decline in global crypto market cap over the past 24 hours. While BTC’s resilience suggests growing confidence, a look at broader market trends reveals that large-cap altcoins remain stagnant, while smaller-cap assets are seeing significant moves.

Ethereum (ETH) remains subdued at $2,000, showing only a 0.5% gain in 24 hours. Similarly, Cardano (ADA) and Binance Coin (BNB) also moved sideways, conslidating at the $0.70, $620 respectively, while Solana (SOL), trading at $132 leads the top 10 assets with a 2.4% gain.

However a closer look at the Coinmarketcap above shows low-cap altcoins, are attracting significant search traffic, a move that could attract further capital inflows in the coming trading seesions.

1. Trump Memecoin (Official Trump) – Political optimism fuels rally

The Trump-themed memecoin is trading at $11.81, up 5.9% in the last 24 hours, making it one of the most notable gainers. This rally alligns with improved sentiment surrounding recent U.S. policy discussions and Trump’s appearance at the Blockwork’s Digital Assets Summit, last week.

With increasing political relevance and heightened social media buzz, this token is one to watch closely. A break above key resistance levels in the coming days could drive further gains.

2. Pi Network (PI) – Struggling to Break $1, But Buzz is Growing

Last week, PI endured major sell-offs as the network migration trigger mixed reactions among investors. However, Pi Network is now flashing recovery signals. At press time on Sunday, March 23, PI network price is facing strong resistance at the $1 mark, struggling to establish a breakout. However, with the token has become one of the most discussed assets in the last 24 hours, investor interest is evident.

If buying pressure continues and $1 resistance caves, a significant breakout could follow, making this an asset to monitor for a potential price explosion.

3. Wormhole (W) – Cross-Chain Demand Fuels Buying Activity

Ethereum’s native cross-chain bridge token, Wormhole (W) price, has surged 23.9%, driven by increased demand as investors rotate funds across chains.

The boost in market optimism, combined with the Fed’s recent decision to pause interest rate hikes, has further supported capital flows into decentralized finance (DeFi).

With more activity on cross-chain protocols, Wormhole’s demand could continue to rise, making it a strong candidate for further upside in the days ahead.

In Summary:

While Bitcoin’s dominance remains strong above $85,000, altcoins, particularly low-cap assets, are gaining momentum. The surge in Trump memecoin, Pi Network’s rising popularity, and Wormhole’s DeFi-driven gains all signal that the altcoin market could be gearing up for major moves. Traders should watch for key breakout levels as these assets continue to gain traction

Frequently Asked Questions (FAQs)

Altcoin Season refers to a market phase where altcoins outperform Bitcoin, often driven by capital rotation and favorable macroeconomic conditions.

Analysts predict an Altcoin Season due to Bitcoin’s stagnation, improving inflation data, and the Federal Reserve’s decision to pause rate hikes.

Trump memecoin, Pi Network, and Wormhole are gaining traction due to political sentiment, technical setups, and cross-chain DeFi demand.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Elon Musk Folds X Into xAI, Creating a $113 Billion Juggernaut

Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future

Bitcoin Plunges Below $84K as Crypto Sell-Off Wipes Out Weekly Gains

Top 4 Crypto to Buy Now as XRP Price Struggles above $2

Ethereum Price Hits 300-Week MA For The Second Time Ever, Here’s What Happened In 2022

US regulators FDIC and CFTC ease crypto restrictions for banks, derivatives

US Authorities Seize $201,400 Worth of USDT Held in Crypto Wallets Allegedly Intended to Support Hamas

Is Bitcoin’s Bull Market Truly Back?

Stablecoin Bills Unfairly Box Out Foreign Issuers Like Tether, Says House Majority Whip

THORChain price prediction | Is THORChain a good investment?

Strategy (MSTR) Holders Might be at Risk From Michael Saylor’s Financial Wizardry

3 Altcoins to Sell Before March 31 to Prepare for Crypto Bull Market

A Big Idea Whose Time Has Finally Come

XRP price may drop another 40% as Trump tariffs spook risk traders

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: