crypto assets

How many cryptocurrencies are there? Total number and types

Published

6 months agoon

By

admin

The first cryptocurrency appeared in 2009, and today, its name is known by almost everyone — Bitcoin. What made it so intriguing was the promise of a new kind of money: no government interference, full privacy, and everyone having the same rights within the system.

At first, Bitcoin (BTC) was not taken seriously. It wasn’t until 2013, when its price passed a few hundred dollars, that the rise of cryptos really took off, and they began spreading and multiplying globally. So, how many cryptocurrencies are there today?

How many cryptocurrencies are in the world?

Statista reports that by September 2024, the number of cryptocurrencies is getting close to 10,000. However, it’s worth noting that many of these cryptocurrencies may not be particularly relevant or active.

Statista also notes that other sources estimate there are around 20,000 cryptocurrencies in existence, though most of these are either inactive or have been discontinued.

As of early November CoinMarketCap, a leading cryptocurrency data aggregator that tracks prices, market cap, and trading volume, lists 9,916 cryptocurrencies, while CoinGecko, another popular crypto data platform known for its comprehensive market statistics, shows 15,142.

Figuring out exactly how many cryptos there are is tricky, since the number keeps changing, but we can say this for sure: there are way more now than there were in 2009.

Why are there so many cryptocurrencies?

Thanks to easier access to blockchain technology, even those with basic coding knowledge can launch their own cryptocurrency. Platforms like Ethereum allow developers to create tokens without needing to build their own blockchain from scratch.

This low barrier to entry has led to an explosion of new projects, each claiming to offer something unique, whether it’s faster transactions, privacy features, or use in specific industries. Some even target niche markets like gaming, art, or supply chains.

While many of these coins won’t survive long-term, the ease of creation fuels constant experimentation and innovation, driving the evolution of the entire crypto ecosystem.

How many types of cryptocurrencies are there?

How many crypto are there?

With so many different types of cryptocurrencies, each designed for a specific goal, here’s a breakdown of the main categories.

Bitcoin and Bitcoin forks

Bitcoin is the first and most famous cryptocurrency, designed as a decentralized, peer-to-peer digital currency. Bitcoin forks like Bitcoin Cash (BCH) and Bitcoin SV (BSV) are versions of Bitcoin with minor adjustments to improve speed or transaction costs.

Altcoins

Altcoins are basically any cryptocurrencies that aren’t Bitcoin, each offering something unique, whether it’s new features, different uses, or fresh technology to shake up the digital currency scene. For example, Ethereum (ETH) brings smart contracts to the table, while Solana (SOL) stands out for its fast and low-cost transactions.

Stablecoins

Designed to reduce volatility, stablecoins are pegged to real-world assets like the US dollar. Tether (USDT) is the most widely used, offering stability for traders.

Meme coins

Meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) were created as fun projects but turned into something much bigger thanks to viral social media moments. Pepe Coin, inspired by the Pepe the Frog meme, has also become popular in the meme-crypto space.

Utility tokens

These tokens are used to power specific applications. Chainlink connects smart contracts to real-world data, while Uniswap is used for governance in the Uniswap decentralized exchange. Binance Coin started as a way to pay lower fees on the Binance exchange but now has broader uses across the Binance ecosystem.

How many cryptos are actually significant?

There are thousands of cryptocurrencies out there, but only a small percentage are truly significant, in terms of widespread use, market value, and technological impact. Bitcoin remains the dominant force, widely recognized as the first and most valuable cryptocurrency.

Ethereum is another heavyweight, known for its smart contract capabilities and dApps, driving much of the DeFi and NFT boom. Other notable cryptos include Binance Coin, which powers the Binance ecosystem, and Solana, praised for its high-speed transactions.

Meme coins, like Dogecoin and Shiba Inu, have certainly gotten attention, but whether they’ll have lasting value is still a big question. The crypto world is moving fast, but not many assets have truly changed the industry. The ones that have are still the ones leading in terms of innovation and market impact.

Source link

You may like

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Altcoin

Dogecoin could rally in double digits on three conditions

Published

1 month agoon

March 28, 2025By

admin

Dogecoin rallied nearly 10% this week, resilient in the face of the U.S. President Donald Trump’s tariff war and macroeconomic developments. Most altcoins have suffered the negative impact of Trump’s announcements, DOGE continues to gain, back above $0.2058 for the first time in nearly two weeks.

Dogecoin rallies in double-digits, what to expect from DOGE price?

Dogecoin (DOGE) hit a near two-week peak at $0.20585 on Wednesday, March 26. In the past seven days, DOGE rallied nearly 10%, even as altcoins struggled with recovery in the ongoing macroeconomic developments in the U.S.

The largest meme coin in the crypto market could continue its climb, extending gains by nearly 11%, and testing resistance at the lower boundary of the imbalance zone between $0.24040 and $0.21465.

The upper boundary of the zone at $0.24040 is the next key resistance for DOGE, nearly 24% above the current price.

Two key momentum indicators, the RSI and MACD support a bullish thesis for Dogecoin. RSI is 52, above the neutral level. MACD flashes green histogram bars above the neutral line, meaning there is an underlying positive momentum in Dogecoin price trend.

Dogecoin on-chain analysis

On-chain analysis of the largest meme coin shows that the number of holders of DOGE is on the rise. If Dogecoin’s number of holders keep climbing or steady in the coming week, the meme coin could remain relevant among traders.

The network realized profit/loss metric shows that DOGE holders have realized profits on a small scale. Typically, large scale profit-taking increases selling pressure on the meme coin and could negatively impact price.

The metric supports a bullish thesis for DOGE in the coming week. Dogecoin’s active address count has been steady since mid-March, another sign of the meme coin’s resilience.

DOGE derivatives analysis and price forecast

The analysis of Dogecoin derivatives positions across exchanges shows that open interest is recovering from its March 12 low. Open Interest is $1.98 billion, as Dogecoin trades at $0.19. Coinglass data shows a steady climb in OI in the chart below.

The total liquidations data shows $4.29 million in long positions were liquidated on March 27. Sidelined buyers need to watch liquidations data and prices closely before adding to their derivatives position.

The long/short ratio on top exchanges, Binance and OKX exceeds 1, meaning derivatives traders are betting on an increase in DOGE price.

When technical analysis and derivatives data is combined, it is likely Dogecoin price could test resistance at $0.21465 next week, if spot prices follow the cue of derivatives traders.

What to expect from DOGE

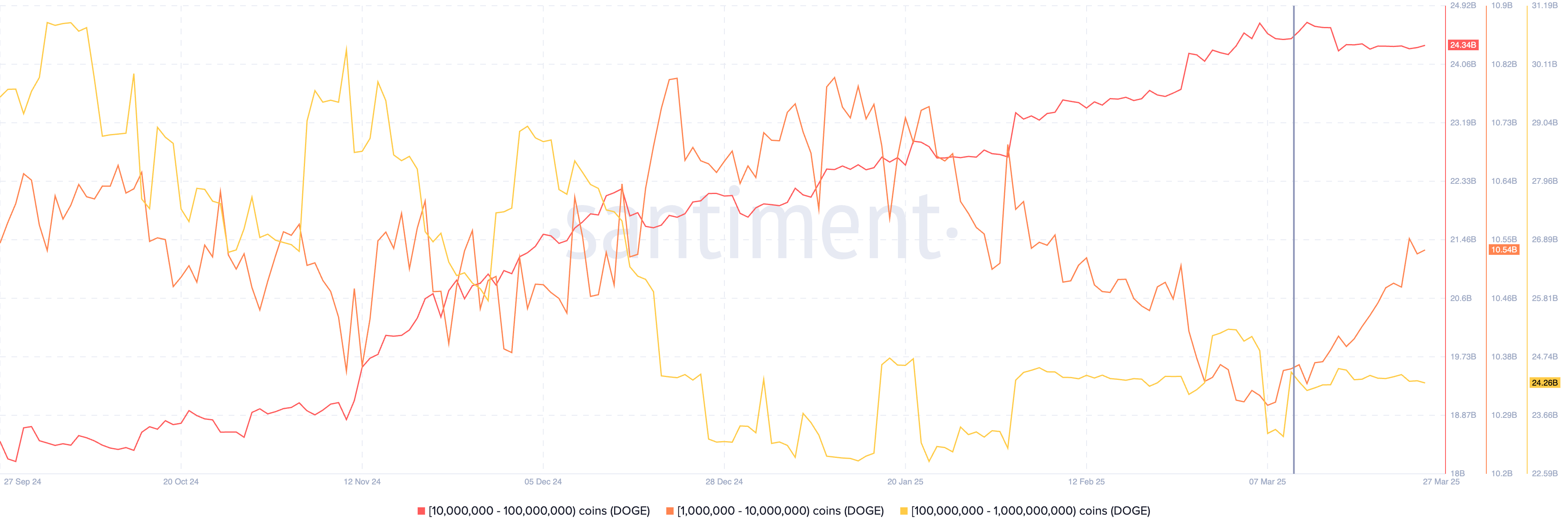

Dogecoin wallets holding between 1 million and 10 million DOGE tokens added to their portfolio consistently between March 10 and 27, while the other two categories, holding between 10 million and 100 million DOGE and 100 million and 1 billion DOGE tokens held nearly steady in the same timeframe.

The data from Santiment shows that DOGE’s traders holding between 1 million and 10 million tokens are rapidly accumulating, even as the token’s price rises. This supports demand for DOGE and a bullish thesis for the meme coin.

Dogecoin ETF and DOGE catalysts

DOGE holders are closely watching developments in Bitwise’s Dogecoin ETF filing with the SEC. The ETF filing is an effort to legitimize the meme coin as an investment category for institutional investors, as DOGE price holds steady among altcoins rapidly eroding in value.

Bitcoin flashcrashes dragged Dogecoin down with it, to a small extent, however the meme token recovered each time and consistent gains could signal an end to DOGE’s multi-month downward trend.

Other key catalysts for Dogecoin are positive updates in crypto regulation, passage of the stablecoin bill in the Congress, and demand for DOGE among whales and large wallet investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Altcoin

XRP hits new all-time high gears to extend bullish streak

Published

3 months agoon

January 19, 2025By

admin

XRP gained 42% in the past week, after rallying close to 1% on Friday. The altcoin hit a new all-time high, with the 24-hour trade volume leaving Ethereum (ETH) to bite the dust on Thursday. The token could extend its streak in the coming days following President-elect Donald Trump’s inauguration.

XRP could extend rally alongside Bitcoin

XRP rallied over 40% in the past week. Bitcoin (BTC), the largest cryptocurrency recovered from its flashcrash under $90,000 and made a comeback above $104,000 on Friday. The native token of the XRPLedger is rallying alongside the top crypto.

Trump’s upcoming inauguration is one of the leading catalysts, alongside optimism on crypto regulation, pro-crypto policy and a new approach by financial regulatory agencies in the U.S.

XRP could gain further, entering price discovery next week.

XRP trades at $3.26 at the time of publication.

On-chain indicators support gains

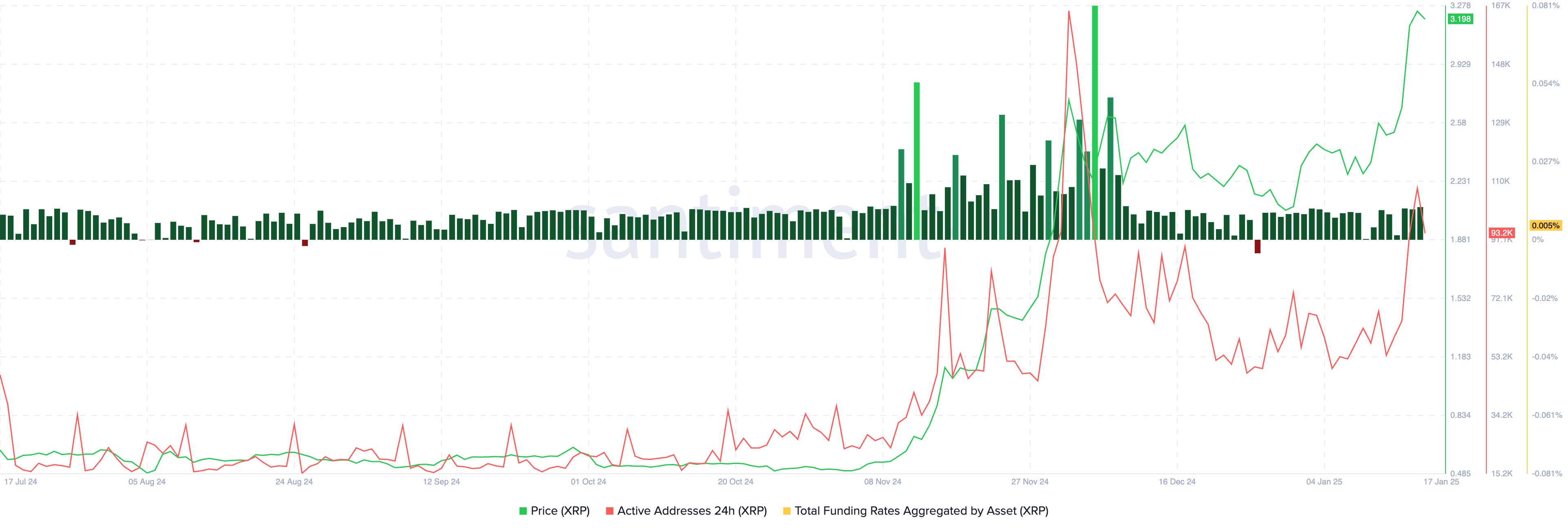

XRP’s on-chain indicators support a bullish thesis for the altcoin. The total funding rate metric is positive, greater than one throughout January 2025. The count of active addresses recorded a large spike on Thursday, Jan. 16.

The on-chain indicators on Santiment are conducive to further gains in XRP in the coming week.

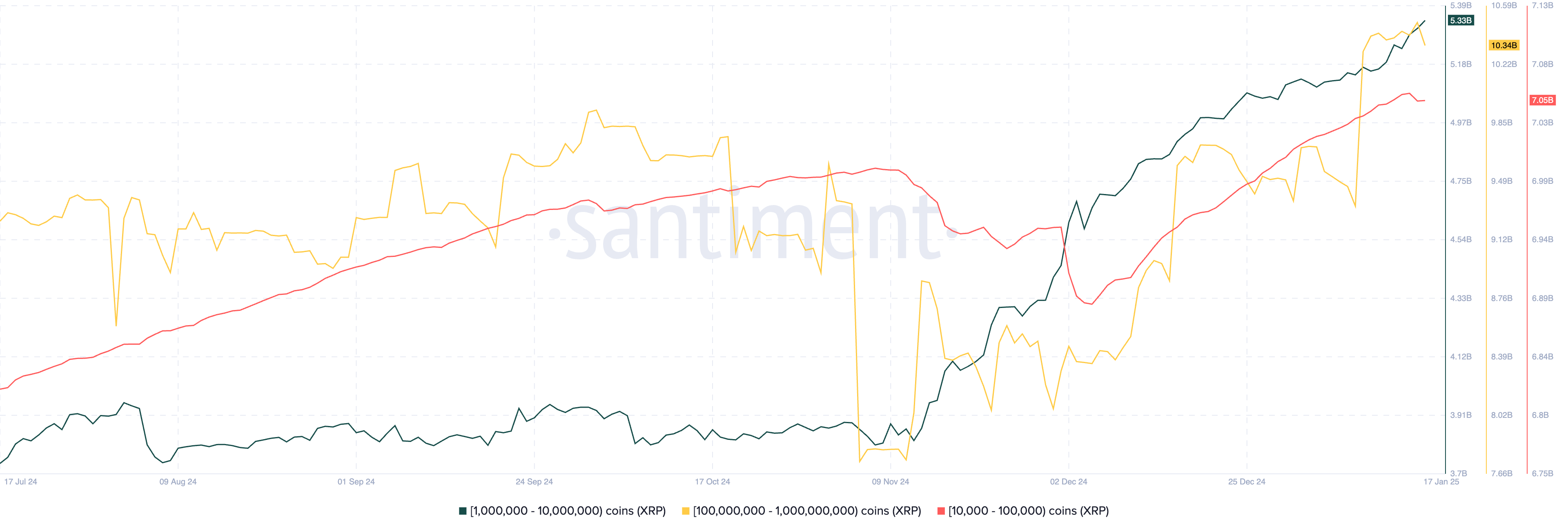

The supply distribution metric on Santiment shows an increase in XRP token supply held by wallets that own 10,000 to 100,000, 1 million to 10 million and 100 million and above XRP tokens. The three classes of holders have accumulated the altcoin, even as the price climbs. This is indicative of a likely XRP price increase in the future.

Market movers and Ripple lawsuit

Monday’s inauguration is the largest market mover in crypto. But RippleNet’s rising adoption among institutions, the developments in RLUSD stablecoin and the SEC’s lawsuit against Ripple are the three key market movers influencing the altcoin’s price.

Even as the U.S. financial regulator filed an appeal against Ripple on Jan. 15, the altcoin continued its rally undeterred. The July 2023 ruling by Judge Analisa Torres that classified secondary sales of XRP as non-securities is being challenged and the SEC is seeking to have those retail sales classified as unregistered securities sales.

Ryan Lee, chief analyst at Bitget Research, told crypto.news in an exclusive interview:

“XRP’s surge can be attributed to favorable outcomes in Ripple’s SEC lawsuit and a more crypto-friendly political climate in the US. If regulatory uncertainties are resolved, the influx of institutional investors could further solidify XRP’s position in the crypto market.”

It remains to be seen whether the Trump administration will support pro-crypto regulation and whether it influences the outcome of lawsuits against firms like Ripple Labs.

Technical analysis and XRP price forecast

XRP is hovering close to its all-time high at $3.40. At the time of writing, XRP traded at $3.2385. A 22% price rally could push XRP into price discovery, at the 141.4% Fibonacci retracement level of the climb from the $1.9054 low to the $3.4000 peak.

The technical indicators, RSI and MACD support a bullish thesis for XRP. MACD flashes consecutive green histogram bars. Traders need to keep their eyes peeled as RSI signals that the token is currently overbought or overvalued, as it reads 83.

In the event of a correction, XRP could find support at the 50% Fibonacci retracement level at $2.6977.

James Toledano, COO at Unity Wallet, told crypto.news in an exclusive interview:

“Given that XRP was stuck at around $0.50 for literally 3 years, its recent breakout momentum reflects new levels of investor optimism around regulatory clarity and the potential approval of an XRP ETF in the following months. If the XRP ETF gets approved, it will have the potential to open the floodgates of capital inflow, meaning it could reach new heights in 2025.”

Toledano warns XRP holders to be wary as altcoins take volatility to the next level in the current market cycle.

He said:

“Altcoin ETFs have genuine potential to attract capital, especially if supported by innovation-friendly policies with the new incoming U.S. administration. But, their success may be less consistent compared to Bitcoin ETFs due to the seemingly episodic nature of interest in altcoins.

Just take a look at fluctuations in Bitcoin’s price this week. The factors are multifaceted; we could say it’s Trump, seasonality, geopolitics, macroeconomics and sentiment all blended together. To play devil’s advocate, we humans are pattern seekers but sometimes there are hidden drivers and the cause and effects are not always linked.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Bitwise

Bitwise CEO predicts Trump administration to boost crypto mergers

Published

4 months agoon

January 6, 2025By

admin

Hunter Horsley links corporate power consolidation to crypto demand.

The CEO of Bitwise Asset Management, Hunter Horsley, has suggested that the economic policies of the Trump administration could have a major impact on the cryptocurrency sector.

In a recent tweet, Horsley noted that the potential deregulation of mergers and acquisitions could allow major companies like Google or Amazon to expand even further through strategic acquisitions. M&As refer to the consolidation of companies, either through the merging of businesses or the purchase of one company by another. This process often helps corporations achieve economies of scale, expand market share, or acquire critical assets.

Trump administration may unfreeze M&A.

Large corporates — mag 7, etc — may finally be able to wield their market cap. Amazon could buy Instacart. Google could buy Uber. etc etc

The big may get bigger, and the middle may shrink.

If that happens, I think it will accelerate…

— Hunter Horsley (@HHorsley) January 5, 2025

Horsley argued that this concentration of power could drive the adoption of decentralized systems, aligning with the core tenet of cryptocurrency: the skepticism toward centralized organizations. He believes that as large corporations gain more control, the demand for cryptocurrencies—designed to offer an alternative to such institutions—could grow.

Corporate behemoths like Google and Amazon are becoming increasingly interested in blockchain technology and digital assets as they look for ways to enter the crypto markets. One example of a blockchain-related service that Amazon Web Services has introduced is Amazon Managed Blockchain, which enables companies to create and oversee scalable blockchain networks. With this action, Amazon establishes itself as a major force in the expanding enterprise blockchain market.

By establishing strategic alliances with prominent blockchain initiatives and participating in campaigns to incorporate blockchain technology into its cloud infrastructure, Google has also increased its presence in the cryptocurrency sector. Blockchain-as-a-service is now available on Google Cloud, allowing companies to create and implement decentralized apps.

These initiatives demonstrate how major companies are using blockchain technology to diversify their business models while leveraging traditional M&As to expand their reach, thereby further driving the adoption of decentralized systems.

Horsley’s statement comes amid a major rebound in the cryptocurrency market, following Donald Trump’s recent re-election. Trump’s victory has been welcomed by many in the cryptocurrency industry, given his pro-business stance and policies that are seen as supportive of digital assets and blockchain technology. These policies have fueled a bullish trend in the market, with experts attributing much of the surge to a more favorable regulatory approach under Trump’s administration.

Since Trump’s election win, the cryptocurrency market has seen notable growth, with the biggest example being Bitcoin which surged from approximately $69,000 on Nov. 8, 2024, to over $100,000 in early December.

This increase has been largely driven by political shifts and the anticipation of loosened regulations, which experts believe will create a more conducive environment for digital assets.

Experts also believe this rise is driven by the political shift and the potential loosening of regulations, which may create a more favorable environment for digital assets.

Horsley is the CEO of Bitwise, an investment firm that has exclusively focused on cryptocurrency investments for the past seven years. The company offers a range of products including crypto-focused funds, ETFs, and others, designed to provide investors exposure to the crypto and Web3 markets.

According to Horsley, the influence of major market players—along with regulatory changes—could shape the future of both digital assets and traditional financial systems in 2025, making this an exciting time for both M&A activity and the cryptocurrency sector.

Source link

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje