Chainalysis

Illicit crypto activity drops 20%, but stolen funds surge, Chainalysis says

Published

4 months agoon

By

admin

Analysts at Chainalysis say illicit blockchain activity has dropped nearly 20% YTD, yet stolen funds and ransomware inflows continue to rise.

Illicit crypto activity has declined nearly 20% year-to-date, a positive sign for the growing legitimacy of the sector, according to a mid-year report from blockchain analytics firm Chainalysis.

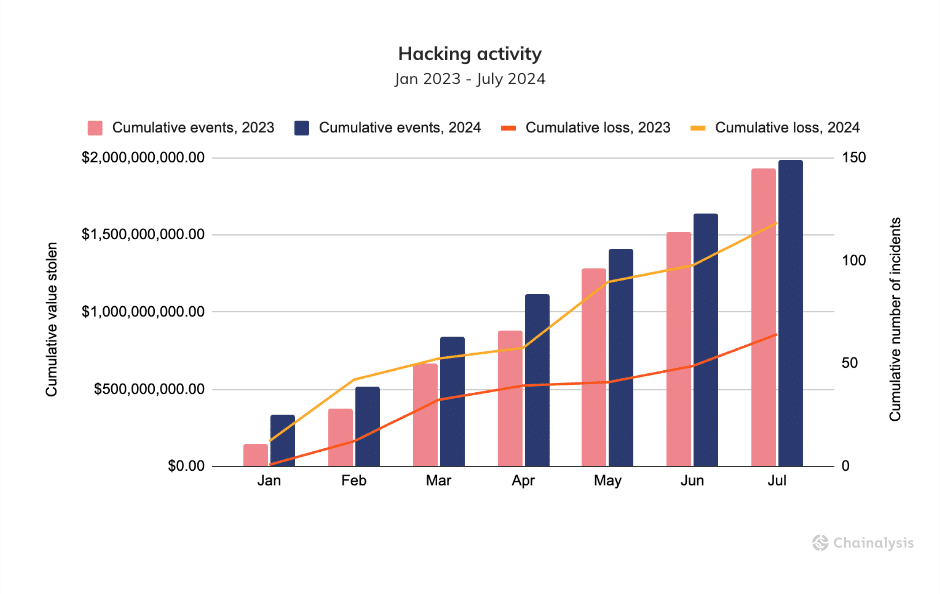

Despite the decline, there are still concerning trends in specific types of cybercrime, the firm noted, saying that funds stolen in crypto heists nearly doubled to $1.58 billion and ransomware inflows rose by 2% to $459.8 million in the first half of 2024.

Chainalysis attributes the surge in stolen funds to a resurgence in attacks on centralized exchanges, pausing a trend where hackers had focused on decentralized finance. The New York-headquartered firm noted that while the overall number of hacking incidents has only “marginally outpaced” that of 2023, the average value stolen per event has soared by nearly 80% in 2024, driven partly by rising crypto prices.

“The average amount of value compromised per event has increased by 79.46%, rising from $5.9M per event from January to July of 2023 to $10.6M per event thus far in 2024, based on the value of the assets at the time of theft.”

Chainalysis

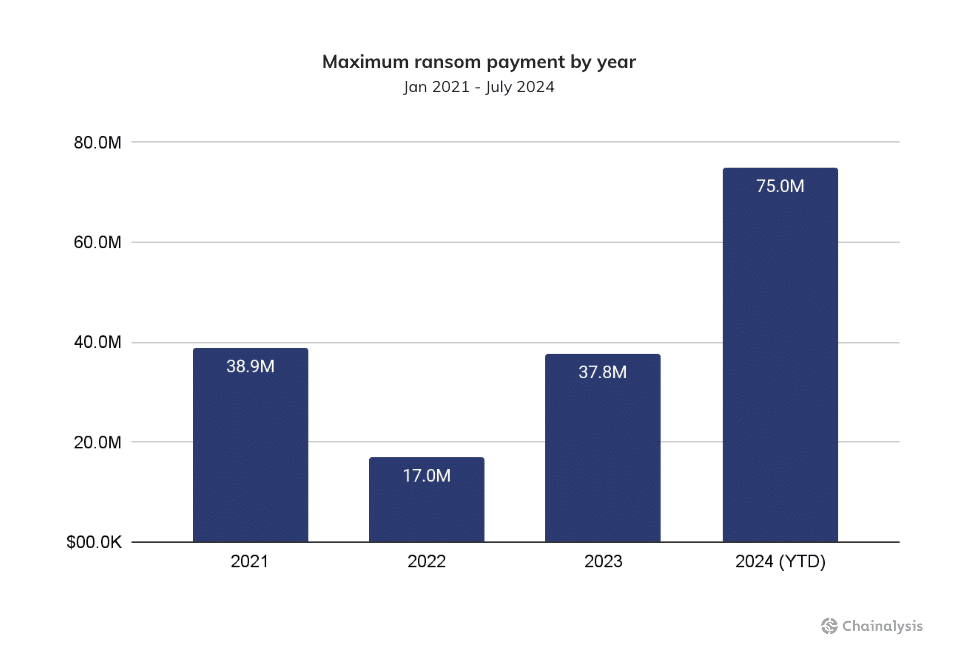

Ransomware also continues to be a persistent threat, with 2024 on track to surpass last year’s record $1 billion in ransom payments. Chainalysis says 2024 has seen the largest ransomware payment ever recorded at approximately $75 million to the Dark Angels ransomware group.

The ransomware landscape has fragmented somewhat following law enforcement actions against major players like ALPHV/BlackCat and LockBit. However, some affiliates have migrated to less effective strains or launched new ones, increasingly targeting “larger businesses,” according to the report.

Chainalysis cautions that while the overall decline in illicit activity is encouraging, the continued rise in stolen funds and ransomware payments underscores the evolving tactics of cybercriminals.

Elephant in the room

Centralized crypto exchanges are not only frequent targets for hackers but also play a significant role in laundering stolen assets. Chainalysis previously found that trading platforms have received nearly $100 billion worth of crypto from known illicit addresses since 2019, pointing to a troubling lack of international cooperation on anti-money laundering efforts.

According to the firm, nearly 30% of all crypto from illicit addresses eventually ends up at sanctioned services, including the Russian exchange Garantex. The peak was in 2022, when $30 billion of “dirty crypto” interacted with such services, underscoring the persistent challenges in combating crypto-based money laundering.

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Blockchain

UAE exempts cryptocurrency transfers from value-added tax

Published

3 months agoon

October 7, 2024By

admin

The UAE, particularly through its Dubai and Abu Dhabi financial hubs, continues to introduce initiatives and regulatory frameworks to attract crypto companies and investors.

Consider the latest update: The UAE announced value-added tax (VAT) exemptions for crypto transfers and conversions.

The UAE’s published changes will take effect on Nov. 15.

The Federal Tax Authority (FTA) on Oct. 2, published Cabinet Decision No. (100) of 2024 to update the executive regulation related to VAT.

The updated executive regulation includes more than 30 amendments affecting various industries.

The nation’s Federal Tax Authority, as per the details shared by business consultancy firm PwC, will apply these exemptions to managing investment funds and other crypto-related activities.

Additionally, PwC reports that the exemptions for the transfer and conversion of virtual assets are treated as effective from Jan. 1, 2018.

Furthermore, the amendments address input tax recovery for crypto companies. PwC explains that in the UAE, crypto is defined as a “representation of value that can be digitally traded or converted and can be used for investment purposes.”

UAE wants to be crypto-friendly

While several countries, including China and India, have been taking a step back when it comes to crypto adoption, the UAE is embracing it.

The country has been actively working to create a favorable environment for blockchain and crypto businesses. Dubai’s Virtual Assets Regulatory Authority is also playing a crucial role in regulating virtual assets in the UAE.

The VAT exemptions for crypto transfers and conversions could attract more crypto businesses to the UAE.

The country’s positive outlook on crypto is also visible from its growth in the market. A recent report from Chainalysis highlighted that the UAE received over $30 billion in crypto between July 2023 and June 2024.

This number has brought the country to the top as MENA’s third-largest crypto economy. Chainalysis also mentioned the rise in the number of venture capital funds and blockchain businesses in the UAE as a factor contributing to the country’s growth.

Source link

Africa

Stablecoins represent 40% of crypto economy in Sub-Saharan Africa

Published

3 months agoon

October 3, 2024By

admin

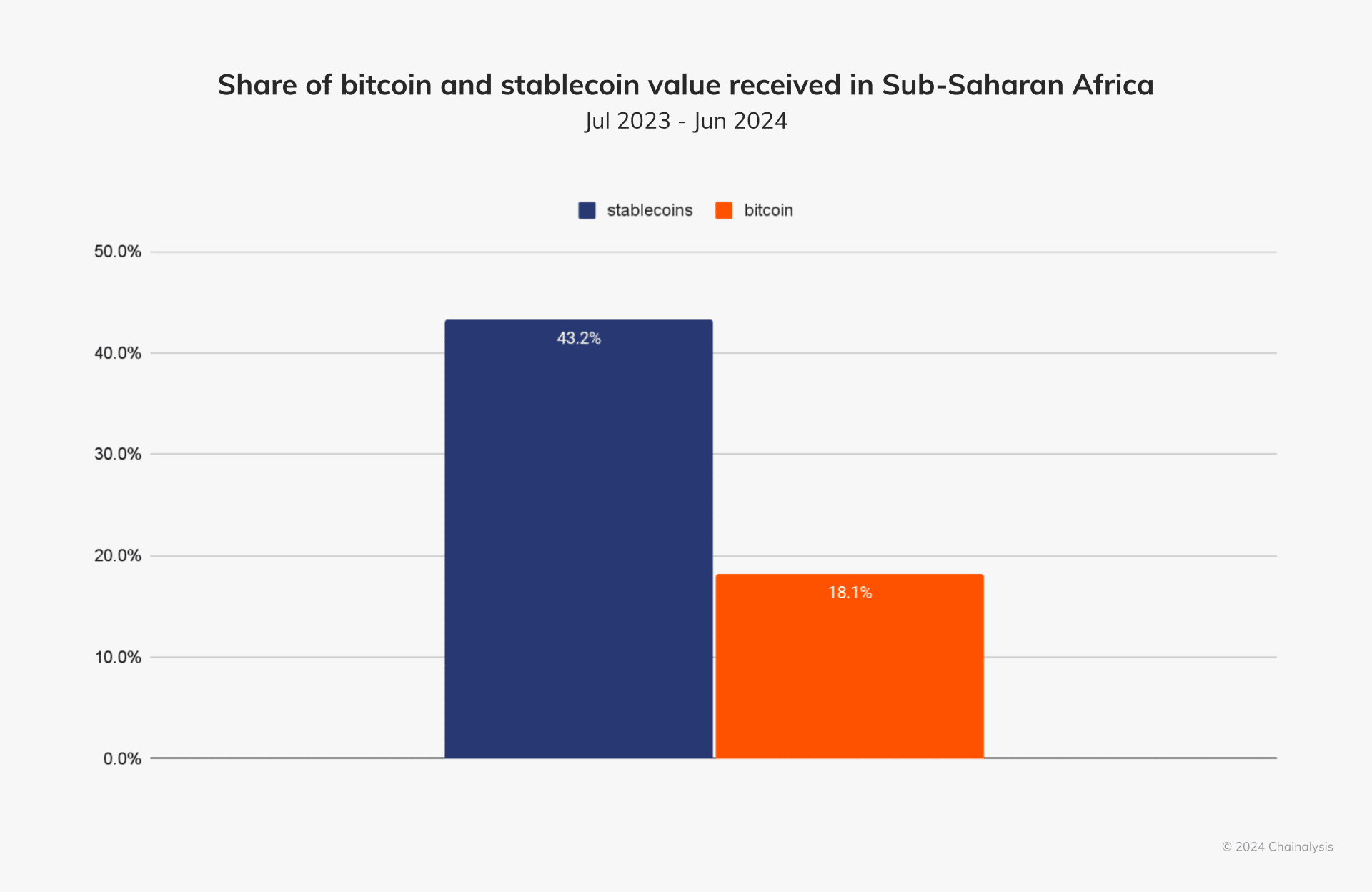

As businesses turn to dollar-pegged options, stablecoins now represent over 40% of Sub-Saharan Africa’s crypto economy.

Stablecoins have emerged as a vital component of Sub-Saharan Africa‘s crypto economy, accounting for approximately 43% of the region’s total transaction volume, according to a recent report from Chainalysis.

In nations grappling with volatile local currencies and limited access to U.S. dollars, dollar-pegged stablecoins such as Tether (USDT) and Circle (USDC) have gained prominence, enabling businesses and individuals to store value, facilitate international payments, and bolster cross-border trade.

In a commentary to Chainalysis, Yellow Card chief executive Chris Maurice said that “about 70% of African countries are facing an FX shortage, and businesses are struggling to get access to the dollars they need to operate.”

Stablecoins to become primary use case for crypto in South Africa

As a result of this struggle, Ethiopia, Africa’s second-most populous nation, has seen retail-sized stablecoin transfers grow by 180% year-over-year, fueled by a recent 30% devaluation of its local currency, the birr.

While traditional financial institutions struggle to meet the demand for U.S. dollars, stablecoins are increasingly viewed as a “proxy for the dollar,” Maurice said, adding that “if you can get into USDT or USDC, you can easily swap that into hard dollars elsewhere.”

Looking ahead, Rob Downes, head of digital assets at ABSA Bank, a major African bank operating in 12 African countries, foresees stablecoins playing a pivotal role in Africa’s economic landscape, stating that dollar-pegged tokens are going to be the “primary use case for crypto in South Africa over the next three to five years.”

Source link

Adoption

MENA received $338b value in crypto as the 7th-largest market

Published

3 months agoon

September 25, 2024By

admin

The Middle East and North Africa region has become the seventh-largest cryptocurrency market as both retail and institutional adoption grows.

According to a Chainalysis report, MENA received $338.7 billion in cryptocurrencies between July 2023 and June 2024, securing the seventh spot. This accounted for 7.5% of the global on-chain value.

1/ MENA is the 7th largest crypto market we studied in 2024, receiving ~$338.7B in on-chain value. Türkiye (#11) and Morocco (#27) rank high in our adoption index, capturing $137B and $12.7B, respectively. pic.twitter.com/uKfFJMsLrF

— Chainalysis (@chainalysis) September 25, 2024

Türkiye leads the region with $137 billion in on-chain value received, followed by Morocco’s $12.7 billion. These two are the only countries in Chainalysis’ global crypto adoption index.

The report found that 93% of the transactions in the region were worth over $10,000, driven by professional and institutional movements.

Per Chainalysis, the United Arab Emirates witnessed impressive growth in retail and institutional on-chain value due to its favorable regulatory landscape.

Last month, Tether, the issuer of the largest stablecoin USDT, announced to create a dirham-pegged stablecoin in the UAE which will be backed by the country’s liquid reserves.

The stablecoin issuer joined forces with Fuze, a crypto infrastructure company, to educate both individuals and large institutions in Türkiye and the Middle East about cryptocurrencies and raise their awareness.

According to data from Chainalysis, Saudi Arabia’s crypto market saw a 154% year-over-year growth in the mentioned timeframe, emerging as the fastest-growing digital asset economy in the region.

Most of the on-chain activity in MENA happened on decentralized exchanges. 32.4% and 30.9% of the on-chain movements in the UAE and Saudi Arabia occurred on DEXs, per the report.

It’s important to note that Saudi Arabia and Qatar still don’t have an operational regulatory framework for crypto companies which could be the main reason behind their DEX use.

The Saudi Arabian Ministry of Investment invested $250 million in the Hedera blockchain in February to boost web3 development in the country.

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential