crypto assets

India’s Ambiguous Crypto Policy: Time for Worldwide Unity

Published

6 months agoon

By

admin

The Indian government stated in a recent declaration to Lok Sabha that there is no fixed timeline for the rollout of the comprehensive set of regulatory guidelines for virtual assets.

The government’s response followed queries posed by two Members of Parliament on what steps were being taken to set up a structured regulatory framework along with an expected timeline for such regulations.

Although the administration noted that it consulted with industry stakeholders and relevant international organizations both formally and informally, it asserted that policy efforts on VDA are needed globally in order to avoid regulatory arbitrage to ANI. India seeks to have effective regulation of borderless crypto assets emerge only through deep international cooperation.

BREAKING:

Crypto regulation discussed in parliament:

Comprehensive Framework: The government is working on a regulatory framework for VDAs but emphasizes the need for international collaboration to address their borderless nature and avoid regulatory arbitrage. pic.twitter.com/Njlvw48Urj

— Crypto India (@CryptooIndia) December 16, 2024

As taxation on VDA-related income already exists and with VDA transactions brought under the Prevention of Money Laundering Act since March 2023, the government said crypto assets are borderless and thus require international cooperation to prevent regulatory arbitrage. The adoption of the “G20 Roadmap on Crypto Assets” during India’s G20 Presidency brought forth the pressing need for collaborative action at the global level while urging all jurisdictions, especially emerging economies, to develop risk-sensitive regulation.

However, challenges linger as India navigates the path of innovation and investor protection alongside economic strength and financial stability. Given that VDAs transcend borders, the investor protection framework is seen as lacking without robust international cooperation. A clear regulatory timeline leaves market participants with clarity to contend with, as policies rooted in national interest as well as shifting global consensus about how to regulate digital assets continue to take shape.

These latest developments uphold a rising vulnerability in India’s quickly changing crypto sector. While it leads many countries in grassroots digital asset adoption, its popularity has also put it at the top of the list for many fraudsters.

The Andhra Pradesh scam, the most recent in a string of high-profile crypto-related frauds, fits a mold that has emerged elsewhere this year in India, where the lure of appealing monthly returns and aggregates framed as affiliated to reputable exchanges have brought investors from all backgrounds into elaborate enterprises.

Source link

You may like

Dems Say They’re Blocked From Info on Verge of Crypto Market Structure Bill Hearings

Dow gains 214 points, markets end higher as strong labor data eases tariff concerns

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

Bitcoin

K33 begins Bitcoin buying with 10 BTC purchase for treasury strategy

Published

8 hours agoon

June 3, 2025By

admin

Norwegian digital asset brokerage K33 has acquired 10 Bitcoin for approximately SEK 10 million.

This purchase marks the first transaction under its newly launched Bitcoin Treasury strategy. The Oslo-based company, listed on the Nasdaq First North Growth Market, plans to scale its Bitcoin (BTC) holdings over time, aiming for a minimum of 1,000 BTC.

It begins. K33 has made its first Bitcoin treasury purchase, and 10 BTC is now held on our balance sheet.

This is more than a transaction. It’s the opening move in a long-term strategy rooted in conviction and operational synergies.

We’re just getting started. pic.twitter.com/EGXi0WJqnj

— K33 (@K33HQ) June 3, 2025

The purchase follows K33’s announcement on May 28 that it raised SEK 60 million (around $5.6 million) from insiders and aligned investors, including Klein Group and Modiola AS, to fund its Bitcoin treasury.

The capital raise involved the issuance of 150.56 million new shares and 301.12 million free warrants, with the latter potentially unlocking an additional SEK 75 million if fully exercised before March 2026.

CEO Torbjørn Bull Jenssen said the strategy reflects K33’s belief in Bitcoin’s long-term role in the global financial system. “Our ambition is to build a balance of at least 1,000 BTC over time and then scale from there,” he said.

Bitcoin as a strategy

K33’s move aligns with a growing trend among public companies using Bitcoin as a strategic asset.

Interest from corporations in digital assets is increasing, with more and more public companies allocating Bitcoin to their balance sheets, according to a recent report from Binance.

K33 offers crypto trading, custody, and research services to institutional clients across EMEA.

By directly holding BTC, the firm aims to deepen synergies between its treasury assets and brokerage business, further anchoring its position in the digital asset market.

Source link

Altcoin

Dogecoin could rally in double digits on three conditions

Published

2 months agoon

March 28, 2025By

admin

Dogecoin rallied nearly 10% this week, resilient in the face of the U.S. President Donald Trump’s tariff war and macroeconomic developments. Most altcoins have suffered the negative impact of Trump’s announcements, DOGE continues to gain, back above $0.2058 for the first time in nearly two weeks.

Dogecoin rallies in double-digits, what to expect from DOGE price?

Dogecoin (DOGE) hit a near two-week peak at $0.20585 on Wednesday, March 26. In the past seven days, DOGE rallied nearly 10%, even as altcoins struggled with recovery in the ongoing macroeconomic developments in the U.S.

The largest meme coin in the crypto market could continue its climb, extending gains by nearly 11%, and testing resistance at the lower boundary of the imbalance zone between $0.24040 and $0.21465.

The upper boundary of the zone at $0.24040 is the next key resistance for DOGE, nearly 24% above the current price.

Two key momentum indicators, the RSI and MACD support a bullish thesis for Dogecoin. RSI is 52, above the neutral level. MACD flashes green histogram bars above the neutral line, meaning there is an underlying positive momentum in Dogecoin price trend.

Dogecoin on-chain analysis

On-chain analysis of the largest meme coin shows that the number of holders of DOGE is on the rise. If Dogecoin’s number of holders keep climbing or steady in the coming week, the meme coin could remain relevant among traders.

The network realized profit/loss metric shows that DOGE holders have realized profits on a small scale. Typically, large scale profit-taking increases selling pressure on the meme coin and could negatively impact price.

The metric supports a bullish thesis for DOGE in the coming week. Dogecoin’s active address count has been steady since mid-March, another sign of the meme coin’s resilience.

DOGE derivatives analysis and price forecast

The analysis of Dogecoin derivatives positions across exchanges shows that open interest is recovering from its March 12 low. Open Interest is $1.98 billion, as Dogecoin trades at $0.19. Coinglass data shows a steady climb in OI in the chart below.

The total liquidations data shows $4.29 million in long positions were liquidated on March 27. Sidelined buyers need to watch liquidations data and prices closely before adding to their derivatives position.

The long/short ratio on top exchanges, Binance and OKX exceeds 1, meaning derivatives traders are betting on an increase in DOGE price.

When technical analysis and derivatives data is combined, it is likely Dogecoin price could test resistance at $0.21465 next week, if spot prices follow the cue of derivatives traders.

What to expect from DOGE

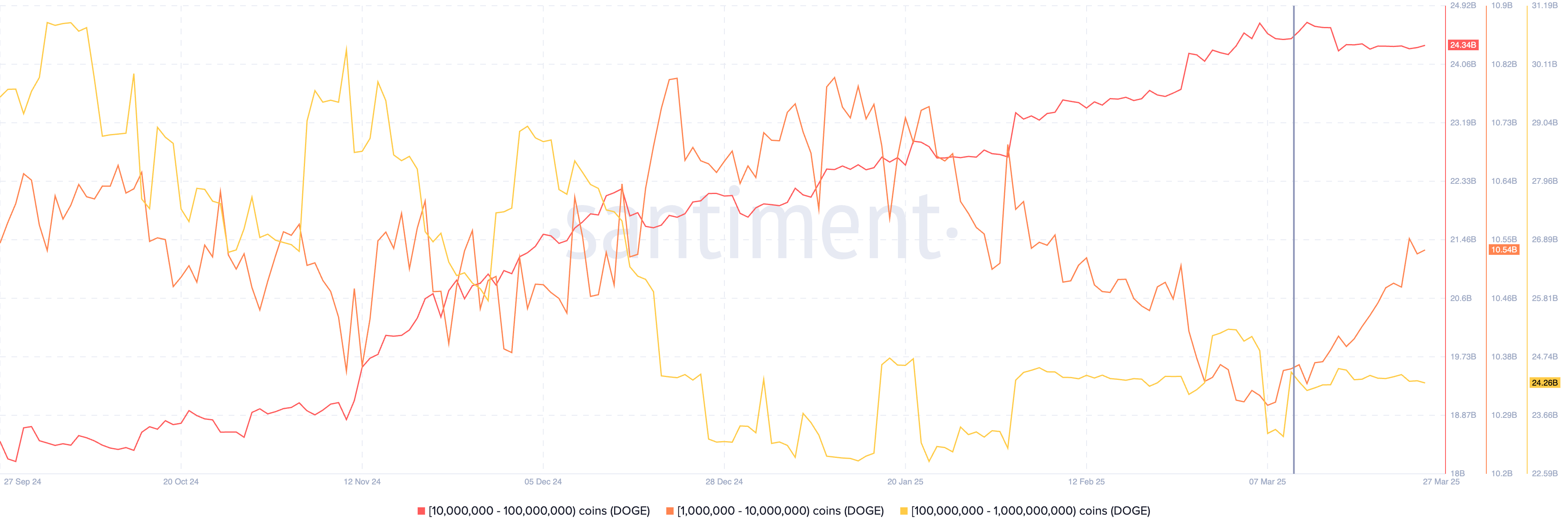

Dogecoin wallets holding between 1 million and 10 million DOGE tokens added to their portfolio consistently between March 10 and 27, while the other two categories, holding between 10 million and 100 million DOGE and 100 million and 1 billion DOGE tokens held nearly steady in the same timeframe.

The data from Santiment shows that DOGE’s traders holding between 1 million and 10 million tokens are rapidly accumulating, even as the token’s price rises. This supports demand for DOGE and a bullish thesis for the meme coin.

Dogecoin ETF and DOGE catalysts

DOGE holders are closely watching developments in Bitwise’s Dogecoin ETF filing with the SEC. The ETF filing is an effort to legitimize the meme coin as an investment category for institutional investors, as DOGE price holds steady among altcoins rapidly eroding in value.

Bitcoin flashcrashes dragged Dogecoin down with it, to a small extent, however the meme token recovered each time and consistent gains could signal an end to DOGE’s multi-month downward trend.

Other key catalysts for Dogecoin are positive updates in crypto regulation, passage of the stablecoin bill in the Congress, and demand for DOGE among whales and large wallet investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Altcoin

XRP hits new all-time high gears to extend bullish streak

Published

5 months agoon

January 19, 2025By

admin

XRP gained 42% in the past week, after rallying close to 1% on Friday. The altcoin hit a new all-time high, with the 24-hour trade volume leaving Ethereum (ETH) to bite the dust on Thursday. The token could extend its streak in the coming days following President-elect Donald Trump’s inauguration.

XRP could extend rally alongside Bitcoin

XRP rallied over 40% in the past week. Bitcoin (BTC), the largest cryptocurrency recovered from its flashcrash under $90,000 and made a comeback above $104,000 on Friday. The native token of the XRPLedger is rallying alongside the top crypto.

Trump’s upcoming inauguration is one of the leading catalysts, alongside optimism on crypto regulation, pro-crypto policy and a new approach by financial regulatory agencies in the U.S.

XRP could gain further, entering price discovery next week.

XRP trades at $3.26 at the time of publication.

On-chain indicators support gains

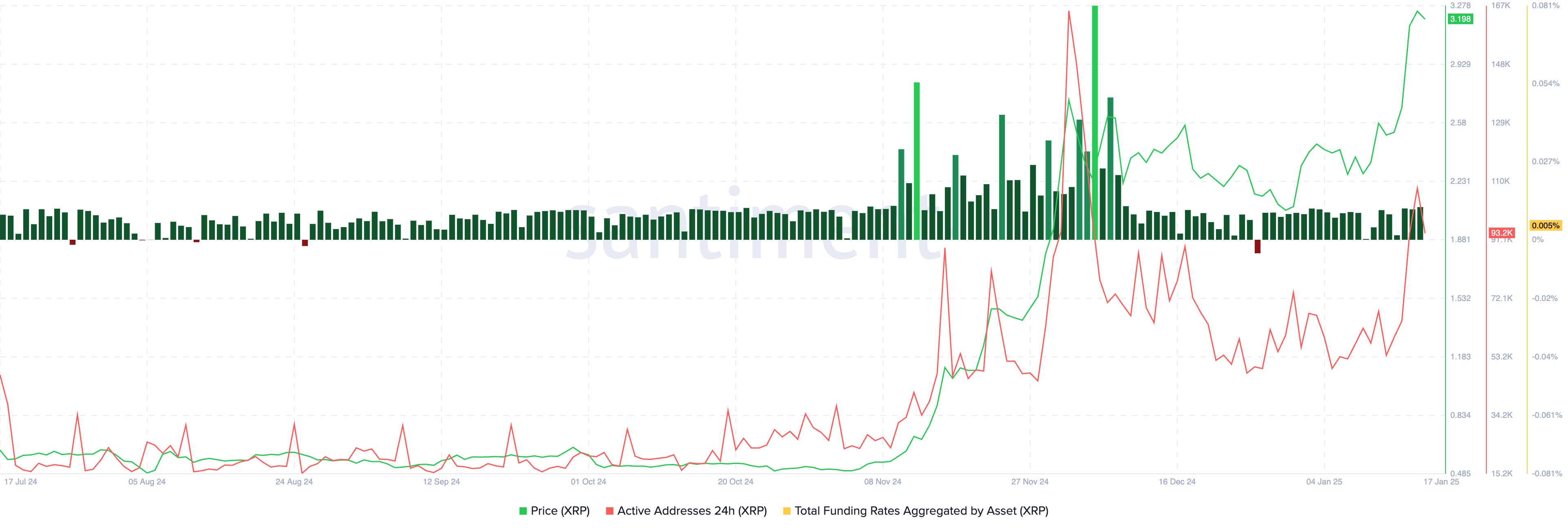

XRP’s on-chain indicators support a bullish thesis for the altcoin. The total funding rate metric is positive, greater than one throughout January 2025. The count of active addresses recorded a large spike on Thursday, Jan. 16.

The on-chain indicators on Santiment are conducive to further gains in XRP in the coming week.

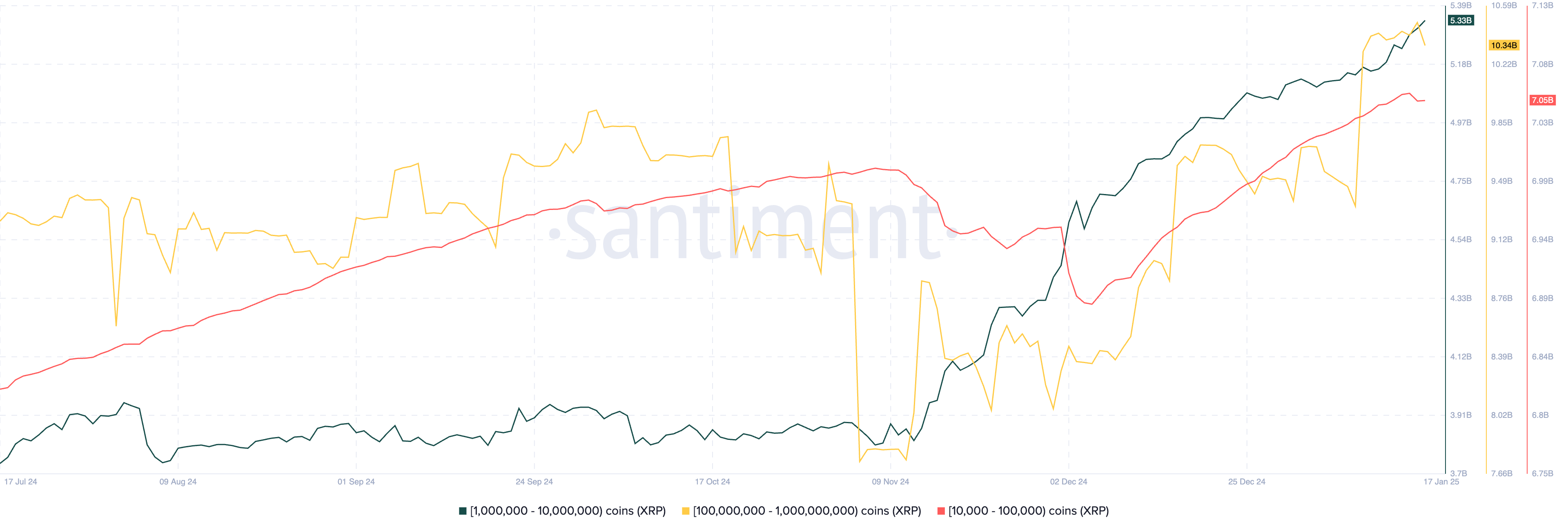

The supply distribution metric on Santiment shows an increase in XRP token supply held by wallets that own 10,000 to 100,000, 1 million to 10 million and 100 million and above XRP tokens. The three classes of holders have accumulated the altcoin, even as the price climbs. This is indicative of a likely XRP price increase in the future.

Market movers and Ripple lawsuit

Monday’s inauguration is the largest market mover in crypto. But RippleNet’s rising adoption among institutions, the developments in RLUSD stablecoin and the SEC’s lawsuit against Ripple are the three key market movers influencing the altcoin’s price.

Even as the U.S. financial regulator filed an appeal against Ripple on Jan. 15, the altcoin continued its rally undeterred. The July 2023 ruling by Judge Analisa Torres that classified secondary sales of XRP as non-securities is being challenged and the SEC is seeking to have those retail sales classified as unregistered securities sales.

Ryan Lee, chief analyst at Bitget Research, told crypto.news in an exclusive interview:

“XRP’s surge can be attributed to favorable outcomes in Ripple’s SEC lawsuit and a more crypto-friendly political climate in the US. If regulatory uncertainties are resolved, the influx of institutional investors could further solidify XRP’s position in the crypto market.”

It remains to be seen whether the Trump administration will support pro-crypto regulation and whether it influences the outcome of lawsuits against firms like Ripple Labs.

Technical analysis and XRP price forecast

XRP is hovering close to its all-time high at $3.40. At the time of writing, XRP traded at $3.2385. A 22% price rally could push XRP into price discovery, at the 141.4% Fibonacci retracement level of the climb from the $1.9054 low to the $3.4000 peak.

The technical indicators, RSI and MACD support a bullish thesis for XRP. MACD flashes consecutive green histogram bars. Traders need to keep their eyes peeled as RSI signals that the token is currently overbought or overvalued, as it reads 83.

In the event of a correction, XRP could find support at the 50% Fibonacci retracement level at $2.6977.

James Toledano, COO at Unity Wallet, told crypto.news in an exclusive interview:

“Given that XRP was stuck at around $0.50 for literally 3 years, its recent breakout momentum reflects new levels of investor optimism around regulatory clarity and the potential approval of an XRP ETF in the following months. If the XRP ETF gets approved, it will have the potential to open the floodgates of capital inflow, meaning it could reach new heights in 2025.”

Toledano warns XRP holders to be wary as altcoins take volatility to the next level in the current market cycle.

He said:

“Altcoin ETFs have genuine potential to attract capital, especially if supported by innovation-friendly policies with the new incoming U.S. administration. But, their success may be less consistent compared to Bitcoin ETFs due to the seemingly episodic nature of interest in altcoins.

Just take a look at fluctuations in Bitcoin’s price this week. The factors are multifaceted; we could say it’s Trump, seasonality, geopolitics, macroeconomics and sentiment all blended together. To play devil’s advocate, we humans are pattern seekers but sometimes there are hidden drivers and the cause and effects are not always linked.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Dems Say They’re Blocked From Info on Verge of Crypto Market Structure Bill Hearings

Dow gains 214 points, markets end higher as strong labor data eases tariff concerns

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

MARA Hits Record-High Bitcoin Production in May

Retail investors no longer FOMO into BTC, altcoins

AVAX Rises 3.8% on Strong Volume, Breaking Key Resistance Levels

K33 begins Bitcoin buying with 10 BTC purchase for treasury strategy

Why $107,500 And $103,500 Are The Levels To Watch

Pakistan Proposes New Crypto Regulations

Japanese Bitcoin Hoarder Metplanet Adds $115,600,000 Worth of BTC As Stock Surpasses 263% Gains on the Year

Bitcoin traders anticipate decline, watch $100K

Ethereum Foundation Restructures R&D Division, Plans ‘Rethink’ on Design and Development

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Pi Network coin to $10? 4 catalysts that may make it possible

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Blockchain groups challenge new broker reporting rule

Xmas Altcoin Rally Insights by BNM Agent I

Trending

24/7 Cryptocurrency News7 months ago

24/7 Cryptocurrency News7 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Markets3 months ago

Markets3 months agoPi Network coin to $10? 4 catalysts that may make it possible

Ripple Price3 months ago

Ripple Price3 months ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin7 months ago

Bitcoin7 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion7 months ago

Opinion7 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin4 months ago

Bitcoin4 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines