Altcoins

Investors Lose Sight Of MATIC As It Drops 16% Ahead Of Upgrade

Published

3 months agoon

By

admin

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

You may like

Shiba Inu Price Eyes 76% Rally As 6.8m SHIB Tokens Burned

VanEck Doubles Down on Big Bitcoin Price Target, Says Key Indicators Continue To ‘Signal Green’

Multichain AI token poised to dethrone SOL, TON: 5,000% gains expected

Will Pi Network Price Reach $100 in This Bull Market?

Axie Infinity developer cuts 21% workforce: report

Chill Guy Meme Coin Pumps Another 50% as Creator Fights Back

The XRP price recently surged to a three-year high of $1.6, marking a significant milestone in the cryptocurrency’s recent bullish rally. This remarkable price movement has garnered the attention of many analysts as investors continue to project the trajectory of the price.

Related Reading

There are basically two ways the XRP price can go from here: either a continued move upwards or a notable correction. An in-between is a consolidation pattern.

CrediBULL Crypto shared his insights on the potential paths the altcoin might take next. Using the Elliott Wave Theory, he highlighted two scenarios that could shape XRP’s near-term future.

What’s The Next Path For XRP Price?

According to CrediBULL Crypto, XRP’s recent rally exhibits a textbook example of a five-wave impulsive move, complete with clearly identifiable subwaves. This pattern confirms that the cryptocurrency has likely reached its absolute bottom at the November low of $0.49, which is a strong foundation for its current upward trend.

The impulsive wave structure suggests that the crypto is at a pivotal juncture, and its future trajectory hinges on whether it sustains specific price levels.

The first possibility centers on XRP failing to maintain its position above $1.05, which is the origin of the fifth subwave in the current impulsive structure. Should this level break, it would confirm that the XRP price is in a larger Wave 2 correction.

According to the Elliot Waves Theory, Waves 2 and 4 are corrective waves, while Waves 1, 3, and 5 are the main bullish waves. before This correction, while bearish in the short term, would lay the groundwork for an even stronger Wave 3 rally in the future.

CrediBULL Crypto predicts a very different outcome if the XRP price manages to hold above the $1.05 level. Holding above the $1.05 level would indicate that the fifth subwave is extending. In this case, the analyst predicted that the XRP price will surpass the $2 mark before experiencing any substantial pullback.

The Road Ahead For XRP

XRP, which had lingered below the $1 threshold for the past three years, has now firmly established itself above this pivotal mark. The recent XRP price surge to $1.6 suggests that the cryptocurrency is in a stronger position to target the $2 milestone rather than retreat into a significant correction. This bullish sentiment is bolstered by speculation around SEC Chairman Gary Gensler’s anticipated resignation in January 2025.

Related Reading

The XRP price climb to $1.6 reflects its growing strength in the market. Nonetheless, the next phase of its journey depends on key support and resistance levels. At the time of writing, the XRP price is trading at $1.46, having corrected by about 8.5% in the past 24 hours. However, the XRP price is still up by 175% in the past 30 days.

Featured image from Pexels, chart from TradingView

Source link

ADA

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Published

1 day agoon

November 24, 2024By

admin

The layer-1 blockchain Cardano (ADA) is primed to continue its long-awaited price surge, according to a popular crypto analyst.

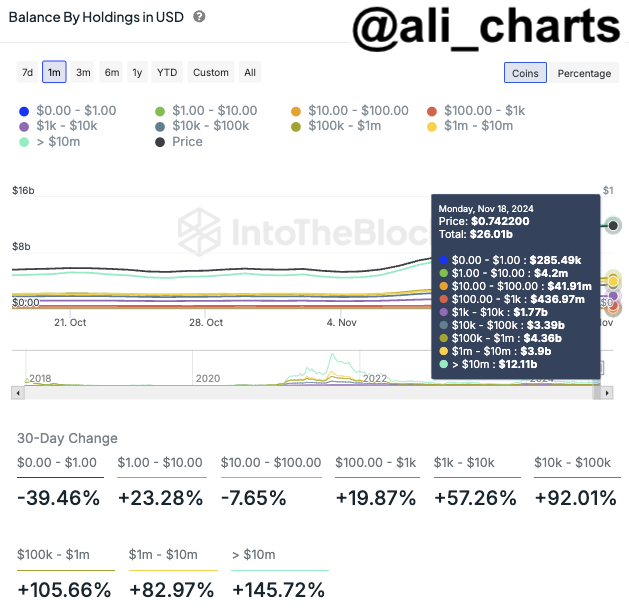

The digital asset trader Ali Martinez tells his 87,300 followers on the social media platform X that whales and “institutional players” have been buying into the Ethereum (ETH) competitor in anticipation of further price increases.

“The volume of large Cardano ADA transactions on the network has surpassed $22 billion per day. Those large transactions appear to be related to high accumulation levels. Indeed, whales holding from $1 million to over $10 million in ADA have increased their positions by more than 100% in the past month.

The high buying pressure is starting to move prices, and from a technical perspective, Cardano seems to be mirroring its previous bullish cycle. If this pattern holds true, ADA could target $6!”

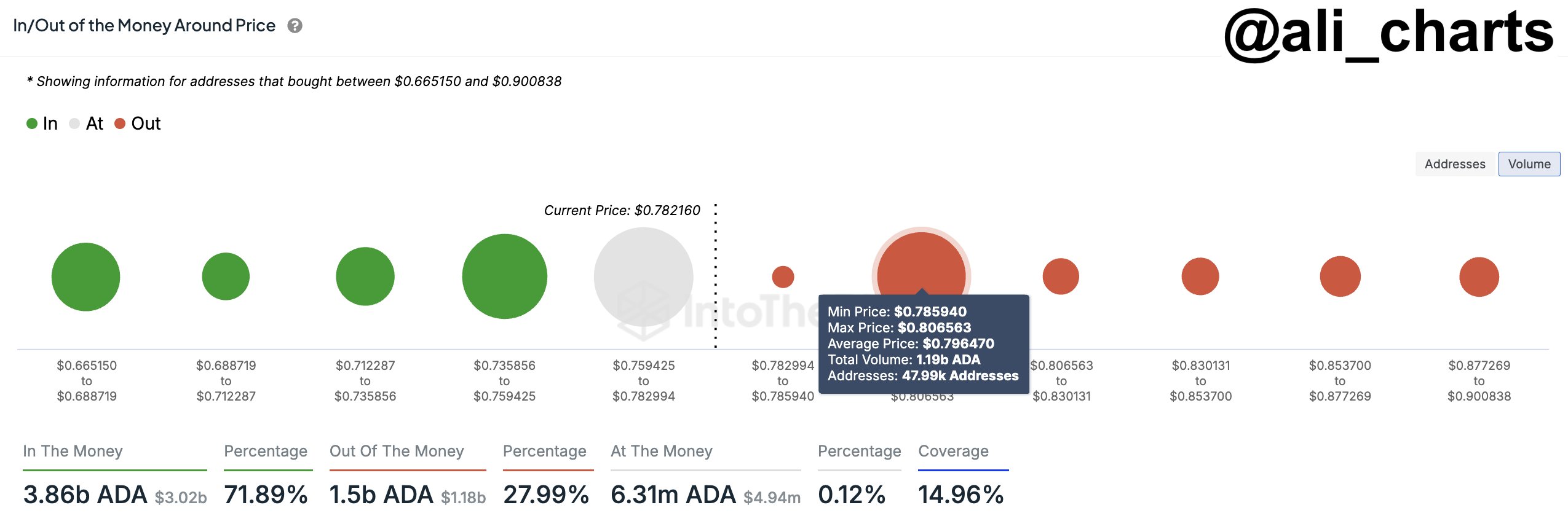

Martinez also notes that one “key area” of support that ADA needs to hold to maintain its bullish thesis is $0.80. At that price point, 48,000 addresses bought nearly 1.20 billion ADA.

ADA is trading at $1.06 at time of writing. The ninth-ranked crypto asset by market cap is up more than 24% in the past 24 hours, more than 48% in the past seven days and nearly 200% in the past month.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

Analyst Says Dogecoin Has Way More Room To Grow, Sees Potential Rally to New All-Time High for DOGE

Published

5 days agoon

November 20, 2024By

admin

A closely followed crypto strategist believes that top memecoin Dogecoin (DOGE) may be gearing up for an explosive surge.

Analyst Ali Martinez tells his 80,000 followers on the social media platform X that DOGE has more upside potential based on the level of public interest relative to its current price level.

He uses Google search trends to gauge the level of interest for the top memecoin by market cap.

“I read people saying Dogecoin will not go higher because of ‘market cap,’ ‘sell the news,’ ‘better memes.’ Well, when you look at the interest in DOGE over time, it isn’t even at peak popularity yet. Long story short, DOGE has way more room to grow.”

He also says that DOGE may be forming a bull flag pattern on the hourly timeframe and may soon surge past its all-time high of about $0.74. In technical analysis, a bull flag is viewed as a continuation pattern, indicating that an asset is consolidating and gearing up for a fresh rally.

“Dogecoin appears to form a bull flag! I’m looking out for an hourly close above $0.40 which could trigger a breakout to $0.85!”

DOGE is trading for $0.3742 at time of writing, up 3.6% in the last 24 hours but down about 49% from its all-time high of $0.731.

Lastly, the analyst says that Bitcoin (BTC) may override a bearish signal from the TD Sequential indicator and hit six figures.

Traders use the TD Sequential indicator to predict potential trend reversals for tokens based on the closing prices of their previous nine or 13 bars or candles.

“Finally, I believe a sustained daily close above $91,900 will invalidate this bearish Bitcoin outlook and trigger a breakout to $100,680!”

Bitcoin is trading for $90,885 at time of writing, up 1.6% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Shiba Inu Price Eyes 76% Rally As 6.8m SHIB Tokens Burned

VanEck Doubles Down on Big Bitcoin Price Target, Says Key Indicators Continue To ‘Signal Green’

Multichain AI token poised to dethrone SOL, TON: 5,000% gains expected

Will Pi Network Price Reach $100 in This Bull Market?

Axie Infinity developer cuts 21% workforce: report

Chill Guy Meme Coin Pumps Another 50% as Creator Fights Back

Super Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

AI predicts one altcoin set to outperform XRP and Solana in 2025

BTC and Major Altcoins Pullback, SAND Soars 60%

Трамп обирає менеджера прокрипто-хедж-фонду Скотта Бессента на посаду міністра фінансів

Trump calls up crypto pals, Senator says sell gold for Bitcoin | Weekly Recap

Where to Invest in November End?

XRP Price Hits 3-Year High At $1.6

Australia seeking advice on crypto taxation to OECD

Crypto Trader Records $2.5M Profit With This Token, Here’s All

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential