ETF

Is the Eth ETF launch a “sell the news” scenario?

Published

5 months agoon

By

admin

Spot Ethereum Exchange-Traded Funds are set to debut on July 23, following the SEC’s rule change over two months ago.

According to a report by Kaiko, the initial inflows to these Exchange-Traded Funds (ETFs) will most likely affect Ethereum’s (ETH) price. However, whether the effect will be positive or negative is still up for grabs.

“The launch of the futures based ETH ETFs in the US late last year was met with underwhelming demand, said Will Cai, head of indices at Kaiko. “All eyes are on the spot ETFs’ launch with high hopes on quick asset accumulation. Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days.”

Several Ethereum ETFs from BlackRock, Fidelity, Bitwise, VanEck, 21Shares, Invesco, Franklin Templeton, and Grayscale are scheduled to start trading on July 23.

What are we expecting today for the Ethereum ETFs?

We expect them to begin trading tomorrow. That means we should see a bunch of filings on SEC site today that say the ETFs’ prospectuses have gone “effective”. Likely after or around market close. Here are the race entrants: pic.twitter.com/AkBxEjBRvv

— James Seyffart (@JSeyff) July 22, 2024

The influx of money could cause ETH to surge even though last year, futures-based ETH ETFs received a lukewarm reception. There is cautious optimism about spot ETFs’ asset accumulation and how it could reflect the price of ETH.

ETH prices briefly spiked in May following spot ETF approval but have since trended lower. At $3,500, ETH is facing a crucial supply wall.

Grayscale’s ETH ETF fees

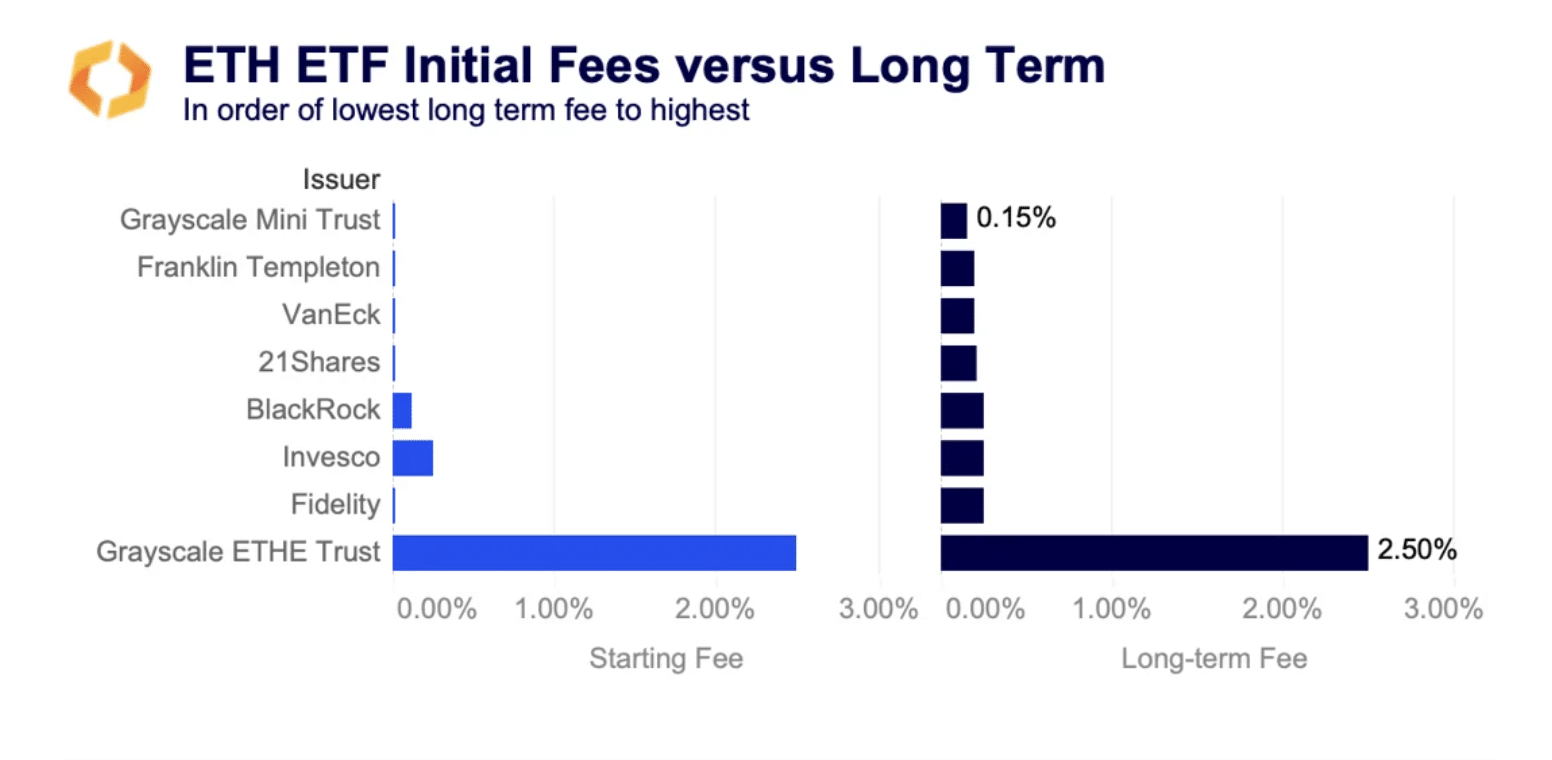

Grayscale, a prominent crypto player, plans to convert its ETHE trust into a spot ETF and introduce a mini trust seeded with $1 billion from the original fund. Grayscale’s ETHE fee will remain 2.5%, much higher than its competitors.

Most issuers will offer fee waivers to attract investors, with some waiving fees for six months to a year or until assets reach between $500 million and $2.5 billion. This fee war reflects the fierce competition in the ETF market, leading ARK Invest to exit the ETH ETF race.

This echoes Grayscale’s Bitcoin (BTC) ETF strategy, where they maintained high fees despite competitive pressures and sell-offs.

According to Kaiko, Grayscale’s decision to keep its fees high might lead to ETF outflows, leading to sell-off prices, similar to the post-conversion performance of its GBTC.

The ETHE discount to net asset value has recently narrowed, indicating traders’ interest in buying ETHE below par to redeem at net asset value post-conversion for profits.

ETH ETF volatility

Additionally, implied volatility for ETH has surged over the past few weeks due to a failed assassination attempt on Donald Trump and President Joe Biden’s announcement that he won’t run for president again. This reflects traders’ nervousness about the upcoming ETF launch.

According to Kaiko, contracts expiring in late July experienced a rise in volatility from 59% to 67%, indicating the market’s anticipation and potential price sensitivity to initial inflow numbers.

Source link

You may like

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Bitcoin

Metaplanet shares added to Amplify Transformational Data Sharing ETF

Published

4 weeks agoon

November 28, 2024By

admin

Metaplanet has been added to the the Amplify Transformational Data Sharing ETF or BLOK, a global index that invests in leading blockchain companies including SBI Holding, MicroStrategy and Nvidia.

On Nov. 28, the Japanese investment firm announced its inclusion into BLOK, joining a lineup of 53 companies that engage in the development and utilization of blockchain technology. The ETF features leading industry players including MicroStrategy, Robinhood, Nvidia, and SBI Holdings.

According to the press release, Metaplanet’s estimated starting weight on the BLOK will be around 2.9%. As of Nov. 29, the companies occupying to top spots on the Amplify Transformational Data Sharing ETF Blockchain leaderboard include Core Scientific, HUT 8, Coinbase, Galaxy Digital, MicroStrategy and Robinhood.

BLOK is managed by Amplify ETFs and leverages an active strategy to find and invest in companies that utilize blockchain technology in its daily operations, serving as a guide for investors looking for opportunities to inject capital into the blockchain sector.

BLOK holds more than $930 million in net assets, cementing itself as a widely followed ETF in the blockchain investment landscape.

CEO of Metaplanet, Simon Gerovich, shared the news on his X account. He stated that Metaplanet’s inclusion into the Amplify Transformational Data Sharing ETF further highlights the growing recognition of Metaplanet’s Bitcoin(BTC) acquisition strategy and the firm’s status as “Japan’s leading Bitcoin Treasury Company.”

Nicknamed “Asia’s MicroStrategy” by market proponents, Metaplanet has accumulated a Bitcoin trove of 1,142 BTC, worth $109.21 million at current market prices.

Excited to announce that Metaplanet has been added to its second major ETF, the Amplify Transformational Data Sharing ETF (“BLOK”). This inclusion highlights growing recognition of our leadership as Japan’s leading Bitcoin Treasury Company. BLOK holds a 4.4% stake in Metaplanet. https://t.co/9mgfCmUtGd pic.twitter.com/d8RgaVUowm

— Simon Gerovich (@gerovich) November 28, 2024

Metaplanet currently stands in 14th place, with the ticker 3350 JP, holding a current market value of $23.04 million.

Earlier this month, Metaplanet was included in CoinShares’ Blockchain Global Equity Index, also known as the BLOCK Index. The index tracks the performance of 45 companies that dabble in crypto and blockchain technology.

As previously reported by crypto.news on Oct. 23, Japan regulators are still reluctant to adopt spot crypto ETFs despite countries like the U.S. and Hong Kong already approving ETFs, according to Sumitomo Mitsui Trust Asset Management.

Source link

Bitcoin

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

Published

4 weeks agoon

November 26, 2024By

admin

Bitcoin (BTC) has dropped 7.6% since it almost — but not quite — touched the psychological wall of $100,000 on Nov. 22.

That’s the biggest drop since Donald Trump won the U.S. presidential election, sparking a rally that sent the largest cryptocurrency by market capitalization soaring from a level of around $66,000 through its record high.

Even so, the slide isn’t out of the ordinary. In bull markets bitcoin typically tumbles as much as 20% or even 30%, so-called corrections that tend to flush out leverage in an overheated market.

A large part of the reason the bitcoin price didn’t get to $100,000 was the amount of profit-taking that took place. A record dollar value of $10.5 billion of profit-taking took place on Nov. 21, according to Glassnode data, the biggest day of profit-taking ever witnessed in bitcoin.

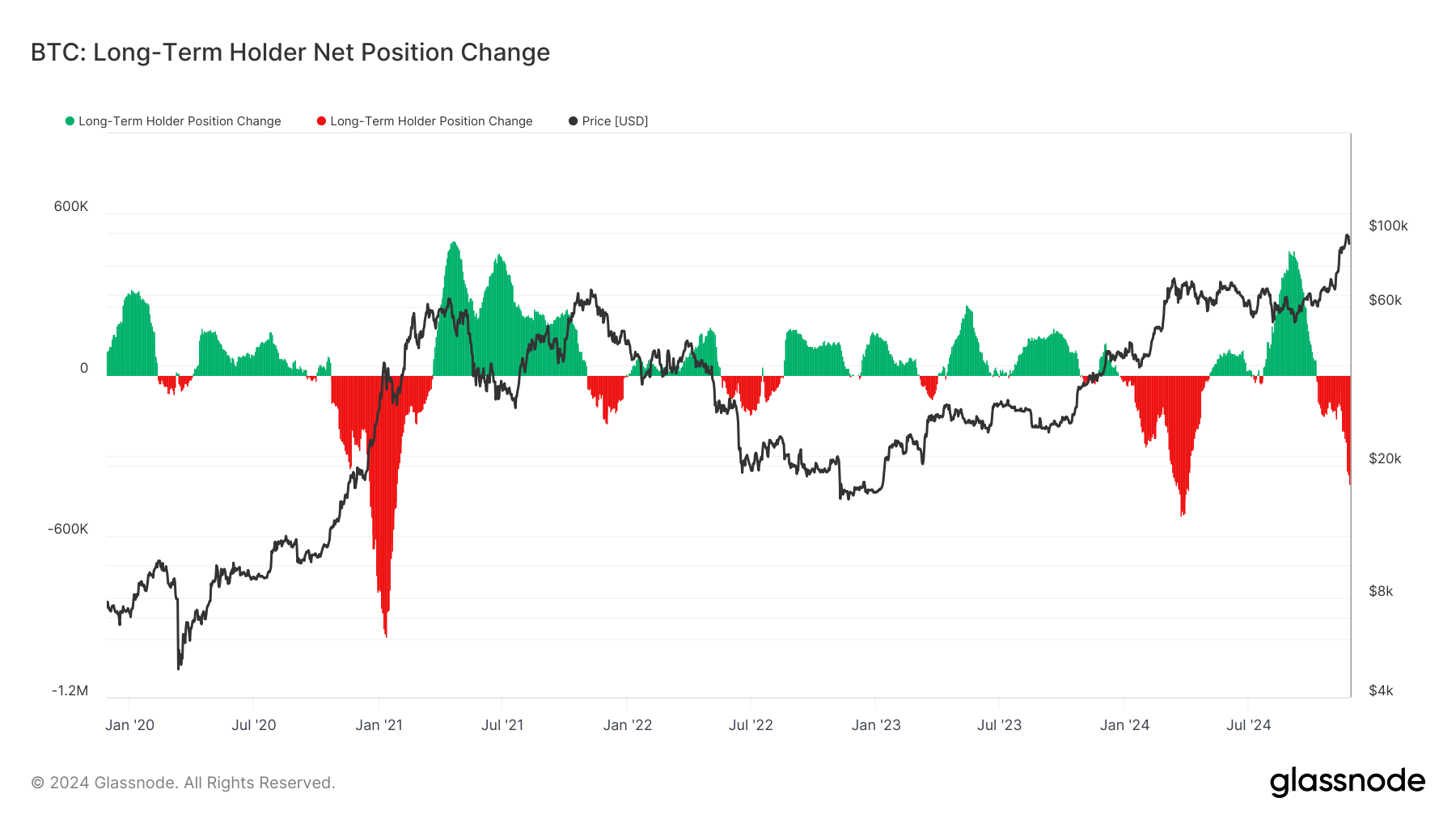

At the root of the action are the long-term holders (LTH), a group Glassnode defines as having held their bitcoin for more than 155 days. These investors are considered “smart money” because they tend to buy when the BTC price is depressed and sell in times of greed or euphoria.

From September to November 2024, these investors have sold 549,119 BTC, or about 3.85% of their holdings. Their sales, which started in October and have accelerated since, even outweighed buying from the likes of MicroStrategy (MSTR) and the U.S. spot-listed exchange-traded funds (ETFs).

How long is this selling pressure going to last?

What’s noticeable from patterns in previous bull markets in 2017, 2021 and early 2024, is that the percentage drop gets smaller each cycle.

In 2017, the percentage drop was 25.3%, in 2021 it reached 13.4% and earlier this year it was 6.51%. It’s currently 3.85%. If this rate of decline were to continue, that would see another 1.19% drop or 163,031 BTC, which would take the cohort’s supply to 13.54 million BTC.

Each time, the long-term investors’ supply makes higher lows and higher highs, so this would also be in line with the trend.

Source link

24/7 Cryptocurrency News

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Published

4 weeks agoon

November 26, 2024By

admin

Asset management firm Hashdex has made further progress toward launching a cryptocurrency-focused exchange-traded fund (ETF) in the United States. According to an announcement on Nov. 25, the company has submitted its second amended S-1 application with the U.S. Securities and Exchange Commission (SEC).

Hashdex Second Amendment for Nasdaq Crypto Index US ETF

Hashdex’s latest filing represents another step in its ongoing efforts to secure regulatory approval for the Nasdaq Crypto Index US ETF. The ETF aims to provide investors with exposure to a diversified portfolio of cryptocurrencies.

Initially, the fund will include Bitcoin (BTC) and Ether (ETH), the only two assets currently listed in the Nasdaq Crypto US Index. However, the filing noted that the portfolio could expand to include other digital currencies over time.

The amended filing comes after Hashdex’s initial S-1 application was modified in October when the SEC sought additional time to review the proposal. The SEC has historically been cautious in approving cryptocurrency-related products, and the amended filings demonstrate Hashdex’s ongoing compliance efforts to meet regulatory requirements. Despite the US SEC’s stance, firms have continued to file for Spot exchange-traded fund (ETF) like the latest one by WisdomTree for an XRP ETF.

Growing Interest in Crypto Index ETFs

Crypto index ETFs have emerged as a key area of focus for asset managers as demand for diversified investment products grows. Industry observers compare these ETFs to traditional index funds, such as those tracking the S&P 500, which provide investors with broad market exposure.

“Index ETFs are efficient for investors — just like how people buy the S&P 500 in an ETF. This will be the same in crypto,” said Katalin Tischhauser, head of investment research at Sygnum, a cryptocurrency-focused financial institution.

Hashdex is not alone in its pursuit of a cryptocurrency index ETF. Other asset managers, such as Franklin Templeton and Grayscale, are also seeking approval for similar products. The Franklin Crypto Index ETF would track the CF Institutional Digital Asset Index, which, like the Nasdaq Crypto US Index, currently focuses on Bitcoin and Ethereum. Grayscale’s Digital Large Cap Fund, which holds a basket of cryptocurrencies including Bitcoin, Ethereum, Solana (SOL), and XRP, has also applied for conversion to an ETF.

Potential Regulatory Changes and Market Implications

The regulatory landscape for cryptocurrency ETFs in the United States could shift significantly in the coming months. The SEC’s current Chair, Gary Gensler, has announced plans to step down on Jan. 20, 2025. This timeline coincides with the start of Donald Trump’s second presidential term. Trump, who has expressed a pro-crypto stance, has previously criticized Gensler’s strict approach to cryptocurrency regulation and promised reforms aimed at fostering growth in the sector.

Regulatory analysts suggest that the leadership transition at the SEC may impact the approval process for cryptocurrency-related financial products. Bloomberg ETF analyst James Seyffart stated that approval for index ETFs holding altcoins like XRP and Solana may depend on whether the SEC considers these smaller assets compliant with existing rules.

“Regulatory concerns about altcoins in index ETFs could be reduced if most of the allocation remains in Bitcoin and Ethereum,” Seyffart explained. He added that while there is optimism about these products, the ultimate decisions will likely hinge on the incoming SEC administration’s priorities and approach.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: