Altcoin

Is Toncoin Set for a Comeback? Key Market Signals Point to a Possible Rebound

Published

4 weeks agoon

By

admin

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis.

Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics.

When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…)

Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life.

In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps.

Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think’s probably unfeasible, I’ve done already a hundredfold.”

PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp.

Source link

You may like

Metaplanet adds 135 Bitcoin, total holdings reach 2,235 BTC

Altseason Canceled? How Trading Syndicates, Scams and Geopolitics Buried Hopes for Growth

Bitcoin Reserve Bill Fails as South Dakota Lawmakers Shut Down Proposal

Citadel Securities Makes a Play for Crypto Trading After Years of Skepticism

U.S. Law Enforcement Seizes $31M in Crypto Tied to Uranium Finance Hack

This hidden crypto project is quickly becoming among the best altcoins to hold in 2025

Altcoin

Technical Indicator Shows Ongoing Rally For Dogecoin

Published

1 day agoon

February 23, 2025By

admin

Dogecoin is holding firm above major support at $0.22 despite repeated threats to break below in the just concluded week. Amidst these fluctuations, an interesting technical indicator suggests that Dogecoin’s long-term rally is still intact.

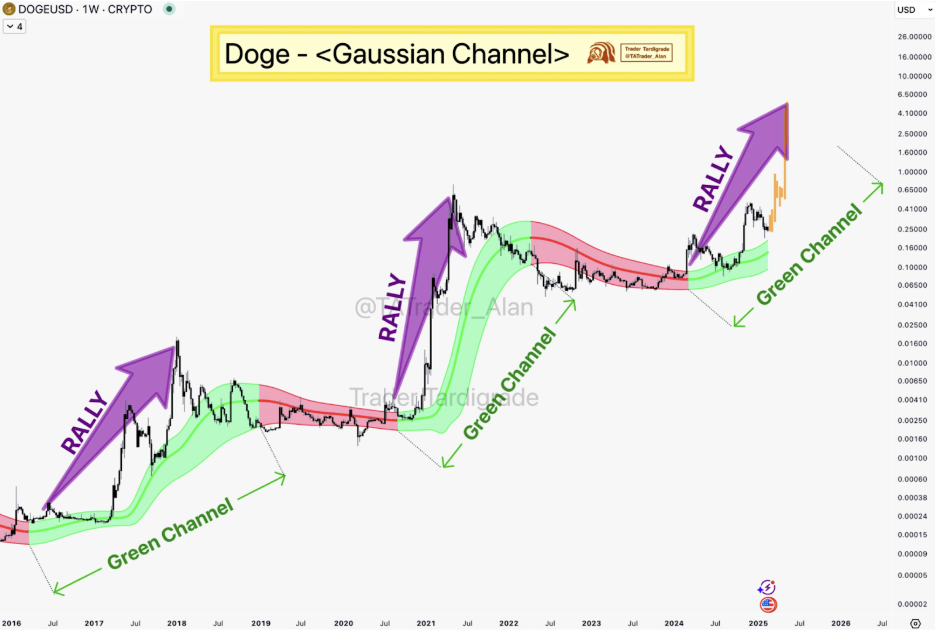

This technical indicator’s outlook was pointed out by crypto analyst Trader Tardigrade, who used the Gaussian Channel, a popular momentum tool, as evidence that Dogecoin’s bullish momentum is still in play despite the current selling pressures.

Related Reading

Gaussian Channel Shows Continued Bullish Strength For Dogecoin

Dogecoin’s price trajectory has been highlighted by a decline since mid-January. This decline has seen Dogecoin fall by as high as 47% from a lower high of $0.4159 on January 18. The price correction is even more pronounced when considering its multi-year high of $0.475, which it achieved on December 9, 2024, from which Dogecoin has now corrected by approximately 54%.

This notable correction has also seen the development of a few bearish signals on the Dogecoin price chart. One such bearish development is the rejection at a macro resistance and the failure to reclaim the macro golden pocket in the recent week.

However, despite the notable correction in the Dogecoin price, the meme coin seems to be still trading in an uptrend in the longer term. This long-term outlook is revealed through the analysis of Dogecoin on the weekly candlestick timeframe using the Gaussian Channel.

The Gaussian Channel is a lesser-known technical analysis tool that helps identify trends and cycles in price movements by highlighting green and red zones in different market cycles. The green zones represent periods of upward momentum, where the price is expected to keep growing. On the other hand, red zones indicate periods of correction or consolidation, during which the market pauses before resuming its upward trajectory.

According to a Dogecoin price chart shared by crypto analyst Trader Tardigrade on social media platform X, Dogecoin entered into its most recent green zone on the Gaussian Channel in 2024. However, despite the recent correction, it has remained in this green zone, indicating that Dogecoin’s uptrend is still active in the long term.

Image From X: Trader Tardigrade

Long-Term Price Target For DOGE

With the Gaussian Channel still indicating the green zone for Dogecoin, the rally could resume anytime soon. According to Trader Tardigrade’s projection, this rally will be enough to push DOGE above multiple resistance levels at $0.3, $0.4, and the recent multi-year high of $0.475.

If momentum builds and buying pressure increases, Dogecoin may even retest its all-time high of $0.7316, which has remained unchallenged since the peak of the 2021 bull run.

Related Reading

Beyond these immediate targets, Tardigrade’s analysis suggests that the meme coin’s long-term trajectory could extend well beyond the $1 mark. The forecast envisions an even more aggressive rally that could see Dogecoin climbing as high as $4.1. At the time of writing, Dogecoin is trading at $0.247, up by 1.5% in the past 24 hours but down by 25% since the beginning of February.

Featured image from TheStreet, chart from TradingView

Source link

Altcoin

Maker Gears to Extend Rally Next Week, 15% Gains Likely

Published

3 days agoon

February 22, 2025By

admin

Maker (MKR) price rallied over 44% in the past week. The DeFi token holds steady even as large wallet investors and whales holding MKR take profits in the ongoing price surge. On-chain and technical indicators support further gains in Maker.

Maker derivatives and on-chain analysis

Sky Protocol (formerly Maker’s) (MKR) MKR token has defied market trends in the past week. The token gained over 44% in value, according to price data on Crypto.news. Derivatives data and on-chain analysis supports a bullish thesis for the DeFi token for next week.

Derivatives data from crypto intelligence platform Coinglass shows a large positive spike in Open Interest in MKR on February 21. The spike represents a massive increase in the total value of open contracts in MKR across derivatives exchanges.

Coinglass data shows that MKR OI is $116.85 million at the time of writing on Friday, February 21.

The total value of assets locked in MKR surged to $5.675 billion, as seen on DeFiLlama. This coincides with the rising price, relevance, and demand for tokens among traders. The rebranding to Sky protocol has proven effective for driving adoption in market participants.

Santiment data shows several negative spikes in Network realized profit/loss metric in the MKR chart since mid-January 2025. This shows several traders and MKR holders are shedding their holdings and realizing losses.

Consistent realization of losses is typically considered a sign of capitulation and is consistent with an eventual recovery in the token’s price. MKR’s daily active addresses recorded a nearly three-month peak this week, signalling the rise in interest from traders.

MKR token’s supply held by whales (excluding exchange wallets) has climbed, recovering from the decline noted in the first week of February. This is another bullish sign for the DeFi token.

The In/Out of money around price indicator on IntoTheBlock shows that 30% of the wallet addresses holding MKR are currently sitting on unrealized losses. 65.55% of MKR token holders have unrealized gains in their portfolio.

Combining the In/Out of the money with the Network realized profit/loss metric, it is less likely that profitable traders take profits as the current trend is that of capitulation. The likelihood of further selling pressure on MKR is low for next week, meaning the token could extend its gains and maintain the underlying positive momentum.

Maker (MKR) weekly price forecast

Maker broke out of its downward trend on February 12, since then the token has rallied, extending gains nearly everyday this week. At the time of writing, MKR is trading at $1,473, on Friday.

The token is close to resistance at $1,632 and $2,050, two key levels in MKR’s upward trend between October 26 and December 4, as observed in the daily price chart. In the event of a correction, MKR could find support at $1,125.

Two key technical indicators, the Moving average convergence divergence indicator and relative strength index flash bullish signs on the daily timeframe. MACD shows consecutive green histogram bars above the neutral line and RSI reads 74 and is sloping upwards.

While this typically generates a sell signal, in the case of MKR, MACD and the underlying positive momentum in the MKR price trend support further gains.

A rally to test resistance at $1,632 marks a nearly 15% rally in MKR price.

Even as whales cash out their MKR holdings amidst price surges, they fail to influence prices negatively. While it is typical of a token to observe a decline in its price if large entities shed their holdings, MKR price is holding steady.

A wallet address identified as inveteratus.eth on the blockchain sold 1,230 MKR worth 1.78 million USDC and secured a 30% profit of $418,000 within less than a month.

On-chain data shows that in April 2024, the whale took a $1.86 million profit from previous MKR trades. The cumulative profit of the whale is $2.27 million through MKR trades.

MKR holds steady amidst DAO drama

The drama surrounding Sky Protocol (Maker DAO) is being identified as a “potential governance attack,” according to the community on X.

@ImperiumPaper, a long-time Maker community member, expressed dissent over a fast-tracked governance proposal that asked for relaxing restrictions on borrowing against MKR, the governance token of the Sky Protocol chain.

Yesterday, an emergency proposal appeared on the MakerDAO @skyecosystem forum and voting portal. This proposal, which has passed but still pending timelock, dramatically increases both the amount and the LTV that Maker will lend against its own gov token.

See below: pic.twitter.com/WWm8FCg1wK

— PaperImperium (@ImperiumPaper) February 19, 2025

As the community debates the proposal, one side argues that it has “bypassed due process” and the effects would include “>2x the credit line for MKR token holders, raising their LTV from 50% to 80%.”

While the DAO drama unfolds, the token continues its rally.

Maker tokens worth $17 million burnt, support gains

The second market mover for MKR this week is the $17 million token burn, identified on the blockchain. When a large volume of tokens is burnt, they are removed from the supply permanently, and they reduce the selling pressure, supporting price gains.

Whale alert: a tracker identified the 14,000 MKR token burn worth upwards of $16.9 million, adding to the catalysts driving the price higher this week.

At the time of writing, MKR trades at $1,432 on Friday.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Altcoin

Experts Say XRP’s True Value Could Be $10,000

Published

4 days agoon

February 21, 2025By

admin

A popular cryptocurrency has once again captured the attention of many crypto investors after some experts started discussing the potential long-term valuation of the digital asset. Prominent market analysts believe that XRP could possibly reach $10,000 per coin, saying that the notion is “not a crazy” prediction but a conservative one.

Related Reading

Realistic Price

Several crypto analysts argued that a valuation forecast of $10,000 is feasible which they believe could be fueled by institutional adoption and its potential role in global finance.

“$10,000 XRP isn’t crazy. It’s conservative,” Rowen Exchange said in an X post.

The crypto analyst showed a number of reasons why the $10,000 price target for XRP is a conservative figure.

Institutional Adoption

According to Rowen Exchange, one of the strongest arguments that XRP could reach $10,000 is the token’s adoption. The crypto analyst explained that the token has experienced exponential growth in its institutional adoption.

$10,000 XRP isn’t crazy. It’s conservative. pic.twitter.com/465NEEhYGm

— Rowen Exchange (@RowenExchange) February 11, 2025

Rowen Exchange pointed out that once major banks, payment processors, and governments increase their usage of XRP for cross-border payments, the demand for the tokens is expected to soar leading to a price surge.

The crypto expert said that XRP has a total supply of 100 billion coins. However, Rowen Exchange noted that only half of the token’s total supply is actually circulating in the market because of escrow releases and long-term holdings.

The analysts theorized that once institutions start hoarding the token for liquidity purposes, it is predicted that it would result in a supply squeeze which might push the price to go up.

Rowen Exchange added that institutional adoption is different from retail-driven speculation because it can provide sustained liquidity and volume, leading to an ascending price over time.

Although $10,000 could be a conservative estimate, XRP would be required to grow by over 362,000% to reach that price target from its current price of $2.76, something skeptics see as a long way to go for the token.

Related Reading

‘Highly Unlikely’

Meanwhile, a crypto community member commented on Rowen Exchange’s post saying that the $10,000 price target is “highly unlikely.”

The crypto investor disagrees with the prediction arguing that in order for XRP to reach $10,000, the token would need to have a market cap of $1 quadrillion, arguing that it is “unrealistic” since the market cap of the entire cryptocurrency is about $3 trillion, as of 2024 while the global economy has around $100 trillion.

However, another crypto analyst believes that market capitalization is irrelevant in XRP’s potentially reaching $10,000, explaining that market cap does not matter because the token’s value is utility and not speculation.

The analyst added that XRP can facilitate massive global transactions efficiently, claiming that the token is built for the next era of global finance.

Featured image from DALL-E, chart from TradingView

Source link

Metaplanet adds 135 Bitcoin, total holdings reach 2,235 BTC

Altseason Canceled? How Trading Syndicates, Scams and Geopolitics Buried Hopes for Growth

Bitcoin Reserve Bill Fails as South Dakota Lawmakers Shut Down Proposal

Citadel Securities Makes a Play for Crypto Trading After Years of Skepticism

U.S. Law Enforcement Seizes $31M in Crypto Tied to Uranium Finance Hack

This hidden crypto project is quickly becoming among the best altcoins to hold in 2025

Solana Faces Make-Or-Break Moment With $1.77 Billion Unlock

OKX Pays $84 Million to Settle US DOJ Probe

Brian Armstrong Calls Memecoins ‘Canary in the Coal Mine,’ Predicts Tokenization of Identity, Songs, Votes and More

Solana Plunges to Lowest Price Since October as Meme Momentum Cools

Bitcoin’s price consolidation opens the door for this crypto to surge

Chintai (CHEX) Tokenizes $570M Real Estate Cashflow for RealNOI

Bitcoin Investments Take A Hit While XRP Leads Altcoins With Net Inflows

Shiba Inu Struggles Might Just Be The Calm Before A 400% Storm

Bybit Ethereum (ETH) Reserves Steadily Recovering Following Massive Hack, According to CryptoQuant

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Has The Bitcoin Price Already Peaked?

SAFE rallies 20% on Bithumb listing

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin1 month ago

Bitcoin1 month agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin3 months ago

Bitcoin3 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins4 weeks ago

Altcoins4 weeks agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x