Cardano

Last Fed rate cut sent Cardano crashing 57% – what about now?

Published

4 months agoon

By

admin

Cardano dropped 57% when the Federal Reserve cut rates back in 2019. With another rate cut on the horizon, the cryptocurrency faces a similar setup that could bring major downside.

Cardano prepares for September decline

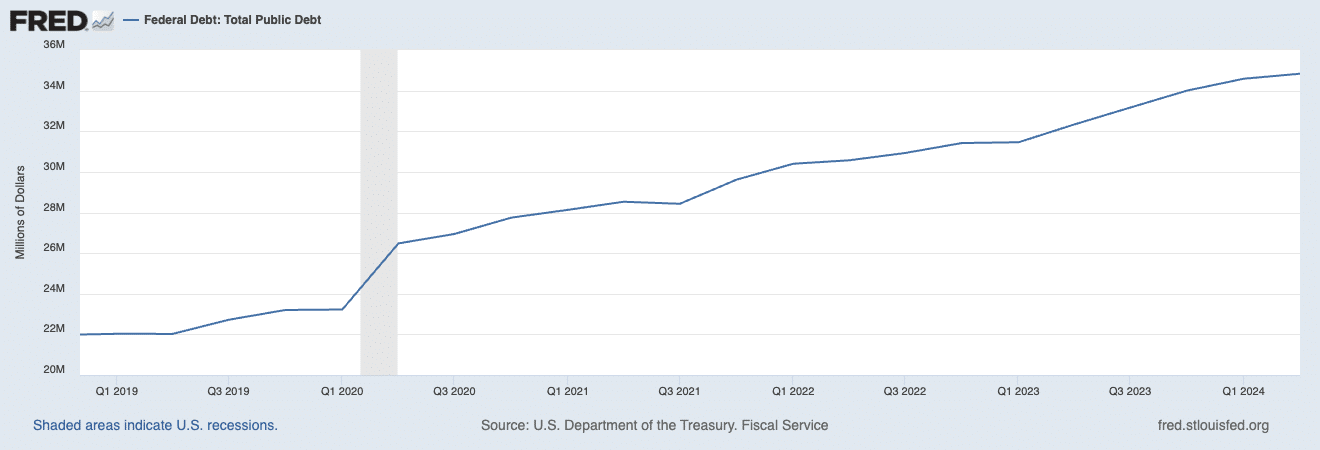

In May 2019, the Federal Reserve initiated its first rate cut, lowering rates from 2.42% to 2.39%. Rates at that time were much lower than today, and the public debt stood at $22 trillion. Today, debt has increased to nearly $35 trillion, and interest rates now stand at 5.33%, more than double the 2019 levels.

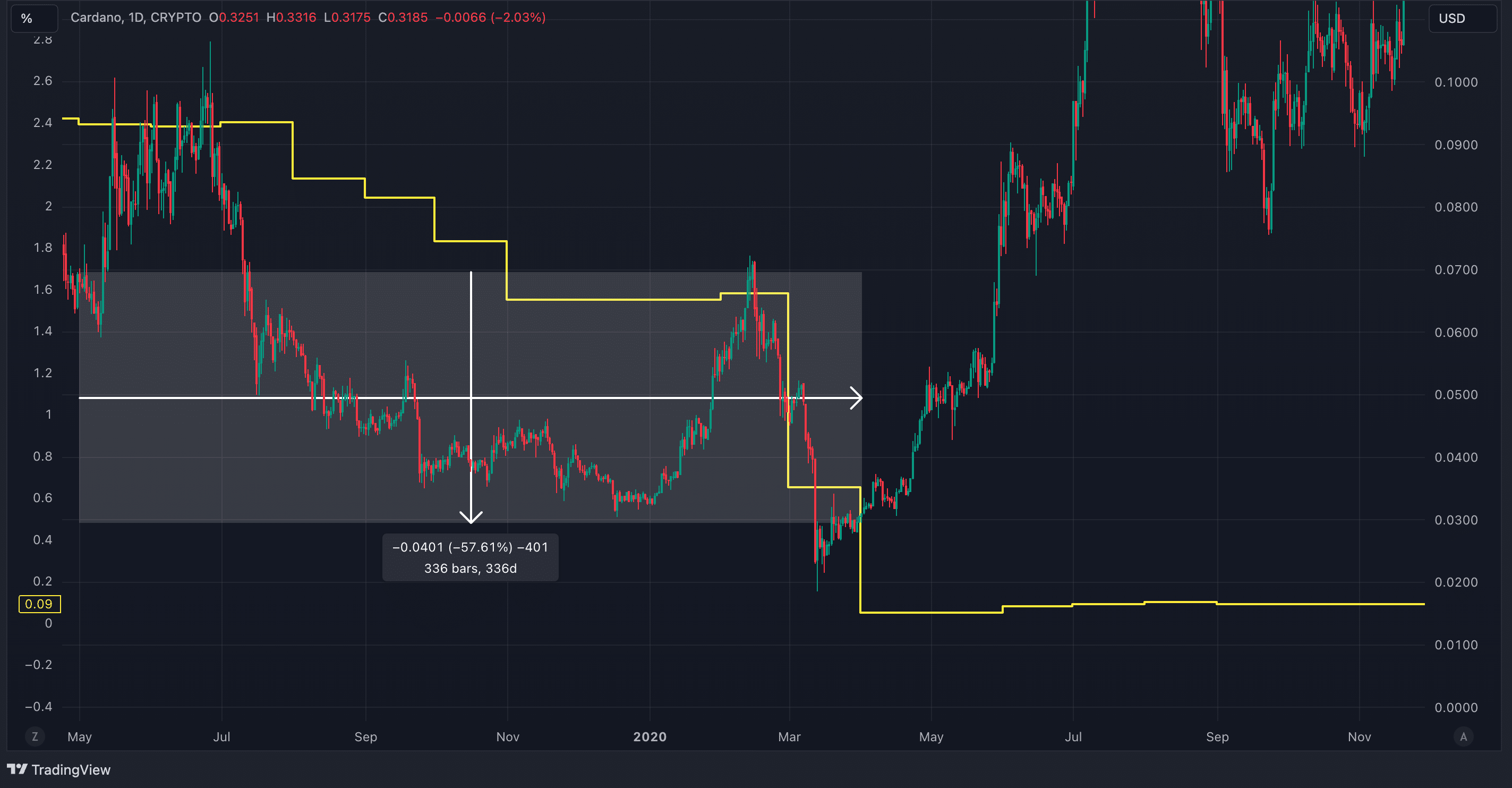

When the rates started to fall in 2019, Cardano experienced a sudden drop. After a brief period of recovery, the downtrend continued for months until early 2020. An uptrend emerged later, but the market downturn during the COVID-19 pandemic coincided with further rate cuts. Despite uncertainties around the exact link between rate cuts and crypto declines, Cardano and the broader market saw a clear decrease in value.

A similar scenario could unfold today. Crypto has shown correlations with traditional finance in the past, including during the 2019 rate cut. The Federal Reserve’s upcoming meeting is likely to result in a rate cut based on CME data. If the market follows the 2019 pattern, Cardano could face a multi-month decline, which could last until the end of the year, before recovering in early 2025. A repeat of the previous trend could push Cardano’s price down to around $0.15.

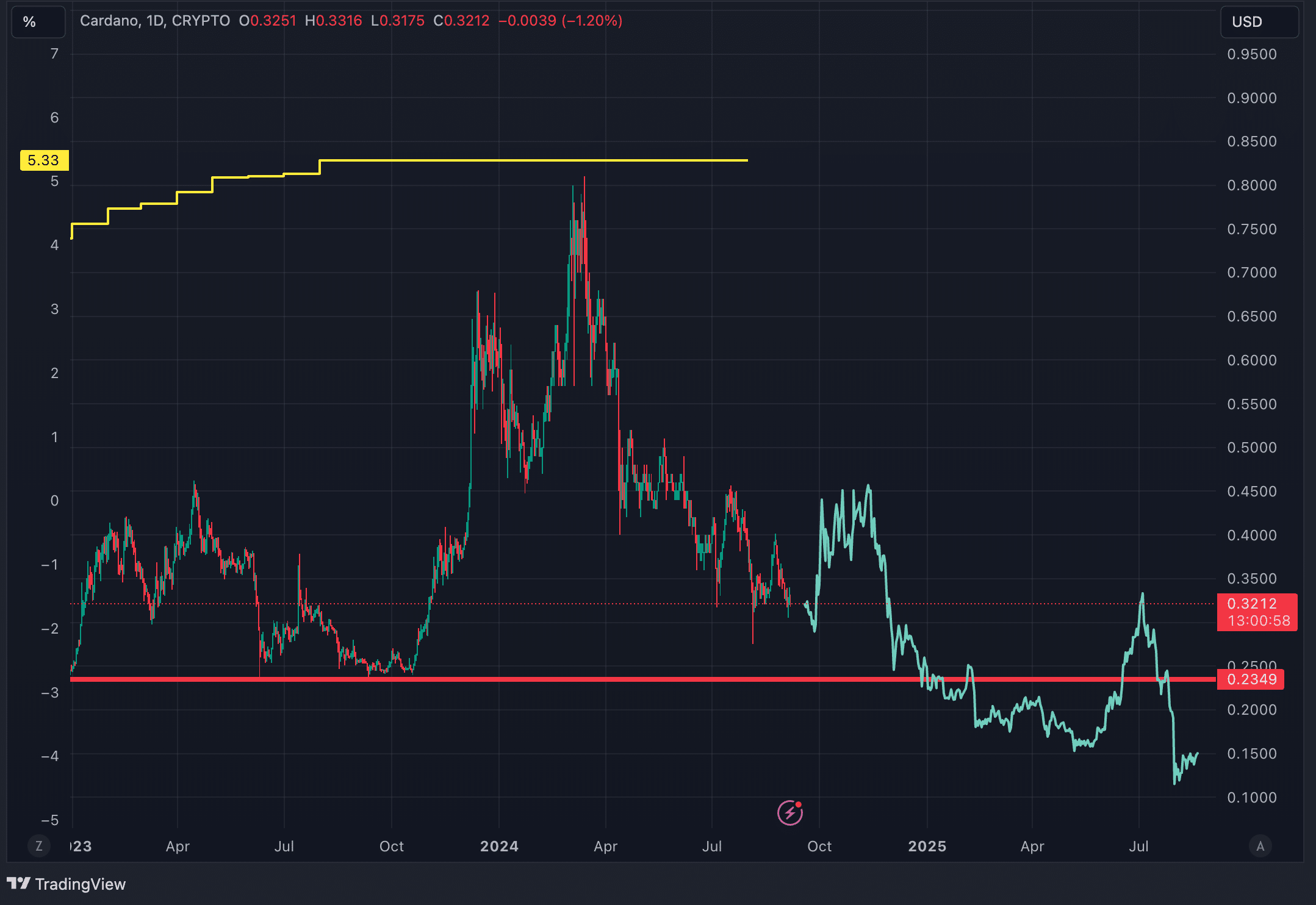

Additionally, September has often proven to be a tough month for both stocks and crypto. In September 2020, during a halving year, Cardano also faced a downtrend. Coupled with the current 10% drop since the start of this month, these factors could drive Cardano toward a deeper fall in the weeks and months ahead below its 2022 support line at $0.2349.

Cardano’s bearish momentum grows with SRSI, MACD, and VRVP

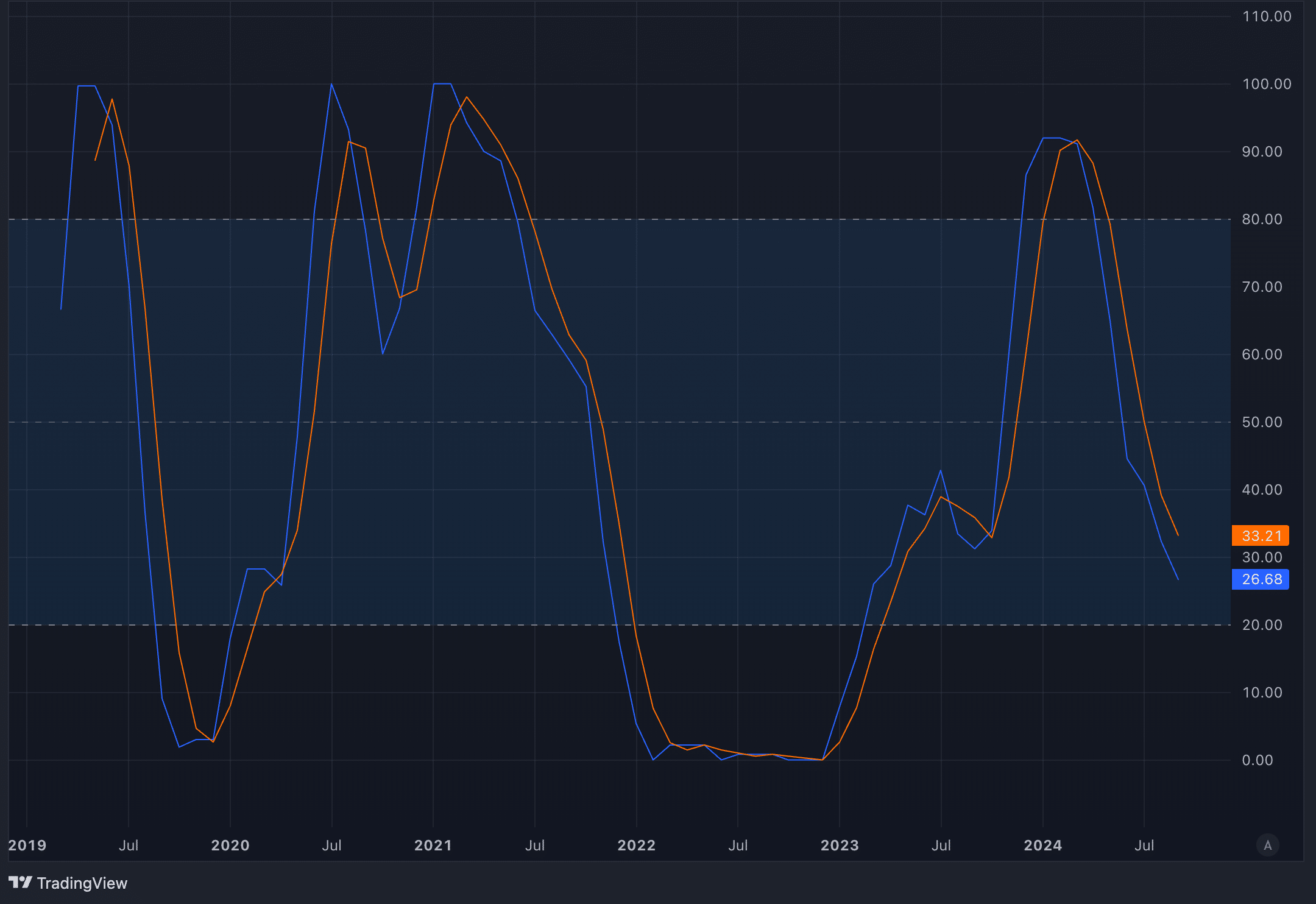

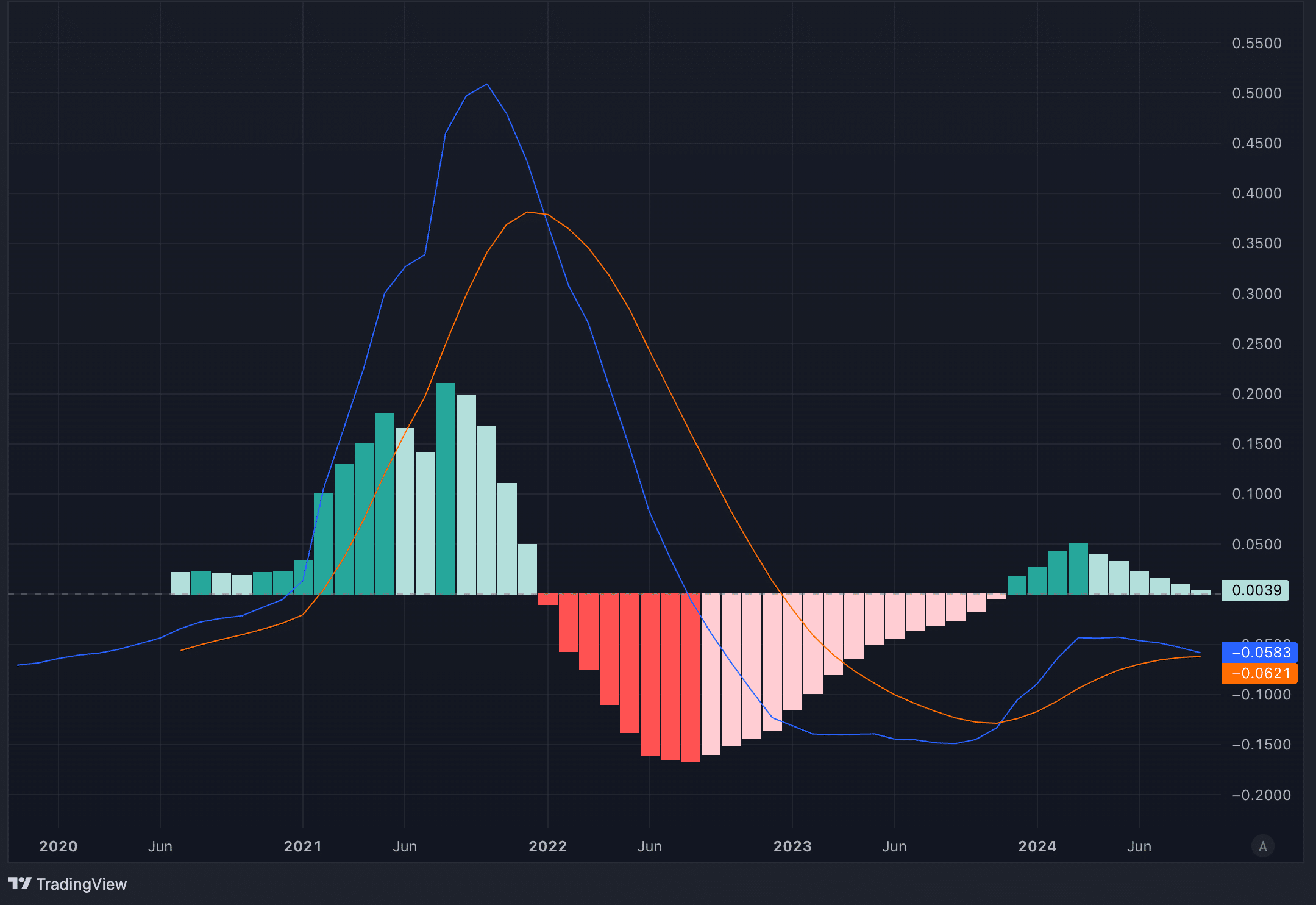

Many traders focus on short-term movements, but stepping back for a longer-term view can give a better sense of the bigger picture. Cardano’s monthly Stochastic RSI (SRSI) and MACD are flashing warning signs that shouldn’t be ignored, and both are painting a rough picture for ADA.

The SRSI tracks momentum by looking at an asset’s price range over time. The scale goes from 0 to 100, with anything below 20 showing oversold conditions. Since March 2024, the SRSI has been sliding, and it’s now closing in on that oversold region.

The MACD, meanwhile, is showing similar bearish vibes. On the monthly chart, the MACD line has already crossed below the signal line, which is a sign of downward pressure. The histogram, which shows the gap between the two lines, is about to flip red, also pointing to a growing bearish momentum.

Alongside the bearish signals from the Stochastic RSI and MACD, the Visible Range Volume Profile (VRVP) adds even more negative pressure to the outlook. The VRVP shows where most trading volumes occurred at various price levels. In Cardano’s case, the volume bars within the current price range are quite thin, which indicates weak support. The biggest volume bar begins at the $0.15 level, suggesting a strong support zone there. Below the current price, there’s a gap in the volume profile, which means if Cardano continues to fall, there’s little trading activity to slow down the drop until it reaches that $0.15 zone.

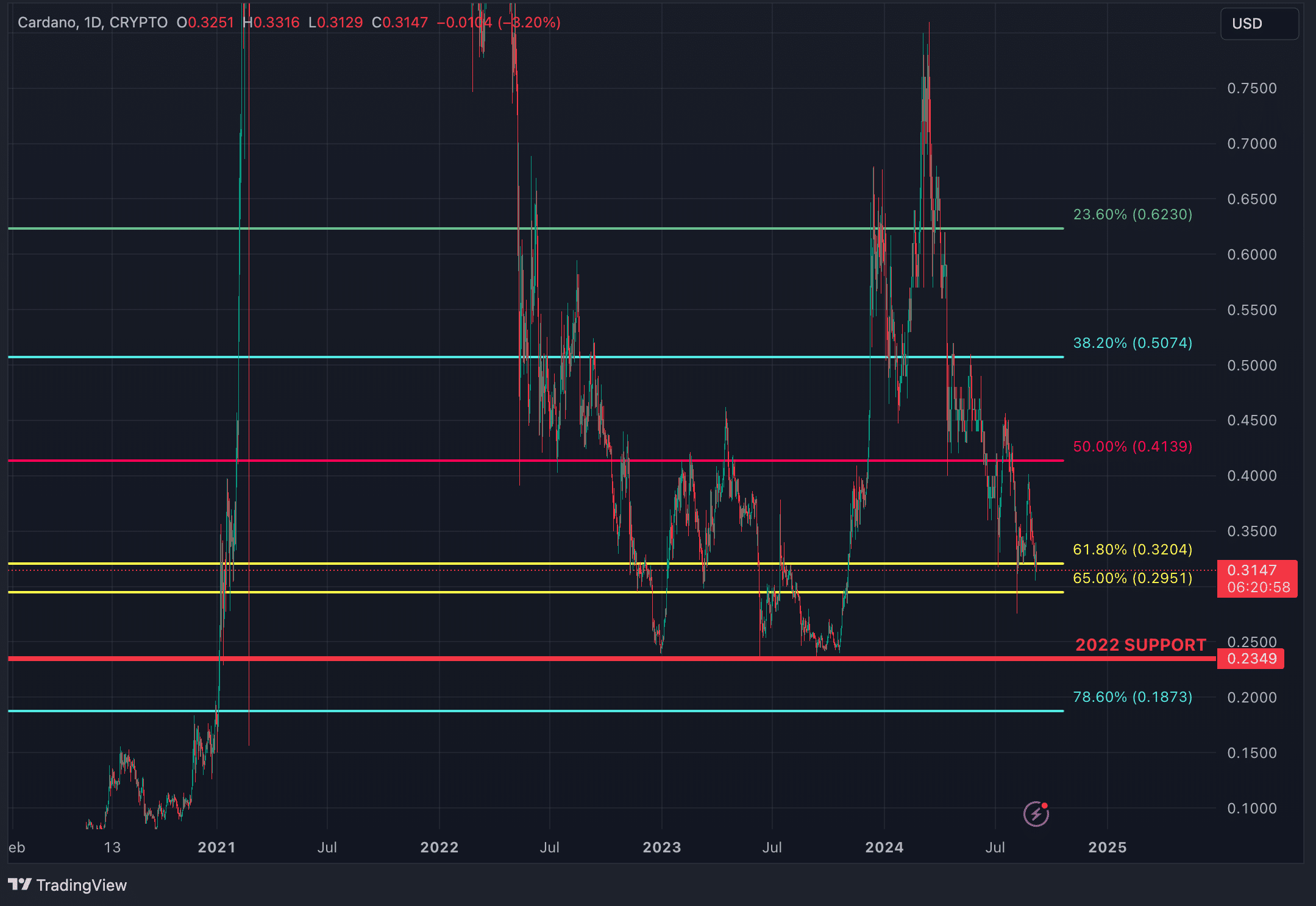

Is Cardano’s 2022 support line strong enough to hold?

Despite the bearish indicators, a couple of factors could prevent Cardano from dropping sharply. At the moment, the price sits within a macro Fibonacci golden pocket, drawn from the all-time low to the recent high in March 2024. This zone, between $0.2951 and $0.3204, has acted as support for now. However, when looking at other Fibonacci retracements from different points, ADA has already fallen below the 78.6% retracement on every one of them. This could raise doubts about the strength of the current golden pocket, as there’s a possibility it may not hold up in the long term.

A stronger support level, however, lies at $0.2349, a line that was respected during the 2022 bear market. But, with ADA currently around $0.315, a drop to that support would still represent a 25% decline, which would be far from ideal.

Strategic considerations

In our view, there could be a dead cat bounce before the September 18 Fed meeting. However, after that, ADA is likely to face a 2-3 month downtrend until the Fed slows the pace of its rate cuts. A more cautious strategy would be to wait for ADA to drop below the $0.2951 golden pocket before shorting. This offers a safer entry point compared to shorting immediately right now, as Cardano could see a short-term uptrend while holding above the golden pocket. If the price falls below this level, shorting down to $0.2349 becomes a more calculated move.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

ADA

Crypto Whales Gobble Up Nearly $149,600,000 Worth of Cardano and Large-Cap Memecoin in Just Two Days: Analyst

Published

1 week agoon

December 16, 2024By

admin

An on-chain analyst says deep-pocketed investors are loading up massive amounts of Cardano (ADA) and a top memecoin as the market went sideways for the past week.

Analyst Ali Martinez tells his 98,800 followers on the social media platform X that crypto whales accumulated $85.6 million worth of ADA in a couple of days.

“Cardano whales bought over 80 million ADA in 48 hours!”

At time of writing, ADA is trading for $1.07.

Martinez also says deep-pocketed investors snapped up $64 million worth of the large-cap memecoin Dogecoin (DOGE).

“Whales bought another 160 million Dogecoin DOGE in 24 hours!”

At time of writing, DOGE is worth $0.40.

In total, the crypto whales accumulated nearly $150 million worth of ADA and DOGE in just two days during the past week.

Turning to Bitcoin, Martinez says he’s looking at BTC‘s In/Out of the Money Around Price (IOMAP) metric. IOMAP classifies crypto addresses as either profiting, breaking even, or losing money – to determine support and resistance levels for BTC.

According to the analyst, Bitcoin has a fortress of support above $94,000 as millions of wallets accumulated millions of BTC around and above the price area.

“Bitcoin sits on top of a significant support wall between $94,300 and $100,250, where 2.25 million wallets bought over 2.18 million BTC.”

At time of writing, Bitcoin is trading for $101,946.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

Cardano (ADA) Rally ‘Woke a Lot of People Up’: Dan Gambardello

Published

1 week agoon

December 14, 2024By

admin

Cardano bull and top analyst Dan Gambardello recently spotlighted a major trend in ADA that has won the hearts of the project’s skeptics. With the ADA price jumping to a three-year high over the past month, Gambardello said the coin’s growth has woken up many people.

Cardano Price Helped Prove Peer Dominance

As Dan Gambardello noted, ADA price jumped from $0.32 to a high of $1.3 over the past month. Gambardello insinuated that this growth, which amounts to 306%, has made Cardano too big to ignore, even for major influencers.

The top analyst said major influencers could no longer continue negative coverage of the asset. This, he claims is because these critics now know how silly they will look with sustained negative coverage as ADA prices continue to soar.

The sudden Cardano move from .32 to $1.30 woke a lot of people up.

Major influencers quickly realized they can’t continue negative $ADA coverage.

They know they’d look silly through the bull market as $ADA keeps pumping.

Now they’re bullish because they’ve fallen in line.

— Dan Gambardello (@cryptorecruitr) December 14, 2024

The statement from Dan Gambardello hinges on the broad backlash Cardano has received over the past few years. As a media personality in crypto, he has used his platform to promote the coin. Gambardello largely supports major price growth for Cardano. Meanwhile, this is in line with previous ADA price analysis that tips a surge to $2.

As of writing, the coin has pared off some of its gains over the past day. It is now down by 6.05% to $1.05 as of writing. The coin has dropped to this lowest level after soaring as high as $1.13 in the past 24 hours.

Prospects and Hurdles

Despite the massive accolades for Cardano, the underlying protocol has a number of hurdles to cross in the near future. Recently, a Cardano Foundation whistleblower flagged gross incompetence at the organization, sparking community speculation.

With the foundation allegedly disaligned with Input Output Global (IOG) and other founding bodies, the prospect of its decentralized endeavors are now in doubt.

However, the protocol has continued to innovate in its technological push. With advanced Hydra test and scalability upgrades, analysts like Dan Gambardello are optimistic the future of ADA remains bright.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ADA

Analyst Says Dogecoin in Early Bull Market Stage, Sees DOGE Skyrocketing to Huge Target ‘If Things Go Wild’

Published

2 weeks agoon

December 12, 2024By

admin

A closely followed crypto trader believes that top memecoin Dogecoin (DOGE) could soar to double digits based on historical patterns.

Crypto strategist Ali Martinez tells his 97,000 followers on the social media platform X that DOGE appears to be in the phase of the cycle when it pauses before skyrocketing to new record highs.

The trader shares a chart suggesting that DOGE is mirroring its price action during the 2017 and 2021 market cycles while trading in a large ascending channel.

“Check out where we are in the Dogecoin DOGE bull cycle! Very early, right?

For that reason, I’m thankful for the dip and will buy more between $0.40-$0.30. The target remains $3, and if things go wild, $18!”

At time of writing, DOGE is trading for $0.391, down nearly 5% on the day.

Turning to the layer-1 protocol Cardano (ADA), Martinez says that the altcoin can find support at the $1 level based on the In/Out of the Money Around Price (IOMAP) metric.

IOMAP classifies crypto addresses as either profiting, breaking even, or losing money – to determine support and resistance levels for ADA. According to the metric, 41,720 addresses have accumulated over one billion ADA at $1.

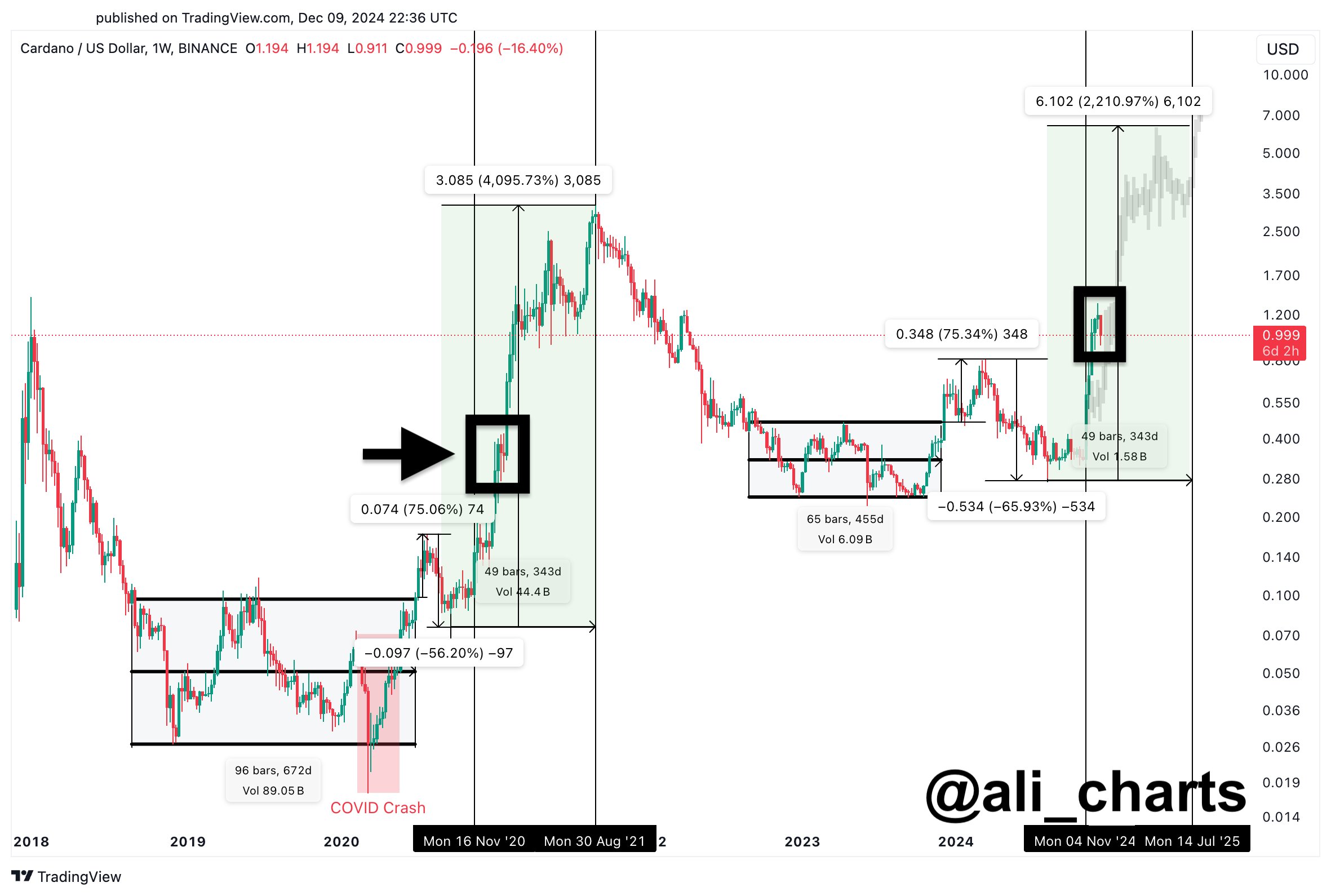

Zooming out, Martinez says Cardano appears to be following its 2020 price action when it witnessed a period of retracement before soaring to fresh highs.

“Cardano is doing the same as it did in 2020, which is why I’m buying! Even if it dips down to $0.76, I’m buying more and plan to book profits between $4 and $6.”

At time of writing, ADA is trading at $1.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: