24/7 Cryptocurrency News

Lawyer Highlights Why SEC Challenges XRP Futures In Bitnomial Case

Published

3 months agoon

By

admin

The Ripple Vs SEC battle has further intensified with Bitnomial revealing key updates recently. Notably, the Bitnomial Exchange has recently sued the US SEC as the agency claims that the XRP Futures are “Security Futures.” However, amid this, pro-XRP lawyer Bill Morgan has shed light on the key reasons why the agency has continued its harsh stance against XRP in the Bitnomial case.

Ripple Vs SEC: Why SEC Continues To Target XRP?

Bitnomial has continued to advance with its strategic plan despite the latest legal hurdles and the ongoing tensions in the Ripple Vs SEC case. In a recent announcement, the exchange revealed the upcoming launch of its perpetual futures platform, Botanical.

The platform, backed by Ripple with a $25 million funding round, aims to provide a flurry of trading options like futures, crypto derivatives, and others, to users. Besides, the firm also said that Ripple CEO Brad Garlinghouse will join its board, which has further fueled speculations in the crypto market.

Meanwhile, Ripple’s involvement in the funding has further fueled discussions about the SEC’s motives in targeting Bitnomial. Some critics argue that the agency’s scrutiny of Bitnomial’s XRP futures is a calculated move to undermine Ripple’s growing influence.

One social media user pointed out that every company working with XRP seems to be under the SEC’s radar. His comment reflects the agency’s actions, which may be more about hindering Ripple’s progress than protecting investors.

However, pro-XRP lawyer Bill Morgan weighed in on this viewpoint. He highlighted that Ripple’s backing of Bitnomial has created a strong incentive for the crypto giant to support Bitnomial in its legal battle. He noted that the SEC’s aggressive stance could be part of a broader strategy to stifle Ripple’s growth through associated businesses like Bitnomial.

What’s Next In XRP Lawsuit?

The Bitnomial case has gained more attention as the US SEC has recently filed an appeal in the XRP lawsuit. The Ripple Vs SEC case was one of the high-profile and long-running legal battles in the crypto sector.

Amid this, the recent appeal by the agency has sparked discussions in the market, with many slamming the SEC for extending the case. However, Ripple has also filed a cross-appeal, indicating its confidence in the ongoing legal fight. Besides, Ripple CLO has also commented on the XRP lawsuit and its potential future developments.

Meanwhile, amid this, Grayscale has filed to covert its Solana, XRP, and AVAX Trust into ETF offerings. This move, despite the US SEC targeting Ripple’s native crypto, showcases the firm’s confidence in the blockchain firm and its native crypto. Besides, Ripple has also revealed major updates on its stablecoin RLUSD, which have fueled speculations in the market.

However, XRP price was down 1.5% today to $0.5384, with its trading volume soaring 9% to $1.22 billion. The crypto has touched a high of $0.5475 and a low of $0.5327 in the last 24 hours. Furthermore, XRP Futures Open Interest also fell 2% to $747.94 million.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Ledn Remains Bitcoin’s Premier Borrowing And Lending Platform

Analysts says Solana price to pass $500 In Q1, while this altcoin could rally 2,000%

Pakistani Trader Kidnapped, Forced to Hand Over $340,000 in Crypto

Will BTC Recover After 2025’s First Crash?

South Korea to allow institutional investors to trade crypto: report

Accurate Indicator Hints Bitcoin’s Top Is Near

24/7 Cryptocurrency News

Accurate Indicator Hints Bitcoin’s Top Is Near

Published

7 hours agoon

January 8, 2025By

admin

Bitcoin is the most dominant cryptocurrency, and its performance alone is significant enough to signal the future of the entire market. Presently, BTC is under correction, but an accurate indicator confirms it is near the top. Let’s discuss the findings of the indicators and when the BTC price will hit the top.

Pi Cycle Indicators Predict the Bitcoin Price Top

The Pi Cycle indicator is an accurate indicator that successfully forecasts the Bitcoin price at the top. It has accurately predicted the top in 2013, 2017, and 2021; the next might be 2025. Pi cycle analysis depends on the 111-day moving average (111DMA) and 350-day moving average multiples by 2, where the intersection of these two moving averages predicts the cycle tops.

Now, after the ongoing BTC price struggle amid the crypto market crash, this tool hints at the top, keeping the investor’s confidence strong amid the crash. The crypto market signals that the BTC top will likely happen in the mid-to-end period of 2025. Although the timeline could vary, the historical result confirms the top formation within days of peak prediction.

Cryptocurrency Peak Prediction: BTC Top To Form on September 17, 2025

The latest Pi cycle top prediction reveals that the next crossover will occur on September 17, 2025, resulting in the BTC market peak. This BTC prediction for 2025 is based on its exponential growth ever since its formation, where the Pi chart indicator has forecasted the peak with 111 DMA and 350 DMAx2 coinciding on the charts on this date.

With high accuracy and historical proof, the next BTC top will form on September 17, but the exact value of the top is unclear for now. Some suggest it could cross six figures based on historical growth patterns, global adoption, and Donald Trump’s presidency.

What You Should Do?

The pi cycle indicator is a famous BTC top indicator that has accurately predicted the peak multiple times. Now, recent reports show that the BTC top will form on September 17, 2025, potentially pushing this digital asset’s price to six figures for the first time in history. Although the BTC price formed massive peaks with Donald Trump’s win, the consolidation frequency increased as Trump’s inauguration approaches.

The market crash has halted the Bitcoin price surge, currently trading at $95k. Arthur Hayes’s prediction hints at a market peak in March, but investors should stay cautious and conduct their own technical analysis before investing.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

BlackRock Bitcoin ETF (IBIT) Sees $597M In Inflow, Saves the Day

Published

10 hours agoon

January 8, 2025By

admin

BlackRock’s iShares Bitcoin ETF (IBIT) recorded over $597 million in inflow on Tuesday. The BlackRock Bitcoin ETF saves the day for the bleeding crypto market after investors turned cautious with strong US JOLTS job openings and ISM Services PMI data.

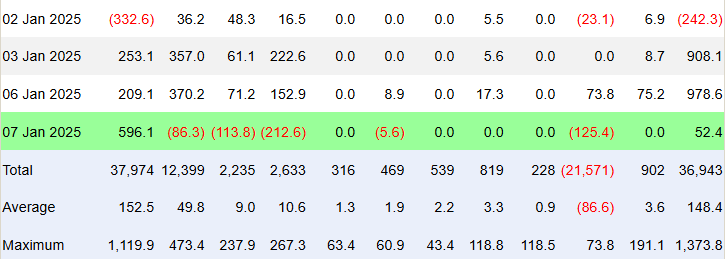

The spot Bitcoin ETF in the United States saw a net inflow of $53.46. Bitcoin ETFs by Fidelity, Bitwise, Ark 21Shares, Franklin Templeton, and Grayscale recorded outflows.

BlackRock Bitcoin ETF Saw Inflow Despite Crypto Market Crash

BlackRock’s iShares Bitcoin ETF (IBIT) purchased 6,078 BTC worth $208.7 on January 7, while miners only mined 450 new BTCs. IBIT recorded an inflow of $597.18 million, as per Trader T data.

This makes the third consecutive inflow into IBIT despite a major selloff in the crypto market. Notably, US Bitcoin ETF saw an inflow of $978.6 million on Monday, sparking optimism as the flagship crypto soared past the $102K mark.

Meanwhile, Fidelity’s FBTC, Bitwise’s BITB, and Ark Invest’s ARKB saw outflow of $86.29 million, $113.85 million, and $212.55 million, respectively. Also, Franklin EZBC saw a $5.58 million in outflow.

Grayscale’s GBTC also witnessed an outflow of $125.45 million. Flows were zero for Invesco, Valkyrie, VanEck, and Grayscale Mini.

According to Farside Investors, the total net inflow for Bitcoin spot ETFs reached $52.4 million. The iShares Bitcoin Trust by BlackRock saw a net inflow of $596.1 million. Whereas, other ETFs experienced varying degrees of outflow.

Bitcoin and Crypto Market Crash On Macro Concerns

According to the U.S. Bureau of Labor Statistics, the JOLTS jobs openings increased by 259,000 to 8,098 million in November 2024, Also, ISM Services PMI came in higher than expected, which shows the resilience of the U.S. economy currently. This caused Bitcoin price to crash by more than 5%.

In fact, the US dollar index (DXY) holds its advance above 108.50 today, after a two-day low move that caused a recovery in Bitcoin price. Also, the 10-year US Treasury yield increased to a 35-week high of 4.68%. The strong US economic data reduced expectations for further rate cuts by the Federal Reserve.

Whereas, BTC price continues to fall despite better performance by BlackRock Bitcoin ETF. The price currently trades at $96,259. The 24-hour low and high are $96,132 and $102,022, respectively. Furthermore, the trading volume has decreased by 23% in the last 24 hours.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ripple CEO Brad Garlinghouse Confirms Mar-a-Lago Meeting with Donald Trump

Published

14 hours agoon

January 8, 2025By

admin

Ripple CEO Brad Garlinghouse revealed on social media that he recently had dinner with former President Donald Trump and Ripple’s Chief Legal Officer, Stuart Alderoty.

The meeting that happened at Trump’s Mar-a-Lago resort is an important beginning to the year 2025 for Ripple especially with the current changes happening in the cryptocurrency market.

Ripple CEO and CLO Meeting with Donald Trump

On Monday evening, Ripple CEO Brad Garlinghouse revealed his meeting with Donald Trump and Stuart Alderoty on the platform X (previously Twitter). “Had a great dinner last night with @realDonaldTrump & @s_alderoty. ”Great start to 2025!” he posted indicating that things are looking good for Ripple.

Stuart Alderoty, Ripple’s legal head, also commented on the event, joking about the dinner’s menu: “The beef bourguignon was really good.”

The dinner at Mar-a-Lago takes place at a time when Ripple has been building up its steam with wins against the U.S Securities and Exchange Commission (SEC) in court.In line with the optimism, crypto analysts have provided bullish signals for XRP, some of whom have forecasted a price surge to $3.

John Deaton Breaks Silence on Ripple CEO Meet Up

Ripple has recently come into the limelight for its legal victory against the SEC where the latter had alleged that the company and Garlinghouse sold unregistered securities via XRP. The lawsuit that lasted for more than two years concluded with the victory of Ripple, which opened up new possibilities for the future of the cryptocurrency market.

John E. Deaton, a pro XRP lawyer and following the case commented on X that Ripple’s win means that the company has remained unshaken. He also pointed to the SEC’s aggressive approach in the litigation process, which involved serving Garlinghouse with personal subpoenas to produce financial information.

”Ripple and Brad disclosed every XRP transaction that has ever taken place, but the SEC acted misconduct when it came to discovery,” Deaton said. However, Ripple has come out even stronger, suggesting that more positive outcomes are in the offing for the company and the sector as a whole.

Cynthia Lummis Chats With US SEC Potential Chairman

Ripple CEO, Brad Garlinghouse has also noted recent expansion of Ripple’s activities within the United States which shows that the focus has shifted back to the domestic market.He disclosed that three quarters of the new positions at Ripple are based in the United States, something that was not the case in the past given the company’s focus on the international market.

Furthermore, the company signed up more US business contracts in the last six weeks of the year 2024 than it had in the six months prior to that period.

The dinner comes after several meetings between politicians and crypto enthusiasts. U.S. Senator Cynthia Lummis, an advocate for blockchain technology, has also been engaging with Paul Atkins, the man expected to be named SEC chairman by President-elect Trump. These discussions focus on the need to reform the SEC’s rule making process and to advance the use of digital assets.

Ripple’s Growing Market Influence

Ripple is also coming up strongly in the blockchain space with new products being introduced. Ripple President Monica Long stated that the stablecoin, RLUSD, which was recently launched, is expected to be listed on multiple platforms.

At the same time, the company has joined Chainlink to work on the integration of secure and accurate pricing of RLUSD into the DeFi ecosystem.

In these developments, Ripple has witnessed a rise in its valuation due to the increased prices of XRP and the increasing adoption of its solutions. Ripple CEO Brad Garlinghouse has earlier stated that the $11 billion valuation of the company is quite dated given the current situation.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Ledn Remains Bitcoin’s Premier Borrowing And Lending Platform

Analysts says Solana price to pass $500 In Q1, while this altcoin could rally 2,000%

Pakistani Trader Kidnapped, Forced to Hand Over $340,000 in Crypto

Will BTC Recover After 2025’s First Crash?

South Korea to allow institutional investors to trade crypto: report

Accurate Indicator Hints Bitcoin’s Top Is Near

Bitcoin Plunges Below $100K Despite Positive Coinbase Premium Signal – What’s Next?

Bitcoin ETF inflows slump as BTC falls over 5% amid macroeconomic pressures

BlackRock Bitcoin ETF (IBIT) Sees $597M In Inflow, Saves the Day

Web 4.0 – Blockchain and AI Will Usher In a More Humane and User-Friendly Web

Democrats Should Reverse Their Stance On Bitcoin

Ripple CEO Brad Garlinghouse Confirms Mar-a-Lago Meeting with Donald Trump

The Most Eye-Catching and Absurd AI Products Unveiled at CES 2025 So Far

Meet Jason Marquez: The Truck Driver Who made $750,000 on MicroStrategy

Why BTC, ETH, DOGE, & Other Altcoins Fell

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: