ETH

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Published

1 month agoon

By

admin

Ethereum surged over 10% yesterday, marking an impressive recovery alongside a very bullish day for the entire crypto market. This surge has reignited investor optimism, especially as Ethereum approaches its yearly highs.

Key data from CryptoQuant highlights a significant bullish signal: Ethereum’s Taker Buy Volume hit an astonishing $1.683 billion in a single hourly candle. This metric reflects aggressive buying activity in the futures market, further supporting Ethereum’s potential for continued upward momentum.

The driving force behind this rising demand for Ethereum appears to stem from profits being cycled out of Bitcoin. With Bitcoin consistently breaking all-time highs, investors are reallocating gains into ETH, boosting its price. Ethereum’s ability to capitalize on Bitcoin’s momentum underscores its position as the second-largest cryptocurrency and a key player in the broader market trend.

However, the next few days will be crucial for Ethereum as it nears its yearly highs. A strong breakout above these levels could propel ETH into a new uptrend, further strengthening its bullish narrative.

Ethereum Bulls Waking Up

Ethereum bulls are finally showing signs of life after eight months of bearish price action, with the price surging over 40% since November 5. This strong upward momentum aligns with the broader market rally, fueling optimism that Ethereum’s recovery is just beginning. The resurgence in bullish sentiment has positioned Ethereum as a key focus for investors seeking opportunities in the current market environment.

According to data by CryptoQuant analyst Maartunn, Ethereum’s Taker Buy Volume recently hit $1.683 billion in a single hourly candle, highlighting significant demand and the involvement of high-volume trades.

This aggressive buying activity is a bullish signal, suggesting increased confidence in Ethereum’s potential to sustain its rally. Strong demand at this scale creates upward pressure on the price, reinforcing the bullish narrative for ETH.

Related Reading

However, Ethereum still faces a critical hurdle at the $3,550 level, a significant supply zone that has acted as a barrier since late July. The next few days will be pivotal for Ethereum, as breaking above this key resistance could signal the continuation of its upward trajectory. Failure to do so, however, might result in a short-term consolidation. All eyes are now on ETH, as its next moves could set the tone for the altcoin market.

ETH Holding Above Key Levels

Ethereum (ETH) is trading at $3,333 after a 10% surge yesterday, marking a significant rebound for the second-largest cryptocurrency. The price is testing a critical supply zone just below the $3,450 level, a resistance area that bulls need to reclaim to confirm the uptrend and maintain momentum for new highs.

This supply zone has historically acted as a key barrier, and breaking above it with conviction would signal strong buying pressure and the potential for a sustained rally. Holding above the 200-day moving average (MA) at $2,959 further strengthens the bullish case for Ethereum, as this indicator is widely regarded as a benchmark for long-term price trends.

Related Reading

Should Ethereum maintain its position above the 200-day MA and push decisively past the $3,450 level, it could pave the way for a bullish rally, targeting higher resistance zones in the coming days.

However, failure to overcome this supply area may result in short-term consolidation as bulls regroup to challenge the level again. For now, the market focuses on Ethereum’s ability to clear this crucial resistance and continue its upward trajectory.

Featured image from Dall-E, chart from TradingView

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Altcoins

Trader Predicts ‘God Candle’ Breakout for Ethereum, Says New All-Time High Loading for One Memecoin

Published

4 days agoon

December 19, 2024By

admin

A popular crypto analyst thinks that Ethereum (ETH) is on the verge of printing a massive breakout rally also known as a god candle.

Pseudonymous analyst Inmortal tells his 221,100 followers on the social media platform X that Ethereum’s two-hour chart looks similar to Bitcoin’s (BTC) price action over the last two weeks.

The analyst says that while Ethereum struggles to clear resistance at $4,000, he notes that BTC also had trouble breaching $100,000 for weeks before surging to new all-time highs.

“Same price action, but with one difference.

God candle after the breakout.

ETH.”

Based on the trader’s chart, he seems to predict that ETH will surge close to its all-time high of $4,800 after the breakout. At time of writing, ETH is worth $3,892.

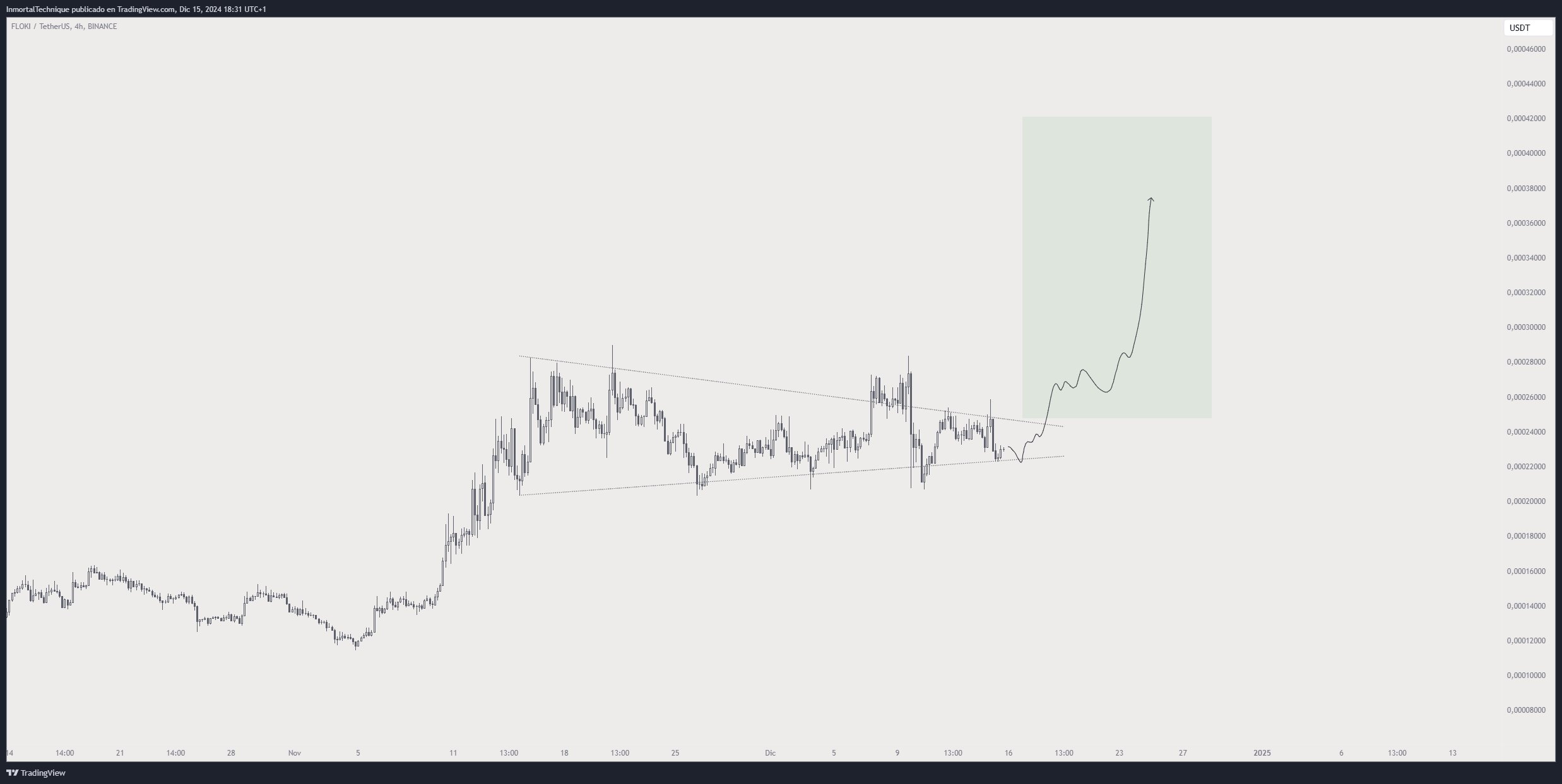

The trader also has his radar locked on the memecoin Floki (FLOKI). According to the trader, FLOKI appears to be trading in a symmetrical triangle pattern and is gearing up to shatter the structure’s diagonal resistance en route to new record highs.

“Second leg up – loading.

New ATH – loading.

Price discovery – loading.

FLOKI.”

Based on the trader’s chart, he seems to predict that FLOKI will explode to a new all-time high of $0.00038. At time of writing, FLOKI is worth $0.000219.

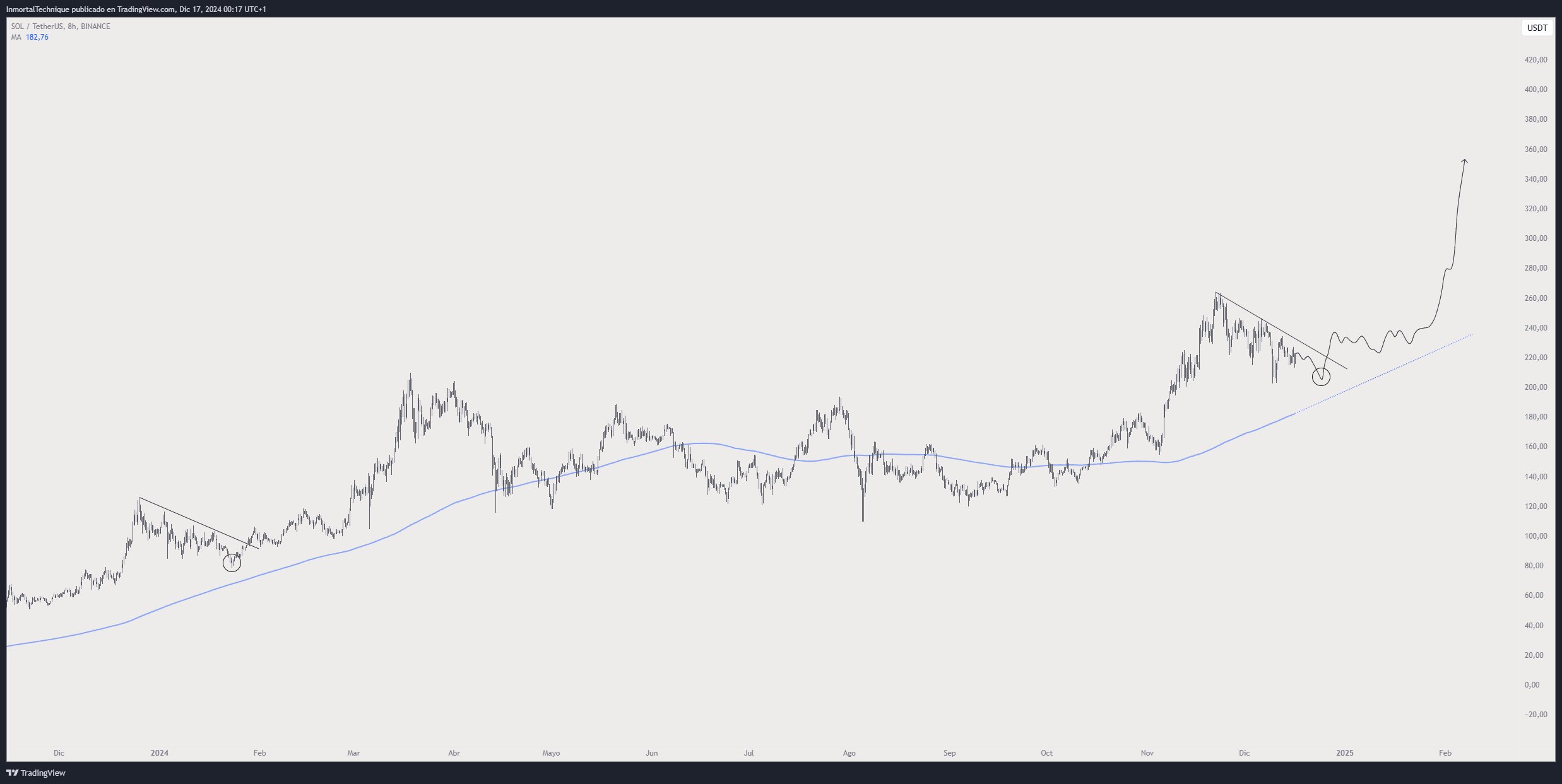

Looking at Solana (SOL), the trader sees the Ethereum rival bursting above its diagonal resistance to rally toward $300.

“Something like this.

SOL.”

At time of writing, SOL is worth $222.60.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Analyst Says It’s Time for New Ethereum All-Time High, Sees Bitcoin Going ‘Full Santa Claus Mode’

Published

5 days agoon

December 18, 2024By

admin

A closely followed crypto trader believes that conditions are nearly ripe for Ethereum (ETH) to witness a surge to fresh record highs.

Crypto strategist Justin Bennett tells his 115,400 followers on the social media platform X that it’s only a matter of time before Ethereum fully reclaims resistance at $4,000 as support.

According to Bennett, Bitcoin has been on a grind-up this month and traders will eventually rotate some of their BTC profits to ETH to capture more upside potential.

“ETH has struggled at $4,000 for obvious technical reasons, and BTC has stolen the show so far in December.

But I’m betting we will see some of those Bitcoin profits flow into Ethereum soon.

If ETH can clear $4,000-$4,100, there isn’t much stopping a sprint to $4,800 and potentially mid $5,000 to complete this channel.

Time for a new Ethereum ATH (all-time high).”

At time of writing, Ethereum is trading for $3,873.

For the rest of December, Bennett thinks that the two largest crypto assets by market cap will outperform the rest of the digital asset market.

“Focusing on BTC and ETH for the next two weeks makes the most sense, IMO (in my opinion).

Alts will have their time again, but probably not before we see some crazy bullish moves from Bitcoin and Ethereum through the end of the year.”

Looking at Bitcoin itself, the trader says that BTC is in the midst of a Christmas rally, and he expects the crypto king to shatter its diagonal resistance en route to new all-time highs.

“Bitcoin going full Santa Claus mode.

Pullbacks might be hard to come by through the end of the year, especially with the speculation of BTC becoming a US reserve asset under Trump.

Wouldn’t be surprised to see $116,000 or even $125,000 through the end of December.”

At time of writing, Bitcoin is trading for $106,339.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

ETH

Ethereum Price Falls Short Above $4,000: Will Bulls Try Again?

Published

5 days agoon

December 18, 2024By

admin

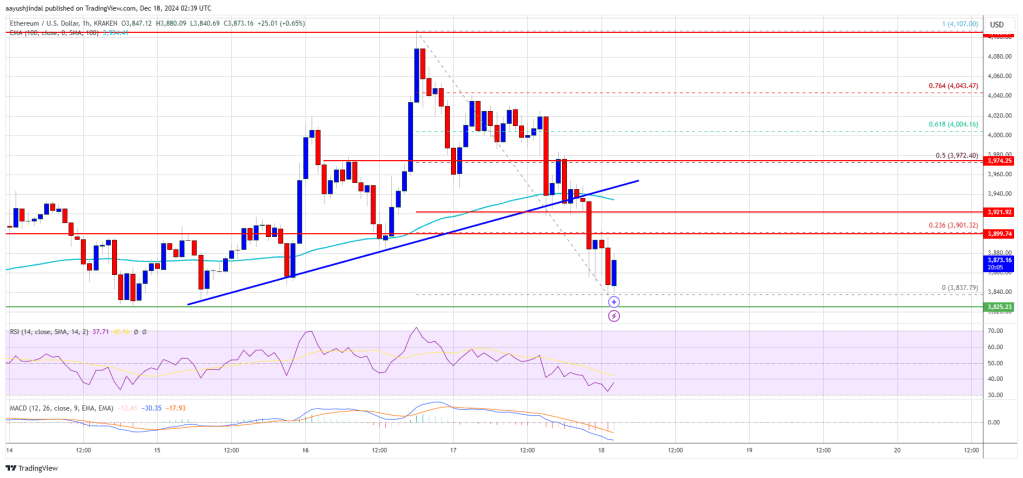

Ethereum price failed to settle above the $4,000 zone. ETH is correcting gains and might struggle to stay above the $3,820 support zone.

- Ethereum started a downside correction from the $4,100 zone.

- The price is trading below $3,980 and the 100-hourly Simple Moving Average.

- There was a break below a key bullish trend line with support at $3,940 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could continue to move down if it fails to stay above the $2,820 support zone.

Ethereum Price Fails Again

Ethereum price struggled to stay above the $4,000 level and underperformed Bitcoin. ETH started a fresh decline and traded below the $4,000 support zone.

There was a move below the $3,980 and $3,940 support levels. Besides, there was a break below a key bullish trend line with support at $3,940 on the hourly chart of ETH/USD. The pair even dipped below the $3,850 level. A low was formed at $3,837 and the price is now consolidating losses.

Ethereum price is now trading below $3,920 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,900 level. It is close to the 23.6% Fib retracement level of the downward move from the $4,107 swing high to the $3,837 low.

The first major resistance is near the $3,970 level or the 50% Fib retracement level of the downward move from the $4,107 swing high to the $3,837 low.

The main resistance is now forming near $4,000. A clear move above the $4,000 resistance might send the price toward the $4,120 resistance. An upside break above the $4,120 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $4,250 resistance zone or even $4,320.

More Losses In ETH?

If Ethereum fails to clear the $3,900 resistance, it could continue to move down. Initial support on the downside is near the $3,820 level. The first major support sits near the $3,780 zone.

A clear move below the $3,780 support might push the price toward the $3,650 support. Any more losses might send the price toward the $3,550 support level in the near term. The next key support sits at $3,500.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $3,820

Major Resistance Level – $3,970

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential