ETFs

Maximizing Bitcoin Gains with ETF Data

Published

3 months agoon

By

admin

Maximizing Bitcoin Gains with ETF Data

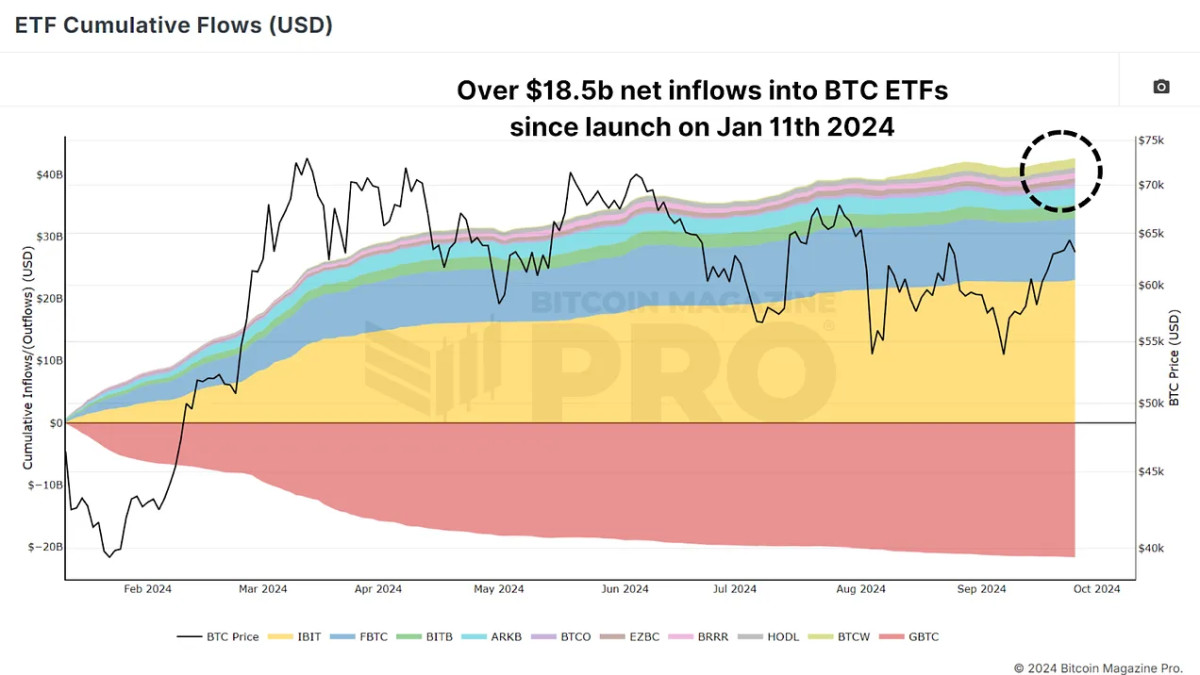

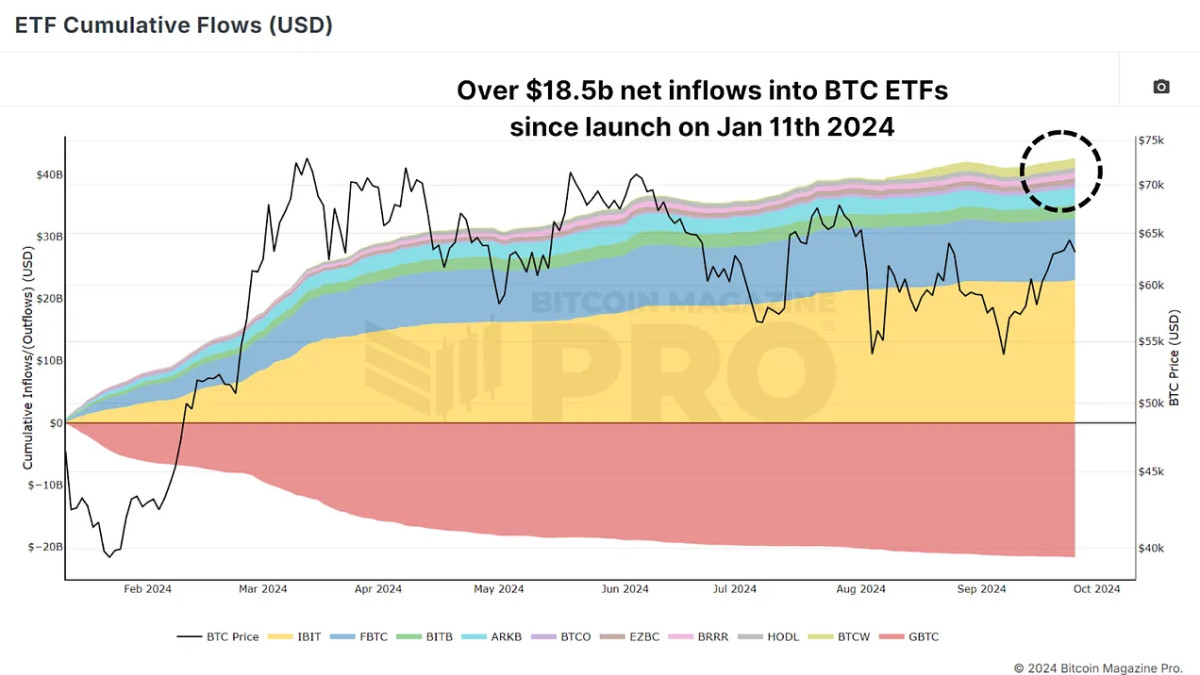

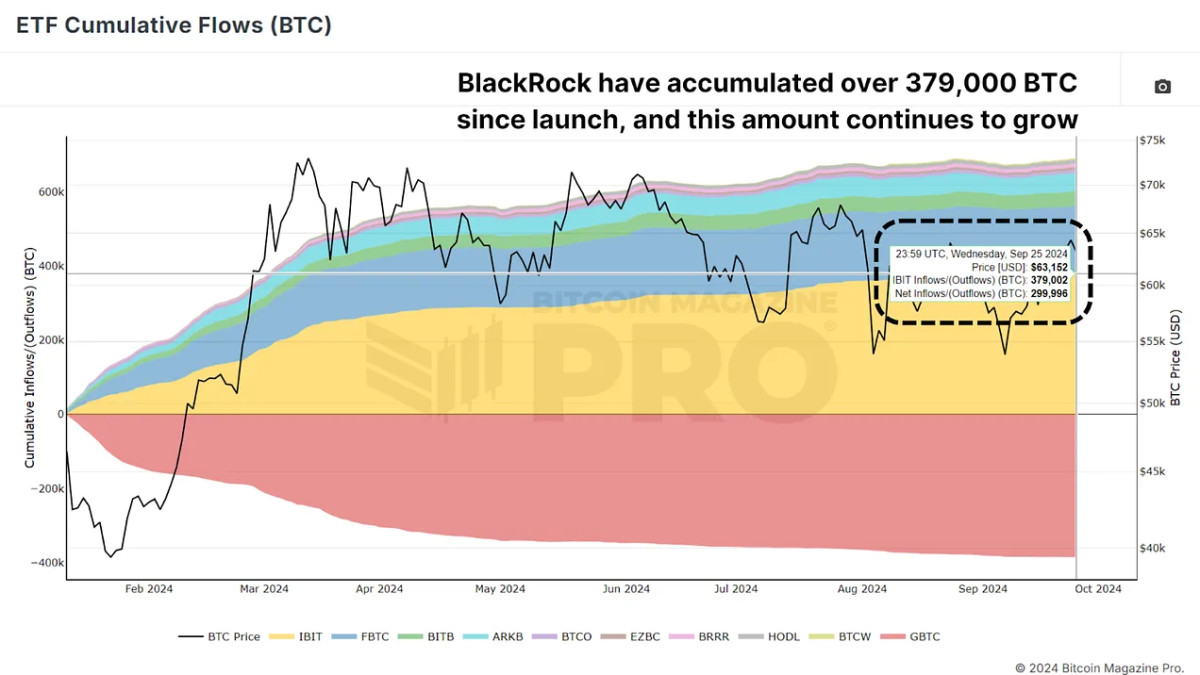

Since the introduction of Bitcoin Exchange Traded Funds (ETFs) in early 2024, Bitcoin has reached new all-time highs, with multiple months of double-digit gains. However, as impressive as this performance is, there’s a way to significantly outperform Bitcoin’s returns by utilizing ETF data to guide your trading decisions.

Bitcoin ETFs and Their Influence

Bitcoin ETFs, launched in January 2024, have quickly amassed large amounts of Bitcoin. These ETFs, tracked by various funds, allow institutional and retail investors to gain exposure to Bitcoin without directly owning it. These ETFs have accumulated billions of USD worth of BTC, and tracking this cumulative flow is essential for monitoring institutional activity in Bitcoin markets, helping us gauge whether institutional players are buying or selling.

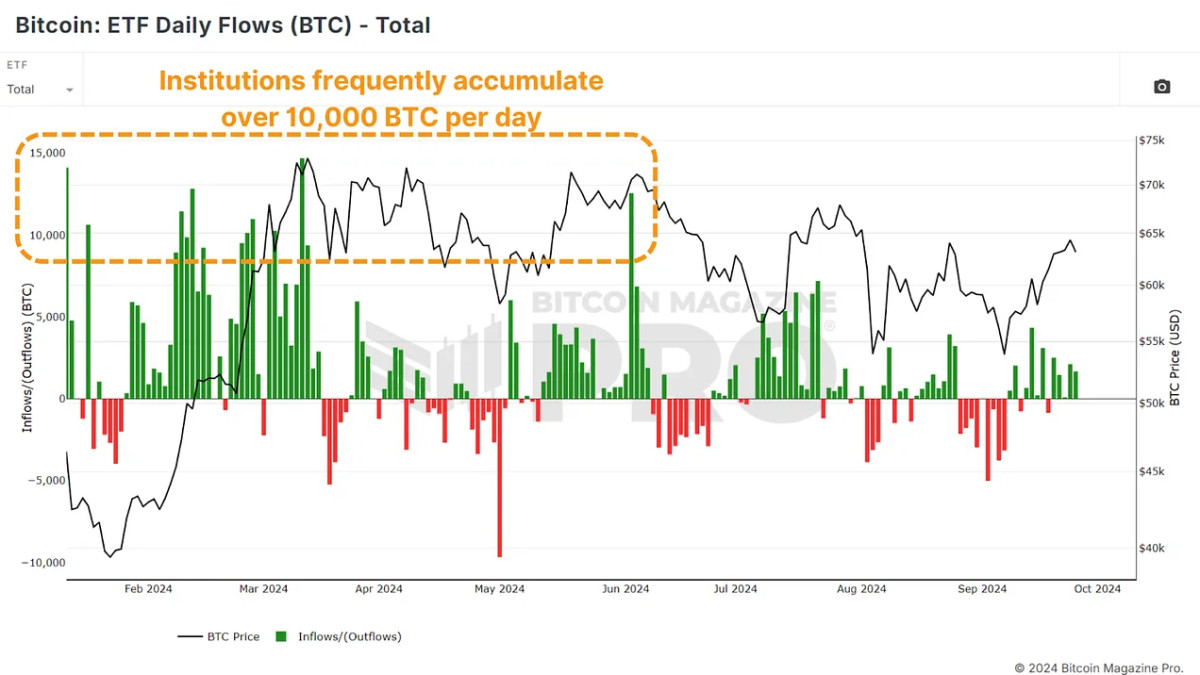

ETF daily inflows denominated in BTC indicate that large-scale investors are accumulating Bitcoin, while daily outflows suggest they are exiting positions during that trading period. For those looking to outperform Bitcoin’s already strong 2024 performance, this ETF data offers a strategic entry and exit point for Bitcoin trades.

A Simple Strategy Based on ETF Data

The strategy is relatively straightforward: buy Bitcoin when ETF inflows are positive (green bars) and sell when outflows occur (red bars). Surprisingly, this method allows you to outperform even during Bitcoin’s bullish periods.

This strategy, while simple, has consistently outperformed the broader Bitcoin market by capturing price momentum at the right moments and avoiding potential downturns by following institutional trends.

The Power of Compounding

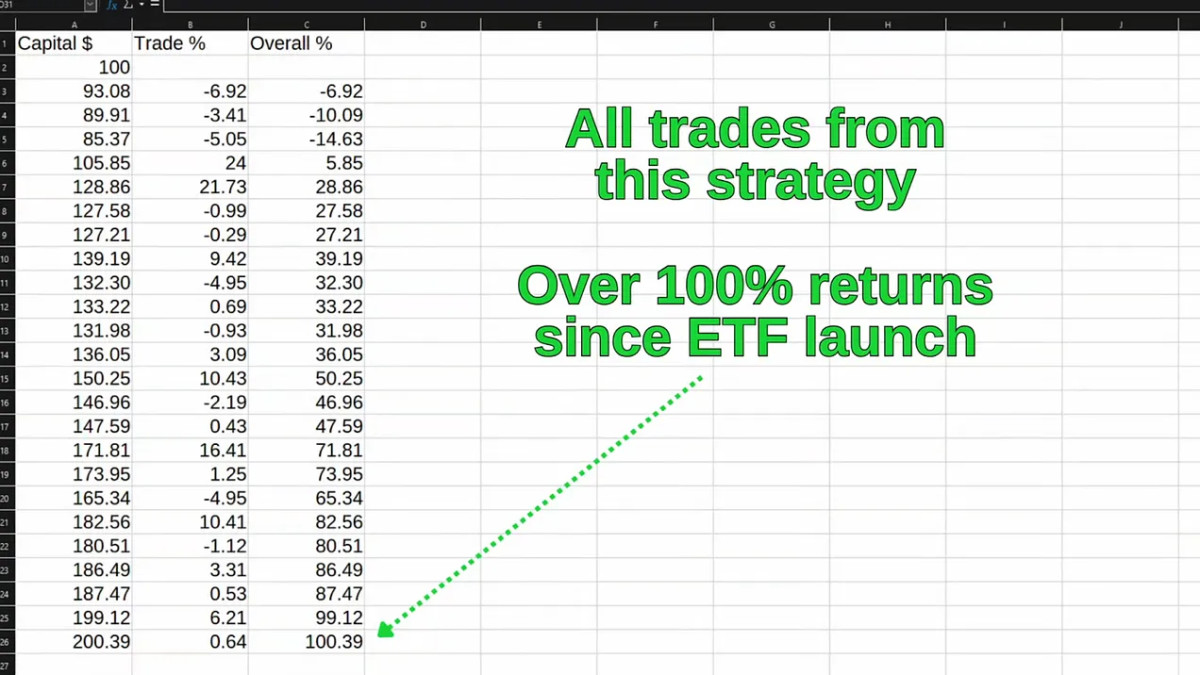

The real secret to this strategy lies in compounding. Compounding gains over time significantly boosts your returns, even during periods of consolidation or minor volatility. Imagine starting with $100 in capital. If your first trade yields a 10% return, you now have $110. On the next trade, another 10% gain on $110 brings your total to $121. Compounding these gains over time, even modest wins, accumulate into significant profits. Losses are inevitable, but compounding wins far outweigh the occasional dip.

Since the launch of the Bitcoin ETFs, this strategy has provided over 100% returns during a period in which just holding BTC has returned roughly 37%, or even compared to buying Bitcoin on the ETF launch day and selling at the exact all-time high, which would have returned approximately 59%.

Can Further Upside Be Expected?

Recently, we’ve begun to see a sustained trend of positive ETF inflows, suggesting that institutions are once again heavily accumulating Bitcoin. Since September 19th, every day has seen positive inflows, which, as we can see, have often preceded price rallies. BlackRock and their IBIT ETF alone have accumulated over 379,000 BTC since inception.

Conclusion

Market conditions can change, and there will inevitably be periods of volatility. However, the consistent historical correlation between ETF inflows and Bitcoin price increases makes this a valuable tool for those looking to maximize their Bitcoin gains. If you’re looking for a low-effort, set-it-and-forget-it approach, buy-and-hold may still be suitable. However, if you want to try and actively increase your returns by leveraging institutional data, tracking Bitcoin ETF inflows and outflows could be a game-changer.

For a more in-depth look into this topic, check out a recent YouTube video here: Using ETF Data to Outperform Bitcoin [Must Watch]

Source link

You may like

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Altcoins

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

Published

1 day agoon

December 22, 2024By

admin

Bitwise CIO Matt Hougan says a wave of institutional interest in altcoins is coming next year, largely due to potential regulatory clarity and more exchange-traded funds (ETFs).

In a new interview with Bloomberg, Hougan says that institutional money is in the early stages of broadening out to other crypto assets besides just Bitcoin (BTC).

Hougan forecasts that 2025 will be the year that institutional investors will begin to incorporate more diversification in their crypto-investing strategies the same way they do in other asset classes like equities or bonds.

“You’re already seeing it broaden out actually. A lot of people were worried about the Ethereum ETFs for instance, which launched this summer and had tepid inflows.

But over the last month or so, you’ve seen billions of dollars flow into those products.

Again, the things that have happened in crypto in the past keep happening. Historically, most people enter crypto through Bitcoin, and then they discover Ethereum, and then they think about Solana. There’s no reason to assume that the institutions that came into Bitcoin won’t move on to other assets in the future.

In fact, I think in 2025, you’re going to see an explosion of interest in index space strategies that give diversified exposure to crypto. Of course, [that is] something we’ve been doing at Bitwise since 2017 when we pioneered that concept. I think 2025 is when that becomes a mainstream way to allocate to this space, the same way it is to stocks and bonds and real estate and everything else.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Julien Tromeur/Sensvector

Source link

Censorship

Governments And Large Institutions Can Buy All The Bitcoin They Want (Except Yours)

Published

1 week agoon

December 13, 2024By

admin

An X post by Anita Posch warning about the risks of governments and institutions buying up large amounts of bitcoin went viral this week— even if just because of the trollish community note that appeared underneath it. I think the main concern here is that these big holders could influence the Bitcoin consensus rules to impose censorship.

When it comes to censorship specifically, mining centralization is actually a more direct threat. But if it’s just miners censoring, it would only last for as long as a majority of miners is willing to keep doing it— at the expense of forfeiting transaction fees. If and when the censorship stops, transactions would start confirming again as if nothing happened.

If economic nodes were to enforce censorship as new protocol rules as well, however, it can indeed be considered a soft fork. In this scenario, miners can’t revert from the censorship without splitting the blockchain between “upgraded” (censoring) and non-upgraded nodes; that would constitute a hard fork. Buyers and sellers of the two versions of bitcoin would then determine which blockchain is more valuable; this is why some bitcoiners are concerned about governments and other large institutions accumulating a significant share of the bitcoin supply.

It’s a reasonable concern, and something to be aware of. At the same time (and similar to my argument in this Take), it’s not obvious to me that governments or large institutions would be willing to risk it all by betting on a censorship fork of Bitcoin. But even more importantly, there isn’t much we can do to stop governments or other institutions from buying bitcoin anyways— nor should there be, as that would (ironically) itself represent a form of censorship.

The best countermeasure, in this regard, was actually already proposed by Nikolaus: Don’t sell MicroStrategy your bitcoin.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Ether (ETH) ETF Inflows Hit Record, Bitcoin ETF Inflows Soar as BTC Price Eyes $90K

Published

1 month agoon

November 12, 2024By

admin

“Assets in the US spot bitcoin ETFs are now up to $84b, which is 2/3 of the way to what gold ETFs have, all the sudden there’s a decent shot they surpass gold before their first birthday (we predicted it would take 3-4yrs),” Eric Balchunas, a senior analyst at Bloomberg, said in a post on X.

Source link

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential