Donald Trump

Meme coin circus rolls on

Published

1 month agoon

By

admin

In 2024, meme coins became one of the most traded and discussed aspects of the cryptocurrency sector. Critics argue they give the industry a bad image. Others enjoy the gambling thrills and, at times, mind-boggling returns. If and when the U.S. government steps in to regulate this controversial industry, what will the outcome look like?

When the crypto sector earned the moniker “Wild West,” meme coins were to blame. Thousands of new tokens are created daily via platforms like Pump.Fun. Investors — a mix of retail traders, crypto insiders, influencers, and sometimes institutional players — all hope to get an unlikely jackpot.

Meme coin opponents also blame the space for being a distraction from the higher-quality projects across the crypto sector. For example, the pre-inauguration launch of the Official Trump (TRUMP) token exemplifies this trend.

“The crypto sector put someone in power whose first act is to emphasize and take advantage of the opportunity for grift within crypto,” Angela Walch, a crypto researcher, told Time. “And that’s just embarrassing.”

The meshing of meme coins and politics isn’t exclusive to the U.S. In Argentina, President Javier Milei promoted the Libra token, which rose to $4.50 before plummeting in value.

As Lyn Alden, the founder of Lyn Alden Investment Strategy, put it in January: “The same bearish [traditional finance] accounts that dismissed bitcoin due to mostly unrelated ICOs, DeFi, and NFTs, will now dismiss it due to meme coins.”

Having watched this space since 2017, I see a lot of the same patterns.

The same bearish tradfi accounts that dismissed bitcoin due to mostly unrelated ICOs, DeFi, and NFTs, will now dismiss it due to meme coins.

When they could just buy it and beat their own portfolios.

— Lyn Alden (@LynAldenContact) January 20, 2025

Democrats speak up

Feb. 27 was marked with two important events in the meme coins space. First, the U.S. Securities and Exchange Commission (SEC) said that the securities regulations will not adhere to meme coins.

Second, the MEME Act proposal from Democrats aims to block American officials from launching their own meme coins, as Trump did before the inauguration. Are these events conflicting, and are meme coins so problematic? Let’s break it down.

The Official Trump token launch was controversial. Some saw it as a bold signal from the then-president-elect that he was ready to embrace crypto. However, many in the crypto community booed the move as a blatant “grift” considering the price dropped in value within just a few days.

The New York Times names $2 billion collectively lost by over 800,000 people who invested in the Trump coin.

Another important point of criticism was that the Official Trump token could line Trump’s pockets. Foreign political actors may bribe him effortlessly by buying TRUMP tokens in bulk (Trump signed an executive order freezing enforcement of the Foreign Corrupt Practices Act).

Various Democratic representatives are speaking up. California Democrat Rep. Sam Liccardo introduced the bill aimed to stop U.S. officials from creating tokens. Liccardo stressed that Trump’s meme coin “raises concerns about transparency, insider trading, and improper foreign influence.”

The bill, which is going to be named Modern Emoluments and Malfeasance Enforcement, or MEME Act, exists now only as a draft. The act is set to block the POTUS, Congress members, and other top officials and members of their families from launching cryptocurrencies.

More than that, the bill will block them from issuing or sponsoring both securities and commodities. The profits generated by Trump via the Official Trump token must be disgorged.

Although Liccardo doesn’t think that the Republican-controlled House of Representatives will support the bill now, he believes it can happen later when “the cult of Trump” will start to degrade and more Republicans will turn against him. The same week, it became known that the Trump family is going to create a branded metaverse that will include the NFT marketplace.

Was Gensler’s SEC too easy on meme coins?

Critics of the Biden-era crypto policies share a viewpoint that the Gary Gensler-led SEC deliberately ignored harmful meme coins while hunting down legitimate crypto brands like Ripple and Coinbase.

This theory suggests that the governmental agencies didn’t go after the thriving meme coin market as it served as a boogeyman to turn people against cryptocurrencies per se. People were investing in meme coins and losing money. It was creating a favorable background for the SEC and served as a good excuse to suppress legitimate crypto projects.

Is The SEC to Blame For the Rise of Meme Coins?

Former CFTC Chairman Chris Giancarlo shares his thoughts on the rise of Meme coins. He highlights that under Gary Gensler’s tenure he attacked good projects which forced the market towards meme coins.

Watch the full interview… https://t.co/mNTR9LWfjg pic.twitter.com/QKL5gJzBbn

— Tony Edward (Thinking Crypto Podcast) (@ThinkingCrypto1) February 16, 2025

SEC stays away, but warns of volatility

While the Gensler-era SEC was criticized for constant equalization of cryptocurrencies to unregistered securities, effectively outlawing them, the crypto-friendly Hester Peirce-era SEC refused to step it when over $2 billion were siphoned away from over 810,000 wallets holding Official Trump.

Peirce indicated that the SEC is not responsible for dealing with meme coins, since they’re not classified as securities.

On Feb. 27, the SEC clarified its stance by ruling that meme coins are not securities and more akin to collectibles. Therefore, it cannot be regulated by the SEC and people launching meme coins don’t have to register them as securities.

The statement warns about the significant market price volatility of meme coins, noting that this disclaimer is usually present in the descriptions of meme coins. This ruling gives the green light to create even more meme coins in the future.

Although the new SEC continues to stay away from regulating the meme coin space, there are signs of crisis in the sector. One of the main hubs of the 2024 meme coin revolution was Pump.Fun, a Solana-based launchpad that acts an Imgflip (a platform known for creating memes and GIFs) for crypto.

The tokens created on Pump.Fun are down 80%. Some attribute this decline to the controversial Libra coin downfall. However, the tariff war affecting the BTC price may be another mighty factor.

Meme coins are often compared to events like an ICO boom or an NFT boom, meaning that the dust will settle and the market will be recalibrated.

Vitalik Buterin said that the downsides of the ICO era were addressed via the DeFi solutions. The meme coin market can mature too.

There is perhaps an analogy with weed here.

Ten years ago, to many weed represented freedom, and rebellion against sclerotic old order that denied self-sovereignty over our bodies. Then, weed became legalized, and “official”.

On that day, I remember my personal interest in weed…

— vitalik.eth (@VitalikButerin) January 23, 2025

Source link

You may like

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Changpeng Zhao

Binance preps US comeback, courts Trump for help: report

Published

1 day agoon

April 13, 2025By

admin

Binance, the world’s largest cryptocurrency exchange, is plotting a return to the U.S. based on newfound ties with the Trump family.

According to the Wall Street Journal, executives from Binance met with U.S. Treasury officials last month to request the removal or reduction of a federal monitorship that has overseen the exchange’s compliance with anti-money-laundering laws since it pled guilty in 2023 and paid a record $4.3 billion fine.

Canada also fined Binance, but the penalty was much lower at $4.3 million.

At the same time, Binance has been exploring a business deal with World Liberty Financial (WLFI), a DeFi venture that claims to be “inspired” by President Donald Trump and has plans to launch a dollar-pegged stablecoin called USD1. Listing the token on Binance could generate billions for the Trumps, who are currently losing millions on the WLFI venture.

Trump and his family control more than 60% of the WLFI project.

The WSJ reports that Binance’s budding alliance with the Trump family stems from a private gathering in Abu Dhabi last December. Binance founder Changpeng Zhao met with Eric Trump and Steve Witkoff, who helped co-found World Liberty.

Fast-forward to now: The quid pro quo for the Trump administration offers a chance to roll back strict oversight; for the Trumps, Binance’s massive global reach — 250 million users and $65 billion in daily volume— could bolster the family’s crypto ambitions.

Crypto.news reached out to WLFI, but a spokesperson did not respond immediately with a comment.

The Trump administration has already made favorable moves toward the exchange, including disbanding a Department of Justice crypto enforcement unit.

Internally, Binance also seeks a presidential pardon for Zhao, who served four months in prison for violating U.S. anti-money laundering and sanctions regulations.

A Binance spokesperson did not respond to a request for comment.

Meanwhile, Trump representatives have reportedly discussed buying a stake in Binance.US, the exchange’s struggling American arm, and using Zhao’s connections to deepen the partnership.

The situation spotlights the unusual overlap between past enforcement targets and a White House now open to alliances with crypto bigwigs. With Trump — himself a convicted felon — already pardoning figures like BitMEX co-founder Arthur Hayes, the new crypto era in Washington, D.C., seems poised to reward the very “bad actors” the sector’s leaders complain about.

Source link

24/7 Cryptocurrency News

Crypto Market Rebounds As Donald Trump Exempts Tech From Tariffs On China

Published

2 days agoon

April 12, 2025By

admin

The crypto market, led by Bitcoin, has rebounded following Donald Trump’s decision to exempt tech products from tariffs he has imposed on China and other countries. Market participants see this as a positive amid the ongoing trade war between the US and China.

Crypto Market Rebounds As Donald Trump Exempts Tech Products From Tariffs

The crypto market has surged following Donald Trump’s move to exempt tech products from reciprocal tariffs imposed on China and other countries. According to a CNBC report, the US president has exempted phones, computers, and chips from the new tariffs.

The Bitcoin price surged past the $85,000 market following this report, with other altcoins also recording significant gains. This development is undoubtedly bullish for the market as it reduces the severity of the tariffs that Trump imposed on almost all countries earlier this month.

Moreover, this represents a big win for the stock market, with companies like Apple the biggest beneficiaries of this exemption. As such, it is normal for the crypto market to rebound alongside, given Bitcoin’s correlation with stocks.

Meanwhile, this move could also mark the beginning of the end of the ongoing trade war between the US and China. As CoinGape reported, China yesterday announced a 125% tariff on US imports following the latter’s decision to impose 145% tariffs on Chinese goods.

Trump already mentioned that he is looking forward to making a deal with China, which is also positive for the market. Bitcoin and altcoins could witness another massive rally once that happens.

Correctional Phase Could Soon Be Over

In a recent X post, crypto analyst Kevin Capital suggested that the correctional phase could soon be over for the crypto market. He noted that this phase has so far gone according to plan. However, he warned that there is still a lot of work to be done.

The analyst believes it is important for the Bitcoin price to clear the $89,000 level before market participants start feeling good. He added that the macro side also needs to line up for things to start looking really good for the market.

The macro side looks to be progressing well as the Federal Reserve recently revealed plans to provide liquidity if necessary. Meanwhile, the latest CPI and PPI inflation data came in lower than expectations, which could also motivate the Fed to start easing monetary policies.

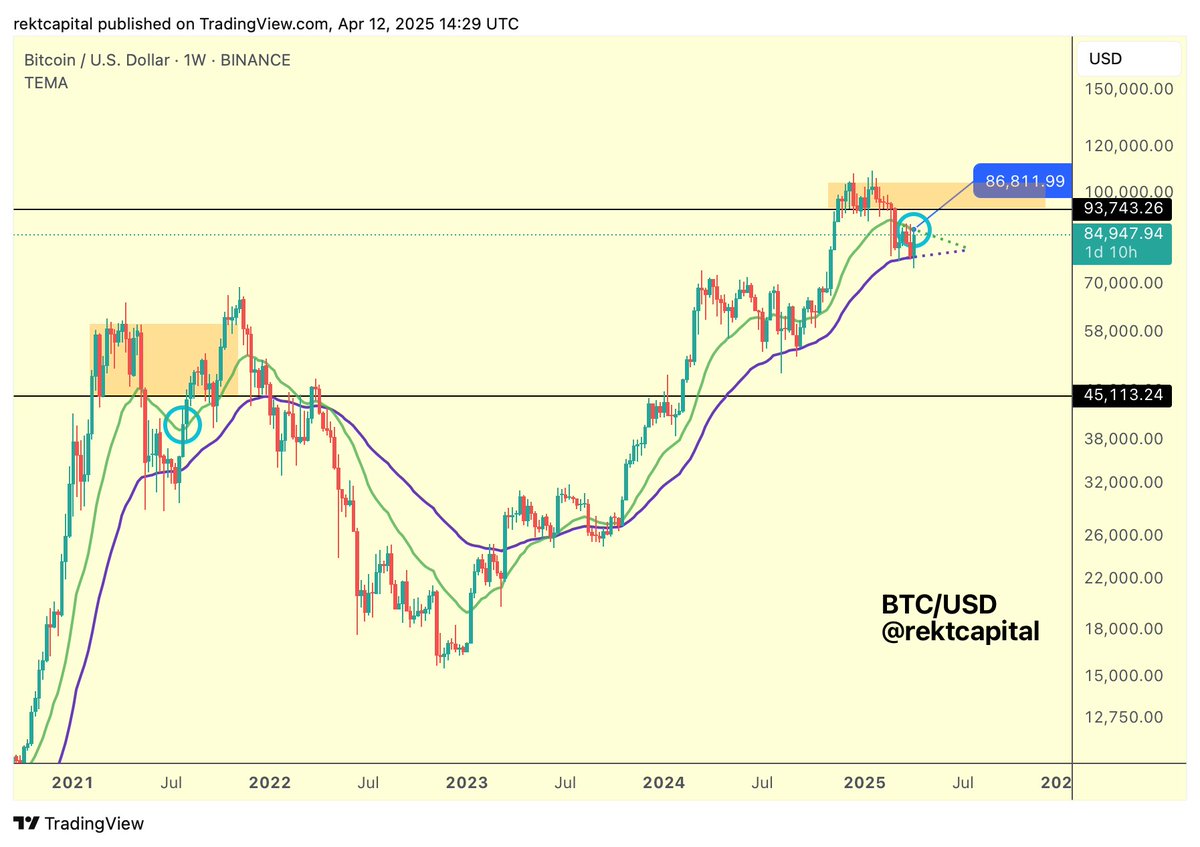

Crypto analyst Rekt Capital warned that Bitcoin isn’t there yet. He stated that it would be momentous to weekly close above $86,000, as this would potentially set BTC up for a repeat of a mid-2021 breakout. However, the flagship crypto is still away from the bullish weekly close of $86,811.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several topics and niches. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover, a traveler and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Chinese companies are leading the AI arms race. Chinese politician and computer scientist Lou Qinjian said as much, recently commending DeepSeek for their accomplishments: “DeepSeek adheres to an open-source approach and promotes the widespread application of AI technology globally, which contributes Chinese wisdom to the world,” he said.

“Through the rise of companies like DeepSeek, we can see the innovation and inclusiveness of China’s technological development.”

In February, at the Artificial Intelligence Action Summit in Paris, US Vice President JD Vance made clear where the Trump Administration stands on artificial intelligence. He said that, first and foremost, the Trump administration will ensure that American AI technology remains “the gold standard” worldwide and that US companies remain the partner of choice for international companies and foreign countries.

The Vice President argued that excessive regulation in the AI sector would kill the nascent industry, and that the administration would encourage pro-AI growth policies. “And I’d like to see that deregulatory flavor, making its way into a lot of the conversations at this conference,” he said. Vance also made it clear that AI should be free of ideological bias and that “American AI will not be co-opted into a tool for authoritarian censorship.”

Finally, the Trump administration will safeguard a pro-worker growth path for AI so it can create jobs in the United States. Vance also brought up the notion of foreign adversaries weaponizing AI software to rewrite history, surveil users, and censorship. As Vance stated:

“This is hardly new, of course, as they do with other tech. Some authoritarian regimes have stolen and used AI to strengthen their military intelligence and surveillance capabilities, capture personal data, and create propaganda to undermine other nations’ national security.”

He warned conference attendees against partnering with such regimes. “From CCTV to 5G equipment, we’re all familiar with cheap tech in the marketplace that’s been heavily subsidized and exported by authoritarian regimes,” he said. “But as I know, and I think some of us in this room have learned from experience, partnering with them means chaining your nation to an authoritarian master that seeks to infiltrate, dig in, and seize your information infrastructure.”

Under the hood of DeepSeek

DeepSeek shocked global markets in January with low-cost models that made it seem like US companies were now behind in the AI arms race. The AI lowered the costs of developing reliable AIs, proving itself to be a powerful and cost-efficient open-source language model.

It changed the way we view how much capital and computational resources are needed to develop AI. Researchers across the Western world are now left playing catch-up, studying DeepSeek’s technical advances and social implications.

There are clear benefits to DeepSeek. For instance, startups without the deep pockets of Google and OpenAI can now compete in the AI sector. AI models can do more with less in the post-DeekSeep world. The company claims it took a mere $6 million using 2,000 Nvidia H800 graphics processing units (GPUs) versus the $80 million to $100 million cost of GPT-4 and the 16,000 H100 GPUs needed for Meta’s LLaMA 3.

The Hangzhou-based startup’s AI model employs reasoning capabilities that allow smaller models, whereas other AIs have had to employ larger models. It also uses reinforcement learning, eliminating the need for supervised fine-tuning. Moreover, DeepSeek’s multi-head latent attention (MHLA) mechanism decreases memory usage to 5%, down from 13%, in earlier AI methods.

DeepSeek raises privacy concerns and questions regarding data-sourcing and copyright. DeepSeek is open-weighted, not open source. Open source models share the full source code and data, and open weight models share trained weights but not the code. Therefore, the exact source code used to train the models is not available.

Due to DeepSeek’s open weight model, it is unknown what its sources are. This seems to be the way most AI companies operate. DeepSeek made public its R1 training and open weight models, which will allow other AI developers to copy and build on the model, but not its sources.

DeepSeek and geopolitics

A race for AI dominance between China and the US has come into focus, while Russian capabilities on the matter remain a secret. Sberbank—Russia’s largest state-owned bank—has revealed its intentions to collaborate with Chinese researchers on AI projects. Russia and China, which share what they call a “no limits” strategic partnership, have long talked about AI cooperation—including in military applications—but little is publicly known about its depth or scope.

Sberbank, under CEO German Gref, once a Soviet-style former state savings bank burdened by onerous bureaucracy, is today one of Russia’s leading players in artificial intelligence. It released its GigaChat model in 2023. “Sberbank has many scientists. Through them, we plan to conduct joint research projects with researchers from China,” Sberbank First Deputy CEO Alexander Vedyakhin told Reuters.

As the AI arms race heats up, the benefits of open source innovation come to the forefront. Little flowers bursting through the concrete all around the world, coming up with cool tech that is open-sourced and decentralized.

Manouk Termaaten

Manouk Termaaten is the founder and CEO of Vertical Studio AI.

Source link

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: