Crypto scam

Meme Coins Die — Bloggers’ Advertising is Ineffective

Published

4 months agoon

By

admin

The vast majority of meme coins promoted by influencers in X end up “dead” — their value drops by 90% or more within three months.

The attention surrounding meme coins has led many famous X personalities to promote these tokens as a quick way to make money. However, the research by CoinWire shows the unpleasant reality: most meme coins have no value, and many investors face heavy losses.

“Our research reveals a sobering truth: most of these meme coins are, in fact, dead, and the majority of investors end up with significant losses.”

CoinWire report

To understand the meme coin situation, the experts analyzed data from over 1,500 tokens endorsed by 377 influential X users. They selected 377 of them with at least 10,000 followers who frequently promote meme coins. They then compiled a list of 1,567 meme coins that were promoted over the past three months.

Using Dune Analytics, experts collected information on the price when they were first promoted, the current price, and the price after one week, one month, and three months. A meme coin is considered dead if its current value has fallen by 90% or more compared to the initial promotion.

“76% of Twitter influencers have promoted meme coins that are now dead. Two out of three meme coins they promote are worthless. This means that many influencer-driven promotions essentially set up investors for failure.”

CoinWire report

The real effectiveness of meme coin promotion

The actual situation with meme coins differs significantly from influencers’ positive picture.

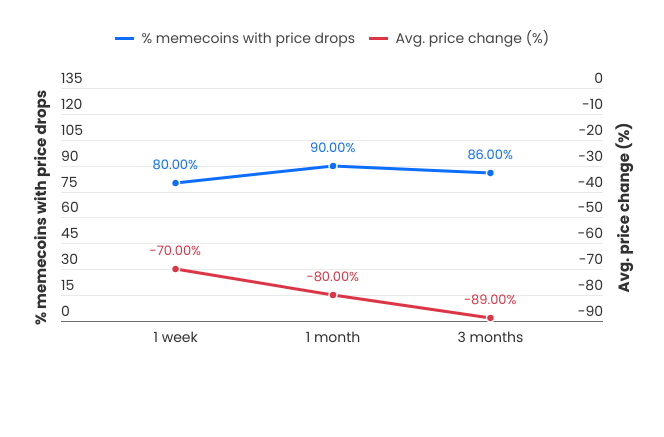

Stats show that these projects rarely meet their expectations: after a week, 80% of meme coins promoted by influencers lose 70% of their value.

After a month, about 90% of these tokens lost about 80% in value, and after three months, 86% of them fell in price by 10 times. As analysts note, this trend indicates significant instability and volatility of meme coins backed by influential individuals. In addition, most investors end up facing serious losses, often just a few weeks after investing.

Achieving high returns is almost impossible

One main factor that makes meme coins attractive is their potential to generate significant returns.

However, in reality, this almost never happens. Only 1% of influencers successfully promoted meme coins. Furthermore, only 3% of meme coins promoted by influencers ever achieved such a significant increase.

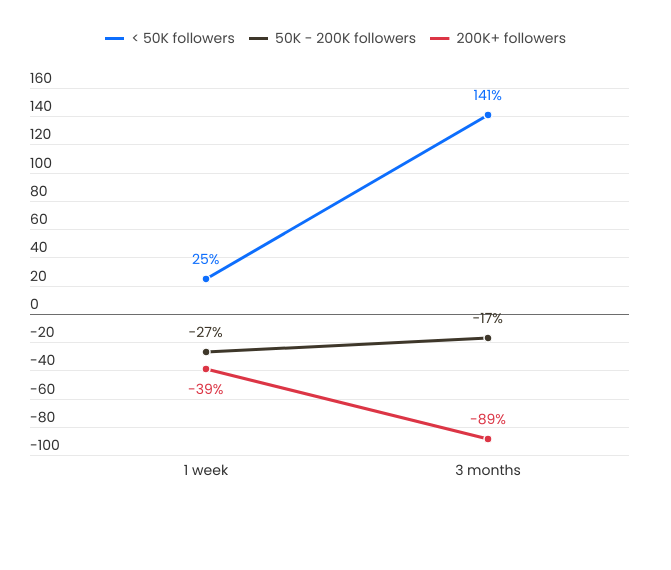

Interestingly, the more followers an influencer has, the worse the performance of the meme coins they promote. Influencers with over 200,000 followers tend to perform the worst, with their meme coin promotions losing 39% of their investment within a week and 89% of their investment within three months.

In contrast to more prominent influencers, those with fewer than 50,000 followers perform better, with 25% of their revenue positive within a week and a 141% increase within three months. This may indicate that smaller influencers are more sincere in their promotional approaches, while larger ones often prioritize financial gain over the quality of the projects they support.

As for influencer earnings from meme coin promotions, analysts used TweetHunter’s X earnings calculator to estimate the potential profit from a sponsored tweet.

While investors often lose money, influencers benefit from promoting meme coins. They earn an average of $399 for each promotional tweet that attracts about 15,000 views. In this way, influencers promote even the most dubious tokens in the hopes of making a high profit.

Influencer promotion is mostly harmful

The data highlights a disturbing reality: meme coin promotion by influencers is mostly doing more harm than good for ordinary investors. 76% of influencers promote tokens without activity, and the probability of getting the desired 10x return is extremely low.

“Investors need to be cautious, questioning the true value behind these promotions and avoiding decisions driven by social media hype alone.”

CoinWire report

A CoinWire study shows that X meme coin hype is good for influencers but almost always disastrous for investors. Most of these tokens quickly lose their value. The chances of serious profits for investors who believe the buzz are minimal.

Source link

You may like

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Crypto Liquidations hit $600M as BTC Plunges Below $80K First Time in 25-days

Bitcoin (BTC) Price Posts Worst Q1 in a Decade, Raising Questions About Where the Cycle Stands

Stablecoins are the best way to ensure US dollar dominance — Web3 CEO

bybit

NFT industry in trouble as activity slows, market collapses

Published

8 hours agoon

April 6, 2025By

admin

As the crypto market prepares for turbulence amid the tariff wars, the NFT market seems to be in a worse position.

Trading volumes are declining and marketplaces shutting down.

The once-hyped world of non-fungible tokens, which analysts once boldly projected could balloon to over $264 billion by 2032, now seems to be limping along. Weekly trading volumes have been falling like dominoes for weeks, scaring off capital and dragging the market back to levels not seen since its explosive 2020 debut.

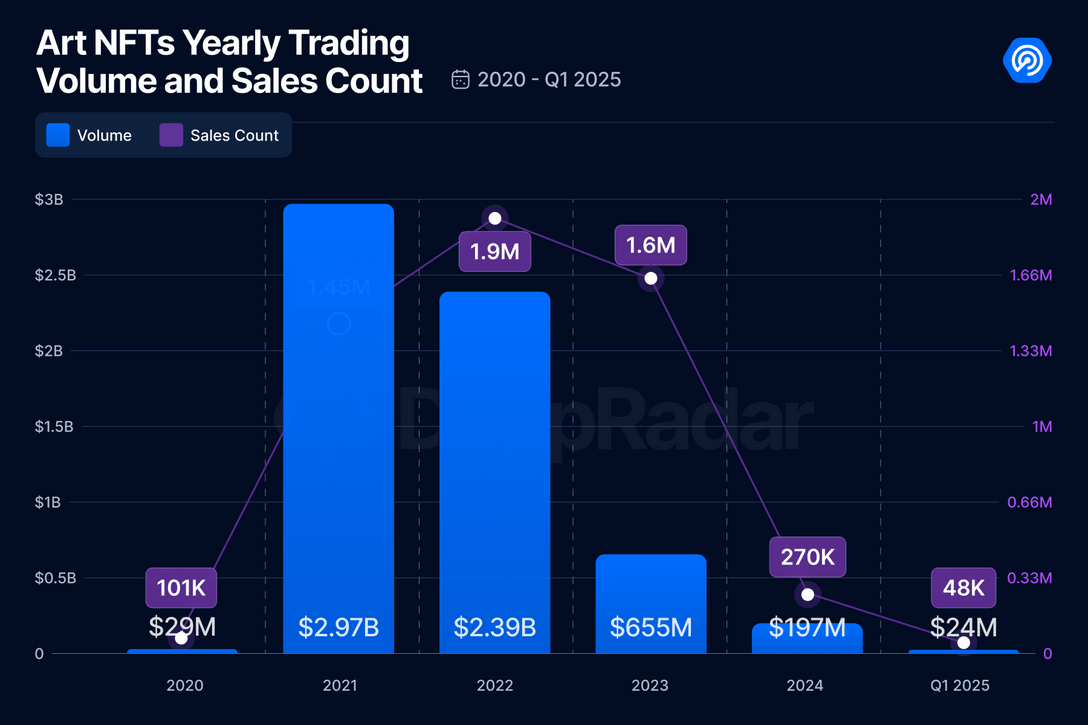

Blockchain analytics firm DappRadar shows that trading volumes in 2021 were riding high, hitting nearly $3 billion.

Fast-forward to the first quarter of 2025. That figure has nosedived 93% to just $23.8 million as “active traders have vanished,” blockchain analyst Sara Gherghelas noted.

“This rapid growth coincided with global shifts driven by the COVID-19 pandemic, accelerating the adoption of digital platforms and pushing artists to explore innovative methods of engaging with their audiences. However, three years later, the hype around Art NFTs has significantly decreased.”

Sara Gherghelas

The data backs her up. In 2024, trading volume dropped nearly 20% from the year prior, while total sales declined 18%. As Gherghelas put it in her 2025 research, it was “one of the worst-performing years since 2020.”

Still speculative assets

In an interview with crypto.news, OutsetPR’s legal officer Alice Frei implied that regulation is still a mess as “governments are still undecided on how to classify NFTs.”

In the U.S., they’re often treated like securities, meaning platforms must walk a legal tightrope. In the U.K., they’re seen more like collectibles under intellectual property law.

“These are examples of leading countries with clear cryptocurrency regulations; in many other countries, the situation is even more uncertain. This lack of regulatory clarity creates an environment that is ripe for fraud and erodes investor confidence. Until there is more consistency, NFT adoption will remain stagnant.”

Alice Frei

Frei also highlighted a deeper issue: beyond the worlds of cryptocurrency and gaming, NFTs are still “trying to prove that they offer real value.”

“In theory, they could revolutionize several industries — think concert tickets that prevent scalping, digital IDs for online verification, or property deeds stored on the blockchain. But in practice, most NFTs are still largely speculative assets.”

Alice Frei

Speaking of gaming, where NFTs have the most potential for mainstream use, their adoption is also struggling, Frei pointed out, recalling that Ubisoft’s Project Quartz, an attempt to integrate NFTs into AAA games, was met with “resistance from players, forcing the company to shut it down.”

Frei notes that gamers are “hesitant about digital assets that feel more like currency than a genuine addition to their experience.”

Revolving door

If the data wasn’t already bleak, March brought more bad news: a string of marketplace shutdowns added fuel to the fire. Among them, South Korean tech giant LG shut down its LG Art Lab, which was launched just three years ago at the height of the NFT mania. The company didn’t share detailed reasons, only saying that “it is the right time to shift our focus and explore new opportunities.”

Just a week later, X2Y2 — a former OpenSea rival that once boasted $5.6 billion in lifetime volume — also ceased its operations, citing a “90% shrinkage of NFT trading volume from its peak in 2021” and struggles to remain competitive in the space.

Then came Bybit. The crypto exchange, still reeling from a $1.46 billion theft linked to North Korea-affiliated hackers, quietly closed its platform.

Emily Bao, head of web3 at Bybit, said the decision would allow the company to “enhance the overall user experience while concentrating on the next generation of blockchain-powered solutions.”

Amid the wave of closures, Frei says the NFT market now “feels like a revolving door.”

“Take Bored Ape Yacht Club, for example – once the pinnacle of NFT status, its prices have dramatically dropped. At the peak, a single Bored Ape sold for $400,000, but now some are barely fetching $50,000. The problem lies in the fact that many NFT projects rely on hype rather than actual utility. If people cannot see long-term value, they are unlikely to return.”

Alice Frei

Last hope

Coinbase, too, seems to be pulling back. While it hasn’t officially shut down its NFT platform, all signs suggest it’s shifting focus. During an earnings call in early 2023, President and COO Emilie Choi indicated that the company sees “medium and long-term opportunities” in NFTs. But its real focus seems to be behind Base, its layer-2 blockchain network.

Coinbase declined to comment on its position as NFT activity continues to decline, despite multiple requests from crypto.news.

The OutsetPR legal officer thinks that with the market’s current trajectory, smaller platforms are unlikely to weather the storm. “Smaller platforms will continue to shut down, leaving only a few dominant players like OpenSea and Blur,” she said.

She explained that the shift is being driven by two major forces. First, tighter regulations are on the horizon, which will likely bring an end to the “Wild West days of NFTs.” Second, the gaming sector may offer NFTs a lifeline—but it’s still a narrow one. As Frei puts it, gaming may be NFTs’ “last hope,” though developers will still need to avoid “pay-to-win mechanics that could turn players away.”

“The hype is over. If NFTs are to survive, they will need to prove that they offer more than just expensive pictures on the blockchain,” Frei concluded.

Source link

From crypto queen to global fugitive: OneCoin’s Ruja Ignatova disappeared with billions, leaving a mystery still unsolved.

For eight years, the world has speculated about the fate of Ruja Ignatova: the so-called “Cryptoqueen” who vanished with billions after pitching OneCoin, a classic Ponzi scheme, leaving behind a trail of lies, lawsuits, and a mystery that refuses to die.

Crypto.news spoke with those who have dug deep into her story to get their take on where she might be now.

Shortly on her background as context: born in May 1980 in Bulgaria, Ruja Ignatova moved to Germany with her family at the age of ten, settling in Schramberg, Baden-Württemberg. She pursued higher education with distinction, earning a doctorate in private international law from the University of Konstanz in 2005. She even had a brief academic stint at the University of Oxford.

Before rising to infamy as the “Cryptoqueen,” Ignatova worked at McKinsey & Company as a consultant. However, her business ventures soon took a questionable turn. In 2012, she and her father, Plamen Ignatov, were convicted of fraud in Germany related to the acquisition and subsequent bankruptcy of a firm.

“The next Bitcoin”

It may not be widely known, but OneCoin wasn’t Ignatova’s first venture into crypto.

In 2013, she was involved in a multi-level marketing scam called BigCoin. Reports indicate that BigCoin was launched by John Ng and based in Hong Kong, with the project marketed using the usual MLM cryptocurrency pitch: “We’re gonna be the next Bitcoin.”

It’s not clear when, but at some point, the project was joined by Ronnie Skold, Sebastian Greenwood, Nigel Allen, and Ruja Ignatova herself. Long story short, BigCoin didn’t make it, as it turned out to be an ordinary Ponzi scheme, operating without a blockchain at all. By 2014, Ignatova left BigCoin to co-found a new venture with Sebastian Greenwood, better known to the world as OneCoin.

Second attempt

While Ruja Ignatova was the mastermind behind the project, Sebastian Greenwood was a key figure in the operations of OneCoin. Unlike Ignatova, though, Greenwood was arrested in 2018 and sentenced to 20 years in prison.

The two branded OneCoin as a revolutionary cryptocurrency poised to kill Bitcoin. Through high-profile events and persuasive marketing, they convinced thousands — if not millions — to invest, raising an estimated $4 billion globally. And still, like BigCoin, OneCoin also wasn’t operating on any blockchain, which led to the project’s crash three years after the launch.

On the run?

As authorities doubled down on their investigations, Ignatova vanished. In October 2017, she boarded a flight from Bulgaria, Greece and… disappeared. Without a trace. Over the years, theories about her fate have ranged from surgical alterations to mafia assassinations. Some reports even suggested that she was murdered on a yacht in the Ionian Sea on the orders of a Bulgarian crime figure, with her body allegedly dismembered and discarded.

There’re also rumors that Ignatova might actually be on the run, hiding in South Africa, Dubai, or even in Russia.

German documentary filmmaker Johan von Mirbach, who directed the 2022 investigative documentary “The Cryptoqueen – The Great OneCoin Fraud” doesn’t buy theories about Ignatova’s death. In an interview with crypto.news, Mirbach said he doesn’t believe in theories about her death, as there are too many “failed efforts to lay false tracks about her whereabouts.”

“I have talked to security sources from South Africa and Germany. There are investigations going on about where she could hide in South Africa. But nobody can tell where she really is. She could be in South Africa, in Dubai or — as you claim — in Russia or elsewhere. I’m convinced though that she is still alive as there are so many failed efforts to lay false tracks about her whereabouts.”

Johan von Mirbach

In June 2022, the FBI placed Ignatova on its ten most wanted fugitives list, initially offering a $100,000 reward for information leading to her arrest. By June 2024, that bounty had grown to $5 million. While Ignatova’s whereabouts aren’t clear, legal proceedings surrounding her name continue up to these days.

New opportunity

For instance, in August 2024, London’s High Court issued a worldwide freeze order on assets linked to Ignatova and her associates following revelations that OneCoin promoters had invested in luxury properties in the United Arab Emirates, including a $2.7 million penthouse in Dubai.

By late 2024, investigators had focused their search on Cape Town, South Africa, with speculation that she was living in an exclusive enclave under a false identity.

However, new reports in November 2024 suggested that Ignatova may instead be hiding in Russia. According to journalist Yordan Tsalov, who specializes in Kremlin affairs and has worked with Bellingcat, a Netherlands-based investigative journalism group, Ignatova has ties to individuals connected to the Russian government.

Tsalov says these links were confirmed by Ignatova’s former security adviser, Frank Schneider, a former Swiss intelligence officer who was hired by OneCoin and later interviewed by Tsalov for a BBC series.

Commenting on the scale of the OneCoin scam, Mirbach says the crypto industry is an “incredible space” not only for new businesses but also for criminals who could gain “much more than with simple analogue frauds.”

“They can just scale their scam to another level. The same mechanism that promotes and boosts online/digital business boots online fraud. Mobsters will also always go into news unexplored and unregulated markets and follow what is coming up.”

Johan von Mirbach

Now, Mirbach says he’s just waiting for the “first AI-driven fraud that is coming up with this new opportunity.”

Source link

Crypto scam

Financial institutions must protect account holders from scam

Published

2 months agoon

January 31, 2025By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Crypto scams are surging across the United States, with the FBI’s latest cryptocurrency report revealing that Americans lost a staggering $5.6 billion in 2023—a worrying 45% increase from 2022. Alarmingly, older adults, particularly those over 65, were hit hardest, collectively losing more than $1.6 billion. California has borne the brunt of these losses, recording the highest state total at $1.1 billion.

What makes these losses even more striking is the volume of financial fraud complaints received by the FBI compared to total losses reported crypto-related crimes, which accounted for around 10% of complaints received but nearly 50% of total losses to financial schemes in 2023. This points to the current effectiveness of crypto scams in extracting large sums of money from victims. The decentralized nature of cryptocurrency may also play a part in this, with a lack of regulation and relative irreversibility of transactions once made, investors must protect themselves, but if they are unable to, they are highly vulnerable to scams.

The FBI is working to proactively warn victims about possible scams as bad actors continue to seek cryptocurrency through fraudulent investments, tech support, romance scams, and employment scams. Despite this effort, evolving financial technology is still unfamiliar to investors, and a lack of financial education has made them more susceptible to crypto scams.

What puts crypto investors at risk?

The crypto industry’s financial environment, with its volatility and potential for lucrative returns, may make investors more susceptible to risky investing decisions and scams. The fear of missing out has been reported to drive investment choices for 8/10 investors. The psychological pressure and rushed decision-making associated with FOMO can be exploited by scammers, and with a lack of verified educational resources for investors, FOMO will continue to have a distinct impact on investor vulnerability.

Research from InvestiFi has also found that 35% of investors rely on internet searches for financial knowledge to help manage their investments, while 25% don’t use any sources. Forty percent of 18-25-year-olds use financial influencers for their financial knowledge, and 50% of those 55 and older do not have a source for their financial knowledge, leaving them susceptible to poor investment decisions.

This reliance on informal sources creates a multitude of investor problems. Fraudulent accounts created by scammers can be created just as easily as legitimate ones, going undetected due to the lack of verification required. It can also lead to investor overconfidence, the vast amount of advice online can present investors with the illusion of a comprehensive understanding, especially if new to the market, regardless of the relevance and validity of the advice. Overconfidence tends to lead to an underestimation of risks and increases such investors’ chances of poor investment choices or susceptibility to scams.

One of the barriers to crypto investing for many account holders is this lack of financial literacy. The majority of investors do not have access to financial advisors due to a lack of initial funds. Financial institutions must adopt educational tools and resources; by providing educational content such as videos, articles, webinars, or personalized insights within the digital investing platform, financial institutions can differentiate their offering from fintechs.

This positions the institution as a trusted advisor that helps account holders build their financial knowledge and confidence.

What can financial institutions do to safeguard their account holders?

By offering in-house financial education resources, whether through blogs, dedicated advisors, or easy-to-understand publications, institutions will fill this gap, positioning themselves as trusted, go-to sources of information. If institutions implement these measures early, they could take advantage of a huge market of people wary of crypto investment and looking for accountability behind the advice.

Additionally, offering personalized advice through robo-advisors or in-house experts will support those seeking guidance from informal sources such as independent advisors or the internet. Accessible and reliable financial education can strengthen customer relationships, improve engagement, and lead to more account holders investing and managing their finances directly within an institution’s ecosystem.

In the United States, it’s common for financial institutions to require a minimum of $25,000 to access a financial advisor. However, the majority of people interested in investing don’t meet this threshold, creating a gap where many potential investors are left without guidance, potentially leading them to third-party apps or independent influencers with often no financial barrier to accessing information.

Financial institutions have an opportunity to bridge this gap by offering accessible, low-barrier investment options. With the addition of digital investing solutions, educational resources, and entry-level investment tools, individuals with smaller portfolios will be empowered to start investing in crypto confidently. Account holders also gain the financial education to make safe crypto investment decisions and avoid unnecessary losses.

Kian Sarreshteh

Kian Sarreshteh has consulted with numerous blockchain, cryptocurrency, and fintech-focused companies across the United States since 2015. In 2015, he founded an IT recruiting and consulting company focused on financial technology and transformed the company into a multi-million dollar operation. Also, in 2015, he acquired a 35-year-old background check company that focused on regulated industries, including financial services. He led new product development, including the development of a Blockchain database to store background check records. Prior to his departure, Kian was instrumental in the company’s growth, with a 50% increase in revenue. In 2020, Kian co-founded CryptoFi, Inc.— now known as InvestiFi.

Source link

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Crypto Liquidations hit $600M as BTC Plunges Below $80K First Time in 25-days

Bitcoin (BTC) Price Posts Worst Q1 in a Decade, Raising Questions About Where the Cycle Stands

Stablecoins are the best way to ensure US dollar dominance — Web3 CEO

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

NFT industry in trouble as activity slows, market collapses

US Tech Sector About To Witness ‘Economic Armageddon’ Amid Trump’s Tariffs, According to Wealth Management Exec

XRP’s Open Interest Surges Above $3 Billion, Will Price Follow?

This Week in Bitcoin: BTC Holds Steady as Trump’s Trade War Wrecks Stocks

Decentralized exchanges gain ground despite $6M Hyperliquid exploit

BTC’s Strength Amid Nasdaq Drop is Impressive, But Potential Basis Trade Blowup That Catalyzed the COVID Crash Poses Risk

Ethereum instant finality? Buterin aims to silence critics

XRP High Stakes Setup: Analyst Warns Of Sharp Move To $17 Or $0.65

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x