BTC

MicroStrategy Buys a Further 1,020 Bitcoin

Published

3 months agoon

By

admin

Disclaimer: The analyst who wrote this piece owns shares of MicroStrategy (MSTR).

MicroStrategy (MSTR) has increased its bitcoin (BTC) holdings for the ninth consecutive week.

MicroStrategy holds more bitcoin than any other publicly traded company. In the week ending Jan. 5, MicroStrategy purchased a further 1,020 BTC for $101 million, bringing its total bitcoin holdings to 447,470 BTC.

It wouldn’t be a Sunday without Executive Chairman Michael Saylor teasing the announcement in a post on X. The average purchase price of the bitcoin was $94,004, which raised the average price to $62,503.

The latest bitcoin purchase was funded through share sales under the company’s at-the-market (ATM) program, for which they have $6.77 billion left on the ATM program.

The share price recovered on Friday with a 13% gain after an almost 50% drop from the Nov. 21 high of $543, while the stock is trading around $353 — 2% higher — in pre-market trading.

In addition, MicroStrategy announced it would be raising up to $2 billion via a preferred stock offering. This $2 billion offering sits separately to the 21/21 plan of $21 billion in equity and $21 billion in fixed income.

Preferred stock takes precedence over Class A common stock. In the filing, some features include convertibility to Class A common stock, payment of cash dividends and provisions allowing for the redemption of shares. The perpetual preferred stock and price offering terms have yet to be determined, while the offering is expected to occur in Q1 2025. The purpose of the offering is for MicroStrategy to acquire more bitcoin.

Source link

You may like

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

bear market

Hints of Long-Term Crypto Bear Market Showing Up, According to Coinbase Analyst

Published

19 hours agoon

April 17, 2025By

admin

A top Coinbase researcher says signs of a long-term crypto bear market are starting to emerge.

David Duong, the global head of research at Coinbase, says in a new analysis that the 200-day moving average (MA) indicates bearishness for Bitcoin (BTC) and the Coinbase 50 Index (COIN50), which tracks the performance of the 50 largest digital assets by market cap.

“As Bitcoin’s role as a ‘store of value’ continues to grow, we think a holistic evaluation of crypto’s aggregate market activity will be needed to better define bull and bear markets for the asset class, particularly as we’re likely to see increasingly diverse behavior in its expanding sectors.

Nevertheless, both BTC and the COIN50 index have recently broken below their respective 200-day MAs, which signals potential bearish long-term trends in the overall market. This is consistent with the fall in the total crypto market cap and decline in venture capital funding for this space, hallmarks of a potential crypto winter rising.”

The analyst says if a crypto bear market does set in, a bullish reversal could start taking shape sometime between July and September.

“Thus, we think this warrants taking a defensive stance on risk for the time being, though we still believe that crypto prices may be able to find their floor in mid-to-late 2Q25 – setting up a better 3Q25.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Published

1 day agoon

April 17, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

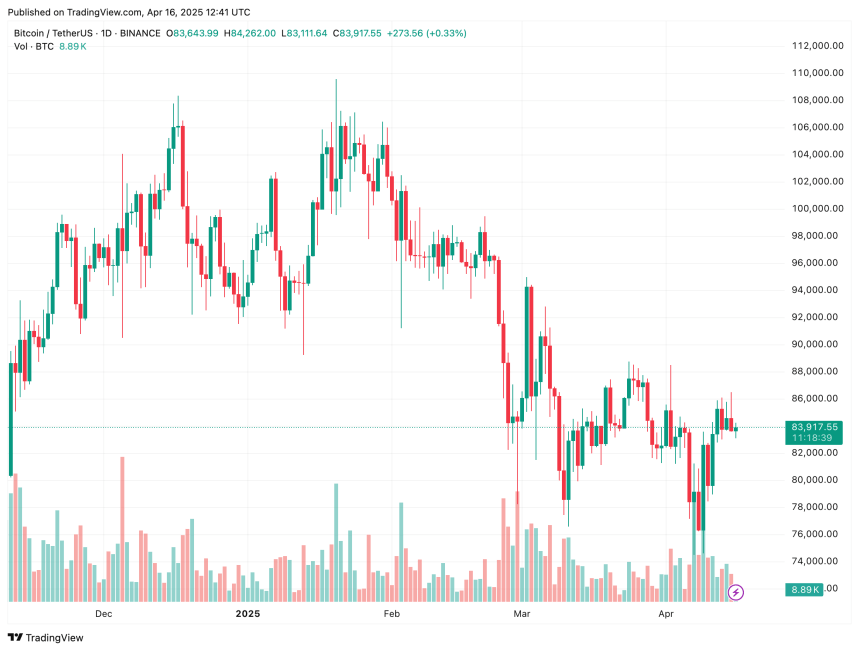

According to a recent CryptoQuant Quicktake post, while Bitcoin (BTC) has seen a steady rise in price from November 2024 to February 2025, sentiment in the cryptocurrency’s futures market has not shown a corresponding uptick.

Bitcoin Futures Sentiment Index Signals Caution

Bitcoin’s price surged from approximately $74,000 in November 2024 to a peak of $101,000 by early February 2025. However, following US President Donald Trump’s tariff announcements, risk-on assets – including BTC -have experienced a significant pullback.

Related Reading

After hitting a potential local bottom of $74,508 earlier this month on April 6, the apex cryptocurrency has recovered some of its recent losses. The top digital asset is trading in the mid $80,000 range at the time of writing.

Despite this recovery, BTC’s futures sentiment has continued to decline since February. Even as the price holds near local highs, sentiment in the futures market has notably cooled.

CryptoQuant contributor abramchart highlighted this divergence, noting that it could indicate increasing caution or profit-taking behavior despite the ongoing bullish trend. The analyst commented:

This indicates a cooling interest or increased fear in the futures market, possibly due to macroeconomic uncertainty, regulatory concerns, or expected corrections.

A look at the BTC futures sentiment index shows a resistance zone around 0.8 and a support level near 0.2. The index is currently hovering around 0.4, pointing to a predominantly bearish sentiment across futures markets.

Similarly, Bitcoin’s average price has steadily declined from its early 2025 highs. It is now ranging between $70,000 and $80,000, signalling possible market indecision amid heightened tariff tensions.

According to abramchart, if futures sentiment remains low, BTC could face extended price consolidation or even downward pressure in the near term. However, any emerging bullish catalyst could quickly shift the sentiment and renew upward momentum.

Is BTC Close To A Momentum Shift?

Some analysts believe Bitcoin may be nearing a breakout. After consolidating in the mid-$80,000s for several weeks, on-chain metrics suggest BTC may be undervalued at current levels. Indicators such as BTC exchange reserves and the Stablecoin Supply Ratio support this view.

Related Reading

In addition, momentum indicators like Bitcoin’s weekly Relative Strength Index have begun to break out of a long-standing downward trendline – raising hopes for a potential bullish rally back toward $100,000.

However, several risks still remain. The recent appearance of a ‘death cross’ on BTC’s price chart – combined with persistent macroeconomic concerns related to trade tariffs – could still weigh heavily on market sentiment. At press time, BTC trades at $83,917, down 1.8% over the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant and TradingView.com

Source link

Altcoins

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

Published

1 day agoon

April 17, 2025By

admin

A widely followed crypto analyst says one Solana (SOL) competitor may be gearing up for a breakout.

In a new thread, crypto trader Michaël van de Poppe tells his 783,000 followers on the social media platform X that Sei (SEI) may increase more than 100% its current value if it breaks through a key resistance level.

“SEI starts to show momentum. The Bitcoin pair has a strong bullish divergence on the higher timeframes and the USD pair faces a crucial resistance. Breaking through $0.20 opens up a continuation towards $0.30-$0.35.”

SEI is trading for $0.17 at time of writing, down 2.4% in the last 24 hours.

Next up, the analyst says that Bitcoin (BTC) is in a consolidation phase that may lead to an explosive move to the upside.

“Bitcoin is stuck in the final range. Another test of $87,000 and we’ll likely break upwards to the rally of a new all-time high.”

Bitcoin is trading for $83,800 at time of writing, flat on the day.

Lastly, the analyst says that Ethereum (ETH) may be kicking off an uptrend if the price of gold peaks, based on ETH’s historic inverse correlation with the precious metal.

“A good start of the week, as ETH is +4% against Bitcoin. The ultimate question whether it will sustain or not, last months it has been giving back the returns in the days after. What to monitor? Gold peaking or not. If that’s the case, then we’ll see more strength on ETH.”

The analyst also says that ETH’s Relative Strength Index (RSI) indicator is flashing bullish, having entered oversold territory.

The RSI is a momentum oscillator used to determine whether an asset is oversold or overbought. The RSI’s values range from zero to 100. A level between 70 and 100 indicates that an asset is overbought. The 0 to 30 level range indicates that an asset is oversold.

“It’s been a bear market for 1,225 days for ETH, as, in this period, gold did a 2x. The lowest RSI on the weekly candle for ETH as well.”

ETH is trading for $1,589 at time of writing, down 2% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals