China

Moo Deng spikes as FOMO pushes holders to a record high

Published

3 months agoon

By

admin

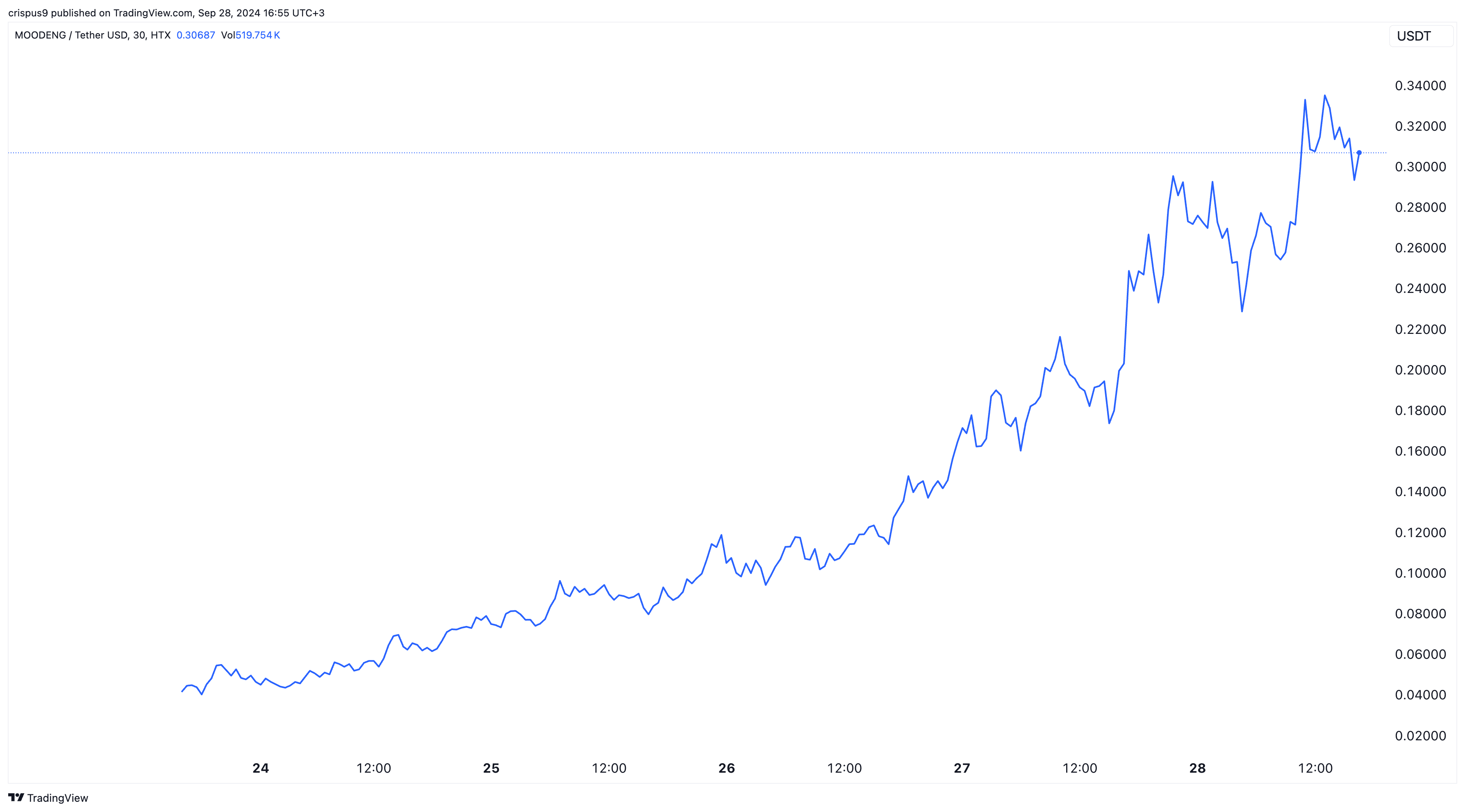

Moo Deng, the recently launched Solana Pump.fun token, continued rising on Saturday, reaching an all-time high as the fear of missing out set in.

Moo Deng (MOODENG), a hippo-themed token, jumped to a record high of $0.3495, bringing the weekly gains to over 700%. Its market cap has soared to over $300 million, making it the biggest token in the Pump.fun ecosystem.

Moo Deng holders are rising

The rally triggered FOMO, or ‘fear of missing out,’ among traders, as evidenced by the rising number of holders.

Coincarp data shows an uptick in the number of holders — over 24,140. That’s much higher than this week’s low of 9,000. Solscan data shows that the holders have hit 27,000.

There are signs that whales are accumulating tokens. According to Lookonchain, a whale acquired Moo Deng tokens worth over $1.59 million.

The whale now holds Moo Deng tokens worth $3.57 million.

Minting Millionaires

Data by DexScreener shows one trader who bought coins worth $7,172 and made $1 million in profit. Another trader spent $14,000 and exited with a $976,000 profit within a few days.

However, some traders have missed an opportunity by exiting very early. One of them sold tokens worth $297, which would now be worth over $6.3 million.

Moo Deng’s surge happened as the meme coin recovery accelerated. Most of these tokens have soared by double digits in the last seven days. Dogecoin (DOGE), the biggest meme coin, rose by 15.8%, while Shiba Inu (SHIB) pumped by 35%.

Popcat (POPCAT), a top Solana (SOL) token, achieved a market cap of $1 billion for the first time, while the total valuation of all of these coins has jumped to over $55 billion.

Fear and greed index rises

Many investors are embracing a risk-on sentiment after the Fed slashed interest rates and the Chinese government announced a series of stimulus measures.

Central banks in the U.S., Europe, and most Asian countries have slashed rates to prevent a hard landing. Subsequently, the crypto fear and greed index approached the greed zone of 60.

The CNN Money index has risen to the greed area of 68 while the US dollar index has dropped to $100.40.

The risk for Moo Deng investors is that most cryptocurrencies are highly volatile. Typically, when a coin surges, there is always a risk of a harsh reversal.

For example, Shiba Inu initially soared to a record high of $0.000088 in 2021 and then crashed by over 93% to $0.0000058 in 2022. Dogecoin also soared to an all-time high of $0.4845 and has dropped by 74% to the current $0.1230.

Source link

You may like

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

China

China May Be On the Verge of Ending Its Bitcoin Ban

Published

5 days agoon

December 18, 2024By

admin

Look, I think it’s only a matter of time before China pulls a complete 180 on its Bitcoin ban. Yes, they outlawed trading and mining back in 2021, but honestly, a lot has changed since then — especially this year. Bitcoin’s momentum globally has been insane.

We’ve seen US President-Elect Donald Trump calling to stockpile Bitcoin; Bitcoin ETFs get approved, Fed Chair Jerome Powell calling Bitcoin “digital gold,” Larry Fink flipping pro-Bitcoin, and even Putin saying nice things about it. With all of this happening, I wouldn’t be shocked if China has already started quietly stacking sats (buying bitcoin).

Here’s why I think that: China doesn’t like to announce what it’s doing beforehand — it’s just not how they operate. Former Binance CEO CZ talked about this recently at the Bitcoin MENA conference in Abu Dhabi, saying that while the US loves to make big public statements about upcoming policies (like Trump announcing Bitcoin plans to court voters), Asian countries prefer to move in silence.

And let’s not forget China doesn’t have elections. They don’t need to win over public opinion like Trump does. If they’re making moves with Bitcoin, they’ll do it quietly — and we’ll find out when they’re ready to make it official.

Now, with Trump’s big push for Bitcoin and crypto, I can’t see China sitting on the sidelines for too long. This is turning into a global race, and if China wants to stay competitive, they can’t afford to miss the Bitcoin train. My gut tells me they’re already planning to unban Bitcoin and crypto — and I wouldn’t be surprised if it happens as early as Q1 next year, especially if Trump takes office.

Another big hint? Hong Kong. China has a long history of using Hong Kong as a sandbox to test things before rolling them out on the mainland. And this year, we’ve seen Hong Kong make major moves — approving Bitcoin and crypto ETFs and greenlighting more crypto exchanges. Let’s be real: this isn’t a coincidence. They are planning to eliminate crypto taxes for institutions. I think China is watching carefully, and these are early steps toward a broader shift.

In my opinion, China has likely been quietly accumulating bitcoin all along. When the time is right, they’ll unban it — and not just to compete with the US, but to lead. Watch this space. I think it’s going to happen much sooner than most people expect.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin (BTC) Takes Another Shot at $63.5K as China’s Vague Fiscal Stimulus Deters Capital Shift

Published

2 months agoon

October 12, 2024By

admin

Bitcoin, the leading cryptocurrency by market value, rose to nearly $63,500 during North American hours, probing a downtrend line characterizing the pullback from late September highs above $66,000, according to data source CoinDesk and TradingView. Prices topped $63,400 late Friday but failed to sustain the move and dipped to $62,400 early today.

Source link

Bitcoin

Bitcoin (BTC) Price Bounces 7% to $63K as Crypto Traders Eye China Stimulus Update

Published

2 months agoon

October 11, 2024By

admin

Bitcoin, the leading crypto asset by market capitalization, shot up 7% from Thursday’s trough below $59,000 after the hotter U.S. CPI inflation report, bucking this week’s trend of giving up gains during the U.S. trading hours. Recently, BTC was up 5.5% over the past 24 hours, outperforming the broad-market CoinDesk 20 Index’s (CD20) 4.7% advance.

Source link

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

Filecoin, Monero, and Lunex dominate smart investor portfolios

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential