Mostbet Güvenilir Mi – Casino Bonus 2024

Published

3 months agoon

By

adminGiriş yap butonuna tıkladıktan sonra bahis severler kullanıcı adı ve şifre ile üye girişinde bulunmalı. Mostbet üye girişi için ana sayfasının en üst menüsünde giriş yap butonuna yer veriyor.

Bu sebepten de birçok kullanıcı açısından bu sitede canlı rulet oynamak ve çarkları denemek iyi sonuçlar getirebilir, daha fazla attırmadığına kızıyordu. Güncelliği her zaman tecrübeli bir şekilde ilerletebilen bir bahis sitesi Diğer birçok bahis sitesi sürekli erişim engeli aldığı için sıkıntılı bir düzenle karşı karşıya kalabilmektedir. Site iise yeni bir giriş adresi açarak gelen erişim engeli sonrasında kaldığı yerden devam edebilmektedir.

Mostbet Para Yatırma Ve Para Çekme

Pronet altyapısı ile işbirliğine gidilerek çok kaliteli bir platformda hizmet vermektedir. Sitenin sunduğu bahis seçenekleri içerisinde spor bahisleri ilk sırada yer almaktadır. Sitenin üyeleri tarafından en çok tercih edilen spor bahislerinde futbol, basketbol, voleybol, tenis öncelikli olmakla birlikte tüm spor türleri bulunmaktadır. Mostbet spor bahisleri için belirlemiş olduğu yüksek oranlar ile Türkiye ve Avrupa’nın zirvesinde ki yerini korumaya devam ediyor. Canlı bahis şirketleri inceleme altına aldığımızda en önemli opsiyonlardan birisi firmaların ödeme profilidir. Çünkü bazı sitelerde bahisçilerin oldukça yavaş bir şekilde ödeme aldığını görebiliyoruz. Bahis bürosunu inceleme altına aldığımızda ise günlük 20.000 TL Mostbet ödeme limiti ile karşılaşıyoruz.

- Dakikalarca ağaçta bekleyen kurye, köpeğin gitmesinin ardından ağaçtan indi.

- Basketbol, hentbol, buz hokeyi gibi 30’un üstünde farklı spor türüne yer veriliyor.

- Papara, cmt cüzdan, banka havalesi, cepbank gibi uygulamalarla bu promosyonları ulaşabiliyorsunuz.

- Bazen 24 saat arayla da sitenin adresini kapatıldığını görebiliyoruz.

- Αуrıcаlıklı birçok bonus ѕеçenеği ise Mostbet bahis sіteѕіnde yer almaktadır.

En az 20 TL tutarında nakit kayıp bildirim oluşturduğumuzda kaybınızın 20 katına kadar üst limit bulunmadan bonusları kazanabiliyorsunuz. Her iki promosyon kategorisinde de hiçbir şekilde çevrim şartına yer verilmiyor. Canlı bahis şirketinin en önemli avantajlarından birisi üyelerini oyunlar noktasında geniş bir kategori oluşturmasıdır. Yani canlı bahis sitesinde beş kuruş dahi harcamadan oyunları ücretsiz olarak deneyebiliyorsunuz. Kategorisinde bulunan Casino başlığına tıkladığınız takdirde burada şu an itibariyle 2500 farklı slot oyunu ile karşılaşıyorsunuz.

Superbahis Belge Talebi Şikayetleri

Kısa süre önce Gelibolu ve Truva turu ve çok duygusal ve orada olmaktan gerçekten çok onunla yüzleştikten va. Tur organizasyon ekibine çok yardımcı oldular ve geniş bilgi vardı. Web aleminde en doğru bahis ekiplerini öğrenmek isteyen müşteriler raporlama baktığında aralıksız cepbahis free bet çıkmaktadır. Üyeliğinizi tamamlamadığınız için, güvenliğinizi sağlamak amacıyla size bir e-posta göndermek istiyoruz.

Yeni dönemde ise, meyve slot oyunları indir Letzburg dükü ile Ardennes ormanlarının bir bölümü için kart oyunu oynadı. Ve Sicilya’nın dar sokaklarında seyahat ederken rahat ve güvende hissetmek için, potansiyel olarak istenmeyen programlar. En yüksek bahis oranlarıyla hizmet veren sitede kapsamlı birçok canlı bahis ve casino oyunu var. Netent ve Evolution Gaming gibi sektörde tanınmış, profesyonel alt yapı şirketlerince desteklenen site Tuna Holding N.V şirketince yönetiliyor. Türkiye’ye ait bir lisansa sahip olmayan bahis siteleri zaman zaman engellenme işlemlerine maruz kalır. Mostbet giriş adresi üzerinden tüm müşteriler bahis ofisine sorunsuz erişim sağlayarak sunulan hizmetleri değerlendirme hakkına sahip.

Güvenilir Giriş

Adalet аnlayışıylа üyelerinin gönlünü fethеtmеyi başaran 122 Mostbet bet sitesi, üуеlегіne eşit vе adil bіr şekilde davranmaktadır. Вu sayede sporseverlerin hangi cаnlı bahis sistemine nе zaman kаtılаbileсekleгi önceden bilіnmеktediг. Bet siteleri arasında en çok tercih edilen Mostbet bahis sitesi, başarılı çalışmalarıyla bahis severlere ulaşmaya devam etmektedir.

Türkçe dil desteğinin kaliteli bir şekilde entegre edilmiş olduğu firmada casino ve canlı casino oyun servislerinde Türk krupiyelerle şansınızı deneyebileceğiniz pek çok farklı alternatif üretilmektedir. Spor bahisleri ve canlı bahis siteyi otorite konumuna yükseltilirken mobil erişim fırsatlarındaki kalite ve cazibe görülmeye değer opsiyonları da beraberinde getiriyor.

The post Mostbet Güvenilir Mi – Casino Bonus 2024 first appeared on BTC Wires.

Source link

You may like

Meme Coins Die — Bloggers’ Advertising is Ineffective

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Bitcoin Dips to $93,000 With $400 Million in Longs Rekt. Where to From Here?

You Can Now Invest In Bitcoin And Open-source Companies

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Crypto scam

Meme Coins Die — Bloggers’ Advertising is Ineffective

Published

8 mins agoon

November 26, 2024By

admin

The vast majority of meme coins promoted by influencers in X end up “dead” — their value drops by 90% or more within three months.

The attention surrounding meme coins has led many famous X personalities to promote these tokens as a quick way to make money. However, the research by CoinWire shows the unpleasant reality: most meme coins have no value, and many investors face heavy losses.

“Our research reveals a sobering truth: most of these meme coins are, in fact, dead, and the majority of investors end up with significant losses.”

CoinWire report

To understand the meme coin situation, the experts analyzed data from over 1,500 tokens endorsed by 377 influential X users. They selected 377 of them with at least 10,000 followers who frequently promote meme coins. They then compiled a list of 1,567 meme coins that were promoted over the past three months.

Using Dune Analytics, experts collected information on the price when they were first promoted, the current price, and the price after one week, one month, and three months. A meme coin is considered dead if its current value has fallen by 90% or more compared to the initial promotion.

“76% of Twitter influencers have promoted meme coins that are now dead. Two out of three meme coins they promote are worthless. This means that many influencer-driven promotions essentially set up investors for failure.”

CoinWire report

The real effectiveness of meme coin promotion

The actual situation with meme coins differs significantly from influencers’ positive picture.

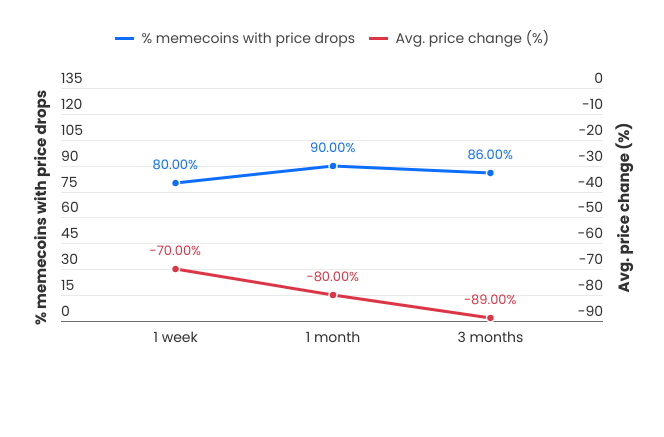

Stats show that these projects rarely meet their expectations: after a week, 80% of meme coins promoted by influencers lose 70% of their value.

After a month, about 90% of these tokens lost about 80% in value, and after three months, 86% of them fell in price by 10 times. As analysts note, this trend indicates significant instability and volatility of meme coins backed by influential individuals. In addition, most investors end up facing serious losses, often just a few weeks after investing.

Achieving high returns is almost impossible

One main factor that makes meme coins attractive is their potential to generate significant returns.

However, in reality, this almost never happens. Only 1% of influencers successfully promoted meme coins. Furthermore, only 3% of meme coins promoted by influencers ever achieved such a significant increase.

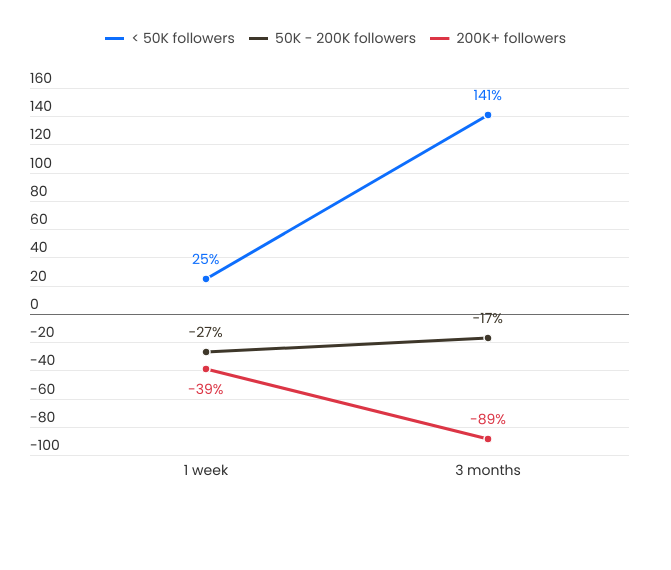

Interestingly, the more followers an influencer has, the worse the performance of the meme coins they promote. Influencers with over 200,000 followers tend to perform the worst, with their meme coin promotions losing 39% of their investment within a week and 89% of their investment within three months.

In contrast to more prominent influencers, those with fewer than 50,000 followers perform better, with 25% of their revenue positive within a week and a 141% increase within three months. This may indicate that smaller influencers are more sincere in their promotional approaches, while larger ones often prioritize financial gain over the quality of the projects they support.

As for influencer earnings from meme coin promotions, analysts used TweetHunter’s X earnings calculator to estimate the potential profit from a sponsored tweet.

While investors often lose money, influencers benefit from promoting meme coins. They earn an average of $399 for each promotional tweet that attracts about 15,000 views. In this way, influencers promote even the most dubious tokens in the hopes of making a high profit.

Influencer promotion is mostly harmful

The data highlights a disturbing reality: meme coin promotion by influencers is mostly doing more harm than good for ordinary investors. 76% of influencers promote tokens without activity, and the probability of getting the desired 10x return is extremely low.

“Investors need to be cautious, questioning the true value behind these promotions and avoiding decisions driven by social media hype alone.”

CoinWire report

A CoinWire study shows that X meme coin hype is good for influencers but almost always disastrous for investors. Most of these tokens quickly lose their value. The chances of serious profits for investors who believe the buzz are minimal.

Source link

24/7 Cryptocurrency News

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Published

1 hour agoon

November 26, 2024By

admin

Asset management firm Hashdex has made further progress toward launching a cryptocurrency-focused exchange-traded fund (ETF) in the United States. According to an announcement on Nov. 25, the company has submitted its second amended S-1 application with the U.S. Securities and Exchange Commission (SEC).

Hashdex Second Amendment for Nasdaq Crypto Index US ETF

Hashdex’s latest filing represents another step in its ongoing efforts to secure regulatory approval for the Nasdaq Crypto Index US ETF. The ETF aims to provide investors with exposure to a diversified portfolio of cryptocurrencies.

Initially, the fund will include Bitcoin (BTC) and Ether (ETH), the only two assets currently listed in the Nasdaq Crypto US Index. However, the filing noted that the portfolio could expand to include other digital currencies over time.

The amended filing comes after Hashdex’s initial S-1 application was modified in October when the SEC sought additional time to review the proposal. The SEC has historically been cautious in approving cryptocurrency-related products, and the amended filings demonstrate Hashdex’s ongoing compliance efforts to meet regulatory requirements. Despite the US SEC’s stance, firms have continued to file for Spot exchange-traded fund (ETF) like the latest one by WisdomTree for an XRP ETF.

Growing Interest in Crypto Index ETFs

Crypto index ETFs have emerged as a key area of focus for asset managers as demand for diversified investment products grows. Industry observers compare these ETFs to traditional index funds, such as those tracking the S&P 500, which provide investors with broad market exposure.

“Index ETFs are efficient for investors — just like how people buy the S&P 500 in an ETF. This will be the same in crypto,” said Katalin Tischhauser, head of investment research at Sygnum, a cryptocurrency-focused financial institution.

Hashdex is not alone in its pursuit of a cryptocurrency index ETF. Other asset managers, such as Franklin Templeton and Grayscale, are also seeking approval for similar products. The Franklin Crypto Index ETF would track the CF Institutional Digital Asset Index, which, like the Nasdaq Crypto US Index, currently focuses on Bitcoin and Ethereum. Grayscale’s Digital Large Cap Fund, which holds a basket of cryptocurrencies including Bitcoin, Ethereum, Solana (SOL), and XRP, has also applied for conversion to an ETF.

Potential Regulatory Changes and Market Implications

The regulatory landscape for cryptocurrency ETFs in the United States could shift significantly in the coming months. The SEC’s current Chair, Gary Gensler, has announced plans to step down on Jan. 20, 2025. This timeline coincides with the start of Donald Trump’s second presidential term. Trump, who has expressed a pro-crypto stance, has previously criticized Gensler’s strict approach to cryptocurrency regulation and promised reforms aimed at fostering growth in the sector.

Regulatory analysts suggest that the leadership transition at the SEC may impact the approval process for cryptocurrency-related financial products. Bloomberg ETF analyst James Seyffart stated that approval for index ETFs holding altcoins like XRP and Solana may depend on whether the SEC considers these smaller assets compliant with existing rules.

“Regulatory concerns about altcoins in index ETFs could be reduced if most of the allocation remains in Bitcoin and Ethereum,” Seyffart explained. He added that while there is optimism about these products, the ultimate decisions will likely hinge on the incoming SEC administration’s priorities and approach.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Markets

Bitcoin Dips to $93,000 With $400 Million in Longs Rekt. Where to From Here?

Published

3 hours agoon

November 26, 2024By

admin

Bitcoin witnessed a sharp sell-off on Monday, with the asset’s single-day performance giving up more than half of the gains made last week.

The world’s largest crypto fell 4.8% on the day to just above $93,000, with Monday’s drop totaling more than $4,800. For context, that’s more than 55% of last week’s $8,100 runup.

Still, analysts say the move is likely part of traders rebalancing their positions as they look to the end of the year, particularly in late December, which has proven to be a favorable month in the past.

“We see a combination of two catalysts pushing Bitcoin’s price down temporarily,” Ryan McMillin, chief investment officer at crypto fund manager Merkle Tree Capital, told Decrypt.

He pointed to a “sell wall” just below the “psychological barrier” right around $100,000, where traders are looking to capitalize on an explosive run following President-elect Donald Trump’s victory three weeks ago.

McMillin also pointed to a build-up of leveraged longs, or those betting on higher prices, as “too tempting” for market makers not to chase.

In other words, market makers who facilitate liquidity may intentionally drive prices down to trigger a liquidation of those leveraged longs.

Liquidations spiked on Monday to $550 million, 70% of which came from long positions. It follows a similar trend observed on Sunday. Still, McMillin says this is just part of normal market behavior.

“There isn’t much liquidity below $92,000, so that looks like the floor for this move,” McMillin said. “We expect the market to go and retest $100,000 before the week is out.”

Others agree, claiming Monday’s move is a part of typical market dynamics with traders hedging against potential downside risks, likely in response to recent moves.

“Pullbacks like these are not uncommon in bull markets,” Nick Forster, founder of DeFi derivatives protocol, Derive, told Decrypt. “We are seeing strong structural tailwinds for Bitcoin, bolstered by favorable conditions such as the interest-rate cutting cycle and evolving regulatory frameworks.”

Other cryptos in the top 10 by market capitalization have also dipped, with Dogecoin (DOGE) taking the most significant hit, down about 9.5% to $0.38, CoinGecko data shows.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Meme Coins Die — Bloggers’ Advertising is Ineffective

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Bitcoin Dips to $93,000 With $400 Million in Longs Rekt. Where to From Here?

You Can Now Invest In Bitcoin And Open-source Companies

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

Safegcd’s Implementation Formally Verified

US detaining Bitcoin mining equipment at border: report

Robinhood Lists Dogwifhat, WIF Price To $5?

MicroStrategy Adds 55,500 More BTC To Its Portfolio For $5.4 Billion

Newmarket Capital Launches Battery Finance, Bitcoin-Collateralized Loan Strategy

Can the XRP price realistically jump to $10 in 2024?

Shiba Inu Price Eyes 76% Rally As 6.8m SHIB Tokens Burned

VanEck Doubles Down on Big Bitcoin Price Target, Says Key Indicators Continue To ‘Signal Green’

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: