crypto

Nevada Welcomes Bitcoin and Crypto: Day Two of the America Loves Crypto Tour

Published

4 months agoon

By

admin

The speakers and performers at the second night of the America Loves Crypto tour were just as impassioned and driven to get out the crypto vote as those from the first night of the tour.

The political figures and crypto industry leaders present at this event, which took place at The Space in Las Vegas, included Sonny Vinuya, Outreach Director for Nevada Governor Joe Lombardo (R); Rudy Pamintuan, Nevada Lieutenant Governor Stavros S. Anthony’s Chief of Staff (R); Nevada State Treasurer Zach Conine (D) and Kate Rouch, Chief Marketing Officer (CMO) at Coinbase, amongst others. Rapper and singer 070 Shake and Las Vegas-based DJ 3LAU performed at the event.

The common threads in the rhetoric of the speakers and performers at the event were that crypto is here to stay, Nevada will be a home for the crypto industry and that the crypto vote matters deeply in Nevada, a swing state with a population of just over 3.1 million in which the 2024 Presidential election vote differential was only 33,516.

Ensuring Victory for Pro-Crypto Candidates in Nevada

“We need to ensure that our policymakers and the leaders we elect are those that embrace what we believe in,” Pamintuan, a crypto investor since 2015, told the audience.

“And so in this coming election cycle, especially here in Nevada, elections are going to be won or lost by 1 or 2 percentage points. That’s about 15,000 to 30,000 votes,” he added.

“When you add up how many people in our state are investors in crypto, that number is far greater than the margin of victory.”

Far greater is an understatement, as 385,000 Nevadans own crypto, according to the Stand With Crypto Alliance. This number was plastered across screens at the event for the entirety of the evening.

“In my business, we always say the market will decide,” began Conine.

“Well, guess what, folks? You’re the market, and your vote matters. Elections in this state are always very close, and they’re not close because everybody votes and both sides are even. They’re close because some people vote, but a lot of people stay home,” he added, before urging those in the audience who weren’t registered to vote to do so while stressing that the crypto vote can sway the ballot in upcoming elections at both the state and federal levels.

Rouch, a resident of Nevada, also issued a call to action from the stage.

“We need you guys this election,” she said.

“It is critically important to figure out where the politicians in your district, in the state, stand on crypto — to really ask them the hard questions — and to tell your friends and family to get out there and vote.”

Nevada as a Home to the Bitcoin and Crypto Industry

“Las Vegas is a city of opportunity — above and beyond the casino floors,” shared Vinuya from the stage.

“Nevada is home to an emerging center of technology and financial innovation, entrepreneurship, and economic growth,” he added before citing that the Governor’s Office of Economic Development facilitated $5 billion in economic investment last year and that the state saw 4% job growth in the same time period.

Part of this trend was fueled by Nevada’s embrace of the crypto industry.

“Amidst all of these exciting achievements under the leadership of Governor Lombardo and Las Vegas Mayor Carolyn Goodman, Nevada has also become a home for innovators in blockchain technology and cryptocurrency,” he explained.

Vinuya then pointed out that next year’s Bitcoin conference will be based in Las Vegas.

“Here in our state, we have a good concept coined by Governor Lombardo called ‘the Nevada way,’ which means that as Nevadans, we never give up, we never give in, and we never stop dreaming,” he concluded. “The spirit of the Nevada Way is alive and well in the Bitcoin community, and we welcome your innovation and big dreams in Nevada.”

Capitalizing on Political Momentum

According to Rouch, we’ve hit the point of no return with crypto, and politicians can no longer afford to not take a stance on the issue, which is why Coinbase supports the Stand With Crypto Alliance.

“What we’re really saying here is ‘pay attention,’” Rouch told Bitcoin Magazine. “This matters to a lot of voters.”

After citing that 52 million Americans of varied backgrounds, ethnicities and socioeconomic status now own crypto, Rouch explained that politicians, up the federal level, now see how big of an issue this is and are acting accordingly.

“We’ve seen undeniable change in Washington, DC over the last year from both parties,” she said.

“We had FIT21 pass in the House with a bipartisan vote. That was really unprecedented. We also have politicians making their statements on crypto known for the first time, and I feel very optimistic about that,” she added.

Rouch wasn’t the only speaker or performer at the event feeling optimistic.

Before beginning his DJ set, 3LAU told the story of how he met the Winklevoss twins, early bitcoin buyers and owners of the Gemini crypto exchange, at a gig a decade ago. He shared how they explained what Bitcoin was to him at that event, and that it gave him hope.

“Bitcoin changed my life, and it’s been that way for the past 10 years,” said 3LAU to the crowd before he started his DJ set.

“This election is probably the most important in my life. We have a choice to make: the future of the financial system or follow the legacy bullshit that we’ve had to put up with,” he added.

“And we’re all going to fucking vote for crypto.”

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Bitcoin

Why $99,800 Is An Important Resistance To Break

Published

2 days agoon

December 21, 2024By

admin

The Bitcoin price is approaching the $100,000 level again after experiencing significant declines these past weeks. A crypto analyst has pointed out that the critical resistance level at $99,800 is crucial for Bitcoin’s next move. If the pioneer cryptocurrency can break through this level, it could trigger a significant breakout, potentially propelling Bitcoin past the $100,000 mark.

Related Reading

Bitcoin Price Faces Resistance At $99,800

Prominent crypto analyst Ali Martinez has shared a chart showing an In/Out of the Money Around Price (IOMAP) analysis of the distribution of Bitcoin wallets based on their purchase price. According to the analyst, the Bitcoin price is facing extreme resistance between the $97,500 and $99,800 price levels as it tries to breach $100,000 again.

Martinez noted that around this price range, approximately 923,890 wallet addresses had purchased over 1.19 million BTC. This price zone acts as an important resistance level because many Bitcoin holders may look to sell and break even, potentially exerting selling pressure.

In the IOMAP chart shared by Martinez, the green dots that signal ‘In the Money’ represent price levels below the current Bitcoin price, where wallet holders are in profit because they bought BTC at a lower value. On the other hand, the red dots that represent ‘Out of the Money’ show price levels of Bitcoin’s present value, where wallet holders are at a loss because they bought BTC at a higher price.

Lastly, the white dot indicates ‘At the Money’ and represents the current price of Bitcoin at an average of $98,676, where some crypto wallets see neither profit nor loss.

Below Bitcoin’s current price, the chart shows strong buying zones, which could provide strong support if the pioneer cryptocurrency experiences a potential pullback. Martinez has forecasted that breaking through the critical resistance range between $97,500 and $99,800 would signal the start of a bullish rally for Bitcoin, potentially leading it to a new all-time high.

Currently, the Bitcoin price is trading at $98,652, steadily rising to return to previous highs above $100,000. To a new all-time high, Bitcoin will have to surge by over 7%, surpassing its present ATH above $104,000.

Related Reading

Bitcoin’s Biggest Gains To Come After Christmas

A popular crypto analyst identified as the ‘Crypto Rover’ has expressed optimism about Bitcoin’s near-term price potential this Q4. According to the analyst, Bitcoin has historically experienced its most significant gains right after Christmas during the halving years.

The analyst shared a price chart showing Bitcoin’s market performance during each halving cycle. In the 2012 halving year, Bitcoin started a significant price rally, which extended into the following year. The same bullish trend occurred in the next halving years in 2016 and 2020, with Bitcoin hitting exponential price highs.

Based on this historical trend, Crypto Rover projects that Bitcoin could witness a similar bullish surge before the end of 2024, with the rally potentially continuing into 2025.

Featured image from Bloomberg Images, chart from TradingView

Source link

Bitcoin

Bitcoin Drops Below $98K—Is This the Perfect Buying Opportunity for Investors?

Published

2 days agoon

December 21, 2024By

admin

Bitcoin, the leading cryptocurrency by market capitalization, has recently experienced a significant and sudden price correction, sparking debate among investors.

Concerns have surfaced about whether this downturn signals the conclusion of the current bull cycle or merely represents a temporary setback.

While short-term holders face losses, long-term metrics provide a broader perspective on Bitcoin’s trajectory, as analyzed by CryptoQuant’s Avocado Onchain in a recent report.

Opportunity Or End of The Bull Cycle?

According to Avocado Onchain, the realized price for investors who entered the market during Bitcoin’s recent peak at $98,000 places them in a loss-making position.

However, for those who invested between one to three months ago, the realized price is significantly lower at $71,000, offering a cushion against the current correction.

Avocado pointed out that historical patterns from Bitcoin’s 2021 bull cycle reveal similar alternations between record highs and sharp corrections, suggesting that these dips may not necessarily indicate the end of the cycle. Instead, they have historically been “opportunities” for market rebalancing and subsequent growth.

A key indicator analyzed is the 30-day moving average of the short-term SOPR (Spent Output Profit Ratio). This metric tracks whether recent market participants are selling at a profit or a loss.

The current SOPR data reveals that recent short-term inflows into Bitcoin have yet to result in substantial profit-taking. Unlike previous cycle peaks characterized by aggressive selling, the ongoing correction appears subdued, indicating that the market may still have room for upward movement.

Bitcoin Short-Term Dips vs. Long-Term Trends

Additionally, Avocado Onchain highlights the importance of distinguishing between short-term corrections and broader cycle trends. Bitcoin’s tendency to rebound after corrections in past bull cycles reinforces the notion that the current downturn might not mark the cycle’s end.

These insights align with the behaviour of long-term holders, who often use corrections to consolidate their positions, strengthening market resilience.

Avocado concluded the analysis, noting:

For investors who have yet to enter the market, this may be an excellent opportunity to buy Bitcoin at a discount. Instead of succumbing to panic selling during short-term downturns, adopting a long-term perspective and a dollar-cost averaging (DCA) strategy could be a more effective approach.

At the time of writing, Bitcoin is seeing a gradual rebound in its price surging by 1.3% in the past 1 hour. Regardless, the asset still appears to be overshadowed by the bears as BTC remains down by 3.5% in the past day and 10.5% from its peak of $108,135 recorded last week.

Featured image created with DALL-E, Chart from TradingView

Source link

Analyst

Here’s Why The Bitcoin Price Continues To Hold Steady Between $96,000 And $98,000

Published

3 days agoon

December 20, 2024By

adminThe Bitcoin price has dropped below the $100,000 psychological level and is now holding between the $96,000 and $98,000 range. Crypto analyst Ali Martinez provided insights into why Bitcoin could be holding well within this range.

Why The Bitcoin Price Is Holding Steady Between $96,000 And $98,000

In an X post, Ali Martinez noted that one of the most important support levels for the Bitcoin price is between $98,830 and $95,830, where 1.09 wallets bought over 1.16 million BTC. This explains why Bitcoin is holding steady between $96,000 and $98,000 as investors who bought between this level continue to provide huge support for the flagship crypto.

Related Reading

As Martinez suggested, it is important for these holders to continue to hold steady as a wave of sell-offs could send the Bitcoin price tumbling even below $90,000. The flagship crypto dropped below $100,000 following the Federal Reserve Jerome Powell’s recent speech, in which he hinted at a hawkish stance from the US Central Bank.

This sparked a massive wave of sell-offs, as a Hawkish Fed paints a bearish picture for risk assets like Bitcoin. However, despite the Bitcoin price drop below, most Bitcoin holders remain in profit, which is a positive for the flagship crypto. IntoTheBlock data shows that 86% of Bitcoin holders are in the money, 4% are out of the money, and 9% are at the money.

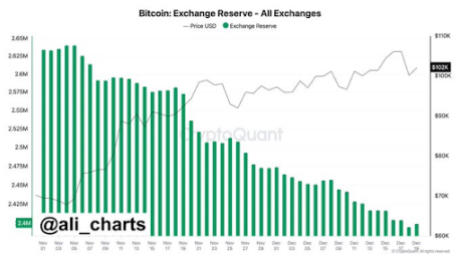

These Bitcoin holders still seem bullish on the leading crypto as they continue to accumulate more BTC. In an X post, Ali Martinez stated that so far in December, 74,052 BTC have been withdrawn from exchanges, and this trend doesn’t seem to be slowing down.

Traders Anticipate A Bullish Reversal

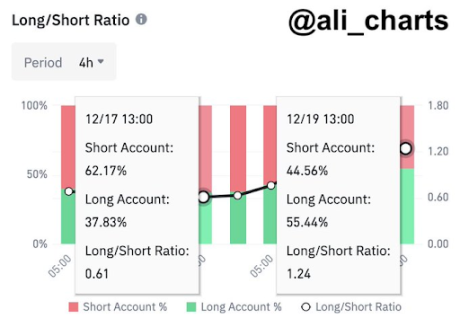

Ali Martinez suggested that crypto traders anticipate a bullish reversal for the Bitcoin price from its current level. This came as he revealed that traders on Binance nailed the top, with 62.17% shorting Bitcoin while it was trading at $108,000. Now, Martinez stated that sentiment has flipped, with 55.44% of these trading now longing dips below $96,000.

Related Reading

Meanwhile, it is crucial for the Bitcoin price to hold this $96,000, as Martinez warned that if BTC loses this support, it could drop below $90,000. The analyst stated that based on the Fibonacci level, if Bitcoin loses $96,000, the next point of focus becomes $90,000 and $85,000. Meanwhile, from a bullish perspective, crypto analyst Justin Bennett suggested that the $110,000 target is still in focus for the Bitcoin price.

At the time of writing, the Bitcoin price is trading at around $97,000, down over 3% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential