Court

New charges — new problems: Will Tether survive them?

Published

3 months agoon

By

admin

Consumer advocacy group Consumers’ Research has released a report accusing Tether, the issuer of the USDT stablecoin, of being opaque and not conducting a full audit of its dollar reserves.

Teather is accused of being non-transparent (again)

Consumers’ Research analysts said that the USDT issuer has yet to conduct an audit of its reserves, although it has promised to do so since 2017. In addition, the stablecoin received a “4 out of 5” stability rating in the S&P Global rating, where “5” is the worst.

The report includes a letter to the governors of all U.S. states, which reports on Tether’s opaque activities. In addition to the open letter, Consumers’ Research has launched a special resource with a detailed description of its claims.

Thus, the organization accuses Tether of repeatedly promising to audit its reserves thoroughly. Despite promises, the project has never provided a full report from a respected auditing firm. They also saw similarities with the situation of FTX and Alameda Research. Tether’s lack of transparency is reminiscent of the circumstances that led to the collapse of FTX.

“As you will see outlined in the attached Consumer Warning, Tether has many of the same issues that FTX and Celsius had before their collapse – potentially costing consumers billions of dollars using deceptive and misleading marketing tactics that are inconsistent with the truth.”

Finally, the company is blamed for doing business with unscrupulous partners. Analysts also believe that the company failed to prevent USDT from being used to circumvent international sanctions and other illegal activities.

At the same time, the first stage of Consumers’ Research against Tether was launched in June. The company accused the issuer of the USDT stablecoin of having ties to Russian and Chinese authorities, terrorist organizations, and drug cartels.

Incognito dollar for sanctioned countries

Earlier, Wall Street Journal (WSJ) journalists said that USDT has become an “incognito dollar” for countries such as Venezuela and Russia, ensuring the free transit of capital abroad.

The article’s authors referred to the fact that USDT threatens the financial system and national security of the United States since it remains unregulated. The WSJ claims that the asset’s trading volume for 2023 exceeded the same indicator for the Visa payment system.

In addition, stablecoin issuer Tether’s profit for the same period amounted to $6.2 billion, which is more than the world’s largest ETF provider, BlackRock. The WSJ emphasized that the company managed to achieve such figures with a staff of 100 people.

WSJ singled out Venezuela and Russia, noting that USDT is widely used in these countries to circumvent sanctions. In the first case, the state-owned company Petroleos de Venezuela is using a stablecoin to pay for oil supplies.

“Russian oligarchs and weapons dealers shuttle Tether abroad to buy property and pay suppliers for sanctioned goods. Venezuela’s sanctioned state oil firm takes payment in tether for cargoes. Drug cartels, fraud rings and terrorist groups such as Hamas use it to launder income.”

The article’s authors also pointed to the rapid scaling of USDT within the global market. In particular, Tether’s efforts to promote itself in Georgia were highlighted here.

Journalists quote Eralp Hatipoglu, CEO of the company’s local partner, the CityPay.io service, as saying that the organization provides international payments in USDT worth about $50 million monthly. According to him, this is due to the pressure exerted by the United States on the global banking system.

Hatipoglu also stated that the service carefully checked transaction participants but did not provide evidence.

Claims against Tether are gaining momentum

Earlier in August, bankrupt Celsius Network accused Tether of misappropriating assets and violating the terms of the agreement.

The court documents indicate that in 2020, Celsius Network entered into an agreement with Tether. Under the agreement, the company received borrowed funds in USDT stablecoins. In response, the platform sent Tether 39,542 Bitocin (BTC) as collateral.

Celsius Network representatives claim that Tether hastily liquidated a large number of bitcoins in 2022, violating the terms of the contract and leading to the company’s bankruptcy.

Tether CEO Paolo Ardoino responded that Celsius Network decided not to provide additional collateral and instructed Tether to liquidate bitcoins to close the position.

There is another equally resonant case in the issuer’s history, which ended relatively recently—a lawsuit against Tether and Bitfinex. The scandal erupted back in 2019. Representatives of Tether and the Bitfinex crypto exchange initially hid the close relationship between the companies. For a long time, the parties did not advertise that both organizations belong to the same parent structure — iFinex Inc. The presence of common managers was also hidden. This led to many suspicions of a conflict of interest.

It was later revealed that Bitfinex used Tether’s reserves to cover its losses. There were also allegations of market manipulation. The New York State Attorney General’s Office uncovered details of the illegal operations. The companies were later forced to admit their connection.

This case raised doubts about how well Tether is backed. Tether and Bitfinex later settled the case, paying a fine of $18.5 million. The companies also agreed to provide regular reports on their reserves.

Is Tether really that bad?

Tether Limited Inc. has been facing fraud allegations almost since its founding. The USDT issuer’s history really does have some dark pages. However, judging by their actions, the company’s representatives are ready to take responsibility for mistakes and fight for the project’s development.

The claims of Consumers’ Research and The Wall Street Journal are not unfounded. Many of them could be resolved by an independent audit.

The claims against Tether have hardly changed over the years. Despite the pressure, the project continues to live and develop. Tether may be able to step over the subsequent investigations with negative conclusions, the validity of which, in turn, can also be challenged.

Source link

You may like

3 Key Metrics That Hint Bitcoin Price Will Hit $100K Soon

Macro Guru Raoul Pal Predicts Crypto Market Will Rally ‘Pretty Strongly’ Into Year-End – Here’s His Outlook

Blockchain auditor Hacken launches AI-powered MiCA-compliance tool for crypto firms

Crypto in 2024: A Game-Changing Year for Investors

Philippines SEC releases new crypto regulatory framework draft

Another Publicly Traded Firm Just Adopted a Bitcoin Reserve Strategy

Alex Mashinsky

Judge denies ex-Celsius CEO’s bid to dismiss fraud, manipulation charges

Published

1 month agoon

November 11, 2024By

admin

Lawyers representing Alex Mashinsky, the former CEO of the crypto platform Celsius facing a criminal indictment in the United States, have lost a motion to drop two charges related to commodities fraud and manipulating the price of the Celsius (CEL) token.

In a Nov. 8 filing in the US District Court for the Southern District of New York, Judge John Koeltl ruled that Mashinsky’s legal team’s arguments to have the charges dismissed were “either moot or without merit.” The judge denied the motion to dismiss the two charges, leaving seven counts on the indictment for the former Celsius CEO’s trial, scheduled to begin in January 2025.

Source: SDNY

The former Celsius CEO’s lawyers claimed that the securities and commodities fraud charges were inconsistent, as prosecutors alleged the platform’s Earn Program was treated as a security while the Bitcoin (BTC) deposited by investors were commodities. Mashinsky also claimed that he lacked “fair warning” that allegedly manipulating the price of CEL (CEL) was a criminal charge.

The motion to dismiss the two charges filed in January included a request for Judge Koeltl not to allow information on Celsius’ bankruptcy to be included in the criminal case. The judge declined to decide on the motion on Nov. 8, suggesting he would respond to motions in limine or at trial.

Questions about FTX for jurors

Following the Nov. 8 order, Mashinsky’s lawyers also requested they be allowed to ask prospective jurors questions about their knowledge of the defunct cryptocurrency exchange FTX. According to the legal team, there will “undoubtedly” be testimony about FTX at trial, and the exchange was “toxic in the cryptocurrency world.”

Related: Celsius token surges 300% a month after $2.5B payment to creditors

Authorities arrested and charged Mashinsky with seven felony counts in July 2023. He pleaded not guilty and has been free to travel with restrictions on a $40 million bond.

Former Celsius chief revenue officer Roni Cohen-Pavon, indicted alongside Mashinsky, also faces charges for “illicitly” manipulating the CEL price. Cohen-Pavon initially pleaded not guilty but later changed his plea to guilty. He is scheduled to be sentenced on Dec. 11.

Magazine: ‘Less flashy’ Mashinsky set for less jail time than SBF: Inner City Press, X Hall of Flame

Source link

Bankruptcy

FTX сreditors reveal compensation details: What’s wrong with it?

Published

3 months agoon

September 30, 2024By

admin

Users were confused by the news that FTX clients would receive between 10% and 25% of the value of the deposited crypto assets. Why did this happen?

Sunil Kavuri, one of the creditors, recently said several other changes are also planned in the reorganization plan. One of the points, which concerns the amount of compensation payments to victims, raised questions in the community.

What is known about the compensation plan

Crypto assets deposited on the platform will be valued at the rate when filing for bankruptcy. Therefore, the actual compensation will be between 10% and 25% of the market value of their cryptocurrency.

FTX is transferring 18% of DOJ forfeiture funds up to $230m to FTX equity holders (Plan supplement)

FTX crypto holders are getting 10% to 25% of their crypto back pic.twitter.com/3f6BePpoNU

— Sunil (FTX Creditor Champion) (@sunil_trades) September 28, 2024

FTX shareholders will also receive an additional 18% of the funds confiscated by the U.S. Department of Justice, but no more than $230 million. This became an additional clause on increasing the share of preferred shareholders.

However, many expressed dissatisfaction with the terms of the payments, calling it a scam. One user suggested this payment schedule may be because most FTX shareholders are either Sullivan & Cromwell (representing FTX debtors) or Quinn Emanuel’s clients, hired by FTX’s new management, acting as conflicts counsel. Both law firms are working to recover assets from the bankrupt exchange’s clients.

The community speculates on the timing of compensation payments

Work is underway to return funds to account holders affected by the FTX collapse. Amid speculation about the timing of the payments, information appeared on the network that FTX crypto holders could begin receiving payments as early as Sep. 30.

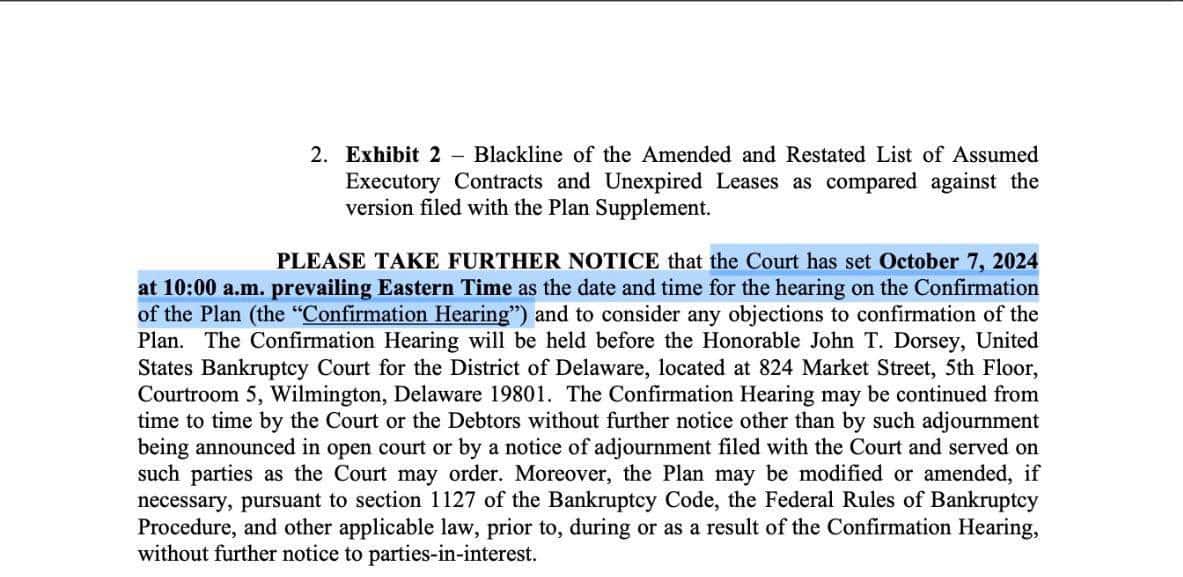

However, this was soon refuted — according to the latest data from the bankruptcy case materials under Chapter 11, the court is still studying a compensation plan.

The court filing shows that the next hearing to approve the restructuring plan is scheduled for Oct. 7. If the court approves the plan, payments for claims under $50,000 could begin in late 2024,

while others will receive compensation during the first half of 2025.

FTT Reacts With Growth

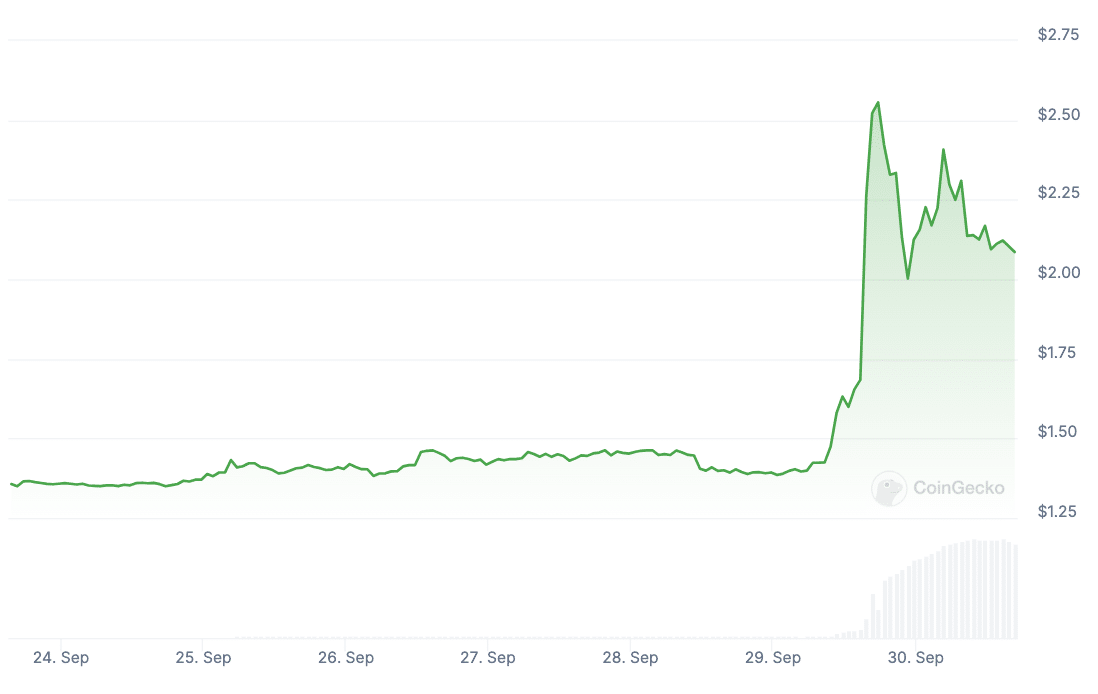

Amid the recent news, FTX has delighted investors. Hoping that the infamous crypto exchange would soon begin returning funds, investors have become more optimistic. Such an event could lead to an influx of $16 billion into the market.

At its peak on Sep. 29, the FTX token (FTT) had gained 113% in a day. By the end of the day, the price had corrected and eventually dropped to $2.11 at the time of writing.

Where did the client funds go?

FTX, once worth $32 billion, used client funds for risky investments through its closely associated hedge fund, Alameda Research. Investigations revealed that the company used client funds to cover losses in other related businesses and finance risky investment deals.

FTX’s colossal budget deficit was discovered after clients requested their money back. After FTX’s bankruptcy, a restructuring procedure was initiated, and processes began to return funds to clients. However, at that time, the exact reasons for the disappearance of funds and where they were sent remained the subject of an investigation. In total, the exchange owes about $9 billion.

Victims are waiting, and the culprits are serving their sentences

FTX’s bankruptcy shook the crypto market and affected the prices of many coins. It also raised concerns among users and regulators about the security and liability of crypto exchanges. In addition to creating a refund plan, the exchange’s top managers are being punished one after another.

Bankman-Fried was charged with fraud, money laundering, and other financial crimes related to the management of FTX and client payments. The charges are based on the fact that he allegedly used client funds to support his other businesses, including the trading company Alameda Research. In March, he was sentenced to 25 years in prison.

Caroline Ellison, former CEO of Alameda Research CEO, was sentenced to two years in prison and forfeited $11 billion on fraud and money laundering charges. Her active cooperation in the investigation of Bankman-Fried mitigated the verdict. The judge emphasized that the collapse of FTX is one of the most significant financial crimes, and Ellison’s cooperation does not absolve her of responsibility. She admitted her guilt and apologized to the victims.

Following the verdict of the former Alameda CEO, other defendants are now awaiting court decisions: FTX co-founder and CTO Gary Wang, as well as head of engineering Nishad Singh.

Source link

Binance

Changpeng Zhao is walking free. What will he do next?

Published

3 months agoon

September 27, 2024By

admin

He’s banned from running Binance for life — and says he plans to educate children and focus on philanthropy. But does that mean CZ’s days in crypto are truly behind him?

Changpeng Zhao was the world’s richest inmate, with Forbes estimating his net worth at $61.6 billion.

Now, after serving four months behind bars for admitting that Binance failed to enforce adequate Know Your Customer checks — a violation of the Bank Secrecy Act — he walked out of a low-security prison in California as a free man on Friday Sept. 27.

CZ’s initial release date had been slated for September 29, but rules suggested that, given this would be a Sunday, wardens had the discretion to release him on Friday instead.

Despite the relatively short sentence, life will be quite different for the billionaire. He commanded a cult-like status while overseeing Binance, but he has now been handed a lifetime ban from managing the exchange.

All of this has led to swirling speculation about what CZ will do next. Will he return to crypto, the industry that made him his vast fortune? Could there be a pivot to AI? At the hearing where he was sentenced back in April, the 47-year-old suggested that neither was a priority, declaring:

“For the next chapter of my life, I want to provide opportunities for others, namely our youth. I’m building a platform to provide high-quality education for underprivileged kids, all around the world, for free.”

To that end, a website has been created called Giggle Academy — but a cursory glance suggests that it remains very much in the pre-launch phase.

For its part, Binance is wishing CZ well and making clear that there are no hard feelings since Richard Teng succeeded him as CEO.

“We are delighted that CZ will be home with his family. While he is not managing or operating Binance, we are excited to see what he does next.”

There’s little doubt that the entrepreneur will be itching to update his 8.8 million followers on X, where he was a visible presence before his incarceration.

CZ’s future

Campaigners maintain that the punishment CZ received amounts to nothing more than a slap on the wrist — with Better Markets previously claiming there was “overwhelming evidence” to suggest CZ “willfully, knowingly, and intentionally designed and ran Binance to be a crypto money laundering superstore for the most despicable global criminals.”

His four-month stint in jail was well short of the 18-month maximum set out in sentencing guidelines — and miles away from the three years that U.S. prosecutors had sought. One former Binance employee, who did not wish to be named, told crypto.news:

“It seems like a pretty short sentence compared to the crimes that he was on trial for — it feels like yet another example of a financial criminal not being prosecuted for long enough.”

They went on to argue that, given their personal knowledge of CZ and his personality, four months is nowhere near enough for the fallen businessman to learn from his crimes.

“I’d imagine he sees this as a small but unfortunate blip in his path towards building his empire.”

The ex-Binance employee told us that they are unsure whether CZ will ever make an appearance in the crypto space — but noted that some of his closest lieutenants have now taken over leadership of the exchange.

“Even if he is never actually ‘working’ in crypto again, the fact that He Yi is still at Binance means that CZ will never be far from crypto.”

He Yi is Binance’s co-founder and chief customer service officer, who has been CZ’s partner since 2014.

But there’s a bigger question to ask here — how much damage has Changpeng Zhao done to the world’s largest crypto exchange? The platform has been banned by some of the world’s largest economies in recent years — including the U.K. and U.S. When asked whether his jail time will have a lasting impact on the platform, our source said:

“I don’t actually think so. No one seems to remember CZ and Binance’s crimes compared to SBF and FTX.”

There’s little doubt that CZ’s top priority now is to start rehabilitating his image — but both he and Binance will continue to face legal challenges in the coming months.

Just a few short years ago, any reference to potential headwinds would have attracted a breezy “4” from CZ — a number he used as shorthand for “FUD“: fear, uncertainty and doubt.

No longer a part of the empire he helped build, Changpeng Zhao may not cut a more humble figure.

Source link

3 Key Metrics That Hint Bitcoin Price Will Hit $100K Soon

Macro Guru Raoul Pal Predicts Crypto Market Will Rally ‘Pretty Strongly’ Into Year-End – Here’s His Outlook

Blockchain auditor Hacken launches AI-powered MiCA-compliance tool for crypto firms

Crypto in 2024: A Game-Changing Year for Investors

Philippines SEC releases new crypto regulatory framework draft

Another Publicly Traded Firm Just Adopted a Bitcoin Reserve Strategy

MicroStrategy Announces Special Shareholders Meeting to Buy More Bitcoin

These 2 Solana killers have potential turn $1000 into $100k in the next 10 week

BTC Touches $94K, VIRTUAL Soars 35%, ZEC Gains 20%

Trump Makes More Pro-Crypto Appointments

Solaxy presale raises $4.5M for Solana Layer 2 solution

Elon Musk xAI Secures $6B To Boost Generative AI Expansion: Details

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential