Bitcoin

New ‘Smart Accounts’ From Cosmos-Based Osmosis Enable 1-Click Trading

Published

5 months agoon

By

admin

(PROTOCOL VILLAGE EXCLUSIVE) July 19: Osmosis, a blockchain project built with Cosmos tech and describing itself as the “only full-service, cross-chain exchange and DeFi hub,” said that one-click trading is now live for all users on Osmosis, powered by the newly implemented “Smart Accounts.” According to the team: “Following the passing of prop 796, Smart Account functionality was rolled out to all Osmosis users. 1-Click Trading lets you trade securely without the hassle of tedious wallet approvals. 1-Click Trading is just the first of many upcoming features that will be enabled by Smart Accounts, like support for Passkeys and Face ID authentication, all intended to streamline user onboarding, and improve UX and account management in DeFi.” (OSMO)

Galaxy Buys Almost All of CryptoManufaktur’s Ethereum Assets to Expand Staking Portfolio

(FIRST ON COINDESK) July 19: Galaxy Digital, the publicly traded crypto firm led by Michael Novogratz, has acquired substantially all the assets of blockchain node operator CryptoManufaktur LLC, in a deal that will increase the company’s Ethereum assets under stake by about 43%. The agreement with CryptoManufaktur, known as CMF, was announced in a press release provided exclusively to CoinDesk. Terms weren’t disclosed. $GLXY

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here. Also please check out our weekly The Protocol podcast.

Shape, Creator-Focused Ethereum L2 in Optimism Superchain, Makes Testnet Available

(PROTOCOL VILLAGE EXCLUSIVE) July 18: Shape, a creator-focused layer-2 network atop Ethereum and part of the Optimism Superchain, announced the availability of its testnet, with GA going live in Q3. According to the team: “The network is an open space where everyone is free to create whatever they want – from high art to weird experiments. Shape ensures creators that thrive on the network share in its success through ‘Gasback.’ This mechanic rewards cultural impact directly by giving 80% of sequencer fees back to smart contract owners. Shape is powered by Optimism and, as part of the Superchain, contributes 15% of sequencer fees to the Optimism Collective to fund public goods.”

Chainlink Releases ‘Digital Asset Sandbox’ for Financial Institutions

July 18: Chainlink, the blockchain oracle project, announced the launch of the Chainlink Digital Assets Sandbox (DAS), “designed to accelerate digital asset innovation within financial institutions.” According to the team: “The Chainlink DAS is the ideal solution for financial institutions that want to quickly innovate and experience the potential of generating new revenue opportunities, increasing efficiencies, improving time-to-market, and more. With the DAS, institutions can seamlessly access ready-to-use business workflows for digital assets.” CoinDesk 20 asset: (LINK)

Bitrue Ventures Launches $40M Fund for ‘Nascent Web3 Companies’

July 18: Bitrue Ventures, the research and investment section of crypto exchange Bitrue, has launched a $40 million investment fund and “is putting out the call to aspiring developers,” according to the team. A blog post reads: “Individual recipients of funding can receive up to $200,000 of investment funds that can be allocated however they feel is most appropriate. In addition, Bitrue will make available their various avenues of expertise to provide further support to these projects. While Bitrue Ventures will consider investing into any niche within the crypto space, we believe that the most successful projects right now are likely to be building in the sectors of Artificial Intelligence (AI), Real World Asset tokenization (RWA), GameFi, Decentralized Physical Infrastructure Networks (DePIN), and Decentralized Finance (DeFi). As such, projects building within these industries will stand a better chance of receiving funding.”

InfStones, Blockchain Infrastructure Provider, Launches Node-as-a-Service

July 18: InfStones, a blockchain infrastructure provider, “launched its node-as-a-service (NaaS) product, empowering emerging protocols to jumpstart their DePIN projects while making sophisticated blockchain node operations accessible to mainstream users,” according to the team: “Since 2018, InfStones has provided enterprise-grade node management services to industry-leading groups such as Binance, CoinList and BitGo. In the recent node sale for cloud computing platform Aethir, InfStones’ NaaS product helped to successfully convert over 26,000 of its Checker Node license holders into long-term node operators.”

Raise to Provide Payment Rails for Polkadot Mobile App, Enabling Retail Purchases

July 18: Raise, a payments provider and with a white-label gift card infrastructure, has partnered with Parity Technologies “to provide the payment rails for the Polkadot mobile app, enabling DOT payments at over 1 million stores and websites across the U.S.” According to the team: “Users can make purchases and earn up to 20% cash back in DOT. This integration, previewed at Polkadot Decoded, bridges the gap between crypto and retail, making it easier and more rewarding to use crypto for everyday transactions. The app is set to launch in Q3, with plans to expand internationally by the end of the year.” (DOT)

Zivoe, RWA Credit Protocol on Ethereum, Raises $8.35M

July 18: Zivoe, a real-world asset credit protocol atop Ethereum, raised $8.35 million in their last round, aiming to broaden credit access by connecting blockchain liquidity with real-world borrowers, according to the team: “The round comes in tandem with Zivoe launching its RWA credit protocol on mainnet on July 31 and their Initial Tranche Offering (ITO), a unique liquidity bootstrapping mechanism.”

AI-Focused Layer-1 Chain Nuklai Announces Launch of DAO for Governance, Say on Use of Funds

July 18: Nuklai, a layer-1 blockchain built for artificial intelligence, announced the launch of the Nuklai DAO, “a decentralized autonomous organization designed to empower its community and ecosystem,” according to the team: “With this development, the company moves towards greater community-driven governance and collaboration. This initiative allows community to have a direct say in the allocation of these funds through proposals and votes on Commonwealth and Snapshot. The launch of the Nuklai DAO will manage the 400,000,000 NAI Community token allocation.”

Polygon, Google Cloud, Accenture Release White Paper on Web3 Loyalty Programs

July 18: Polygon Labs, in collaboration with Google Cloud and Accenture, jointly released a white paper that highlights how Web3 solutions can build high-margin loyalty programs. According to the team: “The paper highlights how users can enjoy rewards such as tokenized privileges, gamification, collectibles and community-generated content. This not only improves the user experience but also generates new revenue streams for brands while empowering users to actively participate in loyalty programs.” (MATIC)

Chainbase Raises $15M to Grow Omnichain Data Network

July 18: Omnichain data network Chainbase has raised $15 million in Series A funding with Tencent Investment Group, Matrix Partners and Hash Global among the investors. Chainbase is an interoperability layer that is building the “first crypto world model,” to deliver data from across the cryptocurrency spectrum, according to an emailed announcement on Thursday.

Fantom Foundation, Sonic Labs Partner With Alchemy for RPC on Opera Chain

July 18: The Fantom Foundation and Sonic Labs announced a partnership with Alchemy “in which the leading Web3 infrastructure provider immediately contributes RPC support (mainnet and testnet) and key development tools to developers on Fantom’s Opera chain.” According to the team: “Alchemy will also support the new Sonic network in the same capacity, enhancing its performance and scalability when it launches later this year.”

Outlier Ventures Partnership With Morgan Creek Digital Brings Accelerator to Latin America

July 18: Global Web3 accelerator Outlier Ventures has announced a new strategic partnership with Morgan Creek Digital, to launch their first-ever accelerator program in the Latin American region. According to the team: “The program seeks to identify startups developing solutions to drive technological and financial innovation across Latin America. The virtual program starts in September and lasts for 12 weeks, offering selected startups support from Outlier Ventures’ in-house team of experts, tailored mentorship from industry experts, networking opportunities with investors, and up to 200K investment.”

Visa’s Data Partner Allium Labs Raises $16.5M as Their New Findings Show Stablecoin Activity is Back Up

July 18: Data platform Allium Labs, which provides enterprise-grade blockchain data to companies like Visa, Stripe and Uniswap Foundation, has raised $16.5 million in a Series A funding round, it announced Thursday. The funding round was led by venture capital firm Theory Ventures whose founder Tomasz Tunguz will join the board as part of the investment. Tunguz said “The demand for cryptocurrencies and tokens has just started” and that Allium will provide the data to “foster broader adoption.”

Pundi X Launches Payment Solution for Merchants

July 18: Pundi X, a blockchain developer, has launched a crypto payment solution, Pundi X Pay for merchants, according to the team: “This innovative solution is set to transform the landscape of physical store crypto transactions with the omni QR code payment layer, making it easier for merchants and customers to embrace cryptocurrency payments. Pundi X Pay InStore QR Code features include extensive wallet integrations (over 500+ direct wallet apps), flexible payment options, instant digital receipts, and AI-powered multi-chain transactions and security: powered by Pundi X AI.”

BitGo Integrates Stacks, Enabling Delegate and Solo Stacking

July 18: BitGo has integrated Stacks, “enabling delegate and solo stacking for its clients,” according to the team: “This grants them the ability to earn BTC directly within their wallets via a secure and risk-controlled process. Additionally, BitGo now supports the Stacks token standard and acts as a network Signer, contributing to consensus and block production. This Signer role will be crucial for the future launch of sBTC, a decentralized Bitcoin-backed asset.”

Zeebit, Solana-Based Casino, to Rely on Sonic L2 Infrastructure

July 18: Zeebit, describing itself as “Solana’s first on-chain casino,” is “launching the first fully decentralized risk-on gaming platform on Solana using SonicSVM infrastructure,” according to the team: “This on-chain platform features casino classics, PVP games, and novel Web3 experiences with provable fairness and non-custodial settlement. Leveraging Sonic’s scalable L2, Zeebit will migrate its current Solana-based platform, including player histories. Supported by major Web3 VCs and incubated by Solana Labs, Zeebit’s testnet launch will offer various games, followed by a mainnet launch with incentivized campaigns.”

Aethir, DePIN for GPUs, Teams With Beamable for Cloud-Based Game Development, Distribution

July 18: Aethir, a DePIN project specializing in GPUs for AI and pixel streaming, and Beamable, a creator-centric platform for building live games, announced a “strategic end-to-end solution that will empower game studios to develop, build, scale and distribute live games entirely in the cloud,” according to the team: “With the launch of this end-to-end solution, developers will be able to store, manage, and process data all on one platform to create more engaging and scalable gaming experiences.”

TON Foundation Says Trustless Bitcoin Bridge for DeFi Launched

July 17: TON Teleport BTC, a trustless bridge facilitating secure bitcoin (BTC) transfers to and from The Open Network (TON) blockchain, has launched. According to a message from the TON Foundation team: “This development enables BTC holders to securely engage in DeFi on TON and participate in decentralized exchanges (DEXs), lending platforms, and other applications. The TON Teleport BTC process is entirely trustless and transparent, operating without a centralized issuer. Each BTC on TON is 100% backed by actual BTC, pegged through the teleport process, ensuring secure and reliable transactions.” (TON)

IoTeX ‘DePIN Infrastructure Modules’ to Reduce Development Time

July 17: IoTeX, an Ethereum compatible blockchain platform optimized for decentralized physical infrastructure projects (DePIN), is launching its 2.0 platform to democratize access to DePIN by partnering with NEAR, Filecoin, RISC Zero, Espresso and more, “to enhance data availability, storage, computation and sequencing,” according to the team: “IoTeX 2.0 features DePIN Infrastructure Modules (DIMs) and Modularity Security Pool (MSP) to cut development costs and support sustainable growth for DePIN projects, positioning itself as the largest decentralized hub for devices and data that will be deployed by both humans and AI agents.” According to a press release: “The introduction of Modularity Security Pool (MSP) enables DePIN layer-1s to restake their Proof-of-Stake security to DIMs, fueling growth and fostering sustainability within the ecosystem.”

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KEKP6O4VIZHFPKKJIHTXQD6RTQ.png)

Source link

You may like

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

Altcoins

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

Published

13 hours agoon

December 22, 2024By

admin

Bitwise CIO Matt Hougan says a wave of institutional interest in altcoins is coming next year, largely due to potential regulatory clarity and more exchange-traded funds (ETFs).

In a new interview with Bloomberg, Hougan says that institutional money is in the early stages of broadening out to other crypto assets besides just Bitcoin (BTC).

Hougan forecasts that 2025 will be the year that institutional investors will begin to incorporate more diversification in their crypto-investing strategies the same way they do in other asset classes like equities or bonds.

“You’re already seeing it broaden out actually. A lot of people were worried about the Ethereum ETFs for instance, which launched this summer and had tepid inflows.

But over the last month or so, you’ve seen billions of dollars flow into those products.

Again, the things that have happened in crypto in the past keep happening. Historically, most people enter crypto through Bitcoin, and then they discover Ethereum, and then they think about Solana. There’s no reason to assume that the institutions that came into Bitcoin won’t move on to other assets in the future.

In fact, I think in 2025, you’re going to see an explosion of interest in index space strategies that give diversified exposure to crypto. Of course, [that is] something we’ve been doing at Bitwise since 2017 when we pioneered that concept. I think 2025 is when that becomes a mainstream way to allocate to this space, the same way it is to stocks and bonds and real estate and everything else.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Julien Tromeur/Sensvector

Source link

Bitcoin

Microsoft says ‘no’ to Bitcoin, corporates say ‘bring it on’

Published

1 day agoon

December 22, 2024By

admin

Microsoft shareholders nixed a Bitcoin treasury idea, but other big-name companies disagree with this strategy. Here’s why.

Bitcoin (BTC) is often likened to “digital gold,” with its fixed supply of 21 million coins making it a potential hedge against currency devaluation and inflation.

And nowadays, Bitcoin’s unique characteristics make it an attractive addition to corporate treasuries. It can balance exposure to traditional assets like cash, stocks, and bonds.

Bitcoin is also one of the most liquid assets globally, and its historical performance has shown significant long-term value appreciation — it reached an all-time high of over $108,000 on Dec. 17.

But there’s no shortage of risks.

A board might avoid adopting a Bitcoin treasury due to the coin’s extreme price volatility, which can lead to substantial losses during downturns. Also, regulatory uncertainties pose potential threats as governments refine crypto policies. Additionally, liquidity challenges during market slumps can amplify price drops when offloading assets.

So it’s no wonder that, on Dec. 10, Microsoft’s board channeled the long-standing crypto skepticism of its co-founder, Bill Gates, and recommended ditching the proposa for a Bitcoin trasury. Gates himself has famously dismissed crypto as “100% based on greater fool theory” — ouch.

Bitcoin evangelist and MicroStrategy Chairman Michael Saylor was busy trying to woo Microsoft when he touted Bitcoin’s own meteoric returns and bragged about MicroStrategy’s stock soaring after their BTC splurge. His pitch? Bitcoin could boost Microsoft’s market cap while acting as a financial guardian angel.

Microsoft’s response? No, thanks.

Meanwhile, at least 10 other companies are embracing the MicroStrategy playbook.

Genius Group

Genius Group, an AI-powered education group, announced in November that it had completed the purchase of 110 Bitcoin for $10 million, at an average price of $90,932 per Bitcoin. The purchase made good on a promise to employ what it called a “Bitcoin-first” strategy where it planed to commit 90% or more of its current and future reserves to be held in Bitcoin, with an initial target of $120 million in Bitcoin.

Earlier this month, the company bolstered its Bitcoin treasury by acquiring 194 Bitcoin worth $18 million at an average price of $92,728 per Bitcoin.

Genius Group CEO Roger Hamilton credited Saylor’s Bitcoin treasury plan for the inspiration, adding that “more companies will see the benefits of establishing a Bitcoin treasury, and will be equipped with the clear steps to follow.”

Worksport

Worksport, a U.S.-based provider of pickup truck solutions, is adding cyptocurency to its corporate treasury strategy.

The Nasdaq-listed company announced on Dec. 5 that it would be adding Bitcoin (BTC) and XRP (XRP) to its treasury assets. This follows a resolution by the company’s board of directors, which approved an initial purchase of $5 million worth of BTC and XRP.

Worksport is committing 10% of its excess operational cash to this corporate pivot, it said in the announcement.

“Our upcoming adoption of Bitcoin (BTC) and XRP (Ripple) reflects our commitment to staying ahead of market trends while prioritizing operational efficiency and shareholder value. As we expand our product offerings and global reach, cryptocurrency has the potential to be a strong strategic complement,” Steven Rossi, chief executive officer of Worksport, said.

Amazon

Amazon shareholders, led by the National Center for Public Policy Research, are urging the Seattle-based company’s board to assess the potential benefits of adding Bitcoin to the company’s financial strategy.

The proposal, submitted on Dec. 6, aims to explore whether Bitcoin could protect and enhance shareholder value, especially amid persistent inflation and declining yields from traditional assets.

The National Center emphasizes Bitcoin’s robust performance—131% growth in the past year and 1,246% over five years—as evidence of its potential as an inflation hedge and a growth asset. The initiative also highlights concerns about the diminishing purchasing power of Amazon’s $88 billion cash reserves due to average inflation of 4.95% over the past four years.

This move represents a broader trend of shareholder proposals influencing corporate policies, leveraging shareholder rights to advocate for financial strategies that address economic risks and enhance long-term value.

MicroStrategy

Perhaps the most vocal of all Bitcoin fans is MicroStrategy’s Saylor who, as of this past week, increased the company’s total holdings to 439,000.

As a result, Saylor has officially strengthening MicroStrategy’s position as the top corporate BTC holder, considering it a long-term store of value.

Saylor, during an appearance on the Dec. 18 episode of the Open Interest show on Bloomberg Television, even voiced his willingness to advise President-elect Donald Trump on crafting a digital assets policy for the U.S.

But Saylor continues to draw scrutiny: Analyst Jacob King has labeled MicroStrategy’s Bitcoin-focused business model a “giant scam,” claiming it is unsustainable and destined for collapse.

MicroStrategy’s business model is a giant scam and relies on a reflexive loop: it issues debt or equity to buy BTC, which drives BTC’s price higher. This increases MSTR’s market cap, boosts its index weight, and attracts more sheep investors. With a higher valuation, it issues… pic.twitter.com/Owyi7mCHaO

— Jacob King (@JacobKinge) December 17, 2024

Marathon Digital Holdings

As one of the largest Bitcoin mining companies, Marathon owns 44,394 BTC. Its business model revolves entirely around mining and holding Bitcoin as part of its assets.

Back in July, the company confirmed it will adopt “a full HODL approach” towards its Bitcoin treasury policy, retaining all that it mines within its operations, in addition to its open market purchases.

“Adopting a full HODL strategy reflects our confidence in the long-term value of bitcoin,” CEO Fred Thiel stated. “We believe bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold bitcoin as a reserve asset.”

Tesla

Tesla initially bought $1.5 billion worth of Bitcoin in 2021 and currently holds 9,720 BTC. While the Elon Musk-led company remains a significant corporate holder.

BitcoinTreasuries data shows that Tesla is the fourth-largest holder of Bitcoin among U.S. public companies with crypto treasuries (MicroStrategy, MARA Holdings and Riot Platforms are believed to hold more).

In October, the electric vehicle company reportedly moved $765 million worth of Bitcoin to unidentified wallets.

Coinbase

The cryptocurrency exchange holds 9,480 BTC as part of its reserves, leveraging its position as a major player in the digital asset ecosystem.

The Brian Armstrong-led firm holds large amounts of Bitcoin as an exchange and converter. It’s also a trusted institution for custody services, and counts the Bitcoin ETF coterie of BlackRock, Grayscale, 21Shares, Invesco, Valkyrie, Wisdom Tree and Franklin Templeton among its clients.

Therefore, Coinbase has a Bitcoin treasury for itself and oversees others.

Hut 8 Mining Corp

On Thursday, crypto.news reported that Hut 8, a Bitcoin mining company, added 990 Bitcoin to its reserves.

The company spent roughly $100 million to increase its total holdings to 10,096 BTC. The reserve, now valued at over $1 billion, places Hut 8 among the largest corporate Bitcoin holders globally.

The company, under the guidance of CEO Asher Genoot, purchased the coins at an average price of $101,710, significantly higher than its cumulative acquisition cost of $24,484 per Bitcoin.

Block Inc.

The startup (formerly Square) holds 8,027 BTC as part of its strategy to integrate Bitcoin into mainstream finance.

The Jack Dorsey-founded company is so bullish on Bitcoin that, last month, it confirmed a company-wide pivot towards the cryptocurrency mining sector.

Block decided to dial down resources towards music streaming service TIDAL, and sunset TBD, a venture focusing on decentralizing the internet, to focus on expanding its presence in the Bitcoin mining sector.

Block acquired TIDAL in a 2021 acquisition for roughly $300 million. The platform has continued to struggle, with reports indicating workforce reductions and a $132.3 million impairment charge.

OneMedNet

OneMedNet Corp., as of Nov. 12, owns some 34 Bitcoins.

Off The Chain Capital, an investor in OneMedNet, was also inspired by Saylor, betting that Bitcoin isn’t just a hedge but a springboard for its healthcare data innovation.

Aaron Green, the company’s CEO, stated, “By continuing to invest a portion of our assets into Bitcoin, we aim to not only safeguard our financial stability but also fuel the ongoing development and innovation within our iRWD platform.”

Source link

Bitcoin

Why $99,800 Is An Important Resistance To Break

Published

1 day agoon

December 21, 2024By

admin

The Bitcoin price is approaching the $100,000 level again after experiencing significant declines these past weeks. A crypto analyst has pointed out that the critical resistance level at $99,800 is crucial for Bitcoin’s next move. If the pioneer cryptocurrency can break through this level, it could trigger a significant breakout, potentially propelling Bitcoin past the $100,000 mark.

Related Reading

Bitcoin Price Faces Resistance At $99,800

Prominent crypto analyst Ali Martinez has shared a chart showing an In/Out of the Money Around Price (IOMAP) analysis of the distribution of Bitcoin wallets based on their purchase price. According to the analyst, the Bitcoin price is facing extreme resistance between the $97,500 and $99,800 price levels as it tries to breach $100,000 again.

Martinez noted that around this price range, approximately 923,890 wallet addresses had purchased over 1.19 million BTC. This price zone acts as an important resistance level because many Bitcoin holders may look to sell and break even, potentially exerting selling pressure.

In the IOMAP chart shared by Martinez, the green dots that signal ‘In the Money’ represent price levels below the current Bitcoin price, where wallet holders are in profit because they bought BTC at a lower value. On the other hand, the red dots that represent ‘Out of the Money’ show price levels of Bitcoin’s present value, where wallet holders are at a loss because they bought BTC at a higher price.

Lastly, the white dot indicates ‘At the Money’ and represents the current price of Bitcoin at an average of $98,676, where some crypto wallets see neither profit nor loss.

Below Bitcoin’s current price, the chart shows strong buying zones, which could provide strong support if the pioneer cryptocurrency experiences a potential pullback. Martinez has forecasted that breaking through the critical resistance range between $97,500 and $99,800 would signal the start of a bullish rally for Bitcoin, potentially leading it to a new all-time high.

Currently, the Bitcoin price is trading at $98,652, steadily rising to return to previous highs above $100,000. To a new all-time high, Bitcoin will have to surge by over 7%, surpassing its present ATH above $104,000.

Related Reading

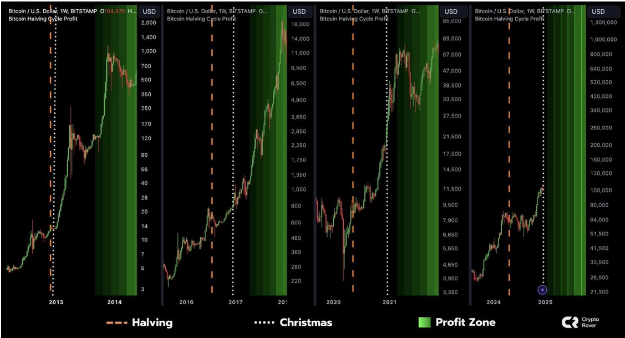

Bitcoin’s Biggest Gains To Come After Christmas

A popular crypto analyst identified as the ‘Crypto Rover’ has expressed optimism about Bitcoin’s near-term price potential this Q4. According to the analyst, Bitcoin has historically experienced its most significant gains right after Christmas during the halving years.

The analyst shared a price chart showing Bitcoin’s market performance during each halving cycle. In the 2012 halving year, Bitcoin started a significant price rally, which extended into the following year. The same bullish trend occurred in the next halving years in 2016 and 2020, with Bitcoin hitting exponential price highs.

Based on this historical trend, Crypto Rover projects that Bitcoin could witness a similar bullish surge before the end of 2024, with the rally potentially continuing into 2025.

Featured image from Bloomberg Images, chart from TradingView

Source link

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

Filecoin, Monero, and Lunex dominate smart investor portfolios

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

How Low Will Ethereum Price Go By The End of December?

Analyst says buying this altcoin at $0.15 could be as profitable as buying ETH at $0.66

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DQ7QIHVHQFAVFORPMZCC7X4NEA.png)