Ethereum NFTs

NFT bubble burst: Monthly sales, transactions crash

Published

4 months agoon

By

admin

The non-fungible token industry remained under pressure in August as sales continued falling.

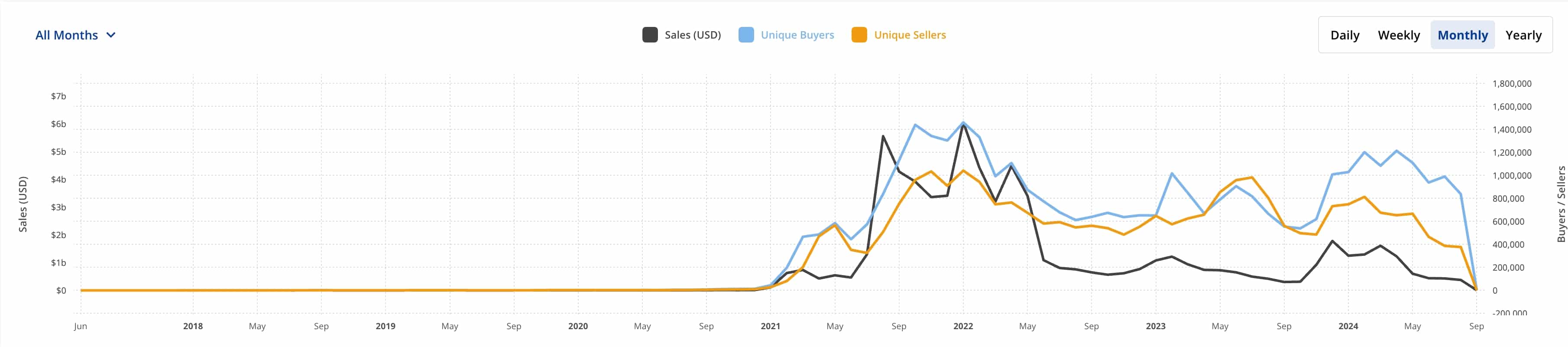

Total NFT sales dropped by 41% in August to $376 million as the number of buyers and sellers fell by double digits.

Data by CryptoSlam shows that the number of buyers dropped by 29% to 127,913 while the number of sellers fell by 17% to 93,600.

Additionally, total NFT transactions declined by 50% to 7.4 million, signaling that demand for these assets has waned.

At the peak in January 2022, total monthly sales were over $6.5 billion while the number of unique buyers and sellers stood at over 1.5 million and over 1 million.

Ethereum (ETH) maintained its lead as the most popular chain for NFT traders, handling over $129 million in August, down by 38% from the previous month.

It was followed by Solana (SOL), which handled $78.9 million. Bitcoin’s NFT sales dropped by 50% to $57 million while Polygon (MATIC) fell by 52% to $36 million.

Mythos Chain saw an improvement in August. It handled $20 million in sales. That’s up by 14% from the previous month. Mythos was led by DMarket, whose sales rose by 17% during the month.

Some of the most popular NFTs have seen their valuation and sales drop in the past few years. For example, Bored Ape Yacht Club has moved from having monthly sales worth over $50 million in 2022 to just $11 million in August.

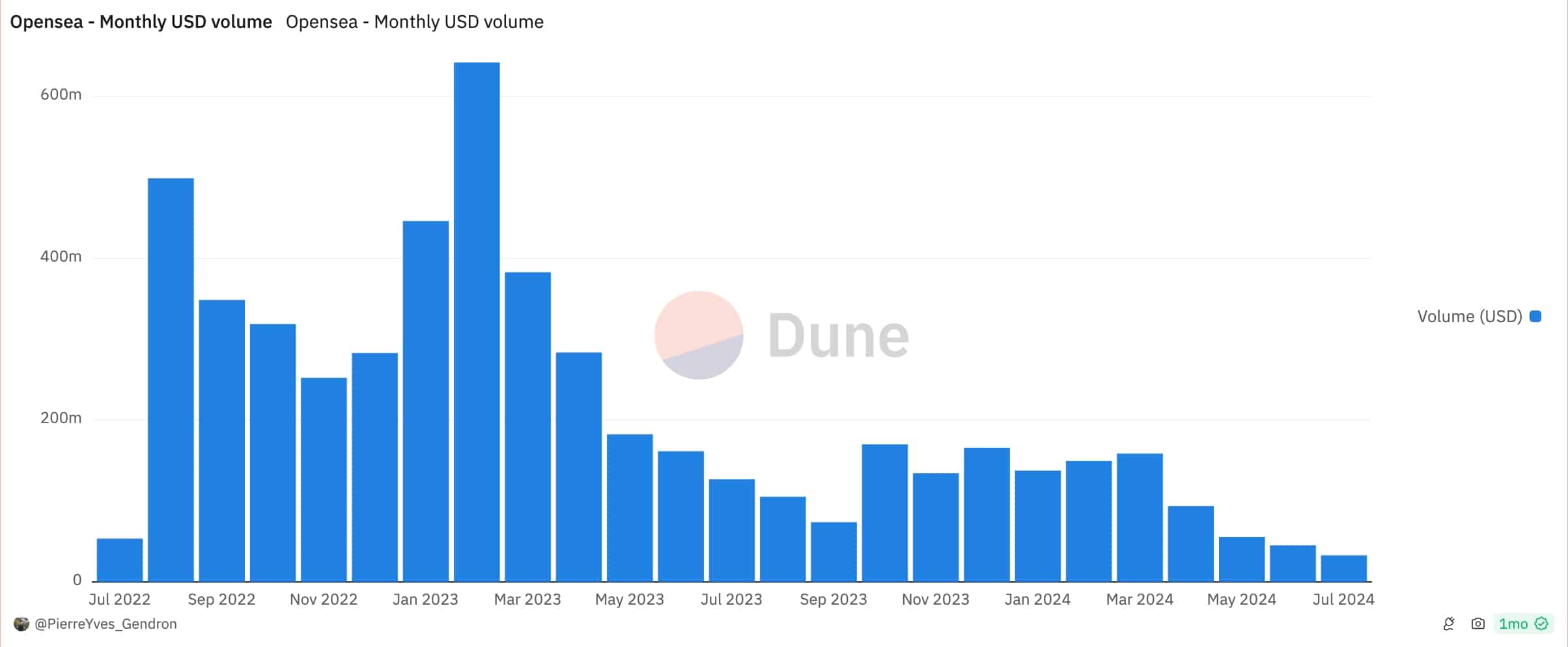

This sharp decline in NFT monthly volume has hurt both investors and marketplaces like OpenSea and Rarible. Data by Dune Analytics shows that OpenSea’s monthly volume in July was just $32 million, down from $641 million in January last year.

Other NFT marketplaces like Blur, Magic Eden, and SuperRare have also had weak volume and users in the past few months.

NFT sales have dropped because of the falling prices. CryptoPunks, the biggest NFT collection, has a floor price of $88,839, a 52% drop from the same period in 2023. Bored Ape Yacht Club’s floor price has dropped by 70% in the past 12 months to $29,593 while Azuki has fallen by 20%.

The top gainers in the same period were Pudgy Penguins and Milady whose floor prices jumped by 166% and 121%, respectively.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

Ethereum NFTs

CyberKongz Fights Back for NFT Industry

Published

6 days agoon

December 17, 2024By

admin

CyberKongz, a gaming-based NFT project, has been issued a Wells Notice by the U.S. Securities and Exchange Commission, raising concerns over its ERC-20 token and blockchain game integration, indicating a potential legal battle might be in the cards.

The team said they were “extremely disappointed at the approach the SEC has taken” on X post on Dec. 16, referring to the Well’s notice, a formal SEC warning of potential enforcement. They also pledged to fight back, arguing the result could have major consequences for the web3 gaming and NFT sectors.

The SEC has expressed some concern with CyberKongz’s pairing of its ERC-20 token with its blockchain-based game. The SEC’s Division of Enforcement argues in CyberKongz’s case that this setup constitutes a security that has to be registered, much like the stance it took against Ripple. This position, the project argued, highlights a failure to understand blockchain technologies and would create a dangerous precedent across the entire web3 gaming industry.

CyberKongz has received a Wells Notice from the SEC.

We are extremely disappointed at the approach the SEC has taken towards us, but we are going to stand up and fight for a brighter future that holds more clarity for NFT projects.

We have been suffering in silence for the last… pic.twitter.com/lc6hyzUPb0

— CyberKongz (@CyberKongz) December 16, 2024

The SEC’s concerns relate to its view that the 2021 Genesis Kongz contract migration was a primary sale. CyberKongz said this was a baffling interpretation of smart contracts and accused the regulator of failing to make a distinction between technical processes versus actual token sales.

CyberKongz stated that its team has been under the microscope for the past 2 years and has suffered in silence during this period. With a small team and no prior capital raises or massive treasuries, the project will now try to challenge the SEC’s position to push for clearer rules in the digital asset space.

The statement also sought to blame the current administration, claiming its “anti-crypto agenda” had harmed the entire blockchain industry, and expressed hope for a new direction under the next administration. CyberKongz also voiced solidarity with industry leaders, including Brian Armstrong of Coinbase, Devin Finzer of OpenSea, and Hayden Adams of Uniswap Labs, who are also facing regulatory pressure from the SEC.

“It has become increasingly apparent that the current administration is trying to force their anti-crypto agenda at the last minute. We hope that the new administration puts an end to this unjustness.”

CyberKongz on X.

By treating tokens as securities, the SEC seeks to subject them to stricter regulatory scrutiny and compliance with existing financial regulations, making it mandatory for projects to register and provide disclosures akin to those of traditional financial instruments. Critics say this approach suppresses innovation and overlooks the decentralized nature of blockchain technologies.

Source link

Bored Ape Yacht Club

Pudgy Penguins NFT price surpass Bored Ape Yacht

Published

2 weeks agoon

December 9, 2024By

admin

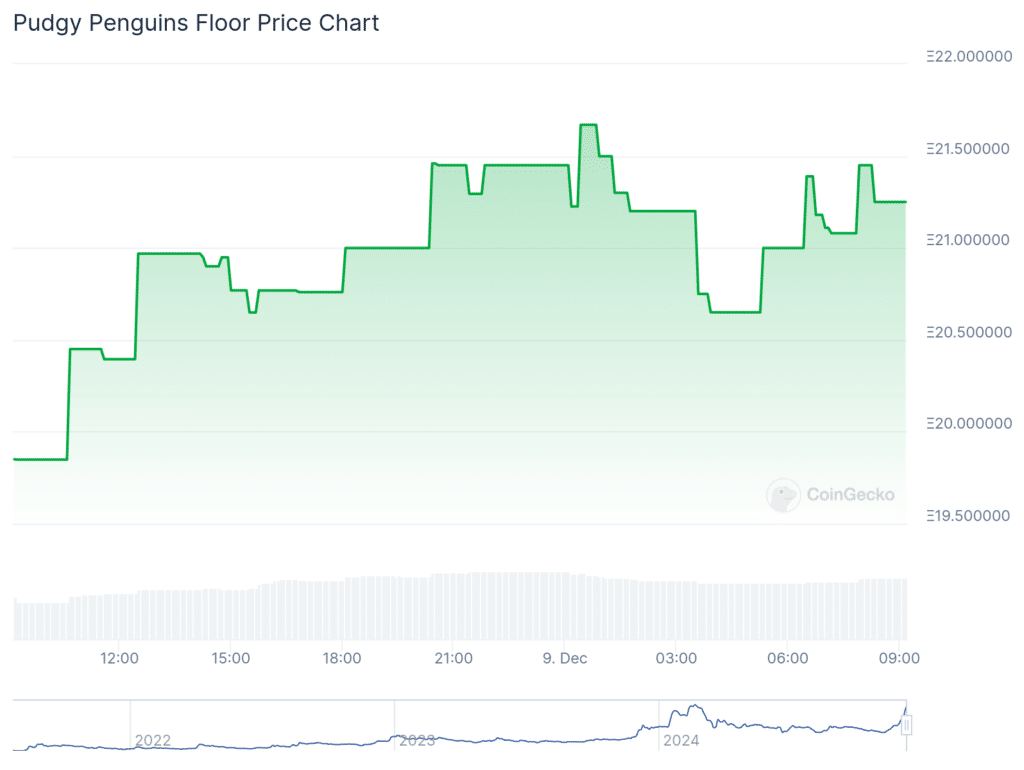

Pudgy Penguins surpassed the phenomenal Bored Ape Yacht on Ethereum price for the first time. This surged amid the NFT’s native token, which would be released in the short term.

Pudgy Penguins price on Ethereum (ETH) surged to 21.49 ETH or equal to $83.930, surpassing the Bored Ape Yacht price of 19.85 ETH or equal to $83.930.

According to CoinGecko data on Dec. 09, these NFTs increased by 7.1% from 19.85 ETH in the past day of trading. Trading volume also surged almost half of the latest trading day to 2,653 ETH.

The increase of this penguin-inspired non-fungible token (NFT) amid the native token $PENGU that was announced a few days ago. This token will be released this year on the Solana (SOL) blockchain.

The Igloo Inc. would prepare 88 billion in token supply, with 25.9% of the supply allocated to the community. Another 24% will be allocated to another community, while the company will account for 11.48%.

“$PENGU will have a total supply of 88,888,888,888 and will launch on Solana,”

they mentioned on X’s post on Dec. 06

Viral Pudgy Penguins NFT

According to the post, these viral Pudgy Penguins were gaining momentum this year with millions of followers and billions of viewers across the globe. These NFTs also reached a market cap of 188,569 ETH after the price surged, which is only a few caps away from Bored Ape Yacht NFT with 196,101 ETH.

The NFTs, with 8,888 unique penguin cartoons, price on Ethereum will also target a new all-time high of 22.9 ETH that was created 10 months ago on Feb. 17.

Penguin’s firm also secured $11 million to build a new project on Layer 2 to support ventures named Cubed Labs and targeting mass cryptocurrency adoptions. This project will take a user-first approach to building abstracts and deploying the testnet ahead of the next wave of consumer crypto products.

Source link

CryptoPunks

Are NFTs Making a Comeback or Just Riding the Hype?

Published

2 months agoon

October 10, 2024By

admin

After a dull stretch, NFT sales have taken a turn for the better. What’s behind this momentum, and is it a sign of a lasting revival?

NFTs are finally making a comeback

Non-fungible tokens are starting to show signs of life again after a rather dull performance in the last few weeks.

According to data from CryptoSlam, sales between Sep. 30 and Oct. 6 soared past $84.9 million, marking the highest sales volume since the week ending Aug. 25, which recorded over $93 million.

What’s even more interesting is that the NFT market has been gaining momentum throughout September. During the week of Sep. 16-22, NFT sales reached $69 million, and the following week, Sep. 23-29, saw a modest uptick to $75 million.

The current week, as of Oct. 7, has already clocked over $5.5 million in sales, suggesting that the market could continue this upward trend.

In addition to the rise in sales volume, there’s been an increase in activity, with over 2 million transactions recorded in the last seven days as of Oct. 7, a 29.73% jump from the previous period.

However, it’s not all sunshine. The average sale price of NFTs has dropped by 32.91%, now sitting at around $43 per sale, indicating that while more people are engaging with NFTs, the high-priced collectibles may still be lagging behind.

With the numbers showing positive momentum, what’s driving this rebound? Let’s dive deeper into which blockchains are leading the NFT race, why NFTs are making a comeback, and what we can expect in the days to come.

Which blockchains are leading the race?

As of Oct. 9, Ethereum (ETH) still holds the crown as the dominant blockchain in the NFT space, but the landscape is shifting, and other platforms are quietly gaining ground.

Ethereum (ETH)

Ethereum remains the leader in terms of NFT sales, bringing in over $26.5 million in the past week. Ethereum’s sales accounted for nearly 31% of the entire NFT market, but it’s also plagued by a relatively high percentage of wash trading — roughly 11.69%.

Wash trading involves artificially inflating the volume by buying and selling within the same wallet to create the illusion of higher demand.

Despite this, Ethereum’s vast user base and dominance in the NFT ecosystem cannot be ignored, as it recorded over 136,000 buyers during this period.

However, the volume of transactions (over 654,000) suggests a growing reliance on smaller trades, with the average sale price taking a sharp dip.

Mythos (MYTH)

Mythos (MYTH), a relatively newer player, is perhaps the most surprising competitor. Sales skyrocketed by over 6200% in the last week alone, reaching $15.3 million, giving it the second spot.

This explosion is driven by its gaming-centric focus, tapping into a relatively untapped and highly passionate user base. In-game assets such as NFTs have been a concept that gamers are increasingly embracing, and Mythos is positioning itself as the leader in this niche.

What’s even more interesting is that this surge isn’t heavily tied to wash trading, as only 0.28% of its transactions are wash trades, showing the platform is experiencing genuine user-driven growth.

Mythos has attracted over 632,000 transactions this week alone, which is nearly five times that of Ethereum, signaling that it might be a blockchain to watch closely as it builds on this rapid adoption.

However, gaming NFTs are highly dependent on the success of the underlying games. Hence, if those games fail to attract or retain users, the NFT market on Mythos might see a sharp decline.

Bitcoin (BTC)

Bitcoin (BTC) entering the NFT race was not something many anticipated a few years ago. Traditionally viewed as a store of value, Bitcoin’s blockchain wasn’t designed with NFTs in mind.

However, the introduction of Ordinals has breathed new life into Bitcoin’s potential in this space. While its weekly sales volume of $14.1 million might seem modest compared to Ethereum, the fact that Bitcoin’s NFT market is growing organically, with only 5.15% wash trading, is worth noting.

Interestingly, despite having fewer transactions and users compared to Ethereum, Bitcoin boasts a higher average sale price, hinting that its NFT market might be more geared toward high-end, premium assets.

Solana (SOL)

Solana (SOL) continues to be a serious competitor, posting over $10.8 million in sales this week, ranking fourth.

However, Solana’s wash trade percentage — at a whopping 22.7% — is one of the highest among the top blockchains, indicating that while Solana is seeing growth, much of its activity may be artificially inflated.

Yet, with nearly 223,000 unique weekly buyers and over 421,000 weekly transactions, it’s clear that Solana remains a key player, especially among collectors who prefer faster and cheaper transaction fees than Ethereum offers.

Polygon (POL)

Polygon (POL), known for its efficiency and low transaction costs, clocked over $10.7 million in sales last week, with wash trades making up only 0.25% of its transactions — far lower than Ethereum or Solana.

Polygon also recorded an impressive 84,532 sellers, indicating that the blockchain is attracting a healthy level of marketplace activity.

Why are NFTs surging again?

The recent surge in NFT sales can be traced to a few key developments, the most notable being a high-profile, yet dubious, CryptoPunk sale and the introduction of innovative NFT features by Telegram.

A flash loan-fueled transaction involving CryptoPunk #1563 recently made headlines when it appeared to sell for an eye-popping $56.3 million on the Ethereum blockchain.

On the surface, this seemed like a monumental sale in a space that has been struggling with lower sales volumes and declining prices.

But a closer look revealed that the sale was anything but legitimate. The buyer of the CryptoPunk used a flash loan — an uncollateralized loan that’s paid back in the same transaction — creating the illusion of a massive purchase.

3/ The progression:

Contract A holds Punk #1563, Contract B holds nothing.

Contract A lists for 24,000 ETH.

Contract B borrows 24,000 ETH from Balancer.

Contract B buys #1563. Contract B now has #1563, contract A has 24,000 ETH.

Contract A returns ETH to Balancer. pic.twitter.com/Clw1JGWASn

— Quit (@0xQuit) October 3, 2024

In reality, the Punk, which had been purchased for just $69,000 in September, was simply transferred between wallets without any real funds changing hands. Despite this, the sale grabbed attention and sparked conversations, renewing interest in the NFT space.

These carefully orchestrated events often attract investors’ attention, especially those who had stepped away from the market amid the broader decline in NFT activity.

The psychological impact of these “sales” can reignite fear of missing out, pulling speculators back into the space as they anticipate that increased attention could lead to real opportunities.

Simultaneously, Telegram’s move into the NFT arena has introduced a more accessible avenue for users to engage with digital collectibles.

On Oct. 5, Telegram launched its new “Gifts” feature — animated images that can be sent to contacts on the platform. But what’s most exciting is that these Gifts are set to be converted into NFTs later this year, with Telegram allowing users to mint these limited-edition assets on the TON blockchain.

This feature builds on Telegram’s previous introduction of its in-app currency, Stars, which users can spend on digital services within the platform. By linking NFTs to social interactions, Telegram is making NFTs more accessible to everyday users.

Telegram’s integration of NFTs is a key development because of its massive user base and the seamless experience it offers. Users will soon be able to convert these digital gifts into NFTs, trade them, and even auction them off, all while staying within the Telegram ecosystem.

While the broader market saw its lowest sales volume since January 2021 in September, these recent events have breathed new life into the sector. Whether this resurgence will hold remains to be seen, but for now, NFTs are back in the spotlight.

What to expect next?

Looking ahead, the NFT space faces some uncertainties, especially with the recent Wells notice issued by the U.S. Securities and Exchange Commission to OpenSea, the largest NFT marketplace.

On Aug. 28, the SEC signaled its intent to take enforcement action against OpenSea, claiming that some NFTs on the platform may qualify as securities. This could have major implications for the entire NFT ecosystem.

A Wells notice is a formal warning that the SEC might pursue legal action, and while OpenSea has the opportunity to respond, the looming threat creates an atmosphere of uncertainty.

If the SEC classifies certain NFTs as securities, it could trigger a wave of regulatory scrutiny, not just for OpenSea, but for other platforms and NFT projects.

The potential for stricter regulations could make some investors hesitant and slow down market growth, especially for projects that don’t have clear legal frameworks in place.

At the same time, the current uptick in NFT sales seems largely fueled by hype. It remains to be seen whether this buzz will translate into long-term growth or if it’s just another short-lived trend.

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential