Culture

Nostr: The Importance of Censorship-Resistant Communication for Innovation and Human Progress

Published

2 months agoon

By

admin

Introduction

In an economic landscape increasingly characterized by monopolization and the dominance of institutionalized credit, innovative technologies and protocols are emerging that have the potential to change the foundations of our economy and society.

At the forefront of this are Bitcoin and Nostr—two groundbreaking protocols that together can usher in a new era of innovation, free from the financial constraints of the fiat system. This article examines the history and mechanisms that enable Bitcoin and Nostr to act as catalysts for innovation and human progress.

Innovation under Hard Metal Currencies

In the days of hard metal currencies, especially during the gold standard, innovation was primarily driven by individuals and private companies who were independent of the state apparatus and institutional lenders. Some of the greatest breakthroughs in science, philosophy and economics were made by private entrepreneurs.

- In 600 BC, a Greek named Thales observed that amber, when rubbed with silk, attracted feathers and other light objects. He discovered static electricity. The Greek word for amber is ‘ëelectron’, from which the words ‘electricity’ and ‘electron’ are derived.

- The Greek philosopher Plato (ca. 428-347 B.C.) is widely considered to be the first person to develop the concept of an atom, the idea that matter is made up of an indivisible component on the smallest scale. He also wrote a number of important books on science, philosophy, economics, politics and mathematics.

- Wei Boyang was a Chinese writer and Taoist alchemist of the Eastern Han dynasty. He is the author of The Kinship of the Three (also known as Cantong Qi), which is considered the earliest book on alchemy in China, and is noted as one of the first individuals to document the chemical composition of gunpowder in 142 AD.

- The car was invented in 1886 by German engineer and automobile manufacturer Carl Benz, who was inspired by Nikolaus Otto, who invented the first gas engine in 1861.

- The Wright brothers are considered the inventors and the first to fly a powered airplane on Dec. 17, 1903, in Kitty Hawk, North Carolina.

The creativity and ingenuity of the Wright brothers has been well documented:

The funds for the brothers’ ventures, including equipment, travel, and their testing site in Kitty Hawk, came from the bicycle shop they operated. They apparently spent just $1,000 over four years (1899-1903) to develop three flying machines, two of which had no engines. The Wright brothers lived during a time when the U.S. was on a gold standard, and saving allowed entrepreneurs to accumulate enough capital to finance innovations, giving them the time and resources needed to pursue their pioneering work in aviation. The ancient Greeks, such as Thales and Plato, also operated under hard metal currencies, contributing to a stable economic environment that fostered philosophical and scientific advancements.

Similarly, Wei Boyang exemplified the pursuit of knowledge during the Eastern Han dynasty in China, which experienced fluctuating monetary conditions, including periods of stability that contributed to intellectual growth in various fields.

Just as the Wright brothers benefited from a time when saving in sound money allowed individuals to focus on their innovations, today’s private entrepreneurs, startups, and bicycle shop owners find it increasingly difficult to earn enough to take the time to think about innovations and finance their implementation.

Inflation has significantly driven up labor and material costs, particularly in industries like aviation and automotive, where advanced technology and greater material requirements demand extensive research and development. As a result, entrepreneurs and freelancers often rely on third-party loans. The average cost of developing a Mercedes car today, for example, is more than two billion euros.

How the Fiat System Blocks Human Progress

The fiat-based monetary system has made it increasingly difficult for innovation to emerge without institutional funding. Monetary inflation erodes purchasing power, limits financing options, and creates obstacles for new ideas to flourish. This is problematic because the institutions that typically fund innovation, including large venture capital firms, banks, and universities, are mostly dependent on the state in one way or another (either because they are regulated by law or because they receive government funding) and therefore have an incentive to support projects that ‘follow’ the current political climate.

The result is a banal misallocation of capital and social stagnation, as can be observed in most countries around the world.

Credit, Fiat and the State Monopoly on Innovation

Credit has become part of a system of control that nation states use in conjunction with fiat money to maintain their monopoly position. Historically, technologies and social movements that undermined the monopoly power of the state and its affiliated institutions were typically banned. At the very least, there was usually an attempt to do so.

A good example is the way Bitcoin is treated by most states, how poorly it is spoken of in most universities, and how most banks used to consider it speculation at best. Because Bitcoin threatens the existence of these institutions. This behavior is generally observed among monopolists and initially makes it difficult for entrepreneurs to enter new disruptive markets like Bitcoin and shifts competition in favor of the monopolist (the state).

Money creation and the granting of credit are fundamental to maintaining the state’s monopoly position. As a result, the reliance on the institutionalized credit system to finance innovation has led to a dependence on a central authority (the state). This disrupts the progress and prosperity of humanity that results from a free market in which capital and information can be freely exchanged and suppresses the collective creativity of humanity.

Bitcoin and the weakening state monopoly on innovation

With the introduction of Bitcoin in 2009, the state monopoly on money was broken. Due to its limited supply and excellent monetary properties (absolute scarcity, durability, fungibility, divisibility, mobility, resilience, self-custody), bitcoin is the hardest money ever created. This allows entrepreneurs to preserve the value of their efforts, giving them time and, in the long term, capital to focus on problems and find and fund appropriate solutions. Which, in turn, creates opportunities for innovation to emerge from the free market in a bottom-up manner.

Innovation and communication

Innovation, especially in the age of the Internet, requires more than capital and people with time. There is a need for efficient and secure real-time communication and collaboration options for people around the world. Communication and collaboration are crucial for efficiently solving increasingly complex problems in a connected world.

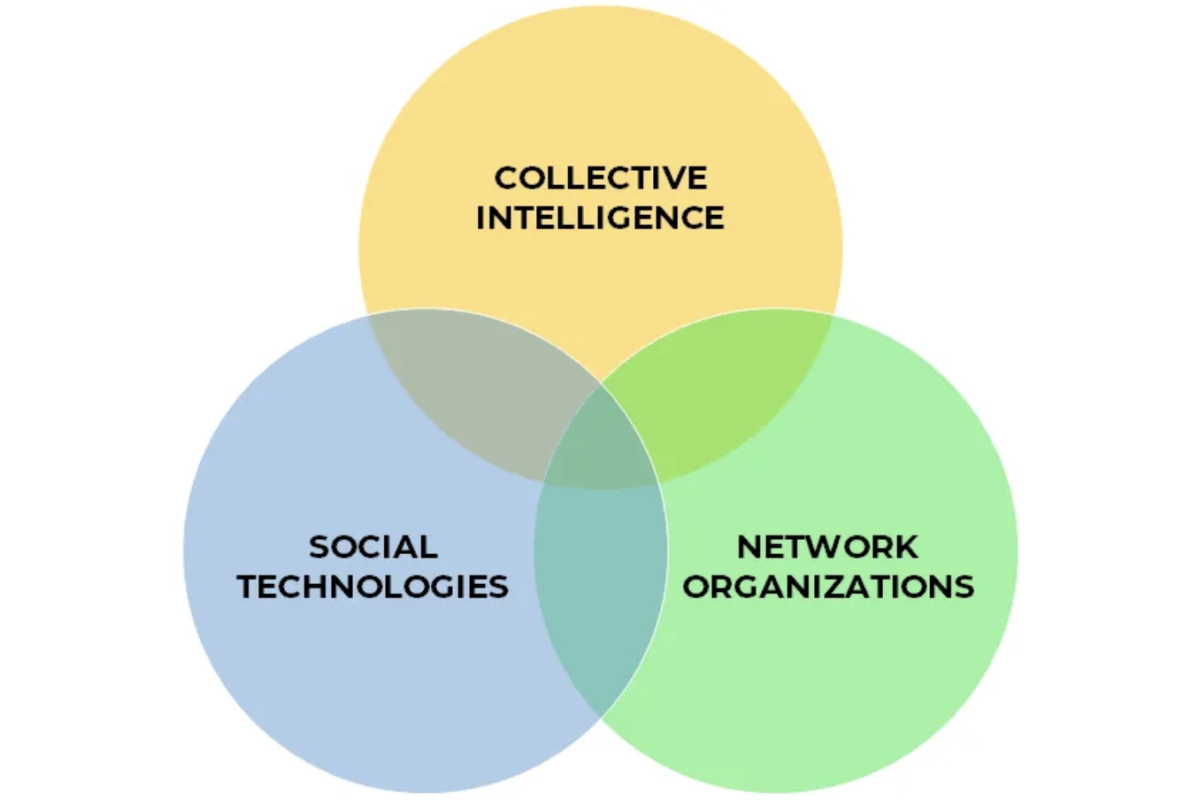

Cunningham’s Law states that the best way to get the right answer on the Internet is not to ask a question; instead, to post the wrong answer because others will correct you. This underscores the importance of collective intelligence. The law is named after Ward Cunningham, who invented the Wiki software that allows users to create and collaboratively edit web pages or entries via a web browser. The most famous example is wikipdia.com.

Nostr: Communication as a tool for innovation

In late 2019, Lightning developer named Fiatjaf published his ideas on a censorship-resistant social network he called Nostr – “Notes and Other Stuff Transmitted by Relays”. With the actual launch of Nostr shortly after, a protocol that adds a layer of censorship-resistant information-sharing to the Bitcoin and Lightning protocol suite, a new territory of freedom opened up in the same tech-stack as Bitcoin and Lightning.

Although there were a number of other decentralized communication networks besides Bitcoin before Nostr (Bittorrent, Limewire, Napster, etc.), in my view none of them had the potential to have a universal long-term impact on collaboration to solve complex problems facing humanity. Nostr has the potential to enable bottom-up innovation and rapid problem-solving that no one can keep a lid on. With Nostr, market participants can communicate, collaborate, and reward each other in real time globally, more independently of nation-state control.

Even though individual applications that use Nostr can be switched off, the protocol itself cannot be effectively controlled or turned off by a central party.

The first widely used application of Nostr is a censorship-resistant social network that can be accessed through various clients. The most commonly used ones include Damus, Primal, Amethyst and Iris. The usability of each client is largely optimized for desktop or mobile. The network structure is similar to the way one can access the IMAP email protocol through various clients such as Gmail, Yahoo Mail, etc. (simplified example). Applications connect to many Nostr relays that are run by network participants with technical know-how. These relays distribute information, so if one relay fails, there are others that continue to run. The relays operate largely independently of each other, giving the network resilience because there is no central point of failure.

Although Nostr is not based on the Bitcoin blockchain, it utilizes peer-to-peer bitcoin payments via the Lightning Network. With Zaps, users can pay each other or tip posts they particularly like. People can now successfully save in bitcoin, communicate via Nostr, and transact with each other through Lightning—potentially independent of any central authority.

Even though. For a long time, I struggled to define the purpose of Nostr beyond its function as a “decentralized X.” However, I eventually realized that the possibilities are nearly endless. Nostr is a protocol for a freer Internet and society, poised to become the gateway to a truly free Internet. In this new landscape, we have the opportunity to innovate faster and reward ingenuity, making way for a more empowered and interconnected world.

There are countless Nostr applications currently being built. Nostrocket, for example, is a client designed to coordinate decentralized, Bitcoin-based economies by rewarding (in satoshis/bitcoin) contributors who work together to find solutions to global challenges. The application uses censorship-resistant communication via Nostr and direct bitcoin payments via the Lightning Network to help create economically sustainable organizations that solve problems on the critical path to a global Bitcoin standard. Nostrocket founder Gsovereignty is a very active member of the Nostr community and worth following.

Conclusion

The Bitcoin protocol was created as an alternative to the fiat system. A decentralized, permissionless peer-to-peer electronic cash system, outside the reach of the state. Satoshi Nakamoto created arguably one of the most important innovations by a private individual or group of people that humanity has ever produced, because he/they laid the foundation for anyone to be able to trade and act independently of the state. As a solid foundation for a freer economy, the Bitcoin network enables other network layers to “dock” to the base, creating new ways to use bitcoin and opportunities for users. The Lightning Network, as a second-layer payment protocol for fast transactions and micropayments, partially addresses the problem of how to scale Bitcoin so that it can be used by all of humanity.

The introduction of Nostr creates a new territory of freedom within the same protocol suite as Bitcoin and Lightning, enhancing Bitcoin’s usability for diverse applications. By facilitating seamless communication and collaboration, Nostr further aids in scaling Bitcoin, empowering us to innovate faster and reward ingenuity. With Nostr, innovation can potentially emerge from the free market again, and ingenuity can be rewarded once more. Thus, Bitcoin, Lightning, and Nostr provide a protocol suite for a freer Internet and society, with Nostr poised to become the gateway to a truly free Internet.

The use cases for Nostr seem endless. I invite you to explore the possibilities of the protocol.

I would like to thank Uncle R0ckstar for the inspiring conversations and encouraging words.

Follow me on Nostr

This is a guest post by Leon Wankum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Culture

How Academia Interacts With The Bitcoin Ecosystem

Published

12 hours agoon

April 16, 2025By

admin

At the MIT Bitcoin Expo earlier this month I had the opportunity to sit down and talk with Neha Narula, the Director of the Digital Currency Initiative under the MIT Media Lab.

Neha previously studied at MIT, completing her PhD in 2015. Her research and work has tended to focus on distributed systems and databases, with many contributions involving analysis of the potential shortcomings and risks of Central Bank Digital Currencies (CBDCs).

She previously worked on relaunching the news aggregation platform Digg, and worked at Google as a senior software engineer, where she designed Blobstore, a scheme for redundant replication and delivery of massive amounts of data.

We discussed the history of the MIT DCI and its role in the history of Bitcoin development in research, as well as the role of academic research in general as it relates to Bitcoin and cryptographic or blockchain systems.

You can watch the interview here:

Source link

conference

The 14 Types Of People You’ll Definitely See At Bitcoin 2025

Published

5 days agoon

April 12, 2025By

admin

Loud. Friendly. Huggy. The Bitcoin Bro is your hype man for hyperbitcoinization. He doesn’t know what “joules per terahash” means, but he’s onboard for the vibes and will yell “Buy the dip!” during your panel Q&A.

They party hard, orange-pill harder, and are basically Bitcoin’s version of a frat brother with a bull market pump tattooed on his calf.

Slicker than a fresh seed phrase, this guy’s teeth are whiter than your Lightning wallet. He’s rented a Lambo for the afternoon and drops your first name way too often, like he’s trying to sell you a time-share in the metaverse.

He doesn’t care about decentralization. He cares about gains, baby. And tailoring. Always with the tailoring.

The apocalypse isn’t a threat—it’s a plan. This dude hasn’t touched fiat since 2018 and bathes in non-KYC sats. He’s already learned to make his own soap and catch fish from nearby lakes and streams.

He’s not paranoid. He’s prepared.

Lives in a van. Pays for tacos with lightning. Might be hiding from the IRS (but only spiritually). They believe Bitcoin is peace, man. And also chaos. And also freedom.

Will fix your flat tire in exchange for a hammock spot and a cold yerba mate.

The unsung hero of Bitcoin. Speaks only in thermodynamic math and SATA cable specs. Makes ASIC firmware upgrades look like wizardry, but can’t explain what he does to his mom without her crying.

Definitely knows the precise BTU-to-wattage ratio for his off-grid, solar-powered mining container. Definitely doesn’t know what “small talk” means.

Yes, plural. Yes, anonymous.

They don’t want to talk to you. They don’t want to be on your podcast. They don’t even want you to know they’re here. Ask them when something will be done and you’ll get the sacred prophecy: “Two weeks.”

They are the shadowy super coders that Elizabeth Warren warned you about—hunched over ThinkPads, pushing protocol upgrades that will quietly redefine monetary history. You won’t recognize them. That’s by design.

Armed with a gimbal and a dream. Their camera roll is 80% memes, 20% selfies with CEOs. Some are here to spread the signal. Some are here for the clout. All are uploading something right now.

Will say “Let’s run it back!” at least 17 times a day.

You’ll spot him by the gravity-defying stack of laminated badges swinging from his neck like a wearable timeline. He doesn’t say much—he lets the passes do the talking. Each one’s a badge of honor. Each one says: I was there.

He’s not here to attend panels—he’s here to assert conference dominance.

Branded polo. Branded backpack. Branded soul. You don’t even know how you ended up holding his business card. He’s not here to network—he’s here to execute. He moves in packs, wears his lanyard like a badge of honor, and will be back at the booth precisely 15 minutes after lunch.

Doesn’t talk about Bitcoin. Is Bitcoin.

Old-school finance dudes who smelled the smoke from Wall Street and headed toward the orange glow. Calm. Calculated. Dollar cost averaging into the sunset.

They don’t shill. They don’t yell. They just quietly stack and nod wisely at panels.

Sleeps 3 to a hotel room and burned half their Series A to get to Vegas. They’re pitching a new Lightning wallet-slash-social network-slash-AI market prediction engine and just need one person to believe in them.

Respect the hustle.

God bless them. They’ve been standing next to their Bitcoin-obsessed partner for three straight days, pretending to understand mining pool fee structures and nodding politely through 5-hour dinner debates.

They are the backbone of the conference. The true MVPs. Probably counting down the minutes to the spa.

Not who you think. No Gucci belts. No megaphones. Just quiet confidence, a phone permanently in hand, and a passive stake in something that’s quietly revolutionizing finance.

Some got lucky. Some built empires. All will ignore your pitch deck.

The rarest sighting of all: A woman. Yes, they exist. Yes, they know more than you. And yes, they’re already five steps ahead of your “Have you heard of Bitcoin?” icebreaker.

Bonus: They’ll probably be the ones explaining immersion cooling to you.

One Event. Endless Energy. Absolute Chaos.

Bitcoin 2025 is more than a conference. It’s a decentralized carnival of code, conviction, and characters. Whether you’re here to build, learn, chill, or meme—there’s a place for you in the movement.

This article was inspired by the video “The People of Bitcoin 2022 Miami Conference” by SPACE DESIGN WAREHOUSE. We acknowledge and appreciate the original creative concept, which served as a foundation for this updated and expanded interpretation for Bitcoin 2025. We encourage readers to view the original video and support the creator on YouTube.

At Bitcoin Magazine, we believe in the power of open-source ideas—because great content, like great code, is better when it’s built together. If you have something you’d like to see featured—whether it’s a video, meme, sketch, or spicy take—send it our way at [email protected]. If we use it, we’ll give you credit in the article and share your work with the broader Bitcoin community.

Source link

Culture

Surreal And Immersive Art On Bitcoin & The Future Of Digital Expression

Published

2 weeks agoon

April 3, 2025By

admin

As the Bitcoin Conference 2025 approaches, set for May 27-29th at the Venetian in Las Vegas, digital artist Post Wook—known for her surreal, psychedelic landscapes that merge cosmic and natural elements—is set to bring her latest series, “The Astronomer’s Daughter” to a large audience of bitcoiners. In tribute to her father, a long-time NASA employee, this ordinals series uniquely merges satellite data and bitcoin block times, alongside seasonal and astronomical patterns such as the phases of the moon. Post Wook will showcase this work as part of both B25 and the off-site ordinals event, Inscribing Vegas.

I caught up with Post Wook to discuss her latest digital art series, the future of immersive art, and the experience of seeing her work featured on the Sphere in Las Vegas.

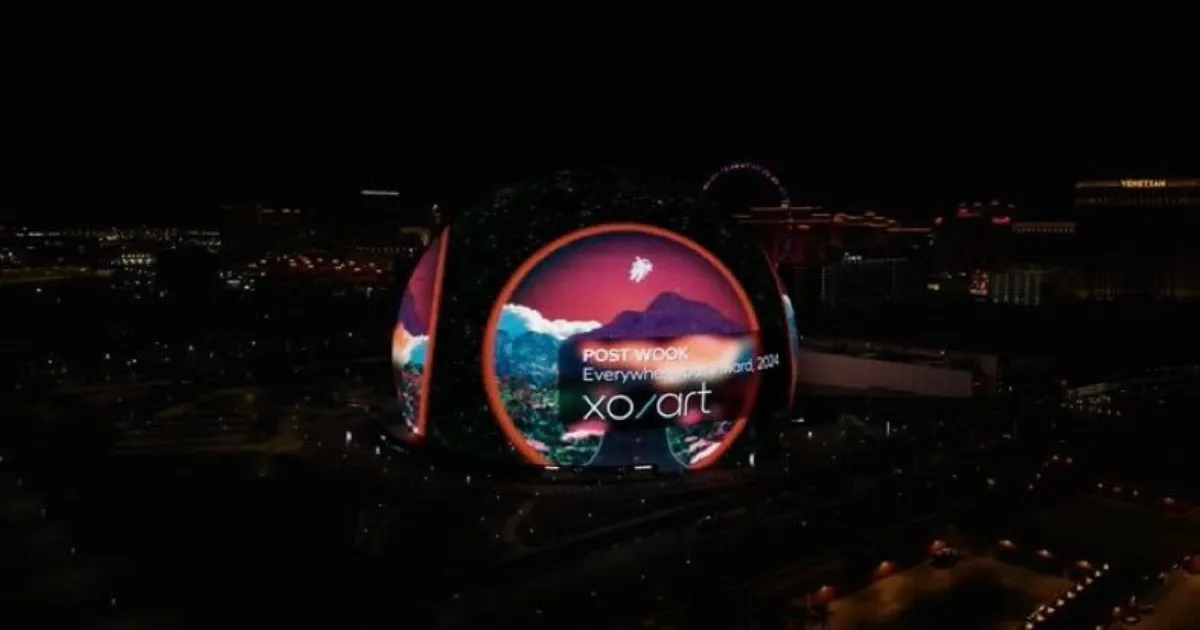

The Las Vegas Sphere has quickly become the principal attraction on the Las Vegas Strip. What was it like to see your artwork, “Everywhere but Inward,” displayed on the Sphere for the first time?

It honestly felt very surreal! Having worked on the piece for over a year, I was super familiar with the animation sequencing, but seeing it actually on the Sphere for the first time felt so cool. The Sphere is LARGE, and you think you know that when you see photos, but then when you see it in real life it blows you away. We got to our lookout spot in Vegas about 15-20 min before it popped up in the programming, and once it actually came on it felt so wild! I think I started clapping. I never do that. I was just so happy to be in the moment.

The Sphere is one of the world’s largest and most sophisticated immersive platforms, featuring a 16K resolution interior and an exterior LED display that spans over 580,000 square feet. How does the scale of the Sphere’s surface affect the viewer’s perception of your digital artwork? You’re no stranger to fantastical landscapes or extra-perceptionary vistas, so this must have been especially interesting to take in.

The actual process of animating Everywhere but Inward, 2024 for Sphere was interesting because with a screen that big the animation had to be a lot slower than I’d normally animate. So honestly, watching the animation as an equirectangular piece on my monitor felt like watching paint dry. But watching it on Sphere, it feels like a regular animation. I guess that’s just showbiz.

On the whole I’m just excited to see digital art take center stage. With Sphere in Vegas becoming literally the talk of the strip to the new Sphere they’re building in Dubai, it’s pretty obvious that digital art is on the rise and is becoming increasingly legitimate to the world around us.

The ephemeral nature of a public display on the Sphere contrasts with the permanence and immutability of on-chain art. How do you view the tension between the grandeur of public spectacle and the private, immutable ownership of digital art? Does this shift in how art is owned and experienced influence your approach to creating and presenting your work?

I sort of look at it like ‘exterior’ and ‘interior’ work with Sphere showing people that digital art is cool and on-chain art reinforces that digital art is valuable. The public spectacle brings people in and on-chain ownership provides traceable provenance. I’d like to think I balance that tension well. By having licensed work in Target and auctions in Sotheby’s, I’m able to find solace in providing art at every level because I really believe art is for everyone, and everyone deserves a little bit of POST WOOK finery in their lives.

On the other hand, on-chain art has broken open the door for me to become a mad scientist for my ‘upper end’ artwork by creating art that uses blockchain as a medium, and honestly it’s become some of my favorite art to make. I’ve always had a soft spot for research, so being able to combine complex data sets and my creativity feels like a dream. To off-chain people, I like to explain this work sort of like the photographs from Harry Potter, except instead of using magic to animate the images, we use code and blockchain.

I find it even cooler that I get to sit down with collectors that share my same data-driven interests and chat about the future of digital art. I honestly have to pinch myself sometimes because I feel like I truly have the best of both worlds with creating meticulously detailed on-chain art and aesthetically pleasing retail art.

Tell us more about “The Astronomer’s Daughter” series, and what can Bitcoin Conference or Inscribing Vegas attendees expect to see from this series in May? I heard a rumor that your dad might be making the trip.

The Astronomer’s Daughter has sort of become my favorite little brainchild, and it’s been really fun to watch it blossom. It’s a collection that honors my dad’s legacy working for NASA through the blended use of satellite data and my artistic style. I chose 100 rare satoshis with varying levels of astronomical and on-chain significance to showcase what happened in space that day.

Of all the various components, the moon phases are accounted for as the moon displayed in each image, the constellation the moon passes through is represented by the color of the sky, any planets close to earth are displayed accordingly, the month and the season are shown as the landscape in the image, solar holidays (equinoxes and solstices) are recorded, and there’s a chromatic filter on top of every image based on the year of the satoshi to tie it all together.

Each piece is then pulled together using recursion and inscribed directly on the satoshi that the artwork represents.

In May, I’m debuting five (5) physical shadow boxes of select pieces from The Astronomer’s Daughter to showcase each layer of the artwork, acting almost as a physical representation of each recursive element. These pieces will be on display in the Bitcoin Conference Las Vegas, and they’ll be a sight to see! And yes, Father Wook might even be there but I don’t want to give too much away – people will have to come see for themselves!

See Post Wook’s artwork at both Bitcoin Conference Las Vegas and Inscribing Vegas. Tickets for these events, along with access to a full range of after parties, are available as part of the Bitcoin Week bundle here: https://b.tc/conference/2025/bitcoin-week.

Source link

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x