24/7 Cryptocurrency News

ONDO Soars 30% Amid Major Perpetual Listing

Published

5 months agoon

By

admin

Ondo Finance’s native token has garnered noteworthy investor attention amid the broader market’s recent recovery. Today, the coin’s price soared nearly 30%, sparking optimism further supported a major perpetual futures market listing. OKX, one of Asia’s leading crypto exchanges, revealed perpetual futures market listing for the RWA token today. This listing ignited significant optimism, paving the way for potential upside momentum ahead with new money inflow into the token’s ecosystem.

OKX Unveils Perpetual Futures Market Listing

According to an official release dated August 6, OKX is set to list the token on its perpetual futures market today at 10:30 AM UTC. The listing paves the way for platform users to partake in futures trading the asset with up to 50x leverage.

Further, the announcement also revealed that spot margin trading and ‘Simple Earn’ for the token will commence today at 10:00 AM UTC. These listings offer the RWA token enhanced user appeal on the platform, potentially injecting more money into its ecosystem.

As seen previously with numerous perpetual listings, such as Coinbase’s announcements on PEPE, MKR, and AAVE, among many others, market sentiments usually remain optimistic with such positive news. Meanwhile, it’s also worth noting that on-chain data by Arkham indicates BlackRock BUIDL fund’s massive $8.1M token transfer to Ondo Finance over the past day, adding a layer of intrigue to the price movements following the recent market crash.

Also Read: US Commences $50B Treasury Buyback, 50 bps Fed Rate Cut Odds Surge

ONDO Price Rallies

As of writing, the ONDO price gained 32.78% in the past 24 hours to reach $0.7134. Its 24-hour bottoms and peaks were registered as $0.5056 and $0.75, respectively. Today’s remarkable pump comes against the backdrop of the broader crypto market recovery alongside Japan’s Nikkei and Topix, both gaining 12%.

Further, the derivatives data offered by Coinglass underscored a strong uptrend for the token today. The RWA token‘s open interest surged 40.32% to $88.38 million, further accompanied by a derivatives volume upswing of 22.15% to $832.87 million. This data spotlighted increased investor enthusiasm surrounding the token.

Also, the RSI rested along the 26 mark, indicating that the asset is in the oversold territory. This further paves the way for potential buying from investors, sparking additional optimism on price movements.

Also Read: WazirX Discloses Important Update Amid Rising Customer Pressure

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Analyst Predicts XRP Price To Reach $27, Here’s Why

Texas, Ohio, and Pennsylvania to create Bitcoin reserves

Why 2025 Will See the Comeback of the ICO

Can Donald Trump Truly Make US The Crypto Capital?

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Why Bitcoin Price Is Falling Today: Is $80K Next?

24/7 Cryptocurrency News

Analyst Predicts XRP Price To Reach $27, Here’s Why

Published

18 minutes agoon

December 26, 2024By

admin

Crypto analyst Egrag Crypto has predicted that the XRP price could rally to as high as $27 in this market cycle. The analyst also provided insights into why XRP could reach such an ambitious price target.

XRP Price To Reach $27 In This Market Cycle

In an X post, Egrag Crypto predicted that the XRP price could reach $27 in this market cycle. The analyst cited some statistics to prove why the crypto could indeed reach this price target.

First, the crypto analyst mentioned when XRP crossed the 21 Exponential Moving Average (EMA) in the 2-week time frame, a move which led to the cycle top in 2017 following an explosive rally of 50,000%.

In applying a similar measurement to the current price action, an XRP crossover of the 21 EMA to $27 represents a price gain of 4,770%. Such a price rally would represent only 9.54% of the 50,000% surge recorded back in 2017.

Egrag Crypto is confident that XRP can reach this price target since it witnessed a more explosive move back in 2017. This isn’t the first time the crypto analyst has raised the possibility of XRP reaching such heights based on historical trends.

Meanwhile, a recent CoinGape market analysis suggested that the XRP price could at least reach double digits as it rallies to $10. Fundamentals such as the RLUSD stablecoin and other Ripple partnerships support such a bullish outlook.

Such a price surge could also happen if the incoming SEC Chair Paul Atkins drops the Commission’s case against Ripple. The Ripple has undoubtedly had a negative impact on the coin’s price.

What To Expect In The Short-Term

In another X post, Egrag Crypto also discussed what to expect from the XRP price in the short term. The analyst stated that everything is just noise until one of these two things happens for XRP.

First, he highlighted $2 as one of the key levels to watch. The analyst remarked that a confirmed break below that target would send the crypto toward the lower targets.

On the other hand, the analyst stated that a break above $2.65 would cause the fireworks to “ignite.” Simply put, a break above this level would lead to a bullish continuation.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Can Donald Trump Truly Make US The Crypto Capital?

Published

3 hours agoon

December 26, 2024By

admin

President-elect Donald Trump’s promise to ensure all remaining Bitcoin is “made in the USA” has sparked widespread debate. Announced during a meeting with crypto mining executives, the pledge reflects a shift in Trump’s stance on digital currencies. Despite this commitment, experts caution that achieving this goal may be unattainable due to various reasons discussed in this article.

Is Donald Trump Bitcoin Strategy Achievable?

Recent data indicate that 95% of Bitcoin has already been mined, leaving only a small fraction available for production. This reality makes President-elect Donald Trump’s promise to produce Bitcoin exclusively within the United States highly challenging. Bitcoin mining operates on a decentralized network, meaning no single country or entity can control the process.

Additionally, global mining operations dominate the industry, with US crypto miners contributing less than 50% of the total computing power. This disparity underscores the difficulty of centralizing Bitcoin production to a single nation. The highly competitive nature of the sector further complicates efforts to shift the balance entirely to domestic players.

More so, these challenges erupt even as Japan rejects Bitcoin for national reserves, prioritizing stability in its foreign exchange strategy. The government highlighted BTC price volatility and misalignment with traditional financial systems.

Interestingly, this cautious stance contrasts sharply with other Japanese private entities. For example, Japan’s MicroStrategy, Metaplanet, invested ¥9.5 billion to purchase 617 BTC, raising its total holdings to 1,761.98 BTC. This move boosted its Bitcoin treasury by 56% amid a price dip. The company reported a 309% yield on its BTC holdings in Q4, with CEO Simon Gerovich emphasizing Bitcoin’s role in safeguarding capital against the declining Yen.

Global Competition and Equipment Reliance Challenges

Bitcoin mining is increasingly driven by international players with deep resources, such as miners in Africa, Asia, and the Middle East. These regions often benefit from lower energy costs and fewer regulatory barriers, providing an edge over US operations. For example, countries like Ethiopia and Argentina offer access to cheap hydropower and stable revenue streams in US dollars. This boosts their competitiveness in the market.

Adding to the challenge, most Bitcoin mining equipment is manufactured by Chinese companies, particularly Bitmain. A trade war or tariff policies under Donald Trump’s administration could raise the cost of importing essential machinery, creating additional obstacles for US crypto miners.

However, despite the ambitious pledge, Donald Trump has found support from several US-based mining companies, such as CleanSpark Inc. and Riot Platforms Inc. These companies anticipate that his administration will reduce environmental regulations and increase industry support. However, some US miners are even turning to overseas partnerships to mitigate rising energy costs at home.

For instance, MARA Holdings Inc. has announced a joint venture with an Abu Dhabi sovereign wealth fund to establish one of the largest mining farms in the Middle East. While Donald Trump’s commitment to making Bitcoin “made in the USA” aligns with his broader economic goals, it faces structural and logistical barriers.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Why Bitcoin Price Is Falling Today: Is $80K Next?

Published

6 hours agoon

December 26, 2024By

admin

The recent dip in Bitcoin price has sparked concerns among investors while triggering massive selling pressure in the broader crypto market. In addition, the recent market developments also hint towards a further dip, with many predicting a potential slip to $80K or even below. Notably, this comes despite the strong institutional interest in the flagship crypto, as evidenced by the buying spree of MicroStrategy (MSTR) and others.

Why Is Bitcoin Price Falling Today?

Bitcoin price has recorded a sharp decline today, sparking concerns in the broader crypto market. A flurry of reasons could have weighed on the investors’ sentiment recently, which has also triggered massive selling pressure in the digital assets space.

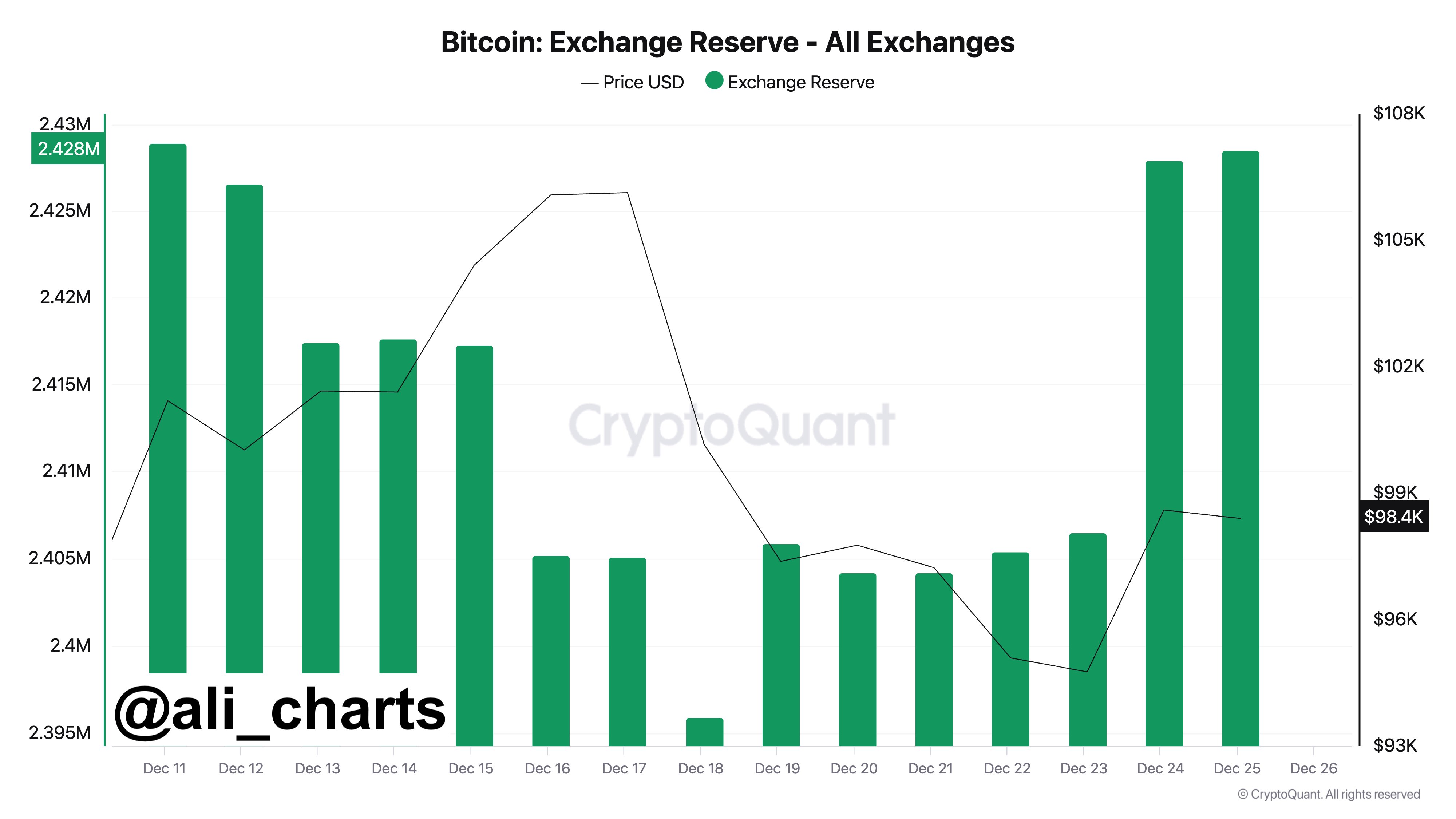

For context, BTC has recorded massive rallies since Donald Trump’s election win in November. Having said that, it also provided a profit-booking opportunity to many investors, with recent on-chain data indicating heavy selling pressure on the crypto. Top crypto market expert Ali Martinez highlighted the trend, saying that 33,000 BTC, worth over $3.23 billion, has moved to exchanges recently.

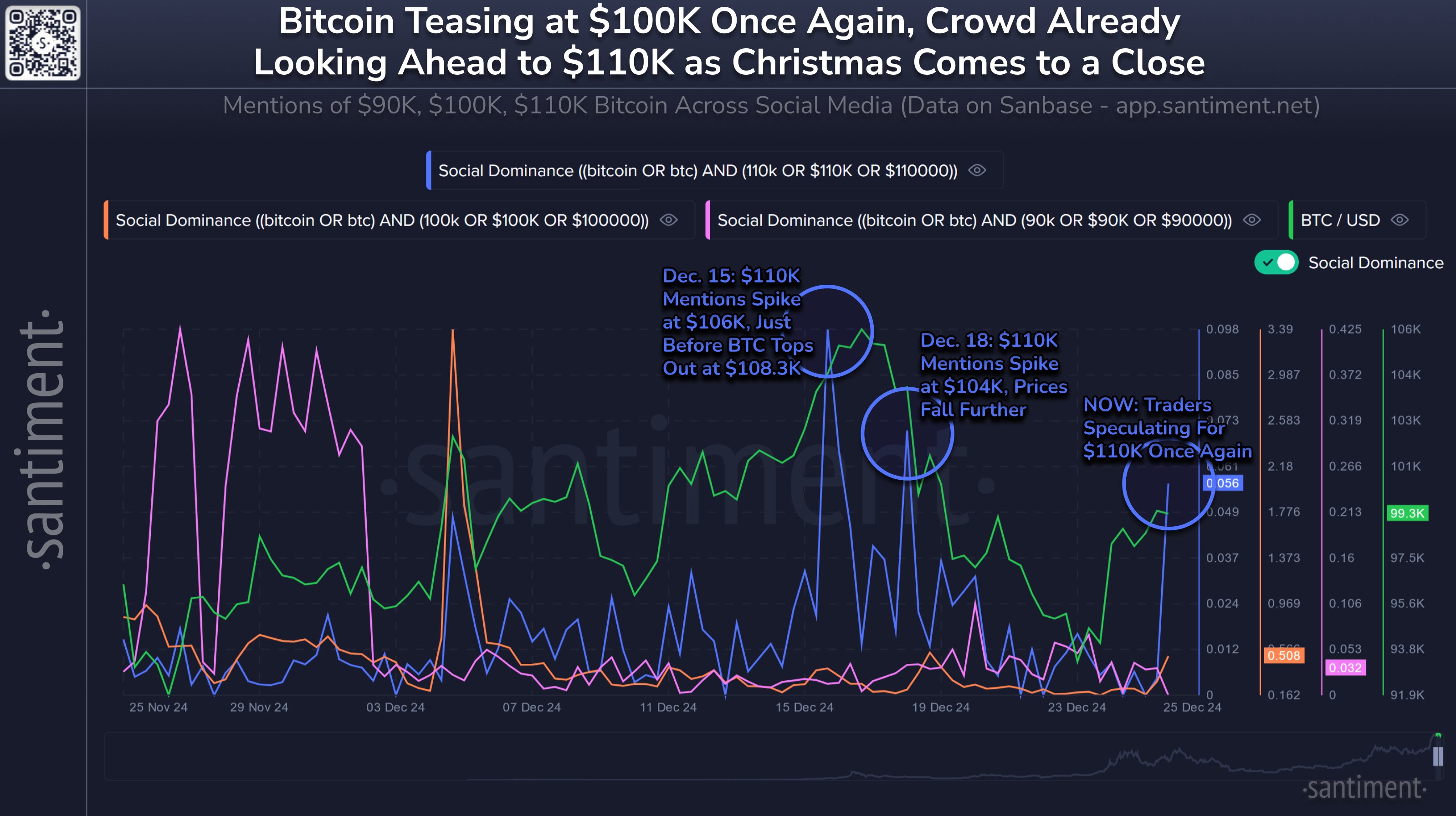

This indicates the profit-booking strategy, which the traders often use when an asset’s price goes higher. On the other hand, Santiment recently highlighted the BTC drop after reaching $99.8K on Christmas, sparked by bullish trader sentiment. The report noted that speculation of the cryptocurrency hitting $110K has also increased due to the recent rally.

However, Santiment suggests that historically, Bitcoin only reaches such highs when crowd expectations are low. This indicates that the current downturn may be a market correction, as traders’ high expectations for $110K may be self-fulfilling prophecies that prevent the price from rising further.

Bitcoin Options Expiry Sparks Concern

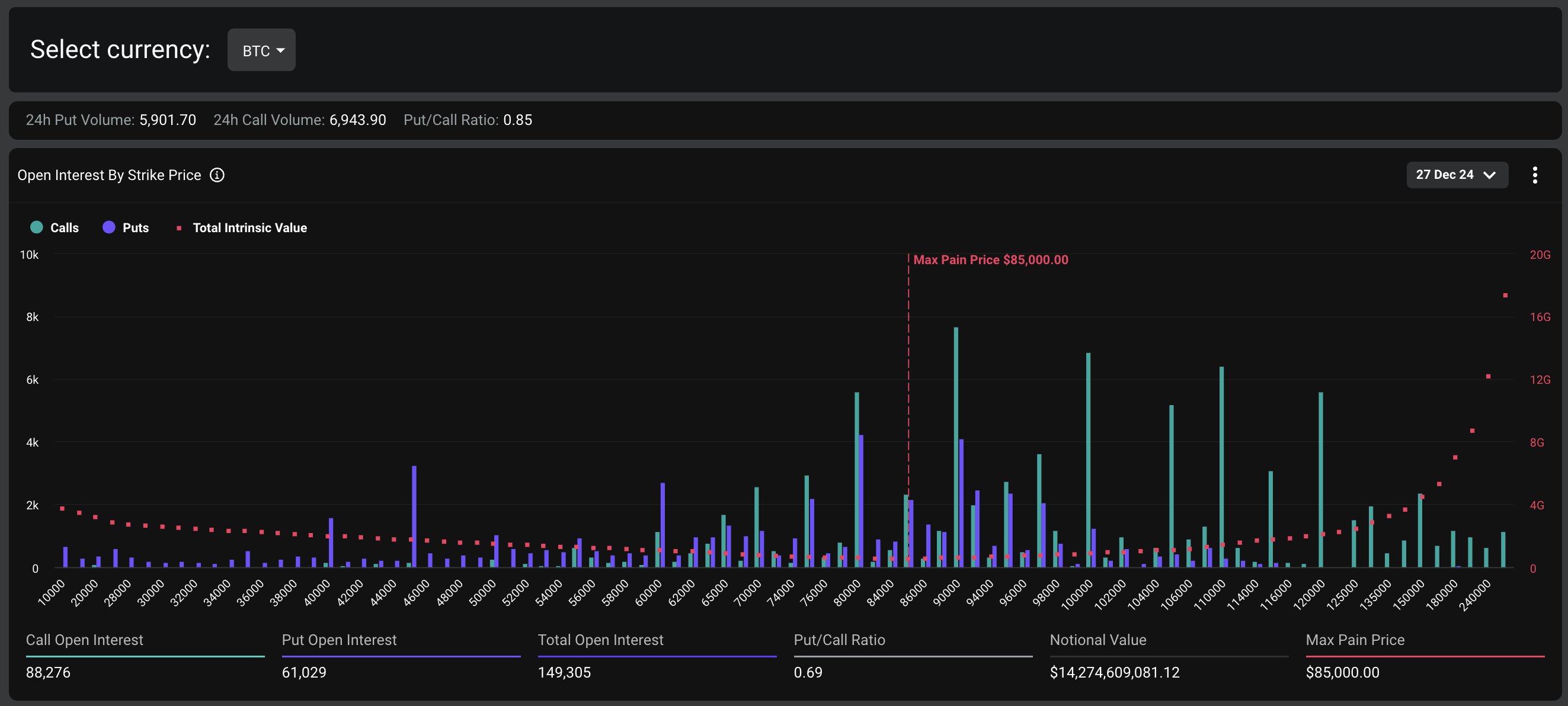

The recent downturn in Bitcoin price comes ahead of the largest crypto options expiry on the Deribit exchange, with over $18 billion in options set to expire tomorrow. The expiry has sparked directional uncertainty, with elevated volatility and “sharp swings in DVOL”, Deribit noted. Besides, market experts also warned that the heavily leveraged market to the upside could trigger a rapid snowball effect with any significant downside move, leading to high volatility.

Notably, the Bitcoin options expiry accounts for the majority of the total notional value, with $14.27 billion set to expire. The put/call ratio stands at 0.69, indicating a slightly bullish sentiment among traders. The max pain point for Bitcoin is $85,000, which could act as a resistance level in the event of a price swing.

On the other hand, Ethereum options expiring tomorrow account for $3.79 billion in notional value. The put/call ratio is 0.41, suggesting a more pronounced bullish bias among Ethereum traders. The max pain point for Ethereum is $3,000, which may influence the asset’s price movement.

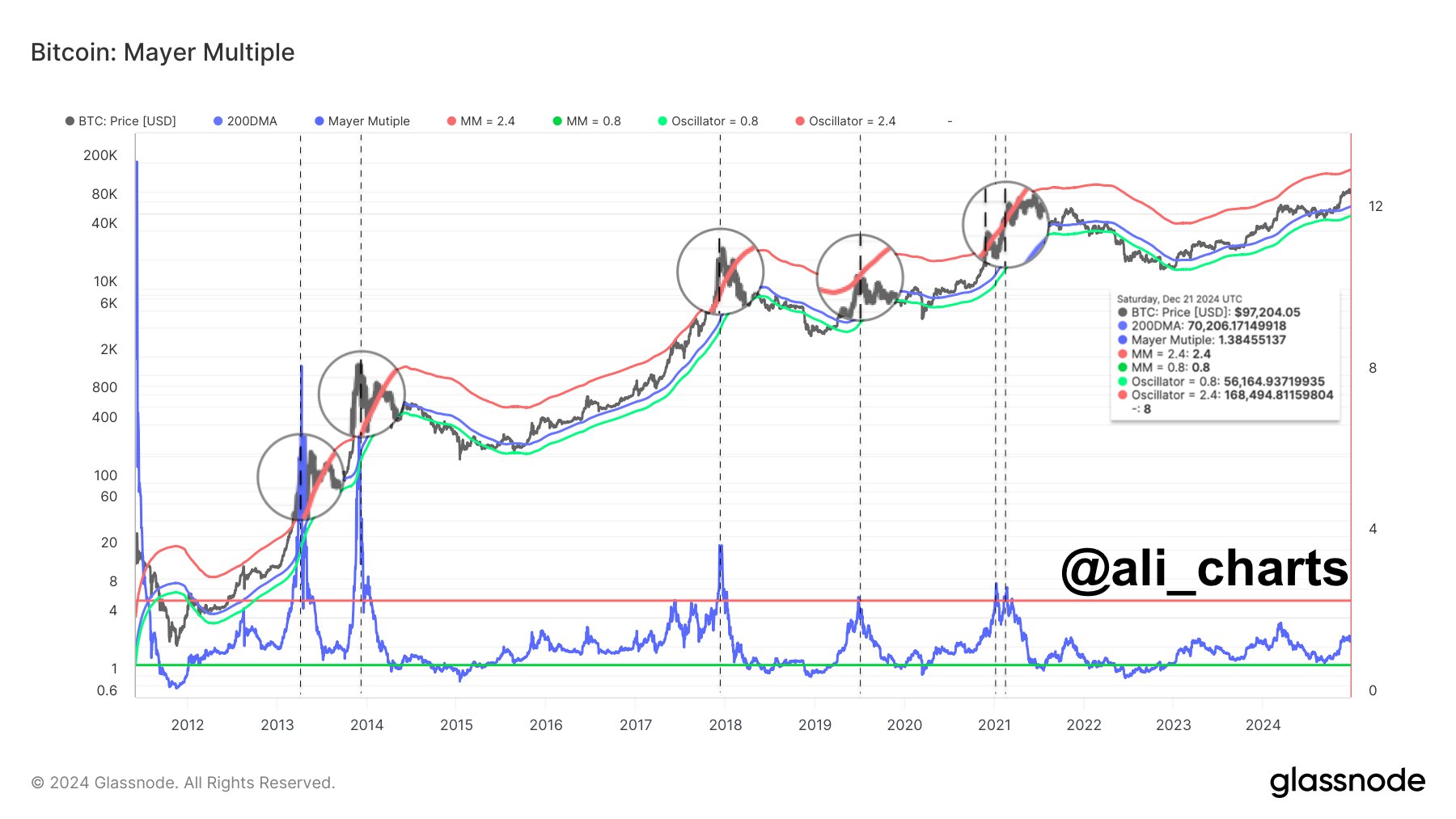

BTC Dip To $80K Imminent?

The latest BTC price chart showed that the crypto plunged about 3.5% to $95,175, with its trading volume falling 1.5% to $42.45 billion. Notably, the crypto has touched a 24-hour high of $99,884, while maintaining a monthly gain of 2%. Further, BTC Futures Open Interest also fell about 3.5%, CoinGlass showed, indicating a bearish momentum hovering in the market.

Notably, the market picture indicates that despite soaring institutional interest, the recent developments have weighed on the market sentiment. For context, MicroStrategy (MSTR) stock recorded volatility recently amid its BTC buying strategy, which has fueled market speculations. Besides, many firms like KULR have also shifted their focus towards BTC accumulation.

Meanwhile, in a recent analysis, popular market expert Justin Bennett said that BTC is likely to fall to the $81K-$85K range. This analysis of Bitcoin price has fueled market concerns, with many other experts echoing a similar sentiment.

For context, Ali Martinez noted as Bitcoin dipped below the $97,300 mark, it indicates a bearish momentum for the crypto. However, he noted if BTC rebounds to this crucial support and rally to $100K, it could rally to $168,500 ahead.

Simultaneously, Peter Brandt has also predicted a potential BTC dip to $80K ahead, citing technical trends. On the other hand, popular market expert Tone Vays also said that if BTC trades below the $95,000 mark, it increases the probability of a correction to $75K.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Analyst Predicts XRP Price To Reach $27, Here’s Why

Monkey Please!

Texas, Ohio, and Pennsylvania to create Bitcoin reserves

Why 2025 Will See the Comeback of the ICO

Can Donald Trump Truly Make US The Crypto Capital?

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Why Bitcoin Price Is Falling Today: Is $80K Next?

Here Are The Major Bitcoin Support Levels To Watch As Bulls Push For $100,000 Again

Flockerz presale enters final stage with 28 days remaining

What Happens to Ethereum Price If Bitcoin Crashes to $80,000?

XRP Has Most Bullish-Looking Chart in Entire Crypto Space, According to Analyst – Here’s Why

Coinbase CLO shares data on crypto hedge funds debanking, demands for answers

Here’s Why Dogecoin Price May Never Hit $50 or $100 Mark

Buying this token under $0.05 could be like buying Solana at $0.50

7 Massive Games From 2024 Worth Playing Over the Holiday Break

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: