PEPE

PEPE Bullish Trend Line Under Threat: $0.00000766 Level On Sight?

Published

5 months agoon

By

admin

PEPE, one of the top meme coins in the crypto space, is currently at a crucial point as it approaches its long-standing bullish trend line. As the price draws near the bullish trend line, a break below it could signal a major shift in market sentiment, triggering a price draw down to the $0.00000766 mark.

This article provides an in-depth analysis of the current price action, focusing on the bullish trend line. It examines whether a potential break below this line could drive the price to the critical support level at $0.00000766 or if a potential reversal is on the horizon.

As of the time of writing, PEPE’s price has dropped by 5.10%, trading at approximately $0.00001005 in the past 24 hours. PEPE boasts a market capitalization exceeding $4.2 billion and a trading volume surpassing $821 million. The asset’s market cap has decreased by 5.32%, while its trading volume has increased by 35.01% in the past 24 hours.

Technical Analysis: Current Market Sentiment For PEPE

On the 4-hour chart, PEPE has demonstrated significant bearish momentum, with the price dropping below the 100-day Simple Moving Average (SMA) and the $0.00001152 support mark, signaling a potential bearish move toward the bullish trend line. A successful breach below this trend line could signal the start of a bearish trend for the cryptocurrency, potentially driving the price down to the next key support level at $0.00000766.

Additionally, on the 4-hour chart, the Relative Strength Index (RSI) signal line has dropped below 50% and is approaching 30%, which is considered the oversold zone. This movement indicates increasing bearish momentum and suggests that selling pressure is intensifying.

Technical analysis on the 1-day chart reveals that, following the rejection at $0.00001313, PEPE has been on a bearish trajectory toward the bullish trend line, marked by the formation of multiple bearish candlesticks. Furthermore, the crypto asset’s price is trading below the 100-day SMA, suggesting a bearish market sentiment.

The signal line of the 1-day RSI indicator has recently dropped below 50% and is moving toward the oversold zone, suggesting that the digital asset may continue its bearish trajectory below the 100-day SMA toward the bullish trend line.

Navigating Potential Breakdowns And Bounces At The Trend Line

PEPE is currently on a bearish path while approaching its long-standing bullish trend line. A successful break below this trend line could indicate the beginning of a bearish trend, potentially driving the asset toward the $0.00000766 support level and beyond.

However, if PEPE bounces back at the bullish trend line, it could retrace towards its previous high of $0.00001152. Should the crypto asset break above this level, it could signal a further upward movement, possibly targeting the $0.00001313 resistance range and other higher levels.

Featured image from iStock, chart from Tradingview.com

Source link

You may like

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

Analyst

PEPE Price Hits $0.000027 ATH, On-Chain Data Says These Are The People Driving It

Published

2 weeks agoon

December 9, 2024By

admin

The PEPE price recently reached a new all-time high (ATH) of $0.00002716, becoming the first major meme cryptocurrency to do so in the ongoing bull cycle. This rally to a new PEPE all-time high was driven by increased whale activity and accumulation.

Whale Accumulation Fuels PEPE’s Bullish Momentum

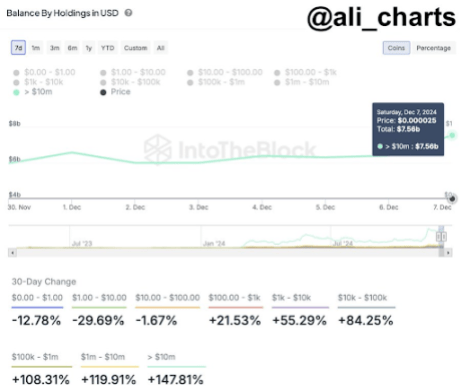

Data shared by crypto analyst Ali Martinez on social media platform X highlights that PEPE whales recently added $1.14 billion in PEPE to their holdings, pushing the total whale-controlled amount to $7.56 billion. This plays into a bullish run over the weekend, which saw PEPE’s market cap surpass $10 billion for the first time. At the time of writing, PEPE has a market cap of about $11.17 billion, meaning this holder cohort now controls about 67% of the total market cap.

Related Reading

Interestingly, on-chain data shows the surge in whale accumulation didn’t just start yesterday. IntoTheBlock’s Balance By Holdings In USD metric shows a 30-day increase of 147.81% in the holdings of addresses holding more than $10 million worth of PEPE tokens. These large holders have been on an accumulation trend, with a massive $1.14 billion purchase coming in on December 7 alone.

Other holder cohorts have also significantly expanded their positions over the past month. Addresses holding between $1 million and $10 million worth of PEPE recorded a 119% increase in their holdings during this period, while those holding between $100,000 and $1 million saw a 108% rise. Mid-tier investors with holdings between $10,000 and $100,000 registered an 84.25% growth in their balances, while even smaller holders with $1,000 to $10,000 worth of PEPE saw their holdings increase by 55.29%.

This increase in accumulation from all cohorts has increased the buying pressure on PEPE, which in turn has allowed the meme cryptocurrency to surge in value by 150% in the past 30 days.

Exchange Listings And Accessibility Boost PEPE’s Popularity

Another notable driver behind PEPE’s record-breaking performance is its growing accessibility after listing on major crypto exchanges. PEPE has been added to crypto exchanges like Coinbase, Robinhood, and Binance US in the past few days, which has significantly increased its exposure to retail and institutional investors in the US These listings have made it easier for a broader audience to trade and invest in the meme cryptocurrency.

Related Reading

The impact of these listings has been profound, especially as the industry is currently in a bull phase. At the time of writing, PEPE is trading at $0.00002616, representing a 3.5% increase in the past 24 hours. PEPE’s bullish trajectory appears set to extend further as whale and retail accumulation continues.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Markets

PEPE Flips UNI and LTC, Surges Past $11 Billion Market Cap to New Record

Published

2 weeks agoon

December 9, 2024By

admin

Meme coin Pepe (PEPE) has reached new heights, breaking past a market cap of $11.37 billion and overtaking Uniswap (UNI) and Litecoin (LTC).

The feat comes as Bitcoin (BTC) crossed the $100,000 threshold for the first time, marking a renewed wave of optimism across the crypto market.

PEPE has witnessed a 4.5% surge in the past 24 hours, achieving an all-time high price of $0.00002708, per CoinGecko data. The asset is now ranked 23rd overall by market cap.

Meme coins are thriving this year, especially since the launch of the controversial Solana-based meme coin launchpad Pump.fun which allows anyone to create a token for free.

This year’s rally has made PEPE one of the market’s most-watched tokens, with a 150% increase over the last 30 days and a 1,900% year-to-date gain.

Analysts credit a combination of whale activity and increased accessibility through platforms like MoonPay for the meme coin’s continued success.

Crypto analyst Ali Martinez reported whales increased their PEPE holdings by $1.14 billion over the weekend, nodding to strong institutional interest. Historically, such accumulation has preceded price rallies, as whales lay the foundation for bullish momentum.

The whale activity surge comes alongside PEPE integration into MoonPay, as the crypto payment service now allows over 20 million users across 180 countries to purchase the token via platforms like Apple Pay and Venmo.

As Bitcoin leads the charge and meme coins ride the wave of investor enthusiasm, the market is seeing a reshuffling of top-ranking digital assets.

Launched in April 2023, PEPE is based on the iconic “Pepe the Frog” internet meme created by artist Matt Furie in 2005.

The token initially gained traction as a community-driven project, rallying supporters who embraced its lighthearted nod to internet culture.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Altcoins

Santa Rally Incoming? Top Crypto Trader Predicts Upside Bursts for Dogecoin, PEPE and One Solana-Based Altcoin

Published

3 weeks agoon

December 2, 2024By

admin

A crypto strategist known as a “Master Trader” on the digital asset exchange Bybit believes three altcoins are gearing up for more rallies.

Pseudonymous analyst Bluntz tells his 299,900 followers on the social media platform X that Dogecoin (DOGE) looks poised to witness fresh bursts to the upside after respecting support at around $0.36.

“You didn’t get bored of DOGE and leave to go chase the newest shiny thing did you?

Things are about to get fun again, in my opinion.”

At time of writing, DOGE is trading for $0.432, a 3.45% increase in the past 24 hours.

Turning to fellow memecoin Pepe (PEPE), Bluntz believes that the altcoin is back to bullish mode after breaching its diagonal resistance.

“PEPE downtrend memeline officially broken.”

At time of writing, PEPE is worth $0.0000209, a 2.7% surge in the past day.

As for the native asset of the Solana (SOL)-based decentralized exchange (DEX) aggregator Jupiter (JUP), the crypto strategist thinks the altcoin is primed to move higher after shattering a diagonal resistance.

“JUP breaking out, the Santa rally is gonna be lit this year.”

At time of writing, JUP is trading at $1.14, a marginal decrease in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential