24/7 Cryptocurrency News

Pi Coin Price Crashes 50%, What Shall Investors Do Next?

Published

2 months agoon

By

admin

All the excitement around the Pi mainnet launch has faded within 24 hours of launch as the Pi Coin sees strong selling pressure with its price crashing more than 50% from the peak of $2 yesterday. The selling pressure comes with huge trading activity as daily trading volumes surge to more than $1.2 billion.

Pi Coin Sees Major Pump and Dump

Pi Coin, the native cryptocurrency of the Pi Network faces a major pump-and-dump as it currently trades around $0.70 falling more than 65% from its peak of $2.0 Investors’ euphoria surrounding the mainnet launch seems to be waning fast.

Even as of the current price of $0.70, the Pi Network pegs a market cap of $4.45 billion. With more than 10 million users, the Pi Network has achieved significant market following. following the mainnet launch, a total of 1 billion from the total 9.7 billion PI tokens are available initially. The remaining tokens will be locked in user wallets and unlocked over a period of time.

Although some market analysts have turned bullish, investors should be careful while taking fresh bets and look for any potential signs of trend reversal.

Will Binance and Coinbase Listing lead to Trend Reversal?

Despite the current Pi Coin price fall, the optimism surrounding the recovery remains high. Some market analysts believe that this would not be the right time to sell at the bottom considering that the daily trading volumes have remained robust at more than $1.2 billion.

Some of the global crypto exchanges like OKX and CoinDCX have already extended support to Pi coin. Furthermore, the industry has been pushing to bring the Pi Network’s native crypto token to top exchanges like Binance and Coinbase.

Binance and Coinbase, being among the largest cryptocurrency exchanges globally, offer access to a vast user base and high trading volumes. This increased liquidity can make Pi Coin more attractive to traders and investors. Besides, it will further boost the credibility of the crypto asset among retail investors.

$PI network chart dosen’t look bad at all

are you selling the bottom?

Almost 1B volume in 8 hours, and pi is listed on only few CEX, when #Binance and other top CEX come real fun will start, buy the dip and hold #Picoin #PiNetwork #Crypto #Trump pic.twitter.com/i8rlk3k4ll

— GEM HUNTER

(@TrueGemHunter) February 20, 2025

Pi Community Shows Discontent

Following the massive pump and dump, there’s a major discontent among the Pi community. Notably, crypto commentator Wood LightYear expressed frustration over a specific narrative surrounding the Pi Network mainnet launch. In a statement shared on social media, LightYear said:

“The only narrative I really hated about yesterday’s listing of Pi was that of people having cheap access to accumulate what we paid for with our time, for many years.”

The sentiment highlights concerns among long-term supporters of the Pi Network, who believe the listing undermines the project’s core narrative of valuing time and attention

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

24/7 Cryptocurrency News

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

Published

7 hours agoon

April 13, 2025By

admin

MicroStrategy is lacing up for a potential Bitcoin purchase after Michael Saylor flashed the tell-tale buy signal. The incoming purchase will be the company’s first in Q2 after pausing Bitcoin purchases at the start of April in an eyebrow-raising move.

Michael Saylor Flashes Bitcoin Buy Signal

MicroStrategy CEO Michael Saylor has dropped clues that the software company will continue its Bitcoin accumulation spree. In an X post, Saylor shared MicroStrategy’s portfolio tracker revealing the company’s Bitcoin holdings and valuations.

Michael Saylor’s previous posts sharing Microstrategy’s portfolio tracker over the weekend have resulted in purchases at the start of the week. Investors are lapping up Saylor’s portfolio tracker post and the accompanying caption as cues for a BTC purchase on Monday.

“No tariffs on Orange Dots,” said Saylor, taking a jibe at brewing tariff wars between the US and China.

MicroStrategy had previously halted its Bitcoin purchase spree at the start of April leading to a slump in MSTR price. At the time, there was significant chatter that MicroStrategy may be forced to offload its Bitcoin holdings to cover obligations following a dip in prices.

Per the portfolio tracker, MicroStrategy holds 528,185 BTC on its balance sheet valued at $44.7 billion. Michael Saylor hinting at a potential Bitcoin purchase follows a small dip in prices with BTC holding the $83K mark.

Will Bitcoin Price Rally?

Saylor’s hint at buying Bitcoin has triggered a small bump in prices as the top cryptocurrency surpassed $83K. However, an actual purchase will trigger a significant price action for BTC in line with previous accumulations.

MicroStrategy’s last Bitcoin purchase of 22,048 BTC jolted the markets in line with investors’ expectations. However, there are fears that macroeconomic events like the US-China tariff war may affect a potential BTC rally following MicroStrategy’s incoming purchase.

Bitcoin price has rebounded after a previous bloodbath, sparking fresh optimism in the markets. Crypto Joao Wedson predicts that Bitcoin is not out of the woods yet and a grim drop to $65K is still a possibility for the top cryptocurrency.

“We’re not ruling out the possibility of the price dipping below $65K, as several metrics point to that region as strong support – such as the True Market Mean Price and Alpha Price, both sitting exactly around $64,700,” said Wedson.

Crypto analyst Doctor Profit warns that a BTC price drop to these levels may force MicroStrategy to sell MSTR to avoid liquidation.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Shiba Inu Price on The Verge of Breaking $0.00002

Published

23 hours agoon

April 13, 2025By

admin

The memecoin ecosystem has joined the latest revival in the broader market, with the Shiba Inu price now in the spotlight. The memecoin has reset its bearish outlook and will break crucial price milestones in the coming days.

For Shiba Inu, the death cross formation was confirmed on April 6 when the price dropped from $0.00001232 to a low of $0.00001030.

Shiba Inu Price Golden Cross Confirmed

Market data shows that the SHIB price is gradually disappearing from its earlier consolidation trend. At the time of writing, the coin’s price was changing hands for $0.00001249, up by 2.14% in 24 hours.

SHIB recovered after trading at a low price of $0.00001205 to a daily high of $0.00001265 before settling at the current level. This price boost comes as the SHIB burn rate jumped 1000% in early trading, setting the memecoin on a possible revival path.

The SHIB/USDT 4h chart confirms a golden cross pattern for the memecoin. This pattern is formed when the short-term Moving Average switches above the longer-term moving average.

Although this pattern is fully formed on the 4-hour chart, it is yet to form on the daily chart. However, with the current momentum, a confirmed breakout is possible. Already, the token has displaced Hedera and now ranks as the 17th largest cryptocurrency.

Shibarium Catalyst for Price Rebound

Different ecosystem factors can boost the price of Shiba Inu in the long term. One of these factors is closely tied to the outlook of Shibarium and its associated Layer-2 scaling solution.

As reported earlier by CoinGape, the Shibarium 200 million addresses milestone is near. If the network attains this landmark, it will show a clear sign of growing adoption, a move that might boost its token valuation.

Already, Shibarium has broken the 1 billion total transaction milestone. Should the Shiba Inu network continue to record organic growth, its chances of outranking Dogecoin is higher.

Amid the ongoing boost, the question remains how high the memecoin could soar. Drawing on this, a potential SHIB retest of its ATH of $0.00008844 is possible moving forward. While it will require as much as a 710% growth from current levels, SHIB can print this uptick, drawing on its historical trend.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Crypto Market Rebounds As Donald Trump Exempts Tech From Tariffs On China

Published

1 day agoon

April 12, 2025By

admin

The crypto market, led by Bitcoin, has rebounded following Donald Trump’s decision to exempt tech products from tariffs he has imposed on China and other countries. Market participants see this as a positive amid the ongoing trade war between the US and China.

Crypto Market Rebounds As Donald Trump Exempts Tech Products From Tariffs

The crypto market has surged following Donald Trump’s move to exempt tech products from reciprocal tariffs imposed on China and other countries. According to a CNBC report, the US president has exempted phones, computers, and chips from the new tariffs.

The Bitcoin price surged past the $85,000 market following this report, with other altcoins also recording significant gains. This development is undoubtedly bullish for the market as it reduces the severity of the tariffs that Trump imposed on almost all countries earlier this month.

Moreover, this represents a big win for the stock market, with companies like Apple the biggest beneficiaries of this exemption. As such, it is normal for the crypto market to rebound alongside, given Bitcoin’s correlation with stocks.

Meanwhile, this move could also mark the beginning of the end of the ongoing trade war between the US and China. As CoinGape reported, China yesterday announced a 125% tariff on US imports following the latter’s decision to impose 145% tariffs on Chinese goods.

Trump already mentioned that he is looking forward to making a deal with China, which is also positive for the market. Bitcoin and altcoins could witness another massive rally once that happens.

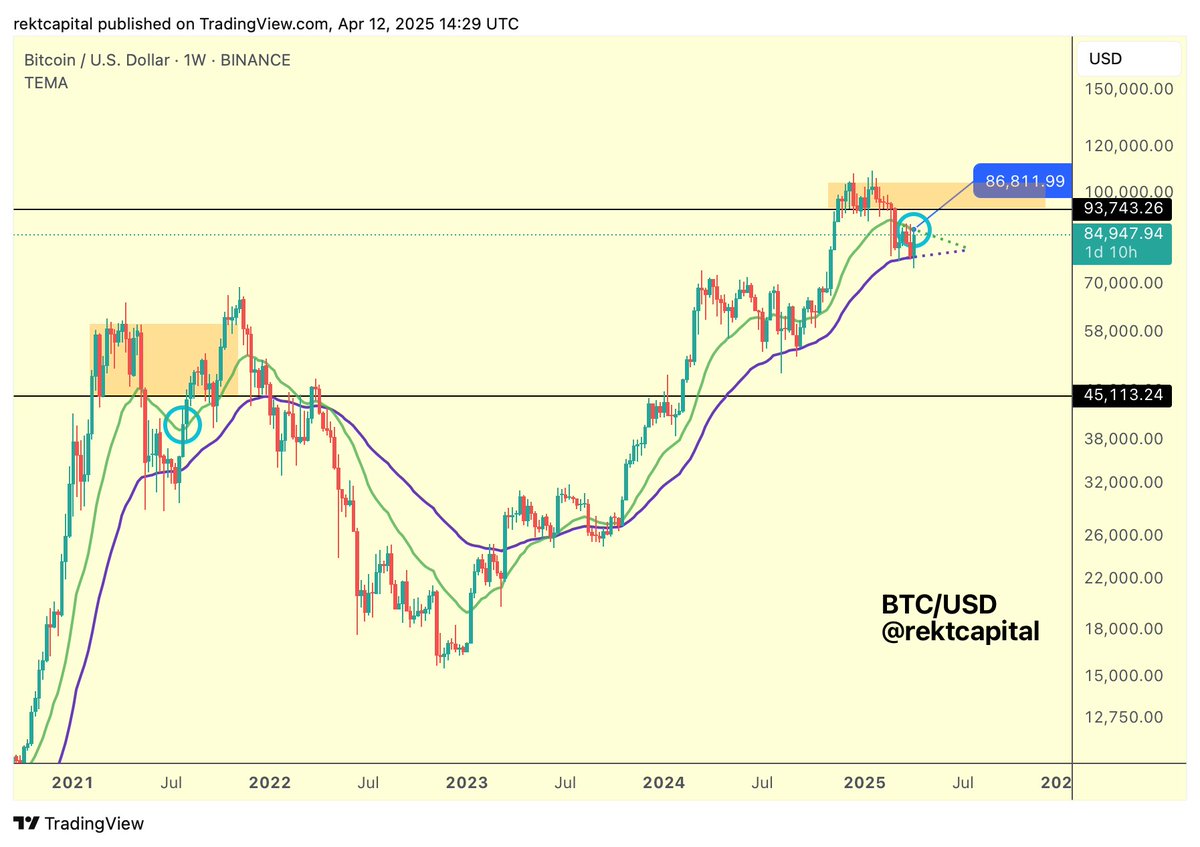

Correctional Phase Could Soon Be Over

In a recent X post, crypto analyst Kevin Capital suggested that the correctional phase could soon be over for the crypto market. He noted that this phase has so far gone according to plan. However, he warned that there is still a lot of work to be done.

The analyst believes it is important for the Bitcoin price to clear the $89,000 level before market participants start feeling good. He added that the macro side also needs to line up for things to start looking really good for the market.

The macro side looks to be progressing well as the Federal Reserve recently revealed plans to provide liquidity if necessary. Meanwhile, the latest CPI and PPI inflation data came in lower than expectations, which could also motivate the Fed to start easing monetary policies.

Crypto analyst Rekt Capital warned that Bitcoin isn’t there yet. He stated that it would be momentous to weekly close above $86,000, as this would potentially set BTC up for a repeat of a mid-2021 breakout. However, the flagship crypto is still away from the bullish weekly close of $86,811.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several topics and niches. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover, a traveler and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Bitcoin price tags $86K as Trump tariff relief boosts breakout odds

Where Top VCs Think Crypto x AI Is Headed Next

India’s Leading Bitcoin And Crypto Exchange Unocoin Integrates Lightning

Solana Triggers Long Thesis After Pushing Above $125 – Start Of A Bigger Rally?

Popcat price surges as exchange reserves fall, profit leaders hold

Crypto Analyst Says Bitcoin Back in Business, Calls for BTC Uptrend if One Support Level Holds

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: