Pi Network

Pi Network Coin Price Surges As Key Deadline Nears

Published

1 month agoon

By

admin

Pi Network price rose for six consecutive days ahead of a key deadline scheduled for later this month. Can the Pi Coin sustain its momentum and retest its October high of $100?

Pi Network KYC Grace Period Is Ending

The Pi Coin IoU token has staged a strong recovery, rising to $80, which was 175% above its lowest level in September. This rally happened as the soaring cryptocurrency prices raised the expectation that its mainnet launch would happen in December.

Pi Network also surged ahead of the November 30th deadline of ending the grace period of the Know Your Customer (KYC) verification process. The KYC process hopes to verify millions of pioneers who have been mining the coin in the last six years and removing bots.

This verification is an important stage towards the mainnet launch, which is anticipated to take place in December. When it happens, all pioneers will finally be able to swap their tokens for fiat currencies and stablecoins. Pioneers who don’t complete their verification will lose all their mined coins.

The KYC is part of three things that need to happen before the Pi Network mainnet launch happens. The other one is the existence of a vibrant ecosystem, which is expected to give the Pi coin utility.

Additionally, the developers hinted that the mainnet launch or the move to the open network would happen when market conditions are conducive. This criterion has been met because most cryptocurrencies are in a strong rally and regulations are expected to be friendly under the Trump administration.

Pi Coin Price Rally Could Continue

Pi Coin is an IoU that is not affiliated with the real project and is only listed in HTX. It is often seen as a proxy for the coin, which explains why its price has jumped in the past few weeks.

On the daily chart, the Pi price jumped to $100 earlier this month after the developers confirmed that the mainnet launch was on the way. It then suffered a harsh reversal and dropped to $45 on November 12.

The coin has now bounced back and remains above the 50-day and 200-day Exponential Moving Averages. It has also rallied above the ultimate resistance of the Murrey Math Lines.

The Average Directional Index (ADX), a popular measure of a trend strength, has moved to above 60. Also, the Relative Strength shows that it has momentum. Therefore, the coin may soon jump to $100, which is about 25% above the current level. A move above that level will raise the probability of it rising to the year-to-date high of $121, 53% above the current level.

On the flip side, a drop below the strong pivot reverse point at $62.5 will invalidate the bull run and raise the odds of it falling to $45.

Frequently Asked Questions (FAQs)

The Pi Network token has rallied as the end of the six-month grace period for pioneers to KYC themselves near. It has also surged because of the ongoing crypto bull run.

The developers have committed to completing the mainnet launch this year. As such, with just a month to go, odds are that it will happen in December.

The Pi Coin IoU is a cryptocurrency traded just in HTX that acts as a proxy for the main Pi network. It is not affiliated with the real project.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Elon Musk xAI Secures $6B To Boost Generative AI Expansion: Details

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Pi Network

Red Alert For Pi Network Price As A Risky Pattern Forms

Published

3 weeks agoon

December 4, 2024By

admin

Pi Network price has been in a downward trend in the past week as hopes of the mainnet launch happening this year faded. The Pi coin has now formed a high-risk chart pattern that could lead to more downside.

Pi Network Price Analysis: Bearish Pennant Forms

The Pi Coin IoU price could be on the cusp of a strong bearish breakdown after forming two risky chart patterns. It formed a near double-top pattern around the resistance level at $92. This pattern is made up of twin peaks and is often a popular sign of more downside.

Pi Network has now formed a bearish pennant pattern, which is characterized by a long vertical line and a triangle-like pattern. This symmetrical triangle has formed well and is slowly bearing its confluence level. A bearish breakout typically happens when the two lines of the triangle are about to converge.

Worse, Pi Network has also moved slightly below the 50-day Exponential Moving Average, while the MACD indicator has dropped below the zero line.

Therefore, a drop below the ascending trendline that connects the key down-swings since September, will point to more downside. If this happens, Pi Network price will drop to $37, its lowest level on October 15, and 30% below the current level.

Conversely, a move above the important resistance level at $57.5 will invalidate the bearish view. This is the upper side of the pennant’s triangle. A bullish case would be supported by the fact that Pi coin price remains above the ascending trendline.

Also, the last strong uptick in November happened after it spent a few weeks in a consolidation. Therefore, if this breakout happens, the coin could jump to about $73, the 61.8% retracement level.

Pi Coin Mainnet Launch

A likely reason why the Pi Network price may have a bearish breakout is that the mainnet launch may not happen this month as expected.

In a statement during the weekend, the developers postponed the grace period for the KYC verification from November 30 to December 31. With this postponement, it means that the transit from the enclosed mainnet to a full mainnet.

The mainnet launch is important because it will let pioneers convert their Pi coins them into fiat currencies. It is impossible to convert these coins into cash during the enclosed mainnet period. The general view is that the Pi Network IoU will rise ahead of the mainnet launch.

To be clear: this IoU is not affiliated with the main Pi Network team and is only listed in HTX. It is, nonetheless, used as a proxy for the Pi Network token.

Frequently Asked Questions (FAQs)

It has formed a small wedge and a bearish pennant, pointing to a potential bearish breakdown.

The Pi Network mainnet launch will happen possibly in the first quarter of next year. Previously, the developers wanted to list it in December.

Yes, the coin still remains above the ascending trendline since September, pointing to a potential rebound.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Pi Network

Will Pi Network Price Reach $100 in This Bull Market?

Published

4 weeks agoon

November 25, 2024By

admin

Pi Network has erased some of the gains made last week as the recent rally in the crypto industry took a breather. Still, there are chances that the Pi coin will resume its rebound, and potentially hit $100 ahead of the mainnet launch.

Pi Network Price Prepares For the Mainnet Launch

The Pi Network IoU price will be on the spotlight after the recent successful PiFest event and the upcoming ending of the KYC verification of pioneers.

In a recent statement, Pi’s developers said that over 27,000 sellers registered in the Map of Pi during the recent PiFest event. Map of Pi is a dApp in its ecosystem that enables sellers accepting the Pi coin to register themselves.

These numbers mean that the coin is getting popular among sellers, a move that could make it a better cryptocurrency compared to Bitcoin in terms of shopping. It also means that the developers have achieved one of the three conditions that needs to happen ahead of the mainnet launch. This condition calls for the network to have an ecosystem that will give the Pi coin utility.

The other condition is that the developer needs to complete the KYC verification of all miners, a process that has accelerated in the past few months. The grace period of this process will complete on November 30.

Additionally, with cryptocurrencies being in a strong bull run, the third condition of a friendly environment has been met. Therefore, there is a likelihood that the Pi mainnet launch will happen as soon as in December.

Pi Coin Analysis: Will It Hit $100?

The Pi Coin IoU, which is not associated with the Pi project, jumped to $100 in October as anticipation of the mainnet launch. It then suffered a harsh reversal and bottomed at $44.95 on November 12. This decline was notable because its lower side was slightly above the 100-day moving average, which explains why the coin has bounced back.

Pi Network’s rebound also happened a few weeks after it formed a golden cross as the 200-day and 50-day moving averages crossed each other.

The current retreat happened after the coin rose to the extreme overshoot of the Murrey Math Lines. Therefore, with the rising expectation of an upcoming mainnet launch, there are chances that the Pi coin price will bounce back, and potentially retest the important resistance at $100. A break above that level will raise the odds of the coin rising to the year-to-date high of $122.05.

On the flip side, a drop below the top of the trading range at $56.25 will invalidate the bullish view, and raise the odds of it falling to $45, its lowest level this month.

Frequently Asked Questions (FAQs)

There are chances that the coin will bounce back ahead of the mainnet launch, which is expected to happen in December this year. If this happens, the coin may retest the key resistance at $100, its highest point last month.

No. Pi coin is not associated with the real project and is not an indicator of what will happen when the mainnet launch happens.

It is unlikely that the Pi Coin will do well after the mainnet launch as evidenced by the recent crashes of Hamster Kombat and Notcoin.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Markets

Pi Network mainnet launch progresses, yet risks persist

Published

4 months agoon

August 13, 2024By

admin

The much-awaited Pi Network mainnet launch progresses while Bitcoin forms a rare death cross pattern.

Pi Network developers have been working diligently this year to ensure the blockchain moves from the enclosed mainnet to the public mainnet phase. In a recent post, they noted that they were progressing well with the Know Your Customer verification for customers. Over 13 million pioneers have passed the KYC process and 6 million have already migrated to the mainnet.

The network has reached over 13 million Pioneers who have passed KYC and over 6 million Pioneers who have migrated to Mainnet! Through our collective efforts, we’re progressing towards the Open Network goals. Keep in mind that the progress is not linear and has been accelerating… pic.twitter.com/fXad6mpe59

— Pi Network (@PiCoreTeam) August 8, 2024

Additionally, the developers have initiated a six-month grace period for pioneers to complete the verification process. KYC is a crucial step in Pi Network’s journey to mainnet as it aims to eliminate potential bots.

It is also one of the three key milestones that must be achieved before the Pi Network’s mainnet launch, which will enable users to sell their Pi coins.

The other two milestones are the development of its ecosystem and a conducive market environment. Regarding the ecosystem, Pi Network creators aim to have at least 100 decentralized applications (dApps) to create utility for the token.

It is unclear the number of Pi Network dApps available so far. A repository shows that there are about 27 dApps in areas like commerce, games, NFTs, and utilities in the ecosystem, meaning that it has a long way to go to hit 100.

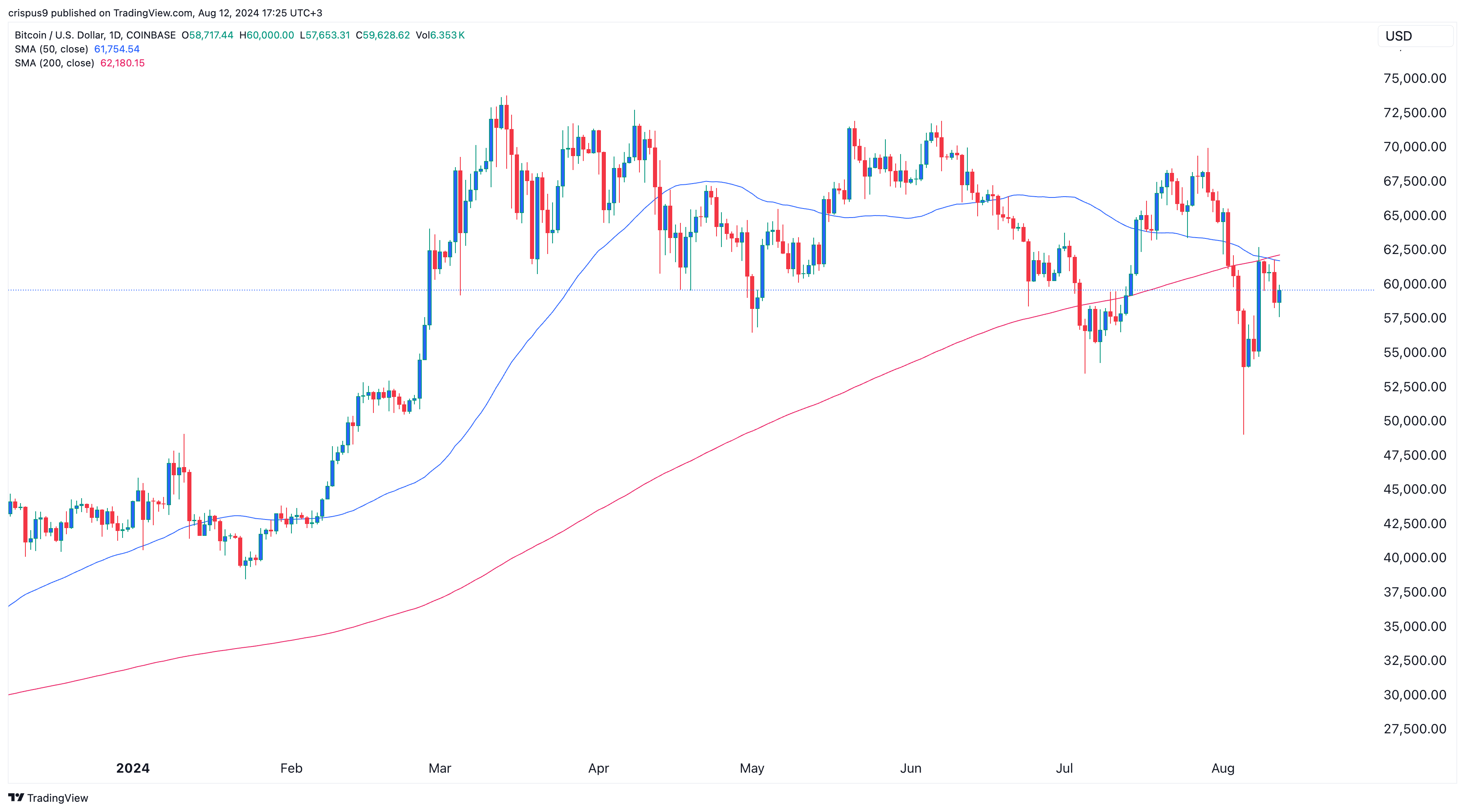

Bitcoin has formed a death cross

The developers also hope that the token listing will occur in a favorable market environment. While Bitcoin (BTC) and most cryptocurrencies reached record highs earlier this year, many have since reversed.

Bitcoin has recently formed a death cross pattern as the 50-day and 200-day Simple Moving Averages made a bearish crossover. Historically, this pattern is often followed by a significant decline. In 2022, Bitcoin dropped by over 60% after the pattern formed.

Listing a cryptocurrency in a bear market is often risky. For example, most newly launched tokens like Notcoin (NOT), Pixelverse (PIXFI), Wormhole (W), and zkSync have retreated by double-digits from their all-time highs.

As we have written before, Pi coin’s price action could also mirror that of other tap-to-earn coins since they have a similar business model.

Publicly traded tap-to-earn tokens like Notcoin and PIXFI have already retreated, while Hamster Kombat’s futures have hit record lows. Therefore, there is a possibility that Pi coin will slump after its listing as pioneers liquidate their tokens, especially since many have held onto them for years.

Source link

Elon Musk xAI Secures $6B To Boost Generative AI Expansion: Details

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: