Layer 2

Polygon Sets September Date for Migration to POL Token from MATIC

Published

5 months agoon

By

admin

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Source link

You may like

Is Bitcoin Self-Custody Under Threat in Europe?

SynFutures announces F token airdrop

Ripple Lawsuit Lead Attorney Joins US SEC As Chief Litigation Counsel

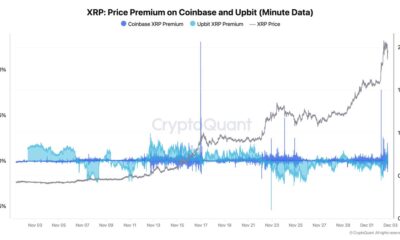

CryptoQuant CEO Warns Not To Short XRP Due To Insider Whales

The lack of soft forks is due to a lack of interest— not a lack of process

Now could be the best time to buy DOGE, XRP and new trending altcoin

layer 1

Bitcoin Bridged Trustlessly to L2; Ethereum’s Blob Mob

Published

6 days agoon

November 27, 2024By

adminWelcome to The Protocol, CoinDesk’s weekly wrap-up of the most important stories in cryptocurrency tech development. I’m Marc Hochstein, CoinDesk’s deputy editor-in-chief for features, opinion and standards.

IN THIS ISSUE:

- Ethereum’s blob mob

- Staking on Starknet

- Avalanche’s big upgrade

- L2 teams beam over Beam Chain

- Sui suffers a brief outage

- Bitcoin bridged, trustlessly

This article is featured in the latest issue of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Also please check out our weekly The Protocol podcast.

Network news

BEAMING OVER THE BEAM CHAIN: What’s good for the L1 is good for the L2s. That’s the assessment the teams behind zkSync and Polygon, two of the leading layer-2 networks running on top of Ethereum, gave of Justin Drake’s proposal to overhaul the $400 billion blockchain, dismissing suggestions it would make their auxiliary networks redundant. “That’s really a misconception,” said Alex Gluchowski, the CEO of Matter Labs, the developer firm behind zkSync. “The changes that Justin announced are focused on the consensus layer, not on the execution layer. It’s not going to affect the execution layer.” In addition to incorporating ZK, Drake’s proposal seeks to shorten block times, which could cut transaction costs for L2s settling on Ethereum. Drake also said he wants to introduce single-slot finality, meaning blocks with transaction data could be finalized immediately, and that information would become permanent right away. “All of those things are great because we depend on Ethereum as the global settlement layer,” Gluchowski said. Brendan Farmer, a co-founder at Polygon, also told CoinDesk he doesn’t think the Beam Chain would obsolesce layer-2s. Instead, he said, the upgrade would “make rollups work better.” However, others in the crypto community were underwhelmed by the whole plan, lamenting in particular that Drake’s five-year timeline wasn’t ambitious enough, leaving ample room for centrally-developed chains like Solana to eat Ethereum’s lunch.” Read more

SUI OUTAGE: Sui Network (SUI), a relatively new blockchain, experienced an unexpected two-hour outage on Thursday. The downtime was caused by a bug in its transaction scheduling logic, which led to its validator network crashing. The issue was resolved, the network said. Blockchain outages can take place for a plethora of reasons, ranging from a 51% attack to technical errors. A common error is that of nodes – or individual entities that process transactions – being unable to sync with each other, causing the blockchain to go offline. Software bugs may be another error vector, where outdated code can render the network’s processes inoperable. Read more

STAKING ON STARKNET: Starknet has become the first major rollup blockchain running on top of Ethereum to let users earn money by staking their tokens and validating transactions. (Metis was the first layer-2 to do so but is far smaller and is an “optimium,” a different kind of L2.) Now, anyone who has at least 20,000 STRK tokens (roughly $12,000 at recent prices) can pledge the asset as collateral and earn rewards for validating transactions. Users with less than 20,000 STRK can delegate their tokens to validators to stake on their behalf. (Validators that behave maliciously or neglect their duties stand to forfeit staked tokens.) Validators and delegators that want to withdraw staked tokens must wait 21 days to receive them as well as any rewards earned from staking. Implementing staking on Starknet is part of a multiphase plan. During this first phase, StarkWare, the company developing Starknet will study staking habits on the network, and from there will assess whether and how its validators can be given the additional responsibilities of creating and “attesting,” or confirming, blocks in the protocol. Read more

AVALANCHE’S BIG UPGRADE: Avalanche, the eighth-largest blockchain by total value locked (TVL), is moving ahead with a major technical makeover. The Avalanche9000 upgrade went live in a test network environment Monday, bringing the changes one step closer to the main network. Avalanche9000 will be the largest upgrade that Avalanche has seen. It is designed to cut the costs of sending transactions, operating validators and building apps on the network, whose native token (AVAX) is the 11th-largest cryptocurrency, with a $16 billion market cap. The foundation is trying to attract developers to Avalanche and encourage users to create customized blockchains using its technology, known as subnets. Somewhat confusingly, subnets are now officially referred to in the Avalanche community as “L1s,” even though they are roughly analogous to the layer-2, or L2, networks that augment Ethereum and other blockchains. (Avalanche’s “primary network,” the equivalent of a layer-1 in other ecosystems, is considered a subnet.) The team is hoping to bring Avalanche9000 to mainnet by yearend. Among other changes, 9000 would allow for a new type of validator with which anyone can launch their own subnets. Read more

ONE-WAY TICKET: BitcoinOS, a smart contract project led by crypto O.G. Edan Yago, has executed what it bills as the first trustless bridge transaction for any blockchain. Using zero-knowledge cryptography, a nominal amount of bitcoin (0.0002 BTC, about $19 and change) was locked up on the main blockchain’s testnet, and a proof was generated minting tokens on the testnet for Merlin Chain, a layer-2 network. No oracle or custodian was involved, according to BitcoinOS. For now, however, Merlin Chain is like the Hotel California or a roach motel for the bridged BTC. “This is one half of the bridge showing the ability to bridge assets from Bitcoin to an EVM,” BitcoinOS said in a press release. “Once the other half of the bridge is completed, Merlin Chain users can settle their Bitcoin-pegged assets back to the mainchain by proving that the tokens were burned.”

Ethereum’s Blob Mob

Usage of binary large objects, or blobs, has surged on the Ethereum network, signaling that more users are embracing layer-2 scaling tech for faster and more affordable transactions.

This year, Ethereum’s Dencun upgrade introduced blobs, which allow large chunks of data to be temporarily attached to transactions, and later deleted after the data is verified. (You can think of a blob as a sidecar that rides along with a motorcycle for a time but eventually gets detached and discarded.) Layer-2 protocols such as BASE, Arbitrum, and Optimism use blobs to bundle transactions together, process them off-chain and then post them to the Ethereum main chain for verification without permanently gumming up the works.

The number of blobs posted to the network consistently averaged more than 21,000 this month, matching the record activity seen in March, according to pseudonymous data analyst Hildobby’s Dune Analytics dashboard.

Posting blobs costs a fee, which fluctuates depending on network conditions. The fees are paid in Ethereum’s native token ether, and are burned just like regular transaction fees, taking supply of ETH off the market, a positive for the coin’s price.

In this way, blobs mitigate the much-discussed cannibalization of the main chain by L2.

The blob base submission fee spiked as high as $80 on Monday, the highest since March, and the average number of blobs posted in each Ethereum block rose to 4.3. More importantly, blob fees have burned over 214 ETH worth $723,000 over the last seven days, the sixth largest source of fee burns on the network over that period, according to data from ultrasound.money.

CLICK HERE FOR THE FULL ANALYSIS BY COINDESK’S OMKAR GODBOLE

Money Center

Vibe shift

Not just fun and games?

Bringing in the big Sun

“Reports are greatly exaggerated”

Calendar

- Dec. 4-5: India Blockchain Week, Bangalore

- Dec. 5-6: Emergence, Prague

- Dec. 9-12: Abu Dhabi Finance Week

- Dec. 11-12: AI Summit NYC

- Dec. 11-14: Taipei Blockchain Week

- Jan 9-12, 2025: CES, Las Vegas

- Jan. 15-19: World Economic Forum, Davos, Switzerland

- January 21-25: WAGMI conference, Miami.

- Jan. 24-25: Adopting Bitcoin, Cape Town, South Africa.

- Jan. 30-31: PLAN B Forum, San Salvador, El Salvador.

- Feb. 1-6: Satoshi Roundtable, Dubai

- Feb. 19-20, 2025: ConsensusHK, Hong Kong.

- Feb. 23-24: NFT Paris

- Feb 23-March 2: ETHDenver

- May 14-16: Consensus, Toronto.

- May 27-29: Bitcoin 2025, Las Vegas.

Source link

Company Name: Ark Labs

Founders: Marco Argentieri and Simone Giacomelli

Date Founded: June 2024

Location of Headquarters: Europe

Number of Employees: Six full time

Website: https://arklabs.to/

Public or Private? Private

Ten years ago, just after graduating from high school, Marco Argentieri began his career in Bitcoin.

Some of his earliest work in the industry included helping people make remittance payments using bitcoin. From those early days, Argentieri looked at bitcoin more like a currency and less like an investment, and he helped to make it easier for others to use.

“I had many people that were using Bitcoin because it was like a Western Union without the KYC hurdles, and it was much cheaper back then,” Argentieri told Bitcoin Magazine.

“They were not even interested in bitcoin price or volatility. They were just using it to send money overseas,” he added.

Fast forward to 2024, and Argentieri is still focused on the same mission: helping people to use bitcoin cheaply, easily and privately. Though these days he does this in a more sophisticated way via his company Ark Labs, through which Argentieri and his team develop the Bitcoin layer 2 Ark.

What is Ark?

Ark is an open-source protocol created to help scale Bitcoin. The protocol enables users to amortize the cost of a single on-chain transaction across many off-chain swaps. These swaps occur on Ark’s servers, and they’re most well-suited for Bitcoin users who already operate Lightning nodes.

Ark servers were created to remedy the liquidity constraints of Lightning by allowing users to receive funds off-chain in what are called vTXOs (Virtual Transaction Outputs), which alleviates the need to open a channel and/or receive inbound liquidity. The off-chain system runs on Ark servers, which also enable unilateral withdrawals on-chain.

Ark provides and sources the liquidity for the transactions it facilitates via its servers (instead of relying on peers for liquidity the way that Lightning does). Argentieri embraced Ark as a solution after acknowledging Lightning’s shortcomings.

“Looking at a current scaling solution like Lightning, the developers were idealistic in the sense that they were saying ‘Okay, people should hold the keys, which is a big, big, big step. And plus they also run server and plus they also became very expert in liquidity management and whatnot,” explained Argentieri. “I think that hasn’t been a very realistic assumption for how people operate.”

Argentieri founded Ark Labs under the pretext that just as most people didn’t want to deal with using bitcoin on their own for remittance payments 10 years ago, they don’t want to become experts in running Lightning nodes to make payment these days.

“Ark tries to build on top of this assumption that there will be specialized people or specialized enterprises that know how to handle liquidity, and that’s what we call Ark servers,” he explained.

“Then you have like the clients — people that only want to send or receive a payment and use bitcoin. They don’t really want to get into all the complexity,” he added.

“Ark starts by assuming that not everyone is a peer, so there will be a liquidity provider on one side and a user on the other side. We acknowledge that this is the natural course of things — even though we may not like it.”

Argentieri, a pragmatist, acknowledges that while the centralized design of Ark might not be philosophically flawless, it is effective.

“The goal again was to have a protocol that starts working backwards from the user perspective and not from an ideal scenario,” explained Argentieri.

“If you think from the user perspective, they really just want to have a user experience that looks like Bitcoin on-chain. With Bitcoin on-chain, you just have a key pair. You just create a simple key and, boom, you can receive,” he added, detailing how Ark works.

A Bitcoin Interest Rate

UTXO owners can serve as liquidity providers for Ark, which Argentieri sees as an opportunity, especially for those in the West.

“In the Western world, we know people really are attached to this concept of yield,” said Argentieri.

“Westerners cannot just hold sats in cold storage and be good with it. They really feel that they’re missing something,” he added with a laugh.

To both obtain liquidity for Ark servers as well as to quench Westerners’ thirst for yield, those willing can become liquidity providers to Ark in exchange for a small fee.

“Ark is really like a way to introduce a bitcoin interest rate,” posited Argentieri. “Ark can be a discovery mechanism for a real true native interest rate for Bitcoin.”

Argentieri described how liquidity providers can share a small percentage of their bitcoin holdings via what he terms a “warm wallet,” a wallet that enables users to hold the keys but that Ark still has access to.

The yield would come in the form of transaction fees via the VTXO model. While Argentieri said that some may look at this as “financializing bitcoin,” he simply sees it as a win-win, a way to help scale while providing a small reward to those who provide the liquidity to help do so.

Scaling Horizontally

While a layer 2 solution like Lightning helps Bitcoin scale vertically, Ark helps Bitcoin scale horizontally, according to Argentieri.

“With Lightning, we set up one address and then two people can do an infinite amount of transactions between each other — but that doesn’t scale,” he said.

With Ark, a UTXO can provide liquidity for an exponential number of transactions compared to the amount of funds in the UTXO. Argentieri gave the example that 100 BTC can provide liquidity for tens of thousands of virtual transactions.

Not only does Ark enable more transactions, but it’s also usable in many of the ways that Bitcoin itself is usable.

“People are very focused on Ark for payments, but the beauty of Ark is that you retain most of the UTXO capability, which means that you can do 95% of things you can do in Bitcoin right now on ARK,” said Argentieri. “You can do multisig and you can open multiple channels with a single address.”

Argentieri also shared that using Ark is nearly as trustless as using Bitcoin, because even if Ark shuts its servers down, you can still get your sats back on-chain.

“If for any reason the server goes away, censors me or goes offline, the whole virtual transactions tree goes on-chain,” explained Argentieri. “This is what we call unilateral exit.”

The Future of Ark

Argentieri said that Ark is hard at work in preparing to bring Ark Node to market, a B2B enterprise-grade offering that Argentieri described as a “plugin for your LND node” that will help businesses with rebalancing liquidity.

At Bitcoin Amsterdam last month, Ark Labs announced a partnership with Boltz to enable off-chain Lightning liquidity management, with the intention of making swaps faster, cheaper and easier via the Ark Node.

Other than that, it seems Argentieri and the team at Ark Labs have a seemingly countless number of new advancements in the works, though, it will take the company some time to roll these out.

“I’m living inside the action, so I wish to release things every week, but engineering takes time, especially when you are the first one doing these things,” he said.

The plan for now is to remain on mission — the latest state of the mission he embarked on ten years ago.

“We can really have a tangible result within the Bitcoin ecosystem,” concluded Argentieri. “People will see Bitcoin payments get better, and we hope to be part of the reason why that will happen.”

Source link

Layer 2

Solana price is falling, but shorting it is risky, crypto analyst says

Published

3 weeks agoon

November 13, 2024By

admin

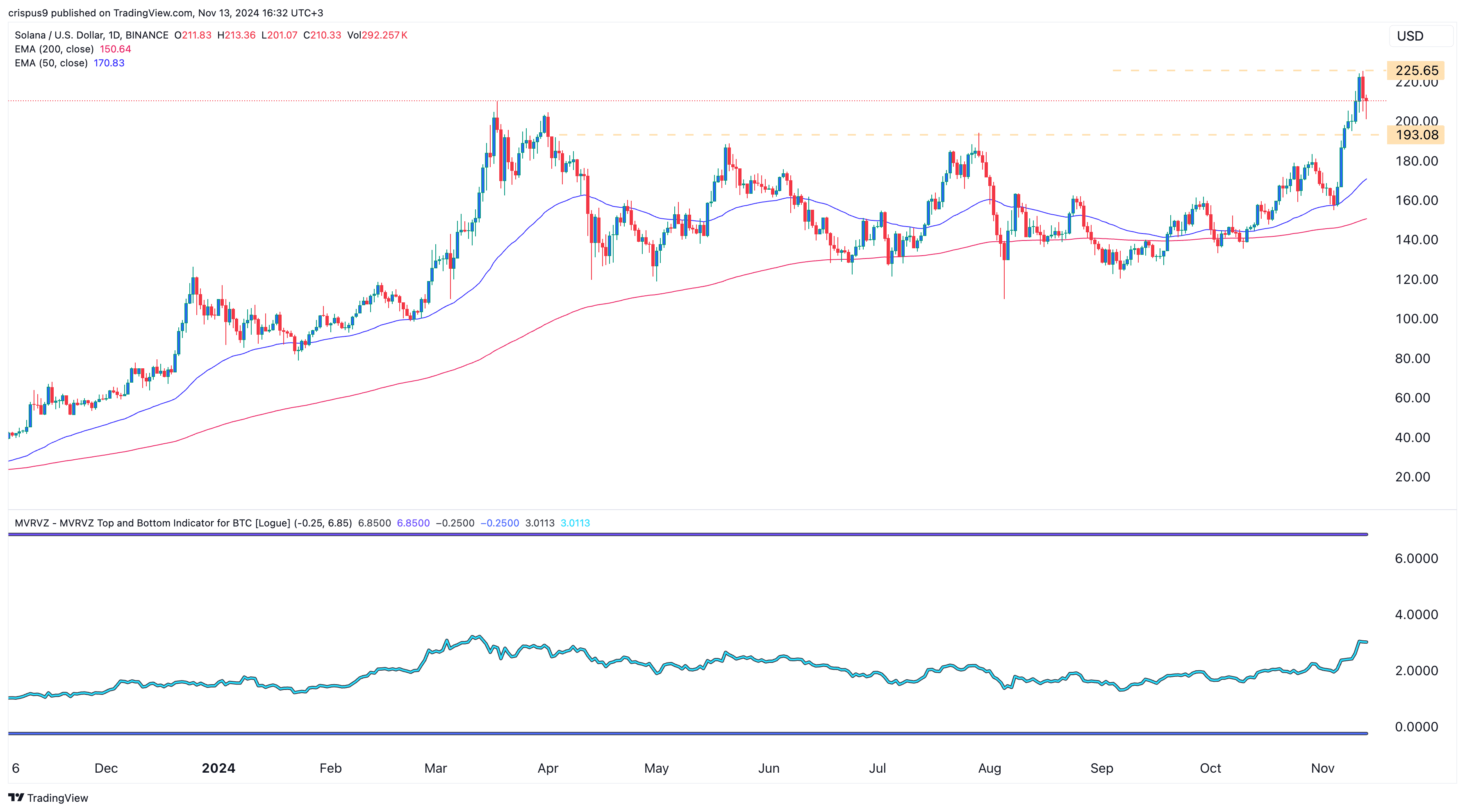

Solana price has fallen for two consecutive days, dropping 7.8% from its highest level this week.

Solana (SOL), the fourth-largest cryptocurrency, fell to $207 on Nov. 13, down from this week’s high of $225.

Its retreat mirrored that of Bitcoin (BTC) and other cryptocurrencies like Ethereum (ETH) and Cardano (ADA).

Despite the sell-off, one analyst believes it is too risky for traders to short SOL at the current prices. In an X post, Kingpin Crypto, an analyst with over 27,000 followers, warned that shorting the coin could be risky. He cited the fact that Solana was breaking out of an eight-month trading range.

Additionally, Solana maintains solid fundamentals as it has become a major player in the crypto industry. For example, it has become the blockchain of choice for developers who are building meme coins.

According to CoinGecko, the total market cap of all Solana meme coins has jumped to over $17.8 billion. Dogwifhat has a market cap of $3 billion, while Bonk, Peanut the Squirrel, and Popcat each have valuations of over $1 billion.

Solana has also overtaken Justin Sun’s Tron to become the second-largest chain in the decentralized finance industry. Its total value locked has jumped to over $7.58 billion, with the biggest players in the network being Jito, Kamino, Jupiter, and Raydium.

After dominating Ethereum in DEX volume in October, Solana is repeating the same trend this month. Its volume has risen by 91% in the last seven days to $24.55 billion, mostly due to several trending Solana meme coins like Department of Government Efficiency and Happy Coin.

Solana price to form break and retest before roaring back

The daily chart shows that the SOL price has pulled back after soaring to $225 on Tuesday. It has remained above the 50-day and 200-day moving averages, which is a bullish sign. Also, the MVRVZ indicator has moved sideways after rising to its highest level since March.

Most importantly, there are signs that Solana is about to form a break and retest pattern by moving to the key support at $193, its highest level on June 29. A break and retest happens when an asset rallies above a key level, retests it, and then resumes the bullish trend. If this is correct, there are high chances that Solana will rebound and retest $250 in the near term.

Source link

Trump’s Top SEC Chair Pick Paul Atkins Reluctant to Take Job: Source

Is Bitcoin Self-Custody Under Threat in Europe?

SynFutures announces F token airdrop

Ripple Lawsuit Lead Attorney Joins US SEC As Chief Litigation Counsel

CryptoQuant CEO Warns Not To Short XRP Due To Insider Whales

The lack of soft forks is due to a lack of interest— not a lack of process

Now could be the best time to buy DOGE, XRP and new trending altcoin

Altcoin Season To Face Challenges Ahead, CryptoQuant CEO Predicts

Crypto, Stocks and ‘Everything Bubble’ Still Has Room To Run, According to Analyst Jason Pizzino

This Cardano alternative expected to reach $1 in 2025, currently priced at $0.0259

Binance To Delist These Crypto In BTC Trading Pairs, What’s Next?

Polymarket Retains Loyal User Base a Month After Election, Data Shows

Coinbase CEO Brian Armstrong Sends Strong Message to Anti-Crypto Law Firms

Elon Musk’s $56 Billion Tesla Pay Deal Struck Down Again: Details

Bitcoin to Enter Final Bull Phase? Key Indicator Hints at Major Price Movement

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

3 months ago

3 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential