Markets

Proof of Reserves: Show Me the Money, Or It Didn’t Happen

Published

3 months agoon

By

admin

If we claim to be an improvement on traditional finance, we had better start playing the part. It’s clear how Bitcoin fixes rampant monetary discretion. It’s clear, too, how Bitcoin changes your relationship with money—both financially because you’re more inclined to save an appreciating asset—as well as physically because you can do novel things like hold the GDP of a small island nation on a USB. There is one thing, however, that is slowly gaining acceptance and needs to be accepted if we are to truly improve on the mistakes of the past, and that’s Proof of Reserves.

Bitcoin has unique audit properties baked into the system itself. Bitcoin allows any third party to audit the entire money supply down to the smallest unit. A third party can do this for free, without any special privileges or permissions. It’s difficult to overestimate how novel and consequential this property of the Bitcoin protocol is and the implications of the guarantees it provides. For context, the total global supply of dollars is an estimate and not an exact number by any stretch of the imagination due to a variety of factors including the existence of physical and digital cash, as well as currency circulation abroad. The total number of gold in existence is also an estimate due to entirely different reasons mainly the lack of certainty when it comes to the volume of mined gold from different mines around the world, gold existing in private hands, gold hoards and stashes, new mining, recycling, and unreported sources. There is no global, trustless, source of truth for any money or commodity other than Bitcoin. And this should be Bitcoin’s driving force moving forward.

Proof of Reserves (PoR) has been an important part of the industry since near-inception. The infamous Mt. Gox collapse of 2014 set the stage for much needed transparency. The exchange was hacked, 850,000 BTC (~47,617,204,000 USD at the time of this article) were stolen and their customers were unaware. The funds were drained over the course of a few years before the actual collapse happened. A PoR system would have mitigated further loss of funds as their customers would have seen the exchange’s reserves depleting at an alarming rate. If this sounds more like recent memory than an ancient piece of Bitcoin history it’s because the same argument applies to FTX, and the same basic thing happened to FTX. If customers, and the wider market at-large, would have seen the exchanges BTC reserves depleting in real-time (or the fact that FTX had zero Bitcoin), systemic-risk would have been dramatically mitigated.

So, what do you think would happen if the single custodian holding 90% of the spot Bitcoin backing these ETF’s were hacked or and/or acted maliciously? Unless the public is notified by the exchange, millions of people would be holding billions of paper Bitcoin. The more we connect ourselves to traditional finance the more cross-risk there is between traditional financial markets and the crypto markets. There are two choices at this point as we continue to mature as an asset class- apply old security and risk management tools to this new technology, or apply new, more performant, standards that are risk-adjusted to ensure we don’t see a systemic collapse if a certain class of financial products experiences a shock.

The claim can be made that having auditors is sufficient, that we already have these tools in place and as regulated financial products, this is essentially already “taken care of.” This claim, itself, is valid as imposing audit controls to mitigate risk is, in fact, the best we’ve been able to do thus far as it relates to financial products. But any meaningful investigation into the function of auditors yields alarming results: PwC vs. BDO in the Colonial Bank Case (2017), Grant Thornton vs. PwC (Parmalat Scandal, 2003), BDO vs. Ernst & Young (Banco Espírito Santo, 2014), KPMG vs. Deloitte (Steinhoff Scandal, 2017), and this is only looking back 20 years. FTX and Enron both had auditors. We use auditors because we don’t trust the individuals running the organization and the best we’ve been able to do to date is defer trust over to a different set of people, outside the organization. But the inherent risk of trusting people and organizations has never been remediated until now. Enron’s biblical collapse was due to clear conflict of interests between them and their auditor—namely that Arthur Andersen was also providing lucrative consulting services to Enron in addition to their audit function and by extension helped them cook their books.

Bitcoin is different, it behaves and lives differently. It behaves differently because the cryptographic guarantees it exhibits is something incomparable to traditional assets. Just as anyone can audit the entire money supply in the system with trustless guarantees, so too can anyone audit the personal holdings of an individual, or corporation, or ETF, holding Bitcoin in a completely risk-less way. It’s an important note, that it is not risk-mitigated, but risk-less. Someone cryptographically proving to any other counterparty that they own Bitcoin for, say, a loan can do so with no question as to whether the person is the actual owner of the BTC. This can happen repeatedly, with little overhead, and can be monitored continuously in real-time. There is no titling, there is no external auditor, there is no reviewing of any books that needs to take place. That data can be ingested without question.

So, what does this mean for ETF products? It should be clear at this point that because ETF products are such a critical pillar of our modern financial system and because Bitcoin introduces unique risk paradigms that old audit standards are inadequately servicing, that new risk infrastructure needs to be applied to these products. The solution is simple and it is the same solution that has been crackling its way up through the ice we’re all standing on in an attempt to get some air. Require spot Bitcoin ETF products to implement and comply with Proof of Reserves regimes. They should be giving their investors the peace of mind that the underlying asset backing these ETF’s exists, that they are sitting in robust custody setups and are not being rehypothecated. A failure to do so, or an unwillingness to do so on the part of the ETF issuer speaks to the priorities of the issuer—namely that they either don’t understand the nature of this particular financial product or that they are more comfortable operating with opacity than transparency. A failure to implement this as a standard industry-wide is simply a ticking time-bomb.

Hoseki was created for this very purpose, to build the plumbing that makes financializing Bitcoin a reality starting with PoR. Hoseki helps individuals prove their reserves to counterparties through Hoseki Connect and through Hoseki Verified provides services to private and public corporates, and ETF issuers so they can publicly verify their Bitcoin holdings building better brands, redefining trust, and mitigating risk for a healthier and more robust financial ecosystem. Contact us at partnerships@hoseki.app to get your organization onboarded to Hoseki.

This is a guest post by Sam Abbassi. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

DeFi

Solana beats Ethereum in a key metric 3 months in a row

Published

51 seconds agoon

December 23, 2024By

admin

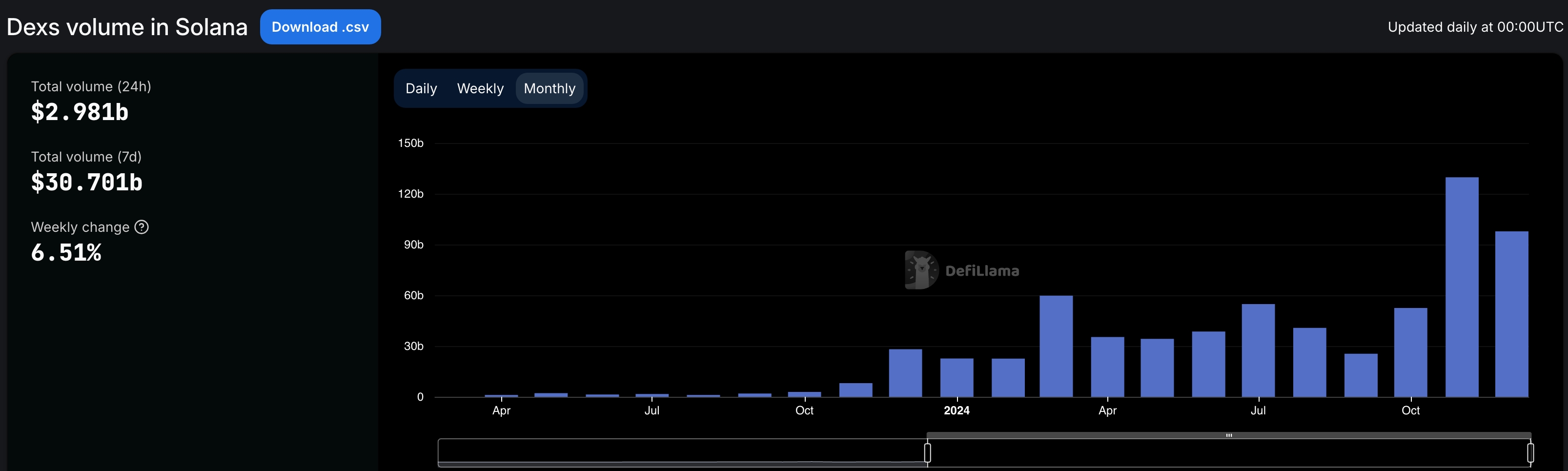

Solana’s continued doing well in December, as meme coins helped it gain market share against Ethereum and other blockchains.

According to DeFi Llama, Solana’s (SOL) protocols in the decentralized exchange industry were the most active in December.

Its volume rose to over $97 billion, much higher than the $22.6 billion it handled in the same period last year.

Notably, it was the third consecutive month that Solana outperformed Ethereum (ETH), which has dominated the industry for years. Ethereum’s protocols had a volume of over $74 billion, while Base and Arbitrum handled $42 billion and $37 billion.

Solana also performed great in November, where its DEX networks had a volume of $129 billion, higher than Ethereum’s $70.6 billion. A month earlier, Solana handled volume of $52 billion, while Ethereum processed $41 billion.

Most of Solana’s DEX volume was because of Raydium (RAY), a network that handled coins worth $65 billion in the last 30 days. Orca handled $24 billion, while Lifinity, Pump, and Phoenix had volumes worth over $5.93 billion.

Solana’s DEX volume has jumped because of the meme coin industry, which has continued doing well this year. Solana has attracted thousands of meme coins this year, helped by the creation of Pump, the biggest token generator. All Solana meme coins have a market cap of over $14.1 billion, led by Bonk, Dogwifhat, Popcat, and Peanut the Squirrel.

This growth has been highly profitable for Solana and its native apps. All Solana native dApps generated a record $365 million in revenue in November, a record high. Similarly, according to TokenTerminal, Solana’s blockchain generated a record $725 million in fees in 2024, making it the third-most profitable chain after Ethereum and Tron.

Developers and users love Solana because of its substantially lower fees and higher throughput.

Base, the layer-2 network launched by Coinbase, has also been a big breakout star in 2024 as its total fees rose to over $82 million. It has become the biggest layer 2 network in the blockchain industry, with its DEX networks handling over $181 billion in assets, while its total value locked soared to $2 billion.

Source link

Crypto exchange

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Published

4 hours agoon

December 23, 2024By

admin

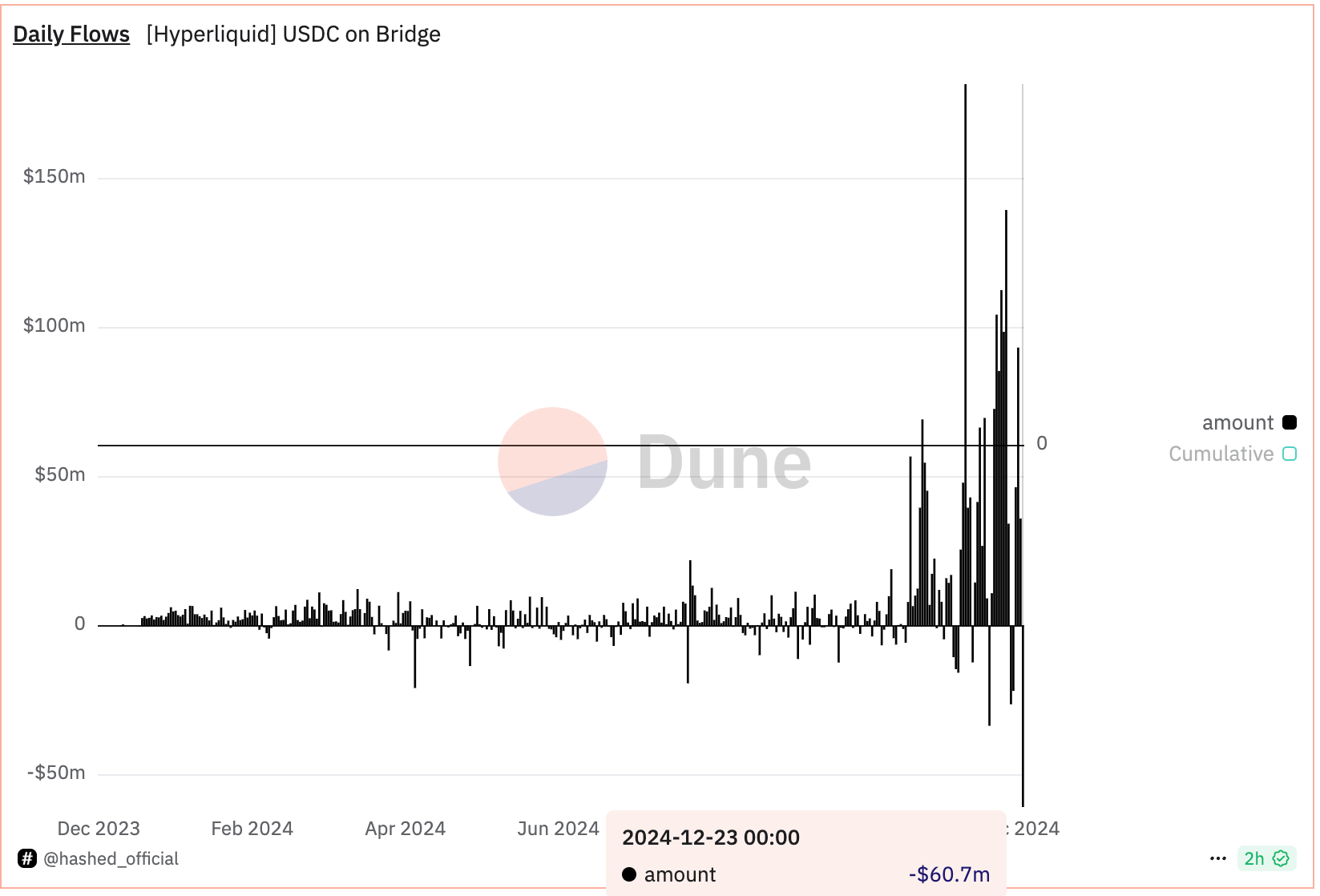

HyperLiquid, a layer-1 blockchain and decentralized exchange for perpetual futures (perps), has experienced a notable outflow of the USDC stablecoin amid speculation North Korean hackers are interacting with the platform, according to a post on X by pseudonymous observer Tay, known for tracking threats posed by to crypto protocols by the country.

A record $60 million of USDC fled the exchange by 10:00 UTC Monday, according to Hashed Official’s Dune-based tracker. USDC, the world’s second-largest dollar-pegged stablecoin, is used as collateral on HyperLiquid. The deposit bridge still holds $2.2 billion in USDC.

Addresses associated with hackers from the Democratic People’s Republic of Korea (DPRK) have accrued losses exceeding $700,000 while trading on HyperLiquid, Tay said. The transactions indicate the hackers are potentially familiarizing themselves with the platform’s inner workings to launch a malicious attack.

“DPRK doesn’t trade. DPRK tests,” Tay said.

CoinDesk contacted HyperLiquid on X for comments on the USDC outflows and potential threat from North Korea.

Tay said they reached out to the platform two weeks ago, offering help in countering a potential threat.

“I really want to emphasize that these are the most sophisticated and rapidly evolving of all of the DPRK threat groups. They are very creative and persistent. They also get their hands on 0days (such as the one Chrome patched today,” Tay’s message to the platform said.

HyperLiquid is the leading on-chain perpetuals exchange, commanding over 50% of the total on-chain perpetuals trading volume, which tallied $8.6 billion in the past 24 hours.

The platform debuted its token HYPE on Nov. 29. Since then, it has

surged over 600% to $28.6, briefly topping $10 billion in market capitalization. As of writing, HYPE was the 22nd largest digital asset in the world, according to Coingecko.

Source link

DeFi

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

Published

20 hours agoon

December 22, 2024By

admin

There’s been a change of guard at the rankings of the $3.4 billion tokenized Treasuries market.

Asset manager Hashnote’s USYC token zoomed over $1.2 billion in market capitalization, growing five-fold in size over the past three months, rwa.xyz data shows. It has toppled the $450 million BUIDL, issued by asset management behemoth BlackRock and tokenization firm Securitize, which was the largest product by size since April.

USYC is the token representation of the Hashnote International Short Duration Yield Fund, which, according to the company’s website, invests in reverse repo agreements on U.S. government-backed securities and Treasury bills held in custody at the Bank of New York Mellon.

Hashnote’s quick growth underscores the importance of interconnecting tokenized products with decentralized finance (DeFi) applications and presenting their tokens available as building blocks for other products — or composability, in crypto lingo — to scale and reach broader adoption. It also showcases crypto investors’ appetite for yield-generating stablecoins, which are increasingly backed by tokenized products.

USYC, for example, has greatly benefited from the rapid ascent of the budding decentralized finance (DeFi) protocol Usual and its real-world asset-backed, yield-generating stablecoin, USD0.

Usual is pursuing the market share of centralized stablecoins like Tether’s USDT and Circle’s USDC by redistributing a portion of revenues from its stablecoin’s backing assets to holders. USD0 is primarily backed by USYC currently, but the protocol aims to add more RWAs to reserves in the future. It has recently announced the addition of Ethena’s USDtb stablecoin, which is built on top of BUIDL.

“The bull market triggered a massive inflow into stablecoins, yet the core issue with the largest stablecoins remains: they lack rewards for end users and do not give access to the yield they generate,” said David Shuttleworth, partner at Anagram. “Moreover, users do not get access to the protocol’s equity by holding USDT or USDC.”

“Usual’s appeal is that it redistributes the yield along with ownership in the protocol back to users,” he added.

The protocol, and hence its USD0 stablecoin, has raked in $1.3 billion over the past few months as crypto investors chased on-chain yield opportunities. Another significant catalyst of growth was the protocol’s governance token (USUAL) airdrop and exchange listing on Wednesday. USUAL started trading on Binance on Wednesday, and vastly outperformed the shaky broader crypto market, appreciating some 50% since then, per CoinGecko data.

BlackRock’s BUIDL also enjoyed rapid growth earlier this year, driven by DeFi platform Ondo Finance making the token the key reserve asset of its own yield-earning product, the Ondo Short-Term US Government Treasuries (OUSG) token.

Source link

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential